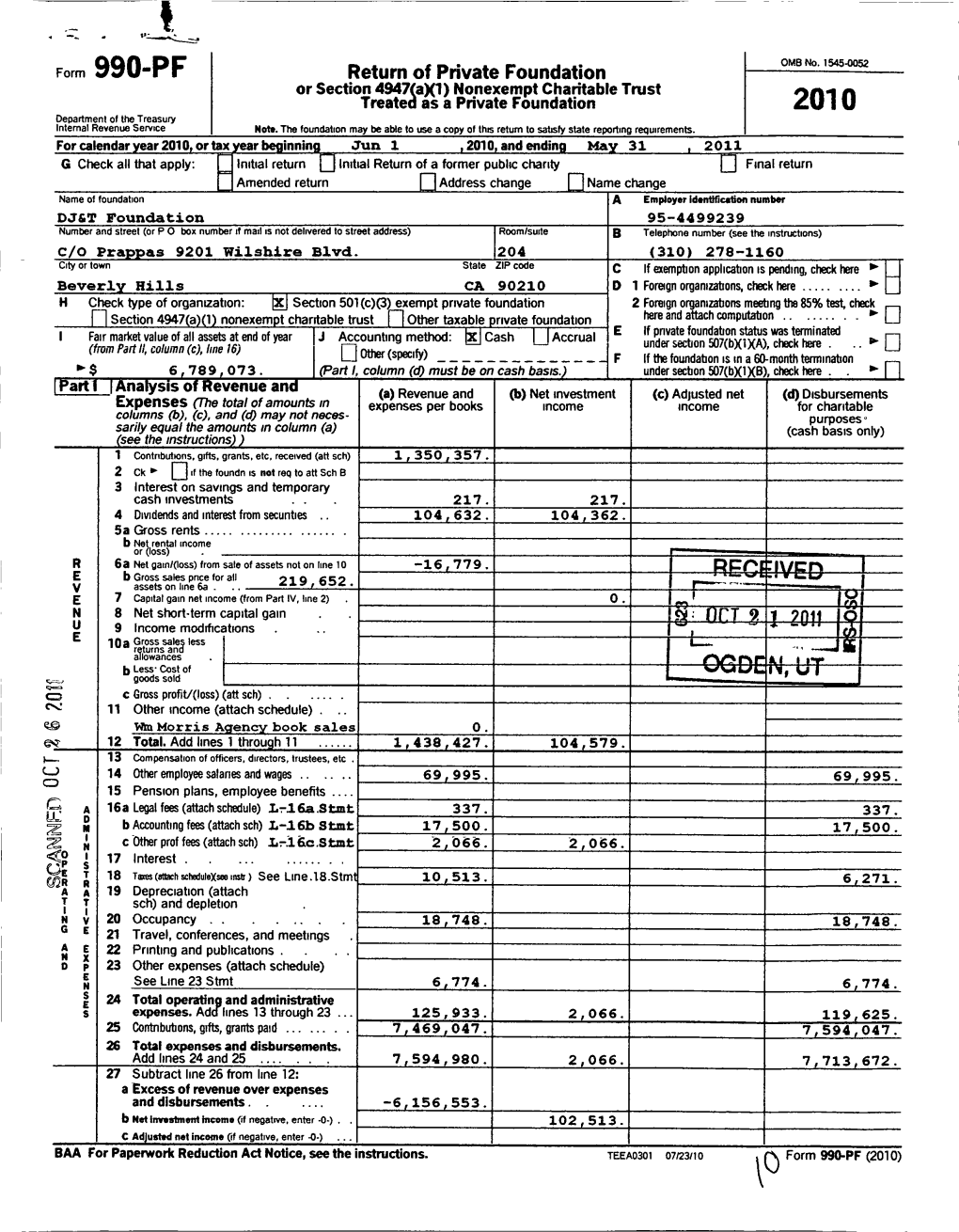

Form 990-PF 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table of Contents County Board Meeting

