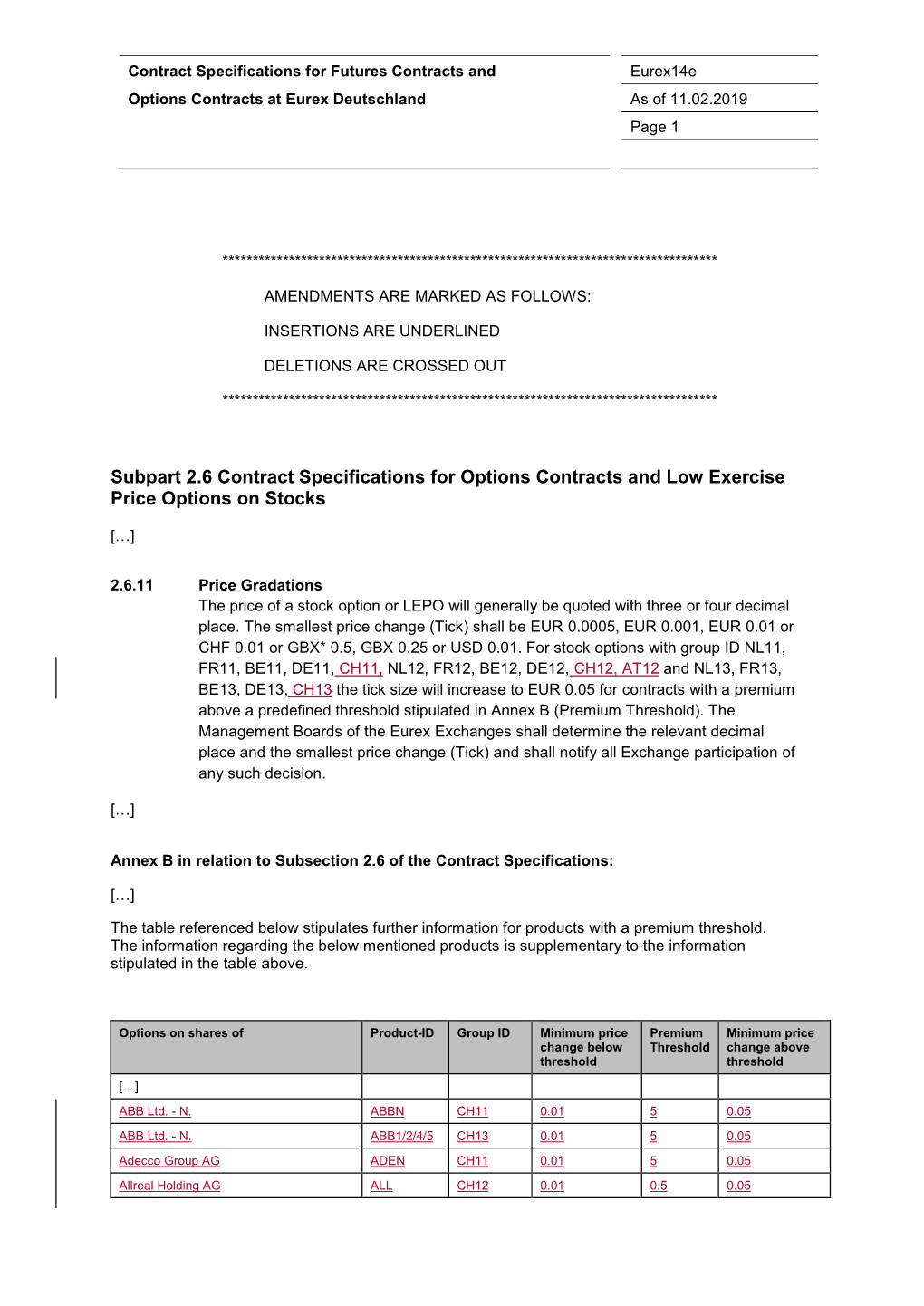

Subpart 2.6 Contract Specifications for Options Contracts and Low Exercise Price Options on Stocks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Release

