Municipal District Profiles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rodeo Program Canadian Senior Pro Rodeo COCHRANE-1SAT Cochrane 05/18/2019

Rodeo Program Canadian Senior Pro Rodeo COCHRANE-1SAT Cochrane 05/18/2019 BARREL RACING 40-49 CALF ROPING 50-59 Contestant City Back # Contestant City Back # 1 APRIL HEEG ACADIA VALLEY, AB 0 1 DUANE GANSKE WETASKIWIN, AB 0 2 TASHA TURNER CALGARY, AB 0 2 MANERD BIRD NANTON, AB 0 3 JULIE BLAND CALGARY, AB 0 3 HAROLD WRIGHT LUNDBRECK, AB 0 4 DONALEE FERGUSON MUNSONAB, AB 0 4 DEAN PEROZAK LETHBRIDGE 0 5 RITA ARTEMENKO WESTLOCK, AB 0 5 CRAIG FITZPATRICK OKOTOKS, AB 0 6 JENNIFER PETERS SUNDRE, AB 0 6 DARYL SUTCLIFF NANTON, AB 0 7 NIKI MAKOFKA PONOKA, AB 0 7 LYLE KATHREIN CLARESHOLM, AB 0 8 NIKKI HOLMES CALGARY, AB 0 8 KELLY CREASY MEDICINE HAT, AB 0 9 ANGIE THOMSON BIG VALLEY, AB 0 9 LYNN TURCATO TABER, AB 0 10 HEATHER PARSONS LOCAL ENTRY, 0 10 VAUGHN STEWART DEWINTON, AB 0 11 KELLY MOYNIHAN BANFF, AB 0 CALF ROPING 60+ BARREL RACING 50-59 Contestant City Back # Contestant City Back # 1 NEIL HOWARD OKOTOKS, AB 0 1 MADELAINE KIMMERLY NANTON, 0 2 LONNY OLSON PONOKA, AB 0 2 TRISH BROWN CALGARY, AB 0 3 KENT MOSHER AUGUSTA, MT 0 3 NADENE ADIE ROCKY VIEW 0 4 DOUG SHIPTON REDMOND, OR 0 4 VAL NELSON COCHRANE, AB 0 5 LORNE LAUSEN STRATHMORE, AB 0 5 RHONDA HENRY GLEICHEN, AB 0 6 GUY PEROZAK CLARESHOLM, AB 0 6 THERESA OLDFORD WINFIELD, AB 0 7 GLEN ADIE ROCKY VIEW 0 7 ANNETTE MCCAUGHAN BRANT, AB 0 8 ROGER GUNSCH THORSBY, AB 0 8 CAROLINE HEFFERNAN CARSELAND, AB 0 9 EVERETT MORTON DEL BONITA, AB 0 9 TAMMY SCHUURMAN DIAMOND CITY, AB 0 10 NEIL WATT CLARESHOLM, AB 0 10 ROSE PEROZAK CLARESHOLM, AB 0 CALF ROPING 68+ 11 CONNIE LEMOINE AIRDRIE, AB 0 Contestant City -

BE IDENTIFIABLE 1 Circlededicated to Raising Quality Charolais CEE Cattle Since

Membership2018-2020 Directory BE IDENTIFIABLE 1 CIRCLEDedicated to Raising Quality Charolais CEE Cattle Since... www.circlecee.com 1971 Bulls Available By Private Treaty Off the Farm! CIRCLE CEE CHAROLAIS The Program You Can Depend On! THE CHOLAK FAMILY | LAMONT, ALBERTA | SSCHOLAK@S HAW.CA Stephen & Deb Cholak - 780-485-7865 | Frank & Elly Cholak - 780-796-2108 2 Welcome Charolais Enthusiasts! Dedicated to Raising Quality Charolais Cattle Since... On behalf of the Alberta Charolais Association Board of Directors and over 210 active CIRCLE CEE Charolais Breeders in the beautiful provinces of British Columbia and Alberta, I would like to welcome you to browse the pages of our Breeders Directory. Thanks to the support of these breeders we have a current snapshot of the operations taking our breed and the entire cattle www.circlecee.com industry into the future. We hope that the information is presented in a readable, easily 1971 accessible format that you will find useful in your next search for Charolais genetics. The Charolais breed has a proven, consistent track record of performance in the feedlot which is only gaining momentum. Charolais influenced calves are simply making cow-calf producers and feedlot owners more money. We are truly the “Identifiable” breed and believe our influence will continue as long as we continue to stay focused on the long term goal of the beef industry – profitability. The Alberta Charolais Association hosts a few key events during the year. In late June we annually host a Breeder’s tour where breeders are showcased in various regions of the two provinces. This complimentary tour has attracted over 200 enthusiasts the past 3 years and is a no miss event. -

