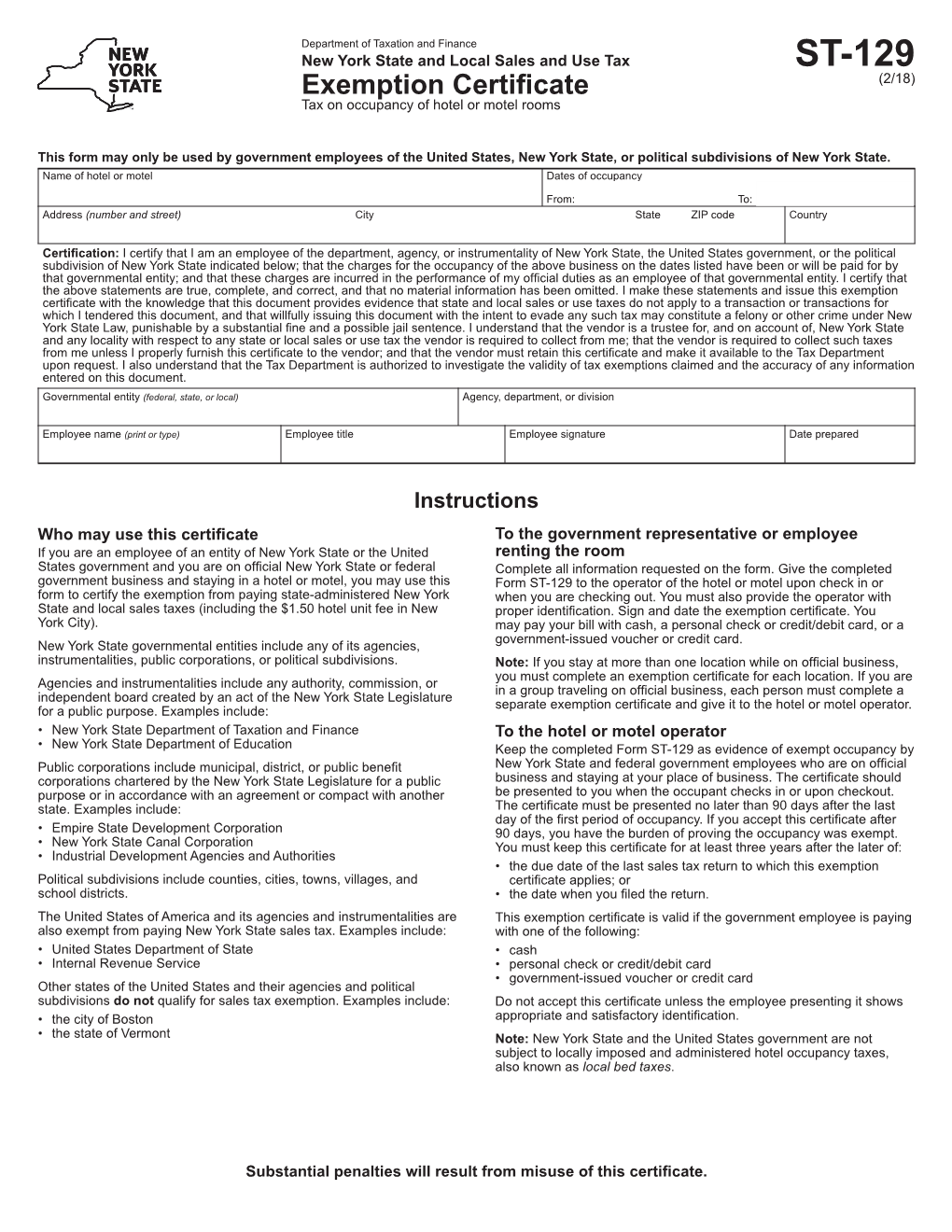

Form ST-129:2/18:Exemption Certificate:St129

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

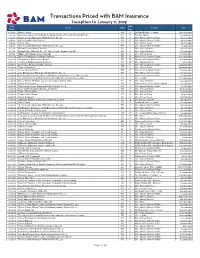

BAM Priced Transactions

Transactions Priced with BAM Insurance Inception to January 11, 2019 Sale Sale Issuer State Sector Par Date Type 1/10/19 Sharp County AR N Dedicated Sales - County $10,340,000 1/9/19 Successor Agency of the Redevelopment Agency of the City of Lake Elsinore CA N Tax Increment $9,260,000 1/9/19 Harris County Municipal Utility District No. 64 TX C GO - Special District Utility $1,535,000 1/8/19 Rolling Creek Utility District TX C GO - Special District Utility $6,595,000 1/8/19 City of Alton TX N GO - City or Town $3,715,000 1/8/19 Harris County Municipal Utility District No. 529 TX C GO - Special District Utility $1,550,000 1/7/19 Warren County School District PA C GO - School District $9,945,000 1/7/19 Unified School District No. 477, Gray County, Kansas (Ingalls) KS C GO - School District $1,500,000 1/7/19 Village of Fontana-on-Geneva Lake WI C GO - City or Town $7,705,000 12/21/18 Upper Trinity Regional Water District TX N Water and/or Sewer Utility $28,390,000 12/21/18 Leavenworth Waterworks Board KS PP Water and/or Sewer Utility $6,900,000 12/21/18 Frankfort Redevelopment Authority IN PP GO - Special District $515,500 12/20/18 New Caney Municipal Utility District TX C GO - Special District Utility $12,100,000 12/19/18 Town of Stratford CT C GO - City or Town $70,000,000 12/18/18 City of Charles Town WV N Water and/or Sewer Utility $3,065,000 12/13/18 Fort Bend County Municipal Utility District No. -

2018 Municipal Affairs Population List | Cities 1

2018 Municipal Affairs Population List | Cities 1 Alberta Municipal Affairs, Government of Alberta November 2018 2018 Municipal Affairs Population List ISBN 978-1-4601-4254-7 ISSN 2368-7320 Data for this publication are from the 2016 federal census of Canada, or from the 2018 municipal census conducted by municipalities. For more detailed data on the census conducted by Alberta municipalities, please contact the municipalities directly. © Government of Alberta 2018 The publication is released under the Open Government Licence. This publication and previous editions of the Municipal Affairs Population List are available in pdf and excel version at http://www.municipalaffairs.alberta.ca/municipal-population-list and https://open.alberta.ca/publications/2368-7320. Strategic Policy and Planning Branch Alberta Municipal Affairs 17th Floor, Commerce Place 10155 - 102 Street Edmonton, Alberta T5J 4L4 Phone: (780) 427-2225 Fax: (780) 420-1016 E-mail: [email protected] Fax: 780-420-1016 Toll-free in Alberta, first dial 310-0000. Table of Contents Introduction ..................................................................................................................................... 