CREDIT SUISSE AG Paradeplatz 8 Tel. +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating Overview of Swiss Companies Company CS Rating CS Outlook Changes since June 2009 S&P Moody's ABB Low A Stable A–, Stable A3, Stable Adecco Mid BBB Negative Outlook changed from Stable to Negative BBB–, Stable Baa3, Stable AFG Low BBB Stable Outlook changed from Negative to Stable n.r. n.r. Alpiq High A Stable n.r. n.r. Aryzta High BBB Stable Coverage initiation n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Low A Stable A–, Stable1 n.r. BKW Low AA Stable n.r. n.r. –1 notch, outlook changed from Negative to Bobst Group Low BBB Stable n.r. n.r. Stable Bucher Industries High BBB Stable n.r. n.r. CKW n.r. n.r. Drop coverage Clariant High BB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. –1 notch, outlook changed from Stable to Edipresse High BB Negative n.r. n.r. Negative –1 notch, outlook changed from Negative to EGL Low A Stable n.r. n.r. Stable EMS Chemie Low A Stable Outlook changed from Negative to Stable n.r. n.r. Energiedienst Low A Stable n.r. n.r. EOS n.r. n.r. Drop coverage Flughafen Zurich Mid BBB Stable BBB+, Positive n.r. Forbo Mid BBB Stable n.r. n.r. Geberit High BBB Stable A–, Stable n.r. -

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

DWS (CH) II Small and Mid Caps Switzerland

Marketing Material DWS (CH) II Small and Mid Caps Switzerland Equity Funds - Europe - Regions/Countries August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class FD (in %) The goal of the sub-fund is primarily to achieve long-term growth in Swiss Francs through investment in a portfolio of stocks from Swiss issuers that are listed in a representative Swiss equities index of small and medium enterprises or the small and mid- cap subindex of a Swiss equities index (“the benchmark”). The investment strategy is based on a transparent and comprehensible investment process, focuses on stock selection. Fund Benchmark (since 09/08/2006): SPI EXTRA Total Return (RI) Past performance is no indication of current or future performance, and the performance data do not take account of the commissions and costs Fund Management's Comment incurred on the issue and redemption of units. For detailed comments on the fund and its corresponding markets please see the annual report. Cumulative performance (in %) - share class FD 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 CHF 3.0 42.7 36.1 77.7 421.8 29.6 10.8 12.2 29.9 -21.6 29.3 1.8 EUR 2.7 42.0 42.2 80.2 650.5 30.2 12.5 12.5 19.4 -18.6 33.7 2.2 BM IN CHF 2.5 34.9 39.1 90.5 284.2 23.7 11.6 13.8 29.7 -17.2 30.4 8.1 Further Characteristics (3 years) / VAR (1 year) - share class FD Volatility 18.36% Maximum Drawdown -21.26% VAR (99%/10 days) 7.23% Sharpe Ratio -- Information Ratio -0.16 Correlation Coefficient 0.97 Alpha -1.26% Beta 1.05 Tracking Error -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Swiss Opportunity Fund

January 2021 Swiss Opportunity Fund FACT SHEET January 2021 / PERFORMANCE 0.19% After stocks ended 2020 with a such a strong performance, a The Swiss Opportunity Fund kept pace with its relevant bench- bumpy start to the new year could be expected. There was a raft mark and crept 0.19% higher. There was no clear trend among of economic news with few upside surprises. Political develop- the portfolio positions. Logitech (8.08%) and Zur Rose (44.7%) ments in the US captured the world's attention. The assault on continued to drive performance, as did some cyclical positions the Capitol Building, the formal confirmation of President-Elect such as Zehnder (10.15%), SIG (3.31%) and Sulzer (3.54%). Mean- Joe Biden’s win and the Democratic sweep of the Georgia run-off while, the rather defensive plays such as Sonova (-6.35%), Strau- election giving them control of the US Senate all happened dur- mann (-4.06%) and Vifor Pharma (-12.81%) hurt overall perfor- ing the space of 48 hours. Observers of these events may have mance. Turning to transaction activity, we opened a position in held their breath, but financial markets hardly reacted. That was Stadler Rail (10.34%) and sharply reduced our position in Zur attributable, in our opinion, to the prospect of more fiscal stimu- Rose as its share price surged on frothy sentiment. So where do lus and to statements from the relevant central banks in which we stand now after the opening month of the new year? Obvi- they pledged to keep monetary policy ultra-expansive. -

