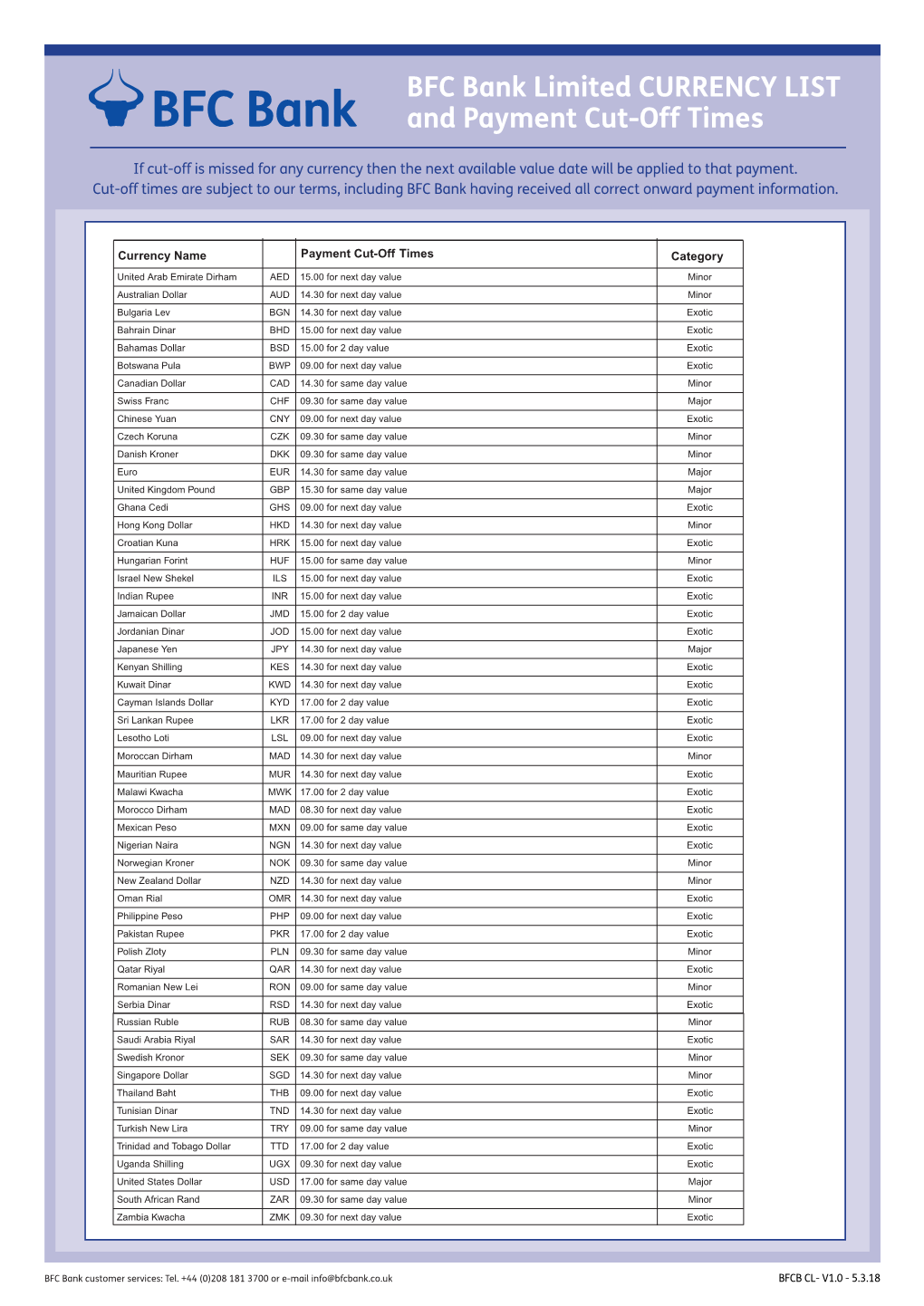

BFC Bank Limited CURRENCY LIST and Payment Cut-Off Times

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code List 11 Invoice Currency

