Kellogg Company (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kellogg Company 2012 Annual Report

® Kellogg Company 2012 Annual Report ™ Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple JacksCONTENTS Gardenburger Famous Amos Pringles Rice Letter to Shareowners 01 KrispiesOur Strategy Kashi Cheez-It03 Club Frosted Mini Wheats Pringles 04 Our People 06 Mother’sOur Innovations Krave Keebler11 Corn Pops Pop Tarts Financial Highlights 12 Our Brands 14 SpecialLeadership K Town House15 Eggo Carr’s Frosted Flakes Financials/Form 10-K All-BranBrands and Trademarks Fudge Stripes01 Crunchy Nut Chips Deluxe Selected Financial Data 14 FiberManagement’s Plus Discussion Be & Analysis Natural 15 Mini Max Zucaritas Froot Financial Statements 30 Notes to Financial Statements 35 LoopsShareowner Tresor Information MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus2 Be NaturalKellogg Company 2012 Annual Mini Report MaxMOVING FORWARD. -

2020-2021 Program Snack Cycle

Wisconsin Youth Company 2020 – 2021 SCHOOL YEAR GROUP CHILD CARE CENTERS DIGITAL SNACK BINDER Snack Cycles Shelf Life Information Nutrition Information Snack Cycles 2020-2021 School Year Dane Cycle 1* Bananas Strawberry Nutri Grain Bar Blueberry Muffins Grahams Cracker Bug Bites Chex Mix Applesauce Apple Cinnamon Cheerios Heart Pretzels Sun Chips Harvest Cheddar Apple Oatmeal Bars Cycle 2* Oranges Blueberry Yogurt Cups Chocolate Chip Oatmeal Bars Apple Cinnamon Nutri Grain Bar Fruit Loops Banana Muffins Blueberry Nutri Grain Bar English and Spanish Shortbread Cookies Cheez It Crackers Cinnamon Toast Crunch *Optional/Available upon request: • Craisins • Raisins • String Cheese • Apple Juice Cups Snack Cycles 2020-2021 School Year Waukesha Cycle 1* Bananas Strawberry Nutri Grain Bar Blueberry Muffins Grahams Cracker Bug Bites Chex Mix Cycle 2* Applesauce Apple Cinnamon Cheerios Heart Pretzels Sun Chips Harvest Cheddar Apple Oatmeal Bars Cycle 3* Oranges Blueberry Yogurt Cups Chocolate Chip Oatmeal Bars Apple Cinnamon Nutri Grain Bar Cheerios Fruity Cereal Cycle 4* Banana Muffins Blueberry Nutri Grain Bar English and Spanish Shortbread Cookies Cheez It Crackers Cinnamon Toast Crunch *Optional/Available upon request: • Craisins • Raisins • String Cheese • Apple Juice Cups Safe Food Storage (created 9/13) Note : This document was developed for use by the DPI CACFP and DCF Child Care Licensing. The information in this document is intended to provide guidance on the following Group Child Care Licensing Rules under DFC 251.06 (9)(c) 1. and (d) Dates on packaging: • If there is an EXPIRATION or USE BY date on the package the food must be used by the EXPIRATION or USE BY date. -

