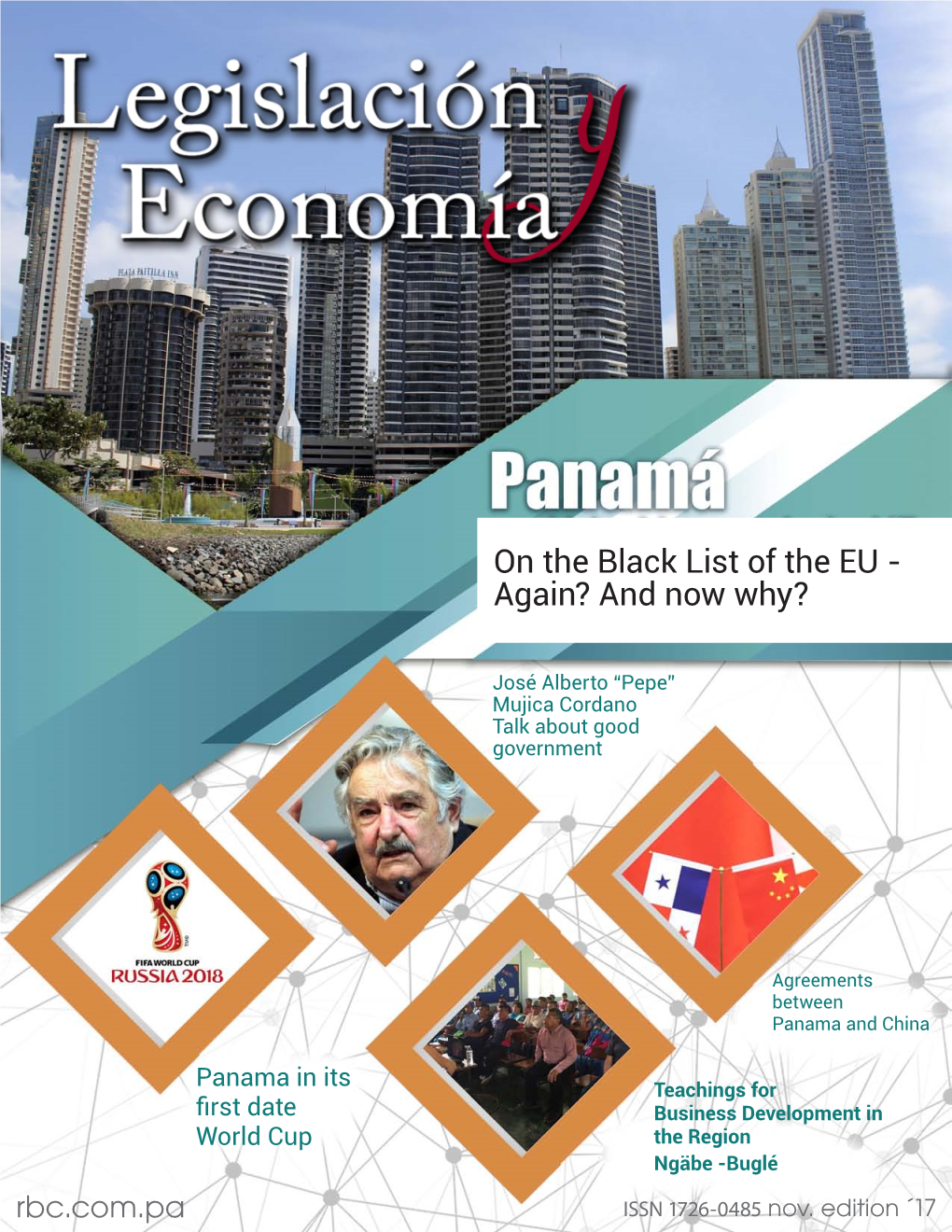

On the Black List of the EU - Again? and Now Why?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

