Dairy100 Table-ONLINE.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sauces Reconsidered

SAUCES RECONSIDERED Rowman & Littlefield Studies in Food and Gastronomy General Editor: Ken Albala, Professor of History, University of the Pacific ([email protected]) Rowman & Littlefield Executive Editor: Suzanne Staszak-Silva ([email protected]) Food studies is a vibrant and thriving field encompassing not only cooking and eating habits but also issues such as health, sustainability, food safety, and animal rights. Scholars in disciplines as diverse as history, anthropol- ogy, sociology, literature, and the arts focus on food. The mission of Row- man & Littlefield Studies in Food and Gastronomy is to publish the best in food scholarship, harnessing the energy, ideas, and creativity of a wide array of food writers today. This broad line of food-related titles will range from food history, interdisciplinary food studies monographs, general inter- est series, and popular trade titles to textbooks for students and budding chefs, scholarly cookbooks, and reference works. Appetites and Aspirations in Vietnam: Food and Drink in the Long Nine- teenth Century, by Erica J. Peters Three World Cuisines: Italian, Mexican, Chinese, by Ken Albala Food and Social Media: You Are What You Tweet, by Signe Rousseau Food and the Novel in Nineteenth-Century America, by Mark McWilliams Man Bites Dog: Hot Dog Culture in America, by Bruce Kraig and Patty Carroll A Year in Food and Beer: Recipes and Beer Pairings for Every Season, by Emily Baime and Darin Michaels Celebraciones Mexicanas: History, Traditions, and Recipes, by Andrea Law- son Gray and Adriana Almazán Lahl The Food Section: Newspaper Women and the Culinary Community, by Kimberly Wilmot Voss Small Batch: Pickles, Cheese, Chocolate, Spirits, and the Return of Artisanal Foods, by Suzanne Cope Food History Almanac: Over 1,300 Years of World Culinary History, Cul- ture, and Social Influence, by Janet Clarkson Cooking and Eating in Renaissance Italy: From Kitchen to Table, by Kath- erine A. -

Some of the Factors Influencing the Growth of Molds in Butter Harold Macy Iowa State College

Iowa State University Capstones, Theses and Retrospective Theses and Dissertations Dissertations 1929 Some of the factors influencing the growth of molds in butter Harold Macy Iowa State College Follow this and additional works at: https://lib.dr.iastate.edu/rtd Part of the Agriculture Commons, and the Food Science Commons Recommended Citation Macy, Harold, "Some of the factors influencing the growth of molds in butter " (1929). Retrospective Theses and Dissertations. 14244. https://lib.dr.iastate.edu/rtd/14244 This Dissertation is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Retrospective Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. INFORMATION TO USERS This manuscript has been reproduced from the miaofilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be from any type of computer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely affect reproduction. in the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Al.so, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand comer and continuing from left to right in equal sections vwth small overiaps. -

Ims List Sanitation Compliance and Enforcement Ratings of Interstate Milk Shippers April 2017

IMS LIST SANITATION COMPLIANCE AND ENFORCEMENT RATINGS OF INTERSTATE MILK SHIPPERS APRIL 2017 U.S. Department of Health and Human Services Public Health Service Food and Drug Administration Rules For Inclusion In The IMS List Interstate milk shippers who have been certified by State Milk sanitation authorities as having attained the milk sanitation compliance ratings are indicated in the following list. These ratings are based on compliance with the requirements of the USPHS/FDA Grade A Pasteurized Milk Ordinance and Grade A Condensed and Dry Milk Products and Condensed and Dry Whey and were made in accordance with the procedures set forth in Methods of Making Sanitation Rating of Milk Supplies. *Proposal 301 that was passed at 2001 NCIMS conference held May 5-10, 2001, in Wichita, Kansas and concurred with by FDA states: "Transfer Stations, Receiving Stations and Dairy Plants must achieve a sanitation compliance rating of 90 or better in order to be eligible for a listing in the IMS List. Sanitation compliance rating scores for Transfer and Receiving Stations and Dairy Plants will not be printed in the IMS List". Therefore, the publication of a sanitation compliance rating score for Transfer and Receiving Stations and Dairy Plants will not be printed in this edition of the IMS List. THIS LIST SUPERSEDES ALL LISTS WHICH HAVE BEEN ISSUED HERETOFORE ALL PRECEDING LISTS AND SUPPLEMENTS THERETO ARE VOID. The rules for inclusion in the list were formulated by the official representatives of those State milk sanitation agencies who have participated in the meetings of the National Conference of Interstate Milk Shipments. -

