Sony IR Day 2018 Pictures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GLAAD Media Institute Began to Track LGBTQ Characters Who Have a Disability

Studio Responsibility IndexDeadline 2021 STUDIO RESPONSIBILITY INDEX 2021 From the desk of the President & CEO, Sarah Kate Ellis In 2013, GLAAD created the Studio Responsibility Index theatrical release windows and studios are testing different (SRI) to track lesbian, gay, bisexual, transgender, and release models and patterns. queer (LGBTQ) inclusion in major studio films and to drive We know for sure the immense power of the theatrical acceptance and meaningful LGBTQ inclusion. To date, experience. Data proves that audiences crave the return we’ve seen and felt the great impact our TV research has to theaters for that communal experience after more than had and its continued impact, driving creators and industry a year of isolation. Nielsen reports that 63 percent of executives to do more and better. After several years of Americans say they are “very or somewhat” eager to go issuing this study, progress presented itself with the release to a movie theater as soon as possible within three months of outstanding movies like Love, Simon, Blockers, and of COVID restrictions being lifted. May polling from movie Rocketman hitting big screens in recent years, and we remain ticket company Fandango found that 96% of 4,000 users hopeful with the announcements of upcoming queer-inclusive surveyed plan to see “multiple movies” in theaters this movies originally set for theatrical distribution in 2020 and summer with 87% listing “going to the movies” as the top beyond. But no one could have predicted the impact of the slot in their summer plans. And, an April poll from Morning COVID-19 global pandemic, and the ways it would uniquely Consult/The Hollywood Reporter found that over 50 percent disrupt and halt the theatrical distribution business these past of respondents would likely purchase a film ticket within a sixteen months. -

Netent Announces Jumanji As Its Latest Branded Game Deal in Collaboration with Sony Pictures Entertainment

PRESS RELEASE 19th January, 2018 NetEnt announces Jumanji as its latest branded game deal in collaboration with Sony Pictures Entertainment. NetEnt, the leading provider of digital gaming solutions, has signed an agreement with Sony Pictures Consumer Products to launch a video slot machine game based on the original Jumanji film. The new Jumanji game, which will be released later this year, follows the recent launch of the holiday blockbuster film ‘Jumanji: Welcome to the Jungle’. The current film has resonated with critics and audiences alike around the globe having delivered more than $676 million in global box office. Henrik Fagerlund, Chief Product Officer of NetEnt, said: “Being able to secure a deal for another high-profile title showcases the moves we’re making in diversifying our roster of games.” Jumanji is a great addition to NetEnt’s renowned branded games portfolio alongside the likes of Planet of the Apes™, Guns N’ Roses™ and Motörhead Video Slot™. “The original Jumanji movie, which debuted in 1995, remains a moviegoer favorite and continues to demonstrate its cross-generational appeal more than 20 years later! Also, with the recent release of the new film, the Jumanji brand is more popular than ever. We’re excited for the game launch in 2018, continued Fagerlund.” Attendees at ICE can visit NetEnt’s stand (N3-242) to get a sneak peek of the game. NetEnt will be continuing the tradition at ICE unveiling another branded title at 15:00 on Tuesday, 6th February. For additional information please contact: [email protected] NetEnt AB (publ) is a leading digital entertainment company, providing premium gaming solutions to the world’s most successful online casino operators. -

READING INTERNATIONAL, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to ______ Commission File No. 1-8625 READING INTERNATIONAL, INC. (Exact name of registrant as specified in its charter) Nevada 95-3885184 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 5995 Sepulveda Boulevard, Suite 300 Culver City, CA 90230 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including Area Code: (213) 235-2240 Securities Registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Class A Nonvoting Common Stock, $0.01 par value RDI NASDAQ Class B Voting Common Stock, $0.01 par value RDIB NASDAQ Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for shorter period than the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2013 Movie Catalog © Warner Bros