'Asegundan' Alacranes a Matamoros

11012037 09/09/2007 11:38 p.m. Page 1 Goleada: Durango Vizcaya venció 5-0 a 49’s | Pág. 2 Lunes 10 de septiembre de 2007 D Editor: JORGE FERNÁNDEZ VÁZQUEZ Coeditor Gráfico: AXEL VÉLEZ AGUILAR [email protected] CONDICIÓN | CUADRO LAGUNERO NO CONOCE LA DERROTA EN EL APERTURA 2007 Santo desplumadero, humillaron al América Guerreros bailaron ner por Miguel Becerra, quien cumplió cabalmente y bajó el te- 4-0 a las Águilas lón, ante un equipo inoperante en calidad de visitante. anoche en el Corona Las ausencias existentes en ambos equipos por lesión y convo- POR HUMBERTO VÁZQUEZ FRAYRE catorias a la selección, pesaron EL SIGLO DE DURANGO más con los azulcremas, que nun- ca encontraron la brújula y que en TORREÓN, COAH.- En una gran de- base a individualidades, quisieron mostración de futbol y contunden- festejar en la Comarca, algo que cia, Santos Laguna bailó y goleó 4- no pudieron hacer. El clima fue 0 a las Águilas del América, para benévolo con el América, ya que el El agua impidió que el juego entre las seleccio- reafirmarse en el liderato general juego en horario nocturno, tuvo nes de México y Panamá tuviera otros 45 mi- y absoluto del Apertura 2007, en una temperatura agradable. nutos de acción. un pletórico Estadio Corona, que Para la parte complementaria, disfrutó la exhibición brindada el “Flaco” realizó dos movimien- por el conjunto local. tos con la intención de tener ma- Se suspende al La lluvia de goles de los Gue- yor posesión de balón, algo que no rreros, fue convertida por su le- ocurrió, al contrario, le dio mayor gión argentina. -

GULF TIMES Pakistan to Win Over Debutants Ireland SPORT Page 6

FFOOTBALLOOTBALL | Page 3 CCYCLINGYCLING | Page 7 Atletico bid to Mohoric sprints erase pain of to stage 10 fi nals past in win as Yates Marseille clash extends lead Wednesday, May 16, 2018 CRICKET Sha’baan 30, 1439 AH Imam-ul-Haq sees GULF TIMES Pakistan to win over debutants Ireland SPORT Page 6 FOOTBALL / AFC CHAMPIONS LEAGUE Unbeaten Al Duhail storm Duhail join fellow Qatari side Sadd and Iran’s Persepolis and Esteghlal into quarter-fi nals in last eight from West Asia SPOTLIGHT We deserved to qualify for quarters: Sadd’s Bounedjah By Sports Reporter portunities,” added Bounedjah, Doha who himself saw a penalty kick blocked by Ahli goalkeeper Mo- hammed al-Owais, before he was aghdad Bounedjah was able to convert the rebound. relieved that missed “At the end of the day, though, chances did not come we were able to score the two back to haunt Al Sadd goals that mattered and we Bafter the AFC Champions League qualifi ed for the quarter-fi nals. Round of 16 win over Al Ahli on That’s all that matters. We con- Monday. sider this qualifi cation a gift for Bounedjah, the leading scorer the Al Sadd fans after ending the in the tournament, was again season without a title,” the strik- the man of the hour for Al Sadd er added. in their Round of 16 second leg Meanwhile, Al Sadd head against Saudi Arabia’s Al Ahli. coach Jesualdo Ferreira praised The 26-year-old netted his eighth the eff orts of his players. Ferreira and ninth goals of the 2018 AFC said: “We played a great game. -

