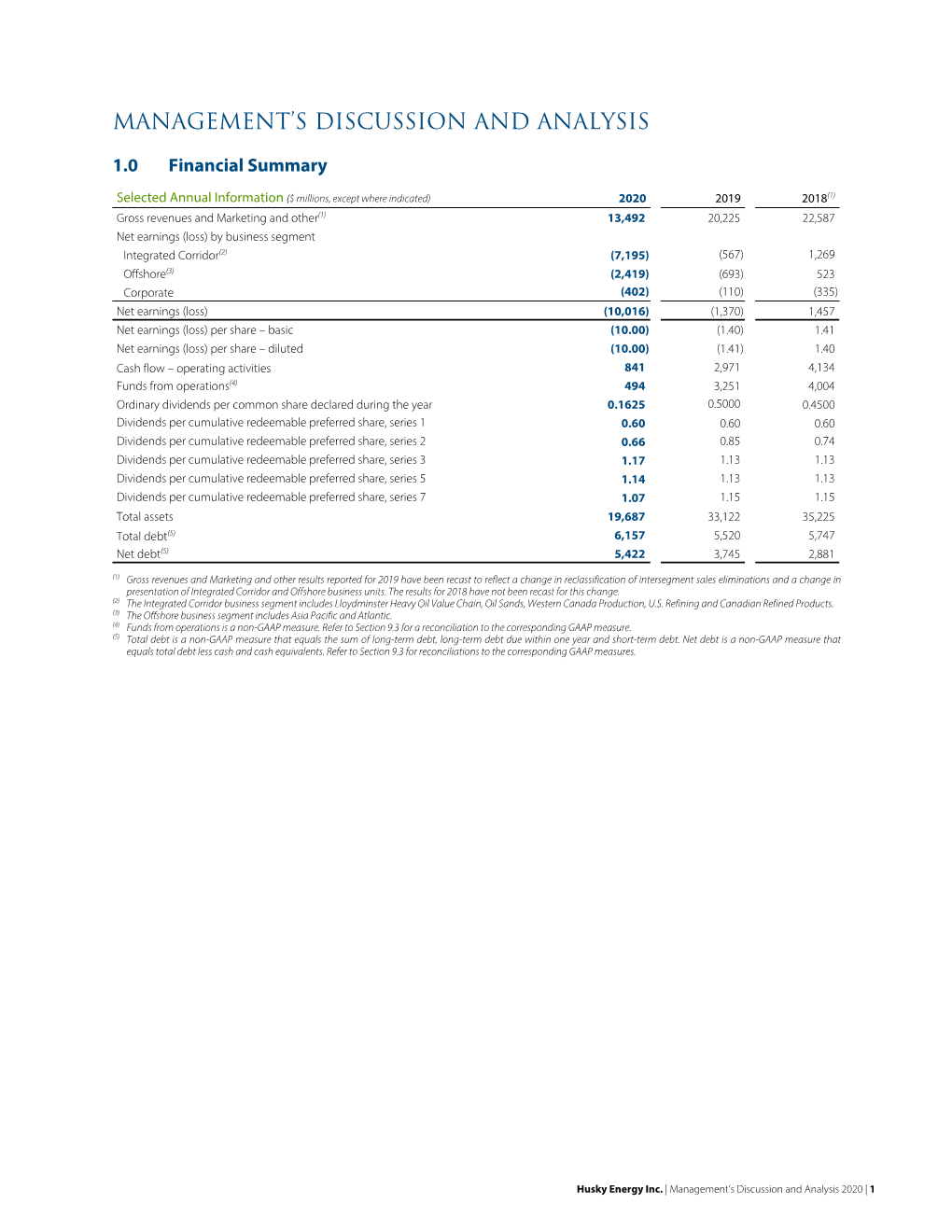

2020 Husky Annual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A New Satellite, a New Vision

A New Satellite, a New Vision For more on RADARSAT-2 Canadian Space Agency Government RADARSAT Data Services 6767 Route de l’Aéroport Saint-Hubert, Quebec J3Y 8Y9 Tel.: 450-926-6452 [email protected] www.asc-csa.gc.ca MDA Geospatial Services 13800 Commerce Parkway Richmond, British Columbia V6V 2J3 Tel.: 604-244-0400 Toll free: 1-888-780-6444 [email protected] www.radarsat2.info Catalogue number ST99-13/2007 ISBN 978-1-100-15640-8 © Her Majesty the Queen in right of Canada, 2010 TNA H E C A D I A N SPA C E A G E N C Y A N D E A R T H O B S E R VAT I O N For a better understanding of our ocean, atmosphere, and land environments and how they interact, we need high-quality data provided by Earth observation satellites. RADARSAT-2 offers commercial and government users one of the world’s most advanced sources of space-borne radar imagery. It is the first commercial radar satellite to offer polarimetry, a capability that aids in identifying a wide variety of surface features and targets. To expand Canada’s technology leadership in Earth observation, the Canadian Space Agency is working with national and international partners on shared objectives to enhance • northern and remote-area surveillance • marine operations and oil spill monitoring • environmental monitoring and natural resource management • security and the protection of sovereignty • emergency and disaster management RADARSAT-2 is the next Canadian Earth observation success story. It is the result of collaboration between the Canadian Space Agency and the company MDA. -

International Space Station Program Mobile Servicing System (MSS) To

SSP 42004 Revision E Mobile Servicing System (MSS) to User (Generic) Interface Control Document Part I International Space Station Program Revision E, May 22, 1997 Type 1 Approved by NASA National Aeronautics and Space Administration International Space Station Program Johnson Space Center Houston, Texas Contract No. NAS15–10000 SSP 42004, Part 1, Revision E May 22, 1997 REVISION AND HISTORY PAGE REV. DESCRIPTION PUB. DATE C Totally revised Space Station Freedom Document into an International Space Station Alpha Document 03–14–94 D Revision D reference PIRNs 42004–CS–0004A, 42004–NA–0002, 42004–NA–0003, TBD 42004–NA–0004, 42004–NA–0007D, 42004–NA–0008A, 42004–NA–0009C, 42004–NA–0010B, 42004–NA–0013A SSP 42004, Part 