1-800-876-5577 www.swank.com Swank Motion Pictures,Inc. Swank Motion 2013 Movie Catalog 2013 Movie © Warner Bros. © 2013 Disney © TriStar Pictures © Warner Bros. © NBC Universal © Columbia Pictures Industries, ©Inc. Summit Entertainment 2013 Movie Catalog Movie 2013 Inc. Pictures, Motion Swank 1-800-876-5577 www.swank.com MOVIES Swank Motion Pictures,Inc. Swank Motion 2013 Movie Catalog 2013 Movie © New Line Cinema © 2013 Disney © Columbia Pictures Industries, Inc. © Warner Bros. © 2013 Disney/Pixar © Summit Entertainment Promote Your movie event! Ask about FREE promotional materials to help make your next movie event a success! 2013 Movie Catalog 2013 Movie Catalog TABLE OF CONTENTS New Releases ......................................................... 1-34 Swank has rights to the largest collection of movies from the top Coming Soon .............................................................35 Hollywood & independent studios. Whether it’s blockbuster movies, All Time Favorites .............................................36-39 action and suspense, comedies or classic films,Swank has them all! Event Calendar .........................................................40 Sat., June 16th - 8:00pm Classics ...................................................................41-42 Disney 2012 © Date Night ........................................................... 43-44 TABLE TENT Sat., June 16th - 8:00pm TM & © Marvel & Subs 1-800-876-5577 | www.swank.com Environmental Films .............................................. 45 FLYER Faith-Based -

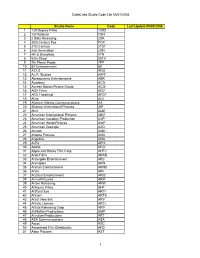

Cablelabs Studio Code List 05/01/2006

CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 1 120 Degree Films 120D 2 1st National FSN 3 2 Silks Releasing 2SR 4 20th Century Fox FOX 5 21st Century 21ST 6 2nd Generation 2GN 7 4th & Broadway 4TH 8 50th Street 50TH 9 7th Planet Prods 7PP 10 8X Entertainment 8X 11 A.D.G. ADG 12 A.I.P. Studios AIPS 13 Abramorama Entertainment ABR 14 Academy ACD 15 Access Motion Picture Group ACM 16 ADV Films ADV 17 AFD Theatrical AFDT 18 Alive ALV 19 Alliance Atlantis Communications AA 20 Alliance International Pictures AIP 21 Almi ALM 22 American International Pictures AINT 23 American Vacation Production AVP 24 American World Pictures AWP 25 American Zoetrope AZO 26 Amoon AMO 27 Andora Pictures AND 28 Angelika ANG 29 A-Pix APIX 30 Apollo APO 31 Apple and Honey Film Corp. AHFC 32 Arab Films ARAB 33 Arcangelo Entertainment ARC 34 Arenaplex ARN 35 Arenas Entertainment ARNS 36 Aries ARI 37 Ariztical Entertainment ARIZ 38 Arrival Pictures ARR 39 Arrow Releasing ARW 40 Arthouse Films AHF 41 Artificial Eye ARTI 42 Artisan ARTS 43 Artist View Ent. ARV 44 Artistic License ARTL 45 Artists Releasing Corp ARP 46 ArtMattan Productions AMP 47 Artrution Productions ART 48 ASA Communications ASA 49 Ascot ASC 50 Associated Film Distribution AFD 51 Astor Pictures AST 1 CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 52 Astral Films ASRL 53 At An Angle ANGL 54 Atlantic ATL 55 Atopia ATP 56 Attitude Films ATT 57 Avalanche Films AVF 58 Avatar Films AVA 59 Avco Embassy AEM 60 Avenue AVE 61 B&W Prods. -