Code list 11 Invoice currency Alphabetical order Code Code Alfa Alfa Country / region Country / region A BTN Bhutan ngultrum BOB Bolivian boliviano AFN Afghan new afghani BAM Bosnian mark ALL Albanian lek BWP Botswanan pula DZD Algerian dinar BRL Brazilian real USD American dollar BND Bruneian dollar AOA Angolan kwanza BGN Bulgarian lev ARS Argentinian peso BIF Burundi franc AMD Armenian dram AWG Aruban guilder AUD Australian dollar C AZN Azerbaijani new manat KHR Cambodian riel CAD Canadian dollar B CVE Cape Verdean KYD Caymanian dollar BSD Bahamian dollar XAF CFA franc of Central-African countries BHD Bahraini dinar XOF CFA franc of West-African countries BBD Barbadian dollar XPF CFP franc of Oceania BZD Belizian dollar CLP Chilean peso BYR Belorussian rouble CNY Chinese yuan renminbi BDT Bengali taka COP Colombian peso BMD Bermuda dollar KMF Comoran franc Code Code Alfa Alfa Country / region Country / region CDF Congolian franc CRC Costa Rican colon FKP Falkland Islands pound HRK Croatian kuna FJD Fijian dollar CUC Cuban peso CZK Czech crown G D GMD Gambian dalasi GEL Georgian lari DKK Danish crown GHS Ghanaian cedi DJF Djiboutian franc GIP Gibraltar pound DOP Dominican peso GTQ Guatemalan quetzal GNF Guinean franc GYD Guyanese dollar E XCD East-Caribbean dollar H EGP Egyptian pound GBP English pound HTG Haitian gourde ERN Eritrean nafka HNL Honduran lempira ETB Ethiopian birr HKD Hong Kong dollar EUR Euro HUF Hungarian forint F I Code Code Alfa Alfa Country / region Country / region ISK Icelandic crown LAK Laotian kip INR Indian rupiah -

Zimra Rates of Exchange for Customs Purposes for the Period 13 to 19

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 13 TO 19 MAY 2021 USD BASE CURRENCY - USD DOLLAR CURRENCY CODE CROSS RATE ZIMRA RATE CURRENCY CODE CROSS RATE ZIMRA RATE ANGOLA KWANZA AOA 654.1789 0.0015 MALAYSIAN RINGGIT MYR 4.1305 0.2421 ARGENTINE PESO ARS 93.8650 0.0107 MAURITIAN RUPEE MUR 40.3500 0.0248 AUSTRALIAN DOLLAR AUD 1.2830 0.7795 MOROCCAN DIRHAM MAD 8.8351 0.1132 AUSTRIA EUR 0.8248 1.2125 MOZAMBICAN METICAL MZN 58.5800 0.0171 BAHRAINI DINAR BHD 0.3760 2.6596 NAMIBIAN DOLLAR NAD 14.0341 0.0713 BELGIUM EUR 0.8248 1.2125 NETHERLANDS EUR 0.8248 1.2125 BOTSWANA PULA BWP 10.7009 0.0935 NEW ZEALAND DOLLAR NZD 1.3838 0.7227 BRAZILIAN REAL BRL 5.2227 0.1915 NIGERIAN NAIRA NGN 380.4786 0.0026 BRITISH POUND GBP 0.7082 1.4121 NORTH KOREAN WON KPW 900.0322 0.0011 BURUNDIAN FRANC BIF 1967.5281 0.0005 NORWEGIAN KRONER NOK 8.2889 0.1206 CANADIAN DOLLAR CAD 1.2117 0.8253 OMANI RIAL OMR 0.3845 2.6008 CHINESE RENMINBI YUAN CNY 6.4384 0.1553 PAKISTANI RUPEE PKR 152.0684 0.0066 CUBAN PESO CUP 24.1824 0.0414 POLISH ZLOTY PLN 3.7380 0.2675 CYPRIOT POUND EUR 0.8248 1.2125 PORTUGAL EUR 0.8248 1.2125 CZECH KORUNA CZK 20.9986 0.0476 QATARI RIYAL QAR 3.6400 0.2747 DANISH KRONER DKK 6.1333 0.1630 RUSSIAN RUBLE RUB 74.1987 0.0135 EGYPTIAN POUND EGP 15.6800 0.0638 RWANDAN FRANC RWF 983.6942 0.0010 ETHOPIAN BIRR ETB 42.6642 0.0234 SAUDI ARABIAN RIYAL SAR 3.7500 0.2667 EURO EUR 0.8248 1.2125 SINGAPORE DOLLAR SGD 1.3251 0.7547 FINLAND EUR 0.8248 1.2125 SPAIN EUR 0.8248 1.2125 FRANCE EUR 0.8248 1.2125 SOUTH AFRICAN RAND ZAR 14.0341 0.0713 GERMANY -

