Tronox Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Saraf Agencies Private Ltd Kolkata

SARAF AGENCIES PRIVATE LTD KOLKATA TECHNO ECONOMIC FEASIBILITY REPORT FOR INTEGRATED 36000 TPA HIGH TITANIUM SLAG, 20,000 TPA PIG IRON, 30000 TPA TITANIUM DIOXIDE PIGMENT PLANT IN ODISHA NOVEMBER 2014 DEVELOPMENT CONSULTANTS PRIVATE LIMITED CONSULTING ENGINEERS 24 PARK STREET, KOLKATA 700016 PHONE: (91) 33 4012 4500, 2249 7603 /05/09/10/12 FAX: (91) 33 4012 4545, 2249 2340 /289 E-mail: [email protected] KOLKATA MUMBAI DELHI CHENNAI SARAF DCPL TABLE OF CONTENTS : PROJECT AT A GLANCE : SECTION – 1 : INTRODUCTION & EXECUTIVE SUMMARY SECTION – 2 : MARKET SCENARIO SECTION - 3 : PLANT SITE & INFRASTRUCTURE SECTION - 4 : PROCESS & PLANT PARTICULARS SECTION – 5 : RAW MATERIALS, PRODUCTS, UTILITY & AUXILIARY SERVICES SECTION – 6 : PLANT LAYOUT & CIVIL WORK SECTION – 7 : POLLUTION & ENVIRONMENTAL CONTROL SECTION – 8 : MAN-POWER SECTION – 9 : PROJECT IMPLEMENTATION SCHEDULE SECTION – 10 : COST ESTIMATES & FINANCIAL ANALYSIS 1 SARAF DCPL PROJECT AT A GLANCE Î Project Title : 36000 TPA HIGH TITANIUM SLAG, 20,000 TPA PIG IRON, 30000 TPA TITANIUM DIOXIDE PIGMENT PLANT Î Owner : SARAF AGENCIES PVT LTD Î Project Location : Chhatrapur, Dist. Ganjam, Odisha - Nearest Rail Station : Chhatrapur (5 Km) - Nearest Highway NH-16 (0.6 Km) - Nearest Town : Chhatrapur (4 Km) - Nearest Port : Paradeep : 260 Km. Vizag : 250 Km. Gopalpur Port –under construction (12 Km) - Nearest Airport : Bhubaneswar : 150 Km. - Survey of India Map : 74 A/15 Î Capacity of Plant : 36000 TPA Titanium Slag, 20,000 TPA Pig Iron, 30000 TPA Titanium Dioxide (both Anatase & Rutile Grade) Î Technology Source/know- : CHINA how for Titanium Project : HPWY (CHINA) for Titanium Slag Plant : Chong Qung Chemical Engineering Design and Research Institute (CCDRI) will supply Process Technology, Basic & Detailed Engineering for Titanium Dioxide Plant. -

