Pension Funds in Figures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DA Evaluation Guidelines

Development Account Final Report 1. KEY PROJECT FEATURES I. Project title UNECE FAO UNDA 8th tranche project “Sustainable Forest Management for Greener Economies in the Caucasus and Central Asia” II. Project DA code 2013-ROA-3634-2944-6875-0036 III. Implementing UNECE FAO Forestry and Timber Section Entity IV. Start date 08/2013 VI. End date a. Original: 06/2015 b. Actual date: 12/2015 VII. Beneficiary 1. Armenia_________________ 5. Kyrgyzstan countries 2. Azerbaijan 6. Tajikistan (pilot) 3. Georgia (pilot) 7. Uzbekistan 4. Kazakhstan (pilot) VIIII Implementing UN system Other partners partners 1. FAO 1. GIZ 2. UNFF 3. UNDP March 2016 2. SUMMARY OF RESULTS All seven project countries, namely Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan completed their activities according to the project workplan. Altogether 2 regional, 7 national, 9 coaching and 28 local capacity-building workshops were organized. The training package including modules on green economy and sustainable forest management, wood energy, forest policy formulation, and forest data collection and reporting, have been produced for the benefits of the participants. In addition, the training package included variety of participatory exercises to better introduce methodology for stakeholder engagement. Based on the workshop evaluations 91% of the participants acknowledged increased knowledge on policy formulation, bioenergy generation and data collection related to sustainable forest management and green economy. Three pilot countries, Georgia, Kazakhstan and Tajikistan made a progress towards inclusion of green economy principles into the national forestry sector’s strategies and programmes. With support of the project, Georgia developed a national action plan for the forest sector in a green economy based on the input received from four local workshops. -

Freedom to Achieve More

FREEDOM TO ACHIEVE MORE ANNUAL REPORT CONTENTS 3 Message from Management 62 Bank Development Results 4 Message from Ruben Vardanian 63 Key Growth Indicators 6 Message from Artak Hanesyan 67 Assets 8 Major Achievements in 2013 70 Liabilities 12 About Ameria Group 73 Development of Management Systems, 13 Ameria Group of Companies Technologies and Infrastructure 16 Historic Milestones of Development 75 Clients and New Products 20 Global Partners 76 Corporate Banking 22 Philosophy and Values 79 Business Lending 23 Mission and Philosophy 82 Finance Lease 25 Our Values 83 Factoring 25 Strategy 85 Trade Finance 26 Corporate Social Responsibility 86 Retail Banking 28 Corporate Governance and Risk Management 89 Retail Lending 29 Ameriabank Shareholders 94 Payment Cards 29 Ameriabank Management 97 Salary Projects 32 Core Management Principles 97 Money Transfers 33 Organizational Chart of the Bank 98 Investment Banking 35 Corporate Governance and Risk Management and Trading Operations 37 HR Management 99 Financial Institutions 39 Client Relationship Management 99 Corporate Finance 40 Risk Management 101 Capital Markets 44 External Environment 103 Mergers and Acquisitions 45 Macroeconomic Prerequisites 105 Trading 51 Legal Framework, Government Regulations, 106 Ameriabank Strategic Goals and Plans for 2014 Financial Infrastructure 110 Financial Statements 54 Banking Sector of Armenia and Independent Auditors Report 58 Position of Ameriabank in the Banking Sector of Armenia 118 Useful Information about the Bank 2 ANNUAL REPORT 2013 обращение руководства MESSAGE FROM MANAGEMENT Message from Ruben Vardanian Dear Ladies and Gentlemen I am happy to announce that due to trust for the 4th consecutive year has undertaken the Board by engaging independent board members and loyalty of our clients, proficiency of our organization of Christmas charity auction aimed and following corporate governance codes and management team and Board members, as well at medical treatment of 17 kids with various policies. -

Gender Dimensions of Inequality in the Countries of Central Asia, South Caucasus, and Western CIS

