Platts Methodology and Specifications Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Offshore References

Past, Ongoing and Future Projects OFFSHORE Date Contractor Project Number of Welding Stations (vessel if offshore) Country Pipelines welded Operator 2020 COOEC Lingshui 17-2-SCR 6 Saturnax stations (HYS201) China 404 welds 6.625" (18.3 mm) for CNOOC - 2.93 km of SRC lines - 2.00 km of flowline 2020 TechnipFMC Nam Con Son 2 & SVDN 4 Saturnax stations (G1200) Vietnam Nam Con Son 2: for PetroVietnam (PV GAS) 89 km 26" (1.1 mm) SVDN: 22 km 26" (19.1 mm) 1 km 26" (23.8 mm) 22 km 18" (15.9 mm) 1 km 18" (17.5 mm) Total : 11,053 welds 2020 Sapura Offshore Pegaga Dev. Project 2 Saturnax stations (S3000) Malaysia 324 welds 38" (22.2 mm, X65) - 4 km for Sarawak Shell Berhad 2020 Thien Nam Offshore Services Nam Con Son 2 3 Saturnax stations (Tos Ha Long) Vietnam Total of 2,542 welds: for PetroVietnam 29.7 km 26" (19.1 mm) 0.8 km 26" (23.8 mm) 2020 Sapura Offshore Merakes 4 Saturnax stations (S1200) Indonesia Deepwater lines : for ENI Sepinggan 2,685 welds 18" (26.7 mm, X65) - 32.74 km 2,688 welds 18" (26.7 mm, X65) - 32.78 km Shallow water lines : 1,083 welds 18" (26.7 mm, X65) - 13.22 km 1,074 welds 18" (26.7 mm, X65) - 13.11 km 2020 Sapura Energy ENI Amoca 2 4 Saturnax stations (Sapura 3500) Mexico Total of 3,377 welds: for ENI 10.75" (14.33 mm, X60) 12.75" (20.6 mm, X60) 14" (15.9 mm, X60) Sweet service 2020 GSP Offshore Midia 1 Saturnax stations (Bigfoot 1) Romania 9,970 welds 16" (11.9/12.7/14.3 mm, X52) for Black Sea Oil & Gas 1,463 welds 8.625" (12.7 mm, X52) 2020 Sapura Energy Kirinskoye 1 Saturnax + 2 manual stations (Sapura 1200) Russie -

NOVA SCOTIA DEPARTMENTN=== of ENERGY Nova Scotia EXPORT MARKET ANALYSIS

NOVA SCOTIA DEPARTMENTN=== OF ENERGY Nova Scotia EXPORT MARKET ANALYSIS MARCH 2017 Contents Executive Summary……………………………………………………………………………………………………………………………………….3 Best Prospects Charts…….………………………………………………………………………………….…...……………………………………..6 Angola Country Profile .................................................................................................................................................................... 10 Australia Country Profile ................................................................................................................................................................. 19 Brazil Country Profile ....................................................................................................................................................................... 30 Canada Country Profile ................................................................................................................................................................... 39 China Country Profile ....................................................................................................................................................................... 57 Denmark Country Profile ................................................................................................................................................................ 67 Kazakhstan Country Profile .......................................................................................................................................................... -