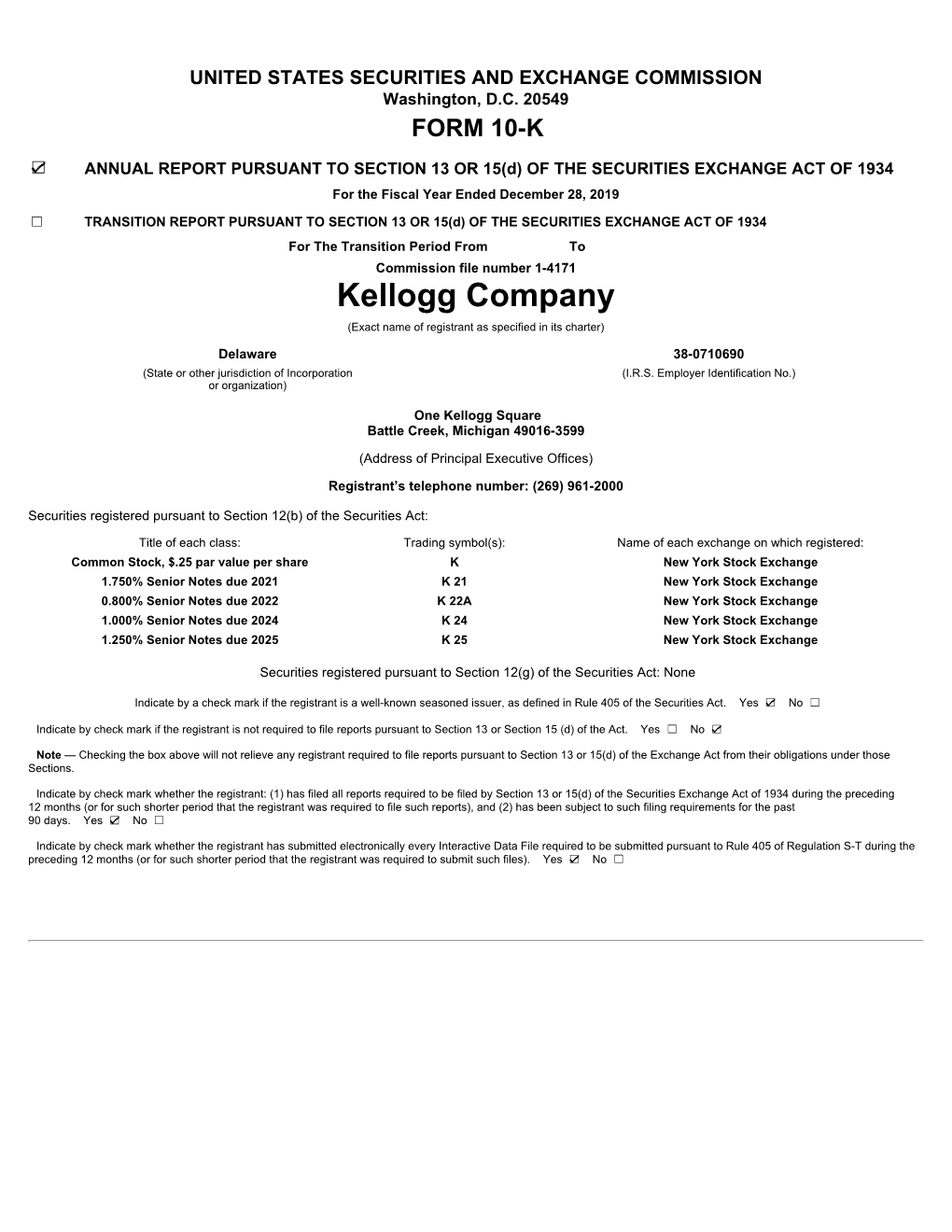

Kellogg Company 2019 Annual Report

Kellogg Company 2019 Annual Report SEC Form 10-K and Supplemental Information Fiscal Year End: December 28, 2019 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 28, 2019 □ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Transition Period From To Commission file number 1-4171 Kellogg Company (Exact name of registrant as specified in its charter) Delaware 38-0710690 (State or other jurisdiction of (I.R.S. Employer Identification No.) Incorporation or organization) One Kellogg Square Battle Creek, Michigan 49016-3599 (Address of Principal Executive Offices) Registrant’s telephone number: (269) 961-2000 Securities registered pursuant to Section 12(b) of the Securities Act: Title of each class: Trading symbol(s): Name of each exchange on which registered: Common Stock, $.25 par value per share K New York Stock Exchange 1.750% Senior Notes due 2021 K 21 New York Stock Exchange 0.800% Senior Notes due 2022 K 22A New York Stock Exchange 1.000% Senior Notes due 2024 K 24 New York Stock Exchange 1.250% Senior Notes due 2025 K 25 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Securities Act: None Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No □ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