The 2014 Sony Hack and the Role of International Law

The 2014 Sony Hack and the Role of International Law Clare Sullivan* INTRODUCTION 2014 has been dubbed “the year of the hack” because of the number of hacks reported by the U.S. federal government and major U.S. corporations in busi- nesses ranging from retail to banking and communications. According to one report there were 1,541 incidents resulting in the breach of 1,023,108,267 records, a 78 percent increase in the number of personal data records compro- mised compared to 2013.1 However, the 2014 hack of Sony Pictures Entertain- ment Inc. (Sony) was unique in nature and in the way it was orchestrated and its effects. Based in Culver City, California, Sony is the movie making and entertain- ment unit of Sony Corporation of America,2 the U.S. arm of Japanese electron- ics company Sony Corporation.3 The hack, discovered in November 2014, did not follow the usual pattern of hackers attempting illicit activities against a business. It did not specifically target credit card and banking information, nor did the hackers appear to have the usual motive of personal financial gain. The nature of the wrong and the harm inflicted was more wide ranging and their motivation was apparently ideological. Identifying the source and nature of the wrong and harm is crucial for the allocation of legal consequences. Analysis of the wrong and the harm show that the 2014 Sony hack4 was more than a breach of privacy and a criminal act. If, as the United States maintains, the Democratic People’s Republic of Korea (herein- after North Korea) was behind the Sony hack, the incident is governed by international law. -

The Business of Making Movies

Cover Story THE BUSINESS OF MAKING MOVIES B Y S. MARK Y OUNG,JAMES J. GONG, AND W IM A. V AN DER S TEDE The U.S. motion picture industry generates close to $100 billion in revenues, is one of the country’s largest exporters, and exerts enormous cultural influence worldwide. But today it also faces enormous pressures. 26 STRATEGIC FINANCE I F ebruary 2008 oing to the movies has always been one of ney Pictures, Warner Brothers Pictures, Paramount Pic- society’s most pleasurable pastimes. Over tures, Columbia Pictures, and Universal Pictures. The the past few years, though, enormous MPAA represents these studios internationally and plays a changes have occurred in the movie- number of roles: It advocates for the U.S. film industry, making business: escalating production protects producers from copyright theft, and fights pira- and marketing costs, the significant impact cy. In 2006, the MPAA studios released 203 films (34%), of increased piracy, the uncertainty in film and other, independent distributors released 396 (66%). financing, the proliferation of digital tech- Even though major studios have made their name in Gnology, and the increase in available entertainment Hollywood, large, vertically integrated conglomerates options for consumers. These and other factors have own them today. These conglomerates also incorporate a implications for the motion picture business, the types of number of other forms of entertainment and media, such movies it will produce, and how and where people will as radio stations, cable and network television stations, view them. Based on research sponsored by the Foundation for Applied Research (FAR) of the Institute of Management THE LARGEST DISTRIBUTORS OF Accountants (IMA®), this is the first in a series of articles on the U.S. -

A SONY PICTURES CLASSICS RELEASE Www

A SONY PICTURES CLASSICS RELEASE www.itmightgetloudmovie.com Running time: 97 minutes *Official Selection: 2008 Toronto International Film Festival *Official Selection: 2009 Sundance Film Festival Publicity Distributor PMK/HBH Sony Pictures Classics Allen Eichhorn Carmelo Pirrone 622 Third Avenue Lindsay Macik 8th Floor 550 Madison Ave New York, NY 10017 New York, NY 10022 212-373-6115 Tel: 212-833-8833 [email protected] Short Synopsis Rarely can a film penetrate the glamorous surface of rock legends. It Might Get Loud tells the personal stories, in their own words, of three generations of electric guitar virtuosos – The Edge (U2), Jimmy Page (Led Zeppelin), and Jack White (The White Stripes). It reveals how each developed his unique sound and style of playing favorite instruments, guitars both found and invented. Concentrating on the artist’s musical rebellion, traveling with him to influential locations, provoking rare discussion as to how and why he writes and plays, this film lets you witness intimate moments and hear new music from each artist. The movie revolves around a day when Jimmy Page, Jack White, and The Edge first met and sat down together to share their stories, teach and play. Long Synopsis Who hasn't wanted to be a rock star, join a band or play electric guitar? Music resonates, moves and inspires us. Strummed through the fingers of The Edge, Jimmy Page and Jack White, somehow it does more. Such is the premise of It Might Get Loud, a new documentary conceived by producer Thomas Tull. It Might Get Loud isn't like any other rock'n roll documentary. -