Breakfast Glycaemic Response in Patients with Type 2 Diabetes: Effects of Bedtime Dietary Carbohydrates

European Journal of Clinical Nutrition (1999) 53, 706±710 ß 1999 Stockton Press. All rights reserved 0954±3007/99 $15.00 http://www.stockton-press.co.uk/ejcn Breakfast glycaemic response in patients with type 2 diabetes: Effects of bedtime dietary carbohydrates M Axelsen1*, R Arvidsson Lenner 2,PLoÈnnroth1 and U Smith 1 1The Lundberg Laboratory for Diabetes Research, Department of Internal Medicine, Sahlgrenska University Hospital, S-413 45 GoÈteborg, Sweden; and 2Department of Clinical Nutrition, Department of Internal Medicine, Sahlgrenska University Hospital, GoÈteborg University, Sweden Objectives: Bedtime carbohydrate (CHO) intake in patients with type-2 diabetes may improve glucose tolerance at breakfast the next morning. We examined the `overnight second-meal effect' of bedtime supplements containing `rapid' or `slow' CHOs. Design: Randomized cross-over study with three test-periods, each consisting of two days on a standardized diet, followed by a breakfast tolerance test on the third morning. Setting: The Lundberg Laboratory for Diabetes Research, Sahlgrenska University Hospital, GoÈteborg, Sweden. Subjects: Sixteen patients with type 2 diabetes on oral agents and=or diet. Interventions: Two different bedtime (22.00 h) CHO supplements (0.46 g available CHO=kg body weight) were compared to a starch-free placebo (`normal' food regimen). The CHOs were provided as uncooked cornstarch (slow-release CHOs) or white bread (rapid CHOs). Results: On the mornings after different bedtime meals we found similar fasting glucose, insulin, free fatty acid and lactate levels. However, the glycaemic response after breakfast was 21% less after uncooked cornstarch compared to placebo ingestion at bedtime (406Æ 46 vs 511Æ 61 mmol min 171, P < 0.01). -

NEW to the MARKET: TWO SPECIALTY BUTTERS Natrel

Press Release For immediate release NEW TO THE MARKET: TWO SPECIALTY BUTTERS Natrel, known for its high-quality dairy products, launches Canada’s first lactose free butter along with an organic butter Montreal, November 8th, 2016 – Natrel, the undisputed dairy market leader across several categories, continues to innovate with the launch of Canada’s first lactose free butter1 in addition to an organic butter. Made of natural ingredients by Agropur, the only dairy cooperative to offer butter made with sea salt, Natrel’s latest products will surely become a butter lover’s dream thanks to their high-quality ingredients. New speciality products An absolute must for anyone who loves authentic taste – nothing beats real butter! That’s exactly why Natrel is launching two new butters, both available in 250 g format, aimed to please lactose-intolerant consumers as well as the ever-growing organic food category. In fact, Canada’s very first lactose free butter was developed to offer a new, appetizing butter option to 7 million lactose intolerant Canadians2. Made with organic cream, Natrel’s new organic butter promises a creamy texture combined with rich taste! Lactose free Butter Organic Butter $4.99 - available in Quebec, Ontario and Atlantic $5.79 – available in Quebec and Ontario provinces Natrel presents the Greatest Dessert Exchange With the holidays fast approaching and just in time with the launch of its two new speciality butters, Natrel kicks off a campaign to spread joy this holiday season! Natrel invites consumers to make their favourite dessert with delicious Natrel products, its two new butters included, offer it to someone close to their heart, and encourage them to continue the dessert chain by doing the same for someone else! It’s a delicious way to celebrate the true values of the holidays. -

