QUESTION 1 Statistics About the Percentage of Clients of Financial

Total Page:16

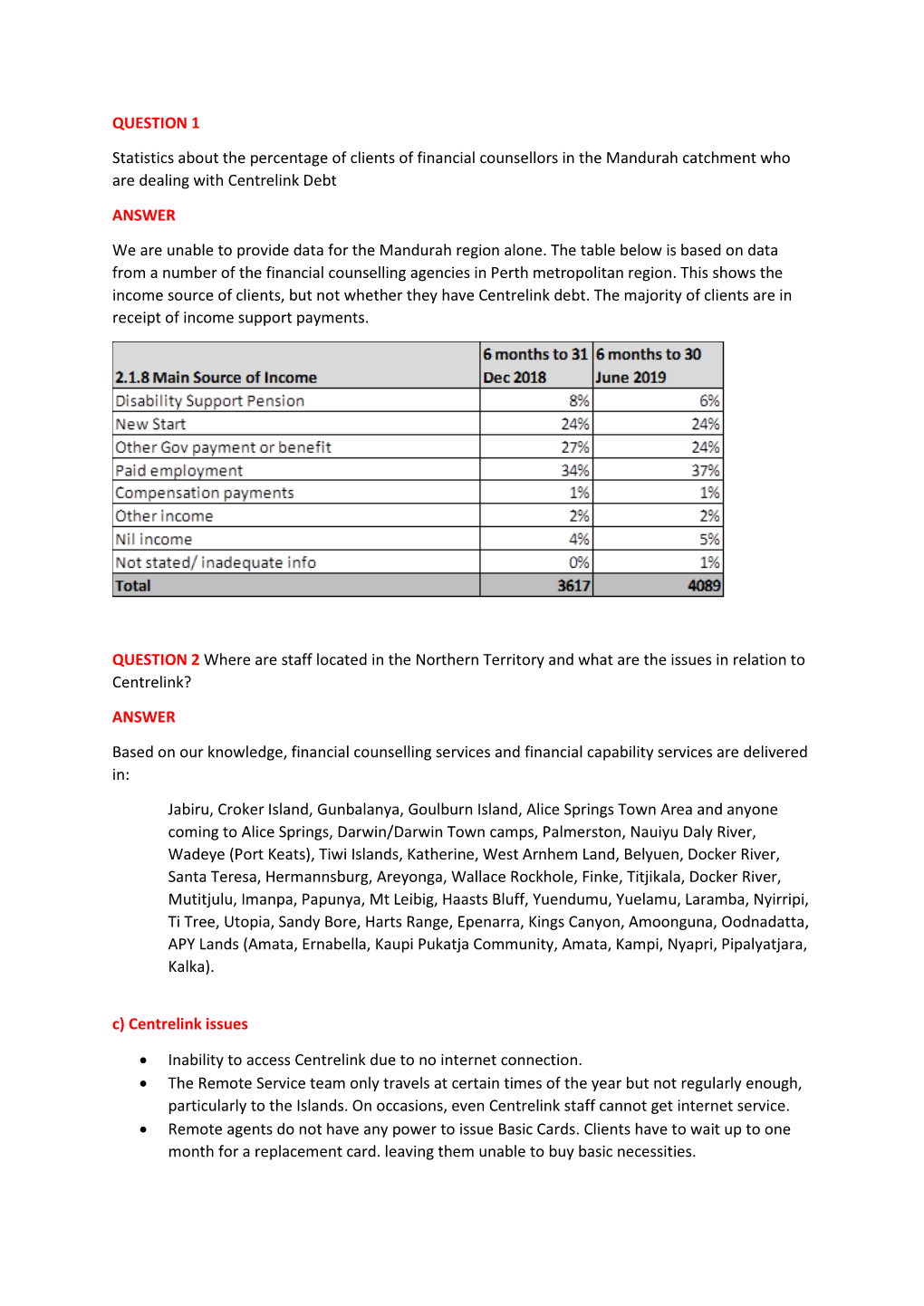

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Ti Tree Creek Camp Study Will Sanders 10