TABLE OF CONTENTS COUNTY BOARD MEETING - October 10, 2000 MINUTE APPROVAL ..............................................................................................233 ZONING PETITIONS #3766 Batavia Township--Raymond H. Grommes Trust..........................................233 #3768 Plato Township--Mark Griffin, et ux...............................................................234 #3770 Big Rock Township--Old Second National Bank of Aurora, Tr#8036............236 RESOLUTIONS AND ORDINANCES #00-262 Chevrolet Astro Van--Tobacco Grant Program........................................251 #00-263 Government Center Bldg. B Addition--Furniture & Equipment.................237 #00-264 Local & Long Distance Usage Rates .......................................................238 #00-265 Cartridge Tape Drives..............................................................................238 #00-266 Revise T1 Circuit Contract.......................................................................239 #00-267 Public Utility & Drainage Easement--County, St. Charles, et ux ..............239 #00-268 Economic Development Committee Small Cities Grants.........................240 #00-269 Mill Creek Water Reclamation District Appointment ................................240 #00-270 Blackberry Creek Watershed Management Plan (Support & Cooperation)241 #00-271 Integrated Management Plan for Fox River Watershedt .........................242 #00-272 Burlington Community Fires Protection District Appointment ..................242 #00-273 Opposing United States -

Animal People News

European Commission votes to ban dog &cat fur B R U S S E L S ––The European Commis- sion on November 20 adopted a proposal to ban the import, export, and sale of cat and dog fur throughout the European Union. “The draft regulation will now be considered by the European Parliament and the Council of Ministers for adoption by the co- decision procedure,” explained the EC Asian dog. (Kim Bartlett) announcement. “There is evidence that cat and dog fur been found not just on clothing, but also on a is being placed on the European market, usually number of personal accessories, as well as chil- dren’s soft toys.” Asian rabbits. (Kim Bartlett) undeclared as such or disguised as synthetic and other types of fur,” the EC announcement sum- “Just the idea of young children playing marized. “The vast majority of the cat and dog with toys which have been made with dog and Olympics to showcase growing fur is believed to be imported from third coun- cat fur is really something we cannot accept,” tries, notably China.” European Consumer Protection Commissioner Fifteen of the 25 EU member nations Markos Kyprianou said. Chinese animal testing industry have already individually introduced legislation “Kyprianou stopped short of calling B E I J I N G ––The 2008 Olympic Glenn Rice, chief executive of Bridge against cat and dog fur. “The proposed regula- for every product containing fur to have a label Games in Beijing will showcase the fast- Pharmaceuticals Inc., is outsourcing the tion adopted today addresses EU citizens con- detailing its exact origin,” wrote London Times growing Chinese animal testing industry, work to China, where scientists are cheap cerns, and creates a harmonized approach,” the European correspondent David Charter, the official Xinhua news agency disclosed and plentiful and animal-rights activists are EC announcement stipulated. -

CONGRESSIONAL RECORD—SENATE October 1, 2001

October 1, 2001 CONGRESSIONAL RECORD—SENATE 18161 of S. 1467, a bill to amend the Hmong will award a gold medal on behalf of have distinguished records of public service Veterans’ Naturalization Act of 2000 to the Congress to Reverend Doctor Mar- to the American people and the inter- extend the deadlines for application tin Luther King, Jr., posthumously, national community; and payment of fees. (2) Dr. King preached a doctrine of non- and his widow Coretta Scott King in violent civil disobedience to combat segrega- S.J. RES. 12 recognition of their contributions to tion, discrimination, and racial injustice; At the request of Mr. SMITH of New the Nation on behalf of the civil rights (3) Dr. King led the Montgomery bus boy- Hampshire, the name of the Senator movement. It is time to honor Dr. Mar- cott for 381 days to protest the arrest of Mrs. from New Hampshire (Mr. GREGG) was tin Luther King, Jr. and his widow Rosa Parks and the segregation of the bus added as a cosponsor of S.J. Res. 12, a Coretta Scott King, the first family of system of Montgomery, Alabama; joint resolution granting the consent the civil rights movement, for their (4) in 1963, Dr. King led the march on Wash- of Congress to the International Emer- distinguished records of public service ington, D.C., that was followed by his famous address, the ‘‘I Have a Dream’’ speech; gency Management Assistance Memo- to the American people and the inter- (5) through his work and reliance on non- randum of Understanding. -