Elfaro-20100623.Pdf

compás Junio 2010-No.28 JUNTA DIRECTIVA: Rómulo Roux (Presidente) Adolfo Ahumada Marco A. Ameglio S. Rafael E. Bárcenas P. Guillermo O. Chapman, Jr. Nicolás Corcione Ricardo de la Espriella Toral Norberto R. Delgado D. Eduardo A. Quirós B. Alfredo Ramírez, Jr. José A. Sosa A. trayectoria Alberto Alemán Zubieta Administrador travesía puente José Barrios Ng Subadministrador ambiente pág.5-6 Reciclaje en equipo. compás pág.20-21 La selección canalera. Fernán Molinos D. Vicepresidente de Comunicación ampliación pág.7-8 Corporativa Estrecha comunicación. Nubia Aparicio trayectoria pág.22-23 Gerente de Comunicación Un deseo cumplido. Vicente Barletta travesía pág.9-10 Jefe de Redacción Fotógrafos: Viento en popa. Armando De Gracia Nicolás Psomas Bernardino Freire reseña pág.24-25 Lina Cossich puente pág.11-12 Alrededor del Canal. Abdiel Julio Javier Conte La historia de un trotador. Edward Ortiz Diseño y diagramación: brújula pág.26 Giancarlo Bianco Antonio Salado abordaje pág.17-18-19 Panamá, centro mundial. De estudiante a director. [email protected] timón 2014: UN AÑO DE METAS CON LOGROS Cuando en la redacción de El Faro consideramos posibles temas para la portada de la edición de junio, tomamos en cuenta que la atención internacional se concentraría durante este mes en la cita a cumplirse, en Sudáfrica, con la disputa de la Copa del Mundo 2010. Surgió entonces la idea de compartir la celebración invitando a la Selección Nacional de Fútbol de Panamá a visitar la vía interoceánica, y a conocer los avances del Programa de Ampliación. Un encuentro del Canal con la selección “canalera”. La invitación no obedecía exclusivamente a la coincidencia con el mundial de fútbol. -

Probable Lineups a 20 86 17 0 3 1 8 10 17 27 14 6 4 5 21 3 18 6 7

SAN JOSE EARTHQUAKES v LA GALAXY (June 27, Stanford Stadium, 7:30 p.m. PT) 2015 SEASON RECORDS PROBABLE LINEUPS ROSTERS GP W-L-T PTS GF GA S.J. EARTHQUAKES Earthquakes 15 6-5-4 22 16 15 1 David Bingham (GK) at home 6 3-1-2 11 6 3 2 Ty Harden (DF) 3 Jordan Stewart (DF) 1 4 Marvell Wynne (DF) Galaxy 19 7-5-7 28 26 20 Bingham 5 Victor Bernardez (DF) on road 9 0-4-5 5 7 15 6 Shea Salinas (MF) 5 21 7 Cordell Cato (MF) LEAGUE HEAD-TO-HEAD 4 Bernardez Goodson 3 8 Chris Wondolowski (FW) ALL-TIME (57 meetings): 9 Khari Stephenson (MF) Earthquakes 18 wins (1 shootout), 75 goals… Wynne Stewart 10 Matias Perez Garcia (MF) Galaxy 27 wins (4 shootout), 89 goals…Ties 12 27 11 Innocent Emeghara (FW) Alashe 12 Mark Sherrod (FW) AT SAN JOSE (30 meetings): 14 Adam Jahn (FW) Earthquakes 13 wins (1 shootout), 43 goals … 15 JJ Koval (MF) Galaxy 10 wins (2 shootout), 39 goals … Ties 7 17 8 10 6 17 Sanna Nyassi (MF) 18 Tomas Gomez (GK) Nyassi Wondolowski Perez Garcia Salinas LAST YEAR (MLS) 19 Mike Fucito (FW) 6/28: SJ 0, LA 1 (Zardes 61) 20 Shaun Francis (DF) 21 Clarence Goodson (DF) 8/8: LA 2, SJ 2 (Zardes 29; Gonzalez 49 – Wondolowski 18; 14 22 Tommy Thompson (FW) Garcia 31) Jahn 23 Leandro Barrera (MF) 9/14: SJ 1, LA 1 (Wondolowski 66 – Gonzalez 28) 24 Steven Lenhart (FW) 7 11 27 Fatai Alashe (MF) UPCOMING MATCHES 35 Bryan Meredith (GK) EARTHQUAKES GALAXY Keane Zardes 38 Paulo Renato (DF) Sun. -

