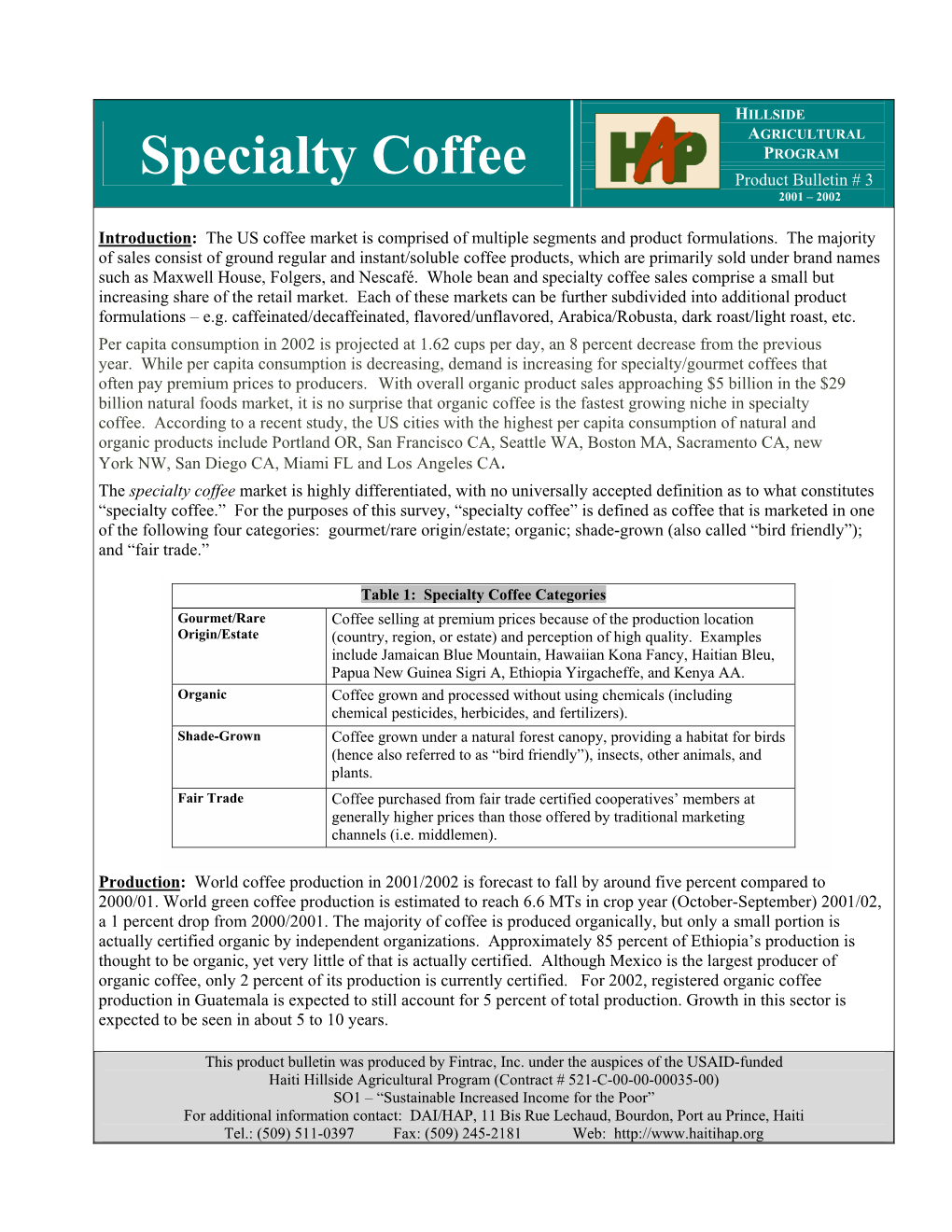

Specialty Coffee Product Bulletin # 3 2001 – 2002

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Niche Markets for Coffee Specialty, Environment and Social Aspects