4 2018 Municipal Census Participation List .................................................................................... 5 Municipal Population Summary ................................................................................................... 5 2018 Municipal Affairs Population List ....................................................................................... -

City Administrator Full PPT 2-25-19

Your Logo Here BETTER TOGETHER PROPOSAL IMPACT ON TOWN AND COUNTRY Revised March 14, 2019 1 Your Logo Better Together Proposal Here . Better Together Proposal Issued Publicly at Press Conference on January 25, 2019. Revised petition filed February 11, 2019. Calls for Statewide Vote on Constitutional Amendment in November 2020 o Creates a new class of city - “A Metropolitan City” o Unify St Louis City & St Louis County as a Metropolitan City o Cities in St Louis County to become “Municipal Divisions” of the Metropolitan City . Effective Date is January 1, 2021 o Transition Period of Two Years to Full Implementation in January 2023 o First election for Metropolitan City Council in November 2022; take office January 2023 o First elections for Metro Mayor, Prosecutor and Assessor November 2024; take office January 2025 2 METROPOLITAN “METRO” Your Logo CITY OF ST LOUIS Here . Combine St Louis City and County into Single Government, Population 1.3 million . All existing cities (including St Louis City and Town & Country) to become Municipal Districts . Partisan Elections for all positions in Metropolitan City . Metropolitan City headed by elected Mayor (4 Year Term) . Metropolitan City Council Composed of 33 elected Councilmen by districts (4 Year Term) . Prosecutor and Assessor Independently Elected at large 3 Your Logo METRO MAYOR Here . Is a “strong Mayor” form of government . Mayor appoints all department heads who serve at the pleasure of the Mayor . Mayor appoints all members of boards and commissions . Mayor SHALL appoint 4 deputy mayors to be called: o Deputy Mayor for Public Health and Safety o Deputy Mayor for Economic Development and Innovation o Deputy Mayor for Community Development and Housing o Deputy Mayor for Community Engagement and Equity . -