Maskwacis Life Skills Training Program

Using Outcome Mapping to Evaluate a Culturally Adapted Prevention Program in an Indigenous Community Melissa Tremblay1, Natasha Rabbit2, Lola Baydala1, Jennilee Louis2, & Kisikaw Ksay-yin2 University of Alberta; Edmonton, Alberta Nehiyaw Kakeskewina Learning Society; Maskwacis, Alberta Faculty/Presenter Disclosure • Dr Lola Baydala, Kisikaw Ksay-yin, Natasha Rabbit and Melissa Tremblay have no relevant financial relationships with the manufacturer(s) of commercial services discussed in this CME activity • The authors do not intend to discuss an unapproved/ investigative use of a commercial product/device in this presentation Outline • Context and Project background • Outcome Mapping • Stages • Highlights of OM findings • Next steps • Conclusions Canadian Context Employment and Social Exclusion social safety net Access to health Housing and care services food security Aboriginal status Education and colonialism Project Background Maskwacis Project Background • Maskwacis First Nations communities – Recognized need for prevention • Partnership – Members of the Maskwacis Four Nations and University of Alberta researchers • Community-based participatory research (CBPR) – Equitable involvement – Collaboration and co-learning – Aim for social change Maskwacis Life Skills Training Program • Started with the evidence-based LST program • Gilbert Botvin, Cornell University • Partners worked together to culturally adapt, implement and evaluate the program Maskwacis Life Skills Training Program • Delivered in the Four Nations schools by community -

County of Stettler No. 06

AAAF SPRING FORUM 2012 AGRICULTURAL FIELDMAN’S DIRECTORY –CURRENT TO April 25, 2012 SOUTH REGION M.D. of Acadia Rick Niwa (AF) Office: (403) 972-3808 Box 30, Acadia Valley Shop: (403) 972-3755 T0J 0A0 Fax: (403) 972-3833 Cell: (403) 664-7114 email [email protected] Cardston County Rod Foggin (AF) Ph: (403) 653-4977 Box 580, Cardston Stephen Bevans (AAF) Fax: (403) 653-1126 T0K 0K0 Cell: (403) 382-8236 (Rod) (403) 634-9474 email: [email protected] [email protected] Municipality of Crowsnest Pass Kim Lutz (AF) Ph: (403)-563-8658 Mail: email: [email protected] Box 600 Crowsnest Pass, AB T0K 0E0 Office: Room 1, MDM Community Center 2802 - 222 Street Bellevue, AB Cypress County Jason Storch (AF) Director Ph: (403) 526-2888 816 2nd Ave, Dunmore Christina Barrieau (AAF) Fax: (403) 526-8958 T1B 0K3 email : [email protected] [email protected] M.D. of Foothills Ron Stead (AF) Ph: (403) 603-5410 (Ron) Box 5605, High River Bree Webb (AAF) Shop: (403) 652-2423 (Bree) T1V 1M7 ext 5446 Fax : (403) 603-5414 email : [email protected] [email protected] County of Forty Mile Dave Matz (AF) Phone (403) 867-3530 Box 160, Foremost Vacant (AAF) fax (403) 867-2242 T0K 0X0 Kevin Jesske (Fieldman’s Asst.) cellular (403) 647-8080 (Dave) email [email protected] [email protected] Lethbridge County Don Bodnar (AF) Ph: (403) 328-5525 905-4th Ave. South Gary Secrist (AAF) shop: (403) 732-5333 Lethbridge T1J 4E4 Terry Mrozowich Fax: (403) 732-4328 Cell : (403) 634-0713 (Don) (403) 634-0680 (Gary) email : [email protected] [email protected] County of Newell Todd Green (AF) Office: (403) 362-2772 Box 130, Brooks Holly White (AAF/Rural Cons. -