The Working Paper Series Working Paper Community governance: Sarah Holcombe The Ti Tree Creek Camp Study Will Sanders 10 July 2007 Contributing author information Sarah Holcombe is the Social Science Coordinator for the DKCRC and a Research Fellow at CAEPR, primarily working on the Indigenous Community Governance Project. She was previously post doctoral fellow at CAEPR for 3 years. Prior to that, she worked for the Central and Northern Land Councils as a social anthropologist on a diverse range of projects. Will Sanders has been a researcher at The Australian National University in various aspects of Indigenous affairs policy since 1981. He joined the staff of the Centre for Aboriginal Economic Policy Research (CAEPR) at The Australian National University in 1993, where he is now a Senior Fellow. Will is a Chief Investigator on the Indigenous Community Governance Project (ICGP), an ARC Linkage Project between CAEPR and Reconciliation Australia. Desert Knowledge CRC Working Paper #10 Information contained in this publication may be copied or reproduced for study, research, information or educational purposes, subject to inclusion of an acknowledgement of the source. ISBN: 1 74158 045 5 (Web copy) ISSN: 1833-7309 (Web copy) Citation Holcombe S and Sanders W 2007, Community Governance: The Ti Tree Creek Camp Study, Working Paper 10, Desert Knowledge CRC, Alice Springs. The Desert Knowledge Cooperative Research Centre is an unincorporated joint venture with 28 partners whose mission is to develop and disseminate an understanding of sustainable living in remote desert environments, deliver enduring regional economies and livelihoods based on Desert Knowledge, and create the networks to market this knowledge in other desert lands. -

Infrastructure Requirements to Develop Agricultural Industry in Central Australia

Submission Number: 213 Attachment C INFRASTRUCTURE REQUIREMENTS TO DEVELOP AGRICULTURAL INDUSTRY IN CENTRAL AUSTRALIA 132°0'0"E 133°0'0"E 134°0'0"E 135°0'0"E 136°0'0"E 137°0'0"E Aboriginal Potential Potential Approximate Bore Field & Water Control Land Trust Water jobs when direct Infrastructure District (ALT) / Allocation fully economic Requirements Area (ML) developed value ($m) ($m) Karlantijpa 1000 20 Tennant ALT Creek + Warumungu $12m $3.94m Frewena ALT 2000 40 (Frewena) 19°0'0"S Frewena 19°0'0"S LIKKAPARTA Tennant Creek Karlantijpa ALT Potential Potential Approximate Bore Field & Water Aboriginal Control Land Trust Water jobs when direct Infrastructure District (ALT) / Area Allocation fully economic Requirements 20°0'0"S (ML) developed value ($m) ($m) 20°0'0"S Illyarne ALT 1500 30 Warrabri ALT 4000 100 $2.9m Western MUNGKARTA Murray $26m (Already Davenport Downs & invested via 1000 ABA $3.5m) Singleton WUTUNUGURRA Station CANTEEN CREEK Illyarne ALT Murray Downs and Singleton Stations ALI CURUNG 21°0'0"S 21°0'0"S WILLOWRA TARA Warrabri ALT AMPILATWATJA WILORA Ahakeye ALT (Community farm) ARAWERR IRRULTJA 22°0'0"S NTURIYA 22°0'0"S PMARA JUTUNTA YUENDUMU YUELAMU Ahakeye ALT (Adelaide Bore) A Potential Potential Approximate Bore Field & B Water LARAMBA Control Aboriginal Land Water jobs when direct Infrastructure C District Trust (ALT) / Area Allocation fully economic Requirements Ahakeye ALT (6 Mile farm) (ML) developed value ($m) ($m) Ahakeye ALT Pine Hill Block B ENGAWALA community farm 30 5 ORRTIPA-THURRA Adelaide bore 1000 20 Ti-Tree $14.4m $3.82m Ahakeye ALT (Bush foods precinct) Pine Hill ‘B’ 1800 20 BushfoodsATITJERE precinct 70 5 6 mile farm 400 10 23°0'0"S 23°0'0"S PAPUNYA Potentia Potential Approximate Bore Field & HAASTS BLUFF Water Aboriginal Control Land Trust l Water jobs when direct Infrastructure District (ALT) / Area Allocati fully economic Requirements on (ML) developed value ($m) ($m) A.S. -

GREAT ARTESIAN BASIN Responsibility to Any Person Using the Information Or Advice Contained Herein