TECHNICAL PAPER NICHE MARKETS FOR COFFEE SPECIALTY, ENVIRONMENT AND SOCIAL ASPECTS StreetStreet Streetaddress address address P: +41P: +41P: 22 +41 73022 73022 0111 730 0111 0111 PostalPostal Poaddressstal address address InternationalInternationalInternational Trade Trade CentreTrade Centre Centre F: +41F: +41F: 22 +41 73322 73322 4439 733 4439 4439 InternationalInternationalInternational Trade Trade CentreTrade Centre Centre 54-5654-56 Rue54-56 Rue de Rue Montbrillantde deMontbrillant Montbrillant E: [email protected]: [email protected]: [email protected] PalaisPalais Padeslais des Nations des Nations Nations 12021202 Geneva,1202 Geneva, Geneva, Switzerland Switzerland Switzerland www.intracen.orgwww.intracen.orgwww.intracen.org 12111211 Geneva1211 Geneva Geneva 10, 10,Switzerland 10,Switzerland Switzerland The International Trade Centre (ITC) is the joint agency of the World Trade Organization and the United Nations. NICHE MARKETS FOR COFFEE SPECIALTY, ENVIRONMENT AND SOCIAL ASPECTS NICHE MARKETS FOR COFFEE: SPECIALTY, ENVIRONMENT AND SOCIAL ASPECTS Abstract for trade information services ID= 42960 2012 SITC-071 NIC International Trade Centre (ITC) Niche Markets for Coffee: Specialty, Environment and Social Aspects Geneva: ITC, 2012. x, 39 pages (Technical paper) Doc. No. SC-12-224.E Paper focusing on environmental and social aspects of the international coffee trade targeted at producers, exporters and others involved in the promotion of higher quality and sustainable coffee – describes the scope and trends for specialty coffee in the United States, Japan, and Northern and Southern Europe; discusses the challenges in the production and export of organic coffee; features a detailed comparison of the leading sustainability schemes; provides insights into the use of trademarks and geographical indications to market coffee; describes the role of women in the coffee sectors; annexes include an overview of The Coffee Exporter's Guide (2011), and sample answers from the Coffee Guide Website's Questions & Answers service (www.thecoffeeguide.org). -

Jonathan A. Gehrig

2011 Association of American Geographers Annual Meeting April 12 to April 16, 2011-- Seattle, Washington Boutique Coffee Consumption and Shifting Coffee Cultivation Jonathan A. Gehrig Geography and the Environment, The University of Texas at Austin [email protected] Introduction Fair Trade/Organic The Fair Trade and Organic coffee movements have emerged over Pros: the past several decades to incorporate the goals of social justice and Fair Trade Versus Direct Trade Guarantees minimum price even during price collapse environmental sustainability into coffee production. While these two Consumer Preference Cycle movements are distinct from one another, producers generally Focus on cooperative production strengthens community choose to participate in both value added markets together. According to Transfair USA, Fair Trade guarantees a minimum price Promotes sustainable production practices for green coffee of $1.40 per pound plus a $0.30 premium for organic production. Certification costs however, are at the expense of Cons: the producer who must pay for certification and foot the cost of the Third party certification costs lies on producer; 3-year time for organic three year organic certification period. Due to these initial high costs, certification production for the elite market is prohibitive as farmers tend to cultivate varieties with the highest yields. Recently, a ‘Third Wave’ Only certifies medium size farms and coops of coffee justice is emerging with the Direct Trade model. This Direct Trade model seeks to provide the a boutique quality cup of coffee in Pros: addition to achieving the goals of social and environmental justice Gives producers immediate entry into market with no certification cost demanded by the consumer. -