Glossary: Common Words Used in Municipal Government

Resources for Learning about Municipal Government Glossary Common words used in municipal government Acclamation: A candidate is elected by Authority: The power and permission to speak, acclamation when there are no opponents make decisions, give orders, and enforce rules. running against him or her in an election. Boundary: An imaginary line or border that Accountability: People are expected to be indicates the limits or extent of an area. responsible for their actions and may be Budget: An estimate of income (also called required to explain them to others. revenue or money coming in) and expenditures Representatives are accountable to the (money that is spent) for a set period of time. residents of the municipality in which they are elected. Built environment: the buildings and spaces in a municipality, such as homes, schools, parks, Administration: The people in the municipal commercial, and industrial areas, as well as the organization who are responsible for making infrastructure that supports and connects sure policies and decisions of council are them, such as roads and sidewalks. carried out for the day-to-day operations. The head of administration is the Chief By-election: an election held to fill a vacant Administrative Officer. position at a date other than the general election date if an elected municipal official Advisory council: a group of people who are must step down or resign part way through appointed to help with the implementation of his/her four-year term of office. the policies and decisions of an area. For example, the Ministry of Municipal Affairs is Bylaw: a law passed and enforced by a local responsible for improvement districts (ID), and authority in accordance with the powers given to an elected advisory council guides the activities that authority. -

Russia's Regions: Goals, Challenges, Achievements'

Russia National Human Development Report Russian Federation 2006/2007 Russia’s Regions: Goals, Challenges, Achievements Russia National Human Development Report Russian Federation 2006/2007 Russia’s Regions: Goals, Challenges, Achievements The National Human Development Report 2006/2007 for the Russian Federation has been prepared by a team of Russian experts and consultants. The analysis and policy recommendations in this Report do not necessarily reflect the views of the UN system and the institutions by which the experts and consultants are employed. Chief authors: Sub-faculty of Geography Department at Irkutsk State Prof. Sergei N. Bobylev, Dr.Sc. (Economics), Department of University (Box. Irkutsk Region) Economics at Lomonosov Moscow State University Albina A. Shirobokova, Ph.D. (Economics), Associate Professor Anastassia L. Alexandrova, Ph.D. (Economics), Executive of Sociology and Social work Department at Irkutsk Director at the Institute for Urban Economics State Technical University; President of Baikal Regional Prof. Natalia V. Zubarevich, Dr.Sc. (Geography), Department Women’s Association ‘Angara’ (Box. Irkutsk Region) of Geography at Lomonosov Moscow State University; Prof. Lidiya M. Shodoyeva, Ph.D. (Economics), Department Head of Regional Programs at the Independent Institute of Management at Gorno-Altai State University (Box. Altai for Social Policy Republic) Taiciya B Bardakhanova, Ph.D. (Economics), Chief of Authors: Economics of Environmental Management and Tourism Prof. Natalia V. Zubarevich (Chapters 1–3, 5–7. Survey of Department at the Ministry of Economic Development Federal Districts. Chapter 9) and External Relations of the Republic of Buryatia (Box. Ivan Y. Shulga, Ph.D. (Economics), Consultant at the Republic of Buryatia) Department of Social Programmes of the World Bank Elena A. -