ZIMRA Rates of Exchange for Customs Purposes for Period 24 Dec 2020 To

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 24 DEC 2020 - 13 JAN 2021 ZWL CURRENCY CODE CROSS RATEZIMRA RATECURRENCY CODE CROSS RATEZIMRA RATE ANGOLA KWANZA AOA 7.9981 0.1250 MALAYSIAN RINGGIT MYR 0.0497 20.1410 ARGENTINE PESO ARS 1.0092 0.9909 MAURITIAN RUPEE MUR 0.4819 2.0753 AUSTRALIAN DOLLAR AUD 0.0162 61.7367 MOROCCAN DIRHAM MAD 0.8994 1.1119 AUSTRIA EUR 0.0100 99.6612 MOZAMBICAN METICAL MZN 0.9115 1.0972 BAHRAINI DINAR BHD 0.0046 217.5176 NAMIBIAN DOLLAR NAD 0.1792 5.5819 BELGIUM EUR 0.0100 99.6612 NETHERLANDS EUR 0.0100 99.6612 BOTSWANA PULA BWP 0.1322 7.5356 NEW ZEALAND DOLLAR NZD 0.0173 57.6680 BRAZILIAN REAL BRL 0.0631 15.8604 NIGERIAN NAIRA NGN 4.7885 0.2088 BRITISH POUND GBP 0.0091 109.5983 NORTH KOREAN WON KPW 11.0048 0.0909 BURUNDIAN FRANC BIF 23.8027 0.0420 NORWEGIAN KRONER NOK 0.1068 9.3633 CANADIAN DOLLAR CAD 0.0158 63.4921 OMANI RIAL OMR 0.0047 212.7090 CHINESE RENMINBI YUANCNY 0.0800 12.5000 PAKISTANI RUPEE PKR 1.9648 0.5090 CUBAN PESO CUP 0.3240 3.0863 POLISH ZLOTY PLN 0.0452 22.1111 CYPRIOT POUND EUR 0.0100 99.6612 PORTUGAL EUR 0.0100 99.6612 CZECH KORUNA CZK 0.2641 3.7860 QATARI RIYAL QAR 0.0445 22.4688 DANISH KRONER DKK 0.0746 13.4048 RUSSIAN RUBLE RUB 0.9287 1.0768 EGYPTIAN POUND EGP 0.1916 5.2192 RWANDAN FRANC RWF 12.0004 0.0833 ETHOPIAN BIRR ETB 0.4792 2.0868 SAUDI ARABIAN RIYAL SAR 0.0459 21.8098 EURO EUR 0.0100 99.6612 SINGAPORE DOLLAR SGD 0.0163 61.2728 FINLAND EUR 0.0100 99.6612 SPAIN EUR 0.0100 99.6612 FRANCE EUR 0.0100 99.6612 SOUTH AFRICAN RAND ZAR 0.1792 5.5819 GERMANY EUR 0.0100 99.6612 -

Zimra Rates of Exchange for Customs Purposes for the Period 18 to 24 March 2021 Usd Base Currency - Usd Dollar