S O U T H A U S T R A L I A A N D N O R T H E R N T E R R I T O R Y G R E A T A R T E S I A N B A S I N ( E RNturiyNaturiyaO M A N G A B A S I N ) Pmara JutPumntaara Jutunta YuenduYmuuendumuYuelamu " " Y"uelamu Hydrogeological Map (Part " 2) Nyirri"pi " " Papunya Papunya ! Mount Liebig " Mount Liebig " " " Haasts Bluff Haasts Bluff ! " Ground Elevation & Aquifer Conditions " Groundwater Salinity & Management Zones ! ! !! GAB Wells and Springs Amoonguna ! Amoonguna " GAB Spring " ! ! ! Salinity (μ S/cm) Hermannsburg Hermannsburg ! " " ! Areyonga GAB Spring Exclusion Zone Areyonga ! Well D Spring " Wallace Rockhole Santa Teresa " Wallace Rockhole Santa Teresa " " " " Extent of Saturated Aquifer ! D 1 - 500 ! D 5001 - 7000 Extent of Confined Aquifer ! D 501 - 1000 ! D 7001 - 10000 Titjikala Titjikala " " NT GAB Management Zone ! D ! Extent of Artesian Water 1001 - 1500 D 10001 - 25000 ! D ! Land Surface Elevation (m AHD) 1501 - 2000 D 25001 - 50000 Imanpa Imanpa ! " " ! ! D 2001 - 3000 ! ! 50001 - 100000 High : 1515 ! Mutitjulu Mutitjulu ! ! D " " ! 3001 - 5000 ! ! ! Finke Finke ! ! ! " !"!!! ! Northern Territory GAB Water Control District ! ! ! Low : -15 ! ! ! ! ! ! ! FNWAP Management Zone NORTHERN TERRITORY Birdsville NORTHERN TERRITORY ! ! ! Birdsville " ! ! ! " ! ! SOUTH AUSTRALIA SOUTH AUSTRALIA ! ! ! ! ! ! !!!!!!! !!!! D !! D !!! DD ! DD ! !D ! ! DD !! D !! !D !! D !! D ! D ! D ! D ! D ! !! D ! D ! D ! D ! DDDD ! Western D !! ! ! ! ! Recharge Zone ! ! ! ! ! ! D D ! ! ! ! ! ! N N ! ! A A ! L L ! ! ! ! S S ! ! N N ! ! Western Zone E -

Family News 67

Family News Edition 67 Lexi Ward from Aputula and story on pg4 © Waltja Tjutangku Palyapayi Aboriginal Corporation “ doing good work with families” Postal: PO Box 8274 Alice Springs NT 0871 Location: 3 Ghan Rd Alice Springs NT 0870 Ph: (08) 8953 4488 Fax: (08) 89534577 Website: www.waltja.org.au Waltja Chairperson 2020ngka ngarangu watjil, watjilpa, tjilura, tjiluru nganampa Waltja tjutaku. Ngurra tjutanya patirringu marrkunutjananya ngurrangka nyinanytjaku wiya tawunukutu ngalya yankutjaku. Tjananya watjanu wiya, ngaanyakuntjaku Waltja kutjupa tjutangku tjana patikutu nyinangi Waltjangku, katjangku, yuntalpanku, tjamuku nyaakuntja wiya. Ngurra purtjingka nyinapaiyi tjutanya, Kapumantaku marrkunu tjananya nyinantjaku ngurrangka Tjanaya watjil watjilpa, nyinangi wiya nganana yuntjurringnyi tawunukatu yankutjaku mangarriku, yultja mantjintjaku Waltjalu? Tjanampa yiyanangi yultja tjuta ngurra winkikutu. Tjana yunparringu ngurra winkinya mangarriku Walytjalu yiyanutjangka. Walytjalu yilta tjananya puntura alpamilaningi. Panya Sharijnlu watjanutjangka. Yanangi warrkana tjutanya ngurra tjutakutu. Youth worker, NDIS, culture anta governance tjuta warrkanarripanya Walytjaku kimiti tjutanyalatju tjungurrikula miitingingka wankangi 12 times Member tjutangku miitingingka wangkangi AGM miitingi. Panya minta kuyangkulampa yangatjunu. AGM miitingi ngaraku March-tjingka (2021-ngngka) Nganana yuntjurrinyi minmya tjutaku ngurra tjutaku. Yukarraku, Ulkumanuku, nganana yuntjurringanyi. Palyaya nyinama ngurrangka Walytja tjuta kunpurringamaya. Palya Nangala. 2020 was a hard year, a sad year for people. The remote communities were locked down and no visiting each other. No shopping in Alice Springs. Everyone was crying for warm clothes and food. Oh we were too busy at Waltja clothes and food everywhere! Sending to every community. The rest of the year we were working with Sharijn to do all the programs, help the workers to go bush. Youth work, NDIS, culture and governance work. -