TO: the Honorable Governor Kelly House Speaker Ron Ryckman

Department of Commerce Phone: (785) 296-3481 1000 S.W. Jackson St., Suite 100 Fax: (785) 296-5055 Topeka, KS 66612-1354 KansasCommerce.gov David C. Toland, Secretary Laura Kelly, Governor TO: The Honorable Governor Kelly House Speaker Ron Ryckman Senate President Ty Masterson House Majority Leader Daniel Hawkins Senate Majority Leader Gene Suellentrop House Minority Leader Tom Sawyer Senate Minority Leader Dinah Sykes Senate Assessment and Taxation Committee Senate Commerce Committee House Commerce, Labor and Economic Development Committee House Taxation Committee FROM: David C. Toland, Secretary of Commerce DATE: February 1, 2021 RE: Fiscal Year 2020 PEAK Annual Report The following information is for the reporting period beginning July 1, 2019 and ending June 30, 2020 (Fiscal Year 2020), and is provided to satisfy the annual reporting requirements of K.S.A. 74-50,216 in the Promoting Employment Across Kansas (PEAK) Act. In 2009, Senate Bill 97 was passed and signed into law creating the PEAK program effective July 1, 2009. Companies that were relocating jobs to Kansas from out of state could retain 95 percent of the withholding taxes generated by the new employees that were paid wages at or above the county wage standard. Legislative changes in 2010 and 2011 broadened the program to allow companies to qualify that were locating a new business operation or function in Kansas, and to allow existing Kansas companies to begin participating in 2012. Additionally, the use of PEAK to retain jobs in Kansas began January 1, 2013 and ended June 30, 2018. 1 PROMOTING EMPLOYMENT ACROSS KANSAS 2020 ANNUAL REPORT JANUARY 2021 Department of Commerce 1 PROMOTING EMPLOYMENT ACROSS KANSAS (PEAK) Promoting Employment Across Kansas program, known as PEAK, is designed to help recruit companies and jobs to Kansas by allowing them to retain up to 95% of the withholding taxes generated by new employees. -

Kdr Quill Scroll Winter 1990

PAGE 2-Qun.L & SCROLL SUPPLEMENT- W1N1ER 1990 , 1989-90 FUND DRIVE Special Recognition Clubs... CLARE AND GORDON JOHNSON Eddie K. Borjesson, Beta '34 ..................... -100.00 RO!Wd L. Stief, Zeta '53 ............................. 100.00 Glenn K. Buc::hanan, Iota '84 ............ - ......... 100.00 ANNUNITY TRUST --·--·-···------$5,000.00 Lamence W. Corbett. Beta '24 .................... 100.00 Carl R. Sturges. Zeta '49 ............................. 100.00 Gary J. Buchmann, Iota '79 ......................... 100.00 Gordon R. Dennis, Beta '54 ......................... 100.00 Jolm w. 1bomas, Zeta '73 ........................... 100.00 Charles L Carpenter, OH, Iota '27 _ ............. 100.00 FOUNDER'S CLUB Richard L. Hmer, Beta '53 .......................... 100.00 Manuel Tubella Jr .. Zeta '55 .. - ... - ............... 100.00 Harold H. Grey, Jota 79 ............._ ............... 100.00 $1,000 AND UP Robert L Heuser, Beta '64 .......................... 100.00 Albert E. Carlson, Eta '34 ............................ 100.00 Stephen R. Ku.pp, Iota '84 ....................... -.110.00 Robert A. Jones, OH. AlJila '59 ........... $20,000.00 Ralph Higley, Beta '30 ................................ 100.00 RobertS. Darke, Eta '39 .............................. 100.00 Aleunder McClinchie, Iota '64 .... - .... - ...... 100.00 Robert D. Corrie, OH, Beta '53 ................ 1,075.00 David R. May, Beta '80 ............................... 200.00 Robert E. Ferris, OH. Eta '39 .................. :._100.00 Walter A. Molawka Jr., Iota '71 ..... __........ 125.00 Scott A. Bailey, OH, Zeta '69 ................... 1,209.13 Michael A. McCarthy, Beta '56 ................... 100.00 Dominic L. Gugliuzza, Eta '55 ............. -..... 100.00 Williun D. Schaeffer Jr., Iota '70 - ...... __ .... 100.00 William L. Nichol, Zeta '59 ...................... 1,050.00 Andrew J. Schroder II, Beta 'Z'I ................. : 150.00 Douglas W. Kentz, Eta '88 .................. :....... 100.00 Jolm W. -