A Community-University Approach to Substance Abuse Prevention Lola Baydala University of Alberta

Journal of Community Engagement and Scholarship Volume 9 | Issue 1 Article 9 May 2016 A Community-University Approach to Substance Abuse Prevention Lola Baydala University of Alberta Fay Fletcher University of Alberta Melissa Tremblay University of Alberta Natasha Rabbit Nehiyaw Kakeskewina Learning Society Jennilee Louis Nehiyaw Kakeskewina Learning Society See next page for additional authors Follow this and additional works at: https://digitalcommons.northgeorgia.edu/jces Recommended Citation Baydala, Lola; Fletcher, Fay; Tremblay, Melissa; Rabbit, Natasha; Louis, Jennilee; Ksay-yin, Kisikaw; and Sinclair, Caitlin (2016) "A Community-University Approach to Substance Abuse Prevention," Journal of Community Engagement and Scholarship: Vol. 9 : Iss. 1 , Article 9. Available at: https://digitalcommons.northgeorgia.edu/jces/vol9/iss1/9 This Article is brought to you for free and open access by Nighthawks Open Institutional Repository. It has been accepted for inclusion in Journal of Community Engagement and Scholarship by an authorized editor of Nighthawks Open Institutional Repository. A Community-University Approach to Substance Abuse Prevention Authors Lola Baydala, Fay Fletcher, Melissa Tremblay, Natasha Rabbit, Jennilee Louis, Kisikaw Ksay-yin, and Caitlin Sinclair This article is available in Journal of Community Engagement and Scholarship: https://digitalcommons.northgeorgia.edu/jces/vol9/ iss1/9 Baydala et al.: A Community-University Approach to Substance Abuse Prevention A Community-University Approach to Substance Abuse Prevention Lola Baydala, Fay Fletcher, Melissa Tremblay, Natasha Rabbit, Jennilee Louis, Kisikaw Ksay-yin, and Caitlin Sinclair Abstract In response to high rates of substance abuse in their communities, members of the Maskwacis four Nations invited university researchers to partner in culturally adapting, implementing, and evaluating an evidence-based substance abuse and violence prevention program, the Life Skills Training program (Botvin & Griffin, 2014). -

Syncrude Pathways 2015

ISSUE NO VI · SYNCRUDE CANADA LTD. ABORIGINAL REVIEW 2015 Truth and Veteran Nicole Astronomer Firefighter NHL Reconciliation welder Bourque- shares Cynthia player Jordin Commission Joe Lafond Bouchier’s Aboriginal Courteoreille Tootoo scores recommendations saves horses family ties perspectives blazes new trails in life 08 14 24 26 30 38 Welcome There are many different pathways to success. It could these stories and connects with First Nations and Métis be sculpting a work of art, preparing dry fish and listening people making positive contributions in their communities, to the wisdom of Elders. It could be studying for certification, bringing new perspectives to the table and influencing a college diploma or university degree. Or it could be change in our society. volunteering for a local not-for-profit organization. Join us as we explore these many diverse pathways There is no end to the remarkable successes and and learn how generations young and old are working accomplishments among Aboriginal people in our region, to make a difference. our province and across our country. Pathways captures THE STORIES in Pathways reflect the six key commitment areas of Syncrude’s Aboriginal Relations BUSINESS EMPLOYMENT program: Business Development, Wood Buffalo is home to some of the As one of the largest employers of Community Development, Education most successful Aboriginal businesses Aboriginal people in Canada, Syncrude’s and Training, Employment, the in Canada. Syncrude works closely goal is to create opportunities that Environment, and Corporate with Aboriginal business owners to enable First Nations, Métis and Inuit Leadership. As a representation identify opportunities for supplying people to fully participate in of our ongoing work with the local goods and services to our operation. -

