Inspection of EXIM's 2014 Transaction with Kenya Airways

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kenya Airways to Increase Flights to Bujumbura

PRESS RELEASE Kenya Airways to increase flights to Bujumbura Nairobi, 7 May, 2019…. National Carrier, Kenya Airways is pleased to announce an additional daily direct service from Nairobi to Bujumbura, Burundi starting 8 May 2019. The new flight to be operated by Jambojet on a Bombardier Q400 will be a direct flight and is set to reduce waiting times and offer better connections to Kenya Airways growing European and new America service. Kenya Airways Group Managing Director & CEO Sebastian Mikosz said, “This increase to our local and regional Network is part of our strategic intent to expand our footprint across Africa.” The new daily afternoon service will operate between Nairobi and Bujumbura in addition to the current daily tagged morning flight that operates between Nairobi and Bujumbura on the Embraer 190. The additional direct flight to Bujumbura will increase travel and trade amongst East African Community (EAC) countries as the common market protocol is already in place. The protocol has paved way for free movement of labour, goods and services within the region. Route Dep (Local Time) Arr (Local Time) Aircraft Type Date Nairobi - Bujumbura 16:30 17:35 Bombardier Q400 08 May 19 Bujumbura - Nairobi 18:15 21:20 Bombardier Q400 Ends/……. About Kenya Airways Kenya Airways, a member of the Sky Team Alliance, is a leading African airline flying to 53 destinations worldwide, 43 of which are in Africa and carries over four million passengers annually. It continues to modernize its fleet with its 33 aircraft being some of the youngest in Africa. This includes its flagship B787 Dreamliner aircraft. -

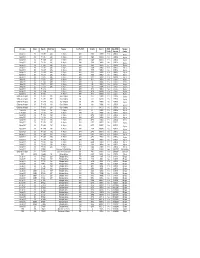

Final AFI RVSM Approvals 05 June 08

Mfr & Type Variant Reg. No. Build Year Operator Acft Op ICAO Serial No Mode S RVSM Date RVSM Operator Yes/No Approval Country Boeing 737 800 7T - VJK 2000 Air Algérie DAH 30203 0A0019 Yes 23/01/02 Algeria Boeing 737 800 7T - VJL 2000 Air Algérie DAH 30204 0A001A Yes 23/01/02 Algeria Boeing 737 800 7T - VJM 2000 Air Algérie DAH 30205 0A001B Yes 23/01/02 Algeria Boeing 737 800 7T - VJN 2000 Air Algérie DAH 30206 0A0020 Yes 23/01/02 Algeria Boeing 737 800 7T - VJQ 2002 Air Algérie DAH 30207 0A0021 Yes 23/01/02 Algeria Boeing 737 800 7T - VJP 2001 Air Algérie DAH 30208 0A0022 Yes 23/01/02 Algeria Boeing 737 600 7T - VJR 2002 Air Algérie DAH 30545 0A0025 Yes 01/06/02 Algeria Boeing 737 600 7T - VJS 2002 Air Algérie DAH 30210 0A0026 Yes 18/06/02 Algeria Boeing 737 600 7T - VJT 2002 Air Algérie DAH 30546 0A0027 Yes 18/06/02 Algeria Boeing 737 600 7T - VJU 2002 Air Algérie DAH 30211 0A0028 Yes 06/07/02 Algeria Airbus 330 202 7T - VJV 2005 Air Algérie DAH 0644 0A0044 Yes 31/01/05 Algeria Airbus 330 202 7T - VJW 2005 Air Algérie DAH 647 0A0045 Yes 05/03/05 Algeria Airbus 330 202 7T - VJY 2005 Air Algérie DAH 653 0A0047 Yes 20/03/05 Algeria Airbus 330 202 7T - VJX 2005 Air Algérie DAH 650 0A0046 Yes 20/03/05 Algeria Boeing 737 800 7T - VKA Air Algérie DAH 34164 0A0049 Yes 23/07/05 Algeria Boeing 737 800 7T - VKB Air Algérie DAH 34165 0A004A Yes 22/08/05 Algeria Boeing 737 800 7T - VKC Air Algérie DAH 34166 0A004B Yes 24/08/05 Algeria Gulfstream Aerospace SP 7T - VPC 2001 Gouv of Algeria IGA 1418 0A4009 Yes 27/07/05 Algeria Gulfstream Aerospace SP -