Cost Implications of Hard Water on Health

The International Indigenous Policy Journal Volume 3 Article 6 Issue 3 Water and Indigenous Peoples September 2012 Cost Implications of Hard Water on Health Hardware in Remote Indigenous Communities in the Central Desert Region of Australia Heather Browett Flinders University, [email protected] Meryl Pearce Flinders University, [email protected] Eileen M. Willis Flinders University, [email protected] Recommended Citation Browett, H. , Pearce, M. , Willis, E. M. (2012). Cost Implications of Hard Water on Health Hardware in Remote Indigenous Communities in the Central Desert Region of Australia. Th e International Indigenous Policy Journal, 3(3) . DOI: 10.18584/iipj.2012.3.3.6 Cost Implications of Hard Water on Health Hardware in Remote Indigenous Communities in the Central Desert Region of Australia Abstract The provision of services such as power, water, and housing for Indigenous people is seen as essential in the Australian Government’s "Closing the Gap" policy. While the cost of providing these services, in particular adequate water supplies, is significantly higher in remote areas, they are key contributors to improving the health of Indigenous peoples. In many remote areas, poor quality groundwater is the only supply available. Hard water results in the deterioration of health hardware, which refers to the facilities considered essential for maintaining health. This study examined the costs associated with water hardness in eight communities in the Northern Territory. Results show a correlation between water hardness and the cost of maintaining health hardware, and illustrates one aspect of additional resourcing required to maintain Indigenous health in remote locations. Keywords Indigneous, water, health hardware, hard water Acknowledgments Thanks are extended to Power and Water, Northern Territory for funding this project. -

Outstations Through Art: Acrylic Painting, Self‑Determination and the History of the Homelands Movement in the Pintupi‑Ngaanyatjarra Lands Peter Thorley1

8 Outstations through art: Acrylic painting, self-determination and the history of the homelands movement in the Pintupi-Ngaanyatjarra Lands Peter Thorley1 Australia in the 1970s saw sweeping changes in Indigenous policy. In its first year of what was to become a famously short term in office, the Whitlam Government began to undertake a range of initiatives to implement its new policy agenda, which became known as ‘self-determination’. The broad aim of the policy was to allow Indigenous Australians to exercise greater choice over their lives. One of the new measures was the decentralisation of government-run settlements in favour of smaller, less aggregated Indigenous-run communities or outstations. Under the previous policy of ‘assimilation’, living arrangements in government settlements in the Northern Territory were strictly managed 1 I would like to acknowledge the people of the communities of Kintore, Kiwirrkura and Warakurna for their assistance and guidance. I am especially grateful to Monica Nangala Robinson and Irene Nangala, with whom I have worked closely over a number of years and who provided insights and helped facilitate consultations. I have particularly enjoyed the camaraderie of my fellow researchers Fred Myers and Pip Deveson since we began working on an edited version of Ian Dunlop’s 1974 Yayayi footage for the National Museum of Australia’s Papunya Painting exhibition in 2007. Staff of Papunya Tula Artists, Warakurna Artists, Warlungurru School and the Western Desert Nganampa Walytja Palyantjaku Tutaku (Purple House) have been welcoming and have given generously of their time and resources. This chapter has benefited from discussion with Bob Edwards, Vivien Johnson and Kate Khan. -

Yuendumu Remote Towns Jobs Profle

Remote Towns Jobs Profile YUENDUMU JOBS PROFILE YUENDUMU 1 © Northern Territory of Australia 2018 Preferred Reference: Department of Trade, Business and Innovation, 2017 Remote Towns Jobs Profiles, Northern Territory Government, June 2018, Darwin. Disclaimer The data in this publication were predominantly collected by conducting a face-to-face survey of businesses within town boundaries during mid-2017. The collection methodology was created in accordance with Australian Bureau of Statistics data quality framework principles. Data in this publication are only reflective of those businesses reported on as operating in the town at the time of data collection (see table at the end of publication for list of businesses reported on). To comply with privacy legislation or where appropriate, some data in this publication may have been adjusted and will not reflect the actual data reported by businesses. As a result of this, combined with certain data not being reported by some businesses, some components may not add to totals. Changes over time may also reflect business' change in propensity to report on certain data items rather than actual changes over time. Total figures have generally not been adjusted. Caution is advised when interpreting the comparisons made to the earlier 2011 and 2014 publications as the businesses identified and reported on and the corresponding jobs may differ between publications. Notes for each table and chart are alphabetically ordered and listed at the end of the publication. Any use of this report for commercial purposes is not endorsed by the Department of Trade, Business and Innovation. JOBS PROFILE YUENDUMU 2 Contents Yuendumu ............................................................................................................................................................... 4 Introduction ........................................................................................................................................................... -