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Khitarishvili, Tamar Working Paper Gender dimensions of inequality in the countries of Central Asia, South Caucasus, and Western CIS Working Paper, No. 858 Provided in Cooperation with: Levy Economics Institute of Bard College Suggested Citation: Khitarishvili, Tamar (2016) : Gender dimensions of inequality in the countries of Central Asia, South Caucasus, and Western CIS, Working Paper, No. 858, Levy Economics Institute of Bard College, Annandale-on-Hudson, NY This Version is available at: http://hdl.handle.net/10419/173467 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Working Paper No. 858 Gender Dimensions of Inequality in the Countries of Central Asia, South Caucasus, and Western CIS* by Tamar Khitarishvili Levy Economics Institute of Bard College January 2016 * Background paper prepared for the United Nations Development Program’s 2016 Regional Human Development Report for Europe and Central Asia. -

The Mineral Industry of Armenia in 2011

2011 Minerals Yearbook ARMENIA U.S. Department of the Interior September 2013 U.S. Geological Survey THE MINERAL INDUSTRY OF ARMENIA By Elena Safirova Armenia was a significant producer of molybdenum and for $287 million, or 21.5% of the country’s export revenue; ranked seventh in the world in mine output in 2011. Besides ferrous metals and articles made out of them accounted for molybdenum, Armenia produced other metals, which included $134 million (10.0%); and precious metals and precious stones copper, gold, silver, and zinc, and industrial minerals, which contributed $196 million (14.7%). The main export partners of included cement, diatomite, gypsum, limestone, and perlite. Armenia were Russia (which accounted for 16.7% of export The country also produced aluminum foil from aluminum revenue), Germany (11.8%), Bulgaria (11.4%), the Netherlands imported from Russia, ferromolybdenum, molybdenum metal, (8.8%), Iran (8.0%), the United States (7.5%), Spain (6.2%), and rhenium salt (potassium perrhenate) from local ores; Belgium and Canada (5.3% each), and Georgia (4.6%). it also had developed a diamond-cutting industry based on In 2011, Armenia’s imports of mineral products included imported diamond. Armenia possesses resources of copper, diamond, natural gas, and petroleum. The main trade partners gold, iron, lead, molybdenum, and zinc. It also has resources for imports were Russia (which provided 20.1%, by value, of of construction material, such as basalt, granite, limestone, Armenia’s imports), China (8.2%), Ukraine (6.9%), Iran (6.5%), marble, and tuff; semiprecious stones, such as agate, jasper, and Germany (5.9%), Italy (4.7%), and Turkey (4.0%) (National obsidian; and other nonmetallic minerals, such as bentonite, Statistical Service of the Republic of Armenia, 2012a, b; diatomite, perlite, and zeolites (Arm3a.org, 2012; Polyak, 2012; U.S. -

Referral Guide for Reintegration of Returnees

Ministry of Labour and Social Affairs of Armenia REFERRAL GUIDE FOR REINTEGRATION OF RETURNEES IN ARMENIA While IOM endeavours to ensure the accuracy and completeness of the content of this Review, the views, findings, interpretations and conclusions expressed herein are those of the authors and do not necessarily reflect the official position of IOM and its Member States. IOM does not accept any liability for any loss, which may arise from the reliance on information contained in this paper. The present review has been issued without formal editing by IOM. Publisher: International Organization for Migration IOM Mission in Armenia: UN House • 14 Petros Adamian Street, 1st floor • Yerevan 0010 • Armenia Tel.: ¥+374 10¤ 58 56 92 Fax: ¥+374 10¤ 54 33 65 www.iom.int © All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means of electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the publisher. Ministry of Labour and Social Affairs of Armenia Referral Guide for Reintegration of Returnees in Armenia Second edition Yerevan 2016 Reintegration Referral Guide Contents List of abbreviations..................................................................................................7 Foreword ...................................................................................................................9 Part I Reintegration system in Armenia ..................................................................11 -