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 18 TO 24 MARCH 2021 USD BASE CURRENCY - USD DOLLAR CURRENCY CODE CROSS RATE ZIMRA RATE CURRENCY CODE CROSS RATE ZIMRA RATE ANGOLA KWANZA AOA 619.8543 0.0016 MALAYSIAN RINGGIT MYR 4.1185 0.2428 ARGENTINE PESO ARS 91.1400 0.0110 MAURITIAN RUPEE MUR 40.2500 0.0248 AUSTRALIAN DOLLAR AUD 1.2941 0.7728 MOROCCAN DIRHAM MAD 9.0089 0.1110 AUSTRIA EUR 0.8404 1.1899 MOZAMBICAN METICAL MZN 73.2000 0.0137 BAHRAINI DINAR BHD 0.3760 2.6596 NAMIBIAN DOLLAR NAD 14.8977 0.0671 BELGIUM EUR 0.8404 1.1899 NETHERLANDS EUR 0.8404 1.1899 BOTSWANA PULA BWP 11.0132 0.0908 NEW ZEALAND DOLLAR NZD 1.3939 0.7174 BRAZILIAN REAL BRL 5.6248 0.1778 NIGERIAN NAIRA NGN 380.6510 0.0026 BRITISH POUND GBP 0.7204 1.3882 NORTH KOREAN WON KPW 900.0122 0.0011 BURUNDIAN FRANC BIF 1952.9208 0.0005 NORWEGIAN KRONER NOK 8.4890 0.1178 CANADIAN DOLLAR CAD 1.2452 0.8031 OMANI RIAL OMR 0.3845 2.6008 CHINESE RENMINBI YUAN CNY 6.5027 0.1538 PAKISTANI RUPEE PKR 155.9525 0.0064 CUBAN PESO CUP 26.5000 0.0377 POLISH ZLOTY PLN 3.8600 0.2591 CYPRIOT POUND EUR 0.8404 1.1899 PORTUGAL EUR 0.8404 1.1899 CZECH KORUNA CZK 21.9538 0.0456 QATARI RIYAL QAR 3.6400 0.2747 DANISH KRONER DKK 6.2495 0.1600 RUSSIAN RUBLE RUB 73.0394 0.0137 EGYPTIAN POUND EGP 15.7100 0.0637 RWANDAN FRANC RWF 989.0352 0.0010 ETHOPIAN BIRR ETB 40.6800 0.0246 SAUDI ARABIAN RIYAL SAR 3.7500 0.2667 EURO EUR 0.8404 1.1899 SINGAPORE DOLLAR SGD 1.3464 0.7427 FINLAND EUR 0.8404 1.1899 SPAIN EUR 0.8404 1.1899 FRANCE EUR 0.8404 1.1899 SOUTH AFRICAN RAND ZAR 14.8977 0.0671 GERMANY -

Payment Systems in Mauritius

THE PAYMENT SYSTEM IN MAURITIUS Table of Contents OVERVIEW OF THE NATIONAL PAYMENT SYSTEM IN MAURITIUS .......................... 79 1. INSTITUTIONAL ASPECTS .............................................................................................. 80 1.1 General legal aspects ................................................................................................... 80 1.2 Role of financial intermediaries that provide payment services ............................ 80 1.2.1 Domestic banks ................................................................................................ 81 1.2.2 Offshore banks ................................................................................................. 81 1.2.3 Non-bank financial institutions authorised to transact deposit-taking business .................................................................................... 81 1.2.4 Savings banks ................................................................................................... 82 1.2.5 Housing corporation ........................................................................................ 82 1.2.6 Development bank............................................................................................. 82 1.2.7 Foreign exchange dealers ................................................................................ 82 1.2.8 Other financial institutions ............................................................................... 83 1.3 Role of the central bank ............................................................................................ -