Value-Added Wheat Products: Analysis of Markets and Competition

Agricultural Economics Report No. 386 April 1998 VALUE-ADDED WHEAT PRODUCTS: ANALYSIS OF MARKETS AND COMPETITION Jianqiang Lou William W. Wilson Department of Agricultural Economics ! Agricultural Experiment Station North Dakota State University ! Fargo, ND 58105-5636 ACKNOWLEDGMENTS The research reported in this paper was motivated in part by a research grant from William C. Nelson, through the U.S. Department of Agriculture’s North Plains International Trade Program, and a contribution by the United Spring Wheat Processors. Helpful comments were received from Frank Dooley, Tim Petry, and Ed Janzen. However, errors and omissions remain the authors’ responsibility. Charlene Lucken provided editorial assistance, and Carol Jensen prepared the manuscript. We would be happy to provide a single copy of this publication free of charge. You can address your inquiry to: Carol Jensen, Department of Agricultural Economics, North Dakota State University, P.O. Box 5636, Fargo, ND, 58105-5636, Ph. 701-231-7441, Fax 701-231-7400, e-mail [email protected] . This publication is also available electronically at this web site: http://agecon.lib.umn.edu/ndsu.html NOTICE: The analyses and views reported in this paper are those of the author. They are not necessarily endorsed by the Department of Agricultural Economics or by North Dakota State University. North Dakota State University is committed to the policy that all persons shall have equal access to its programs, and employment without regard to race, color, creed, religion, national origin, sex, age, marital status, disability, public assistance status, veteran status, or sexual orientation. Information on other titles in this series may be obtained from: Department of Agricultural Economics, North Dakota State University, P.O. -

Flowers Industries Inc

SECURITIES AND EXCHANGE COMMISSION FORM 424B4 Prospectus filed pursuant to Rule 424(b)(4) Filing Date: 1998-04-23 SEC Accession No. 0000950144-98-005017 (HTML Version on secdatabase.com) FILER FLOWERS INDUSTRIES INC /GA Mailing Address Business Address PO BOX 1338 200 US US HWY 19 CIK:826227| IRS No.: 580244940 | State of Incorp.:GA | Fiscal Year End: 0629 HIGHWAY 19 S P O BOX 1338 Type: 424B4 | Act: 33 | File No.: 333-48787 | Film No.: 98599266 THOMASVILLE GA 31792 THOMASVILLE GA 31792 SIC: 2050 Bakery products 9122269110 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document 1 FILED PURSUANT TO RULE 424(b)(4) REGISTRATION NO. 333-48787 PROSPECTUS $200,000,000 Flowers Industries, Inc. 7.15% DEBENTURES DUE 2028 ------------------------ Interest payable April 15 and October 15 ------------------------ THE DEBENTURES WILL BE REDEEMABLE ON AT LEAST 30 DAYS NOTICE AT THE OPTION OF THE COMPANY, IN WHOLE OR FROM TIME TO TIME IN PART, AT A REDEMPTION PRICE EQUAL TO THE GREATER OF (I) 100% OF THE PRINCIPAL AMOUNT OF THE DEBENTURES TO BE REDEEMED AND (II) THE SUM OF THE PRESENT VALUES OF THE REMAINING SCHEDULED PAYMENTS OF PRINCIPAL AND INTEREST THEREON (EXCLUSIVE OF INTEREST ACCRUED TO SUCH REDEMPTION DATE) DISCOUNTED TO SUCH REDEMPTION DATE ON A SEMIANNUAL BASIS (ASSUMING A 360-DAY YEAR CONSISTING OF TWELVE 30-DAY MONTHS) AT THE TREASURY RATE PLUS 20 BASIS POINTS, PLUS IN EITHER CASE, ACCRUED AND UNPAID INTEREST ON THE PRINCIPAL AMOUNT BEING REDEEMED TO SUCH REDEMPTION DATE. THE DEBENTURES WILL BE REPRESENTED BY A GLOBAL CERTIFICATE REGISTERED IN THE NAME OF THE NOMINEE OF THE DEPOSITORY TRUST COMPANY, WHICH WILL ACT AS THE DEPOSITARY (THE "DEPOSITARY"). -