00076016 DRR Annual Report ENG 2013

Reporting Agency: UNDP Country: Armenia STANDARD PROGRESS REPORT No. and title: 00076016 / Strengthening of National Disaster Preparedness and Risk Reduction Capacities Reporting period: January– December, 2013 I. PURPOSE The project (00076016) is aimed at further enhancement and contribution to build a well‐structured and effective DRR system in Armenia. Developed DRR capacities will enable to systematically address existing and emerging disaster risks in the country, maintaining inclusive and coordinated mechanism for risk identification, assessment and early warning, implementing risk reduction measures and increasing preparedness for effective response and recovery. There are three outputs in support of the project objective. These are as follows: • Strengthened enabling environment for the implementation of the National DRR Strategy and HFA; • Improved coordination and cooperation in disaster risk reduction; • Integration of disaster and climate risk management into community, local, and municipal development. Based on the decision of UNDP CO Senior Management 50,000 USD (committed in 2010 within the frame of DRR 3rd Phase project) was allocated for extension of the Project for six months period. The main purposes of the extension of the Project were to organize the participation of Armenian Delegation in 4th DRR Global Platform Meeting and possible mobilization of funds for the future Project. Due to the lack of funds in the beginning of 2013 the Project staff was decreased and only Project Coordinator was contracted and implemented all administrative and programmatic tasks until mid‐July 2013. In April 2013, BCPR approved the allocation of a total amount of USD 500,000 to support the continuation and implementation of project 00076016 “Strengthening of National capacities for Disaster Risk Reduction” during 2013‐2015 years. -

The Deployment of Law-Enforcement Equipment in Central Asia and The

The Deployment of Law- enforcement Equipment in Central Asia and the South Caucasus Working Paper JOE FARHA AND KATE WRAITH, OMEGA RESEARCH FOUNDATION This report was written with grant funding from the Open Society Foundations, using research undertaken as part of a European Commission funded program of work by the Omega Research Foundation into policing technologies and human rights, under the European Initiative for Democracy and Human Rights. September 2015 Contents Summary iv 1. Introduction 1 Box 1.1. A note on sources 5 2. Devices authorized for use by law-enforcement officials in the 6 Caucasus and Central Asia I. Mechanical-restraint devices 6 II. Electric-shock equipment 10 III. Riot control agents 11 IV. Handheld impact weapons and launched kinetic-impact rounds 14 V. Riot-control vehicles and water cannons 16 VI. Acoustic devices 17 VII. Equipment used in places of detention and in public-order 19 situations Figure 2.1. Restraint chair 8 Figure 2.2. Wall cuffs 9 Figure 2.3. Thumb cuffs 10 Figure 2.4. Russian manufactured direct contact electric shock stun devices 11 Figure 2.5. US- (left) and Taiwanese- (right) manufactured projectile 12 electric-shock devices Figure 2.6. Multi-barrel launching device. 13 Figure 2.7. The FN 303 14 Figure 2.8. Turkish-manufactured water cannon 16 Figure 2.9. Russian-manufactured grenades and stun grenades 18 Figure 2.10. US-manufactured acoustic devices 19 Table 2.1. Equipment authorized for use by law-enforcement personnel in 7 selected Eurasian states 3. International and regional instruments applicable to the transfer of law- 24 enforcement equipment I. -