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

1 Passenger Information on Special Travel Needs Kenya Airways Offers A

Passenger Information on special travel needs Kenya Airways offers a full range of services for our passengers who require special medical assistance on ground or on board. Please read the information below and contact us if you need any of the services outlined here. Reservation requirement Our recommendation is that you make your travel plans early to enable us give you the best service. You are required to declare any medical condition you could be having, at the time of booking your ticket or at least 24 hours before departure. This is because some conditions are aggravated by flying and in order to make your flight comfortable and for us to prepare to handle any complications that may occur during the flight, you need clearance from the KQ Medical team. Medical clearance Medical clearance is required to assess your fitness to fly if you have a medical condition. A medical information form (MEDIF) should be filled by your doctor or the Kenya Airways appointed doctor. It must be signed by you (or your guardian) and your doctor. You are required to have the form filled if: 1. You had recent illness, injury, surgery or hospitalization. 2. You need special services such as - Oxygen supply - stretcher - medical escort/in-flight medical treatment and/or - carriage of medical equipment 3. You are travelling on a medical visa - You can obtain this form from your sales agent, booking office or download it before booking the ticket and have your Doctor fill it. The medical information is handled confidentially. Once completed, the MEDIF must be scanned and sent to the KQ medical team within 24 hours on Doctors.KQ@kenya- airways.com The KQ medical team can also be reached through telephone numbers: +254 738 210065; +254 (20) 6423677/78; +254 (20) 3274747. -

The Best of Air France-KLM in Africa December 2014

The best of Air France-KLM in Africa December 2014 1 Libreville AIRF_1310357 • MASTER Presse Mag UK AF/KLM Afrique • PP • 210 x 297 mm • Visuel : Réseau Afrique ILG • BAG ENJOY THE ENTIRE WORLD DEPARTING FROM AFRICA Thanks to the partnership between AIR FRANCE and KLM along with our SkyTeam partners, we offer one of the largest networks giving you access to over 1000 destinations. AIRF_1310357_AF_KLM_Afrique_UK_210x297_PM_CS3.indd 1 20/11/13 14:14 In Africa, the Air France-KLM Group aims to meet its customers’ expectations by offering them the best of its products and services. NEW TRAVEL CABINS ON BOARD On 4 December 2014, Air France unveils all its new long-haul cabins in Africa for the first time during a special flight from Paris-Charles de Gaulle to Libreville (Gabon). African customers will be able to enjoy a designer suite in La Première or make themselves comfortable in a private cocoon in the sky in Business class. They will also discover the new Premium Economy class, offering 40% more space and the new Economy class, offering optimum travel comfort. As from spring 2015, Libreville as well as Douala (Cameroon) and Malabo (Equatorial Guinea) will be regularly served by Boeing 777 equipped with the Company’s new cabins. Moreover, KLM now offers its new World Business Class to Africa, on flights operated by Boeing 747- 400 between Amsterdam-Schiphol and Nairobi (Kenya). NEW ON THE AIR FRANCE-KLM NETWORK IN AFRICA Since 26 October 2014, Air France has been serving Abidjan by A380, the largest superjumbo in its fleet, with three weekly frequencies. -

