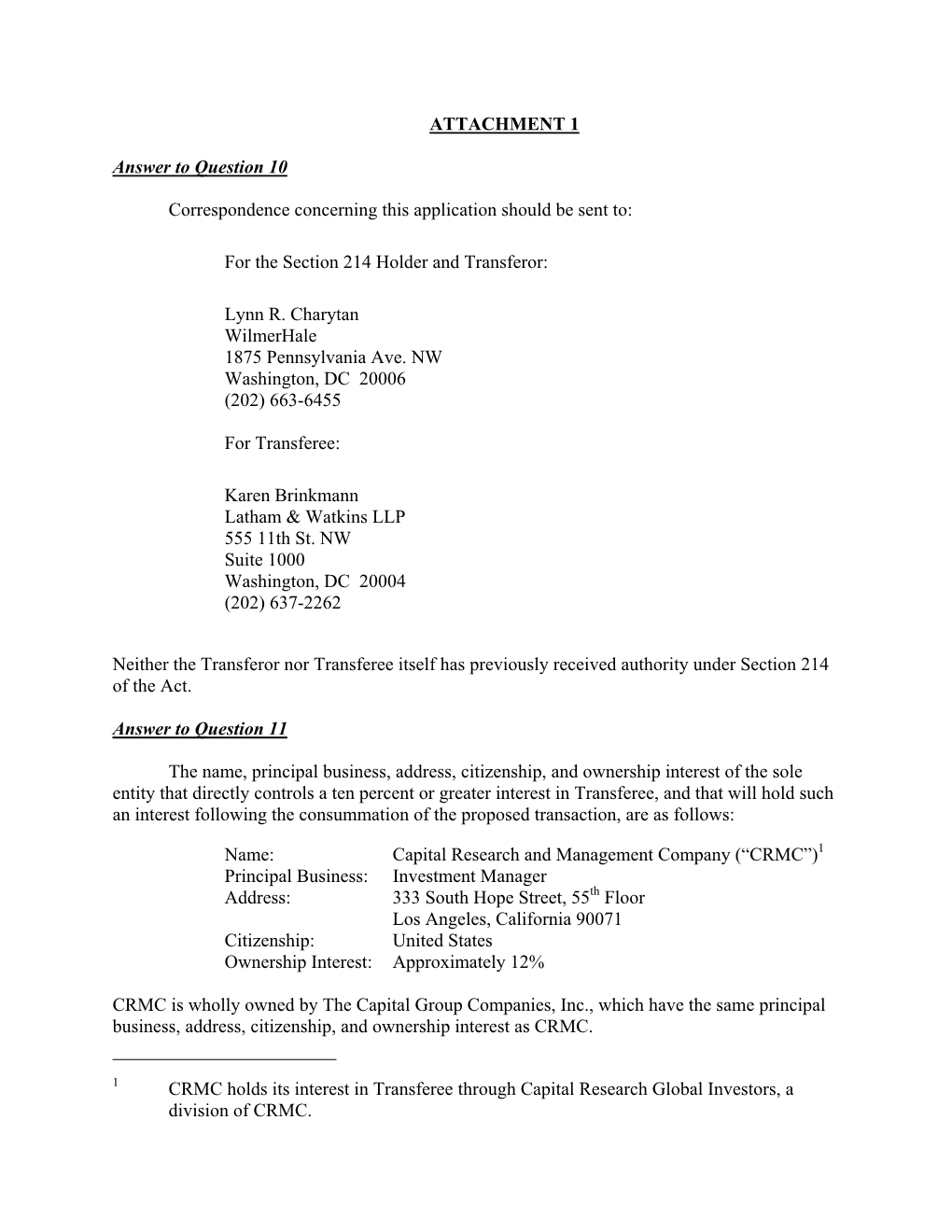

ATTACHMENT 1 Answer to Question 10 Correspondence Concerning This

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Centurylink™TM Columbia, SC 29201 Tel:Tel 803.252.4505803 252Rt505