En China, Una Muralla Para El Real Madrid

10606364 7/26/2005 10:21 AM Page 2 2D |EL SIGLO DE DURANGO | LUNES 25 DE JULIO DE 2005 | DEPORTES EXTENUANTE | ENCUENTRO FINAL DE CERTAMEN DE CONCACAF SE EXTENDIÓ 120 MINUTOS EU conquista la Copa de Oro en penales Panamá padece del “mal” de los 11 metros en el momento decisivo AGENCIAS NUEVA JERSEY, EU.- La selección de Estados Unidos se adjudicó la oc- tava edición de la Copa Oro 2005, tras vencer en penales a Panamá, en el duelo realizado en la cancha Lance Armstrong arriba y abajo de la bicicle- del estadio de los Gigantes de esta ta es un ejemplo a seguir. ciudad, el cual registró casi el lleno. Panamá dejó escapar la opor- tunidad de ganar por primera vez Lance Armstrong, en su historia el título de campeón de la Copa de Oro de la Concacaf; por su parte Estados Unidos con- una leyenda que se quistó su tercer cetro. La selección panameña se pre- sentó por primera vez en el torneo despide en la cumbre de la Confederación Norte, Centro- americana y del Caribe de Futbol AGENCIAS (Concacaf) en más de una década y disputó por primera vez la final de PARIS, FRANCIA.- Durante seis horas, el cirujano la Copa de Oro ante la selección es- extirpó tumores del cerebro de Lance tadounidense, que llegó invicta. Armstrong. Una vez terminada la delicada ope- Panamá se clasificó a la final al ración y los efectos de la anestesia se disipaban, vencer 3-2 a Colombia, mientras el doctor quiso cerciorarse del estado de su pa- que el conjunto de las barras y las ciente preguntándole su nombre. -

Mundial Rusia 2018 Mundial R

24 • JUNIO 21, 2018 MMUNDIALUNDIAL RUSIA 2018 Astoria Dental Group Implantes dentales Transparente Alternativa Periodoncia Odontología cosmética a Los Frenillos Cosmetologia BOTOX Blanqueamiento de dientes Reconstrucción bucal Cosmetologia e implantes Invasalign Odontología general dentales GRATIS REGULAR $500 EXAMEN 10% MENOS $500 MENOS $250 DENTAL Y POR CON RADIOGRAFIAS BLANQUEAMIENTO SU PRIMER SU NUEVO Carmen LLAME PARA DENTAL INVISALIGN Every-Degel UNA CITA IMPLANTE PHILIPS ZOOM DDS CUPON DE DESCUENTO CUPON DE DESCUENTO CUPON DE DESCUENTO CUPON DE DESCUENTO Clifford Degel, DDS Carmen Every-Degel. DDS 718-313-9159 Clifford Degel.DDS 32-17 BROADWAY, ASTORIA • www.smileDr.com Aceptamos la mayoría de planes PANA $UJHQWLQH%DUDQG*ULOO Plantilla de Jugadores • Porteros: • Volantes: Jaime Penedo (Dínamo Bucarest - RUM) Gabriel Gómez (A. Bucaramanga - COL) José Calderón (Chorrillo FC) Aníbal Godoy (San José Alex Rodríguez (San CELEBRA EN BUENOS AIRES TANGO Earthquakes - EE.UU.) EL DIA DE LOS PADRES DOMINGO JUNIO 17 Francisco FC - EE.UU.) Armando Cooper (Universidad DESDE LAS 3.00 PM PLATOS DELICIOSOS, MUSICA EN VIVO,BAILARINES DE TANGO, de Chile - CHI) MUSICA BAILABLE DJ. CUPON • Defensas: SE ACEPTAN RESERVACIONES AL (718)520-6488 GRATIS UN VASO DE SANGRIA CON SU CENA Valentín Pimentel (Plaza Amador) 111-08 Queens Blvd,Forest Hills,NY 11375 DEBE PRESENTAR EL AVISO Adolfo Machado José Luis Rodríguez (Kaa Gent II - BEL) (Houston Dynamo - EE.UU.) Edgar Yoel Bárcenas (Xolos de Tijuana - MEX) THE INKAN Michael Amir Murillo Restaurant & Pisco Bar (NY Red Bull - EE.UU.) • Delanteros: Peruvian Cuisine Felipe Baloy (Municipal - GUA) Blas Pérez (Municipal - GUA) Harold Cummings Luis Tejada (Sport Boys - PER) (San José Earthquakes - EE.UU.) Gabriel Torres (Huachipato - CHI) Fidel Escobar (NY Red Bulls - EE.UU.) Abdiel Arroyo (LD Alajuelense - CR) Román Torres (Seattle Sounders - EE.UU.) Ismael Díaz (Fabril - ESP) Eric Davis (DAC Dunajska Streda - ESL) Luis Ovalle (Olimpia - HON) • Entrenador 22-24 Jericho Tpke., 45-02 23rd. -

