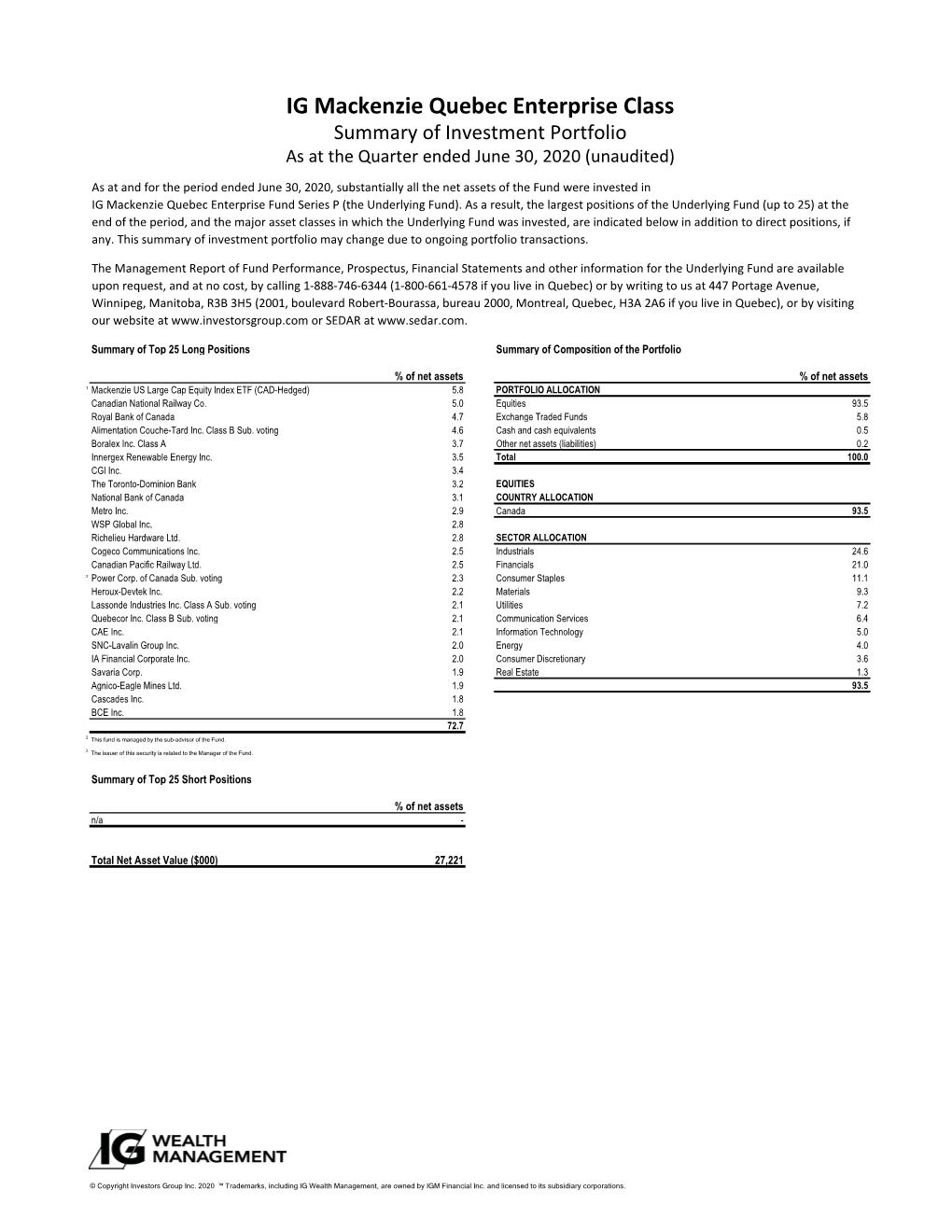

IG Mackenzie Quebec Enterprise Class Summary of Investment Portfolio As at the Quarter Ended June 30, 2020 (Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS -

ATSX Fund Facts 05.09.19

ACCELERATE ENHANCED CANADIAN BENCHMARK ALTERNATIVE FUND QUICK FACTS About the Fund The Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX) provides Type: combined exposure to the S&P/ TSX 60 plus a long-short Canadian equity overlay Long-short equity portfolio designed to add outperformance above the broad Canadian equity index. Date started: May 10, 2019 Investment Objectives Management Fee: ・ Outperform the broad Canadian equity index 0.00% ・ Provide volatility in-line with the broad Canadian equity index Performance Fee / Hurdle: 50% of outperformance over high watermark / S&P/ TSX 60 Total Return Investment Manager: Accelerate Enhanced Canadian Benchmark Accelerate Financial Technologies Inc. Reference Portfolio Performance 25,000 Distribution Frequency: Quarterly 16.6% annualized Exchange: 20,000 TSX Currency: CAD 15,000 Risk-Rating: Medium 10,000 As of May 09, 2019 ATSX Price: n/a 5,000 ATSX NAV: n/a Change: 0 n/a Volume: n/a Growth of 1,000 Net Assets: DISCLAIMER: Results of the Accelerate Enhanced Canadian Benchmark reference portfolio are hypothetical and do not reflect investment results attained by any investor. Past performance is not indicative of future results. Performance is net of all estimated trading fees and performance fees. Investing involves varying n/a degrees of risk and there can be no assurance that the future performance of any investment strategy will be profitable. This does not constitute investment advice. [email protected] www.accelerateshares.com 1-855-892-0740 ACCELERATE ENHANCED CANADIAN BENCHMARK ALTERNATIVE FUND Investment Process In addition to providing exposure to the broad Canadian equity index, either through derivatives, ETFs or the underlying equities, ATSX holds a diversified, long-short equity overlay portfolio of Canadian equities. -

Canadian Equities │ As at June 30, 2020

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2020 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) ROYAL BANK OF CANADA 11,271,593 ATS AUTOMATION TOOLING SYS INC 1,384,288 TORONTO DOMINION BANK 9,536,684 ENGHOUSE SYSTEMS LTD 1,291,660 SHOPIFY INC 8,737,059 RESTAURANT BRANDS INTL INC 1,290,046 BROOKFIELD ASSET MGMT INC 7,011,275 NORBORD INC 1,262,688 BARRICK GOLD CORP 6,630,926 WINPAK LTD 1,238,925 CANADIAN PACIFIC RAILWAY LTD 6,483,728 ENBRIDGE INC 1,193,735 CONSTELLATION SOFTWARE INC 6,413,612 ONEX CORP 1,170,728 ALIMENTATION COUCHE-TARD INC 6,178,610 LASSONDE INDUSTRIES INC 1,082,435 FRANCO-NEVADA CORP 5,398,387 ARITZIA INC 1,076,555 TC ENERGY CORP 5,050,176 FIRSTSERVICE CORP 1,075,129 SUN LIFE FINANCIAL INC 4,033,656 GDI INTEGRATED FAC SVCS INC 1,072,430 FORTIS INC 3,645,439 ELEMENT FLEET MANAGEMENT CORP 964,862 SUNCOR ENERGY INC 3,358,993 SAVARIA CORP 934,213 CANADIAN NATIONAL RAILWAY CO 3,191,563 EQUITABLE GROUP INC 871,672 INTACT FINANCIAL CORP 2,984,363 PARKLAND CORP 863,920 THOMSON REUTERS CORP 2,548,130 CHOICE PROPERTIES REIT 846,535 WHEATON PRECIOUS METALS CORP 2,543,825 FIRST QUANTUM MINERALS LTD 842,348 MANULIFE FINANCIAL CORP 2,543,799 ALTUS GROUP LTD 836,113 CANADIAN APARTMENT PPTYS REIT 2,514,435 LOGISTEC CORP 820,545 CGI INC 2,501,068 LEON'S FURNITURE LTD 771,345 DOLLARAMA INC 2,438,279 BOYD GROUP SERVICES INC 755,338 PEMBINA PIPELINE CORP 2,352,178 BADGER DAYLIGHTING LTD 688,969 COLLIERS INTL GROUP INC 2,133,136 METHANEX -