1, Revision E May 22, 1997 INTERNATIONAL SPACE STATION PROGRAM MOBILE SERVICING SYSTEM TO USER (GENERIC) INTERFACE CONTROL DOCUMENT MAY 22, 1997 CONCURRENCE PREPARED BY: PRINT NAME ORGN SIGNATURE DATE CHECKED BY: PRINT NAME ORGN SIGNATURE DATE SUPERVISED BY (BOEING): PRINT NAME ORGN SIGNATURE DATE SUPERVISED BY (NASA): PRINT NAME ORGN SIGNATURE DATE DQA: PRINT NAME ORGN SIGNATURE DATE i SSP 42004, Part 1, Revision E May 22, 1997 NASA/CSA INTERNATIONAL SPACE STATION PROGRAM MOBILE SERVICING SYSTEM (MSS) TO USER INTERFACE CONTROL DOCUMENT MAY 22, 1997 Print Name For NASA DATE Print Name For CSA DATE ii SSP 42004, Part 1, Revision E May 22, 1997 PREFACE SSP 42004, Mobile Servicing System (MSS) to User Interface Control Document (ICD) Part I shall be implemented on all new Program contractual and internal activities and shall be included in any existing contracts through contract changes. -

Core 1..44 Committee (PRISM::Advent3b2 9.00)

House of Commons CANADA Standing Committee on Industry, Science and Technology INDU Ï NUMBER 024 Ï 2nd SESSION Ï 39th PARLIAMENT EVIDENCE Wednesday, March 5, 2008 Chair Mr. James Rajotte Also available on the Parliament of Canada Web Site at the following address: http://www.parl.gc.ca 1 Standing Committee on Industry, Science and Technology Wednesday, March 5, 2008 Ï (1535) I've been tracking the development of RADARSAT-2 for a [English] number of years and was invited to appear before the House of Commons Standing Committee on Foreign Affairs and International The Chair (Mr. James Rajotte (Edmonton—Leduc, CPC)): Trade in 2005 to speak about the Remote Sensing Space Systems We'll call this meeting to order. This is the 24th meeting of the Act, which was at that time called Bill C-25. At that time I was Standing Committee on Industry, Science and Technology. representing my previous employer, the Polaris Institute, and we Members, we have 13 votes at 5:30, so we'll have to end this raised concerns about the potential defence applications of meeting at 5:15. RADARSAT-2 and the need for its sensitive technology to be firmly controlled by the Canadian government. I believe our last guest is here. We have with us today four guests. The orders of the day today are, pursuant to Standing Order 108 In recent years my work has become more involved in promoting (2), for the study of the proposed sale of part of MacDonald, Canadian leadership and ensuring that the benefits of space and its Dettwiler and Associates Ltd. -