Corporate Governance

Business report Corporate governance Transparency is one of the key elements of good corporate governance, to which Sonova is committed. Good corporate governance is essential for Sonova and we strive for high standards in this field. What “good corporate governance” means is an evolving matter and we constantly monitor the latest changes to the requirements. Compliance is an integral element of our corporate culture and embedded in our core values. We therefore continued to strengthen the Sonova Group compliance program during the 2017/18 financial year, putting particular emphasis on integrating our acquired businesses into our compliance culture, designing new global compliance training, and updating our antibribery policy. Our continuing compliance efforts help us to live our values of ethical behavior and unquestionable integrity. At Sonova, corporate governance is based upon, and structured to conform with, relevant standards and practices. The company fulfils its legal duties under the Swiss Code of Obligations, the SIX Swiss Exchange Directive on Information relating to Corporate Governance, and the standards defined in the Swiss Code of Best Practice for Corporate Governance. This report describes the principles of corporate governance for the Sonova Group and provides background information on the Group’s executive officers and bodies as of March 31, 2018. All relevant documents can be accessed at the corporate governance section of the Sonova website: www.sonova.com/en/commitments/corporategovernance. For clarity and transparency, the compensation report is presented as a separate chapter of the annual report. Sonova Annual Report 2017/18 37 CORPORATE GOVERNANCE Group structure Operational group structure The Sonova Group is headquartered in Stäfa, Switzerland, and is active in over 100 countries. -

Bekanntmachung Auf Keyinvest Bezugsrechtsemission AMS AG

Bekanntmachung auf KeyInvest Bezugsrechtsemission AMS AG Rights issue AMS AG Im Zusammenhang mit der Kapitalerhöhung der AMS AG (Bloomberg Code: AMS SE) durch Bezugsrechtsemission wurden die Bedingungen der unten genannten Produkte der UBS AG, per 16. März 2020 angepasst. Die detaillierten Informationen befinden sich in der entsprechenden Produktedokumentation (Termsheets). With regard to the rights issue of AMS AG (Bloomberg Code: AMS SE), UBS AG will adjust the terms of the following products as of 16th March 2020. Detailed information can be found in the respective product documentation (Termsheets). ISIN Name CH0406766680 PERLES Plus on AMS AG CH0434739725 Kick-In Certificate on AMS AG / U-Blox / ABB CH0434739717 Kick-In Certificate on AMS AG / U-Blox / ABB CH0524660716 8.40% p.a. Callable Kick-In GOAL on AMS AG / Logitech / Temenos CH0391676241 PERLES Plus on AMS AG CH0405218907 PERLES Plus on AMS AG CH0428536335 9.00% p.a. ER Worst of Kick-In GOAL on AMS AG / Temenos / OC Oerlikon CH0437181537 Kick-In Certificate on AMS AG / Autoneum Holding AG / Dufry AG CH0524663124 10.20% p.a. ER Kick-In GOAL on AMS AG CH0522755518 6.00% p.a. Callable Kick-In GOAL on AMS AG / Kühne + Nagel / Swatch I / Richemont / LafargeHolcim CH0509384506 6.496023402505% p.a. Kick-In GOAL on AMS AG / Credit Suisse / Swiss Re CH0512543437 FACTOR CERTIFICATE ON AMS AG CH0512543445 FACTOR CERTIFICATE ON AMS AG CH0512547974 FACTOR CERTIFICATE ON AMS AG CH0527058983 FACTOR CERTIFICATE ON AMS AG CH0453246909 CHF MINI-FUTURE ON AMS AG CH0521942109 CHF EQUITY-WARRANT -

Annual Report 2018 19 Table of Content

FINANCIAL REPORT Annual Report 2018 19 Table of content Letter to shareholders 2 Our product and service offering 6 Strategy and businesses 10 Corporate governance 36 Compensation report 60 Financial review 96 5 year key figures 104 Consolidated financial statements 105 Financial statements of Sonova Holding AG 175 Investor information 188 Corporate Responsibility Report 190 Letter to shareholders Dear shareholders, 2018/19 marked another year of solid financial performance, posting further record levels of sales and profits to which all three businesses contributed. Moreover – and as expected – growth accelerated from the first half-year to the second, driven by the launch of a number of innovative products and solutions. Sonova affirmed its leading position in audiological performance with the release of the Marvel™ technology platform. Marvel takes full advantage of the unique connectivity enabled by our SWORD™ (Sonova Wireless One Radio Digital) chip and combines it with the proven convenience of our rechargeable solutions. We also made significant progress in our retail business, which we have renamed “audiological care” for one simple reason: care is what we deliver. The expert service We have made significant provided by our hearing care professionals adds key value for the consumer. progress in implementing our strategy. Our cochlear implants business launched a series of innovative new products to strengthen its leading position in this expanding market. Robert Spoerry You will find details of these and other strategic initiatives in the “strategy and businesses” section of this report. The global market in which we operate is poised for further growth, as developed countries see increasing demand from the “baby boomer” generation and developing countries begin to bridge the gap in hearing care provision. -