The 5 Hidden Dangers Lurking in Your Coffee Cup

The 5 Hidden Dangers Lurking in Your Coffee Cup Things you should know before you indulge Researched and produced by: Sponsored by: Camano Island Coffee Roasters 2 © Camano Island Coffee Roasters - 2012 Why did Camano Island Coffee Roasters commission a study? • Many coffee drinkers are unaware of the many risks coffee can pose and what to look for when selecng a quality product. • We hired an independent research company to invesgate both the risks and benefits of coffee and to provide recommendaons on selecng the best products available. • We are pleased to share this study with you! 3 © Camano Island Coffee Roasters - 2012 Areas Covered • Food in America . the good, the bad, and the ugly! • Revealing the hidden truths about coffee • A consumer guide to enjoying the very best coffee 4 © Camano Island Coffee Roasters - 2012 How is food affecting our lives? Many of our food choices today are influenced by our fast-paced lives • The tendency to eat high- calorie, low-value fast foods is on the rise. • In our troubled economy, more and more people are seling for “cheap and easy” meals over healthier restaurant or home prepared opons. • All of this “fast food” is having a negave impact on our health. 6 © Camano Island Coffee Roasters - 2012 Obesity rates are climbing • The number of obese Americans has more than doubled in the past 20 years! • Obesity greatly increases the risk for other major health concerns, such as diabetes. Number of states reporng percentage of obese populaon According to the Less than 30% or Naonal Diabetes 10%-14% 15%-19% 20%-24% 25%-29% 10% more Fact Sheet, 2011: 1990 10 34 0 0 0 0 1995 0 23 27 0 0 0 “Diabetes affects 25.8 million 2000 0 1 27 22 0 0 people – 8.3% of 2005 0 0 4 29 14 3 the U.S. -

Dillanos Coffee Roasters

AWARDS PRESENTATION WELCOME THANK YOU SPONSORS THANK BARISTAS RUNNERS YOU TOM BRIAN GREG (HEAD BARISTA) JOHNNO (HEAD LOGISTICS) STACEY JEN TILLY COLE MATT KIM ABNER DEAN BONNIE BRENDO STEVE AWARDS 8 - CHAIN / FRANCHISE MILK CATEGORIES 7 - CHAIN / FRANCHISE ESPRESSO 6 - DECAFFEINATED (MILK BASED) 5 - SINGLE ORIGIN ESPRESSO 4 - ORGANIC ESPRESSO 3 - EMERSION FILTER (ESPRO) 2 - MILK BASED 1 - ESPRESSO CATEGORY 8 FRANCHISE / CHAIN (MILK) BRONZE CATEGORY FRANCHISE / CHAIN (MILK) Caffe Darte - Caffe Darte Dillanos Coffee Roasters - Bigfoot Java It’s A Grind - Blend 2 Ristretto Roasters - Beaumont Blend SILVER CATEGORY FRANCHISE / CHAIN (MILK) Dillanos Coffee Roasters - Cherry Street Dillanos Coffee Roasters - Red Leaf Gloria Jean’s - Blend 2 Gloria Jean’s - Blend 1 It’s A Grind - Blend 1 Temple Coffee Roasters - Dharma Espresso Water Avenue Coffee - El Toro CATEGORY GOLD GOLD MEDAL WINNER FRANCHISE / CHAIN (MILK) Dillanos Coffee Roasters - Wake Up - CATEGORY 7 FRANCHISE / CHAIN (ESPRESSO) BRONZE CATEGORY FRANCHISE / CHAIN (ESPRESSO) Caffé Ladro - Ladro Espresso Dillanos Coffee Roasters - Wake Up Dillanos Coffee Roasters - Cherry Street Gloria Jean’s - Blend 1 It’s A Grind - Blend 1 Water Avenue Coffee - El Toro SILVER CATEGORY FRANCHISE / CHAIN (ESPRESSO) Dillanos Coffee Roasters - Red Leaf Dillanos Coffee Roasters - Bigfoot Java It’s A Grind - Blend 2 Oslo Coffee Roasters - Doin Espresso Blend Ristretto Roasters - Beaumont Blend Temple Coffee Roasters - El Salvador Pacamara CATEGORY GOLD GOLD MEDAL WINNER FRANCHISE / CHAIN (ESPRESSO) Gloria -

The Coffee Bean: a Value Chain and Sustainability Initiatives Analysis Melissa Murphy, University of Connecticut, Stamford CT USA Timothy J

The Coffee Bean: A Value Chain and Sustainability Initiatives Analysis Melissa Murphy, University of Connecticut, Stamford CT USA Timothy J. Dowding, University of Connecticut, Stamford CT USA ABSTRACT This paper examines Starbucks’ corporate strategy of sustainable efforts in Ethiopia, particularly in the sustainable sourcing Arabica coffee. The paper discusses the value chain of coffee, issues surrounding the coffee supply chain and the need for sustainable coffee production. In addition it also discusses Starbucks’ position and influence on the coffee trade, and the measures that Starbucks is taking to ensure sustainability efforts throughout the coffee supply chain. COFFEE VALUE CHAIN & P3G ANALYSIS Coffee is produced in more than fifty developing countries in Latin America, Africa, and Asia and it is an important source of income for 20-25 million families worldwide [1]. The initial production of coffee beans including farming, collecting, and processing is labor intensive and as a result is performed in more labor abundant developing countries. The roasting and branding of coffee is more capital intensive and therefore is situated in northern industrialized countries. The top five coffee consumers are United States of America, Brazil, Germany, Japan, and France [1]. The structure of the value chain is very similar regardless of producing or consuming country. The coffee value chain is made up of the four main phases: Cultivation, Processing, Roasting, and Consumption. Each phase in the process has environmental, social, economic -

