Mapping the Financial Sector in Drc and Identifying Opportunities for the Access to Finance Sub Component

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New Unhas Drc Schedule Effect

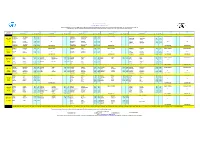

UNHAS DRC FLIGHT SCHEDULE EFFECTIVE FROM SEPTEMBER 11th 2017 All Planned Flight Times are in LOCAL TIME: Kinshasa, Mbandaka, Brazzaville, Impfondo, Enyelle, Gemena, Libenge, Gbadolite, Zongo, Bangui (UTC + 1); All Other Destinations (UTC + 2) PASSENGERS ARE TO CHECK IN 2 HOURS BEFORE SCHEDULE TIME OF DEPARTURE - PLEASE NOTE THAT THE COUNTER WILL BE CLOSED 1 HOUR BEFORE TIME OF THE DEPARTURE MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY SUNDAY AIRCRAFT DESTINATION DEP ARR DESTINATION DEP ARR DESTINATION DEP ARR DESTINATION DEP ARR DESTINATION DEP ARR KINSHASA MBANDAKA 7:30 9:00 SPECIAL FLIGHTS KINSHASA BRAZZAVILLE 7:30 7:45 SPECIAL FLIGHTS KINSHASA MBANDAKA 7:30 9:00 SPECIAL FLIGHTS SPECIAL FLIGHTS UNO 113H MBANDAKA LIBENGE 9:30 10:30 BRAZZAVILLE MBANDAKA 8:45 10:15 MBANDAKA GBADOLITE 9:30 10:50 DHC8 LIBENGE ZONGO 11:00 11:20 MBANDAKA IMPFONDO 10:45 11:15 GBADOLITE BANGUI 11:20 12:05 5Y-STN ZONGO BANGUI 11:50 12:00 OR IMPFONDO ENYELLE 11:45 12:10 OR BANGUI LIBENGE 13:05 13:25 OR OR BANGUI GBADOLITE 13:00 13:45 ENYELLE MBANDAKA 12:40 13:30 LIBENGE MBANDAKA 13:55 14:55 GBADOLITE MBANDAKA 14:15 15:35 MBANDAKA BRAZZAVILLE 14:00 15:30 MBANDAKA KINSHASA 15:25 16:55 MBANDAKA KINSHASA 16:05 17:35 MAINTENANCE BRAZZAVILLE KINSHASA 16:00 16:15 MAINTENANCE MAINTENANCE MAINTENANCE KINSHASA KANANGA 7:15 9:30 SPECIAL FLIGHTS KINSHASA GOMA 7:15 10:30 SPECIAL FLIGHTS KINSHASA KANANGA 7:15 9:30 SPECIAL FLIGHTS SPECIAL FLIGHTS UNO 213H KANANGA KALEMIE 10:00 11:05 GOMA KALEMIE 12:15 13:05 KANANGA GOMA 10:00 11:25 EMB-135 KALEMIE GOMA 11:45 12:35 OR KALEMIE -

Tangled! Congolese Provincial Elites in a Web of Patronage

Researching livelihoods and services affected by conflict Tangled! Congolese provincial elites in a web of patronage Working paper 64 Lisa Jené and Pierre Englebert January 2019 Written by Lisa Jené and Pierre Englebert SLRC publications present information, analysis and key policy recommendations on issues relating to livelihoods, basic services and social protection in conflict-affected situations. This and other SLRC publications are available from www.securelivelihoods.org. Funded by UK aid from the UK Government, Irish Aid and the EC. Disclaimer: The views presented in this publication are those of the author(s) and do not necessarily reflect the UK Government’s official policies or represent the views of Irish Aid, the EC, SLRC or our partners. ©SLRC 2018. Readers are encouraged to quote or reproduce material from SLRC for their own publications. As copyright holder SLRC requests due acknowledgement. Secure Livelihoods Research Consortium Overseas Development Institute (ODI) 203 Blackfriars Road London SE1 8NJ United Kingdom T +44 (0)20 3817 0031 F +44 (0)20 7922 0399 E [email protected] www.securelivelihoods.org @SLRCtweet Cover photo: Provincial Assembly, Lualaba. Lisa Jené, 2018 (CC BY-NC-ND 2.0). B About us The Secure Livelihoods Research Consortium (SLRC) is a global research programme exploring basic services, livelihoods and social protection in fragile and conflict-affected situations. Funded by UK Aid from the UK Government’s Department for International Development (DFID), with complementary funding from Irish Aid and the European Commission (EC), SLRC was established in 2011 with the aim of strengthening the evidence base and informing policy and practice around livelihoods and services in conflict. -

