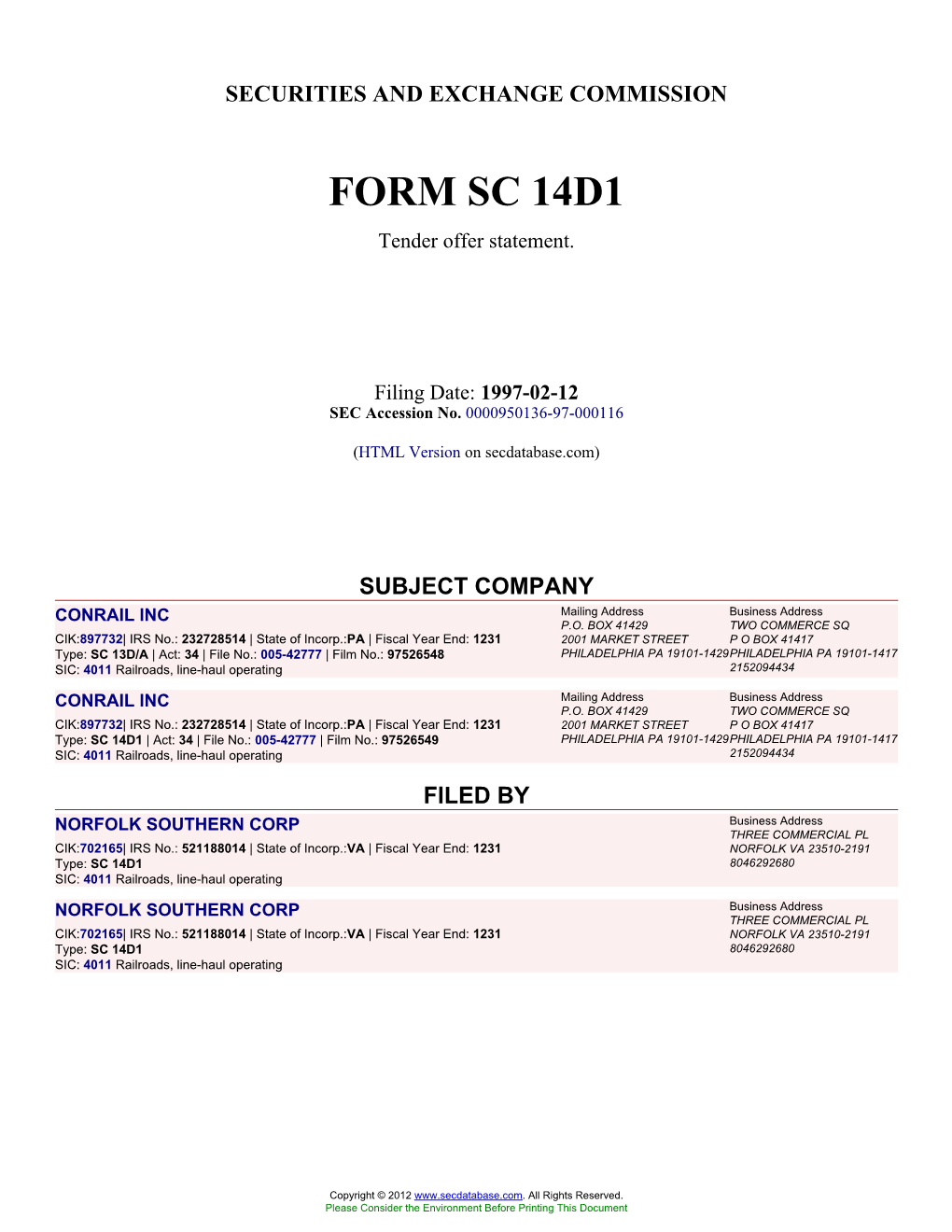

CONRAIL INC Mailing Address Business Address P.O

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to the Delaware, Lackawanna and Western Railroad Records

