Asset Management Plan 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EEA Conf Programme 2021

Conference Programme - Provisional - 29 March 2021 WEDNESDAY, 30 JUNE 2021 8.30am REGISTRATION & TRADE EXHIBITION OPENS ROOM 3 ROOM 4 ROOMS 2 TO 4 9.30am CONFERENCE OPENING 9.35am Keynote Address 1 10.10am Keynote Address 2 10.45am ROOM 1 ROOM 2 ROOM 3 ROOM 4 CARBON ZERO SMART TECHNOLOGY FUTURE GRIDS PANEL SESSION 1 11.00am Architecture of the Future Low-Carbon, ConductorDown – A groundbreaking safety solution for New approaches to network planning. Details to be advised Resilient, Electrical Power System. overhead distribution networks. Richard Kingsford, WEL Networks Prof. Neville Watson, University of Rodger Griffiths, Electronet Technology Canterbury 11.30am Perverse incentives creating an impact on Practical experience of IEC61850 and future IoT for a smarter grid. network performance and New Zealand’s zero applications. Max Feickert, Energy Outcomes & Darren carbon future. Nathan Rich, Connetics Ltd Lucinsky, Electra Ltd Dougal McQueen & Junaid Qureshi, Aurora Energy 12.00pm The effects on the wider electricity network of Enhancing rating studies through soil digital twin. The use, development and improvement of heating decarbonisation projects. Nu’man Rashid, Unison Networks Ltd approaches for generation balancing to meet peak Campbell Rae, Connetics Ltd demand. Katherine Moore, Transpower NZ Ltd 12.30pm LUNCH ASSET MANAGEMENT INNOVATION FUTURE ENERGY SECURITY INNOVATIVE TECHNOLOGY SMART TECHNOLOGY 1.30pm Rethinking test data and reporting. An Electricity network infrastructure resilience through the Implementation of Whangamata’s -

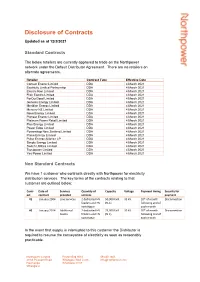

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

Genesis Energy

NEW ZEALAND Genesis Energy 13 June 2008 Performance evaluation Genesis Energy equity valuation Macquarie Research’s discounted cashflow based equity valuation for Genesis Energy is $2,115m (nominal WACC 9.17%, asset beta 0.60, TGR 3.0%). Forecast financial model A detailed financial model with explicit forecasts out to 2030 has been completed and is summarised through this report. 12 month and 24 month target valuations Our 12 month ($2,257m) and 24 month ($2,433m) target valuations for the company have been derived by rolling forward the discounted cashflow model 12 and 24 months respectively and deducting from these values the forecast 12 and 24 month dividends to the Crown. Financial model assumptions and commentary We have assessed the sensitivity of our equity valuation to a wide range of inputs. Broadly, these sensitivities are divided into five categories: generation Inside assumptions, electricity supply, gas supply, financials and price path. Performance evaluation report 2 This report highlights and discusses a number of key model input assumptions: Valuation summary 5 ⇒ The extent to which Huntly coal is backed off; Financial model assumptions and ⇒ The company’s retail and SME pricing position; commentary 11 ⇒ Future fuel cost position; Financial statements summary 18 ⇒ Genesis Energy Retail Gas margins; and Genesis Energy historic and forecast performance 21 ⇒ Wholesale electricity price paths. Historic and forecast performance versus SCI Financial flexibility and generation development 22 We have analysed the spread between Genesis Energy’s return on funds and its WACC to gauge its historic and forecast financial performance; Alternative valuation methodologies 23 We have compared our forecasts for Genesis Energy against those outlined in its Statement of Corporate Intent (SCI). -