2018 | 3:15Am Bst

GLOBAL MACRO RESEARCH | June 11, 2018 | 3:15AM BST 2018 THE WORLD CUP AND ECONOMICS For a list of authors, please see inside Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. The Goldman Sachs Group, Inc. THE WORLD (aCs UselPect2ed0 by1 y8ou!D) REAM TEAM Keeper: Toni Kroos (GER): David de Gea (ESP): The German outperformed his The Manchester United keeper club teammate Luka Modric by has dethroned Manuel Neuer only 25 votes and N’Golo Kante between the sticks in the latest by 35 votes and will act as edition of the Dream Team with holding midfielder for the team. 45% of the votes, 15% more David de Gea than the German. (ESP) Philippe Coutinho Manchester United (BRA): Defence: Thanks to a strong season, first Joshua Kimmich (GER): at Liverpool and then Marcelo The promising Bayern Munich Joshua Kimmich Barcelona, the Brazilian (GER) (BRA) defender replaces Dani Alves Bayern Munich Real Madrid squeaks into the Dream Team Sergio Ramos Mats Hummels at right-back: time to make (ESP) (GER) ahead of Paul Pogba of France. way for the young! Real Madrid Bayern Munich Attack: Sergio Ramos (ESP): Lionel Messi (ARG): The only defender to keep his As in 2010 and 2014, the slot from the 2014 team. The Kevin De Bruyne Toni Kroos Argentinian is again the top (BEL) (GER) experienced Spaniard was the Manchester City Real Madrid pick among clients. -

2018 World Cup Prizm Soccer Checklist

2018 World Cup Prizm Soccer Checklist by Country 39 Countries; 30 with Autographs; 9 Without Autographs; Green = Autograph Card Player Set Country Print Run # Angel Di Maria Base Set + Prizm Parallels 2 Argentina ?? Team/Country Card Insert - Group Stage 4 Team Quad 4 Argentina ?? Team/Country Card Insert - Group Stage 4 Team Quad Prizm Parallels 4 Argentina 31 Team/Country Card Insert - World Cup Champions 8 Argentina ?? Team/Country Card Insert - World Cup Champions 10 Argentina ?? Team/Country Card Insert - World Cup Champions Prizms Parallels 8 Argentina 31 Team/Country Card Insert - World Cup Champions Prizms Parallels 10 Argentina 31 Diego Maradona Auto - Dual Player Signatures + Prizm Parallels 17 Argentina 76 Diego Maradona Auto - Quad Player Signatures + Prizm Parallels 4 Argentina 51 Diego Maradona Auto - Signature Moments 5 Argentina ?? Diego Maradona Auto - Signature Moments Prizm Parallels 5 Argentina 36 Diego Maradona Auto - Signatures 3 Argentina ?? Diego Maradona Auto - Signatures Prizm Parallels (Except Blue Shimmer) 3 Argentina 36 Diego Maradona Auto - Signatures Prizms Blue Shimmer 3 Argentina ?? Diego Maradona Auto - Trio Player Signatures + Prizm Parallels 9 Argentina 61 Enzo Perez Base Set + Prizm Parallels 12 Argentina ?? Ever Banega Base Set + Prizm Parallels 4 Argentina ?? Gabriel Batistuta Auto - Quad Player Signatures + Prizm Parallels 4 Argentina 51 Gabriel Batistuta Auto - Signatures 4 Argentina ?? Gabriel Batistuta Auto - Signatures Prizm Parallels (Except Blue Shimmer) 4 Argentina 36 Gabriel Batistuta Auto -