Tronox Limited

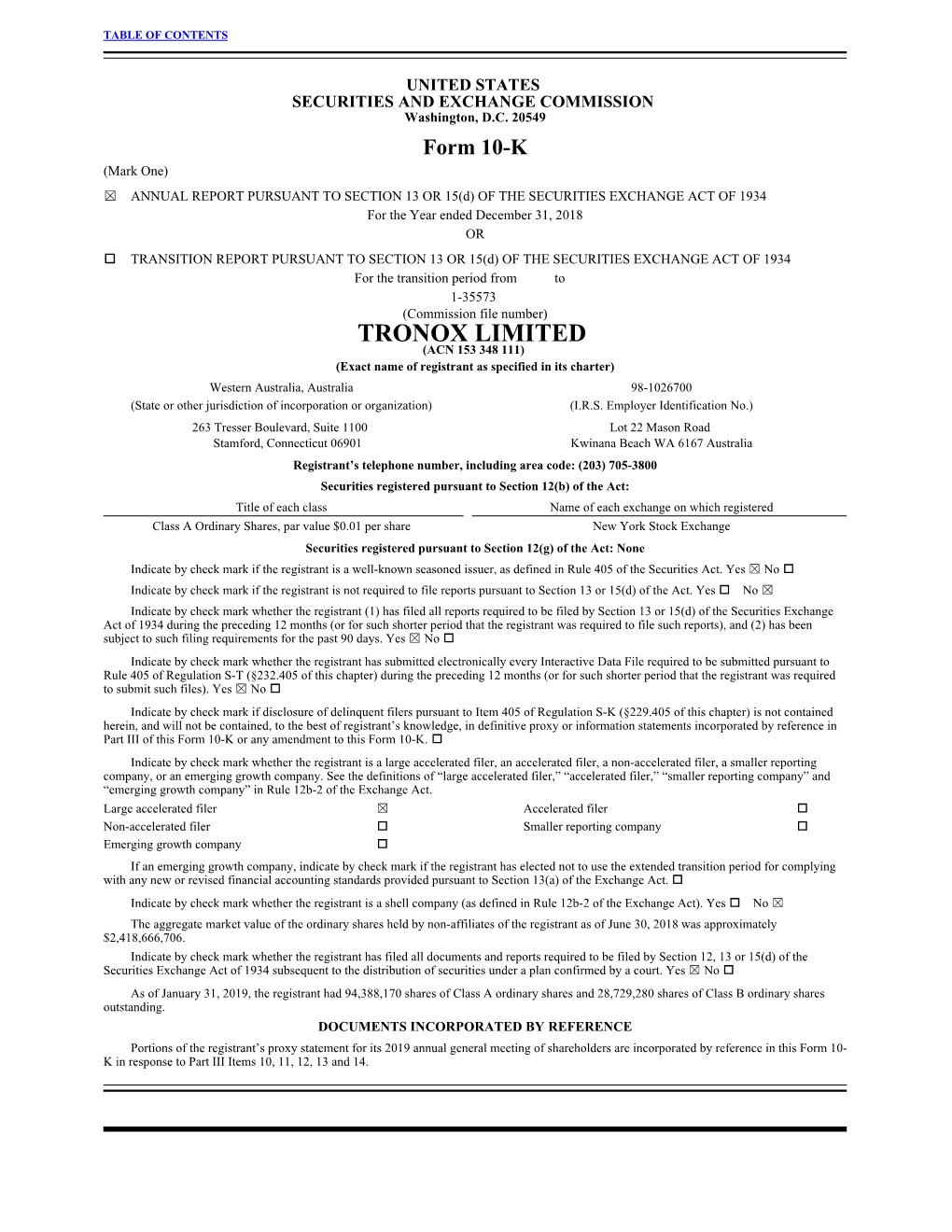

TABLE OF CONTENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Year ended December 31, 2017 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to 1-35573 (Commission file number) TRONOX LIMITED (ACN 153 348 111) (Exact name of registrant as specified in its charter) Western Australia, Australia 98-1026700 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 263 Tresser Boulevard, Suite 1100 Lot 22 Mason Road Stamford, Connecticut 06901 Kwinana Beach WA 6167 Australia Registrant’s telephone number, including area code: (203) 705-3800 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Ordinary Shares, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2010 Minerals Yearbook

2010 Minerals Yearbook TITANIUM U.S. Department of the Interior October 2012 U.S. Geological Survey TITANIUM By Joseph Gambogi Domestic survey data and tables were prepared by Elsie D. Isaac, statistical assistant, and the world production table was prepared by Lisa D. Miller, international data coordinator. Although import dependent on titanium mineral concentrates reducing cost and shortening delivery lead times for structural and titanium sponge, the United States continued to be a net titanium and titanium armor. The initial goal of the second exporter of titanium dioxide (TiO2) pigment and wrought program was to direct roll titanium in widths and thicknesses titanium metal products. Improving global economic conditions that could be used for armor tiles on military ground vehicles caused domestic production of TiO2 pigment to increase by 7% (U.S. Department of Defense, 2011, p. 72). compared with that of 2009. After declining in 2009, demand for titanium metal from the commercial aerospace industry Production rebounded, resulting in increased domestic production of Titanium industry data for this report are collected by the U.S. titanium ingot and mill products. U.S. consumption of titanium Geological Survey (USGS) from annual and quarterly surveys used in steel and other alloys increased by 25% from that in of domestic titanium operations. In 2010, the USGS annual 2009. survey canvassed titanium mineral and pigment production World production of TiO contained in titanium mineral 2 operations. The two producers of titanium mineral concentrates concentrates increased by 13% compared with that of 2009. responded, but data were withheld to avoid disclosing company The leading sources of imports of titanium mineral concentrates proprietary information. -