County Board Views Conditions at the Jail by PAUL Nailing •

at the Kane County Correctional raclilty Kane County Board member Hollie Kissane peers into an inmate holding cell Thursday in Geneva as part of a tour for the new members of the county board. County board views conditions at the jail By PAUL nAILING • . Kane CoUnty Jail by the numbers mates, 15 more than Its ca- Kane Count)' Cbronicic . pacityovertlowinmatesare • opened: October 1975. to 13 sent to jails in McHenry, nthe Kane County Jail, Additions made in 1984, • Ratio of prisoners Jefferson and Kendall coun- the ceiling in booking 1989 and 1996 guards: 40 to 1, to 120 to ties. I leaks when it rains. • Estimated square '1, depending on type of cell McHenry County, which The stains in the ceilings footage: 87,000 square • Cost to house one housed an average 78 Kane are among the first things in- feet prisoner per day: $38 County inmates per day in coming inmates see when • Capacity: 398 prisoners (excluding overhead) 2004, charges $67 a day per being admitted to the over- • Currently houses: 413 • Security status: Entire jail inmate. crowded facility at 777 E. prisoners; 78 prisoners on now considered maximum Lee Barrett, R-East Fabyan Parkway. were housed in security. Former medium Dundee. said this is lower A leaky thof was one of average security cell blocks designed than the $74 they usually several eyesores Kane County McHenry County Jail per day charge because Kane in 2004. for 16 prisoners, currently Board members saw hold 32- Original maximum. Countyhouses sdme of Thursday. Six of the seven • McHenry County charges $67 McHenry County's juvenile a day per prisoner; prisoners security cell blocks designed newboard members toured for three prisoners, currently offenders. -

Approaching Nokill

Approaching NoKill: Challenges and Solutions for the Los Angeles Animal Services Department Caroline Nasella April 28, 2006 UEP Comps 1 TABLE OF CONTENTS Executive Summary 3 Introduction 4 Chapter I: The Players and Politics Behind the LAAS Controversy 9 Chapter II: Methods 20 Chapter III: Animal Shelters and the CompanionPet Surplus 26 Chapter IV: The Animal Welfare and Liberation Philosophy 39 Chapter V: What is possible: The San Francisco SPCA And Animal Care and Control Facilities 47 Chapter VI: A Policy Analysis of the Los Angeles Animal Services Department 69 Chapter VII: Recommendations 80 Conclusion 86 Bibliography 89 2 EXECUTIVE SUMMARY This paper is an examination of the Los Angeles Animal Services (LAAS) Department. It looks at the historical, political and philosophical context of the Department. It examines the validity of grievances made by local animal welfare groups against the Department and analyzes the LAAS Department structure and policies. Using a comparative casestudy, it identifies the San Francisco animal care facilities as effective models for LAAS. Through an exploration of such themes, this report makes pragmatic policy recommendations for the Department with the goal of lowering shelter euthanasia rates. 3 INTRODUCTION 4 When asked about why activists have targeted LAAS in recent years, cofounder of Animal Defense League – Los Angeles (ADLLA) Jerry Vlasik argued that the group wanted to focus on one municipal shelter whose reformed policies could translate “throughout the nation”. He believes that if the city goes “nokill” it will serve as a model for all cities. Vlasik contends that LAAS is not worse than other municipalities. -