For Immediate Release

NEWS RELEASE FOR IMMEDIATE RELEASE October 17, 2018 MDA leaders outline opportunities, challenges for Canada in space Speech to the Greater Saskatoon Chamber of Commerce highlights innovation and economic upsides for Canada, if government acts to secure our place in space Saskatoon, SK – MDA, a Maxar Technologies company (formerly MacDonald, Dettwiler and Associates Ltd.) (NYSE: MAXR) (TSX: MAXR), today outlined that Canada’s role and potential involvement in the growing new space economy requires a full commitment from the Government of Canada for a new space strategy that would secure Canada’s place as a leader in space, Mike Greenley, the Group President of MDA, said in a speech to the Greater Saskatoon Chamber of Commerce. “We need a long-term, fully funded space plan for Canada that establishes the requisite funding to maintain and enhance our existing world-leading capabilities in AI-based space robotics, satellite communications, Earth observation and space science, while cultivating new areas of leadership. And we need it now, because there are pressing decisions that need to be made,” Greenley said. Greenley and Holly Johnson, the president’s business manager at MDA, made their presentation today in Saskatchewan to highlight the impact space has in the region, from Canadian Light Source Inc. to Calian SED Systems, a partner with MDA in the Don’t Let Go Canada campaign currently underway. Greenley and Johnson took advantage of their time in Saskatchewan to discuss MDA Launchpad, the company’s initiative to bring more Canadians companies on board the space industry. MDA has tasked senior leaders to deal with small- to medium-sized enterprises looking to collaborate with MDA. -

Maxar 2020 Annual Report

A message from Maxar CEO, Dan Jablonsky I would like to take this opportunity to provide a recap of last year’s performance, remind stockholders of our commitment to innovation and the path ahead, and end with a reminder of our commitment to value creation and our broader purpose. Despite the numerous challenges of the global COVID-19 pandemic, the year proved to be another important and successful year in our company’s journey. Maxar is a world leading space technology and intelligence company. We unlock the promise of space to help customers solve problems on Earth and beyond. In 2020, Maxar continued to lead the throughout the year, and we look forward industry in Earth Intelligence by providing to serving and growing with them in the critical data and insights that government years to come. Our team members are and commercial customers need to make passionate about the work we do and informed decisions in an increasingly believe strongly our Earth Intelligence and complex world. In Space Infrastructure, Space Infrastructure capabilities have the we continued to provide innovative ways power to change how we navigate and for our customers to support understand our changing world and explore communications and exploration across what’s beyond it. our planet and beyond, including the power needed to return to the moon and Mars. Our commitment to customers and their critical missions remained unwavering 1 annual shareholder letter 2020 PERFORMANCE AND KEY HIGHLIGHTS Managed well during the COVID-19 pandemic: One of the largest stories of the year was the global pandemic, and we remained steadfast in our efforts to protect our workforce while producing the products and solutions our partners need to complete their critical missions. -

Loral Space & Communications Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-14180 LORAL SPACE & COMMUNICATIONS INC. (Exact name of registrant specified in its charter) Jurisdiction of incorporation: Delaware IRS identification number: 87-0748324 600 Fifth Avenue New York, New York 10020 Telephone: (212) 697-1105 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common stock, $.01 par value LORL Nasdaq Global Select Market Preferred Stock Purchase Rights Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ◻ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

The RADARSAT-Constellation Mission (RCM)