- / 38- E1 Fp~ 1122 Lady Street, Suite 1050 CenturyLiakCenturyLink™TM Columbia, SC 29201 Tel:Tel 803.252.4505803 252rt505 VIA HAND DELIVERY June 29, 2012 Jocelyn D. Boyd, Esquire Chief Clerk and Administrator Public Service Commission of SouthSouth Carolina 101 Executive Center Drive, Suite 100 Columbia, South Carolina 29211 Re: Certification of the Use of Universal Service Funds pursuant to 4747 C.F.R. §§55 54.313, 54.314;54,314; and Telecommunications Act §5 254 (e) CC Docket No. 96-45 Dear Ms. Boyd:Boyd: On November 18, 2011 the Federal Communications Commission ("FCC") released its USF/ICC Transformation Order in WC Docket No. 10-90 et al. With that Order, the FCC began a transition toto a national framework for certification of Eligible Telecommunications Carriers ("ETCs") and setset forth a standard set of information that all ETCs must file by April 1 of each year. The Order also requiredrequired ETCs to provide thethe same informationinformation to the respective state commissions. In subsequent orders, issued on February 3, and May 14, 2012, the FCC modified certain ofof the reporting requirements to comply with the federal Paperwork Reduction Act and revisedrevised its rules toto move the annual filing date to July I1 of each year For 2012,2012, ETCs must filefile information that fulfills 47 C.F.R. 54.313(a)(2) through (a)(6)(a)(6) to the extentextent thethe informationinformation has been collected pursuant to state ETC certification requirements and 47 C.F.R. 54.313(h) by July 2,2, 2012. CenturyLink hereby provides the informationinformation that fulfills 47 C.F.R. -

EXHIBIT 1 Centurylink Subsidary List CENTURYLINK, INC

EXHIBIT 1 CenturyLink Subsidary List CENTURYLINK, INC. List of Subsidiaries (As of February 13, 2012) Subsidiary Actel, LLC Bloomingdale Telephone Company, Inc. Century Cellunet International, Inc. Cellunet of India Limited Century Interactive Fax, Inc. Century Telephone of West Virginia, Inc. CenturyTel Acquisition LLC CenturyTel of Adamsville, Inc. CenturyTel of Arkansas, Inc. CenturyTel Broadband Services, LLC CenturyTel TeleVideo, Inc. CenturyTelfTeleview of Wisconsin, Tnc. v Qwest Broadband Services, Inc. CenturyTel Broadband Wireless, LLC CenturyTel of Central Indiana, Inc. CenturyTel of Central Louisiana, LLC CenturyT el of Chatham, LLC CenturyTel of Chester, Inc. CenturyTel of Claiborne, Inc. CenturyTel of East Louisiana, LLC Centu1yTel of Evangeline, LLC Century Tel Fiber Company II, LLC CenturyTel Holdings, Inc. Century Marketing Solutions, LLC CenturyTel Arkansas Holdings, Inc. CentlllyTel of Central Arkansas, LLC CenturyTel ofNorthwest Arkansas, LLC Century Tel Holdings Alabama, lnc. Century Tel of Alabama LLC CenturyTe l Holdings Missouri, Inc. CenturyTel of Missouri, LLC ctl org struct\sublist.word - 1 - February 15, 2012 Subsidiary CenturyTel Investments of Texas, lnc. Century Tel of the Northwest, Inc. Brown Equipment Corp. Carter Company, Inc. Honomach PR, Inc. Cascade Autovon Company CcnturyTei/Cable Layers, Inc. CenturyTel of Central Wisconsin, LLC CenturyTel of Colorado, Inc. CenturyTel ofEagle, Inc. CenturyTel of Eastern Oregon, lnc. CenturyTel Entertainment, Inc. CenturyTel ofFairwater-Brandon-Aito, LLC Centu.ryTel of Forestville, LLC CenturyTel of the Gem State, Inc. CenturyTel oflnter Island, Inc. CenturyTel of Larsen-Readfield, LLC CenturyTel of the Midwest-Kendall, LLC CenturyTel of the Midwest-Wisconsin, LLC CenturyTel ofMinnesota, Inc. CenturyTel of Monroe County, LLC CenturyTel of Montana, Inc. CenturyTel of Northern Wisconsin, LLC CenturyTel ofNorthwest Wisconsin, LLC CenturyTel of Oregon, Inc. -