Guide to the Delaware, Lackawanna and Western Railroad Records NMAH.AC.1074 Alison Oswald 2018 Archives Center, National Museum of American History P.O. Box 37012 Suite 1100, MRC 601 Washington, D.C. 20013-7012 [email protected] http://americanhistory.si.edu/archives Table of Contents Collection Overview ........................................................................................................ 1 Administrative Information .............................................................................................. 1 Arrangement..................................................................................................................... 3 Scope and Contents........................................................................................................ 3 Historical........................................................................................................................... 2 Names and Subjects ...................................................................................................... 4 Container Listing ............................................................................................................. 5 Series 1: Business Records, 1903-1966.................................................................. 5 Series 2: Drawings, 1878-1971................................................................................ 6 Delaware, Lackawanna and Western Railroad Records NMAH.AC.1074 Collection Overview Repository: Archives Center, National Museum of American History Title: -

Review of Anti-Money Laundering and Sanctions Policy and Enforcement

Client Alert | Financial Institutions Advisory / International Trade Review of Anti-Money Laundering and Sanctions Policy and Enforcement January 2019 Authors: Kevin Petrasic, Paul Saltzman, Nicole Erb, Jeremy Kuester, Cristina Brayton-Lewis, John Wagner TABLE OF CONTENTS: Financial Institutions Advisory Executive Summary Bank Regulation, compliance Developments and Trends in Policy and Enforcement and risk management US Department of the Treasury Financial services digital transformation, including AI The Office of Foreign Assets Control and RegTech Treasury’s Financial Crimes Enforcement Network Payments Department of Justice AML/BSA Blockchain and digital assets Office of the Comptroller of the Currency Regulatory and supervisory Federal Reserve Board remediation, investigations Federal Deposit Insurance Corporation and enforcement Bank recovery, restructuring, Securities and Exchange Commission and resolution Financial Industry Regulatory Authority Marketplace and online lending Commodity Futures Trading Commission Capital and liquidity regulation Consumer financial services New York State Department of Financial Services Banking board and senior Proposed Legislative Changes to BSA/AML Policy management governance Market Infrastructure, financial Executive Summary market utilities and CCPs This anti-money laundering and sanctions review provides an overview and insights with respect to material developments in the United States regarding Bank Secrecy Act (“BSA”)/anti-money laundering (“AML”) and economic sanctions policy and enforcement in 2018. Going forward, White & Case expects to publish a similar review on a semi-annual basis to provide financial institutions with regular updates and insights. Future editions will also address material developments outside of the United States. 1 This review discusses key developments and trends in BSA/AML and economic sanctions policy and enforcement on an agency-by-agency basis, including rule implementations, enforcement actions and agency statements suggesting future priorities and actions. -

TCRP Report 52

T RANSIT C OOPERATIVE R ESEARCH P ROGRAM SPONSORED BY The Federal Transit Administration TCRP Report 52 Joint Operation of Light Rail Transit or Diesel Multiple Unit Vehicles with Railroads Transportation Research Board National Research Council TCRP OVERSIGHT AND PROJECT TRANSPORTATION RESEARCH BOARD EXECUTIVE COMMITTEE 1999 SELECTION COMMITTEE OFFICERS CHAIR ROBERT G. LINGWOOD BC Transit Chair: Wayne Shackelford, Commissioner, Georgia DOT Vice Chair: Martin Wachs, Director, Institute of Transportation Studies, University of California at Berkeley MEMBERS Executive Director: Robert E. Skinner, Jr., Transportation Research Board GORDON AOYAGI Montgomery County Government MEMBERS J. BARRY BARKER Transit Authority of River City SHARON D. BANKS, General Manager, AC Transit (Past Chairwoman, 1998) LEE BARNES THOMAS F. BARRY, JR., Secretary of Transportation, Florida DOT Barwood, Inc. BRIAN J. L. BERRY, Lloyd Viel Berkner Regental Professor, University of Texas at Dallas RONALD L. BARNES SARAH C. CAMPBELL, President, TransManagement, Inc., Washington, DC Central Ohio Transit Authority ANNE P. CANBY, Secretary of Transportation, Delaware DOT GERALD L. BLAIR E. DEAN CARLSON, Secretary, Kansas DOT Indiana County Transit Authority JOANNE F. CASEY, President, Intermodal Association of North America, Greenbelt, MD ROD J. DIRIDON JOHN W. FISHER, Joseph T. Stuart Professor of Civil Engineering and Director, ATLSS Engineering Research IISTPS Center, Lehigh University SANDRA DRAGGOO GORMAN GILBERT, Director, Institute for Transportation Research and Education, North Carolina State CATA University CONSTANCE GARBER DELON HAMPTON, Chair and CEO, Delon Hampton & Associates, Washington, DC York County Community Action Corp. LESTER A. HOEL, Hamilton Professor, Civil Engineering, University of Virginia DELON HAMPTON JAMES L. LAMMIE, Director, Parsons Brinckerhoff, Inc., New York, NY Delon Hampton & Associates THOMAS F. -