Exchange List 2009

Updated October 2015 PROTEIN EXCHANGE LIST 2015 1 gram protein list Each of the Following in the Amount Stated = 1 Exchange NOTE: Information is correct at time of printing. Always remember to check food labels incase any products have changed. Updated October 2015 BREAKFAST CEREALS Breakfast Cereal Grams Measurements Harvest Morn Chocolate Pillows 18g 1 level blue scoop Kelloggs All Bran Branflakes 9g 2 level tablespoons Kelloggs Cocopops 18g 2 ½ level blue scoops Kelloggs Cornflakes 14g 2 level blue scoops Kelloggs Crunchy Nut Flakes 17g 2 level blue scoops Kelloggs Frosted Wheats 10g 5 pieces Kelloggs Frosties 22g 2 ½ level blue scoops Kelloggs Honey Loops 14g 2 level blue scoops Kelloggs Mini Max 9g 7 pieces Kelloggs Raisin Wheats 11g 5 pieces Kelloggs Rice Krispies 17g 3 level blue scoops Kelloggs Rice Krispies Multigrain Shapes 13g 2 level blue scoops Kelloggs Special K 11g 1 level blue scoop Kelloggs Special K Red Berries 11g 1 ½ level blue scoops Nestle Coco Shreddies 11g 1 level blue scoop Nestle Cookie Crisp 14g 2 level blue scoops Nestle Curiously Cinnamon 18g 2 level blue scoops Nestle Frosted Shreddies 11g 1 level blue scoop Nestle Golden Nuggets 13g 1 ½ level blue scoops Nestle Honey Cheerios 12g 2 level blue scoops Nestle Honey Shreddies 11g 1 level blue scoop Nestle Nesquick 13g 1 ½ level blue scoops Nestle Oat Cheerios 11g 2 level blue scoops Nestle Shredded Wheat Bitesize 9g 6 pieces Nestle Shreddies 10g 1 level blue scoop Oatibix 8g ⅓ biscuit Oatibix Flakes 11g 1 level blue scoop Porridge 9g 2 level tablespoons Ready Brek 8g 2 tablespoons Weetabix 10g ½ biscuit Weetabix Banana 11g ½ biscuit Weetabix Chocolate 11g ½ biscuit Weetabix Chocolate 11g ½ biscuit Weetabix Crispy Minis Chocolate Chip 10g 4 pieces Weetabix Crispy Minis Fruit & Nut 10g 4 pieces Weetabix Golden Syrup 11g ½ biscuit Weetabix Organic 10g ½ biscuit Weetos 12g 1 ½ level blue scoops NOTE: Information is correct at time of printing. -

Top Sellers Retail Planograms

Improve your sales Market insight Market Trends Must stocks New products Increase your footfall Top sellers Retail planograms www.bestway.co.uk www.batleys.co.uk MARKET INSIGHT Total Cereal market Cereal shoppers is worth spend 2.6 x more £1.34bn than a non-cereal shopper (Nielsen) (Source: Kantar World Panel 03.01.2016) Breakfast is the largest Health is the biggest trend in Cereal. meal occasion. Granola, Muesli and Oat Clusters are bought by 50% of UK households 60% of UK households eat and shoppers will pay more for these cereals breakfast (Source: Kantar World Panel 03.01.2016) 96% of The UK munches through UK households 10 billion cereal bowls a year eat cereal each week (Source: Kellogg’s) (Source: Kantar World Panel 03.01.2016) MARKET INSIGHT Price Mark Packs are key to shoppers and must be stocked Stock the best- 20% of selling brands – shoppers claim the Breakfast 26% of shoppers variety of cereal in is becoming will go elsewhere convenience stores is too increasingly if a cereal is small, so make sure you segmented unavailable stock a selection of the with more options Must Stock lines available to Gluten-Free shoppers & protein filled fruit & fibre options are growing TOP 5 PUrCHaSe driverS 1 Price 2 Product familiarity 3 Brand 4 Quality 5 Health All above IGD Category Benchmarks Cereals 2016 MUST STOCK LINES These are the ‘Must Stock’ lines which customers expect to see in a convenience store. By stocking these lines, you will be meeting your customers’ needs and therefore they will visit your store again. -