Exhibit 4.204.14

ANZ.800.772.0092 Identified ATMs Location No. Site Name Community Locality State 1. Aherrenge Community Store Aherrenge via Alice Springs NT 2. Ali Curung Store Ali Curung NT 3. Mount Liebig Store Mount Liebig NT 4. Aputula Store Aputula via Alice Springs NT 5. Areyonga Supermarket Areyonga NT 6. Arlparra Community Store Utopia NT Atitjere Homelands Store Aboriginal 7. Atitjere NT Corporation 8. Barunga Store Barunga via Katherine NT 9. Bawinanga Aboriginal Corporation #1 Maningrida NT 10. Bawinanga Aboriginal Corporation #2 Maningrida NT 11. Belyuen Store Cox Peninsula NT 12. Canteen Creek Store Davenport NT 13. Croker Island Store Minjilang (Crocker Island) NT - - 14. Docker River Store Kaltukatjara (Docker River) NT 15. Engawala Store Engawala NT 16. Finke River Mission Store Hermannsburg via Alice Springs NT 17. Gulin Gulin Store Bulman via Katherine NT 18. lmanpa General Store lmanpa WA via Alice Springs NT NT 19. lninti Store Mutitjulu via Yulara NT 20. Jilkminggan Store Mataranka NT 21. MacDonnel Shire Titjikala Store Titjikala via Alice Springs NT 22. Maningrida Progress Association Maningrida NT 23. Milikapiti Store #1 Milikapiti, Melville Island NT 24. Milikapiti Store #2 Milikapiti, Melville Island NT 25. Nauiyu Store Daly River NT 26. Nguiu Ullintjinni Ass #1 Bathurst Island NT 27. Nguiu Ullintjinni Ass #2 Bathurst Island NT 28. Nguiu Ullintjinni Ass #3 Bathurst Island NT 29. Nguru Walalja Yuendumu NT 30. Nyirripi Community Store Nyirripi NT 31. Papunya Store Papunya via Alice Springs NT 32. Pirlangimpi Store Melville Island NT 33. Pulikutjarra Aboriginal Corporation Pulikutjarra NT 34. Santa Teresa Community Store Santa Teresa NT ANZ.800.772.0093 Location No. -

Wallace Rockhole Is Open for Business…

MacDonnell Regional Council Staff Newsletter SEPTEMBER 2015 volume 7 issue 3 Developing supportive communities communitiesLiveable communitiesEngaged A organisation COUNCIL GOAL COUNCIL GOAL COUNCIL GOAL COUNCIL GOAL #1 #2 #3 #4 Despite being a small community Wallace Rockhole has always shown great initiative to get things done Wallace Rockhole is open for business… Following the completion of MacDonnell Regional Council’s upgrade of the access road linking Wallace Rockhole to Larapinta Drive, tourists can now drive regular cars to experience the rock art and dot painting tours the community offers. Along with the road upgrade, a recent announcement by the Federal Government to install a mobile phone tower at this and three other communities, in the coming years will add to their accessibility. All this follows Wallace Rockhole being named the first ever community to be awarded a Tidy Town 4 Gold Star Tourism Award, after many years of community support for its cultural tourism infrastructure and services… Find out the latest instalments at Wallace Rockhole and other communities of the MacDonnell Regional Council inside MacDonnell Regional Council Staff Newsletter SEPTEMBER 2015 volume 7 issue 3 page 2 Welcome to MacDonnell Regional Council, CEO UPDATE We have all been very busy since the last MacNews finalising Our Regional Plan, meeting our Key Performance Indicators (KPIs) and finishing off another financial year full of improvements to the lives of our residents. At our most recent Council meeting, the KPI Report for the past financial year was presented, showing an outstanding effort across all areas of the MacDonnell Regional Council through some very impressive results. -