4. Key Organic Foods

16 |ORGANIC FOOD PROCESSING IN CANADA Table 4.2. Top Canadian processed organic foods and 4. Key organic foods beverages by number of processors Processed Product Number of In this section, we examine major organic food types Processors in order of sales value. Beverages led organic sales Maple products 227 in 2017 (Table 4.1). Non-alcoholic beverages ranked Non alcoholic beverages 184 first in overall sales, while dairy was the largest selling Baked goods 138 food segment, followed by bakery products and ready Fruits & vegetables 98 meals. Maple products were the number one product Meat products 92 processed by Canadian organic processors (227 Dairy products 71 processors), followed by non-alcoholic beverages Snack foods 70 (184), baked goods (138), fruit and vegetable products Edible oils 55 (98) and meat (88) (Table 4.2). Sauces, dressings & condiments 39 Alcoholic beverages 37 Table 4.1 Top organic packaged foods sold at retail in Breakfast cereals 35 2017, $CAN millions Spreads 28 Processed Product Value Rice & pasta 27 Non alcoholic beverages 779.0 Ready meals 23 Dairy 377.6 Soup 16 Bakery products 237.4 Aquaculture products 8 Alcoholic beverages 230.0 Baby food 6 Ready meals 192.3 Breakfast cereals 132.3 Canadian retail sales values for each of the types Processed fruits/vegetables 86.4 of non-alcoholic beverages are shown in Table 4.3. Snacks 72.6 There were 184 organic non-alcoholic beverage man- Baby food 68.0 ufacturers in 2018, with the majority located in ON. Table 4.4 shows the number of manufacturers for each Meat 64.3 non-alcoholic beverage type. -

