Housing Index Report for Quarter 1, 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Deconstructing Windhoek: the Urban Morphology of a Post-Apartheid City

No. 111 DECONSTRUCTING WINDHOEK: THE URBAN MORPHOLOGY OF A POST-APARTHEID CITY Fatima Friedman August 2000 Working Paper No. 111 DECONSTRUCTING WINDHOEK: THE URBAN MORPHOLOGY OF A POST-APARTHEID CITY Fatima Friedman August 2000 DECONSTRUCTING WINDHOEK: THE URBAN MORPHOLOGY OF A POST-APARTHEID CITY Contents PREFACE 1. INTRODUCTION ................................................................................................. 1 2. WINDHOEK CONTEXTUALISED ....................................................................... 2 2.1 Colonising the City ......................................................................................... 3 2.2 The Apartheid Legacy in an Independent Windhoek ..................................... 7 2.2.1 "People There Don't Even Know What Poverty Is" .............................. 8 2.2.2 "They Have a Different Culture and Lifestyle" ...................................... 10 3. ON SEGREGATION AND EXCLUSION: A WINDHOEK PROBLEMATIC ........ 11 3.1 Re-Segregating Windhoek ............................................................................. 12 3.2 Race vs. Socio-Economics: Two Sides of the Segragation Coin ................... 13 3.3 Problematising De/Segregation ...................................................................... 16 3.3.1 Segregation and the Excluders ............................................................. 16 3.3.2 Segregation and the Excluded: Beyond Desegregation ....................... 17 4. SUBURBANISING WINDHOEK: TOWARDS GREATER INTEGRATION? ....... 19 4.1 The Municipality's -

GOVERNMENT GAZETTE of the REPUBLIC of NAMIBIA No

GOVERNMENT GAZETTE OF THE REPUBLIC OF NAMIBIA No. 1820 N$2.12 WINDHOEK - 20 March 1998 Advertisements 7. No liability is accepted for any delay in the publication of advertisements/notices, or for the publication of such or any date other than that stipulated by the advertiser. Similarly no liability is accepted in respect of any editing, revision, PROCEDURE FOR ADVERTISING IN THE omission, typographical errors or errors resulting from faint GOVERNMENT GAZETTE OF THE REPUBLIC or indistinct copy. OF NAMIBIA 8. The advertiser will be held liable for all compensation and costs arising from any action which may be instituted 1. The Government Gazette (Estates) containing against the Government of Namibia as a result of the advertisements, is published on every Friday. If a Friday falls publication of a notice with or without any omission, errors, on a Public Holiday, this Government Gazette is published on lack of clarity or in any form whatsoever. the preceding Thursday. 9. The subscription for the Government Gazette is 2. Advertisements for publication in thc Government N$474,24 plus GST per annum, obtainable from Central Gazette (Estates) must be addressed to the Government Gazette Bureau Services (Pty) Ltd., Shop 3, Frans Indongo Gardens, Office, P.B. 13302, Windhoek, or be delivered at Cohen P.O. Box 1155, Windhoek. Postage must be prepaid by all Building, Ground Floor, Casino Street entrance, Windhoek, subscribers. Single copies of the Government Gazette are not later than 15:00 on the ninth working day before the date obtainable from Central Bureau Services (Pty) Ltd., Shop 3, of publication of this Government Gazette in which the Frans Indongo Gardens, P.O.Box 1155,Windhoek, at the price advertisement is to be inserted. -