Since 1985, Stars Has Flown Nearly 40,000 Missions Across Western Canada

Alberta + British Columbia | 2017/18 Missions SINCE 1985, STARS HAS FLOWN NEARLY 40,000 MISSIONS ACROSS WESTERN CANADA. Alberta Airdrie 4 Alberta Beach 1 Alder Flats 1 Aldersyde 1 Alexander FN 1 Alexis Nakota Sioux Nation 2 Alix 1 Athabasca 14 Atikameg 5 Balzac 1 Banff 24 Barrhead 16 Bassano 10 Bawlf 1 Beaumont 2 Beaverlodge 7 Beiseker 3 Bentley 2 Berwyn 1 Bezanson 7 Black Diamond 14 Blairmore 10 Bluesky 1 Bonanza 1 Bonnyville 17 Bow Island 2 Bowden 2 Boyle 9 Bragg Creek 5 Breton 1 Brooks 29 Buck Lake 1 Cadotte Lake 4 Calahoo 2 Calgary 9 Calling Lake 1 Calmar 1 Camrose 42 Canmore 13 Cardston 1 Carmangay 2 Caroline 4 Carseland 2 Carstairs 6 Castor 4 Chestermere 2 Claresholm 15 Cochrane 6 Cold Lake 18 Consort 1 Cooking Lake 1 Coronation 1 Cremona 6 Crossfield 4 Darwell 1 Daysland 6 De Winton 1 Debolt 7 Demmitt 1 Devon 1 Didsbury 11 Donnelly 2 Drayton Valley 14 Driftpile FN 2 Drumheller 18 Eaglesham 1 Eden Valley 1 Edmonton 5 Edson 16 Elk Point 10 Evansburg 2 Exshaw 3 Fairview 7 Falher 3 Fawcett 1 Flatbush 2 Fort Macleod 8 Fort McMurray 1 Fort Saskatchewan 5 Fox Creek 9 Frog Lake 1 Gibbons 1 Gift Lake 1 Girouxville 1 Gleichen 8 Goodfish Lake 3 Grande Cache 20 Grande Prairie 17 Grimshaw 7 Grovedale 18 Gull Lake 1 Hanna 8 Hardisty 4 Hay Lakes 2 High Prairie 15 High River 20 Hines Creek 2 Hinton 20 Horse Lake FN 2 Hussar 1 Hythe 7 Innisfail 15 Jasper 7 Kananaskis Village 6 Kathyrn 1 Killam 2 Kinuso 2 La Glace 1 Lac La Biche 5 Lacombe 6 Lake Louise 10 Lamont 5 Langdon 1 Leduc 3 Legal 1 Lethbridge 55 Little Buffalo 1 Little Smoky 1 Lloydminster -

2020 Alberta Highways Historical ESAL Report

ALBERTA HIGHWAY HISTORICAL ESAL REPORT 2020 Alberta Transportation Produced: 24-Feb-2021 By CornerStone Solutions Inc. Length ESAL / Day / Dir Hwy CS TCS Muni From To in Km WAADT 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 1 2 4 Bigh BANFF PARK GATE W OF 1A NW OF CANMORE WJ 3.777 19480 1830 2220 2140 1760 1710 1600 1470 1370 1610 1550 1550 1530 1370 1400 1 2 8 Bigh E OF 1A NW OF CANMORE WJ W OF 1A S OF CANMORE EJ 4.741 18030 1730 2050 1980 1730 1690 1590 1620 1530 1570 1500 1250 1230 1140 1160 1 2 12 KanC E OF 1A S OF CANMORE EJ W OF 1X S OF SEEBE 23.165 20220 1890 2050 1980 1680 1660 1570 1510 1420 1810 1730 1680 1660 1700 1710 1 2 16 KanC E OF 1X S OF SEEBE KANANASKIS RIVER 0.896 20820 2510 2750 2650 2360 2350 2240 2080 1970 2050 1960 1960 1920 2110 2110 1 2 BANFF PARK GATE KANANASKIS RIVER 32.579 19832 1870 2090 2010 1720 1690 1590 1530 1440 1750 1670 1600 1580 1590 1600 1 4 4 Bigh KANANASKIS RIVER W OF 40 AT SEEBE 3.228 20820 1960 2140 2070 1820 1810 1720 1600 1510 1630 1560 1560 1530 1520 1530 1 4 8 Bigh E OF 40 AT SEEBE E BDY STONY INDIAN RESERVE 22.296 22610 2310 2470 2380 2310 2310 2230 2070 1960 1980 1650 1650 1580 1270 1230 1 4 KANANASKIS RIVER E BDY STONY INDIAN RESERVE 25.524 22384 2260 2430 2340 2240 2240 2160 2010 1900 1940 1640 1630 1570 1300 1270 1 6 4 Rkyv E BDY STONY INDIAN RESERVE W OF JCT 68 3.166 21830 1860 1990 1920 2040 2040 1950 1810 1710 2140 2040 2030 1970 2250 2250 1 6 8 Rkyv E OF JCT 68 W OF 22 S OF COCHRANE 17.235 22340 2330 2410 2330 2520 2530 2640 2490 2360 2410 2010 2000 1960 1880 1800 1 6 E BDY STONY INDIAN RESERVE W OF 22 S OF COCHRANE 20.401 22261 2250 2360 2280 2450 2450 2540 2390 2260 2360 2010 2000 1950 1930 1880 1 8 4 Rkyv E OF 22 S OF COCHRANE W OF 563 W OF CALGARY 11.441 26100 1730 1960 1630 1610 1570 1550 1380 1300 1160 1110 1100 1060 1020 1010 1 8 8 Rkyv E OF 563 W OF CALGARY CALGARY W.C.L. -