Corporate Board Governance and Director Compensation in Canada

Corporate Board Governance and Director Compensation in Canada A Review of 2014 In Partnership with Patrick O’Callaghan and Associates $110.00 per copy © Korn Ferry, January 2015 All rights reserved. No part of the contents of this report may be reproduced or transmitted in any form or by any means without the written permission of the Publisher. This report is also available in French. Table of contents The Surveyed Companies 2 Special Report: Counting the Hours 6 Board Independence 20 Board Composition 28 Board Size 40 Board Assessments, Director Selection and Director Development 44 Meetings and Attendance 52 Board Committees 56 Director Compensation 60 Board Chair Compensation 68 Lead Director Compensation 72 Committee Chair Compensation 74 Committee Member Compensation 80 Stock-Based Compensation 84 Director Share Ownership 89 Company Data 93 Endnotes 102 Korn Ferry 105 Patrick O’Callaghan and Associates 107 1 The Surveyed Companies The Most Comprehensive Canadian Governance Study We are pleased to present the most comprehensive review of public issuer governance data available in Canada. This twenty-second annual report examines governance in Canadian companies and includes our special report, Counting The Hours: How Time Consuming Is It To Be A Canadian Director? Our commitment is to provide directors and trustees with accurate and relevant Canadian data across a wide spectrum. 2 The data is collected from publicly traded companies that were on one or more of the following lists: * The Financial Post Top 210 (June 2014) * The Report on Business Top 205 (July 2014) * The S&P/TSX Composite Index (at any time during 2013) • We draw data from annual reports, management proxy circulars and annual information forms for fiscal year-ends in late 2013, or the first few months of 2014. -

Top News Before the Bell Stocks To

TOP NEWS • Thousands of Canadian National Railway workers go on strike About 3,000 workers of Canadian National Railway, the country's largest railroad operator, went on strike, labor union Teamsters Canada said after both parties failed to resolve contract issues. • EXCLUSIVE-Mine workers demanded more protection before deadly Burkina Faso attack Five months before an ambush killed 39 colleagues, local workers at a Canadian-owned gold mine in Burkina Faso pleaded with managers to fly them to the site rather than go by a road that was prone to attacks, two people present at the meeting said. • Keystone operator TC Energy sees EBITDA exceeding C$10 billion in 2022 Canada's TC Energy said it expects comparable earnings before interest, taxes, depreciation and amortization to exceed C$10 billion in 2022, driven by long-term contracts and assets. • Trump's "Section 232" autos tariff authority runs out of time, experts say The clock has run out on President Donald Trump's authority to impose "Section 232" tariffs on imports of foreign-made cars and auto parts, and he may have to find other means if he wants to pursue tariffs on European or Japanese cars, legal experts say. • Sales of grounded Boeing 737 MAX gather pace at Dubai Airshow Boeing's 737 MAX took centre stage at the Dubai Airshow as airlines announced plans to order up to 50 of the jets worth $6 billion at list prices despite a global grounding in place since March. BEFORE THE BELL Canada's main stock index futures gained, mirroring Wall Street futures, on fresh hopes over the progress in trade talks between the U.S. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

Top Stocks Canada Accelerate Alpha Rank

December 2020 Accelerate Alpha Rank - Top Stocks Canada Past Month Performance of Top Decile Alpha Rank Portfolio Growth of 100K in Top Decile Alpha Rank Portfolio over 5 Years 150,000 10.4% 125,000 100,000 -0.4% 75,000 Nov/2015 Nov/2016 Nov/2017 Nov/2018 Nov/2019 Nov/2020 TSX` 60 Total Return Top Decile AlphaRank Price Operating Company Alpha Rank* Value Quality Momentum Momentum Trend ATD.B Alimentation Couche-Tard Inc 95.3 OSB Norbord Inc 95.2 PBL Pollard Banknote Ltd 94.8 LAS.A Lassonde Industries Inc 94.7 WJX Wajax Corp 94.7 QBR.B Quebecor Inc 94.6 TCL.A Transcontinental Inc 94.6 CFP Canfor Corp 94.4 RME Rocky Mountain Dealerships Inc 94.1 ORA Aura Minerals Inc 94.0 Accelerate Alpha Rank - Bottom Stocks Canada Past Month Performance of Bottom Decile Alpha Rank Portfolio Growth of 100K in Bottom Decile Alpha Rank Portfolio over 5 Years 175,000 10.4% 150,000 125,000 100,000 75,000 -3.8% 50,000 TSX 60 Total Return Bottom Decile AlphaRank Nov/2015 Nov/2016 Nov/2017 Nov/2018 Nov/2019 Nov/2020 Price Operating Company Alpha Rank* Value Quality Momentum Momentum Trend OGI Organigram Holdings Inc 0.5 KEL Kelt Exploration Ltd 2.0 FURY Fury Gold Mines Ltd 2.2 AC Air Canada 2.5 NVO Novo Resources Corp 3.8 SCR Score Media And Gaming Inc 4.1 HSE Husky Energy Inc 4.3 SDE Spartan Delta Corp 4.7 BSR Bluestone Resources Inc/Canada 4.8 TRZ Transat AT Inc 5.6 * AlphaRank is ex clusiv ely produced by Accelerate Financial Technologies Inc. -