Confidential Version

Public Version ISSN No. 0114-2720 11711/900832 Decision No. 682 Determination pursuant to the Electricity Industry Reform Act 1998 (EIR Act) in the matter of an application for exemption, of a prohibited involvement in an electricity lines business and an electricity generation and sales business, from the application of the EIR Act. The application is made by: MARK TUME The Commission: M N Berry P J M Taylor Summary of Application: Application by Mark Tume for exemption from the application of the EIR Act in respect of certain prohibited involvements in Powerco Limited’s lines and in the generation and sale of electricity by TrustPower Limited. Determination: The Commission, pursuant to section 81 of the EIR Act, determines to grant an exemption from compliance with section 17(2)(a) of the EIR Act, but with the conditions specified in the Notice of Exemption. Date of Determination: 10 November 2009 CONFIDENTIAL MATERIAL IN THIS REPORT IS CONTAINED IN SQUARE BRACKETS 2 CONTENTS INTRODUCTION .........................................................................................................3 COMMISSION PROCEDURES...................................................................................3 General.......................................................................................................................3 Criteria Used by the Commission to Consider Exemption Applications ..................3 PARTIES .......................................................................................................................5 -

Commerce Commission CPP Open Letter July 2018

First Gas Limited 42 Connett Road West, Bell Block 31 July 2018 Private Bag 2020, New Plymouth, 4342 New Zealand P +64 6 755 0861 F +64 6 759 6509 Matthew Lewer Manager, Regulation Development Commerce Commission PO Box 2351 WELLINGTON Sent via email: [email protected] Dear Matthew Feedback on recent CPP processes This is First Gas’ submission on the Commerce Commission’s open letter requesting feedback on recent customised price-quality path (CPP) processes dated 3 July 2018. Summary of key points First Gas welcomes the Commission’s review of recent CPPs. The findings of this work are of interest to us as we consider a CPP application for our gas transmission business to address the risk of coastal erosion near our pipelines at White Cliffs in northern Taranaki. We disagree with the Commission’s view that the principle of proportionate scrutiny is sufficiently defined in the Input Methodologies. We consider that the Wellington Electricity (WELL) CPP process demonstrates the value of considering high-priority, specific resilience issues outside of a full CPP process. This ensures a timely response to identified major resilience risks, without the resource required for a full CPP. Most of the other topics canvassed in the open letter set out activities that we expect any prudent regulated business would undertake prior to submitting a CPP application. These activities require a degree of flexibility to reflect the drivers of the individual CPP applications, so we do not support these being codified into the CPP requirements. We expand on these points below. Importance of consultation on CPP processes and experience to date Industry consultation and feedback on the CPP process is of considerable interest to First Gas, as we are currently considering a CPP application for our White Cliffs realignment project. -

2010 Default Price-Quality Path Compliance Assessment Decision

COMMERCE COMMISSION Regulation of Electricity Lines Businesses Price-Quality Regulation Reasons for Not Declaring Control of the following Non-exempt Electricity Distribution Businesses: Alpine Energy Limited, Centralines Limited, Eastland Network Limited, Horizon Energy Distribution Limited, Nelson Electricity Limited, Network Tasman Limited, Orion New Zealand Limited, OtagoNet Joint Venture, Powerco Limited, The Lines Company Limited, Top Energy Limited and Wellington Electricity Lines Limited 1 April 2011 CONTENTS PAGE INTRODUCTION .................................................................................................. 3 Purpose and Scope .............................................................................................. 3 Electricity Distribution Businesses Assessed ................................................... 3 Statutory Framework ......................................................................................... 4 Consumer-owned .................................................................................................................. 4 Process and Analytical Framework Applied ................................................... 5 Overview of the 2009/10 Assessment ................................................................ 6 Breaches of the Price Path ................................................................................................... 6 Breaches of the Quality Threshold ..................................................................................... 11 DECISIONS – -

Certus Industry Focus: Energy and Utilities Product Sheet

CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES PRODUCT SHEET Our Industry Experience Certus Certus’s long track record means we Certus Solutions is the largest IBM systems understand the business drivers and integrator and reseller in the Australasian technology needs of companies in region, with a complete end-to-end IBM the energy and utilities sector. offering we call Certus PurePlay. We have been Our experience encompasses: helping energy and utilities companies achieve their business objectives for more than 20 • asset management, including networked, years. Utility industry certified by IBM, and an distributed, mobile and linear assets IBM Premier Business Partner, Certus brings • work management, including optimised its PurePlay advantage to downstream and scheduling upstream energy and resources operations, and • faults and outage management water supply operations. • health, safety and the environment • connectivity and real-time data, encompassing everything from smart metering to SCADA, and condition monitoring to network operations, and the Big Data implications of smart grids • spatial and geo-locational data • mobile work and workforce management • predictive analytics, ranging from predictive maintenance to demand forecasting • supply chain management • compliance, regulation, risk, and emerging industry standards e.g. PAS 55 • regulatory reporting, and other challenges inherent in a regulated CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES ENERGY FOCUS: INDUSTRY CERTUS asset industry. FRESH IDEAS. EXCEPTIONAL OUTCOMES. certussolutions.com -

