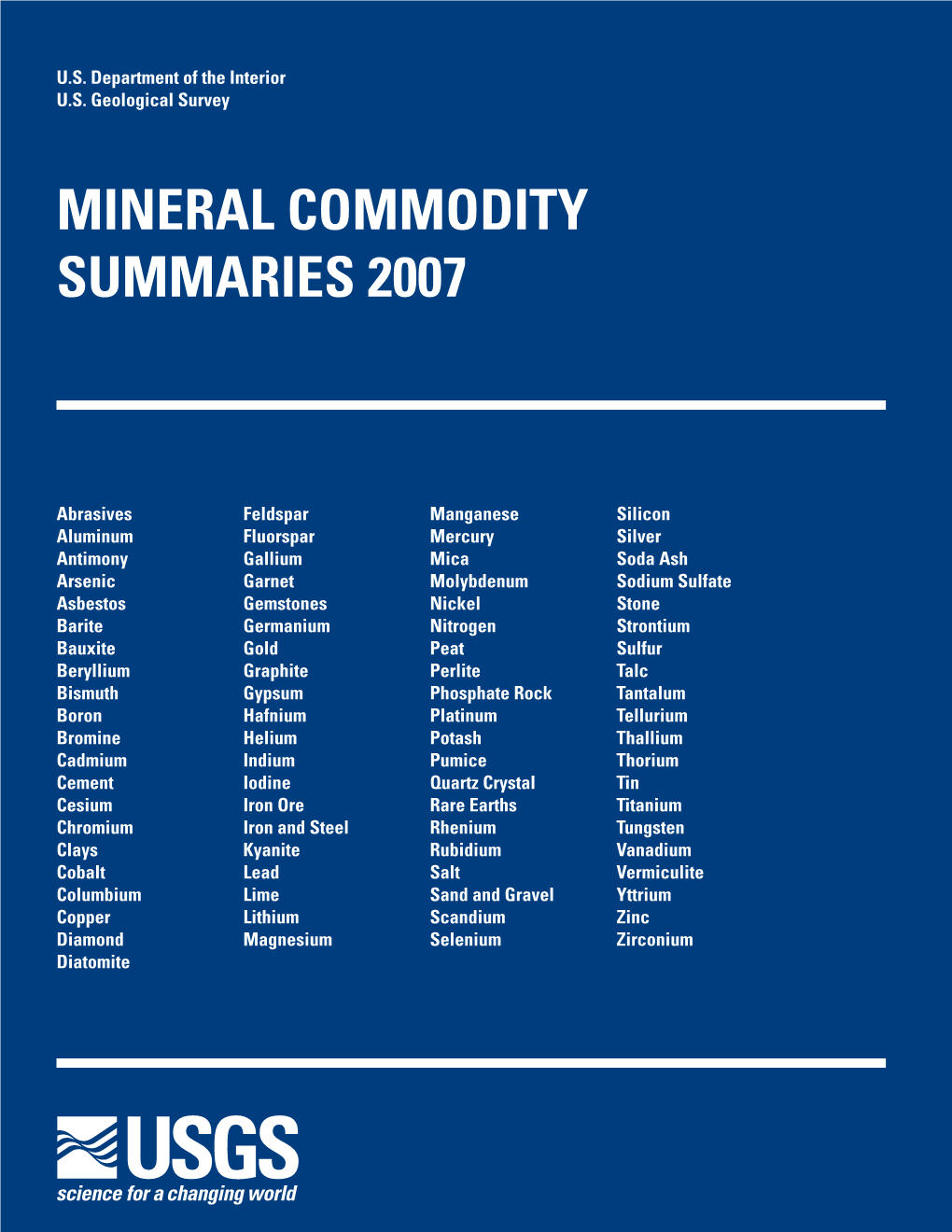

Mineral Commodity Summaries 2007, by the U.S. Geological Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lithium Enrichment in the No. 21 Coal of the Hebi No. 6 Mine, Anhe Coalfield, Henan Province, China