Tronox Limited

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Year ended December 31, 2015 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to 1-35573 (Commission file number) TRONOX LIMITED (ACN 153 348 111) (Exact name of registrant as specified in its charter) Western Australia, Australia 98-1026700 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) Lot 22 Mason Road 263 Tresser Boulevard, Suite 1100 Kwinana Beach WA 6167 Stamford, Connecticut 06901 Australia Registrant’s telephone number, including area code: (203) 705-3800 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Ordinary Shares, par value $0.01 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Titanium 2012

2012 Minerals Yearbook TITANIUM U.S. Department of the Interior August 2016 U.S. Geological Survey Titanium By George M. Bedinger Domestic survey data and tables were prepared by Elsie D. Isaac, statistical assistant, and the world production table was prepared by Glenn J. Wallace, international data coordinator. Domestic production of titanium dioxide (TiO2) pigment numerous technologies are used to produce synthetic rutile, decreased by 12% compared with that of 2011 (table 5). nearly all are based on either selective leaching or thermal U.S. consumption of titanium used in steel and other alloys reduction of iron and other impurities in ilmenite. Rutile, increased by 4% from that in 2011 (table 7). U.S. production naturally occurring TiO2, has the highest TiO2 content but is of titanium mineral concentrates in 2012 was unchanged from less abundant. that of 2011. The United States was 78% import reliant for U.S. mineral concentrate producers were DuPont Titanium titanium mineral concentrates and 71% for titanium sponge, Technologies [a subsidiary of E.I. du Pont de Nemours and and continued to be a net exporter of TiO2 pigment and wrought Co. (DuPont)] and Iluka Resources, Inc. (a subsidiary of Iluka titanium metal products. The leading sources of imported Resources Ltd.). DuPont’s mining operations near Starke, FL, titanium mineral concentrates were Australia, Canada, and produced a mixed product containing ilmenite, leucoxene, and South Africa (table 11). World production of titanium mineral rutile that was used as a feedstock in DuPont’s TiO2 pigment concentrates in 2012 was 8.31 million metric tons (Mt) of plants. -

Cristal Global to Construct Ilmenite-Processing Plant in Jazan

9/10/2014 Cristal Global to Construct Ilmenite-Processing Plant in Jazan Cristal Global to Construct Ilmenite-Processing Plant in Jazan Date: 6/2/2012 Contact Name: Amy N. Drusano Manager - Communications Contact Number: +1.410.229.8062 JEDDAH, SAUDI ARABIA (June 2, 2012) – Cristal Global has awarded Outotec an EPC contract (engineering, procurement and construction) for design, installation and construction of a new, fully scalable ilmenite processing facility. The overall contract value: EUR 350 million, which includes two (2) years of production and maintenance management with Training and Team building. The location of the new facility, previously announced, in November 2011, as Yanbu, Saudi Arabia has been relocated to Jazan Economic City, Saudi Arabia. The plant, scheduled to be operational in 2014, will be constructed on a turnkey basis. The plant’s initial annual capacity will be 500,000 tonnes of titanium slag, and its design enables expansion to one million tonnes. Additionally, it will produce 235,000 tonnes of high purity pig iron as a valuable co-product. Cristal is the world's second-largest producer of titanium dioxide and a leading producer of titanium chemicals. Cristal is the world’s leading supplier of ultrafine titanium dioxide products and titanium chemicals and is a fast- growing producer of mineral sands and titanium metal powder. Cristal operates seven manufacturing plants in six countries on five continents and employs nearly 4,500 people worldwide. Cristal is owned 66% by Tasnee, a listed Saudi joint stock company and 33% by Gulf Investment Corporation, a company equally owned by the six states of the Gulf Cooperation Council and headquartered in Kuwait. -