Sustainable Coffee Certifications a Comparison Matrix

Sustainable Coffee Certifications A Comparison Matrix Created by the SCAA Sustainability Committee (2009) Certification / Organic Fair Trade Rainforest Smithsonian 4 C Utz Certified Verification Certified Alliance Bird Friendly® Common Code Create a verified Support a better life for Integrate biodiversity Conduct research and UTZ CERTIFIED’s Achieve global sustainable agriculture farming families in the conservation, community education around issues mission is to achieve leadership as the system that produces developing world through development, workers’ of neo-tropical migratory sustainable agricultural baseline initiative that food in harmony with fair prices, direct trade, rights and productive bird populations, supply chains, where: enhances economic, nature, supports community development agricultural practices to promoting certified shade Producers are social and environmental biodiversity and and environmental ensure comprehensive coffee as a viable professionals production, processing enhances soil health. stewardship. sustainable farm supplemental habitat for implementing good and trading conditions to management. birds and other practices which enable all who make a living in organisms. better businesses, the coffee sector. livelihoods and Mission environments; The Food industry takes responsibility by demanding and rewarding sustainably grown products; Consumers buy products which meet their standard for social and environmental responsibility. All markets All markets Global, with special All markets Mainstream and Mainstream market emphasis on N. America, Specialty (ambition: vast majority Market Focus Europe, Japan, and of coffee market) Australia Trace back to 19th century Began as Max Havelaar Begun in 1992 by Founded in 1997 with Begun in 1997 as Begun in 2003 as public- practices formulated in in the Netherlands in the Rainforest Alliance and a criteria based on initiative from industry private partnership England, India, and the US. -

Are Consumers Willing to Pay More for Fair Trade Certified Coffee?

Are Consumers Willing to Pay More for Fair Trade CertifiedTM Coffee? Adam P. Carlson University of Notre Dame Department of Economics [email protected] Instructor: William N. Evans Abstract This study estimates the American consumers’ willingness to pay for Fair Trade Certified coffee using a Hedonic Price Model and Retail Scanner Data. Consistent with prior work, a cross- sectional model finds that Certification has a large positive effect on the price of coffee. However, these models may be subject to an omitted variables bias in that coffees that eventually become Fair Trade Certified are substantially more expensive than other brands. To eliminate this potential bias, I utilize a fixed-effects difference-in-difference specification. Because the certification process takes many months, I observe retail coffee prices for 21 brands before and after a brand becomes Fair Trade Certified. Since the only thing changing over time is certification, I can hold constant the fact that more expensive coffees from the start are more likely to become certified. Comparing this time series change in prices with the changes that occur over time for other coffees, this model finds Certification to cause a minor increase in the price of coffee of about $0.12, a change of 1.1 percent, -- a substantially smaller estimate than has been found in the past. These results suggest that consumers are willing to pay only a small premium for Fair Trade coffee. I. Introduction Traditional models in economics assume that the price of a good is determined by the desirability of the physical characteristics of that good. -

ORGANIC COFFEE CULTIVATION Published by Deutsche Gesellschaft Für Internationale Zusammenarbeit (GIZ) Gmbh