Forty-Eighth Annual Report Board of Public Utility Commissioners

You Are Viewing an Archived Report from the New Jersey State Library STATE OF NEW JERSEY Forty-Eighth Annual Report OF THE Board of Public Utility Commissioners TO N.J. STATE LIBRARY P.O. BOX 520 TRENTON, NJ 08625-0520 HoN. RoBERT B. MEYNER Governor FOR THE YEAR 1957 TRENTON, NEW JERSEY You Are Viewing an Archived Report from the New Jersey State Library ST A TE OF NEW JERSEY BOARD OF PUBLIC UTILITY COMMISSIONERS DEPARTMENT OF PUBLIC UTILITIES EDWARD J. HART, President D. LANE POWERS, Commissioner RALPH L. Fusco, Commissioner RICHARD F. GREEN, Secretary You Are Viewing an Archived Report from the New Jersey State Library BOARD OF PUBLIC UTILITY COMMISSIONERS STAFF HERBERT J. FLAGG, Executive Officer JACK SCHWARTZ, Assistant Executive Officer DIVISION OF ACCOUNTS AND FINANCE JoHN A. MATSON, Director LEIGH P. HARTSHORN, Assistant Director DIVISION OF ENGINEERING D. M. LANE, Director ROBERT G. PESCHEL, Assistant Director DIVISION OF MOTOR CARRIERS ]A.MES E. FARRELL, Director RICHARD E. KANE, Assistant Director EDWARD D. McCuE, Assistant Director DIVISION OF RAILROADS WALTER T. McGRATH, Director CHARLES N. GERARD, Assistant Director DIVISION OF RATES AND RESEARCH WILLIAM H. WooD, Director SIDNEY H. KIKEN, Assistant Director SECRETARIAL SECTION NEWARK OFFICE: HELEN D. WOODRUFF, Secretarial Assist61-nt TRENTON OFFICE: MARIE M. DROPELA, Head Clerk 3 You Are Viewing an Archived Report from the New Jersey State Library You Are Viewing an Archived Report from the New Jersey State Library TABLE OF CONTENTS GENERAL MA TIERS Page Jurisdiction 11 Duties and Policies . .. .. .. .. .. .. .. .. .. 12 Rate Activities 13 Procedure and Practice 13 Pre hearing Conferences 14 Formal Procedure 14 State Rate Counsel 14 Classification of Board's Decisions, Orders and Certificates ..................... -

Attachment (121 KB PDF)

FEDERAL RESERVE SYSTEM Allied Irish Banks, p.l.c. Dublin, Ireland Order Approving Acquisition of Shares of a Bank Holding Company Allied Irish Banks, p.l.c. (“Allied Irish”), a bank holding company within the meaning of the Bank Holding Company Act (“BHC Act”), has requested the Board’s approval under section 3 of the BHC Act (12 U.S.C. § 1842) to acquire up to 25 percent of the voting shares of M&T Bank Corporation (“M&T”)1 and thereby indirectly acquire shares of M&T’s subsidiary banks, including its lead subsidiary bank, Manufacturers and Traders Trust Company, both in Buffalo, New York (“Trust Company”).2 In addition, Allied Irish has requested the Board’s approval under section 4(c)(8) and (j) of the BHC Act (12 U.S.C. § 1843(c)(8) and (j)) and section 225.24 of the Board’s Regulation Y (12 C.F.R. 225.24) to acquire shares of nonbanking subsidiaries of M&T.3 Allied Irish also has 1 Under the terms of the proposal, Allied Irish would sell its wholly owned subsidiary bank holding company, Allfirst Financial Inc., Baltimore, Maryland (“Allfirst”), to M&T in exchange for the shares of M&T and other consideration. M&T and Trust Company have filed related applications with the Board to acquire Allfirst and Allfirst’s nonbanking subsidiaries; to merge Allfirst’s lead subsidiary bank, Allfirst Bank, also in Baltimore, into Trust Company; and for Trust Company to retain and operate branches at the locations of Allfirst Bank’s offices. By order dated today, the Board has approved the M&T proposal. -