Group G World Cup Overview

FIRSTTOUCH WORLD CUP OVERVIEW Focus: Group G BELGIUM PANAMA TUNISIA ENGLAND CONTENTS BELGIUM PANAMA pg.3 pg.5 NARRATIVE NARRATIVE COACH: Roberto Martinez COACH: Hernán Darío Gómez CAPTAIN: Eden Hazard (MD) CAPTAIN: Roman Torres (CB) COUNTRY PROFILE COUNTRY PROFILE X-FACTOR: Kevin De Bruyne X-FACTOR: Luis Tejada TOP U23 PLAYER: Youri Tielemans TOP U23 PLAYER: José Luis Rodríguez HOW WILL THEY PLAY? HOW WILL THEY PLAY? PROJECTED LINE-UP PROJECTED LINE-UP BREAKDOWN BREAKDOWN TUNISIA ENGLAND pg.7 pg.9 NARRATIVE NARRATIVE COACH: Nabil Maâloul COACH: Gareth Southgate CAPTAIN: Wahbi Khazri (MD) CAPTAIN: Harry Kane (ST) COUNTRY PROFILE COUNTRY PROFILE X-FACTOR: Wahbi Khazri X-FACTOR: Harry Kane TOP U23 PLAYER: Bassem Srarfi TOP U23 PLAYER: Dele Alli HOW WILL THEY PLAY? HOW WILL THEY PLAY? PROJECTED LINE-UP PROJECTED LINE-UP BREAKDOWN BREAKDOWN Powered by FIRSTTOUCH F I R S T T O U C H | P A G E 2 WORLD CUP 2018 GROUP G BELGIUM The Red Devils squad boasts of top quality players, with many of them plying their trade in the acclaimed English Premier League. They powered to Russia finals by claiming top spot of Europe’s Group H, finishing the qualifying campaign unbeaten. Their 3rd place global ranking tells you a lot about how much potential they have to win the tournament - both experience and talent. They play entertaining attacking football, scoring goals for fun but are still without any major trophy. They have won nothing. Many people have dubbed them perennial underachievers and what surprises many is that they seem to have it and yet have nothing-quality in all the right areas, from Thibaut Courtois to Toby Alderweireld and Eden Hazard. -

Page 01 June 13.Indd

ISO 9001:2008 CERTIFIED NEWSPAPER Thursday 13 June 2013 4 Shaaban 1434 - Volume 18 Number 5729 Price: QR2 Tasweeq, Pearl Ibra steers load first GTL Sweden jet fuel cargo to victory Business | 17 Sport | 26 www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 4455 7741 | Advertising: 4455 7837 / 4455 7780 Dusty weather to continue Erdogan open to vote Qatar bourse on park development ANKARA: Turkish Prime Minister Recep Tayyip Erdogan yesterday said he would con- sider holding a referendum on plans to redevelop shoots up on an Istanbul park that have sparked nationwide protests, in his first major concession in nearly two weeks of anti-government unrest. “We might put it to a referendum.... In democ- racies only the will of the people counts,” said MSCI upgrade Huseyin Celik, a spokesman for Erdogan’s rul- ing Justice and Development Party after talks between Erdogan and protest leaders. “We think Index at highest point since 2008 that after this gesture of goodwill people will decide to go home.” BY SATISH KANADY made by Qatar Exchange over The gesture came as thousands gathered in the past years to meet the MSCI the city’s Taksim Square, next to Gezi Park, for DOHA: Qatar’s stock mar- requirements, in terms of the a 13th evening of demonstrations. The mood was ket jumped to its highest level development of the market infra- subdued and peaceful, in stark contrast to the since September 2008 yesterday structure and the implementation previous night when protesters fought running after an upgrade to emerging of a number of important projects battles with riot police. -