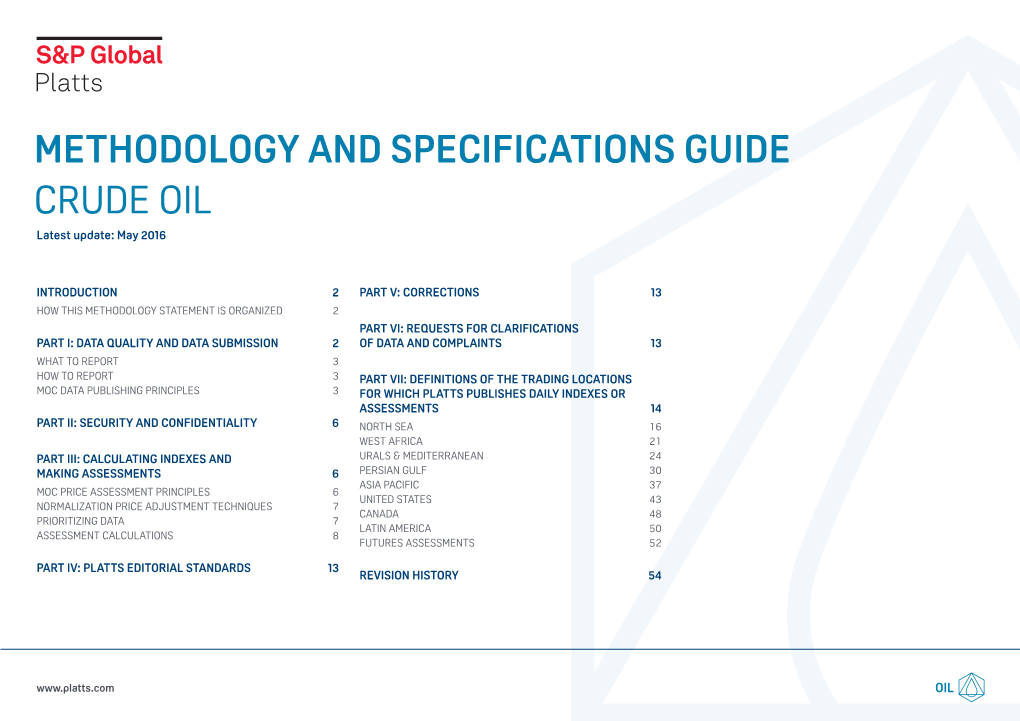

Methodology and Specifications Guide Crude Oil Latest Update: January 2019

Methodology and specifications guide Crude oil Latest update: January 2019 Introduction 2 Part V: Corrections 12 How this methodology statement is organized 2 Part VI: Requests for clarifications of data and Part I: Input data 2 complaints 12 Reporting data to Platts 3 What to report 3 Part VII: Definitions of the trading locations for which How to report 3 Platts publishes daily indexes or assessments 13 MOC data publishing principles 3 North Sea 16 West Africa 23 Part II: Security and confidentiality 7 Urals and Mediterranean 27 Persian Gulf 35 Part III: Determining assessments 8 Asia Pacific 42 MOC price assessment principles 8 United States 52 Normalization price adjustment techniques 8 Canada 57 Prioritizing data 9 Latin America 59 Assessment Calculations 9 Futures Assessments 62 Part IV: Platts editorial standards 12 Revision History 64 www.spglobal.com/platts Methodology and specifications guide Crude oil: January 2019 INTRODUCTION market acceptance for any proposed introduction or changes to where one or more reporting entities submit market data methodology. For more information on the review and approval that constitute a significant proportion of the total data upon Platts methodologies are designed to produce price procedures, please visit: https://www.spglobal.com/platts/en/ which the assessment is based. assessments that are representative of market value, and of the our-methodology/methodology-review-change particular markets to which they relate. Methodology documents ■■ Part IV explains the process for verifying that published prices describe the specifications for various products reflected All Platts methodologies reflect Platts commitment to comply with Platts standards. by Platts assessments, the processes and standards Platts maintaining best practices in price reporting. -

Argus Crude Crude Market Prices and Analysis Issue 10H - 189 Friday 24 September 2010