1 New Jersey Railroads

1 NEW JERSEY RAILROADS – SL214 01.08.20 page 1 of 26 PASSENGER STATIONS & STOPS New York Central RR (1), Erie (2-11), New York Susquehanna & Western (12-15), Delaware Lackawanna & Western (16-26), Lehigh Valley (27-29), Central RR of New Jersey (30-49), New York & Long Branch (38), Pennsylvania (50-86), Philadelphia & Reading (87-97), New Jersey Transit River Line (60), Port Authority Trans Hudson (98-99), Short Lines (100-115) and Interurban Rlys (116-125) Based on Dinsmore Guide 1851(x), Official Guides (G) 1875 (y) & 1893 (z), Company Public (t), Working (w) TTs & Tariffs ($) as noted, 1976G (e) and current Amtrak TTs (f). n: Dinsmores Guide 1858; p: Rand McNally 1876; q: 1884G AG/DG/IG/PG/MG/RG/SG: Appletons/Dinsmore/International/Peoples/Rand McNally/Russells/Shermans Guides. j: current New Jersey Transit (NJT) Light Rail stns on ex RR right of way; k: current NJT RR stations Former names: [ ] Distances in miles, Gauge 4’ 8½” unless noted. (date)>(date): start/end of passenger service op. opened; cl. closed; rn. renamed; rl. relocated; tm. terminus of service at date shown; pass. passenger service Certain non-passenger locations shown in italics thus: (name) # names from Histories. #? passenger service? Reference letters in brackets: (a), location shown in public timetable, but no trains stop. x-f = xyzabcdef etc. NEW YORK CENTRAL (NYC) (via PRR/NYSW, 12, to:) 1. JERSEY CITY - TAPPAN > 1959 1.5 North Bergen ex New Jersey Midland; West Shore RR (WS). Service originally from Jersey City via NYSW (12) to ERIE RR (Erie) Hackensack. NJT Light Rail service op. -

Corridor Rail Facilities

7 CORRIDOR RAIL FACILITIES PENNSYLVANIA COMMISSION JANUARY 1991 1·95 Intermodal MobilitV Pioieet: Heading for the Twentv·First Century CORRIDOR RAIL 7 FACILITIES 1-95 Intermodal Mobility Project Prepared for the PENNSYLVANIA DEPARTMENT OF ® TRANSPORTATION by the DELAWARE VALLEY fJ REGIONAL PLANNING COMMISSION January 1991 . ~95 HEADING FOR THE TWENTY-FIRST CENTURY This report, prepared by the Transportation Planning Division of the Delaware Valley Regional Planning Commission, was financed by the Pennsylvania Department of Transportation and the Federal Highway Administration. The authors, however, are solely responsible for its finding and conclusions, which may not represent the official views or policies of the funding agencies. Created in 1965, the Delaware Valley Regional Planning Commission (DVRPC) is an interstate, intercounty and intercity agency which provides continuing, comprehensive and coordinated planning for the orderly growth and development of the Delaware Valley region. The region includes Bucks, Chester, Delaware, and Montgomery counties as well as the City of Philadelphia in Pennsylvania and Burlington, Camden, Gloucester, and Mercer counties in New Jersey. The Commission is an advisory agency which divides its planning and service functions among the Office of the Executive Director, the Office of Public Affairs, and four line Divisions: Transportation Planning, Regional Information Services Center, Strategic Planning, and Finance and Administration. DVRPC's mission for the 1990s is to emphasize technical assistance and services and to conduct high priority studies for member state and local governments, while determining and meeting the needs of the private sector. The DVRPC logo is adapted from the official seal of the Commission and is designed as a stylized image of the Delaware Valley. -