Profile and Capabilities

PROFILE AND CAPABILITIES TZMI.COM TZ MINERALS INTERNATIONAL PTY LTD ABOUT TZMI TZ MINERALS INTERNATIONAL PTY LTD (TZMI) is a global Consulting Specialists for: consulting and publishing company, established in 1994, which specialises in all aspects of the mineral sands, titanium dioxide, - Heavy mineral deposits titanium metal and coatings industries. The strength of TZMI’s consulting services stems from extensive - Recovery and processing practical experience in the various industries in chief executive, of mineral sands senior operational, analytical and marketing roles. - TiO2 pigment plants TZMI’s publications and data services support the consulting activities and ensure up-to-date, high quality and comprehensive - Titanium sponge production data, analysis and information is available, supported by a the most globally comprehensive and current database of - High level strategic M&A production and market data which has been built up over 20 years. decision support At TZMI, professional research analysts collect and analyse data - Operationally focused plant of industry production, market information and best practices in optimisation the world, including supply and demand models, technical data and operating cost data for all major producers. - Feasibility studies incorporating TZMI services are also complemented by Allied Mineral mining, processing and Laboratories (AML). AML is 100% owned by TZMI and is a testing beneficiation up to and facility located in Western Australia that specialises in resource assessment and flowsheet development for mineral sands, iron including basic engineering, ore and other heavy mineral deposits. suitable for use in IPOs or This combination of services provided globally ensures that every private equity raising. assignment and offering is one that takes into consideration all aspects across the value chain – a very important factor which leads to successful results for our clients. -

Complaint Counsel's Post-Trial Reply Finding of Fact and Conclusions Of

PUBLIC UNITED STATES OF AMERICA BEFORE THE FEDERAL TRADE COMMISSION 09 17 2018 OFFICE OF ADMINISTRATIVE LAW JUDGES 592217 In the Matter of ~ETARV Tronox Limited a corporation, ORIGINAL National Industrialization Company PUBLIC (TASNEE) a corporation, Docket No. 9377 National Titanium Dioxide Company Limited (Cristal) a corporation, And Cristal USA Inc. a corporation. COMPLAINT COUNSEL’S POST-TRIAL REPLY FINDINGS OF FACT AND CONCLUSIONS OF LAW Dominic Vote Robert Tovsky Deputy Assistant Director Cem Akleman Peggy Bayer Femenella Charles A. Loughlin Alicia Burns-Wright Chief Trial Counsel Steven Dahm EricEdmondson Federal Trade Commission Eric Elmore Bureau of Competition Sean Hughto 600 Pennsylvania Ave., NW Janet Kim Washington, DC 20580 Joonsuk Lee Telephone: (202) 326-3505 Meredith Levert Email: [email protected] David Morris JonNathan RohanPai Blake Risenmay KristianRogers Lily Rudy CeceliaWaldeck Attorneys Dated: September 17, 2018 PUBLIC TABLE OF CONTENTS I. Response to Proposed Findings Regarding "THE PARTIES, THE TRANSACTION, AND THE PROCEEDING"................................................................. 1 II. Response to Proposed Findings Regarding "BACKGROUND ON THE TIO2 INDUSTRY" ..................................................................................................................... 28 III. Response to Proposed Findings Regarding "THE TRONOX-CRISTAL ACQUISITION WILL GENERATE SIGNIFICANT OUTPUT-ENHANCING AND COST-SAVING SYNERGIES". ............................................................................. 72 -