minerals Article Lithium Enrichment in the No. 21 Coal of the Hebi No. 6 Mine, Anhe Coalfield, Henan Province, China Yingchun Wei 1,* , Wenbo He 1, Guohong Qin 2, Maohong Fan 3,4 and Daiyong Cao 1 1 State Key Laboratory of Coal Resources and Safe Mining, College of Geoscience and Surveying Engineering, China University of Mining and Technology, Beijing 100083, China; [email protected] (W.H.); [email protected] (D.C.) 2 College of Resources and Environmental Science, Hebei Normal University, Shijiazhuang 050024, China; [email protected] 3 Departments of Chemical and Petroleum Engineering, and School of Energy Resources, University of Wyoming, Laramie, WY 82071, USA; [email protected] 4 School of Civil and Environmental Engineering, Georgia Institute of Technology, Mason Building, 790 Atlantic Drive, Atlanta, GA 30332, USA * Correspondence: [email protected] Received: 18 May 2020; Accepted: 3 June 2020; Published: 5 June 2020 Abstract: Lithium (Li) is an important strategic resource, and with the increasing demand for Li, there are some limitations in the exploitation and utilization of conventional deposits such as the pegmatite-type and brine-type Li deposits. Therefore, it has become imperative to search for Li from other sources. Li in coal is thought to be one of the candidates. In this study, the petrology, mineralogy, and geochemistry of No. 21 coal from the Hebi No. 6 mine, Anhe Coalfield, China, was reported, with an emphasis on the distribution, modes of occurrence, and origin of Li. The results show that Li is enriched in the No. 21 coal, and its concentration coefficient (CC) value is 6.6 on average in comparison with common world coals. -

2015 AFMS Endowment Fund Drawing

2015 AFMS Endowment Fund Drawing The 2014 Endowment Fund Drawing took place in Tulsa, Oklahoma. We had some very nice donations for prizes, and a lot of people stepped up and bought tickets to support the AFMS Endowment Fund. Thank you for your support. And thank you to those who picked up prizes to deliver at the banquet in Tulsa. That helped save the cost of mailing the items. We have received the following donations for the 2015 Endowment Fund Drawing, which will be held on October 24, 2015, at the awards banquet in Austin, Texas. 1.Copper piece and stock certificate donated by Pam Hecht. Estimated value is $65. MWF 2. Howelite and onyx agate necklace and earrings. Donated by Sharon Rogow, crafted by Betsy Oberheim. Estimated value is $75. CFMS 2015 AFMS Endowment Fund Drawing Page 1 of 11 10-11-2015 3. A large agatized coral head donated by the Suncoast Gem and Mineral Society. It was from an old collection of Withlacoochee River coral donated by a member who passed some years ago. The value is estimated to be at least $100. SFMS (This one is larger than the one given last year.) 4. Phareodus encaustus (fossil fish) from the Eocene Period, Green River formation, Kemmerer, Wyoming. This was donated by J.C. and Donna Moore with an approximate value of $65. MWF #5 - is a Tampa Bay Coral pair donated by Barbara Sky, MWF Uniform Rules Chairman. The pair is about six inches long and two and a half inches wide. The estimated value is $50. -

The Use of Raman Spectroscopy in the Characterization of Variscite Provenance: the Gavà Case

Chapitre III : Apport des méthodes d’analyses à l’étude de la diffusion des productions The use of Raman spectroscopy in the characterization of variscite provenance: the Gavà case Joan Carlos Melgarejo, Laia Arqués, Cristina Villanova-de-Benavent, Tariq Jahwari, Lisard Torró, Josep Bosch Argilagós, Montgarri Castillo-Oliver, Marc Campeny, Sandra Amores, Aleu Andreazini, Saleh Lehbib, Antoni Camprubí Abstract. The Gavà phosphate deposit, mined during the Neolithic, was produced by weathering processes affecting primary apatite beds. It exhibits a neat vertical zoning, related to chemical gradients during weathering. Strengite, yellowish Al-rich strengite and ferroan variscite are found at the top, pale- green variscite at the intermediate levels, and green variscite in depth. Fe values are very low in the greenish samples, as well as Cr and V. Raman spectrums of the Gavà variscite show differences with samples from other occurrences worldwide. Moreover, some spectral differences can also be observed in the Raman spectra of variscite coming from different depths in the deposit. Raman spectroscopy can be an efficient tool to discriminate not only samples from different geographical localities, but also from its original position in a given deposit. Key-words: variscite, Raman, microprobe, veins, supergene. Résumé. Le gîte de phosphates de Gavà, exploité au Néolithique, s’est formé par des processus de météorisation qui auraient affecté des strates primaires d’apatite. Ce gîte a une zonation chimique verticale, qui aurait été produite par des gradations chimiques lors de la météorisation. La partie haute du gîte contient de la strengite, de l’Al-strengite et de la Fe-variscite jaunâtres ; les niveaux intermédiaires contiennent de la variscite verdâtre et les niveaux plus profonds, de la variscite verte. -