Town of Provincetown Zoning By-Laws

TOWN OF PROVINCETOWN ZONING BY-LAWS Provincetown Planning Board September 1, 1978 Last Updated: August 18, 2021 Town of Provincetown, Massachusetts – Zoning By-laws Page 2 Amendments Adoption Revisions APPROVED BY TOWN APPROVED BY THE APPROVED BY TOWN APPROVED BY THE MEETING ATTORNEY GENERAL MEETING ATTORNEY GENERAL November 13, 1978 April 6, 1979 April 6, 2009 ATM July 14, 2009 March 10, 1980 November 8, 2010 STM February 22, 2011 March 9, 1981 December 16, 1981 April 4, 2011 June 20, 2011 March 8, 1982 July 12 and 13, 1982 October 24, 2011 STM November 3, 2011 October 27, 1982 January 11, 1983 April 2, 2012 ATM May 7, 2012 March 14, 1983 April 26, 1983 October 21, 2013 STM January 13, 2014 March 12, 1984 July 5, 1984 April 7, 2014 ATM May 15, 2014 March 11, 1985 June 11, 1985 April 6, 2015 ATM May 19, 2015 June 10, 1985 August 19, 1985 October 26, 2015 STM December 10, 2015 October 15, 1985 January 31, 1986 April 4, 2016 ATM July 11, 2016 March 10, 1986 April 11, 1986 April 3, 2017 ATM July 6, 2017 October 27, 1986 November 25, 1986 September 13, 2017 STM January 11, 2018 March 9, 1987 April 17, 1987 April 2, 2018 ATM July 18, and Oct 12, 2018 March 14, 1988 May 19, 1988 October 29, 2018 STM February 22, 2019 March 13, 1989 June 5, 1989 April 1, 2019 ATM May 6, 2019 March 12, 1990 May 7 and June 8, 1990 May 1, 2021 ATM August 18, 2021 April 1, 1991 June 12, 1991 April 6, 1992 July 2, 1992 November 5, 1992 January 11, 1993 April 7, 1993 July 13, 1993 October 27, 1993 January 7, 1994 April 1, 1996 May 6, 1996 October 28, 1996 November -

Handy Township Planning Commission Regular Meeting Minutes Thursday, February 25, 2021

HANDY TOWNSHIP PLANNING COMMISSION REGULAR MEETING MINUTES THURSDAY, FEBRUARY 25, 2021 The regular meeting of the Handy Township Planning Commission was held electronically via Zoom pursuant to the Open Meetings Act and called to order at 7:00 P.M. by Chairman Redinger. Roll Call: Chairman Redinger announced he was attending the meeting virtually from Handy Township. Members present: Members Elliott, Towns, Roddy and Limonoff announced each were attending the meeting virtually and all stated they were located in Handy Township. Chairman Redinger welcomed Township Board liaison Dave Roddy to the Planning Commission. Members- Absent: None. Also present: Township Zoning Administrator- Flanery, Foster, Swift, Collins, and Smith PC- Township Attorney- Michael Homier, Carlisle Wortman Associates- Township Planner- John Enos, Township Supervisor- Alverson, Livingston County Planner- Scott Barb, and residents or members of the public John Belcher, Ichav and Mike Kelly. Approval of Agenda MOTION ELLIOTT SUPPORT LIMONOFF TO APPROVE THE AGENDA AS PRESENTED. MOTION CARRIED. OPEN PUBLIC HEARING: 7:00 P.M. Re-zoning of Properties located NE & SE Corners of Section 11, From RB, Residential B District to RA, Residential A District and SP, Special Purpose District Re-zoning of Properties NE Corner of Section 14, From RB, Residential B District to RA, Residential A District Zoning Amendment: 2020-8, Chapter 22, SP- Special Purpose District, Sections 22.1, 22.2, 22.3, 22.4, Intent, Permitted Uses, Special Uses and Site Development Requirements Handy Township Planning Commission Regular Meeting Minutes of February 25, 2021 Page 2 Public Hearing, continued: MOTION ELLIOTT SUPPORT TOWNS TO GO OUT OF REGULAR BUSINESS SESSION AND OPEN THE PUBLIC HEARING FOR PUBLIC COMMENT ON THE RE-ZONING OF PROPERTIES LOCATED NE AND SE CORNERS OF SECTION 11, FROM RB, RESIDENTIAL B DISTRICT TO RA, RESIDENTIAL A DISTRICT AND SP, SPECIAL PURPOSE DISTRICT, RE-ZONING OF PROPERTIES NE CORNER OF SECTION 14, FROM RB, RESIDENTIAL B DISTRICT TO RA, RESIDENTIAL A DISTRICT AND ZONING AMENDMENT NO. -