Ilmenite and Rutile

ILMENITE AND RUTILE Indian Minerals Yearbook 2013 (Part- III : MINERAL REVIEWS 52nd Edition ILMENITE AND RUTILE (FINAL RELEASE) GOVERNMENT OF INDIA MINISTRY OF MINES INDIAN BUREAU OF MINES Indira Bhavan, Civil Lines, NAGPUR – 440 001 PHONE/FAX NO. (0712) 2565471 PBX : (0712) 2562649, 2560544, 2560648 E-MAIL : [email protected] Website: www.ibm.gov.in July, 2015 27-1 ILMENITE AND RUTILE 27 Ilmenite & Rutile ndia is endowed with large resources of heavy 160.72 sq km inland areas in Tamil Nadu and West Iminerals which occur mainly along coastal Bengal have been investigated for over six decades stretches of the country and also in inland placers. by AMD. The ilmenite resources estimation for the Heavy mineral sands comprise a group of seven areas explored up to 2012 has been completed and minerals, viz, ilmenite, leucoxene (brown ilmenite), the resources are up from 520.38 million tonnes to rutile, zircon, sillimanite, garnet and monazite. 593.50 million tonnes (including leucoxene), inclusive Ilmenite (FeO.TiO2) and rutile (TiO2) are the two of indicated, inferred and speculative categories. chief minerals of titanium. Titanium dioxide occurs Resource estimation for the areas explored during in polymorphic forms as rutile, anatase (octahedrite) 2012-13 is under progress. The most significant and brookite. Though, brookite is not found on a deposits which are readily available and attract large-scale in nature, it is an alteration product of attention of industry for large-scale operations are other titanium minerals. Leucoxene is an alteration as follows: product of ilmenite and found associated with ilmenite. State/Deposit Ilmenite reserves RESOURCES (In million tonnes) Ilmenite and rutile along with other heavy Andhra Pradesh 1. -

Improving the Agronomic Quality of a Residual Red Gypsum Landfill Through Phytomanagement

Improving the agronomic quality of a residual red gypsum landfill through phytomanagement. José Zapata Carbonell To cite this version: José Zapata Carbonell. Improving the agronomic quality of a residual red gypsum landfill through phytomanagement.. Agricultural sciences. Université Bourgogne Franche-Comté, 2020. English. NNT : 2020UBFCD023. tel-03220644 HAL Id: tel-03220644 https://tel.archives-ouvertes.fr/tel-03220644 Submitted on 7 May 2021 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. CHRONO ""'11.._..._ ENVIRONNEMENT ÊCOlE DOCTORALE Environnement, - Santé �&OVRGOGNE,�:,�fl\ANCHE-COMTE � � 'l'•IF ..0-..e Université de Bourgogne Franche-Comté École Doctorale Environnement Santé Laboratoire Chrono-Environnement -- UMR 6249 CNRS THÈSE Présentée en vue de l'obtention du titre de Docteur de l'Université de Bourgogne Franche-Comté Spécialité<< Sciences Agronomiques>> Améliorer la qualité agronomique d’un dépôt de gypse rouge résiduel par phytomanagement Présentée et soutenue par José Gonzalo ZAPATA CARBONELL Le 15 mai 2020 à Besançon Membres du jury: Engracia Maria MADEJÔN RODRÎGUEZ (Directrice de recherche, IR AS. CSIC) Rapponeuse Michel MENCII (Directeur de recherche, INRAE, U-Bordeaux) Rapponeuret président du jury Olivier FAURE (Maitre de conférences. PEG. EMSE) Examinateur Nadia CRINI (Ingénieur de recherche. -

Titanium 2016 Conference and Exhibition, Scottsdale, AZ, BSE ASX March Quarterly Activities Report Final.Pdf.) September 26–28, Presentation, 19 P