The US Film Industry

Jono Polansky, Onbeyond LLC August 2020 _____________________________________________________________________________________________ This SFM guide to who owns what in the US screen entertainment industry — movies, broadcast, cable and streaming — has been updated to reflect developments in tobacco content and changes in corporate ownership. We put this map together so public health experts, parents, young people and policy makers can identify who decides if smoking shows up in entertainment accessible to kids. The US film industry MAJOR STUDIOS | The US feature film industry is dominated by five “major studio” distributors. In 2019, their top-grossing films accounted for 81 percent of all youth-rated tobacco impressions delivered to domestic theater audiences. The studios develop, finance, and market film projects domestically and worldwide. Almost all films with production budgets greater than $50 million are major studio films. Studios may not break even on theatrical showings of a film, but a film’s box office, split roughly 50-50 with the theaters, strongly predicts the revenue the studio keeps to itself when the film is later released on DVD and licensed to on-demand, cable, and broadcast services. Most studio revenue comes from those “long tail” after-markets. In addition, 70 percent of US studios’ theatrical revenue now comes from outside the United States, which helps explain why easy-to-sell “franchise” films are prized by major studios. The major studios are represented by a trade group, the Motion Picture Association (MPA), dominate its board of directors. The MPA owns and administers the movie ratings (G/PG/PG-13/R,NC-17), with a nod to the National Association of Theatre Owners (NATO), which plays a role in enforcing age restrictions. -

Feature Film

RAMIN DJAWADI AWARDS & NOMINATIONS HOLLYWOOD MUSIC IN MEDIA TOM CLANCY’S JACK RYAN AWARD NOMINATION (2019) Main Title Theme – TV Show/Limited Series EMMY AWARD (2019) GAME OF THRONES Outstanding Music Composition for a “The Long Night” Series (Original Dramatic Score) EMMY AWARD (2018) GAME OF THRONES Outstanding Music Composition for a Series (Original Dramatic Score) EMMY NOMINATION (2018) WESTWORLD Outstanding Music Composition for a Series (Original Dramatic Score) GRAMMY NOMINATION (2017) GAME OF THRONES Best Score Soundtrack for Visual Media WORLD SOUNDTRACK AWARD WESTWORLD, PRISON BREAK: NOMINATION (2017) RESURRECTION, THE STRAIN Best TV Composer of the Year EMMY NOMINATION (2017) WESTWORLD Best Original Main Title Theme Music EMMY NOMINATION (2014) GAME OF THRONES Outstanding Music Composition for a Series GAME AUDIO NETWORK GUILD MEDAL OF HONOR NOMINATION (2011) Best Cinematic / Cut-Scene Audio EMMY NOMINATION (2010) FLASH FORWARD Outstanding Music Composition for a Series GRAMMY NOMINATION (2006) IRON MAN Best Score Soundtrack Album iTUNES AWARD (2008) IRON MAN Best Score The Gorfaine/Schwartz Agency, Inc. (818) 260-8500 1 RAMIN DJAWADI WORLD SOUNDTRACK AWARD MR. BROOKS NOMINATION Discovery Of The Year (2007) EMMY NOMINATION (2006) PRISON BREAK Outstanding Main Title Theme Music FEATURE FILM ELEPHANT EDEN Alastair Fothergill, prod. DisneyNature Mark Linfield, dir. THE QUEEN’S CORGI Ben Stasson, prod. Lionsgate Ben Stasson, dir. SLENDER MAN Robyn Meisinger, Sarah Snow, Bradley Fischer, James Screen Gems Productions Vanderbilt, William Sherak, prods. *With Brandon Campbell Sylvain White, dir. A WRINKLE IN TIME Jim Whitaker, Catherine Hand, Adam Borba, prods. Walt Disney Studios Ava DuVernay, dir. THE MOUNTAIN BETWEEN US Peter Chernin, Jenno Topping, prods. -

FOR IMMEDIATE RELEASE Press Contact: Bebe Lerner (323) 822-4800 Sheri Goldberg (646) 723-3800