Mauritius April 2019

Poverty & Equity Brief Sub-Saharan Africa Mauritius April 2019 Between 2007 and 2012, Mauritius economic growth translated into moderate poverty reduction from 8.3 to 7.9 percent. The incidence of poverty measured at the lower middle-income class international poverty line ($3.20 a day (2011 PPP)) is low: it is estimated at 3.2 percent in 2012 and projected to decline to 2.9 percent in 2019. Better-off individuals benefited from economic growth more than poorer ones. Indeed, the shared prosperity premium was negative between 2006 and 2012 (-0.1 percent), with the poorest households posting a negative consumption growth. Inequality in household consumption was stable between 2006 and 2012 (with the Gini index at about 35.8), while income inequality, particularly from labor, has expanded rapidly, and it is now threatening the standards of living of the poor. The Gini index calculated on household labor income in per adult equivalent terms increased from 41.7 in 2001 to 50 in 2015. The main driver of surging household labor income inequality was the expansion of inequality in individual earnings, which can be attributed to the skills shortage associated with structural changes of the economy from traditional and low-skills sectors to services, notably professional, real estate, and financial services. This transformation generated a considerable increase in the demand for skilled workers. However, the supply failed to match the rising demand, notwithstanding the significant improvements in educational attainments of the Mauritian population. A well-targeted system of public transfers contributed to mitigate the rise in total income inequality. -

AIBMS Multicurrency List

AIBMS PROCESSING AND SETTLEMENT CURRENCIES END TO END CURRENCIES WILL BE SETTLED LIKE-FOR-LIKE AND ALL OTHER CURRENCIES PROCESSED WILL BE SETTLED AS EURO, GBP OR USD DEPENDING ON BUSINESS REQUIREMENTS AED United Arab Emi Dirham EUR GMD Gambian Dalasi EUR PAB Panamanian Balboa EUR AFA Afghani EUR GNF Guinean Franc EUR PEN Peruvian New Sol EUR ALL Albanian Lek EUR GRD Greek Drachma EUR PGK Papua New Guinea Kia EUR AMD Armenian Dram EUR GTQ Guatemalan Quetzal EUR PHP Philippine Peso EUR ANG West Indian Guilder EUR GWP Guinea Peso EUR PKR Pakistani Rupee EUR AON Angolan New Kwan EUR GYD Guyana Dollar EUR PLN Polish Zloty (new) PLN ARS Argentine Peso EUR HKD Hong Kong Dollar HKD PLZ Polish Zloty EUR ATS Austrian Schilling EUR HNL Honduran Lempira EUR PTE Portuguese Escudo EUR AUD Australian Dollar AUD HRK Croatian Kuna EUR PYG Paraguayan Guarani EUR AWG Aruban Guilder EUR HTG Haitian Gourde EUR QAR Qatar Rial EUR AZM Azerbaijan Manat EUR HUF Hungarian Forint EUR ROL Romanian Leu EUR BAD Bosnia-Herzogovinian EUR IDR Indonesian Rupiah EUR RUB Russian Ruble EUR BAM Bosnia Herzegovina EUR IEP Irish Punt EUR RWF Rwandan Franc EUR BBD Barbados Dollar EUR ILS Israeli Scheckel EUR SAR Saudi Riyal EUR BDT Bangladesh Taka EUR INR Indian Rupee EUR SBD Solomon Islands Dollar EUR BEF Belgian Franc EUR IQD Iraqui Dinar EUR SCR Seychelles Rupee EUR BGL Bulgarian Lev EUR IRR Iranian Rial EUR SEK Swedish Krona SEK BGN Bulgarian Lev EUR ISK Iceland Krona EUR SGD Singapore Dollar EUR BHD Bahrain Dinar EUR ITL Italian Lira EUR SHP St.Helena Pound EUR BIF Burundi -

Monetary and Exchange Rate Policies, and Challenging Reforms Undertaken by the Bank of Mauritius