The Big News This Week Is That the Israeli Media Is Reporting That Avaya

March 2012 Volume 28 Dear Subscribers, The big news this week is that the Israeli media is reporting that Avaya is set to buy Israeli videoconferencing manufacturer RADVISION for between $200-$250MM which has triggered a 19% increase in the price of RADVISION’s stock. Neither side has confirmed the transaction. The move would make perfect sense for Avaya which is currently owned by private equity powerhouses Silver Lake and TPG Capital. Silver Lake also owns AVI-SPL, the largest telepresence and videoconferencing systems integrator in the world. AVI-SPL recently purchased telepresence and managed service provider Iformata Communications giving AVI-SPL its own VNOC and nascent telepresence and videoconferencing exchange capability. Silver Lake also owns Sabre who provides the back end reservation systems for airline flights and travel management companies. Sabre recently announced that it would be adding virtual meeting reservations to its global scheduling and delivery system AND also announced a partnership with shared workspace provider Regus to add access to their 1200+ publicly available telepresence and videoconferencing rooms in 550 cities to Sabre’s Virtual Meeting Network. So… now add a capable videoconferencing endpoint and infrastructure capability to the Silver Lake / Avaya portfolio and you have a substantial collection of end-to-end videoconferencing capabilities. Of course hitting the market with another HD videoconferencing end-point isn’t going to set the world on fire, but given the fact that Avaya chairman and Silver Lake partner Charlie Giancarlo was the genesis for telepresence at Cisco I wouldn’t be surprised if he has a couple of key differentiators up his sleeve. -

2019 Biennial Compensation and Benefits Survey EXECUTIVE SUMMARY Information Submitted on Or Before May 7, 2020

2019 Biennial Compensation and Benefits Survey EXECUTIVE SUMMARY Information Submitted on or before May 7, 2020 I N T R O D U C T I O N A N D I N S I G H T S Organizations in the field of animal welfare employ a unique workforce with distinctive expertise in leadership, organizational governance, animal protection, animal cruelty investigation, behavior rehabilitation, veterinary care, adoption, fundraising, advocacy, human resources, finance, community education and collaboration. Although compensation and benefits surveys exist for many industries, no salary study is compatible with the knowledge and skills needed for mastery of animal welfare. For that reason, The Association for Animal Welfare Advancement (The Association) leadership were compelled to begin collecting data in 2003 (based on FY 2002 data). Since 2003, animal welfare services have evolved: adoption is no longer the main activity at animal care facilities as the numbers of homeless dogs and cats have declined in many regions; community needs have altered; collaborations and mergers have increased; and, animal focused legislation has fluctuated. In response, animal care facilities models continue to adapt to community and animal needs. Consequently The Association volunteer leadership continually reviews the compensation and benefits survey adding or altering job descriptions and accessing needs for additional decision making data. For instance, the effect on salary of those achieving Certified Animal Welfare Administrator (CAWA) status; or, being a male/female in the same role are now studied. In 2019 the first “digital” survey was launched, based on FY 2018 data, allowing participants to instantly compare their data with other regions and budget size over a variety of key performance indicators. -

Council Follies Ill Foie Gras Be Banned from the Restau- the Abuse of Prisoners in Iraq

30 CHICAGO READER | DECEMBER 9, 2005 | SECTION ONE [snip] You know what they’d say if they dared. Writing in Slate, Meghan O’Rourke points out that in recent diatribes against premarital sex, paleoconservatives Leon Kass (University of Chicago) and Harvey Mansfield (Harvard) agreed to fight on their opponents’ turf, saying things like “Without mod- esty, there is no romance”—in effect acknowledging that the language of sin won’t play anymore. Instead “they cast the sexual revolution as something that makes women unhappy, couching their critique in the Our Town fuzzy language of gratification and personal gain that we Oprah-raised kids can relate to.” —HH Council Follies ill foie gras be banned from the restau- the abuse of prisoners in Iraq. But Mayor Daley W rants of Chicago? Next week the City has noted that a ban could open the door to a Some Animals Are Just Council is scheduled to vote on Alderman Joe slew of other animal rights causes. “What is the More Delicious Than Others Moore’s bill to outlaw the sale of the livers of fat- next issue?” he said. “Chicken? Beef? Fish?” tened ducks. Certain animal rights activists link Good question. We put it to the animal By Mick Dumke the violent force-feeding of the doomed ducks to rights champions. THE PROBLEM WHOSE CAUSE IS IT?POSSIBLE LEGISLATION JOE MOORE SAYS Elephant abuse. Three elephants Alderman Mary Ann Smith, Smith has submitted an ordinance that would “I met with a couple of activists who’ve been floating in the Lincoln Park Zoo died between Paul McCartney, P!nk, People guarantee each zoo elephant in Chicago at that. -