FNB HOUSING INDEX Report for Quarter 3, 2006

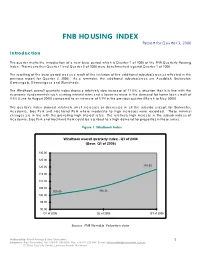

FNB HOUSING INDEX Report for Quarter 3, 2006 Introduction This quarter marks the introduction of a new base period which is Quarter 1 of 2006 of the FNB Quarterly Housing Index. This means that Quarter 2 and Quarter 3 of 2006 were benchmarked against Quarter 1 of 2006. The resetting of the base period was as a result of the inclusion of five additional suburbs/areas as reflected in the previous report for Quarter 2, 2006. As a reminder, the additional suburbs/areas are Auasblick, Brakwater, Goreangab, Okuryangava and Wanaheda. The Windhoek overall quarterly index shows a relatively slow increase of 11.6%, a situation that is in line with the economic fundamentals such as rising interest rates and a lower increase in the demand for home loan credit of 3.6% (June to August 2006) compared to an increase of 5.9% in the previous quarter (March to May 2006). This quarter’s index showed relatively small increases or decreases in all the suburbs except for Brakwater, Academia, Eros Park and Hochland Park where moderate to high increases were recorded. These minimal changes are in line with the prevailing high interest rates. The relatively high increase in the suburb indices of Academia, Eros Park and Hochland Park could be ascribed to a high demand for properties in these areas. Figure 1: Windhoek Index Windhoek overall quarterly index - Q3 of 2006 (Base: Q1 of 2006) 130.00 125.00 120.00 118.55 115.00 110.00 105.00 100.00 106.22 100.00 95.00 90.00 Q1 of 2006 Q2 of 2006 Q3 of 2006 Source: FNB Namibia Valuation data Authored by: Martin Mwinga & Alex Shimuafeni 1 Enquiries: Alex Shimuafeni, Tel: +264 61 2992890, Fax: +264 61 225 994, E-mail: [email protected] 5th Floor, First City Centre, Levinson Arcade, Windhoek Brakwater recorded an extraordinary high quarterly increase of 72% from Quarter 2. -

Final Project Report for 2016 START Grants for Global Change Research in Africa

Final Project Report for 2016 START Grants for Global Change Research in Africa Project Title Water Security in Windhoek: governance, water demand and supply, and livelihoods in the context of urbanization and climate change Abstract Governance In the study, UJAMS Waste Water Treatment Plant (UWWTP) served as a case study to investigate governance and policy analysis in relation to water security in the city of Windhoek. The study revealed that there are different actors that were involved in discussion and decision making to address the issue of water supply to industries, pollution from industrial effluent and the need to find diverse alternatives to the water insecurity problem that ultimately led to establishment and operation of the (UWWTP) Analysis of Water Management Plan for City of Windhoek 2017 and Transformational Strategic Plan (2017-2022) for City of Windhoek policies revealed that despite being developed recently after the Namibia Climate Change Policy, Strategy and Action Plan had been enacted, very little climate change related issues are mainstreamed and used in these policies despite Windhoek. Water demand and supply In central Namibia, where the Capital Windhoek is hosted, water is very scarce. To cope with the effect of drought, water is transferred from Kombat Karst Aquifer and Von Bach and Swakoppoort dam on the Swakop River. The effect of drought on the Swakop River is not well known. To understand the effect of drought, streamflow, and rainfall data from 1969 to 2016 were collected and analyzed using drought indices such as Standardized Precipitation Index (SPI) and Streamflow Drought Index (SDI). It was found that, drought periods were not continuous and a wet period was always followed. -

19 December 1994

* TODAY: RUSSIA BOMBS ·CHECHEN * MAKWETU HANGS ONTO' PAC LEADERSHIP * LATEST BONDS * > Bringing Africa South Vol No 564 N$1 .50 (GST ,Inc.) Tuesday December 20 1994 Plane crashes near Sesfontein • LU CIENNE FI LD THE two crew members of a small Cana 'd .··N<lItUlI" _C'':'''Q fN<lItlYnhl <llt n '· W .... .,.. ..n '. ..... ~""l • .rI .._ht ···· dian aircraft which crashed in north-east ~~~:~!~i~~~£~~~Opuwo. ;?ii:~~:~~~~~~~B oth crew mem bers ~~:~~;.~;~~~:~::th at th e pI ane dI not !lll;lllll i ern Namibia while conducting a geological Grellmann said ·two were found dead. Their belong to Westair survey on Sunday are dead. planes and one helicop- bodies will be flown to Aviation and that A Westair Aviation ling at Sesfontein on ter left Windhoek early Windhoek before being maintenance on the spokesperson, Karin Sunday as scheduled, yesterday morning to flown home to Canada. plane was done using Grellmann, said the The Canadian plane search for the plane and It is thought that the Westair facilities. As plane, a Cessna 402 with two Canadian crew crew members after no planemusthavecrashed a result the company Titan, was reported members on board had news was received, into a mountain and had been asked tohelp missing after it failed bee~ conducting,a geo- Yesterdaythe,charred burst into, flames. w~e~ the plane went ;:,-:; Tb~fe. ,. are . clirrently . l :.· 9.:57 . ~~d~ntsJ~)1ng : Jlf t to turn up for refuel- logIcal survey m Na- wreck of the Il l-fated Grellmann SaId only the mlss1Og. t,h~ . ~OtP,9~ ,'Pe.r c~Dt .gf, ,\!~QQ(~r~ · fJ;Qm A~g~J~. -