Avianca in Brazil

REFERENCE GUIDE 2015 STAR ALLIANCE WELCOMES AVIANCA IN BRAZIL FOR EMPLOYEES OF STAR ALLIANCE MEMBER CARRIERS 18th Edition, July 2015 WELCOME WELCOME TO THE 2015 EDITION OF THE STAR ALLIANCE REFERENCE GUIDE This edition includes baggage, airport and frequent flyer information for our newest member, Avianca in Brazil. Its flights, operated under the Avianca logo and the O6 two-letter code, add new unique destinations in the fast-growing Brazilian market. The addition of Avianca in Brazil brings the Star Alliance membership to 28 airlines. This guide is designed to provide a user-friendly tool that gives quick access to the information needed to deliver a smoother travel experience to international travellers. Information changes regularly, so please continue to consult your airline’s publications and information systems for changes and updates, as well as for operational information and procedures. We welcome your feedback at [email protected]. Thank you, Star Alliance Internal Communications 2 TABLE OF CONTENTS OVERVIEW AIRPORTS INFORMATION 68 Welcome 2 Priority Baggage Handling 69 Greetings from Avianca in Brazil 4 Free Checked Baggage Allowances 70 Vision / Mission 5 Special Checked Baggage 75 Facts & Figures 6 Carry-on Baggage Policy 133 Irregular Operations Handling 134 GENERAL INFORMATION 10 Interline E-Ticketing FAQ - Airports 139 Customer Benefits 11 Frequent Flyer Programmes 15 Reservation Call Centres 19 LOUNGE INFORMATION 141 Reservations Special Service Items 51 Lounge Access 142 Booking Class Alignment 53 Lounge Access Chart 148 Ticketing Procedures 60 Destinations with Lounges 151 Interline E-Ticket FAQ - Reservations 64 GDS Access Codes 67 MAJOR AIRPORT MAPS 173 World Time Zones 254 Star Alliance Services GmbH, Frankfurt Airport Centre, Main Lobby, D-60546 Frankfurt∕Main Vice-President, Director, Internal Editor Layout Photography Corporate Office Communication Garry Bridgewater, Rachel Niebergal, Ted Fahn, British Airports Authority Christian Klick Janet Northcote Sherana Productions Peridot Design Inc. -

Report Afraa 2016

AAFRA_PrintAds_4_210x297mm_4C_marks.pdf 1 11/8/16 5:59 PM www.afraa.org Revenue Optimizer Optimizing Revenue Management Opportunities C M Y CM MY CY CMY K Learn how your airline can be empowered by Sabre Revenue Optimizer to optimize all LINES A ® IR SSO A MPAGNIE S AER CO IEN C N ES N I A D ES A N A T C IO F revenue streams, maximize market share I T R I I O R IA C C A I N F O N S E S A S A ANNUAL and improve analyst productivity. REPORT AFRAA 2016 www.sabreairlinesolutions.com/AFRAA_TRO ©2016 Sabre GLBL Inc. All rights reserved. 11/16 AAFRA_PrintAds_4_210x297mm_4C_marks.pdf 2 11/8/16 5:59 PM How can airlines unify their operations AFRAA Members AFRAA Partners and improve performance? American General Supplies, Inc. Simplify Integrate Go Mobile C Equatorial Congo Airlines LINKHAM M SERVICES PREMIUM SOLUTIONS TO THE TRAVEL, CARD & FINANCIAL SERVICE INDUSTRIES Y CM MY CY CMY K Media Partners www.sabreairlinesolutions.com/AFRAA_ConnectedAirline CABO VERDE AIRLINES A pleasurable way of flying. ©2016 Sabre GLBL Inc. All rights reserved. 11/16 LINES AS AIR SO N C A IA C T I I R O F N A AFRICAN AIRLINES ASSOCIATION ASSOCIATION DES COMPAGNIES AÉRIENNES AFRICAINES AFRAA AFRAA Executive Committee (EXC) Members 2016 AIR ZIMBABWE (UM) KENYA AIRWAYS (KQ) PRESIDENT OF AFRAA CHAIRMAN OF THE EXECUTIVE COMMITTEE Captain Ripton Muzenda Mr. Mbuvi Ngunze Chief Executive Officer Group Managing Director and Chief Executive Officer Air Zimbabwe Kenya Airways AIR BURKINA (2J) EGYPTAIR (MS) ETHIOPIAN AIRLINES (ET) Mr. -