The RADARSAT-Constellation Mission (RCM) Dr. Heather McNairn Science and Technology Branch, ORDC [email protected] Daniel De Lisle RADARSAT Constellation Mission Manager Canadian Space Agency [email protected] Why Synthetic Aperture Radar (SAR)? The Physics: • At microwave frequencies, energy causes alignment of dipoles (sensitive to number of water molecules in target) • Characteristics of structure in target impacts how microwaves scatter (sensitive to roughness and canopy structure) The Operations: • At wavelengths of centimetres to metres in length, microwaves are unaffected by cloud cover and haze • As active sensors, SARs generate their own source of energy; can operate day or night and under low illumination conditions The Reality for Agriculture: • The backscatter intensity and scattering characteristics can be used to estimate amount of water in soils and crops, and tell us something about the type and condition of crops • The near-assurance of data collection is critical for time sensitive applications, in times of emergency (i.e. flooding), risk (i.e. disease), and for consistent measures over the entire growing season (i.e. monitoring crop condition) Why a RADARSAT Constellation? • The use of C-Band SAR has increased significantly since the launch of RADARSAT-1 • Many Government of Canada users have developed operational applications that deliver information and products to Canadians and the international community, based on RADARSAT • This constellation ensures C-Band continuity with improved system reliability, primarily to support current and future operational users • RCM is a government-owned mission, tailored to respond to Canadian Government needs for maritime surveillance, disaster management and ecosystem monitoring Improved stream flow forecasts1 Estimates of crop biomass2 AAFC’s annual crop inventory Produced by ACGEO Contact: [email protected] 1Bhuiyan, H.A.K.M, McNairn, H., Powers, J., and Merzouki, A. -

Canadian Space

COTS View Case Study: Space Station Robot Embeds Ada Despite rumors of its demise, Adas is at the heart of the International Space Station’s in-orbit Canadarm 2 where it assures software safety and reliability. The ISS-based, next-generation Canadarm 2, the key element Robert Dewar, President, Ada Core Technologies of the MSS, is a bigger, better, smarter version of Canadarm, the robotic arm that operates from the cargo bay of the Space Shuttle. hile safety-critical characteristics have been introduced This arm is capable of handling large payloads and assisting with into the design of many programming languages, Ada docking the space shuttle to the space station. The new arm, built Wis the language specifically targeted at “life-critical” specifically for the space station, is 17.6 meters (57.7 feet) long systems. Developed between 1975 and 1984 by the US Department when fully extended and has seven motorized joints, each of of Defense (DoD), Ada has been classically targeted for use in which operates as a complex real-time embedded control system. mission-critical embedded systems that emphasize safety, low cost, Canadarm 2 is “self-relocatable” and can move around the sta- and a near-perfect degree of reliability. The most important safety tion’s exterior like an inchworm. Each end of the arm is equipped features that make Ada ideal for development of fail-safe software with a specialized mechanism called a Latching End Effector that include its information-hiding capability, its ability to provide can lock its free end on one of many special fixtures, called Power re-useable code and its “strong typing”, which helps detect and Data Grapple Fixtures placed strategically around the station, and solve many types of coding errors at compile time, very early in then detach its other end and pivot it forward. -

RADARSAT-2 Data

Article Figure 1a: Orthorectified RADARSAT-2 U2 data using RFM/RPC method without post-processing overlaid with Google Earth Automated High Accuracy Geometric Correction and Mosaicking without Ground Control Points RADARSAT-2 data Imagine a fully automated system used to produce accurate high resolution radar ortho-images and -mosaics all over the world with excellent reliability! Emergency management teams could then have access to highly-accurate radar data as soon as it becomes available for their time-sensitive needs. This was a difficult task in the past, mainly due to the arduous process of collecting ground control points (GCPs). It is now possible with the successful operation of the RADARSAT-2 satellite and a new 3D hybrid satellite model that process this data without user-collected GCPs. Philip Cheng and Thierry Toutin RADARSAT-2 satellite advancements that provide enhanced informa- Following the highly successful predecessor RADARSAT-2 is Canada’s second-generation com- tion for applications such as environmental RADARSAT-1 program (satellite launched in 1995), mercial Synthetic Aperture Radar (SAR) satel- monitoring, ice mapping, resource mapping, RADARSAT-2 was launched in December 14, 2007. lite and was designed with powerful technical disaster management, and marine surveillance. RADARSAT-2 is the world’s most advanced July/August 2010 22 Article Figure 1b: Orthorectified RADARSAT-2 U2 data using Toutin’s hybrid method without post-processing overlaid with Google Earth commercial C-band SAR satellite and heralds a Geometric Correction of RADARSAT-2 Since the RADARSAT-2 satellite has multiple GPS new era in satellite performance, imaging flexi- Data receivers on board with accurate real-time bility and product selection and service offer- For most SAR applications, it is required to positioning, this information could potentially ings. -