Partnership to Promote Qatar As Art, Sports

BUSINESS | Page 1 SPORT | Page 1 Qatar’s El Jaish defeat INDEX DOW JONES QE NYMEX QATAR 3 – 12, 31, 32 COMMENT 28, 29 Qapco close to REGION 13 BUSINESS 1 – 8, 12 – 16 UAE’s 16,238.83 9,917.52 31.02 ARAB WORLD 14 CLASSIFIED 9 – 11 fi nalising ethane -192.25 -85.28 -0.85 INTERNATIONAL 15 – 27 SPORTS 1 – 12 Al Ain 2-1 -1.17% -0.85% -2.67% expansion project Latest Figures published in QATAR since 1978 THURSDAY Vol. XXXVII No. 10009 February 25, 2016 Jumada I 16, 1437 AH GULF TIMES www. gulf-times.com 2 Riyals Caution on ceasefire plan Partnership In brief to promote WORLD | Survey Doha ranks among top 100 safe cities Mercer’s Quality of Living rankings 2016 places Doha among top Qatar as art, 100 cities for personal safety of expatriates in the Middle East and Africa region. The host city of FIFA World Cup 2022 ranks 70th in this segment of the rankings. Only a handful of cities in this region sports hub place in the top 100 for personal safety – with Abu Dhabi ranking Qatar Museums and the Supreme channels, including social media and highest in 23rd place, followed by Committee for Delivery & newsletters. Muscat (29), Dubai (40) and Port Legacy sign a memorandum of The SC recently organised work- Louis (59). Mercer has crowned understanding shops at the Fire Station, the home of the Austrian capital Vienna as the QM’s Artist in Residence Programme. city with the best quality of living atar will be promoted as a lead- The workshops were led by Qatari art- in the world. -

![Henry Spira Papers [Finding Aid]. Library of Congress. [PDF Rendered](https://docslib.b-cdn.net/cover/0798/henry-spira-papers-finding-aid-library-of-congress-pdf-rendered-1020798.webp)

Henry Spira Papers [Finding Aid]. Library of Congress. [PDF Rendered

Henry Spira Papers A Finding Aid to the Collection in the Library of Congress Manuscript Division, Library of Congress Washington, D.C. 2017 Contact information: http://hdl.loc.gov/loc.mss/mss.contact Additional search options available at: http://hdl.loc.gov/loc.mss/eadmss.ms017017 LC Online Catalog record: http://lccn.loc.gov/mm00084743 Prepared by Colleen Benoit, Karen Linn Femia, Nate Scheible with the assistance of Jake Bozza Collection Summary Title: Henry Spira Papers Span Dates: 1906-2002 Bulk Dates: (bulk 1974-1998) ID No.: MSS84743 Creator: Spira, Henry, 1927-1998 Extent: 120,000 items; 340 containers plus 6 oversize ; 140 linear feet ; 114 digital files (3.838 GB) Language: Collection material in English Location: Manuscript Division, Library of Congress, Washington, D.C. Summary: Animal welfare advocate and political activist. Correspondence, writings, notes, newspaper clippings, advertisements, printed matter, and photographs, primarily relating to Spira's work in the animal welfare movement after 1974. Selected Search Terms The following terms have been used to index the description of this collection in the Library's online catalog. They are grouped by name of person or organization, by subject or location, and by occupation and listed alphabetically therein. People Douglas, William Henry James. Fitzgerald, Pegeen. Gitano, Henry, 1927-1998. Grandin, Temple. Kupferberg, Tuli. Rack, Leonard. Rowan, Andrew N. Singer, Peter, 1946- Singer, Peter, 1946- Ethics into action : Henry Spira and the animal rights movement. 1998. Spira, Henry, 1927-1998--Political and social views. Spira, Henry, 1927-1998. Trotsky, Leon, 1879-1940. Trull, Frankie. Trutt, Fran. Weiss, Myra Tanner. Organizations American Museum of Natural History. -