Turquoise: the Cerrillos Mineral Gem

A Living History Museum Turquoise: The Cerrillos Mineral Gem The mines of Cerrillos, New Mexico produce a particularly beautiful blue/ green variety of turquoise, so stunning in fact that they have been mined for roughly the last 3,000 years! Chemically, it is a phosphate of aluminum carrying small quantities of copper and iron and a green mineral, variscite. These give the gemstone its color as well as its value and beauty. This is the only phosphate that is considered a precious stone. Ancestral Puebloans first started mining the Cerrillos hills circa 900 BCE, and it’s been mined ever since. This “gem” of a mineral has been found across the state, and archaeological evidence shows it’s been mined and fashioned into ornaments and jewelry for centuries, with remnants found at one of the most ancient sites in the state, Chetro Ketl at Chaco Canyon. Southwest indigenous groups call turquoise chalchihuitl, as did the ancient peoples of Mexico and Central America who used the same word to describe jade or green turquoise. One of the hills still being mined in Cerrillos still bears the name, Mount Chalchihuitl. Combined with shell and coral from the California coast acquired in trade, turquoise jewelry itself became a valued commodity. Spanish settlers didn’t have much interest in turquoise as they were looking for what they considered a more important prize, namely gold and silver. In fact, outside of local indigenous groups, other cultural groups weren’t much interested in it and it didn’t really gain popularity with the American cultural at large until the 1890s. -

Turquoise and Variscite by Dean Sakabe MEETING Wednesday

JANUARY 2015 - VOLUME 50, ISSUE 1 Meeting Times Turquoise and Variscite By Dean Sakabe MEETING We are starting the year off with Tur- Wednesday quoise and Variscite. January 28, 2015 Turquoise is a copper aluminum phosphate, whose name originated in 6:15-8:00 pm medieval Europe. What happened was Makiki District Park that traders from Turkey introduced the blue-green gemstone obtained Admin Building from Persia (the present day Iran) to Turquoise (Stabilized), Europeans. Who in turn associated Chihuahua, Mexico NEXT MONTH this stone with the Turkish traders, Tucson Gem & rather than the land of the stones origin. Hence they called this stone Mineral Show “Turceis” or, later in French “turquois.” Over time english speakers adopted this French word, but adding an “e” (Turquiose). The Spanish called this stone “Turquesa”. LAPIDARY The gemstone grade of Turquoise has a hardness of around 6, however Every Thursday the vast majority of turquoise falls in the softer 3–5 range. With the 6:30-8:30pm exception being the Turquoise from Cripple Creek, Colorado which is in the 7-8 range. Turquoise occurs in range of hues from sky blue to grey Makiki District Park -green. It is also found in arid places that has a high concentration of 2nd floor Arts and copper in the soil. The blue color is created by copper and the green Crafts Bldg by bivalent iron, with a little amount of chrome. Turquoise often, has veins or blotches running MEMBERSHIP through it, most often brown, but can be light gray or black DUE COSTS 2015 depending on where it was Single: $10.00 found. -