Location and History Profile County Of

Location and History Profile Created on 9/24/2021 12:50:01PM County of Stettler No. 6 Municipal Code: 0299 Location Description View Location Map (url to the pdf location map) Twp Rge Mer Longitude Latitude 37 18 W4 112°36' 52°14' Urban municipalities within the municipal boundary Town of Stettler Village of Big Valley Village of Donalda Summer Village of Rochon Summer Village of White Sands Sands Hamlets/urban service areas within the municipal boundary Botha Byemoor Endiang Erskine Gadsby Nevis Red Willow Incorporation History Municipal Boundary Document Search (url to search results page of Annexation PDF's) Status: Municipal District Effective Date: January 01, 1955 Authority: Order in Council 1782/54 Authority Date: December 29, 1954 Gazette: Jan 15, 1955, p.20 Comments: Formed as the County of Stettler No. 6. Status: Municipal District Effective Date: April 01, 1945 Authority: Ministerial Order Authority Date: April 06, 1945 Gazette: Apr 14, 1945, p. 335 Comments: The Municipal District of Stettler No. 336 was renumbered as the Municipal District of Stettler No. 54. Numbers were changed for all municipal districts throughout the province. Status: Municipal District Effective Date: March 01, 1943 Authority: Ministerial Order Authority Date: February 09, 1943 Gazette: Feb 15, 1943, p. 165 Comments: The Municipal Districts of Success No. 336, Vimy No. 337, Dublin No. 366 and Waverly No. 367 were merged into one new municipal district to be known and designated as the Municipal District of Stettler No. 336. * No information is available to explain the change from the Rural Municipality of Success No. 336 to the Municipal District of Success No. -

2019 Municipal Affairs Population List ISBN 978-1-4601-4623-1 ISSN 2368-7320

Alberta Municipal Affairs, Government of Alberta November 2019 2019 Municipal Affairs Population List ISBN 978-1-4601-4623-1 ISSN 2368-7320 Data for this publication is from the 2016 federal census of Canada, or from the most recent municipal census conducted by the municipality. For more detailed data on the censuses conducted by Alberta municipalities, please contact the municipalities directly. Additional census information on Alberta municipalities from the 2016 federal census can be found from the Statistics Canada website. © Government of Alberta 2019. The publication is released under the Open Government Licence. This publication and previous editions of the Municipal Affairs Population List are available in pdf and excel version https://open.alberta.ca/publications/2368-7320. Strategic Policy and Planning Branch Alberta Municipal Affairs 17th Floor, Commerce Place 10155 - 102 Street Edmonton, Alberta T5J 4L4 Phone: (780) 427-2225 Fax: (780) 420-1016 E-mail: [email protected] Fax: 780-420-1016 Toll-free in Alberta, first dial 310-0000. Table of Contents Introduction ..................................................................................................................................... 1 2019 Municipal Census Participation List .................................................................................... 2 Municipal Population Summary ................................................................................................... 2 2019 Municipal Affairs Population List ....................................................................................... -