Public Perception of Windhoek's Drinking Water and Its Sustainable

Public Perception of Windhoek’s Drinking Water and its Sustainable Future A detailed analysis of the public perception of water reclamation in Windhoek, Namibia By: Michael Boucher Tayeisha Jackson Isabella Mendoza Kelsey Snyder IQP: ULB-NAM1 Division: 41 PUBLIC PERCEPTION OF WINDHOEK’S DRINKING WATER AND ITS SUSTAINABLE FUTURE A DETAILED ANALYSIS OF THE PUBLIC PERCEPTION OF WATER RECLAMATION IN WINDHOEK, NAMIBIA AN INTERACTIVE QUALIFYING PROJECT REPORT SUBMITTED TO THE FACULTY OF WORCESTER POLYTECHNIC INSTITUTE IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF BACHELOR OF SCIENCE SPONSORING AGENCY: Department of Infrastructure, Water and Waste Management The City of Windhoek SUBMITTED TO: On-Site Liaison: Ferdi Brinkman, Chief Engineer Project Advisor: Ulrike Brisson, WPI Professor Project Co-advisor: Ingrid Shockey, WPI Professor SUBMITTED BY: ____________________________ Michael Boucher ____________________________ Tayeisha Jackson ____________________________ Isabella Mendoza ____________________________ Kelsey Snyder Abstract Due to ongoing water shortages and a swiftly growing population, the City of Windhoek must assess its water system for future demand. Our goal was to follow up on a previous study to determine the public perception of the treatment process and the water quality. The broader sample portrayed a lack of awareness of this process and its end product. We recommend the City of Windhoek develop educational campaigns that inform its citizens about the water reclamation process and its benefits. i Executive Summary Introduction and Background Namibia is among the most arid countries in southern Africa. Though it receives an average of 360mm of rainfall each year, 83 percent of this water evaporates immediately after rainfall. Another 14 percent goes towards vegetation, and 1 percent supplies the ground water in the region, thus leaving merely 2 percent for surface use. -

Government Gazette Republic of Namibia

GOVERNMENT GAZETTE OF THE REPUBLIC OF NAMIBIA N$39.00 WINDHOEK - 24 July 2017 No. 6364 CONTENTS Page Road Carrier Permits ........................................................... 1 _______________ ROAD CARRIER PERMITS The under-mentioned applications for Public Road Carrier Permits indicate (1) reference number and the area within which the proposed road transport will be undertaken, (2) name of applicant and nature of application, (3) number and type of vehicles, (4) nature of proposed road transportation and (5) points between and routes over or area within which the proposed road transportation is to be effected are published in terms of section 14(1) of the Road Transportation Act, 1977 (Act No. 74 of 1977), Representations which interested parties wish to make in respect of the applications must comply with the provisions of regulation 4(1) of the Road Transportation Regulations, 1977 and must be in quadruplicate in respect of each application and must be delivered by hand or sent by registered post to the Secretary, Road Transportation Board, Private Bag 13178, Windhoek to reach that office not later than 21 days after the date of publication of this Government Gazette. Address to which representations must be submitted: M. Cloete, Private Bag 12030, Ausspannplatz, Windhoek, Namibia. Full particulars in respect of each application are open to inspection at the ROADS AUTHORITY, NaTIS House, Faraday Street, Windhoek. ________________ 2 Government Gazette 24 July 2017 6364 App. 143503 (2) CARS AND GUIDES FOR HIRE App. 143661 (2) -