Omv Aktiengesellschaft

Prospectus dated 27 August 2020 OMV AKTIENGESELLSCHAFT (incorporated as a joint stock corporation (Aktiengesellschaft) under the laws of the Republic of Austria) Euro 750,000,000 2.500 % Perpetual Subordinated Fixed to Reset Rate Notes ISIN XS2224439385, C ommon C ode 222443938, W KN A281UC Issue Price: 100.00 per cent. Euro 500,000,000 2.875 % Perpetual Subordinated Fixed to Reset Rate Notes ISIN XS2224439971, C ommon C ode 222443997, W KN A281UD Issue Price: 100.00 per cent. OMV Aktiengesellschaft, T rabrennstraße 6-8, 1020 Vienna, Republic of Austria ("OMV AG" or the "Issuer") will issue on 1 September 2020 (the "Issue Date") EUR 750,000,000 2.500% Perpetual Subordinated Fixed to Reset Rate Notes (the "NC6 Notes") and EUR 500,000,000 2.875% Perpetual Fixed to Reset Rate Notes (the "NC9 Notes" and together with the NC6 Notes, the "Notes" and each a "Series of Notes") in the denomination of EUR 100,000 each. The Notes will be governed by the laws of the Federal Republic of Germany ("Germany"). T he NC6 Notes shall bear interest on their aggregate principal amount (i) from and including the Issue Date to but excluding 1 September 2026 (the "NC6 First Reset Date") at a fixed rate of 2.500% per annum; (ii) from and including the NC6 First Reset Date to but excluding 1 September 2030 at the relevant 5-year swap rate for the relevant interest period plus a margin being equal to the initial credit spread and (iii) from and including 1 September 2030 at the relevant 5-year swap rate for each interest period thereafter plus a margin being equal to the initial credit spread plus 100 basis points per annum (as set forth in the terms and conditions of the NC6 Notes, the "NC6 Terms and Conditions"). -

Carbon Report - VBV VK Aktiendachfonds Identifier: - | Report Created On: Feb 20, 2020 | Holdings Date: Dec 31, 2019 | Benchmark: Equity - MSCI World Index

Carbon Report - VBV VK Aktiendachfonds Identifier: - | Report created on: Feb 20, 2020 | Holdings Date: Dec 31, 2019 | Benchmark: Equity - MSCI World Index Currency: EUR | Industry Classification: GICS | Company Breakdown Metrics: carbon intensity (tCO2e / Mio. revenue) | Value: 611'301'158.00 EUR Executive Summary Coverage Carbon Disclosing Titles by Weight Emissions Emissions incl. Relative Carbon Carbon Intensity Weighted Average Scope 1+2 Scope 3 Footprint Carbon Intensity Portfolio 72.9% 99.6% 48'604.6 184'845.5 79.2 114.2 104.5 Benchmark 74.5% 99.5% 79'450.6 317'877.6 129.3 202.5 198.8 market value tCO2e tCO2e tCO2e / EUR Mio tCO2e / EUR Mio tCO2e / EUR Mio invested revenue revenue This report analyses a portfolio of securities in terms of the carbon emissions and other carbon related characteristics of the underlying portfolio companies. It compares this data to the performance of a relevant respectively chosen market benchmark. The data below represents a high-level subset of the information found in the following pages. The headline metrics provided in the table above includes absolute and relative figures for portfolio carbon emissions as well as intensity measures: The total carbon emission answers the main question “What is my portfolio’s total carbon footprint?” as it measures the carbon footprint of a portfolio taking scope 1-2 as well as scope 3 emissions into account The relative carbon footprint is a normalized measure of a portfolio’s contribution and is defined as the total carbon emissions of the portfolio per million EUR invested. It enables comparisons with a benchmark, between multiple portfolios, over time and regardless of portfolio size.