Fish Stocking Report, 2020 (Final)

Fish Stocking Report 2020 (Final) Fish stocking managed by the Government of Alberta and the Alberta Conservation Association Updated February 18, 2021 Notes There are no cutthroat trout stocked in the 2020 stocking season, as we will not be operating the Job Lake spawn camp due to COVID-19 restrictions. Average Length = adult fish stocked. Reference Species Stocked Strains Stocked Ploidy Stocked ARGR = Arctic Grayling BEBE = Beity x Beity TLTLJ = Trout Lodge / Jumpers 2N = diploid BKTR = Brook Trout BRBE = Bow River x Beity TLTLK = Trout Lodge / Kamloops 3N = triploid BNTR = Brown Trout CLCL = Campbell Lake TLTLS = Trout Lodge / Silvers AF2N = all female diploid CTTR = Cutthroat Trout JLJL = Job Lake AF3N = all female triploid RNTR = Rainbow Trout LYLY = Lyndon TGTR = Tiger Trout PLPL = Pit Lakes For further information on Fish Stocking visit: https://mywildalberta.ca/fishing/fish-stocking/default.aspx ©2021 Government of Alberta | Published: February 2021 Page 1 of 24 Waterbody Waterbody ATS Species Strain Genotype Average Number Stocking Official Name Common Name Length Stocked Date (2020) ALFORD LAKE SW4-36-8-W5 RNTR Campbell Lake 3N 18 3000 18-May-20 BEAR POND NW36-14-4-W5 RNTR Trout Lodge/Jumpers AF3N 19.7 750 22-Jun-20 BEAUVAIS LAKE SW29-5-1-W5 RNTR Trout Lodge/Jumpers AF3N 16.3 23000 11-May-20 BEAVER LAKE NE16-35-6-W5 RNTR Trout Lodge/Jumpers AF3N 21.3 2500 21-May-20 BEAVER LAKE NE16-35-6-W5 TGTR Beitty/Bow River 3N 16.9 500 02-Sep-20 BEAVER LAKE NE16-35-6-W5 TGTR Beitty/Bow River 3N 20 500 02-Sep-20 BEAVER MINES LAKE NE11-5-3-W5 -

Final-Alberta-Loss-Factors-For-2009

2009 Loss Factors TABLE OF CONTENTS 1.0 PURPOSE ................................................................................................. 3 2.0 INTRODUCTION ....................................................................................... 3 3.0 2009 LOSS FACTORS.............................................................................. 3 4.0 2009 AND 2008 LOSS FACTORS CALCULATION ................................. 6 5.0 2009 OVERALL LOSS FACTOR RESULTS ............................................ 8 6.0 LOSS FACTOR MAP ................................................................................ 9 7.0 CONCLUSION........................................................................................... 9 APPENDIX I. CASE COMPARISON .................................................................... 10 ii Alberta Electric System Operator 2009 Loss Factors 1.0 Purpose The purpose of this document is to present the 2009 loss factors complete with a brief explanation of changes. A loss factor map is included. The loss factors published in this document will be effective from January 01, 2009 to December 31, 2009. 2.0 Introduction The AESO has completed the final analysis of 2009 loss factors and the results are attached. The analysis includes the application of the 2009 Generic Stacking Order (GSO) results published earlier this summer and the 2009 Base Cases published in October on the AESO web site. Both the GSO and the Base Cases have been updated during the course of the final calculations and reposted. The requirements -