1-Animals on Their Own Terms

Animals on Their Own Terms: Where Advocacy Can Go From Here by Lee Hall1 It’s an especially important time to be an animal advocate. The word’s out that our little planet will be home to more than nine billion human beings by 2050. The resources we allocate to the animals we domesticate are drawing intense scrutiny. Many people in the industrialized world accept that we must “cut back” on consumption; but serious change is called for. Animal-rights voices must be heard in this urgent discussion, because without them -- that is, without transcending the individual and collective habits connected with dominion over the planet’s life -- humans will be locked into a cycle of pollution and pillage of the land and seas. Taking animal rights seriously can free us from the cycle. Had we respected the lives and futures of pink dolphins, marmosets, jaguars and tamarins, could we have ravaged the forests to make way for an industry that creates hamburgers? Surely we could never have devoted the great plains of North America to single-crop feed growing, interspersed with cattle feedlots, had we taken seriously the interests of river otters, whooping cranes, burrowing owls, long-billed curlews, wolves, black-footed ferrets, coyotes and kit foxes. Respecting free-living animals would keep natural areas intact, force humanity to confront its dependence on animal agribusiness, and address the causes of our climate crisis. What has animal-rights theory proposed so far? We are not the only ones born with interests, and so, advocates have urged, we are not the only ones whose interests should be respected. -

Animals' Rights Considered in Relation to Social Progress

COLUMBIA LIBRARIES OFFSITE HEALTH SCIENCES STANDARD HX64099725 RECAP QP45 .Sa3 1 894 Animals' rights i QP4-5 Sa3 College of l^hiv^itimi anb ^urgeonss ^.itirarp Digitized by tlie Internet Arcliive in 2010 witli funding from Open Knowledge Commons (for the Medical Heritage Library project) http://www.archive.org/details/animalsrightscoOOsalt. WORKS BY MR. H. S. SALT. SHELLEY PRIMER. London, 1887. LITERARY SKETCHES, Crown 8vo. London, 1888. THE LIFE OF JAMES THOMSON, with a Selec- tion from his Letters, and a Study of his Writings. 8vo. London, PERCY BYSSHE SHELLEY : A Monograph. With Portrait. Fcap. 8vo. London, 1889. RICHARD JEFFERIES: A Study. With Portrait. Fcap. 8vo. Dilettante Library, London, 1893. SONGS OF FREEDOM. i6mo. Canterbury Poets. London, 1893. TENNYSON AS A THINKER. i2mo. London, 1893. THE LIFE OF HENRY DAVID THOREAU. HUMANITARIANISM : Its General Principles and Progress. London. A PLEA FOR VEGETARIANISM, and Other Essays. Manchester. •/ ANIMALS' RIGHTS, " I saw deep in the eyes of the animals the human soul look out upon me. " I saw where it was born deep down under feathers and fur, or condemned for awhile to roam four-footed among the brambles. I caught the clinging mute glance of the prisoner, and swore that I would be faithful. " Thee my brother and sister I see and mistake not. Do not be afraid. Dwelling thus for a while, fulfilling thy ap- pointed time—thou too shalt come to thyself at last. " Thy half-warm horns and long tongue lapping round my wrist, do not conceal thy humanity any more than the learned talk of the pedant conceals his—for all thou art dumb, we have words and plenty between us.