IMCK Newsletter 17.3.Pages

INSTITUT MEDICAL CHRETIEN DU KASAI !1 OFINSTITUT MEDICAL!5 CHRETIEN DU KASAI B.P. 205 KANANGA B.P. 205 KANANGA INSTITUT MEDICAL CHRETIENREPUBLIQUE DEMOCRATIQUE DU DUKASAI CONGO REPUBLIQUE DEMOCRATIQUE DU CONGO Christian Medical Institute Hôpitalof – theEcole d’infirmiers Kasai – Ecole de laborantins - Serving – Service de santé communautairein Central - Service d’ophtalmologie Congo Service dentaire – Centre d’études et de recyclage Hôpital – Ecole d’infirmiers – Ecole de laborantins – Service de santé communautaire - Service d’ophtalmologie E-mail : [email protected] Service dentaire – Centre d’études et de recyclage B. P. 205 Kananga, Republic Democratic du Congo ; Email: [email protected] E-mail : [email protected] 2. Find a way to channel a greater percentage of donations back into that unpopular category 2. Find a way to channel a greater percentage of donations back into that unpopular category of “undesignated” gifts so that we can have the flexibility to apply them where A Periodic Newsletter operational needs are Issuethe most desperate. No. 41 But ifJanuary you cannot (and - thatMarch is understandable, 2017 of “undesignated” gifts so that we can have the flexibility to apply them whereA considering all the news stories one sees about mismanaged funds), then consider operational needs are the most desperate. But if you cannot (and that is understandable, designating gifts carefully to those things that are at the core of IMCK’s operational considering all the news stories one sees about mismanaged funds), then consider The current conflict in the Kasai has needs.I askedFor example the new: Specify IMCK money Administrator, for medicines and Kastin medical Katawa, supplies; Specifyto describe money designating gifts carefully to those things that are at the core of IMCK’s operational added new suffering and danger. -

Introduction Generale

P a g e | 1 INTRODUCTION GENERALE 0.1. Problématique Le présent mémoire porte sur les logotypes et la signification : Analyse de la dénotation et de la connotation des logotypes des banques Trust Merchant Bank (TMB) et Rawbank. En effet, Sperber1 dit qu’il n’y a rien de plus banal que la communication, car les êtres humains sont par nature des êtres communiquant par la parole, le geste, l’écrit, l’habillement et voire le silence, etc. La célèbre école de Palo Alto le dit tout haut aussi: on ne peut pas ne pas communiquer, tout est communication2. La communication, nous la pratiquons tous les jours sans y penser (mais également en y pensant) et généralement avec un succès assez impressionnant, même si parfois nous sommes confrontés à ses limites et à ses échecs. La communication demeure l’élément fondamental et complexe de la vie sociale qui rend possible l’interaction des personnes et dont la caractéristique essentielle est, selon Daniel Lagache3, la réciprocité. Elle est ce par quoi une personne influence une autre et en est influencée, car elle n’est pas indépendante des effets de son action. Morin affirme même que la communication a plusieurs fonctions : l’information, la connaissance, l’explication et la compréhension. Toutefois, pour lui, le problème central dans la communication humaine est celui de la compréhension, car on communique pour comprendre et se comprendre4. Raison pour laquelle, les chercheurs en matière de communication, surtout de notre ère, époque marquée par l’accroissement des entreprises dans la plupart des secteurs de la vie sociale, se trouvent confronté à de nouvelles problématiques qui sont autant d’enjeux pour améliorer la communication. -