Germans Win Protocol Fight For

' THE WEATHER & Washington, Dec. 8. UnscitltD NIGHT and Tuesday; cooler tonlcht. TiaiTEBATDBE AT EACH ItOttlt J I IV 1 S 0"10 111 12 1 I 2 I 3 I 4TT merger EXTRA 10 Mi 141 141 42 HO I Euentng public l. VOL. VI.-r- NO. 73 Entered as Bacond-Claa- a Matter at the roatofflce, at Thtladatphla. Ta. Published Dallv T.xreM flmdaj- - RuWrlptlon Trlra fn a Tear l.y Mn Under tha Act of March 8. 1879. PHILADELPHIA, MONDAY, DECEMBER 8, 1910 Copyright, 1910, by PuWIo Company. PRICE TWO CENTS n Iedaer j 35 i V GERMANS WIN PROTOCOL FIGHT FOR President Opposes Resolution Advocating Break in Diplomatic Relations With Carranzd, i v: Bets Slock Exchange 25 GOPIMUTATION on VAREMEANSFIGHT WILSON "GRAVELY Thugs Hold Up Woman ALLIES BACK DOWN; ,i on Liquor War Outcome m TRANSONREADING Wet or dry? ANDITISKNOWNTO and Tear Out Earrings jw So great has the Interest in the CONCERNED" OVER - REFERSCAPAFLOW outcome of tho Supreme Court hear- fijjmEk. ing grown that today bc,ts were Mrs. Jacob Taylor Set Upon 54th Spruce placed on the Stoclr Exchange here. at and TO DEC. IB Some bets were the Supremo LEADERS ON INSIDE that , PROPOSED BREAK Streets by Bandits, Who Flee CASETOTHEHAGUE Bffl Court would declare the time pro- 1j hibition act unconstitutional, thus in Motorcar . throwing open tho saloons of the - Coal Shortage Causes With- country until the prohibition amend, Big Trouble Browing in Phila $$am "' - Says Fall Motion Reverses Cus- - Provision for Use of mcut becomes effective January 10. Three automobile bandits hist night old and the mother of five children todaw Military drawal of 17 Weekday and Others, delphia Politics and Denials :f told how she beeu uttneked und with tore a of bad more nerve, were $ ' - tom and Might Lead to pair diamond flirrings from Measures in Executing Peace betting that If the bnn on liquor is Mis. -

Jenkintown Wyncote Train Station Other Names/Site Number: Jenkintown Station Name Ofrelated Multiple Property Listing: N/A

NPS Form 10-900 0MB No. 1024-001 B United States Department of the Interior National Park Service National Register of Historic Places Registratiu++--F-4:::H- This fonn is for use in nominating or requesting determinations for individual properties and districts S«-"C in.suuctlnmt in Nnucmal Register Oulletln, 1/o tb Ci Historic Places Registration Form. If any item does not apply to the property being documented, enter •NtA" for "not :i pplicable." For t"un c:tlons. 1uchi1oc:: 1111 c 1 of significance, enter only ca tegories and subcategories fro m the instructions n,..--------- 1. Name of Property Historic name: Jenkintown Wyncote Train Station Other names/site number: Jenkintown Station Name ofrelated multiple property listing: N/A 2. Location Street & number: 3 West Avenue City or town: Jenkintown and Cheltenham Township State: PA County: Montgomery Not For Publication: □ Vicinity: □ 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this _x_ nomination _ request for determination of eligibility meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements set forth in 36 CFR Part 60. In my opinion, the property __x_ meets _ does not meet the National Register Criteria. I recommend that this property be considered significant at the following level(s) of significance: __national _statewide X local Applicable National Register Criteria: _K_A _B _c _D November 5, 2014 Signature of certifying official/Title: Date Pennsylvania Historical and Museum Commission State or Federal agency/bureau or Tribal Government In my opinion, the property __ meets _ does not meet the National Register criteria. -

A Brief History of the Newtown Branch Operated by the Reading Railroad

A Brief History of the Newtown Branch Operated by the Reading Railroad Long after the Reading had Railroads.Initially the line was operated by completed their electrification project in the the Pennsylvania, with trains operating via early 1930's the Newtown Branch remained the New York Main Line to the West as the only steam operated commuter line in Philadelphia Station at 32nd and Market the Philadelphia area. It was one of the last Streets. This arrangement was short lived rail lines built in the 19th Century and it had and the PN&NY was soon under lease to the a very rural atmosphere. Another 30 years P&R by 1879. Under control of the would pass before the Reading would install Philadelphia & Reading, Newtown Branch catenary on the Newtown Branch to Fox trains began using the station at Third & Chase, electrifying all passenger service Berks Streets for their Philadelphia terminus. within the City of Philadelphia. The opening of the Reading Terminal and In the days just prior to the American the desire to consolidate his passenger Civil War, a group of investors had received operations led Archibald McLeod to to permission by special act of the General construct the Philadelphia & Newtown Assembly of the Commonwealth of Connecting Railroad. Incorporated March 1, Pennsylvania to incorporate the Philadelphia 1892, the line was built, opened and merged & Montgomery County Railroad. It was with the P&R system all within the time hoped that the line would be built from period of several months. This allowed Philadelphia to Newtown. The financial Newtown trains to be routed from the instability of the times and a depression PN&NY at Olney, travel over the new following the end of the Civil War had branch to Newtown Junction on the Tabor delayed the start of construction until 1872. -