www.argusmedia.com Argus Crude Crude market prices and analysis Issue 10H - 189 Friday 24 September 2010 North Sea $/bl Mideast Gulf $/bl Basis Diff Bid Ask +/- Month Basis Diff Bid Ask +/- Dated Nov -0.22 78.70 78.76 +1.18 Dubai Nov 75.18 75.28 +0.40 Brent Dated +0.75 79.45 79.51 +1.18 Oman Nov Dubai swaps -0.59 75.50 75.60 +0.35 Forties Dated +0.13 78.83 78.89 +1.19 Murban Nov Adnoc +0.35 76.95 77.05 +0.39 Oseberg Dated +1.45 80.15 80.21 +1.18 See p10 for all other Mideast Gulf assessments Ekofisk Dated +1.25 79.95 80.01 +1.18 Asia-Pacific $/bl See p4 for all other North Sea assessments Basis Diff Bid Ask +/- Russia-Caspian $/bl Minas ICP +0.90 79.74 79.84 +0.59 Urals NWE Dated -0.65 78.05 78.11 +1.23 Tapis Tapis APPI +5.05 83.46 83.56 +0.62 Urals Med (80kt) Dated -0.55 78.15 78.21 +1.18 Northwest Shelf Dated -2.00 76.68 76.78 +1.18 Azeri Light Dated +2.05 80.75 80.81 +1.18 ESPO Blend Dubai +0.48 75.66 75.76 +0.40 CPC Blend Dated +0.70 79.40 79.46 +1.18 Sokol Dubai swaps +3.60 79.69 79.79 +0.39 See p6 for all other Russia-Caspian assessments See p11 for all other Asia-Pacific assessments US pipeline $/bl Russia-Caspian fob netbacks $/bl Month Basis Diff Price +/- Urals fob Primorsk Dated -1.51 77.19 77.25 +1.23 LLS Oct Oct +5.05 79.88 +0.48 Urals Fob Novo (80kt) Dated -1.52 77.18 77.24 +1.18 Mars Oct Oct +1.24 76.07 +1.41 CPC fob terminal Dated +0.12 78.82 78.88 +1.18 Argus Sour Crude Index (ASCITM) $/bl Azeri fob Supsa Dated +1.21 79.91 79.97 +1.18 Month Basis Diff Price +/- See p6 for all other Russia-Caspian assessments ASCI Oct -

WTI Crude Oil Factsheet

WTI Crude Oil Factsheet Introduction Crude oil trading Crude oil, also known as petroleum, is the most actively traded commodity in the world. Leading marketplaces are Geneva, London, New York, Chicago and Singapore. Because crude oil serves various production needs as the primary raw material and energy source, it is often referred to as “the black gold”. There are several grades of crude oil with respect to the gravity/density and sulphur content. These are the three primary benchmark grades: . West Texas Intermediate (hereafter “WTI”), also known as “Texas Light Sweet”; . Brent Crude, which is sourced from the North Sea; and . Dubai Crude, extracted from the United Arab Emirates. Other well known blends/grades include the OPEC basket (weight average made up of many blends), Malaysian Crude (known as “Tapis Crude”) and Nigerian Crude (known as “Bonny light”). WTI is recognised as a high grade crude oil and is used primarily in the United States of America, it is also considered worldwide (alongside with Brent) as a benchmark for oil pricing. WTI is a light (low density) and sweet (low sulphur) crude oil thus making it ideal for producing products such as low-sulphur gasoline and low-sulphur diesel. WTI crude oil is refined mostly in the Midwest and Gulf Coast regions of the USA. WTI crude oil is lighter and sweeter than other grades of crude oil (such as Brent for example). This difference in grade quality compared with others, results in WTI being traded with a premium over the others. Oil price is usually quoted per barrel (around 160 litres). -

Download the PDF File

DWCS RECORD (April 2020) Key data Summary Projects 1004 ROV assisted 423 Diver assisted 398 Surface 183 Platform removals 134 Platform Removals Back-up 6 Pipeline Removals 210 Pipeline Repairs 67 Contingency Projects 87 Number of Cuts 6929 Platforms 2124 Pipelines 1694 Multistrings/Casings 705 Chains/Shackles 238 Flexible and Special Pipelines 637 Drill strings 64 Risers/Guide posts 655 Wrecks & Various items 1453 Fat/Demo Tests 323 Cuts Offshore 6606 Cuts deeper than 1000m water depth 256 Cut surfaces and Time Steel (sqdm) 91066 Coating/Concrete (sqdm) 417693 Total cutting time (hours) 15633 Deepest EPRS Shell USA - 1,600m Deepest CUT Production Scorpion Subsea 6,5” Jumper GOM - 2,745m Deepest CUT Exploration Chevron Texaco 8" Drill pipe Nigeria - 2,434 m DWCS RECORD (April 2020) Projects details Year Assisted Water Customer Project by Depth m Location Details Petronas/Franklin 2020 ROV 68 Offshore/Kemaman/MMA Vigilant Mooring Chain Cutting 2020 ROV 300 Allseas/Norway Cutting of Stud Bolt and Clamp Body Contingency Vattenfall/Global Marine/Dan Tysk 2020 ROV 25 Germany/Global Symphony Dan Tysk Inter Array Cable Replacement Reliance Industries Ltd/McDermott SA/Krishna Godavari Basin, East 2020 ROV 2150 Coast India/DLV2000 and Audacia Reliance KG D6 Project - Contingency Dubai Petroleum- UAE/Boskalis/Offshore Dubai/DSV- 2020 Diver 30 Constructor Riser Cutting Project 2019 Surface --- Shell/PD&MS/North Sea/Brent Alpha Conductors Cuts in air Spirit Energy/Heerema/53FA 2019 ROV 38 Platform North Sea/SSCV THIALF Cutting Truss Frame - F3FA THIALF -