Deportistas Boricuas Recaudan Dinero Para Damnificados Del Huracán María

Deportes noticiali.com p.27 I 27 de Septiembre al 3 de Octubre 2017 Deportistas boricuas recaudan dinero para damnificados del huracán María EL PEOR DESASTRE DE LA HISTORIA El gobernador de Puerto Rico, Ricardo Rosselló, dijo que en lo que a daños materiales se refiere, el paso del huracán María por la isla, “es la mayor catástrofe en su historia moderna”. Toletero Carlos Correa brinda su apoyo. interesados en ayudar pueden hacerlo enviando el mensaje STORM mediante de los Angelinos de Los Ángeles, Martín mensaje de texto al 51555. Maldonado, su contraparte con los Indios de n grupo de peloteros y deportistas los Cardenales de San Luis, abrieron una Hernández, en tanto, abrió la Cleveland, Roberto Pérez, y el campocorto puertorriqueños se unió para cuenta en el Banco Popular (cuenta número “microfinanciación (colectiva)” YouCaring. Francisco Lindor. U recolectar dinero para las personas 203393960, con número de ruta 021502011) com para recolectar 100.000 dólares. Asimismo, la tenista Mónica Puig, damnificadas en la isla tras el reciente paso para recolectar fondos para el pueblo madalla de oro de los Juegos Olímpico del huracán María. puertorriqueño. Más Solidaridad de Río 2014, arrancó una campaña de Yadier Molina, Carlos Correa y Enrique “Por favor, Puerto Rico necesita su recaudación de fondos para sus compatriotas “Kike” Hernández son parte de los toleteros ayuda. Cualquier cantidad que usted pueda Además, el ex receptor de los Yankees de damnificados en el portal YouCaring.com. boricuas que han creado cuentas de banco donar será bien recibido”, escribió Molina en Nueva York, Jorge Posada, solicitó que las Puig estableció una meta de 100.000 o “crowdfundings” para recoger la mayor su cuenta de Instagram. -

P20 Layout 1

Piercy breezes Liverpool defeat to16 victory Adelaide19 TUESDAY, JULY 21, 2015 Outplayed and out-fought, England face selection headache Page 17 EAST RUTHERFORD: Mexico’s goalkeeper Guillermo Ochoa (13) stops a shot on goal by Costa Rica’s Joel Campbell (12) during the extra time period of a CONCACAF Gold Cup soccer match. —AP Mexico, Panama in Gold Cup semis EAST RUTHERFORD: Mexico and Panama American regional football championship when event for Costa Rica, which reached the World Cup Jones and Radanfah Abu Bakr answered to keep Penedo then went back inside the woodwork advanced to a Gold Cup semi-final showdown with they meet again on Wednesday in Atlanta. quarter-finals last year in Brazil. Trinidad and Tobago going. and dove to his left on Peltier’s shot. Penedo lifted triumphs Sunday, one thanks to a dramatic save That winner earns a berth in next Sunday’s final Costa Rica coach Paulo Wanchope said he did Marvin Phillip saved the seventh-round shot of his right hand and deflected the ball off the cross- and the other on a penalty kick after a controversial at Philadelphia against the winner of Wednesday’s not feel as if his job was in jeopardy after the defeat. Alberto Quintero to put the Canaleros on the edge bar and out, dooming the Soca Warriors’ dreams of call. other semi-final between Jamaica and holders “I do not feel out of the team by being eliminated,” of elimination but Trinidad and Tobago’s Daneil matching their Cup-best run by reaching the 2000 Mexican captain Andres Guardado scored the United States.