EV CONNECT CONSULTATION DRAFT ROADMAP Consultation Close Date: 15 July 2021

EV CONNECT CONSULTATION DRAFT ROADMAP Consultation close date: 15 July 2021 Released May 2021 EV CONNECT – DRAFT ROADMAP CONTENTS 1. Introduction 3 2. Context 7 3. Roadmap objectives 11 4. Roadmap approach and actions 12 5. Building on EV Connect progress 17 6. Getting to the starting line 20 Acknowledgements We acknowledge the input and engagement from our stakeholders through 2020-21 which have contributed to the scope and direction outlined in the roadmap and key actions within it. We also acknowledge the support of GreenSync – particularly Bridget Ryan - in helping us to write and refine this Draft Roadmap. Finally, we acknowledge the funding, support and engagement of EECA on the EV Connect project. Copyright © 2021, Wellington Electricity Lines Limited (WELL) Disclaimer The information contained in this document provides a summary of the subject matter covered. While we use all reasonable attempts to ensure the accuracy and completeness of the information, facts and opinions herein, we make no warranty or guarantees on the information. Page 2 of 25 EV CONNECT – DRAFT ROADMAP In New Zealand, electricity distribution is regulated. The Commerce 1. Introduction Commission sets how much money an Electricity Distribution Business As electric vehicle (EV) uptake increases, electricity networks will be (EDB) has to build and operate their network, the services provided and required to manage the associated increase in demand for electricity. The the level of quality delivered. The Electricity Authority defines how EDBs increase will be significant – our studies show that a small EV will increase interact with other industry participants and customers. household electricity use by 35%. -

Waikato and Upper North Island Voltage Management

WAIKATO AND UPPER NORTH ISLAND VOLTAGE MANAGEMENT ATTACHMENT D - STAKEHOLDER CONSULTATION SUMMARY Transpower New Zealand Limited December 2019 Waikato and Upper North Island Voltage Management © Transpower New Zealand Limited 2007. All rights reserved. i Table of Contents Table of Contents Glossary................................................................................................................................ 5 1 Introduction .................................................................................................................. 7 1.1 Purpose ..................................................................................................................... 7 1.2 Document structure ................................................................................................... 7 1.3 Stakeholder engagement to date ............................................................................... 8 2 Long-list stakeholder consultation (July 2016): Summary of submissions with Transpower responses................................................................................................. 8 2.1 Need and project scope ............................................................................................. 9 2.1.1 Need for wider scope .............................................................................................. 9 2.1.2 Definition of the N-1 contingency ........................................................................... 10 2.2 Reactive power devices, batteries and transmission ............................................... -

Contracts Disclosure 2019 9/07/2019 1 2

Disclosure of Contracts relevant to Northpower’s Electricity Lines Business Updated 9 July 2019 This disclosure is made in accordance with clauses 2.4.9 to 2.4.17 of the Electricity Distribution Information Disclosure Determination 2012 (EDIDD 2012) published by the Commerce Commission which requires Northpower to publicly disclose “Prescribed Terms & Conditions” of Northpower’s standard and non- standard contracts relating to the supply of Electricity Lines Services. Contracts with Electricity Retailers Northpower’s contractual arrangement for the provision of Lines Services to most end-use consumers connected to the Northpower network is on an interposed basis. The electricity retailers are “interposed” between Northpower and the end-use consumers, meaning that Northpower has contracts with the electricity retailers and the electricity retailers have individual contracts with the end-use consumers. Table 1 following lists the electricity retailers who have contracts with Northpower for line services to supply consumers on the Northpower network and, for completeness, some additional details. Table 1: Electricity Retailers who have contracts with Northpower for line services (Listed in alphabetical order) Retailer Services provided Basis of contract Contract date Body Corporate Power Lines services Model Use of System July 2018 Limited Agreement 2012 Contact Energy Limited Lines services Model Use of System January 2008 Agreement 2005 Ecotricity Limited Lines services Model Use of System September 2015 Agreement 2005 Electric Kiwi Limited -