Public Notice

PUBLIC NOTICE Federal Communications Commission News Media Information 202 / 418-0500 445 12th Street, S.W. Fax-On-Demand 202 / 418-2830 Washington, D.C. 20554 TTY 202 / 418-2555 Internet: http://www.fcc.gov ftp.fcc.gov DA 10-993 Released: May 28, 2010 APPLICATIONS FILED BY QWEST COMMUNICATIONS INTERNATIONAL INC. AND CENTURYTEL, INC., D/B/A/ CENTURYLINK FOR CONSENT TO TRANSFER OF CONTROL PLEADING CYCLE ESTABLISHED WC Docket No. 10-110 Comments/Petitions to Deny Due: July 12, 2010 Replies/Oppositions Due: July 27, 2010 On May 10, 2010, Qwest Communications International Inc. (Qwest) and CenturyTel, Inc. d/b/a CenturyLink (CenturyLink) (together, Applicants) filed a series of applications pursuant to sections 214 and 310(d) of the Communications Act of 1934, as amended, 47 U.S.C. §§ 214, 310(d), and Section 2 of the Cable Landing License Act, 47 U.S.C. § 35,1 seeking Commission approval for various transfers of control of licenses and authorizations held by Qwest and its subsidiaries from Qwest to CenturyLink. Qwest, a publicly traded Delaware corporation, is a full-service communications provider offering an array of telecommunications and broadband Internet services, including fiber-optic Internet service, digital switched telephone service, private-line dedicated high-speed data connections, switched data networking services, long-distance services, and voice over Internet Protocol (VoIP) services, through its wholly owned operating companies.2 It currently has approximately 10.3 million access lines in 14 states,3 and approximately 3 million broadband customers. Qwest subsidiary QC, through sales relationships with Verizon Wireless and DirecTV, also sells wireless services and multichannel video 1 See Qwest Communications International Inc., Transferor, and CenturyTel, Inc. -

El Paso County Telephone Co. D/B/A Centurylink Local Terms of Service Colorado

El Paso County Telephone Co. d/b/a CenturyLink Local Terms of Service Colorado EFFECTIVE: 11-15-2016 Section 1 Original Page 1 This Local Terms of Service Contains the Terms, Conditions and Rates Applying to the Provision of Intrastate Exchange and Network Services Within the Operating Territories of El Paso County Telephone Co. d/b/a CenturyLink Effective November 15, 2016, this Local Terms of Service cancels and replaces in entirety the previously existing El Paso County Telephone Company d/b/a CenturyLink Exchange Services Catalog that became effective on October 4, 2011 and also cancels all subsequent revisions thereto. Also effective on November 15, 2016, pursuant to HB14-1331 and Colorado Revised Statutes 40-15-201, services no longer subject to regulation which were previously found in Colo. P.U.C. No. 7 are now located within this Local Terms of Service. El Paso County Telephone Co. d/b/a CenturyLink is referred to with this Local Terms of Service as “CenturyLink” or “Company”. CO2016-032 EP El Paso County Telephone Co. d/b/a CenturyLink Local Terms of Service Colorado EFFECTIVE: 08-16-2021 Section 1 2nd Revised Page 2 APPLICATION AND REFERENCE 1.1 APPLICATION A. This Local Terms of Service contains terms, conditions and charges applicable to intrastate exchange and network services furnished by El Paso Country Telephone Co. d/b/a CenturyLink (hereinafter referred to as “CenturyLink” or “Company”). The services offered herein by CenturyLink are subject to the terms and conditions of this Local Terms of Service. B. URLs for Links to Documents Referenced Herein URLs for hyperlinks used throughout this document are listed below and will direct you to the applicable terms and conditions for the specified services. -