Participating Products

PARTICIPATING PRODUCTS Look for this on the package Print this list or view it on your phone for an easy reminder while you’re shopping. Sam's Club and BJ's Wholesale Club Shoppers: scroll down for your participating products lists. Cheez-It® Original Caddy Pack (12 oz. & 20 oz.) Cheez-It® Variety Caddy Pack (12.1 oz.) Keebler® Cheese & Peanut Butter Cracker Packs (11 oz.) Keebler® Chips Deluxe® Rainbow with M&Ms Cookies (11.3 oz.) Keebler® Club® Cheddar Crackers (8.8 oz.) Keebler® Club® Minis Crackers (11 oz.) Keebler® Club® Multi- Grain Crackers (12.7 oz.) Keebler® Club® Original Crackers (12.5 oz. & 13.7) Keebler® Club® Peanut Butter Crackers (8.8 oz.) Keebler® Coconut Dreams™ (8.5 oz.) Keebler® Chips Deluxe® Original cookies (12.6 oz.) Keebler® Cookies Variety Caddy Pack (12 oz. & 12.2 oz.) Keebler® Fudge Stripes™ Cookies 11.5 oz. Keebler® Fudge Stripes™ Minis Caddy Pack (12 oz.) Kellogg’s Corn Flakes® Cereal (12 o., 18 oz. & 24 oz.) Kellogg’s Frosted Flakes® Cereal (10.5 oz., 15 oz., 19 oz., 24 oz. & 48 oz.) Kellogg’s Krave™ Chocolate Cereal (11.4 oz.) Kellogg’s Krave™ Double Chocolate Cereal (11 oz.) Kellogg’s Raisin Bran Crunch® Cereal (18.2 oz. & 24.8 oz.) Kellogg’s Raisin Bran® Cereal (18.7 oz. & 23.5 oz.) Kellogg’s® Apple Jacks® Cereal (8.7 oz., 12.2 oz., 17 oz. & 19.4 oz.) Kellogg’s® Chocolate Frosted Flakes™ Cereal (13.2 oz.) Kellogg’s® Cinnamon Frosted Flakes™ Cereal (13.6 oz.) Kellogg’s® Cocoa Krispies® Cereal (11 oz. -

Little Cookbooks – Accent – Accent International, Skokie, Illinois

Little Cookbooks – Accent – Accent International, Skokie, Illinois No Date – Good. Accent Cookout Recipes open up a wonderful world of flavor through seasoning. Vertical three-folded black and white sheet. Each panel 5” x 3 3/5”. No Date – Very Good. Accent Flavor Enhancer Serve Half, Freeze Half. Saves your budget …time…and energy! Everyone is looking for ways to serve good-tasting nutritious meals yet stay within the food budget. “Freeze Half. Serve Half” helps you to do just that! Vertical three-folded beige and brown sheet. Each panel 5” x 3”. No Date – Very Good. “Great American Recipes” Magazine insert. Title in red with servings of food and package of Accent in the center. Food in color. Recipes on three panels. Single folded sheet. Each panel 5” x 3”. 11/29/05 Little Cookbooks – Ace Hi – California Milling Corporation, 55th and Alameda, Los Angeles, California 1937 – Fine. Personally Proven Recipes BREAD, BISCUITS, PASTRY. California Milling Corporation, 55th and Alameda, Los Angeles, California. Modern drawing of woman in yellow dress, white apron holding Ace-Hi recipe book. Royal blue background. Back: Ace Hi in bright pink in circle and Family Flour and Packaged Cereals on royal blue background. 4 ¾”x 6 1/8”, no page numbers. 02/13/06 Little Cookbooks – Adcock Pecans – Adcock Pecans, Tifton, Georgia No date – Very Good. Enjoy ADCOCK’S FRESH Papershell Pecans prize-winning Recipes inside . Four folded sheet, blue and white. Brown pecan under title. Each panel, 3 ½”x 8 ½”. 8/21/05 Little Cookbooks – Airline Bee Products – The A. I. Root Company, Medina, Ohio 1915 – Poor. -

Kellogg Company (Exact Name of Registrant As Specified in Its Charter)

KELLOGG CO FORM 10-K (Annual Report) Filed 02/26/13 for the Period Ending 12/29/12 Address ONE KELLOGG SQ P O BOX 3599 BATTLE CREEK, MI 49016-3599 Telephone 2699612000 CIK 0000055067 Symbol K SIC Code 2040 - Grain Mill Products Industry Food Processing Sector Consumer/Non-Cyclical Fiscal Year 01/03 http://www.edgar-online.com © Copyright 2013, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 29, 2012 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Transition Period From To Commission file number 1-4171 Kellogg Company (Exact name of registrant as specified in its charter) Delaware 38 -0710690 (State or other jurisdiction of Incorporation (I.R.S. Employer Identification No.) or organization) One Kellogg Square Battle Creek, Michigan 49016-3599 (Address of Principal Executive Offices) Registrant’s telephone number: (269) 961-2000 Securities registered pursuant to Section 12(b) of the Securities Act: Title of each class: Name of each exchange on which registered: Common Stock, $.25 par value per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Securities Act: None Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.