Gem News International

(1 I /1 IIJ' ~ ) ~! I I I Gem News International 1/ Contributing Editors \ t Emmanuel Fritsch, University of Nantes, CNRS, Team 6502, Institut des Matériaux Jean Rouxel (IMN), I Nantes, France ([email protected]) ti''1 ) ) I ( J f ( I' Gagan Choudhary, Gem Testing Laboratory, Jaipur, India j 11 ([email protected]) I j\ I r \, ) I\ r I / { ' Christopher M. Breeding, GIA, Carlsbad ([email protected]) - ~ .. 1\ - 1 ( t 1/I J ~ 1 1 ________________' ( _1 ____J ____ I\ J __tc _, __ ) l _______,_____________________ , ___________________ .._________ 4( _,' : 1 , _______ __ _ Opal, particularly black opal, has seen a resurgence among high-end jewelers. Boehm believes there could be a TUCSON 2019 growing appreciation for the gem due to the discovery of opal in Ethiopia, which has brought opal to different price The 2019 gem shows came to Tucson with a wealth of ma- points and different audiences in the past decade. Rod Grif- terial, both new and old, as eager buyers descended on ex- fin (Rod Griffin Boulder Opals) discussed his experiences in hibitors to take in the latest trends. While traffic was not Australian opal mining and the new technology he is using as heavy as in recent years, several vendors noticed an in- to exploit deposits once thought to be depleted (pp. 122–123). flux of young people looking for natural, untreated gem- Color, of course, continues to reign, and dealers are see- stones. Spectacular color in gems and stunning jewelry ing what Boehm called “an increased appreciation for the designs were on view, while many pointed to sustainable unusual.” Beyond the classic “Big Three,” vendors stocked and ethical practices as a major consideration in their col- gemstones such as sphene, grandidierite, and various colors ored gemstone and jewelry purchases. -

Gemstones by Donald W

GEMSTONES By Donald W. olson Domestic survey data and tables were prepared by Nicholas A. Muniz, statistical assistant, and the world production table was prepared by Glenn J. Wallace, international data coordinator. In this report, the terms “gem” and “gemstone” mean any gemstones and on the cutting and polishing of large diamond mineral or organic material (such as amber, pearl, petrified wood, stones. Industry employment is estimated to range from 1,000 to and shell) used for personal adornment, display, or object of art ,500 workers (U.S. International Trade Commission, 1997, p. 1). because it possesses beauty, durability, and rarity. Of more than Most natural gemstone producers in the United states 4,000 mineral species, only about 100 possess all these attributes and are small businesses that are widely dispersed and operate are considered to be gemstones. Silicates other than quartz are the independently. the small producers probably have an average largest group of gemstones; oxides and quartz are the second largest of less than three employees, including those who only work (table 1). Gemstones are subdivided into diamond and colored part time. the number of gemstone mines operating from gemstones, which in this report designates all natural nondiamond year to year fluctuates because the uncertainty associated with gems. In addition, laboratory-created gemstones, cultured pearls, the discovery and marketing of gem-quality minerals makes and gemstone simulants are discussed but are treated separately it difficult to obtain financing for developing and sustaining from natural gemstones (table 2). Trade data in this report are economically viable deposits (U.S. -

Human Impact Overwhelms Long-Term Climate Control of Weathering and Erosion in Southwest China

1 Geology Achimer June 2015, Volume 43 Issue 5 Pages 439-442 http://dx.doi.org/10.1130/G36570.1 http://archimer.ifremer.fr http://archimer.ifremer.fr/doc/00266/37754/ © 2015 Geological Society of America. For permission to copy, contact [email protected]. Human impact overwhelms long-term climate control of weathering and erosion in southwest China Wan S. 1, *, Toucanne Samuel 2, Clift P. D. 3, Zhao D. 1, Bayon Germain 2, 4, Yu Z. 5, Cai G. 6, Yin Xiaoming 1, Revillon Sidonie 7, Wang D. 1, Li A. 1, Li T. 1 1 Key Laboratory of Marine Geology and Environment, Institute of Oceanology, Chinese Academy of Sciences, Qingdao 266071, China 2 IFREMER, Unité de Recherche Géosciences Marines, BP70, 29280 Plouzané, France 3 Department of Geology and Geophysics, Louisiana State University, Baton Rouge, Louisiana 70803, USA 4 Department of Earth Sciences, Royal Museum for Central Africa, B-3080 Tervuren, Belgium 5 Laboratoire IDES, UMR 8148 CNRS, Université de Paris XI, Orsay 91405, France 6 Guangzhou Marine Geological Survey, Guangzhou 510760, China 7 SEDISOR/UMR 6538 “Domaines Oceaniques”, IUEM, Place Nicolas Copernic, 29280 Plouzané, France Abstract : During the Holocene there has been a gradual increase in the influence of humans on Earth systems. High-resolution sedimentary records can help us to assess how erosion and weathering have evolved in response to recent climatic and anthropogenic disturbances. Here we present data from a high- resolution (∼75 cm/k.y.) sedimentary archive from the South China Sea. Provenance data indicate that the sediment was derived from the Red River, and can be used to reconstruct the erosion and/or weathering history in this river basin. -