Specialized and Rural Municipalities and Their Communities

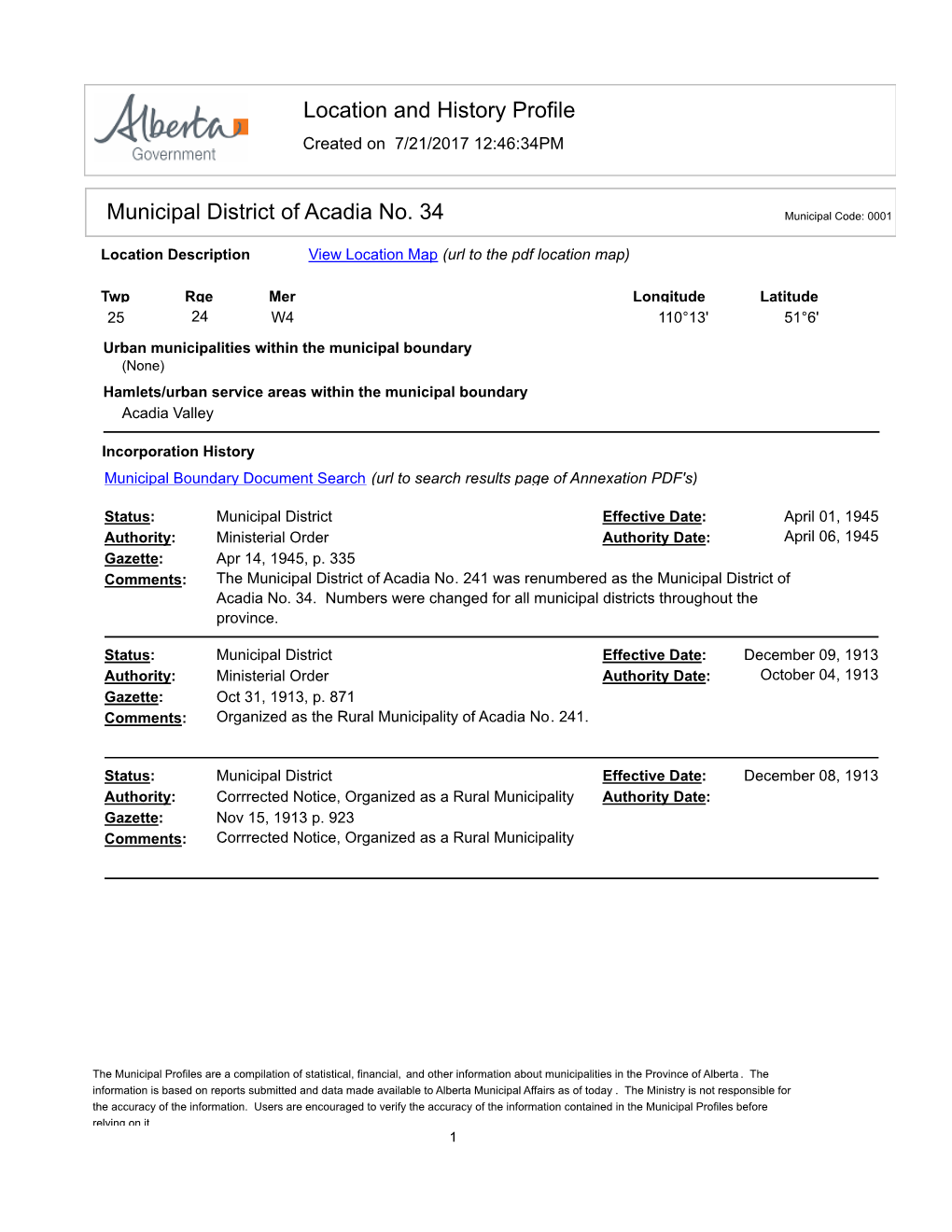

Specialized and Rural Municipalities and Their Communities Updated December 18, 2020 Municipal Services Branch 17th Floor Commerce Place 10155 - 102 Street Edmonton, Alberta T5J 4L4 Phone: 780-427-2225 Fax: 780-420-1016 E-mail: [email protected] SPECIALIZED AND RURAL MUNICIPALITIES AND THEIR COMMUNITIES MUNICIPALITY COMMUNITIES COMMUNITY STATUS SPECIALIZED MUNICIPALITES Crowsnest Pass, Municipality of None Jasper, Municipality of None Lac La Biche County Beaver Lake Hamlet Hylo Hamlet Lac La Biche Hamlet Plamondon Hamlet Venice Hamlet Mackenzie County HIGH LEVEL Town RAINBOW LAKE Town Fort Vermilion Hamlet La Crete Hamlet Zama City Hamlet Strathcona County Antler Lake Hamlet Ardrossan Hamlet Collingwood Cove Hamlet Half Moon Lake Hamlet Hastings Lake Hamlet Josephburg Hamlet North Cooking Lake Hamlet Sherwood Park Hamlet South Cooking Lake Hamlet Wood Buffalo, Regional Municipality of Anzac Hamlet Conklin Hamlet Fort Chipewyan Hamlet Fort MacKay Hamlet Fort McMurray Hamlet December 18, 2020 Page 1 of 25 Gregoire Lake Estates Hamlet Janvier South Hamlet Saprae Creek Hamlet December 18, 2020 Page 2 of 25 MUNICIPALITY COMMUNITIES COMMUNITY STATUS MUNICIPAL DISTRICTS Acadia No. 34, M.D. of Acadia Valley Hamlet Athabasca County ATHABASCA Town BOYLE Village BONDISS Summer Village ISLAND LAKE SOUTH Summer Village ISLAND LAKE Summer Village MEWATHA BEACH Summer Village SOUTH BAPTISTE Summer Village SUNSET BEACH Summer Village WEST BAPTISTE Summer Village WHISPERING HILLS Summer Village Atmore Hamlet Breynat Hamlet Caslan Hamlet Colinton Hamlet -

Location and History Profile Cardston County