Implemented by CAPACITY BUILDING TOOLKIT (MODULE 7) BUSINESS MODEL: ORGANIC COFFEE CULTIVATION Published by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH Registered offices: Bonn and Eschborn Umbrella Programme for Natural Resource Management A2/18, Safdarjung Enclave New Delhi 110 029 India T: +91 11 4949 5353 F : + 91 11 4949 5391 E: [email protected] I: www.giz.de Responsible Mohamed El-Khawad Program Director and Cluster Coordinator Environment, Climate Change and Biodiversity Email: [email protected] Rajeev Ahal Director, Natural Resource Management Email: [email protected] Technical Partners Intellect Consortium Content Review Dr R.S.Reddy (BIRD), Deepak Chamola, Technical Expert, GIZ Editor Raj Pratim Das Design and Layout Rouge Communications [email protected] Photo credits/GIZ GIZ is responsible for the content of this publication On behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ) New Delhi, India October, 2019 ABOUT THE MODULE National Bank for Agriculture and Rural Development (NABARD), Bankers Institute of Rural Development (BIRD) and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH has come up with a ‘Farmer Producer Organisation (FPO) Capacity Building Toolkit’. The toolkit contains the following modules: 1. FPO orientation material 2. FPO capacity assessment tool 3. Training for Trainers (ToT) manual for Board of Directors (BOD) 4. FPO Massive Open Online Course (MOOC) 5. Guidebook on FPO business planning 6. Guidebook on FPO legal compliances 7. Business models for FPOs 8. Schemes and policy initiatives for supporting FPO 9. Guidebook on common derivative market for FPOs 10. Guidebook on input business planning for FPOs 11. -

Ethiopian Coffee Buying Guide

Fintrac Inc. www.fintrac.com [email protected] US Virgin Islands 3077 Kronprindsens Gade 72 St. Thomas, USVI 00802 Tel: (340) 776-7600 Fax: (340) 776-7601 Washington, D.C. 1436 U Street NW, Suite 303 Washington, D.C. 20009 USA Tel: (202) 462-8475 Fax: (202) 462-8478 USAID’s Agribusiness and Trade Expansion Program 4th Floor, Ki-Ab Building Alexander Pushkin Street Kebele 23 Addis Ababa Ethiopia Tel: + 251-(0)11-372-0060/61/62/63/64 Fax: + 251-(0)11-372-0102 () parenthesis indicate use within Ethiopia only Author Willem J. Boot Photography All photos by Willem J. Boot March 2011 This publication was produced for review by the United States Agency for International Development. It was prepared by Willem J. Boot for Fintrac Inc., the U.S. contractor implementing USAID/Ethiopia’s Agribusiness and Trade Expansion Program. March 2011 The author’s views expressed in this publication do not necessarily reflect the views of the United States Agency for International Development or the United States Government. CONTENT INTRODUCTION ....................................................................................................................... 1 PART ONE: THE MOTHERLAND OF COFFEE ...................................................................... 2 Culture and Geography ................................................................................................ 2 Coffee Characteristics ................................................................................................. 3 Processing: Sun-dried Natural Coffees vs. Washed Coffees -

In-Room Dining Menu

IN-ROOM DINING MENU Prices are in US dollars, 16% local Tax and a 15% Service Charge are included & $5 Delivery Fee will be Added. Prices are in US dollars, 16% local Tax and a 15% Service Charge are included & $5 Delivery Fee will be Added. For payments in national currency please consult valid exchange rate at front desk. For payments in national currency please consult valid exchange rate at front desk. BREAKFAST WINE BY THE GLASS 150ml 7 AM - 11 AM BEVERAGES 220 ML $9 CHAMPAGNE & SPARKLING FRESH SQUEEZED JUICE Champagne Veuve Cliquot Brut, France $33 ORANGE, GRAPEFRUIT, AND CARROT Santa Margherita, Prosecco, Italy $24 GREEN SUNSHINE SMOOTHIE WHITE WINE Chardonnay Casa Madero, México $13 HOT SPECIALTIES SELECTIONS 220 ML OTHER DRINKS Sauvignon Blanc Roganto, México $16. BLEND SELECTION OF VERACRUZ AND Blend De Cote Inedito, México $20 ALOE VERA DRINK $9 CHIAPAS ORGANIC COFFEE $10 FRESH COCONUT WATER $9 Caffeinated or Decaffeinated CARAJILLO $16 CASERO HOT CHOCOLATE $10 RED WINE MIMOSA $25 100% Mayan Cocoa ESPRESSO 75 ML $7 HO USE BLOODY MARY $16 Blend Monte Xanic Calixa, Mexico $20 Blend Roganto Piccolo, México $22 OR DOUBLE ESPRESSO 150 ML $9 Cabernet Sauvignon Anxelin, México $25 ARTE + LAT TE 220 ML LATTE, CAPPUCCINO, ICED COFFEE $12 ROSE WINE ARTISAN WHOLE LEAF TEA BY TESIS 220 ML $8 Casa Madero V Rosé, Coahuila, México $20 FOREST RED FRUITS / MASALA CHAI CHAMOMILE / GREEN T EA (CITRUS SENCHA) ENGLISH BREAKFAST (BLACK TEA) Non- Dairy Milk, Almond, Soy, Coconut, Rice Available Prices are in US dollars, 16% local Tax and a 15% Service Charge are included & $5 Delivery Fee will be Added. -