Amalgamation – Matters to Consider

Amalgamation – Matters to Consider The list below is intended to serve as a guide for the matters that should be considered during amalgamation negotiations and addressed in the resulting report. The issues are listed in a summarized form for your reference. For each one of these items, a more detailed explanation or additional guidance can be provided. For ease of reading, the items are organized into the following groups: Group 1: Mandatory Issues Group 2: Transitional Matters Group 3: Additional Mandatory Requirements for Specialized Municipalities Group 4: Public Consultation Requirements Group 1: Mandatory Issues 1. Municipal Name The proposed legal name of the municipality is required. Background information and/or other context behind the name is recommended as thorough checks will be completed to ensure that the new name does not: match any other municipal jurisdiction’s name in Alberta; does not infringe on the any existing trademark or registered trademarks in Canada; does not use prohibited terms such as “royal”, “Alberta”, “Alta” or other terms identified in the Trade-marks Act (this is not an exhaustive list) Traditionally, the name would have two components – the type of municipality, and place name. However, the type of municipality may take a different form if a specialized municipality type is chosen. (Specialized municipalities are formed to recognize unique and special circumstances – Section 3: Municipal Status) For example: the table below shows the names of some specialized municipalities and names of municipalities that have amalgamated since 1995: Current Name of Type of Type of Place Name Previous Name(s) Municipality Municipality Municipality of Municipality (Actual) (Inferred from name) Strathcona County Specialized Municipal District Strathcona County of Municipality Strathcona No. -

Order in Council ORDER in COUNCIL

O.C. 76 1 I95 DEC O 6 1995 Province of Alberta Order in Council ORDER IN COUNCIL. Approved and ordered: Lieutenant Governor The Lieutenant Governor in Council (a) changes the status of Strathcona County from a municipal district to a specialized municipality, (b) makes the order in Schedule 1, and (c) establishes the wards for the specialized municipality as described in Schedule 2, effective ~anua&1, 1996. z-%- - 'c = /' -/ , -- /t. - --cZ-fzr- - - ( CHAIR Clerk of the Executive Councll For Information only Alborra Recommended by: Minister of Municipal Affairs Authority: Municipal Government Act (section 96) Schedule 1 Special Provisions for the Organization and Operation of Strathcona County Definitions: 1 In this order, (a) "Rural Service Area" means the territory of Strathcona County excluding the Sherwood Park Urban Service Area, (b) "Shehood Park Urban Service Area" means the territory described in Schedule 3. Specialized Municipality 2(1) The status of Strathcona County is changed to that of a specialized municipality to provide for the unique needs of a mur~icipalitythat includes both a large urban centre and a significant rural territory and population. (2) The provisions of the Municipal Government Act and other enactments are modified to the extent necessary to accomplish the intent of this order. , (3) Except as otherwise provided in this order, the enactments applicable to a city apply in the Shewood Park Urban Service Area and the enactments applicable to a municipal district apply in the Rural Service Area. Urban Service Area 3(1) The Sherwood Park Urban Service Area shall be recognized as equivalent to a city by the Government of Alberta for the purposes OF program delivery and grant eligibility. -

BOUNDARY SIGNS Revised: Page 1 of 2

Issued: OCT 2009 BOUNDARY SIGNS Revised: Page 1 of 2 PART HIGHWAY SIGNS RECOMMENDED SECTION GUIDE AND INFORMATION SIGNS PRACTICES SUB-SECTION General without resorting to special Acts of the Legislature. Often, specialized Boundary information is significant for municipalities allow urban and rural motorists because it alerts them to the fact communities to coexist in a single municipal that they are entering an area that is government. There are four specialized distinctive. The characteristics of a municipalities in Alberta. The Regional designated area may be related to cultural Municipality of Wood Buffalo and or tourist activities or attractions. Strathcona County are two examples. Motorists are informed of designated areas Special Areas refer to rural areas in with the use of Boundary Signs placed at southeast Alberta administered by a board of the entrance to such an area. three people appointed by the Lieutenant Governor in Council. There are three Special Corporate limits define the borders of urban Areas in southeast Alberta. municipal areas (cities, towns, villages, etc.) which are governed by a municipal Improvement District (I.D.) refers to an area government or council composed of elected officials. governed through Alberta Municipal Affairs and Housing. Five of the province’s Rural Alberta is presently made up of the seven I.D.s are located in national parks: I.D. following administrative subdivisions: No. 4 (Waterton), I.D. No. 9 (Banff), I.D. No. 12 (Jasper), I.D. No. 13 (Elk Island) and I.D. - Municipal districts or counties; No. 24 (Wood Buffalo) and 2 are in provincial - Specialized municipalities parks: Kananaskis Improvement District - Special Areas (including Kananaskis Provincial Park) and I.D.