Location and History Profile Created on 9/24/2021 12:49:39PM Cardston County Municipal Code: 0053 Location Description View Location Map (url to the pdf location map) Twp Rge Mer Longitude Latitude 4 24 W4 113°10' 49°17' Urban municipalities within the municipal boundary Town of Cardston Town of Magrath Village of Glenwood Village of Hill Spring Hamlets/urban service areas within the municipal boundary Aetna Beazer Carway Del Bonita Kimball Leavitt Mountain View Spring Coulee Welling Welling Station Woolford Incorporation History Municipal Boundary Document Search (url to search results page of Annexation PDF's) Status: Municipal District Effective Date: January 01, 2000 Authority: Order in Council 504/99 Authority Date: December 08, 1999 Gazette: Dec 31, 1999, p. 2442 Comments: The name of the Municipal District of Cardston No. 6 was changed to Cardston County. Status: Municipal District Effective Date: January 01, 1954 Authority: Mininsterial Order Authority Date: January 01, 1954 Gazette: Dec 31, 1953, p. 2085 Comments: Formed the Municipal District of Cardston No. 6 by merging part of Municipal District of Sugar City No. 5 and part of the Municipal District of Cochrane No. 6. Status: Municipal District Effective Date: January 01, 1946 Authority: Ministerial Order Authority Date: Gazette: Dec 15, 1945, p. 1266 Comments: Erected as the Municipal District of Cochrane No. 6 by merging the Municipal District of Cochrane No. 7 and Improvement District No. 6 into one new Municipal District. Status: Improvement District Effective Date: April 01, 1945 Authority: Ministerial Order Authority Date: February 15, 1945 Gazette: Feb 28, 1945, p. 177 Comments: Improvement Districts No.