VARISCITE (Alpo4·2H2O) from CIOCLOVINA CAVE (ŞUREANU MOUNTAINS, ROMANIA): a TALE of a MISSING PHOSPHATE

STUDIA UNIVERSITATIS BABEŞ-BOLYAI, GEOLOGIA, XLIX, 1, 2004, 3-14 VARISCITE (AlPO4·2H2O) FROM CIOCLOVINA CAVE (ŞUREANU MOUNTAINS, ROMANIA): A TALE OF A MISSING PHOSPHATE BOGDAN P. ONAC1, JOE KEARNS2, RADU BREBAN3, SIMONA CÎNTĂ PÂNZARU4 ABSTRACT. Recent investigations on a phosphatized sediment sequence in the Cioclovina Cave led to the identification of a second occurrence in Romania (first time in the cave environment) of variscite, AlPO4·2H2O. The mineral exists as dull- white, tiny crusts and veinlets within the thick argillaceous material accumulated on the cave floor. Under scanning electron microscope (SEM) variscite appears as subhedral to euhedral micron-size crystals. The {111} pseudo-octahedral form is rather common. Variscite was further characterized by means of X-ray diffraction, thermal, vibrational FT-IR and FT-Raman spectroscopy, and by SEM energy- dispersive spectrometry (EDS). The calculated orthorhombic cell parameters are a = 9.823(4), b = 8.562(9), c = 9.620(5) Å, and V = 809.167(6) Å3. The ED spectrum of variscite shows well-resolved Al and P lines confirming thus the presence of the major elements in our compound. The formation of variscite is attributed to the reaction between the phosphate-rich leachates derived from guano and the underlying clay sediments. Keywords: phosphate minerals, variscite, Cioclovina Cave, Romania. GENERAL DATA The Cioclovina Cave is located 40 km southeast of the city of Hunedoara, in the west-southwest side of Şureanu Mountains, Romania (Fig. 1, inset), at an altitude of 770 m asl. The investigated part of the cave develops in reef limestone of Lower Cretaceous age (Stilla, 1981; Pop et al., 1985). -

'Uravesmountain Artd-·

/' ;~~ . - . :-.--... -~~;~-'. ' ) ;;. :,~~., . -'uravesMountain artd-· . ',MagrudetMine·, " . WiIkes_ Lmeolll~Gee"'.- .··~-SOUth~(JeolegicalSoc~~ OOidebOOk;NWIlber~3B- - April- 23-25, 1999 -. GRAVES MOUNTAIN AND MAGRUDER MINE Compiled and Edited by: Marc V. Hurst and Cornelis Winkler III - GUIDEBOOK NtTMBER 38 Prepared for the Annual Field Trip of the Southeastern Geological Society April 23-25, 1999 Published by the Southeastern Geological Society P.O. Box 1634 Tallahassee, Florida 32302 TABLE OF CONTENTS LOCATIONS OF GRAVES MOUNTAIN AND MAGRUDERMINE...................................... 1 INTRODUCTION TO GRAVES MOUNTAIN by John S. Whatley, JM. Huber Corporation.................................................................3 PHOSPHATE MINERALS OF GRAVES MOUNTAIN, GEORGIA by Henry BatWood............. .............................................................................................5 GRAVES MOUNTAIN, SLATE BELT, GEORGIA GEOLOGY by Gilles O. Allard, University of Georgia.................................................................... 11 GEOLOGY AND ECONOMIC POTENTIAL OF THE MAGRUDER MINE AND VICINITY by Norman L. Bryan ..................................................................................................... 17 \ \ \ \ \ \ \ \ \ \ Magruder Mme ~\ \ ,\(". ~\1- "'..,.. \9 \'> <'\'ci0;: \ I I I I l-s £-''d C!.'s., "I~ ~ \«\ (>\~ o I' I \ i-20 \ \ I \ \ I \ \ \ \ ~ \ '\ '\ '\ LOCATIONS OF GRAVES MOUNTAIN AND MAGRUDER MINE 2 J 5 ! ! I Scole in Hites Ap,.it 15. 1'J'J'J INTRODUCTION TO GRAVES MOUNTAIN by John S. -