Coffea Arabica

COFFEA ARABICA A MONOGRAPH 1 COFFEA ARABICA A MONOGRAPH Catalina Casasbuenas Agricultural Science 2016-17 Colegio Bolivar 2017 Table of Contents Introduction 2 ORIGIN AND DISTRIBUTION 2 1.1 Origin 2 1.2 Affinities and taxonomy 3 ENVIRONMENTAL FACTORS AFFECTING DISTRIBUTION 3 2.1 Biology. 3 2.2 Cultivation. 3 2.2 Rainfall 4 2.3 Elevation 4 2.4 Climate 5 2.5 Pests and diseases 5 3. BIOLOGY 9 3.1 Chromosome complement. 9 3.2 Life cycle and phenology 10 3.2.1 Life cycle and longevity 10 3.2.2 Flowering and fruit seasonality10 3.2.3 Flowering and fruiting frequency. 11 3.3 Reproductive biology 11 3.3.1 Pollen 11 3.3.3 Pollination and potential pollinators 12 3.3.4 Fruit development and seed potential 12 4. Propagation and Management 13 4.1 Natural regeneration 13 4.2 Nursery propagation 13 4.2.1 Propagation from seed 13 5. Vegetative propagation 14 5.1 Grafting 14 5.2 Cuttings 15 5.3 Planting 15 6. Management 16 6.1 Flowering 16 6.2 Tending 16 6.2.1 Pest and disease control 17 7. Emerging products, potential markets. 22 7.1. The overall picture 22 7.2 Potential markets 23 7.2.1 Coffee bean exports and produces. 23 7.3 Food items based on coffee bean 23 7.3.1 Brewed coffee 23 8. Medicinal and traditional uses 24 8.1 Medicinal uses and effectiveness 24 8.2.1 Type 2 Diabetes 25 8.2.2 Parkinson’s disease 25 8.2.3 Gallstones 26 8.2.4 Colorectal cancer 26 8.2.5 Health benefits 26 Bibliography 27 INTRODUCTION Coffea arabica, native of Ethiopia, is known to be as one of the most important crops worldwide. -

Coffee: Theagainst Poverty

Author: Basic At the junction between civil society and the research community, the Bureau for the Appraisal of Social Impacts for Citizen information (BASIC) takes an innovative approach to analysing the societal costs and impacts associated with our production and consumption methods. Objectives: • Enable an improved understanding of societal issues currently faced by economic stakeholders and individuals; • Encourage the development of effective solutions to these challenges. BASIC is a cooperative social company (SCIC) as well as a Young Innovative Enterprise. For more information, visit www.lebasic.com Sponsors: The French Fair Trade Platform Founded in 1997, the French Fair Trade Platform promotes and defends fair trade in France and abroad, to support social and ecological transitions in production and consumption patterns. The platform brings together around 30 French organisations in the sector: committed companies, labels, distribution networks, consumer and education for global citizenship organisations, international solidarity organisations and research and education stakeholders. It also agitates for greater equity in all economic relations in order to promote social justice, human rights and environmental protection. Find out more at www.commercequitable.org/ The "Rethinking Value Chains" Collective This network brings together civil society actors – including NGOs, trade unions and academic institutions – who are experts on issues regarding the value chain and the empowerment of workers and local communities faced with the economic effects of globalisation. Its objective is to provide a platform for diverse organisations to have in-depth discussions on the prevailing economic system (neo-liberalism) and ways of working together to implement sustainable alternatives, which prioritise people and the environment.