FOR IMMEDIATE RELEASE Press Contact: Bebe Lerner (323) 822-4800 Sheri Goldberg (646) 723-3800 SONY PICTURES CLASSICS ACQUIRES ALL NORTH AMERICAN RIGHTS TO LIFE, ABOVE ALL New York (June XX, 2010) – Sony Pictures Classics announced today that they have acquired all North American rights to the highly acclaimed LIFE, ABOVE ALL from Munich based world sales company Bavaria Film International. The film was an official selection at this year’s Cannes Film Festival and received overwhelmingly positive responses from critics and audiences alike, also winning the “Francois Chalais Prize,” awarded to those films dedicated to the values of life affirmation and journalism. The film was previously sold to ARP for France and Nachshon for Israel with Senator handling German speaking Europe. LIFE, ABOVE ALL, directed by Oliver Schmitz (MAPANTSULA, PARIS JE T’AIME) is based on the 2005 award-winning novel CHANDA’S SECRETS by Allan Stratton. It is a suspense-filled drama about a young girl in South Africa who fights to rescue the people she loves. Through dramatic storytelling, the film captures the enduring strength of loyalty, the profound impact of loss, and a fearlessness that is powered by the heart. SPC and Bavaria previously worked together on RUN LOLA RUN, GOOD BYE, LENIN!, THE MAN WITHOUT A PAST, and I SERVED THE KING OF ENGLAND. LIFE, ABOVE ALL is a Dreamer Joint Venture production in co-production with Senator Film Produktion, Enigma Pictures and Niama-Film. “I am exceedingly happy that Sony Pictures Classics is releasing LIFE, ABOVE ALL in North America. I have always admired their unfailing ability to honor cinema at its best and really look forward to working with them. -

Hollywood Foreign Press Association 2017 Golden Globe Awards for the Year Ended December 31, 2016 Press Release

HOLLYWOOD FOREIGN PRESS ASSOCIATION 2017 GOLDEN GLOBE AWARDS FOR THE YEAR ENDED DECEMBER 31, 2016 PRESS RELEASE 1. BEST MOTION PICTURE – DRAMA a. HACKSAW RIDGE Pandemonium Films / Permut Productions; Summit Entertainment A Lionsgate Company b. HELL OR HIGH WATER Sidney Kimmel Entertainment / Film 44 / LBI Entertainment / OddLot Entertainment; CBS Films / Lionsgate c. LION See-Saw Films; The Weinstein Co. d. MANCHESTER BY THE SEA Pearl Street Films / The Media Farm / K Period Media / The A | Middleton Project / B Story; Amazon Studios e. MOONLIGHT A24 / Plan B / Pastel; A24 2. BEST PERFORMANCE BY AN ACTRESS IN A MOTION PICTURE – DRAMA a. AMY ADAMS ARRIVAL b. JESSICA CHASTAIN MISS SLOANE c. ISABELLE HUPPERT ELLE d. RUTH NEGGA LOVING e. NATALIE PORTMAN JACKIE 3. BEST PERFORMANCE BY AN ACTOR IN A MOTION PICTURE – DRAMA a. CASEY AFFLECK MANCHESTER BY THE SEA b. JOEL EDGERTON LOVING c. ANDREW GARFIELD HACKSAW RIDGE d. VIGGO MORTENSEN CAPTAIN FANTASTIC e. DENZEL WASHINGTON FENCES HOLLYWOOD FOREIGN PRESS ASSOCIATION 2017 GOLDEN GLOBE AWARDS FOR THE YEAR ENDED DECEMBER 31, 2016 PRESS RELEASE 4. BEST MOTION PICTURE – MUSICAL OR COMEDY a. 20TH CENTURY WOMEN Annapurna; A24 b. DEADPOOL Twentieth Century Fox; Twentieth Century Fox c. FLORENCE FOSTER JENKINS Paramount Pictures / Pathe / BBC Films; Paramount Pictures d. LA LA LAND Impostor Pictures / Gilbert Films / Marc Platt Productions; Summit Entertainment A Lionsgate Company e. SING STREET Cosmo Films; The Weinstein Co. 5. BEST PERFORMANCE BY AN ACTRESS IN A MOTION PICTURE – MUSICAL OR COMEDY a. ANNETTE BENING 20TH CENTURY WOMEN b. LILY COLLINS RULES DON'T APPLY c. HAILEE STEINFELD THE EDGE OF SEVENTEEN d.