Downstream Petroleum

DOWNSTREAM PETROLEUM DOWNSTREAM PETROLEUM CONTENTS } AIP mission and objectives } Message from the AIP Chairman } Australian liquid fuel supply and demand } International and Asian refining } Financial performance of AIP Members } Economic contribution of the Industry } Australian refinery competitiveness } National fuel quality standards } Biofuels and alternative fuel } Reducing greenhouse gas emissions } Maintaining supply security and reliability } The international crude oil and product markets } The Australian wholesale fuels market and prices } The Australian retail fuels market } Environment health and safety DOWNSTREAM PETROLEUM AIP MISSION AND OBJECTIVES AIP was formed in 1976 to promote effective dialogue between the oil industry, government and the community. It replaced a number of other organisations such as the Petroleum Information Bureau that had been operating in Australia since the early 1950s. AIP has gained national and worldwide recognition as a key representative body of Australia’s downstream petroleum industry. AIP’s mission is to promote and assist in As well as its policy development and the development of a strong, internationally advocacy role, AIP also runs the Australian competitive Australian downstream Marine Oil Spill Centre (AMOSC) in Geelong petroleum industry, operating safely, and Perth to support oil spill preparedness efficiently, economically, and in harmony with and response by the broader petroleum the environment and community expecations. industry. AIP also manages or sponsors important industry environmental and health Through the active involvement of its member programs, including CRC Care and Health companies, AIP provides responsible and Watch. The Cooperative Research Centre for principled representation of the industry Contamination Assessment and Remediation along with factual and informed discussion of the Environment (CRC CARE) undertakes of downstream petroleum sector issues. -

Ensuring Canadian Access to Oil Markets in the Asia-Pacific Region by Gerry Angevine and Vanadis Oviedo

Studies in ENERGY POLICY July 2012 Ensuring Canadian Access to Oil Markets in the Asia-Pacific Region by Gerry Angevine and Vanadis Oviedo Key findings Demand for oil products in countries in the Asia-Pacific region is rapidly increasing and crude oil can be sold in those markets at a premium. If Canadian oil producers had access to the US and the Asia-Pacific region, they could secure the best possible return on their investment. This would also reduce the risk that growth in Canadian oil production could be constrained by US opposition inhibiting the construction of new pipelines. Construction and operation of pipelines from Alberta to ports in British Columbia could contribute substantially to GDP, and to employment and income in Alberta, British Columbia, and the rest of Canada. Additionally, the possible price premiums on sales to markets in the Asia-Pacific region would benefit the shareholders of the oil production companies, including many public and private pension funds. Outdated regulatory processes and procedures, First Nations’ opposition, and unwieldy environmental review processes are impeding the timely development of the infrastructure required to transport oil to the west coast and beyond. For Canadians to prosper from environmentally responsible development of the oil sands, the Alberta and British Columbia governments must act quickly, using legal and regulatory reforms, to expedite development of the crude-oil transportation infrastructure needed for access to markets in the Asia-Pacific region. Summary This report provides a comprehensive overview of the outlook for Alberta crude oil and bitumen production and an assessment of the economic attractiveness and feasibility of exporting oil to countries in the Asia-Pacific region instead of solely to markets in the United States. -