Crime Problem'' of the Northern Territory Intervention

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Analysis and Policy Observatory (APO) Addressing the “crime problem’’ of the Northern Territory Intervention: alternate paths to regulating minor driving offences in remote Indigenous communities Dr Thalia Anthony Dr Harry Blagg Report to the Criminology Research Advisory Council Grant: CRG 38/09-10 June 2012 1 This is a project supported by a grant from the Criminology Research Grants. The views expressed are the responsibility of the author and are not necessarily those of the Council. TABLE OF CONTENTS EXECUTIVE SUMMARY ............................................................................................................................ 5 Background ......................................................................................................................................... 5 Methodology ....................................................................................................................................... 6 Quantitative findings .......................................................................................................................... 7 Qualitative findings ............................................................................................................................. 7 Key Recommendations ....................................................................................................................... 8 RATIONALE AND AIMS OF STUDY ........................................................................................................ -

Yuendumu Dialysis Support Service Feasibility Study Final Report

Yuendumu Dialysis Support Service Feasibility Study Final Report May 2008 Western Desert Nganampa Walytja Palyantjaku Tjutaku Aboriginal Corporation Table of Contents 1. The Yuendumu Dialysis Services Feasibility Study 4 2. Executive Summary 5 2.1 Key Findings 5 3. Background 7 3.1 The WDNWPT Story 7 3.2 WDNWPT Services for Yanangu families 8 3.3 WDNWPT Structure 9 3.4 WDNWPT Dialysis Service Model 10 3.5 Membership of Current WDNWPT Governing Committee 11 4. Renal Patient Data for Yuendumu and Surrounding Communities 12 4.1 Current Renal Patient Numbers for Yuendumu, Nyirripi, Willowra and Yuelamu 12 4.2 Chronic Kidney Disease (CKD) Figures for Yuendumu, Nyirripi, Willowra and Yuelamu 12 4.3 Interpreting CKD Data 12 5. Consultations 15 5.1 Feasibility Study Consultation, Milestone and Meeting Timeline 15 5.2 Process for Consulting Renal Patients, Family and Community 17 Members 5.3 Development of a Yuendumu Dialysis Service Model 17 5.3.1 Community Based Dialysis 17 5.3.2 Social and Community Support 18 5.4 Key Meetings 19 5.4.1 Patient and Family Meeting, Purple House, 26 November, 2007 19 5.4.2 Family and Community Meeting, Yuendumu, 4th February, 2008 21 5.4.3 Yapa Kidney Committee Meeting, 4th February, 2008 22 6. Resolution to Kurra Aboriginal Corporation 25 7. Glossary 30 2 ATTACHMENTS A. Patient List 31 B. Kidney Committee Members 32 C. Consultations (detail) 33 D. Meeting Attendance Lists 41 E. Initial Consultation Questionnaire 43 F. Support for Warlpiri Dialysis Patients during the Feasibility Study 44 G. Job Descriptions 45 1. -

Destination Management Plan Lasseter Region 2020

Destination Management Plan Lasseter Region 2020 Key Partners Front Cover: Kings Canyon – Watarrka National Park Back Cover: Kata Tjuta - Uluru-Kata Tjuta National Park This Page: Longitude 131 with Uluru-Kata Tjuta National Park in the background Contents 1. The Lasseter Destination Management Plan 4 2. The Lasseter Region 18 3. Destination management planning 22 4. Trends in regional tourism 26 5. Stakeholder consultation 30 6. Visitor market analysis 34 Appendix A - Product development opportunities 43 Appendix B - Socio-economic profile 47 Appendix C - Key location descriptions 48 Appendix D - Lasseter Region visitor market 50 Appendix E - Tourism development planning in the Lasseter Region 52 Appendix F – Accessible Tourism 56 Watarrka National Park The Lasseter Destination 1 Management Plan The Lasseter Region (the Region) is located south of Alice Springs, extending to the South Australian border and stretching Tourism in the Lasseter Region across the width of the Northern Territory (NT), from the Queensland and Western Australia borders. The Lasseter Region includes the iconic and World Heritage listed Uluru-Kata Tjuta National Park and Watarrka National Park, The Lasseter Region Destination Management Plan (DMP) location of the famous landmark Kings Canyon. The Region is identifies key strengths and assets across the Region. The plan associated with remarkable landscapes, pioneering history and considers visitation demand insights, existing planning and rich Aboriginal culture. Visitors to the Region are offered diverse priorities for destinations in the Region and stakeholder input. and unique natural, cultural and adventure experiences. Actions have been identified to activate opportunities, address gaps and prioritise product development seeking to meet visitor Figure 1 also highlights the range of potential experiences demand while encouraging the development of a sustainable to be addressed throughout the Region, as identified during tourism sector for the Region.