CENTURYLINK® LOCAL TERMS of SERVICE: CALL LINE IDENTIFIER Version 5 Page 1 of 3 Effective: June 1, 2021

CENTURYLINK® LOCAL TERMS OF SERVICE: CALL LINE IDENTIFIER This service-specific Local Terms of Service and the company-specific Service Agreement (a.k.a. Standard Agreement, End User Agreement, or Standard Terms and Conditions) located at http://www.centurylink.com/Pages/AboutUs/Legal/Tariffs/displayTariffServiceAgreements.html where applicable, govern Call Line Identifier in the following states for the companies shown, each company referred to herein as “CenturyLink”: State Companies Alabama CenturyTel of Alabama, LLC Gulf Telephone Company Arkansas CenturyTel of Arkansas, Inc. CenturyTel of Central Arkansas, LLC CenturyTel of Missouri, LLC CenturyTel of Mountain Home, Inc. CenturyTel of Northwest Arkansas, LLC CenturyTel of Northwest Louisiana, Inc. CenturyTel of Redfield, Inc. CenturyTel of South Arkansas, Inc. Colorado CenturyTel of Colorado, Inc. CenturyTel of Eagle, Inc. El Paso County Telephone Company Qwest Corporation Florida Embarq Florida, Inc. Georgia Coastal Utilities, Inc. Illinois Gallatin River Communications LLC Idaho CenturyTel of Idaho, Inc. CenturyTel of the Gemstate, Inc. Qwest Corporation Indiana CenturyTel of Central Indiana, Inc. CenturyTel of Odon, Inc. United Telephone Company of Indiana, Inc Iowa CenturyTel of Chester, Inc. CenturyTel of Postville, Inc. Qwest Corporation Michigan CenturyTel Midwest – Michigan, Inc. CenturyTel of Michigan, Inc. CenturyTel of Northern Michigan, Inc. CenturyTel of Upper Michigan, Inc. Missouri CenturyTel of Missouri, LLC CenturyTel of Northwest Arkansas, LLC Embarq Missouri, Inc. Spectra Communications Group, LLC Montana CenturyTel of Montana, Inc. Qwest Corporation Nevada Central Telephone Company-Nevada Division North Carolina Carolina Telephone and Telegraph Company LLC Central Telephone Company Mebtel, Inc. North Dakota Qwest Corporation Ohio CenturyTel of Ohio, Inc. United Telephone Company of Indiana, Inc. -

In the Matter, on the Commission's ) Own Motion, to Receive Eligible

In the matter, on the Commission’s ) Own Motion, to receive eligible ) Case No. U-17815 telecommunications carrier ) filings for 2015. ) January 28, 2015 Ms. Mary Jo Kunkle, Executive Secretary Michigan Public Service Commission 7109 West Saginaw Highway Lansing MI 48917 Re: MPSC Case No. U-17815 CenturyLink’s Lifeline Recertification pursuant to 47 CFR 54.416(b) - FCC Form 555 Dear Ms. Kunkle: Pursuant to the Federal Communications Commission’s Report and Order1 requiring eligible telecommunications carriers to re-certify the eligibility of their Lifeline subscribers and to report the results to the Federal Communications Commission, Universal Service Administrative Company and to state commission and Tribal governments, CenturyLink hereby submits its 2014 Lifeline re-certification results for the state of Indiana. Separate recertification forms are provided for: (1) CenturyTel of Midwest-Michigan, Inc., d/b/a CenturyLink; (2) CenturyTel of Upper Michigan Inc., d/b/a CenturyLink; (3) CenturyTel of Michigan Inc., d/b/a CenturyLink; and (4) CenturyTel of Northern Michigan Inc., d/b/a CenturyLink. If you have any questions regarding this filing, please contact me at (317) 531-0710. Sincerely, Alan I. Matsumoto CenturyLink (317) 531-0710 Email: [email protected] 1 In the Matter of Lifeline and Link Up Reform and Modernization, Lifeline and Link Up, Federal-State Joint Board on Universal Service, Advancing Broadband Availability Through Digital Literacy Training, Report and Order and Further Notice of Proposed Rulemaking, 27 -