RIM Crude Reports Are Copyrighted Publications

RIM INTELLIGENCE CRUDE 1-17-18,Shinkawa, Chuo-ku,Tokyo,Japan Tel (81)-3-3552-2411, Fax (81)-3-3552-2415 Singapore Tel (65)-6345-9894, Fax (65)-6345-9894 RIM CRUDE INTELLIGENCE DAILY NO.4023 May 06 2011 Copyright (C) 2011 RIM Intelligence Co. All rights reserved. --Tokyo, 16:00 May 06 2011 Notice --Added and dropped items in the RIM crude assessments RIM Intelligence will launch assessments for Qua Iboe, Agbami, Dalia and Zafiro as Physical Crude (Africa), effective from May 23. --Changes in RIM Crude assessments RIM Intelligence will change the benchmark for the following crude grades in Physical Crude (ASIA) to Dated Brent, instead of APPI Tapis, effective from May 16. These grades are Tapis, Labuan、Gippsland、Thevenard、Mutineer Exeter、Varanus、Le Gendre、Nanhai Light. If you have any inquiries, please contact RIM's crude oil team. (Tel: 03-3552-2411, E-Mail, [email protected]). For details, please refer to RIM Website's assessment methodology. (http://www.asia-energylinks.com/method/method.html). TOKYO SPOT CRUDE ASSESSMENTS (06May11) --Cash Crude May Jun Jul Aug Sep WTI - 100.33-100.38 100.87-100.92 101.17-101.22 101.37-101.42 BFO 111.97-112.02 111.86-111.91 111.66-111.71 111.42-111.47 111.08-111.13 Dubai - - 105.97-106.02 105.61-105.66 105.32-105.37 Spreads May Jun Jul Aug Sep WTI/BFO / -11.56/-11.51 -10.82/-10.77 -10.28/-10.23 -9.74/ -9.69 BFO/Dubai / / 5.66/ 5.71 5.78/ 5.83 5.73/ 5.78 Oman/Dubai / / 0.74/ 0.79 0.44/ 0.49 0.39/ 0.44 Intermonth Spreads May/Jun Jun/Jul Jul/Aug Aug/Sep Sep/Oct BFO 0.08/ 0.13 0.17/ 0.22 0.21/ 0.26 0.31/ 0.36 0.43/ 0.48 Dubai / / 0.33/ 0.38 0.26/ 0.31 0.24/ 0.29 Oman* / / -0.02/ 0.02 -0.02/ 0.02 -0.02/ 0.02 *Intermonth spreads of Oman is Premium/discounts to OSP(MOG) --Paper Crude May Jun Jul Aug Sep Dubai 105.97-106.01 105.61-105.65 105.32-105.36 105.05-105.09 104.81-104.85 DME/Dubai 0.73/ 0.81 0.43/ 0.51 0.38/ 0.46 0.38/ 0.46 0.38/ 0.46 Murban swp 4.70/ 4.90 4.75/ 4.95 4.80/ 5.00 / / DTD/Dubai 6.02/ 6.06 5.91/ 5.95 5.96/ 6.00 5.83/ 5.87 5.68/ 5.72 *DME/Dubai is the spread between DME Oman swap and Dubai swap. -

Production and Processing of Sour Crude and Natural Gas - Challenges Due to Increasing Stringent Regulations