AFRAA Annual Report 2019

IRLINES ASS A PAGNIES O OM AERI C 20N S C EN 19 E N I A D ES A N A T C IO F I T R I I O R IA C C A I N F O N S E S A S A ANNUAL AFRAA REPORT Amadeus Airline Platform Bringing SIMPLICITY to airlines You can follow us on: AmadeusITGroup amadeus.com/airlineplatform AFRAA Executive Committee (EXC) Members 2019 AIR MAURITIUS (MK) RWANDAIR (WB) PRESIDENT OF AFRAA CHAIRPERSON OF THE EXECUTIVE COMMITTEE Mr. Somas Appavou Ms. Yvonne Makolo Chief Executive Officer Chief Executive Officer CONGO AIRWAYS (8Z) KENYA AIRWAYS (KQ) CAMAIR-CO (QC) Mr. Desire Balazire Esono Mr. Sebastian Mikosz Mr. Louis Roger Njipendi Kouotou 1st Vice Chairman of the EXC 2nd Vice Chairman of the EXC Chief Executive Officer Chief Executive Officer Chief Executive Officer ROYAL AIR MAROC (AT) EGYPTAIR (MS) TUNISAIR (TU) Mr. Abdelhamid Addou Capt. Ahmed Adel Mr. Ilyes Mnakbi Chief Executive Officer Chairman & Chief Executive Officer Chief Executive Officer ETHIOPIAN AIRLINES (ET) AIR ZIMBABWE (UM) AIR NAMIBIA (SW) MAURITANIA AIRLINES (L6) Mr. Tewolde GebreMariam Mr. Joseph Makonise Mr. Xavier Masule Mrs. Amal Mint Maoulod Chief Executive Officer Chief Executive Officer Chief Executive Officer Chief Executive Officer ANNUAL REPORT 2019 I Foreword raffic growth in Africa has been consistently increasing since 2011. The demand for air passenger services remained strong in 2018 with a 6.9% year Ton year growth. Those good results were supported by the good global economic environment particularly in the first half of the year. Unlike passenger traffic, air freight demand recorded a very weak performance in 2018 compared to 2017. -

Sabre and South African Airways Sign New Multi-Year Technology Agreement

October 27, 2014 Sabre and South African Airways sign new multi-year technology agreement Airline to make all fares and inventory available in the Sabre travel marketplace JOHANNESBURG, Oct. 27, 2014 /PRNewswire/ -- Sabre Corporation and South African Airways have signed a new multi-year agreement to make the carrier's airfares and inventory available in the Sabre global distribution system. The agreement provides Sabre travel agencies and corporations globally with access to the airline's full range of fares, schedules and availability including published fares sold through the airline's own website and reservations offices. "We have a long and successful partnership with South African Airways to market and sell their products and services, and to support their expansion and growth in new markets," said Greg Webb, president, Sabre Travel Network. "South Africa is an important new market for Sabre and we are especially pleased to renew our agreement at a time we are seeing strong interest from the industry." Sylvain Bosc, chief commercial officer at South African Airways said: "Sabre is an important technology partner for us, which has been strengthened by their launch and growth in South Africa, and across the African continent. Sabre provides us with an easy and efficient way to market and sell our fares the way we want to, and continues to be a very valuable channel for reaching high-yielding corporate travelers." Sabre's travel marketplace plays an important role in facilitating the marketing and sale of airfares, ancillary services, hotel rooms, rental cars, rail tickets and other types of travel, to more than 400,000 travel agents and thousands of corporations who use it to shop, book and manage travel. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010.