Rameswurlall Basant Roi: Monetary and exchange rate policies, and challenging reforms undertaken by the Bank of Mauritius Address by Mr Rameswurlall Basant Roi, Governor of the Bank of Mauritius, at the annual dinner for major economic stakeholders, Flic-en-Flac, 17 November 2017. * * * Distinguished guests Ladies and gentlemen Good evening I am pleased to welcome you, once again, to the Bank of Mauritius Annual Dinner. Ever since I initiated this annual ritual of holding a dinner with major economic stakeholders way back in December 1998, I have often been told by a few that my speeches tend to be lengthy. I have a problem. And the problem is that short speeches take too long to write; it also requires an exhaustive use of my cerebral capacity. Long speeches take less time to write. This evening, I’ll ask for your forbearance once again because the Bank of Mauritius is 50 years old. There cannot be a more fitting occasion to travel back into 50 years of central banking policies than one of golden jubilee celebrations. In an address that I gave exactly two weeks ago on the occasion of the Inauguration of The Bank of Mauritius Museum, I focused on the institutional development aspects of the Bank over the 50-year period. This evening, I have chosen to give a very broad brush stroke of monetary and exchange rate policies as they have evolved in Mauritius and of the financial sector reforms and regulatory and supervisory reforms undertaken by the Bank over the years. Against a backdrop of high unemployment rates and widespread poverty, the overriding need for leading the Mauritian economy into a self-sustained growth path had set the agenda for monetary, exchange rate and fiscal policies quite soon after independence. -

The Mauritius Wastewater Master Plan Study

AFRICAN DEVELOPMENT BANK MAURITIUS WASTEWATER MASTER PLAN STUDY REQUEST FOR TECHNICAL ASSISTANCE FUND FOR MIDDLE INCOME COUNTRIES THE GOVERNMENT OF MAURITIUS WATER AND SANITATION DEPARTMENT January 2009 TABLE OF CONTENTS Page 1. INTRODUCTION 1 2. THE SANITATION SUB-SECTOR IN MAURTIUS 2 2.1 Legal and Institutional Framework 2 2.2 Sector Development 3 3. THE PROPOSED STUDY 4 3.1 Objective 4 3.2 Justification for Use of MIC/TAF Resources 4 3.3 Justification for the study 4 3.4 Summary Description of the Study 6 3.5 Study Outputs 7 4. STUDY COST ESTIMATES AND FINANCING 8 4.1 Cost Estimates 8 4.2 Financing Plan 8 5. PROCUREMENT 8 5.1 Procurement Arrangement 9 5.2 General Procurement Notice 9 5.3 Review Process 9 5.4 Disbursement 9 6. IMPLEMENTATION 10 7 CONCLUSIONS AND RECOMMENDATIONS 10 7.1 Conclusions 10 7.2 Recommendations 11 ANNEXES 1. Location Map of Project Area 2. Study Cost Estimate 3. Implementation Schedule __________________________________________________________________________ Any matters relating to this report may be referred to Mr. A.R. Rakotobe, Director, OWAS (Ext. 2055), Mr. S. Jallow, Manager, OWAS.2, (Ext. 2191), and Ms. M.A. Negussie (Ext.2799) CURRENCY AND MEASURES Currency Equivalents (January, 2009) 1 UA = 48.9120 MUR 1 UA = 1.54027 USD 1 USD = 31.7555 MUR Fiscal Year: 1st July to 30th June Measures km = kilometer l/c/d = liters per capita per day m = meter m3/d = cubic meter per day LIST OF ABBREVIATIONS AND ACRONYM ADB/ ADF = African Development Bank / African Development Fund CPB = Central Procurement Board CWA -

List of Currencies of All Countries

The CSS Point List Of Currencies Of All Countries Country Currency ISO-4217 A Afghanistan Afghan afghani AFN Albania Albanian lek ALL Algeria Algerian dinar DZD Andorra European euro EUR Angola Angolan kwanza AOA Anguilla East Caribbean dollar XCD Antigua and Barbuda East Caribbean dollar XCD Argentina Argentine peso ARS Armenia Armenian dram AMD Aruba Aruban florin AWG Australia Australian dollar AUD Austria European euro EUR Azerbaijan Azerbaijani manat AZN B Bahamas Bahamian dollar BSD Bahrain Bahraini dinar BHD Bangladesh Bangladeshi taka BDT Barbados Barbadian dollar BBD Belarus Belarusian ruble BYR Belgium European euro EUR Belize Belize dollar BZD Benin West African CFA franc XOF Bhutan Bhutanese ngultrum BTN Bolivia Bolivian boliviano BOB Bosnia-Herzegovina Bosnia and Herzegovina konvertibilna marka BAM Botswana Botswana pula BWP 1 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Brazil Brazilian real BRL Brunei Brunei dollar BND Bulgaria Bulgarian lev BGN Burkina Faso West African CFA franc XOF Burundi Burundi franc BIF C Cambodia Cambodian riel KHR Cameroon Central African CFA franc XAF Canada Canadian dollar CAD Cape Verde Cape Verdean escudo CVE Cayman Islands Cayman Islands dollar KYD Central African Republic Central African CFA franc XAF Chad Central African CFA franc XAF Chile Chilean peso CLP China Chinese renminbi CNY Colombia Colombian peso COP Comoros Comorian franc KMF Congo Central African CFA franc XAF Congo, Democratic Republic Congolese franc CDF Costa Rica Costa Rican colon CRC Côte d'Ivoire West African CFA franc XOF Croatia Croatian kuna HRK Cuba Cuban peso CUC Cyprus European euro EUR Czech Republic Czech koruna CZK D Denmark Danish krone DKK Djibouti Djiboutian franc DJF Dominica East Caribbean dollar XCD 2 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Dominican Republic Dominican peso DOP E East Timor uses the U.S. -