Production and processing of sour crude and natural gas - challenges due to increasing stringent regulations Darkhan Duissenov Petroleum Engineering Submission date: June 2013 Supervisor: Jon Steinar Gudmundsson, IPT Norwegian University of Science and Technology Department of Petroleum Engineering and Applied Geophysics Production and processing of sour crude and natural gas – challenges due to increasing stringent regulations Darkhan Duissenov Petroleum engineering Submission date: June 2013 Supervisor: Jon Steinar Gudmundsson Norwegian University of Science and Technology Faculty of Engineering Science and Technology Department of Petroleum Engineering and Applied Geophysics Trondheim, Norway Abstract The worldwide demand for petroleum is growing tremendously. It is expected that the demand will have incremental capacity of 20 mb/d for crude oil, reaching 107.3 mb/d, and demand for natural gas will rise nearly 50% to 190 tcf in 2035, compared to 130 tcf now. According to the International Energy Agency 70% of crude oil reserves and 40% of natural gas reserves are defined as having high content of organosulfur compounds. Obviously, for decades to come, to satisfy the growing global needs for fossil fuels, reservoirs with sour contaminants will be developed intensively. The sulfur compounds in crude oils and natural gas generally exist in the form of free sulfur, hydrogen sulfide, thiols, sulfides, disulfides, and thiophenes. These compounds can cause considerable technical, environmental, economic, and safety challenges in all segments of petroleum industry, from upstream, through midstream to downstream. Currently, the sulfur level in on-road and off-road gasoline and diesel is limited to 10 and 15 ppm respectively by weight in developed countries of EU and USA, but this trend is now increasingly being adopted in the developing world too. -

Malaysia Overview

Malaysia International energy data and analysis Last Updated: September 29, 2014 (Notes) full report Overview Malaysia is the world's second-largest exporter of liquefied natural gas and the second-largest oil and natural gas producer in Southeast Asia, and is strategically located amid important routes for seaborne energy trade. Malaysia's energy industry is a critical sector of growth for the entire economy, and it makes up almost 20% of the total gross domestic product. New tax and investment incentives, starting in 2010, aim to promote oil and natural gas exploration and development in the country's deepwater and marginal fields as well as promote energy efficiency measures and use of alternative energy sources. These fiscal incentives are part of the country's economic transformation program to leverage its resources and geographic location to be one of Asia's top energy players by 2020. Another key pillar in Malaysia's energy strategy is to become a regional oil and natural gas storage, trading, and development hub that will attract technical expertise and downstream services that can compete in Asia. Malaysia, located within Southeast Asia, has two distinct parts. The western half contains the Peninsular Malaysia, and the eastern half includes the states of Sarawak and Sabah, which share the island of Borneo with Indonesia and Brunei. The country's western coast runs alongside the Strait of Malacca, an important route for the seaborne trade that links the Indian Ocean and the Pacific Ocean. Malaysia's position in the South China Sea exposes the country to various disputes among neighboring countries over competing claims to the sea's resources. -

Is the Leadership of the Brent-Wti Oil Futures Market Threatened?

IS THE LEADERSHIP OF THE BRENT-WTI OIL FUTURES MARKET THREATENED? Marta Roig Atienza Trabajo de investigación 019/019 Master en Banca y Finanzas Cuantitativas Director/a: Dr. Fernando Palao Sánchez Dr. Ángel Pardo Tornero Universidad Complutense de Madrid Universidad del País Vasco Universidad de Valencia Universidad de Castilla-La Mancha www.finanzascuantitativas.com Is the leadership of the Brent-WTI oil futures market threatened? Marta Roig Atienza MSc Thesis for the degree MSc in Banking and Quantitative Finance July 2019 Supervisors: Dr Fernando Palao Sánchez Dr Ángel Pardo Tornero Universidad Complutense de Madrid Universidad del País Vasco Universidad de Valencia Universidad de Castilla-La Mancha www.finanzascuantitativas.com Agradecimientos En primer lugar, quiero agradecer a mis tutores, Fernando Palao y Ángel Pardo, su apoyo y ayuda desinteresada durante estos meses. He sido muy afortunada de tenerles como tutores. La ilusión con la que ambos viven las finanzas y la enseñanza se ha traducido en ilusión y ganas por trabajar en este proyecto común. Además de esto, no encontraría una mejor forma de cerrar esta etapa, ya que en mis estudios de grado Ángel fue quién me despertó mi interés por el mundo de las finanzas cuantitativas. Gracias a Jesús Ruíz por sus valiosos comentarios en el ámbito de la econometría. Gracias también a mi madre Bienve, a mi hermano Sergio y a mi tía Carmen. Gracias por soportarme, siempre apoyarme en conseguir mis sueños y creer muchas veces más en mí de lo que yo misma lo hago. Por último, gracias a Ale por acompañarme a donde la magia ocurre.