Centurylink Complaint

DISTRICT COURT, CITY AND COUNTY OF DENVER, COLORADO 1437 Bannock Street Denver, CO 80202 STATE OF COLORADO, ex rel. PHILIP J. WEISER, ATTORNEY GENERAL Plaintiff, v. CENTURYLINK, INC.; CENTURYTEL BROADBAND SERVICES, LLC; CENTURYTEL OF COLORADO, INC.; QWEST BROADBAND SERVICES, INC.; QWEST CORPORATION; CENTURYLINK COMMUNICATIONS, LLC; CENTURYTEL OF EAGLE, INC.; CENTURYTEL COURT USE ONLY TELEVIDEO, INC.; EL PASO COUNTY TELEPHONE COMPANY Defendants. PHILIP J. WEISER, Attorney General JAY B. SIMONSON, 24077* Case No. First Assistant Attorney General MARK T. BAILEY, 36861* Senior Assistant Attorney General Div.: Ralph L. Carr Judicial Center 1300 Broadway, 10th Floor Denver, CO 80203 Telephone: (720) 508-6000 FAX: (720) 508-6040 *Counsel of Record COMPLAINT Plaintiff, the State of Colorado, upon relation of Philip J. Weiser, Attorney General for the State of Colorado, by and through undersigned counsel, alleges as follows: 1 INTRODUCTION 1. Since 2014, CenturyLink has systematically overcharged Colorado consumers for telephone, internet, and television services. 2. CenturyLink falsely advertised “price locks” and fixed prices and then charged more than the advertised price by adding a misleading “Internet Cost Recovery Fee” to customers’ bills. Even though the price was supposedly locked, CenturyLink twice increased the amount of the “Internet Cost Recovery Fee.” Also, CenturyLink relied on a complex promotional pricing scheme that led to frequent misquotes. Finally, CenturyLink failed to provide promised refunds to consumers who returned their equipment at the completion of service. PARTIES 3. Philip J. Weiser is the duly elected Attorney General of the State of Colorado and is authorized under C.R.S. § 6-1-103 to enforce the provisions of the CCPA. -

Consent Judgment

DISTRICT COURT, CITY AND COUNTY OF DENVER, COLORADO 1437 Bannock Street Denver, CO 80202 STATE OF COLORADO, ex rel. PHILIP J. WEISER, ATTORNEY GENERAL Plaintiff, v. CENTURYLINK, INC.; CENTURYTEL BROADBAND SERVICES, LLC; CENTURYTEL OF COLORADO, INC.; QWEST BROADBAND SERVICES, INC.; QWEST CORPORATION; CENTURYLINK COMMUNICATIONS, LLC; CENTURYTEL OF EAGLE, INC.; CENTURYTEL COURT USE ONLY TELEVIDEO, INC.; and EL PASO COUNTY TELEPHONE COMPANY, Defendants. PHILIP J. WEISER, Attorney General JAY B. SIMONSON, 24077* Case No. First Assistant Attorney General MARK T. BAILEY, 36861* Senior Assistant Attorney General Ralph L. Carr Judicial Center Div.: 1300 Broadway, 10th Floor Denver, CO 80203 Telephone: (720) 508-6000 FAX: (720) 508-6040 *Counsel of Record FINAL CONSENT JUDGMENT This matter is before the Court on the Parties’ Stipulation for Entry of a Final Consent Judgment. The Court has reviewed the Stipulation and the Complaint filed in this action (“Complaint”) and is otherwise advised in the grounds 51040487.1 therefore. The Court concludes that good cause has been shown for entering this Final Consent Judgment. Accordingly, IT IS ORDERED that: I. DEFINITIONS 1. “CenturyLink” means CenturyLink, Inc., together with its operating subsidiaries CenturyTel Broadband Services, LLC; CenturyTel of Colorado, Inc.; Qwest Broadband Services, Inc.; Qwest Corporation; CenturyLink Communications, LLC; CenturyTel of Eagle, Inc.; CenturyTel Televideo, Inc.; El Paso County Telephone Company; and any other related entity that participates in the promotion, offering, marketing, or billing of CenturyLink services to Colorado consumers. CenturyLink, Inc., is a holding company with ownership interests in these operating subsidiaries, but does not itself carry out the activities described in this Final Consent Judgment. -