United States Bankruptcy Court for the Southern District of New York

20-10161-jlg Doc 270 Filed 03/05/20 Entered 03/05/20 16:06:52 Main Document Pg 1 of 254 20-10161-jlg Doc 270 Filed 03/05/20 Entered 03/05/20 16:06:52 Main Document Pg 2 of 254 EXHIBIT A EXHIBIT A Master Service List Served as set forth below Description Name Address Email Method of Service *NOA ‐ Counsel for Benihana New York Akerman LLP Attn: John P. Campo [email protected] Email Concession Corp. 666 Fifth Ave, 20th Fl New York, NY 10103 *NOA ‐ Counsel for 400 Walnut Ave, Ansell Grimm & Aaron, P.C. Attn: Anthony J. D'Artiglio [email protected] Email LLC. Attn: Joshua S. Bauchner [email protected] 365 Rifle Camp Rd Woodland Park, NJ 07424 20-10161-jlg Doc270Filed03/05/20Entered16:06:52MainDocument *NOA ‐ Counsel for Cream‐O‐Land Archer & Greiner, PC Attn: Harrison Breakstone [email protected] Email Dairy, LLC 630 3rd Ave New York, NY 10017 *NOA ‐ Counsel for Cream‐O‐Land Archer & Greiner, PC Attn: Stephen M Packman [email protected] Email Dairy, LLC Attn: Jorge Garcia [email protected] Three Logan Square 1717 Arch St, Ste 3500 Philadelphia, PA 19103 *NOA ‐ Counsel for US Food and Archer, Byington Glennon & Levine LLP Attn: James W Versocki [email protected] Email Commercial Workers Local 1500 1 Huntington Quad, Ste 4C10 Pension Fund P.O. Box 9064 Melville, NY 11747 *NOA ‐ Attorney for Local 1500 Archer, Byington Glennon & Levine LLP Attn: John H. Byington III [email protected] Email Pension Fund Attn: Matthew Hromadka [email protected] One Huntington Quadrangle, Ste 4C10 P.O. -

February 2008 Bulletin.Pub

NEW YORK DIVISION BULLETIN - FEBRUARY, 2008 The Bulletin New York Division, Electric Railroaders’ Association Vol. 51, No. 2 February, 2008 The Bulletin HUDSON & MANHATTAN CENTENNIAL Published by the New There were joyous opening day ceremonies bly. York Division, Electric Railroaders’ Association, when Hudson & Manhattan trains started When construction began in 1874, the tech- Incorporated, PO Box running on February 25, 1908. At 3:30 PM, nique of building river tunnels was not per- 3001, New York, New 400 invited guests entered the 19th Street fected, and most people were reluctant to York 10008-3001. station, which was illuminated by the cars’ finance a risky venture. emergency lights, whose power was supplied In 1869, Colonel DeWitt Clinton Haskin, an For general inquiries, by batteries. A special Telegraph Operator on engineer who helped build the Union Pacific contact us at nydiv@ duty at the station signaled President Theo- Railroad, arrived in New York with the idea of electricrailroaders.org dore Roosevelt, who was at his desk in the building a tunnel under the Hudson River. In or by phone at (212) White House. The President then pressed a 1873, he incorporated the Hudson Tunnel 986-4482 (voice mail available). ERA’s button, which rang a bell in the station. Railroad Company to construct the tunnel. A w e b s i t e i s Power was turned on, the lights were lit, and year later, he obtained patents that proposed www.electricrailroaders. the trains’ compressors started building up air using compressed air. Work began promptly org. pressure. The crowd cheered when the 8-car at the foot of 15th Street in Jersey City.