Maritime Environmental Surveillance with RADARSAT-2

Anais XVI Simpósio Brasileiro de Sensoriamento Remoto - SBSR, Foz do Iguaçu, PR, Brasil, 13 a 18 de abril de 2013, INPE Maritime environmental surveillance with RADARSAT-2 Gordon Staples1 Douglas Fraga Rodrigues2 1MDA 13800 Commerce Parkway – Richmond – B.C – Canada – V6V 2J3 [email protected] 2Threetek Soluções em Geomática México Str., 41 – Downtown – 20031–144 – Rio de Janeiro – RJ, Brazil [email protected] Abstract: Two key maritime surveillance applications for RADARSAT-2 are ship detection and oil slick detection. Ship detection applications primarily focuses on illegal bilge dumping and oil slick detection focuses on the detection of natural oil seeps and the accidental discharge of oil from offshore drilling platforms. Ship detection depends on three main parameters: wind, ship properties, and radar characteristics. Ship detection improves with decreasing wind speed and increasing ship length. The use of cross-polarized data in the near- range and co-polarized data in the far-range provide good ship detection performance across a wide range of incidence angles. Oil slick detection depends primarily on wind speed. Radar polarization also plays a role in oil slick detection. Co-polarized (HH or VV) images provide similar results, but cross-polarized return is generally not used due to weak scattering from oil. Case studies that outline the application of RADARSAT-2 data for oil spill monitoring, oil seep mapping, and illegal bilge dumping are discussed. End user needs are discussed as either a requirement for data or information products. To be of the greatest value both data and information products are usually needed in a timely manner, and must be interpretable and interoperable, allowing for end users to use the information in any manner. -

Telesat Today Announced Its Financial Results for the Three and Six-Month Periods Ended June 30, 2021

Telesat Reports Results for the Quarter and Six Months Ended June 30, 2021 OTTAWA, CANADA, August 13, 2021 - Telesat today announced its financial results for the three and six-month periods ended June 30, 2021. All amounts are in Canadian dollars and reported under International Financial Reporting Standards (“IFRS”) unless otherwise noted. For the quarter ended June 30, 2021, Telesat reported consolidated revenue of $188 million, a decrease of 10% ($20 million) compared to the same period in 2020. When adjusted for changes in foreign exchange rates, revenue declined 3% ($7 million) compared to 2020. Revenue decreases were primarily due to a slight reduction of service for one of Telesat’s North American DTH customers, non-renewals of certain enterprise contracts, and lower consulting revenue. Operating expenses for the quarter were $57 million, an increase of $11 million from 2020. When adjusted for changes in foreign exchange rates, operating expenses increased by $14 million from 2020. The increase in operating expenses was principally the result of a $16 million increase in non-cash share-based compensation combined with higher wages due to the hiring of additional employees primarily to support our Telesat Lightspeed program. These increases were partially offset by higher capitalized engineering and lower bad debt expense in the three months ended June 30, 2021. Adjusted EBITDA1 was $149 million, a decrease of 10% ($16 million) or, when adjusted for foreign exchange rates, a decrease of 3% ($5 million). The Adjusted EBITDA margin1 for the second quarter of 2021 was 79.2%, compared to 79.1% in 2020. For the quarter ended June 30, 2021, net income was $61 million, compared to net income of $162 million for 2020. -

Mda Fas Dashboard Legend & Disclaimers

Monitoring Forest Cover Change In the Protected Areas of APP’s Suppliers Concession Areas Table of Contents Introduction ......................................................................................................................................................... 2 Challenges............................................................................................................................................................ 3 The Satellite : RADARSAT-2 ................................................................................................................................. 4 Reliable Forest Change Observations From Space .............................................................................................. 4 How Does RADARSAT-2 Detect Changes in Forest Cover ................................................................................... 7 Processing the Data ............................................................................................................................................. 9 Verification Process ........................................................................................................................................... 11 ATTACHMENTS .................................................................................................................................................. 13 References ......................................................................................................................................................... 17 External Links ....................................................................................................................................................