Aftermath of BREXIT and Its Impact on Mauritian Exports

Aftermath of BREXIT and its impact on Mauritian Exports A. Export Structure: (i) Export Market – Global Perspective: It is a fact that exports of Mauritius has always been euro-centric. Indeed, EU remains the largest trade partner of Mauritius with an average annual exports of Rs 25,551 million (excluding sugar). As a consequence, exports to EU, including United Kingdom represent more than 50% of our total exports. Exports by Block of Countries (Yr 2015) Oceania 1% America 18% Europe 52% Africa 19% Asia 10% Source: Statistics Mauritius . Exports within EU Countries: Within the EU countries, the United Kingdom remains the largest export destination followed by France, and Italy with exports of Rs 8,917 million, Rs 6,741 million and Rs 2,229 million respectively. Total EOE Exports Yr. 2015 48,687 (Rs Million) Europe 25,551 United Kingdom 8,917 France 6,741 Italy 2,229 Netherlands 1,944 Spain 1,691 1 Aftermath of BREXIT and its impact on Mauritian Exports Belgium 1,249 Other 1,083 Switzerland 916 Germany 396 Portugal 232 Austria 153 Note: Total EOE Exports to UK in 2015 amounted to Rs 8,917 million, excluding exports of sugar to the UK which amounted to around Rs 1,368 million. Main Export Market: On its own, the United Kingdom (UK) remains the main export market of Mauritius with a share of 18% of total exports, followed by United States, France and South Africa. Following the global financial crisis and the euro-zone crisis in 2008, the export companies have started to diversify their export markets, shifting away from the traditional markets such as UK and France to South Africa and other EU countries like Germany and Italy. -

VALUE CHAIN ANALYSIS of FISHERIES SECTOR for RODRIGUES June 2012

REPORT/RAPPORT : SF/2012/18 VALUE CHAIN ANALYSIS OF FISHERIES SECTOR FOR RODRIGUES June 2012 Funded by European Union Implementation of a Regional Fisheries Stategy For The Eastern-Southern Africa And Indian Ocean Region 10th European Development Fund Agreement No: RSO/FED/2009/021-330 “This publication has been produced with the assistance of the European Union. The contents of this publication are the sole responsibility of the author and can in no way be taken to the views of the European Union.” Implementation of a Regional Fisheries Strategy For The Eastern-Southern Africa and India Ocean Region Programme pour la mise en oeuvre d'une stratégie de pêche pour la region Afrique orientale-australe et Océan indien Value Chain Analysis of Fisheries Sector For Rodrigues SF/2012/18 Soobaschand Sweenarain Implementation of a Regional Fisheries Stategy For The Eastern-Southern Africa And Indian Ocean Region 10th European Development Fund Agreement No: RSO/FED/2009/021-330 Funded by “This publication has been produced with the assistance of the European Union. The contents of this publication are the sole responsibility of the author and can in no way European be taken to the views of the European Union.” Union Table of content Preface.......................................................................................................................... 5 Acronyms...................................................................................................................... 6 Acknowledgement.............................................................................................................