The Eastern Partnership a Decade on a Decade On

CHAILLOT PAPER / PAPER CHAILLOT 153 THE EASTERN PARTNERSHIP THE EASTERN PARTNERSHIP A DECADE ON DECADE A THE EASTERN PARTNERSHIP A DECADE ON Looking back, thinking ahead Edited by | LOOKING BACK, THINKING AHEAD BACK, LOOKING Stanislav Secrieru and Sinikukka Saari With contributions from Vano Chkhikvadze, Iulian Groza, Mikayel Hovhannisyan, Leonid Litra, Dzianis Melyantsou, Zaur Shiriyev and Kateryna Zarembo CHAILLOT PAPER / 153 July 2019 THE EASTERN PARTNERSHIP A DECADE ON Looking back, thinking ahead Edited by Stanislav Secrieru and Sinikukka Saari With contributions from Vano Chkhikvadze, Iulian Groza, Mikayel Hovhannisyan, Leonid Litra, Dzianis Melyantsou, Zaur Shiriyev and Kateryna Zarembo CHAILLOT PAPER / 153 July 2019 European Union Institute for Security Studies (EUISS) 100, avenue de Suffren 75015 Paris http://www.iss.europa.eu Director: Gustav Lindstrom © EU Institute for Security Studies, 2019. Reproduction is authorised, provided the source is acknowledged, save where otherwise stated. The views expressed in this publication are solely those of the authors and do not necessarily reflect the views of the EUISS or of the European Union. print ISBN 978-92-9198-842-6 online ISBN 978-92-9198-841-9 CATALOGUE NUMBER QN-AA-19-003-EN-C CATALOGUE NUMBER QN-AA-19-003-EN-N ISSN 1017-7566 ISSN 1683-4917 DOI 10.2815/279488 DOI 10.2815/61360 Published by the EU Institute for Security Studies and printed in Belgium by Bietlot. Luxembourg: Publications Office of the European Union, 2019. Cover image credit: Daniel Born/unsplash The editors Stanislav Secrieru is a Senior Analyst and Sinikukka Saari is a Senior Associate Analyst at the EUISS. Their area of expertise focuses on EU‑Russia relations, Russia’s foreign and se‑ curity policy, Eastern Europe and Central Asia. -

Smallholders and Family Farms in Armenia

Regional TCP on Empowering Smallholders and Family Farms (TCP/RER/3601) Smallholders and family farms in Armenia Country study report 2019 Regional TCP on Empowering Smallholders and Family Farms (TCP/RER/3601) Smallholders and family farms in Armenia Country study report 2019 Food and Agriculture Organization of the United Nations Budapest, 2020 Required citation: FAO. 2020. Smallholders and family farms in Armenia. Country study report 2019. Budapest. https://doi.org/10.4060/ca9823en The designations employed and the presentation of material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. The mention of specific companies or products of manufacturers, whether or not these have been patented, does not imply that these have been endorsed or recommended by FAO in preference to others of a similar nature that are not mentioned. The views expressed in this information product are those of the author(s) and do not necessarily reflect the views or policies of FAO. ISBN 978-92-5-132973-3 © FAO, 2020 Some rights reserved. This work is made available under the Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO licence (CC BY-NC-SA 3.0 IGO; https://creativecommons.org/licenses/by-nc-sa/3.0/igo/legalcode). Under the terms of this licence, this work may be copied, redistributed and adapted for non-commercial purposes, provided that the work is appropriately cited. -