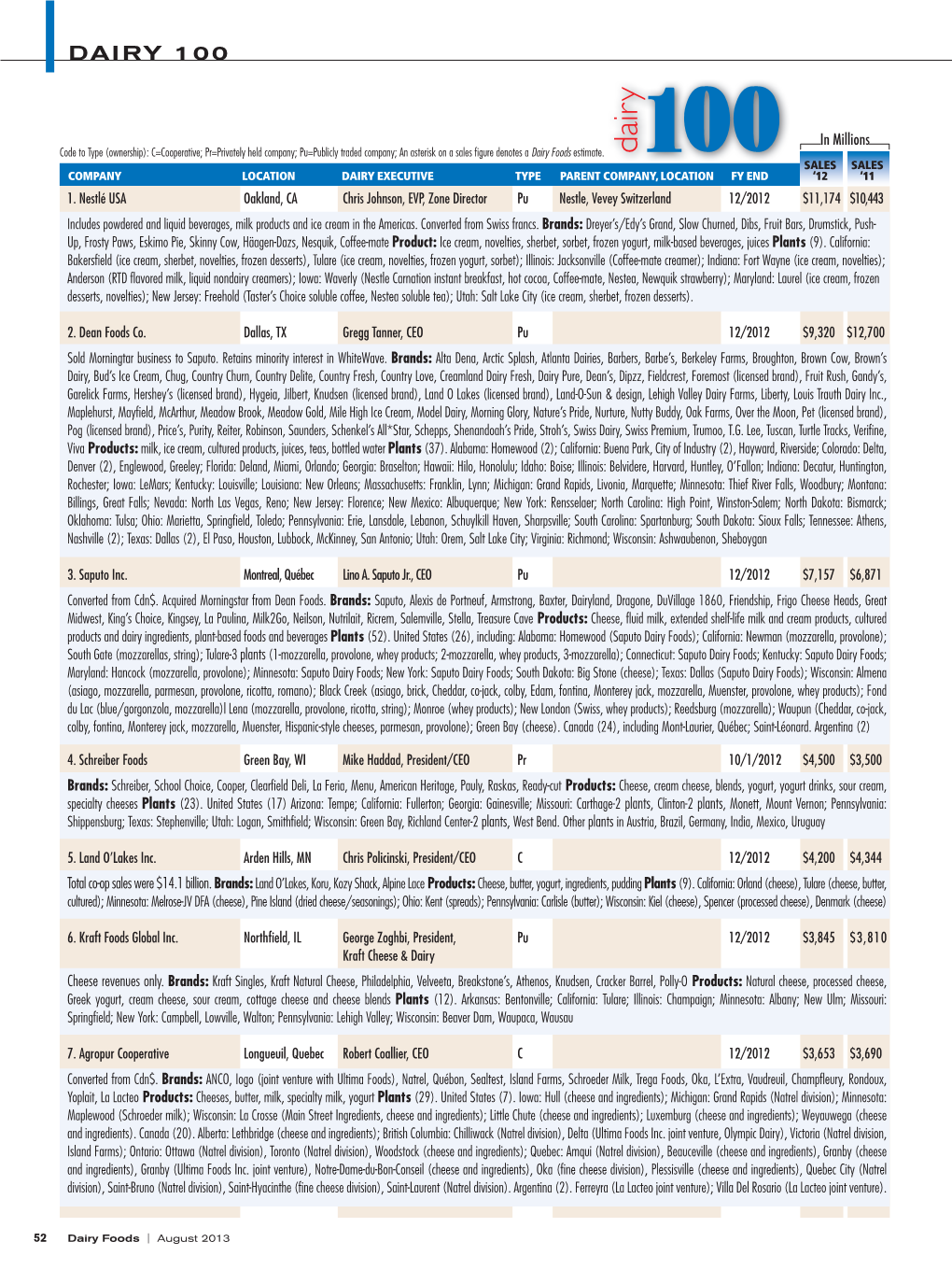

List of the Top Dairy Processors in the Dairy 100

DAIRY 100 In Millions Code to Type: C=Cooperative; Pr=Privately-held company; Pu=Publicly-traded company; S=Subsidiary; An asterisk on a sales figure denotes a Dairy Foods estimate. SALES SALES COMPANY LOCATION DAIRY EXECUTIVE TYPE PARENT COMPANY, LOCATION FY END ‘11 ‘10 1. Dean Foods Co. Dallas, TX Gregg Engles, Chairman/CEO Pu 12/31/2011 $12,700 $12,123 Brands: Alpro (Europe), Alta Dena, Arctic Splash, Atlanta Dairies, Barbers, Barbe’s, Berkeley Farms, Broughton, Borden (licensed brand), Brown Cow, Brown’s Dairy, Bud’s Ice Cream, Chug, Country Charm, Country Churn, Country Delite, Country Fresh, Country Love, Creamland, Dairy Fresh, Dean’s, Dipzz, Fieldcrest, Foremost (licensed brand), Friendship, Gandy’s, Garelick Farms, Hershey’s (licensed brand), Horizon Organic, Hygeia, International Delight, Jilbert, Knudsen (licensed brand), LAND O LAKES (licensed brand), Land-O-Sun & design, Lehigh Valley Dairy Farms, Liberty, Louis Trauth Dairy Inc, Maplehurst, Mayfield, McArthur, Meadow Brook, Meadow Gold, Mile High Ice Cream, Model Dairy, Morning Glory, Nature’s Pride, Nurture, Nutty Buddy, Oak Farms, Over the Moon, Pet (licensed brand), Pog (licensed brand), Price’s, Provamel (Europe), Purity, Reiter, Robinson, Saunders, Schenkel’s All*Star, Schepps, Shenandoah’s Pride, Silk, Silk Pure Almond, Silk Pure Coconut, Stok, Stroh’s, Swiss Dairy, Swiss Premium, Trumoo, T.GLee, Tuscan, Turtle Tracks, Verifine, Viva. Products: Milk, cultured dairy, juice/drinks, water, creamers, whipping cream, ice cream mix, ice cream novelties. Plants: Fresh Dairy -