2019 Info TC104

~,,.~.. , TM C L. k entury 1n ™ ~"'- l~a Jason D. Topp Associate General Counsel (651) 312-5364 June 25, 2019 Patricia Van Gerpen, Executive Director South Dakota Public Utilities Commission 500 East Capitol Avenue Pierre, SD 57501 patty. [email protected]. us Re: CenturyLink's 2019 Federal ETC Filing Dear Ms. Van Gerpen: On November 18, 2011, the Federal Communications Commission ("FCC") released its USF/ICC Transformation Order in WC Docket No. 10-90, et al. With that Order, the FCC began a transition to a national framework for certification of Eligible Telecommunications Carriers ("ETCs") and set forth a standard set of information that all ETCs must file with the FCC typically by July 1st of each year. The Order also required ETCs to provide the same information to the respective state commissions. Annual ETC reporting requirements are contained in 47 C.F.R. § 54.313 of the FCC's rules. For the reporting of the data and certifications required by 47 C.F.R. §§ 54.313 and 54.422, the FCC has developed a reporting template, Form 481, to be utilized by ETCs. The FCC Form 481 no longer requires that high-cost recipients file information regarding network outages; unfulfilled service requests; the number of complaints received by an ETC per 1,000 subscribers for voice and broadband services; and pricing for voice and broadband services. The FCC Form 481 also no longer includes certifications for high-cost recipients regarding service quality standards and consumer protection rules. Finally, the FCC centralized filing of the FCC Form 481 and ETCs no longer file duplicate copies of FCC Form 481 with the FCC and with states, U.S. -

Colorado Local Exchange and Interexchange

CLEAR RATE COMMUNICATIONS, INC. COLORADO TARIFF NO. 1 ORIGINAL PAGE 1 COLORADO LOCAL EXCHANGE AND INTEREXCHANGE TELECOMMUNICATIONS SERVICES TARIFF OF CLEAR RATE COMMUNICATIONS, INC. This Tariff List contains the descriptions, regulations, and rates applicable to the furnishing of service for local exchange and interexchange telecommunication services within the state of Colorado provided by Clear Rate Communications, Inc. This Tariff is on file with the Colorado Public Utilities Commission and copies may be inspected at Clear Rate Communications, Inc.’s principal office located at 555 S. Old Woodward, Birmingham, Michigan 48009, during normal business hours. Advice Letter No. 1 -- Issued: April 20, 2016 Effective: May 20, 2016 Issued by: Haran C. Rashes, General Counsel and Director of Legal and Regulatory Affairs Clear Rate Communications, Inc. 555 S. Old Woodward, Suite 600, Birmingham, Michigan 48009 CLEAR RATE COMMUNICATIONS, INC. COLORADO TARIFF NO. 1 ORIGINAL PAGE 2 TABLE OF CONTENTS Table of Contents ........................................................................................................................2 Check Sheet ................................................................................................................................4 Explanation of Symbols ..............................................................................................................5 Tariff Format ..............................................................................................................................6 -