Extending the Electricity Price Review's

Extending the Electricity Price Review’s Final Recommendations to the Gas Market – Submissions Analysis and Recommendations 8 March 2021 Executive Summary In April 2018, the Government appointed an advisory panel to investigate whether the current electricity market delivers “efficient, fair and equitable prices [to customers]” (Electricity Price Review or EPR). That panel issued its final report in May 2019 (Report). Given the similarities and links between the electricity and natural gas and LPG (Gas) markets1, and Gas Industry Company's (GIC) policy objective “To ensure that gas is delivered to existing and new customers in a safe, efficient, fair, reliable and environmentally sustainable manner”, GIC considers it prudent to consider extending the EPR recommendations to the Gas market. GIC has established a workstream to investigate the application of the 32 EPR recommendations to the Gas market. GIC published a consultation paper on 6 November 2020 (Consultation Paper). Submissions closed on 4 December 2020. GIC received 15 submissions in response to the Consultation Paper. GIC has now reviewed these submissions and has developed a set of recommended next steps. These recommendations are set out in this paper. 1 Both markets referred to from this point as the “Gas market”. 2 Contents EXECUTIVE SUMMARY 2 CONTENTS 3 1. PURPOSE AND PROCESS UPDATE 4 1.1 Purpose 4 1.2 Consultation process update 4 2. SUMMARY OF SUBMISSIONS 5 2.1 Overview 5 2.2 Submission themes 5 3. GIC IMPLEMENTATION RECOMMENDATIONS SNAPSHOT 6 3.1 GIC has updated its EPR recommendations following its analysis of the submissions received 6 3.1.1 Strengthening the consumer voice 6 3.1.2 Reducing energy hardship 6 3.1.3 Increasing retail competition 7 3.1.4 Reinforcing wholesale market competition 7 3.1.5 Improving transmission and distribution 8 3.1.6 Improving the regulatory system 8 3.1.7 Preparing for a Low-Carbon Future 9 4. -

Pwco AR 2004 AW.Id2

ANNUAL REPORT POWERCO HAS GROWN TO BECOME NEW ZEALAND’S LARGEST GAS DISTRIBUTION COMPANY A N D SECOND LARGEST CONTENTS 1 HIGHLIGHTS OF 2003-2004 39 FINANCIAL STATEMENTS 2 FINANCIAL PERFORMANCE AND KEY RATIOS 40 STATEMENT OF FINANCIAL PERFORMANCE 4 CHAIRMAN’S LETTER 40 STATEMENT OF MOVEMENTS IN EQUITY 10 CHIEF EXECUTIVE’S REVIEW 41 STATEMENT OF FINANCIAL POSITION 18 NEW ZEALAND AND AUSTRALIA BUSINESS PROFILES 42 STATEMENT OF CASH FLOWS 20 LINE CHARGES 44 RECONCILIATION OF OPERATING SURPLUS AFTER TAXATION WITH CASH INFLOW FROM OPERATING 21 NEW PRICE REGULATIONS ACTIVITIES 22 NETWORK RELIABILITY 45 STATEMENT OF ACCOUNTING POLICIES 24 FEBRUARY STORMS 47 NOTES TO FINANCIAL STATEMENTS 25 TASMANIAN NETWORK 63 AUDITOR’S REPORT 26 BOARD OF DIRECTORS 64 STATUTORY INFORMATION 28 EXECUTIVE MANAGEMENT TEAM 73 DIRECTORY 30 CORPORATE GOVERNANCE 35 DIRECTORS’ INFORMATION FINANCIAL CALENDAR 18 June 2004 2003-04 final dividend payment Mid December 2004 2003-04 interim dividend payment 29 June 2004 Guaranteed bond interest payment 29 December 2004 Guaranteed bond interest payment 27 July 2004 Shareholders’ annual meeting 22 February 2005 Capital bond interest payment 23 August 2004 Capital bond interest payment 1 March 2005 Redeemable fixed coupon bond 1 September 2004 Redeemable fixed coupon bond interest payment interest payment 29 March 2005 Guaranteed bond interest payment 29 September 2004 Guaranteed bond interest payment This Annual Report is dated 16 June 2004 and is signed on Mid November 2004 2003-04 interim report behalf of the Board by: 22 November 2004 Capital bond interest payment Barry Upson Ian Lobb Chairman Deputy Chairman EBITDA and dividend increased in 2003-04 ELECTRICTY DISTRIBUTOR.