Government Gazette Republic of Namibia

GOVERNMENT GAZETTE OF THE REPUBLIC OF NAMIBIA N$6.75 WINDHOEK- 22 November 1999 No. 2233 0 CONTENTS PROCLAMATION Page No. 35 Amendment of Proclamation No. 25 of 1 September 1992, as amended by Proclamation No. 16 of31 August 1998 ....................................................... .. GOVERNMENT NOTICES No. 254 Electoral Act 1992: General election for the election of President: Publication of list of candidates ......................................................................................... 2 No. 255 Electoral Act, 1992: General election for the election of members of the National Assembly: Publication of names of political parties and lists of candidates ....................................................................................................... 4 No. 256 Electoral Act, 1992: General election for the election of President and members ofthe National Assembly: Notification of polling stations ........................... .. 25 Proclamation by the PRESIDENT OF THE REPUBLIC OF NAMIBIA No. 35 1999 AMENDMENT OF PROCLAMATION NO. 25 OF 1 SEPTEMBER 1992, AS AMENDED BY PROCLAMATION NO. 16 OF 31 AUGUST 1998 In terms of section 5{3)(b) of the Regional Councils Act, 1992 (Act No. 22 of1992) and pursuant to the report of the Second Delimitation Commission on Determination of Regions and Constituencies, dated 3 August 1998, which has been accepted by me, I hereby amend the Schedule to Proclamation No. 25 of 1992 (as amended by Proclamation No. 16 of31 August 1998) as set out hereunder. Given under my Hand and the Seal of the Republic of Namibia at Windhoek this 19th day of November, One Thousand Nine Hundred and Ninety-nine. SAMNUJOMA PRESIDENT BY ORDER OF THE PRESIDENT-IN-CABINET 2 Government Gazette 22 November 1999 No. 2233 SCHEDULE The item "REGION NO. 5: OSHIKOTO REGION" is hereby amended- (a) by the substitution for the heading "Okatope Constituency" of the heading "Onyaanya Constituency"; and (b) by the substitution for the heading "Oshikoto Constituency" of the heading "Tsumeb Constituency". -

Black Power, Black Consciousness, and South Africa's Armed Struggle

Binghamton University The Open Repository @ Binghamton (The ORB) Graduate Dissertations and Theses Dissertations, Theses and Capstones 6-2018 UNCOVERING HIDDEN FRONTS OF AFRICA’S LIBERATION STRUGGLE: BLACK POWER, BLACK CONSCIOUSNESS, AND SOUTH AFRICA’S ARMED STRUGGLE, 1967-1985 Toivo Tukongeni Paul Wilson Asheeke Binghamton University--SUNY, [email protected] Follow this and additional works at: https://orb.binghamton.edu/dissertation_and_theses Part of the Sociology Commons Recommended Citation Asheeke, Toivo Tukongeni Paul Wilson, "UNCOVERING HIDDEN FRONTS OF AFRICA’S LIBERATION STRUGGLE: BLACK POWER, BLACK CONSCIOUSNESS, AND SOUTH AFRICA’S ARMED STRUGGLE, 1967-1985" (2018). Graduate Dissertations and Theses. 78. https://orb.binghamton.edu/dissertation_and_theses/78 This Dissertation is brought to you for free and open access by the Dissertations, Theses and Capstones at The Open Repository @ Binghamton (The ORB). It has been accepted for inclusion in Graduate Dissertations and Theses by an authorized administrator of The Open Repository @ Binghamton (The ORB). For more information, please contact [email protected]. UNCOVERING HIDDEN FRONTS OF AFRICA’S LIBERATION STRUGGLE: BLACK POWER, BLACK CONSCIOUSNESS, AND SOUTH AFRICA’S ARMED STRUGGLE, 1967-1985 BY TOIVO TUKONGENI PAUL WILSON ASHEEKE BA, Earlham College, 2010 MA, Binghamton University, 2014 DISSERTATION Submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy in Sociology in the Graduate School of Binghamton University State University of New -

Of 4 NAMIBIA DISABILITY PERSONS ORGANISATION and SERVICE PROVIDERS

NAMIBIA DISABILITY PERSONS ORGANISATION AND SERVICE PROVIDERS INSTITUTION ADDRESS EMAIL ROLE F. A. Indongo 0814385745 ailishilongo@gmail Special Care Center is a day care SCC .com for children with disabilities in Oshana region northern Namibia Stepping Swakopmund pre- Erongo region special school for Stone school 081- children with special needs 1433896 Down P.O. Box 24876, anita@downsyndr Raised awareness and educate the Syndrome Windhoek omenamibia.org public on Down syndrome and the Association of 812422302 eline@downsyndr rights of persons with Down Namibia omenamibia.org syndrome. NFPDN National Trumdaniel0@gm Acts as the central voice of all Federation of ail.com persons with disabilities in Namibia. People with It advocates for the protection and Disabilities in promotion of the rights of persons Namibia (NFPDN), with disability to ensure inclusive PO Box 3659, economic development in Namibia. Windhoek There is a national umbrella disabled people's organisation in the country, NACU NACU, ebenpress@gmail. Khomas com Onyose Trust Onyose Tust, onyosetrust@mwe Works with young disabled people in Windhoek, P: b.com.na Khomasdal, Windhoek. There are 45 61213358, carees from age 8 to 30, all with Fax:61212383 physical or mental disability. Office of the Windhoek DRC, Edward1m1@gma Its mandate is provided for under the Vice-President Okuryangava il.com National Disability Policy 1997. Its D-A mission is to improve the quality of life through enhancing the dignity, wellbeing and empowerment of persons with disabilities. CLaSH P.O Box 24361 [email protected] Facilitates development towards Windhoek a equal opportunities for children with language, speech and hearing impairments, ensure equal access to education, training and all other facilities and promote services to meet these children's special needs as early as possible. -