June Monthly Update

June 17, 2019 PI Financial QScore – June Monthly Update Highest PI QScore ranked companies Energy – Parex Resources, Parkland Fuel, Pembina Pipeline, Enerflex Ltd Materials – Kirkland Lake Gold, Largo Resources, Semafo, West Fraser Timber Industrials – Badger Daylighting, Toromont, Air Canada, Boyd Group, CP Rail Consumer Discretionary – BRP Inc, MTY Food Group, Dollarama Inc Consumer Staples – Empire Company, Premium Brands Healthcare – Sienna Senior Living Inc Financials – TD, Canadian Western Bank, Brookfield Business Partners, Manulife Infotech – Open Text, Enghouse Systems, CGI Inc. Telecom – Cogeco, Cogeco Communications Utilities – Superior Plus, Northland Power, Algonquin Power Inc Real Estate – Summit Industrial REIT, FirstService Corp, Colliers International The PI QScore is a multi-factor equity valuation tool designed to assist in the equity selection process and to enhance portfolio returns by ranking the most and least attractive companies within each sector. Our analytical process screens and ranks each company using a diverse list of about 40 financial, technical and accounting ratios and metrics categorized and ranked under four investment factor styles: Value, Financial Growth, Price Growth and Quality. Our Value factors include a range of ratios, such as price to earnings, price to book and price to sales. Quality and Credit factors include measures such as a company’s profitability, shareholder yield, leverage and free cash flow yield ratios. Price Growth or momentum factors reflect the company’s share price trend and the industry’s index price performance. Financial Growth factor includes various accounting measures highlighting a company’s past, current and forecasted revenue, cash flow and earnings growth. Our relative ranking system allows one to easily see how a company ranks among its peers and across all four investment styles. -

Proxy Circular 2021

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR 2021 Thursday, May 13, 2021 at 9:30 a.m. Virtual meeting via live webcast NOTICE OF ANNUAL MEETING OF SHAREHOLDERS 2021 Date: Thursday, May 13, 2021 Time: 9:30 a.m. Place: Virtual meeting via live webcast at https://web.lumiagm.com/450090203 Please note that at the Annual Meeting of the holders of Class A Multiple Voting Shares and Class B Subordinate Voting Shares of Quebecor Inc. (the “Corporation”), the shareholders will be asked to: . receive the consolidated financial statements of the Corporation for the year ended December 31, 2020 and the external auditor’s report thereon; . elect Class A Directors and Class B Directors; . appoint the external auditor; . consider and, if deemed advisable, approve the advisory resolution to accept the Board of Directors of the Corporation’s approach to executive compensation; and . transact such other business as may properly be brought before the meeting or any adjournment thereof. Enclosed are the Corporation’s Management Proxy Circular and a form of proxy or a voting instruction form, including an electronic document delivery consent. Only persons shown on the register of shareholders of the Corporation at the close of business on March 16, 2021 are entitled to receive notice of the meeting and to vote. This year, to deal with the unprecedented public health impact of the COVID‐19 outbreak, and to mitigate risks to the health and safety of our communities, shareholders, employees and other stakeholders, we will hold the meeting in a virtual only format, which will be conducted via live webcast. -

DFA Canada Canadian Core Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Core Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use -

Form 20-F Quebecor Media Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR _ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report...... For the transition period from to Commission file number: 333-13792 QUEBECOR MEDIA INC. (Exact name of Registrant as specified in its charter) Province of Québec, Canada (Jurisdiction of incorporation or organization) 612 St-Jacques Street Montréal, Québec, Canada H3C 4M8 (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered None None Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Table of Contents Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. 5¾% Senior Notes due January 2023 (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 79,377,062.24 Common Shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.