Centurylink Qwest Corporation

(t,M4 , i9- ct t Annual Lifeline Eligible Telecommunications Carrier Certification Form All carriers must complete all ot' h&(iqrls; of all sections Form must be submitted to USAC and filed with the Federal Communications Commission IMPORTANT: PLEASE READ INSTRUCTIONS FIRST' :, F'lt l, ; r Deadline: January 31,l- (Annually) l0f\X 475103 143005231 $t.rtL, Study Area Code (SAC) Service Provider Identification Number (SPIN) (An Eligible Telecommunications Carrier (ETC) must provide a certification form for each SAC through which it provides Lifeline semice). 2018 ID CenturyLink Qwest Corporation Recertification Year State ETC Name N/A CENTURYLINK DBA, Marketing, or Other Branding Name Holding CompanyName (If same as ETC name, list "N/A" Do not leave blank) (lf same as ETC name, list "N/A" Do not leave blank) Does the reporting company have affiliated ETCs? Yes Eil No Eil Provide a list of all ETCs that are ffiliated with the reporting ETC, using page 4 and additional sheets if necessary. Afiliation shall be determined in accordance with Section 3(2) of the Communications Act. That Section defines "ffiliate" as "a person that (directly or indirectly) owns or controls, is owned or controlled by, or is under common ownership or control with, another person." 47 U.S.C. S 153(2). See also 47 c.r.R..$ 76.t200. Affiliated ETC's SAC lnfntlut.a ETC's Name -- See attache{ worksheet - 1 ETCs Subject to the Non-Usage Requirements All ETCs must complete the appropriate check-box. ETCs that do not assess and collect a monthlyfeefrom their Lifeline subscribers are subject to the non-usage requirements. -

Consumer Assistance Summary for Filed Contacts

State of Colorado - Public Utilities Commission - Consumer Contact Tracking System (CCTS) Consumer Assistance Summary for Filed Contacts - Fixed Utilities From: 7/1/2011 00:00:00 To: 6/30/2012 23:59:59 Filed Closed Not in Request for Consumer Contacts Compliance Information Objections Name Contacts [A+B+C]: [A] [B] [C] $ Saved ACN Communication Services Inc 1 1 0 0 1 0.00 Airnex Communications Inc 1 0 0 0 0 0.00 American Telecommunications Systems Inc 2 2 0 0 2 256.94 American Telephone and Internet Company 1 1 0 0 1 36.02 Americatel Corporation 1 1 0 0 1 39.47 AT&T Communications of the Mountain States Inc 8 8 0 4 4 130.40 Atmos Energy Corporation 15 16 3 2 11 1,751.91 Big Sandy Telecom Inc 1 0 0 0 0 0.00 Black Hills/Colorado Electric Utility Company LP 68 68 2 11 55 815.37 Black Hills/Colorado Gas Utility Company, LP 8 8 1 2 5 6.80 Bresnan Broadband of Colorado LLC 3 4 2 1 1 0.00 Cbeyond Communications LLC 2 2 0 2 0 495.00 Central Telecom Long Distance Inc 1 1 0 0 1 0.00 CenturyTel of Colorado Inc dba CenturyLink 37 39 4 15 20 1,335.78 Colorado Natural Gas, Inc. 9 9 0 1 8 700.00 Columbine Telephone Company 1 1 0 0 1 0.00 Comcast Phone of Colorado LLC 4 4 3 0 1 0.00 Comtel Telcom Assets LP d.b.a. Vartec 1 1 0 0 1 0.00 Consumer Telcom Inc 1 1 0 0 1 0.00 DishNET Wireline LLC 8 8 2 2 4 80.33 Eastern Slope Rural Telephone Association Inc 2 2 0 0 2 0.00 El Paso County Telephone Company 2 2 0 2 0 0.00 Eschelon Telecom of Colorado Inc dba Integra Telecom 8 8 0 6 2 8,900.00 d_cct_rslt_consumer_assist_summ_no_group {Type(s): 'ELECTRIC', 'GAS',