Proposed New Fuel Retail Facility in Khomasdal Township, in Windhoek

ENVIRONMENTAL IMPACT ASSESSMENT PROPOSED NEW FUEL RETAIL FACILITY IN KHOMASDAL TOWNSHIP, IN WINDHOEK KHOMAS REGION VALLEY VIEW FUEL RETAIL FACILITY CONSULTANT: PROPONENT: March 2019 Waterberg Investments (Pty) Ltd Matrix Consulting Services P.O. Box 3925, Windhoek P.O. Box 25824 Windhoek Mobile: +264-81 124 3434 Tel: +264-61 224197 [email protected] Fax: +264-61 212165 [email protected] WATERBERG INVESTMENTS (PTY) LTD This document is for the use of Waterberg Investments (Pty) Ltd only and may not be transmitted to any other party, in whole or in part, in any form without written consent permission of Matrix Consulting Services EXECUTIVE SUMMARY An Environmental Impact Assessment (EIA) has been commissioned by Waterberg Investments (Pty) Ltd, for the proposed Valley View fuel retail facility in Khomasdal, Windhoek (22.55068°S; 17.03613°E). Considering the nature of the proposed development and its activities, the EIA has been undertaken in accordance with the requirements of existing national legislations, of which the National Environmental Assessment Policy (1995), the Environmental Management Act (2007) and its regulations of 2012, and other relevant legislations and regulations pertaining to Environmental Assessments and protection of the environment in the Republic of Namibia are considered most important. Some existing international policies are also taken into account and are used as guidelines. Impacts identified from baseline studies, site visits and stakeholder consultation process have been assessed making use -

Khomas Regional Development Profile 2015

KHOMAS REGIONAL DEVELOPMENT PROFILE 2015 Khomas Regional Council PO Box 3379, Windhoek Tel.: +264 61 292 4300 http://209.88.21.122/web/khomasrc Khomas Regional Development Profile 2015 Page i KHOMAS REGIONAL DEVELOPMENT PROFILE 2015 ENQUIRIES [email protected] [email protected] [email protected] http://209.88.21.122/web/khomasrc TABLE OF CONTENTS Acronyms iii List of Charts, Maps and Tables vi Acknowledgment 1 Foreword 2 Executive Summary 3 Chapter 1: Introduction 1.1. Introduction to the region 5 Location 6 Size of the region 7 Population and demography 7 Landscape 8 1.2. Governance and Planning Structures 15 1.3. High Level Statements of the Khomas Regional Council 17 1.4. Methodology 18 Chapter 2: Key Statistics 2.1. Demographics 20 2.1.1 Population size 20 2.1.2 Population size per constituency 20 2.1.3 Age composition 21 2.1.4 Population groups 22 2.1.5 Unemployment rate 23 2.1.6 Average Life Expectancy 24 2.1.7 Poverty Prevalence in Khomas Region 24 2.2. Household Percentage with access to: 26 Safe water 26 Health facilities 26 Sanitation 27 Chapter 3: Regional Development Areas 28 3.1. Economic Sector 28 Agriculture 28 Tourism and Wildlife 28 Trade and Industrial Development 29 Mining 30 3.2. Social Sector 30 Housing 30 Health (and health facilities) 34 KRDP 2015 – Table of Contents i Water and Sanitation accessibility 36 Education and Training 38 3.3. Infrastructure 39 Transport 40 Roads 40 Air 40 Railway 40 Water and Sanitation Infrastructure 43 Telecommunication 44 3.4.