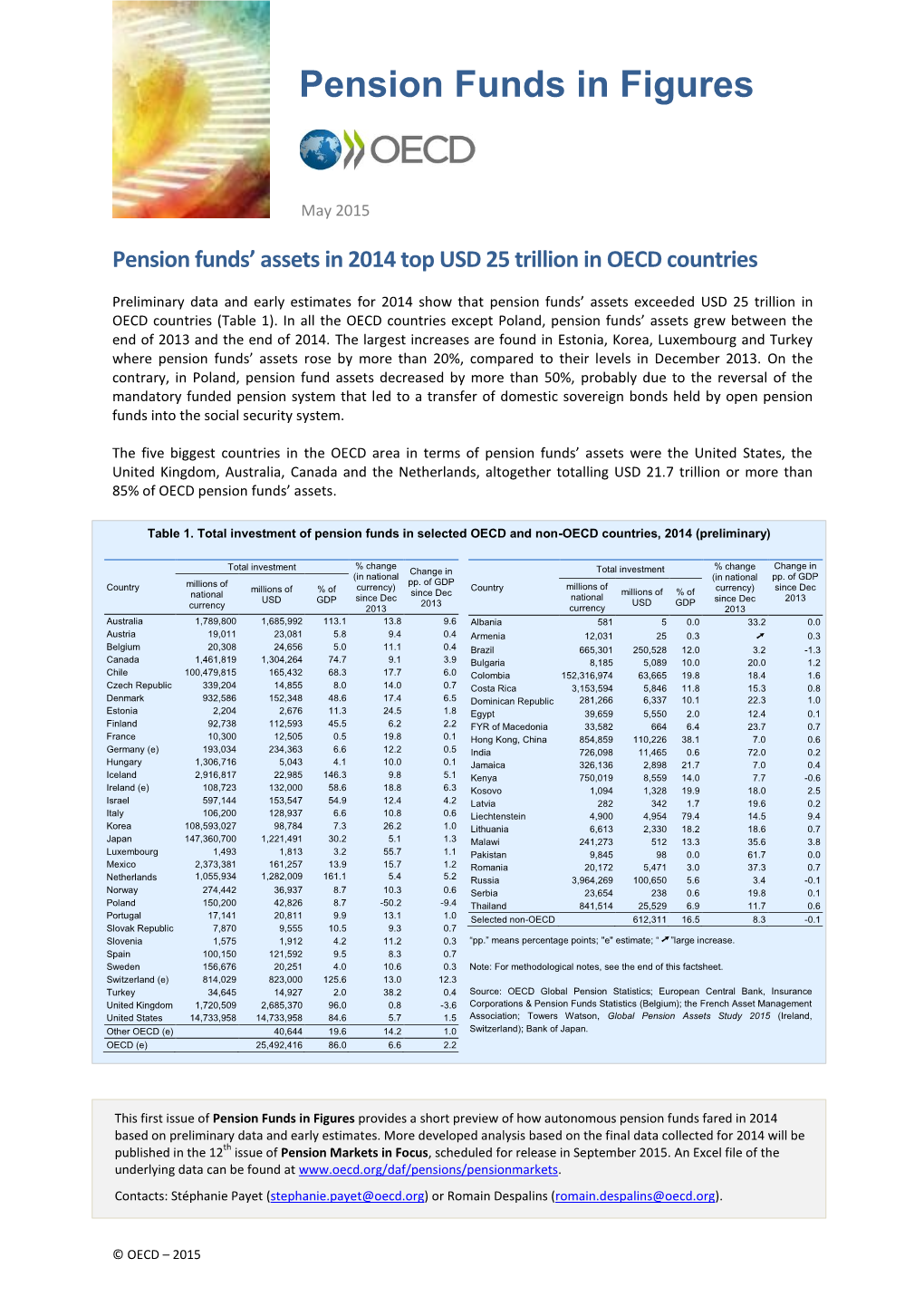

Pension Funds in Figures

Pension Funds in Figures June 2020 Pension fund assets rose to USD 32 trillion in 2019 but COVID-19 impacts are set to reverse some of these gains Preliminary data for 2019 show that pension funds held USD 32.3 trillion in the OECD area and USD 0.7 trillion in 29 other reporting jurisdictions (Table 1). The United States exhibited the largest amount of assets in pension funds at end-2019 (USD 18.8 trillion), followed by the United Kingdom (USD 3.6 trillion), Australia (USD 1.8 trillion), the Netherlands (USD 1.7 trillion), Canada (USD 1.5 trillion), Japan (USD 1.4 trillion) and Switzerland (USD 1.0 trillion). These seven countries held over 90% of all pension fund assets in the OECD area. Table 1. Assets in pension funds and all retirement vehicles in 2019 (preliminary) All retirement All retirement Pension funds Selected other Pension funds OECD countries vehicles vehicles jurisdictions % change in USD million % of GDP % of GDP % change in USD million % of GDP % of GDP Australia 6.3 1,779,374 132.0 135.0 Albania 26.8 27 0.2 0.2 Austria 13.5 27,293 6.1 .. Angola 13.1 554 0.8 .. Belgium 18.0 44,674 8.4 .. Armenia 58.2 524 3.8 .. Canada 7.3 1,531,845 89.1 158.9 Brazil 5.9 218,406 12.2 26.2 Chile 19.4 215,373 80.8 .. Bulgaria 16.9 9,037 13.6 13.6 Colombia 16.6 83,737 26.0 26.0 Costa Rica 19.7 20,503 32.2 32.2 Czech Republic 8.0 22,445 9.0 9.0 Croatia 15.4 18,083 30.0 30.0 Denmark 12.4 169,434 48.7 219.1 Egypt 10.0 4,873 1.5 1.5 Estonia 20.7 5,342 17.0 18.6 Georgia n.a. -