2016 Minerals Yearbook TITANIUM [ADVANCE RELEASE] U.S. Department of the Interior January 2020 U.S. Geological Survey Titanium By George M. Bedinger Domestic survey data and tables were prepared by Joseph J. Kohler, statistical assistant. In 2016, there were two producers of titanium mineral reduction of iron and other impurities in ilmenite. Titaniferous concentrates in the United States. The United States was 91% and slag is produced from ilmenite by pyrometallurgical processing. 45% import reliant, as a percentage of apparent consumption, for U.S. mineral concentrate producers were The Chemours Co. titanium mineral concentrates and titanium sponge, respectively. (Wilmington, DE) and Southern Ionics Minerals LLC (Offerman, The United States continued to be a net exporter of titanium GA). Chemours’ mining operations near Starke, FL, produced dioxide (TiO2) pigment and wrought titanium metal products. a mixed product containing ilmenite, leucoxene, and rutile The leading sources of imported titanium mineral concentrates which was used as a feedstock in Chemours’s TiO2 pigment were, in decreasing order, South Africa, Australia, and plants. Southern Ionics’ operations included its Mission Mine Mozambique (table 11). Domestic production of TiO2 pigment and a mineral-sands processing plant in Charlton County, GA. increased by 2% compared with that of 2015 (table 5). U.S. Iluka Resources Ltd. (Perth, West Australia, Australia) idled its consumption of titanium used in steel and other alloys increased mining operations near Stony Creek, VA, in December 2015 by 2% from that in 2015 (table 7). World production of titanium (Iluka Resources Ltd., 2016, p. 5). mineral concentrates in 2016 was 9.62 million metric tons (Mt), TiO2 Pigment.—TiO2 pigment is produced from titanium an increase of 2% from revised totals for 2015. -

Tronox Limited, Et Al., FTC V.: Complaint for Temporary

Case 1:18-cv-01622-TNM Document 1 Filed 07/10/18 Page 1 of 26 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA FEDERAL TRADE COMMISSION 600 Pennsylvania Avenue, N.W. Washington, DC 20580 Plaintiff, V. TRONOX LIMITED 263 Tresser Boulevard, Suite 1100 Stamford, CT 06901 NATIONAL INDUSTRIALIZATION Case: 1:1 8-cv-01622 (D Deck) COMPANY Assigned To : McFadden, Trevor N. Building C3, Business Gate Assign. Date : 7/10/2018 Eastern Ring Road, Cordoba Area Description: TRO/Privacy Act Riyadh 11496, Kingdom of Saudi Arabia, NATIONAL TITANIUM DIOXIDE COMPANY LIMITED 17th floor, King Road Tower King Abdulaziz Street, Beach District Jeddah 21414, Kingdom of Saudi Arabia, and CRISTAL USA INC. 6752 Baymeadow Drive Glen Burnie, MD 21201 Defendants. COMPLAINT FOR TEMPORARY RESTRAINING ORDER AND PRELIMINARY INJUNCTION PURSUANT TO SECTION 13(b) OF THE FEDERAL TRADE COMMISSION ACT Plaintiff, the Federal Trade Commission ("FTC" or "Commission"), by its designated attorneys, petitions this Court for a temporary restraining order and preliminary injunction enjoining Defendant Tronox Limited ("Tronox") and Defendants National Industrialization Case 1:18-cv-01622-TNM Document 1 Filed 07/10/18 Page 2 of 26 Company ("TASNEE"), National Titanium Dioxide Company Limited ("Cristal Global"), and Cristal USA Inc. ("Cristal USA") (collectively, "Cristal"), including Tronox's and Cristal's agents, divisions, parents, subsidiaries, affiliates, partnerships, or joint ventures, from consummating their proposed acquisition (the "Acquisition"). Plaintiff seeks this provisional relief pursuant to Section 13(b) of the Federal Trade Commission Act ("FTC Act"), 15 U.S.C. § 53(b). Absent such provisional relief, Tronox and Cristal (collectively, "Defendants") will likely be free to consummate the merger as soon as July 16, 2018, the earliest date it appears the European Commission ("EC") is likely to complete its process by approving a remedy package intended to address the EC's concerns about the Acquisition's effects in Europe.