Diabetes Exchange List

THE DIABETIC EXCHANGE LIST (EXCHANGE DIET) The Exchange Lists are the basis of a meal planning system designed by a committee of the American Diabetes Association and the American Dietetic Association. The Exchange Lists The reason for dividing food into six different groups is that foods vary in their carbohydrate, protein, fat, and calorie content. Each exchange list contains foods that are alike; each food choice on a list contains about the same amount of carbohydrate, protein, fat, and calories as the other choices on that list. The following chart shows the amounts of nutrients in one serving from each exchange list. As you read the exchange lists, you will notice that one choice is often a larger amount of food than another choice from the same list. Because foods are so different, each food is measured or weighed so that the amounts of carbohydrate, protein, fat, and calories are the same in each choice. The Diabetic Exchange List Carbohydrate (grams) Protein (grams) Fat (grams) Calories I. Starch/Bread 15 3 trace 80 II. Meat Very Lean - 7 0-1 35 Lean - 7 3 55 Medium-Fat - 7 5 75 High-Fat - 7 8 100 III. Vegetable 5 2 - 25 IV. Fruit 15 - - 60 V. Milk Skim 12 8 0-3 90 Low-fat 12 8 5 120 Whole 12 8 8 150 VI. Fat - - 5 45 You will notice symbols on some foods in the exchange groups. 1. Foods that are high in fiber (three grams or more per normal serving) have the symbol *. 2. Foods that are high in sodium (400 milligrams or more of sodium per normal serving) have the symbol #. -

James E. Tillison, the Alliance of Western Milk Producers (Pdf)

,- tU. rllllldtlll~l ~ ~.elt:~l ft rlU||l, dllll IllllauIt I../l:ltl~.. II I"IId.UU~ lillll~., t. I t .3"t" r"lVl Page 2 of 5 USDA The Ilia n c e OALJ/HCO of Western Milk Procluoers ZOO0 JUL 11..4 I::9 U,: 22 July 14, 2000 RECEIVED Office of the Hearing Clerk USDA Room 1081, South Building, 1400 Independence Ave., S. W. Washington, D.C., 20250 SUBJECT: Milk in the Northeast and other Marketing Areas Docket No. AO-14-A69, et al., DA-003 Alexandria, Virginia May 8-12, 2000 Dear Sir: The Alliance of Westem Milk Producers is a trade association that represents two major operating cooperatives in Califomia -- California Dairies Inc. and Humboldt Creamery. These organizations represent nearly 50 percent of the milk and milk producers in California. Comments on the above federal order milk marketing hearing are being submitted on their behalf. While California is not part of the federal milk marketing system, what the federal system does has both direct and indirect impacts on California milk producers and the cooperatives they own. That is why the Alliance both attended the hearing and is now submitting this post-hearing brief on the proposals submitted prior to the hearing and the testimony given at the hearing. Butterfat value Several proposals were submitted to modify the value of butterfat in the price formulas under consideration at this hearing. The National Milk Producers Federation (NMPF) and the International Dairy Foods Association (IDFA) both proposed lowering the value of butterfat. NMPF proposed reducing the Class IV blatterfat value by six cents a pound. -