Dissolution Rates of Amorphous Al- and Fe-Phosphates and Their Relevance to Phosphate Mobility on Mars

UNLV Theses, Dissertations, Professional Papers, and Capstones 5-1-2013 Dissolution Rates of Amorphous Al- and Fe-Phosphates and their Relevance to Phosphate Mobility on Mars Valerie Tu University of Nevada, Las Vegas Follow this and additional works at: https://digitalscholarship.unlv.edu/thesesdissertations Part of the Astrophysics and Astronomy Commons, Geochemistry Commons, and the Geology Commons Repository Citation Tu, Valerie, "Dissolution Rates of Amorphous Al- and Fe-Phosphates and their Relevance to Phosphate Mobility on Mars" (2013). UNLV Theses, Dissertations, Professional Papers, and Capstones. 1900. http://dx.doi.org/10.34917/4478319 This Thesis is protected by copyright and/or related rights. It has been brought to you by Digital Scholarship@UNLV with permission from the rights-holder(s). You are free to use this Thesis in any way that is permitted by the copyright and related rights legislation that applies to your use. For other uses you need to obtain permission from the rights-holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/ or on the work itself. This Thesis has been accepted for inclusion in UNLV Theses, Dissertations, Professional Papers, and Capstones by an authorized administrator of Digital Scholarship@UNLV. For more information, please contact [email protected]. DISSOLUTION RATES OF AMORPHOUS AL- AND FE-PHOSPHATES AND THEIR RELEVANCE TO PHOSPHATE MOBILITY ON MARS By Valerie M. Tu Bachelor of Science in Geology University of Nevada, Las Vegas 2011 A thesis submitted in partial fulfillment of the requirements for the Master of Science in Geoscience Department of Geoscience College of Science The Graduate College University of Nevada, Las Vegas May 2013 Copyright by Valerie M. -

VARISCITE from CENTRAL TAJIKISTAN: PRELIMINARY RESULTS Andrey K

NOTES & NEW TECHNIQUES VARISCITE FROM CENTRAL TAJIKISTAN: PRELIMINARY RESULTS Andrey K. Litvinenko, Elena S. Sorokina, Stefanos Karampelas, Nikolay N. Krivoschekov, and Roman Serov variscite group (variscite and strengite) are isodimor- An occurrence of variscite containing strengite, phous with the metavariscite monoclinic phosphate as well as other minerals from both the variscite mineral group members metavariscite and phospho- and metavariscite groups, was discovered in the siderite, respectively. late 1970s in central Tajikistan. The material, Most of the variscite in the market today comes ranging from light blue to light green to green, is from the state of Utah, close to the cities of Lucin and suitable for cabochon cutting. The samples pre- Fairfield, though some of these mines are practically sented in this study showed traces of sulfur and exhausted (Larsen, 1942; Solodova et al., 1985; Willing arsenic, with higher iron and generally lower et al., 2008). The occurrences at Woodlands, Western vanadium and chromium concentrations than Australia, and Yauli, Peru were discovered in 2004 and variscites reported from other localities.These dif- 2011, respectively (Willing et al., 2008; Hyršl, 2011). ferences may result from the intergrowth of Among the minerals of the variscite and variscite with other minerals from the variscite metavariscite groups, variscite is most often used for and metavariscite groups. carvings and ornaments (see Koivula, 1986; Fritz and Rockwell, 2006; Willing et al., 2008; and Hyršl, 2011). Variscite has a waxy luster and is transparent to translucent with a color range from white to brown ariscite (figure 1), a relatively common cave min- and blue to green to yellow, which can cause misiden- eral that forms as a result of phosphate-bearing V tification as turquoise and chrysoprase (Willing et al., surface solutions reacting with aluminum-rich rocks 2008).