Social Dialogue Interventions: What Works and Why? Lessons Learned from a Synthesis Review 2013–2016 September 2017

Social dialogue interventions: What works and why? Lessons learned from a synthesis review 2013–2016 September 2017 EVALUATION Social dialogue interventions: What works and why? Lessons learned from a synthesis review 2013–2016 review Lessons learned from a synthesis why? and works Social dialogue interventions: What OFFICE BIT Social dialogue interventions: What works and why? Lessons learned from a synthesis review 2013–2016 September 2017 EVALUATION OFFICE International Labour Office • Geneva Copyright © International Labour Organization 2017 First published 2017 Publications of the International Labour Office enjoy copyright under Protocol 2 of the Universal Copyright Convention. Never- theless, short excerpts from them may be reproduced without authorization, on condition that the source is indicated. For rights of reproduction or translation, application should be made to ILO Publications (Rights and Licensing), International Labour Office, CH-1211 Geneva 22, Switzerland, or by email: [email protected]. The International Labour Office welcomes such applications. Libraries, institutions and other users registered with a reproduction rights organization may make copies in accordance with the licences issued to them for this purpose. Visit www.ifrro.org to find the reproduction rights organization in your country. Social dialogue interventions: What works and why? Lessons learned from a synthesis review 2013–2016 / International Labour Office, Evaluation Office – Geneva: ILO, 2017. ISBN: 978-922-129864-9 (print) ISBN: 978-922-129865-6 (web pdf) International Labour Office. Evaluation Office. ILO Cataloguing in Publication Data The designations employed in ILO publications, which are in conformity with United Nations practice, and the presentation of material therein do not imply the expression of any opinion whatsoever on the part of the International Labour Office concerning the legal status of any country, area or territory or of its authorities, or concerning the delimitation of its frontiers. -

The Work of WHO in the European Region in 2014–2015: Interim Report of the Regional Director

REGIONAL COMMITTEE FOR EUROPE 65TH SESSION Vilnius, Lithuania, 14–17 September 2015 © WHO The work of WHO in the European Region in 2014–2015: interim report of the Regional Director Working document Regional Committee for Europe EUR/RC65/5 Rev.1 65th session + EUR/RC65/Conf.Doc./1 Rev.1 Vilnius, Lithuania, 14–17 September 2015 20 August 2015 150560 Provisional agenda item 2(a) ORIGINAL: ENGLISH The work of WHO in the European Region in 2014–2015: interim report of the Regional Director This report highlights some of the most important work of the WHO Regional Office for Europe in 2014–2015 for better health in the European Region. As Health 2020 forms the framework for all the Regional Office’s work, this report addresses Health 2020’s priority areas for action: • investing in health through a life-course approach and empowering people; • tackling the Region’s major challenges of noncommunicable and communicable diseases; • strengthening emergency preparedness, surveillance and response; • strengthening people-centred health systems and public health capacity; and • creating resilient communities and supportive environments. WORLD HEALTH ORGANIZATION REGIONAL OFFICE FOR EUROPE UN City, Marmorvej 51, DK-2100 Copenhagen Ø, Denmark Telephone: +45 45 33 70 00 Fax: +45 45 33 70 01 Email: [email protected] Web: http://www.euro.who.int/en/who-we-are/governance EUR/RC65/5 Rev.1 page 2 Contents page Abbreviations .................................................................................................................... 4 Introduction: implementing the vision of better health for Europe ................................... 6 Better health for Europe: more equitable and sustainable ................................................. 7 Renewed policy environment, framed by Health 2020 ............................................ 7 Implementation of Health 2020 ..............................................................................