International Dairy Journal 97 (2019) 111E119

International Dairy Journal 97 (2019) 111e119 Contents lists available at ScienceDirect International Dairy Journal journal homepage: www.elsevier.com/locate/idairyj Physicochemical properties and issues associated with trypsin hydrolyses of bovine casein-dominant protein ingredients * Aaron S.L. Lim, Mark A. Fenelon, Noel A. McCarthy Food Chemistry & Technology Department, Teagasc Food Research Centre, Moorepark, Fermoy, Co. Cork, Ireland article info abstract Article history: Milk protein concentrate (MPC) and sodium caseinate (NaCas) were hydrolysed using the enzyme trypsin Received 25 March 2019 and the subsequent physical properties of the two ingredients were examined. Trypsin hydrolysis was Received in revised form carried out at pH 7 and at 45 C on 11.1% (w/w) protein solutions. Heat inactivation of trypsin was carried 23 May 2019 out when the degree of hydrolysis reached either 10 or 15%. Size-exclusion chromatography and elec- Accepted 23 May 2019 trophoresis confirmed a significant reduction in protein molecular weight in both ingredients. However, Available online 6 June 2019 whey proteins in MPC were more resistant to trypsin hydrolysis than casein. Oil-in-water emulsions were prepared using intact or hydrolysed protein, maltodextrin, and sunflower oil. Protein hydrolysis had a negative effect on the subsequent physical properties of emulsions, compared with non-hydrolysed proteins, with a larger particle size (only for NaCas stabilised emulsions), faster creaming rate, lower heat stability, and increased sedimentation observed in hydrolysed protein emulsions. © 2019 Elsevier Ltd. All rights reserved. 1. Introduction with a protein content of ~90% (w/w) and approximately 1.3% (w/ w) sodium content on a dry basis (Augustin, Oliver, & Hemar, 2011). -

Trade Focus Dairy Trade and Canada

Trade Focus Last updated A p r i l 2 0 1 7 c onnect to the world of dairy Dairy Trade and Canada The EU Dairy Sector and EDA The European Dairy Association (EDA) is the voice of the milk processing companies, cooperatives and privately owned dairies, at EU level. With 12,000 milk and dairy processing sites across Europe, our sector represents the economic backbone of rural Europe and the industrial basis in many so-called less favoured areas. We @EDA_Dairy | partner daily with over 700,000 dairy farms, accounting for 14% of the whole EU food and drinks industry. Together with over 300,000 industry employees, we all guarantee the high quality of our raw material and our dairy products, which are an essential part of our culinary heritage and of our European cultural treasure. Self-sufficient at 114%, milk and dairy consumption in the EU [email protected] is expected to remain stable while global demand will increase by 1.8% per annum over the | 1 coming decades . While 5 out of the global TOP 10 dairies are headquartered in Europe, the European ‘lactosphère’ is characterised by a tissue of SMEs (small and medium sized enterprises) comprising more than 80% of the total number of dairies in most of the EU Member States. More than €6 bill. were invested over the last years into milk processing capacities in the Union to prepare for the end of the milk quota regime and to be best placed to answer the growing www.euromilk.org/eda global demand. We do support the EU Commission’s efforts to enhance global trade and – as a dairy sector – we are proud to add nearly €10 bill. -

The Marin-Sonoma Artisan Cheese Cluster by Carol A. Pranka a Dissertation Submitted in Partial Satisfaction Of

Good as Gold: The Marin-Sonoma Artisan Cheese Cluster by Carol A. Pranka A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Environmental Science, Policy and Management in the Graduate Division of the University of California, Berkeley Committee in charge: Professor J. Keith Gilless, Chair Professor Lynn Huntsinger Professor Nathan Sayre Spring 2014 © Carol A. Pranka 2014 Abstract Good as Gold: The Marin-Sonoma Artisan Cheese Cluster by Carol A. Pranka Doctor of Philosophy University of California, Berkeley Professor J. Keith Gilless, Chair The overall economic performance of rural communities across the United States is challenged by shifting patterns of production, consumption, and global competition. Recent research has identified clusters - geographically proximate group of interconnected companies and associated institutions in a particular field, linked by commonalities and complementaries - as a prominent feature of successful rural economies. This dissertation explores the emergence of an artisan cheese cluster from historic dairy roots in Marin and Sonoma Counties in the North Coast region of California. The artisan and farmstead cheese producers there provide an instructive case study to assess the social, cultural, and economic impacts of the artisan cheese clusters generally. Michael Porter’s (1990) “Diamond Model of Competitive Advantage” is utilized as an analytic framework to consider factors that provided competitive advantages during various historical periods before and during the emergence of the cluster, as well as to assess its current business environment. The viability of encouraging such artisan cheese clusters in other rural regions as an economic development strategy is evaluated based on these findings.