Ituri:Stakes, Actors, Dynamics

ITURI STAKES, ACTORS, DYNAMICS FEWER/AIP/APFO/CSVR would like to stress that this report is based on the situation observed and information collected between March and August 2003, mainly in Ituri and Kinshasa. The 'current' situation therefore refers to the circumstances that prevailed as of August 2003, when the mission last visited the Democratic Republic of the Congo. This publication has been produced with the assistance of the European Union. The contents of this publication are the sole responsibility of the author and can in no way be taken to reflect the views of the European Union. This publication has been produced with the assistance of the Swedish International Development Agency. The contents of this publication are the sole responsibility of the author and can in no way be taken to reflect the views of the Swedish Government and its agencies. This publication has been produced with the assistance of the Department for Development Policy, Ministry for Foreign Affairs of Finland. The contents of this publication are the sole responsibility of the author and can in no way be taken to reflect the views of the Finnish Government and its agencies. Copyright 2003 © Africa Initiative Program (AIP) Africa Peace Forum (APFO) Centre for Study of Violence and Reconciliation (CSVR) Forum on Early Warning and Early Response (FEWER) The views expressed by participants in the workshop are not necessarily those held by the workshop organisers and can in no way be take to reflect the views of AIP, APFO, CSVR and FEWER as organisations. 2 List of Acronyms............................................................................................................................... 4 EXECUTIVE SUMMARY...................................................................................................................................... -

Equateur Province Context

Social Science in Humanitarian Action ka# www.socialscienceinaction.org # # # Key considerations: the context of Équateur Province, DRC This brief summarises key considerations about the context of Équateur Province in relation to the outbreak of Ebola in the DRC, June 2018. Further participatory enquiry should be undertaken with the affected population, but given ongoing transmission, conveying key considerations for the response in Équateur Province has been prioritised. This brief is based on a rapid review of existing published and grey literature, professional ethnographic research in the broader equatorial region of DRC, personal communication with administrative and health officials in the country, and experience of previous Ebola outbreaks. In shaping this brief, informal discussions were held with colleagues from UNICEF, WHO, IFRC and the GOARN Social Science Group, and input was also given by expert advisers from the Institut Pasteur, CNRS-MNHN-Musée de l’Homme Paris, KU Leuven, Social Science Research Council, Paris School of Economics, Institut de Recherche pour le Développment, Réseau Anthropologie des Epidémies Emergentes, London School of Hygiene and Tropical Medicine, University of Edinburgh, Stellenbosch University, University of Wisconsin, Tufts University, Institute of Development Studies, Anthrologica and others. The brief was developed by Lys Alcayna-Stevens and Juliet Bedford, and is the responsibility of the Social Science in Humanitarian Action Platform. Overview • Administrative structure – The DRC is divided into 26 provinces. In 2015, under terms of the 2006 Constitution, the former province of Équateur was divided into five provinces including the new smaller Équateur Province, which retained Mbandaka as its provincial capital.1 The province has a population of 2,543,936 and is governed by the provincial government led by a Governor, Vice Governor, and Provincial Ministers (e.g. -

The DRC Seed Sector

A Quarter-Billion Dollar Industry? The DRC Seed Sector BRIEF DESCRIPTION: Compelling investment opportunities exist for seed companies and seed start-ups in the Democratic Republic of the Congo (DRC). This document outlines the market potential and consumer demand trends in the DRC and highlights the high potential of seed production in the country. 1 Executive Summary Compelling investment opportunities exist for seed companies and seed start-ups in the Democratic Republic of the Congo (DRC). This document outlines the market potential and consumer demand trends in the DRC and highlights the high potential of seed production in the country. The DRC is the second largest country in Africa with over 80 million hectares of agricultural land, of which 4 to 7 million hectares are irrigable. Average rainfall varies between 800 mm and 1,800 mm per annum. Bimodal and extended unimodal rainfall patterns allow for two agricultural seasons in approximately 75% of the country. Average relative humidity ranges from 45% to 90% depending on the time of year and location. The market potential for maize, rice and bean seed in the DRC is estimated at $191 million per annum, of which a mere 3% has been exploited. Maize seed sells at $3.1 per kilogramme of hybrid seed and $1.6 per kilogramme of OPV seed, a higher price than in Tanzania, Kenya, Uganda and Zambia. Seed-to-grain ratios are comparable with regional benchmarks at 5.5:1 for hybrid maize seed and 5.0:1 for OPV maize seed. The DRC is defined by four relatively distinct sales zones, which broadly coincide with the country’s four principal climate zones. -

Organized Crime and Instability in Central Africa

Organized Crime and Instability in Central Africa: A Threat Assessment Vienna International Centre, PO Box 500, 1400 Vienna, Austria Tel: +(43) (1) 26060-0, Fax: +(43) (1) 26060-5866, www.unodc.org OrgAnIzed CrIme And Instability In CenTrAl AFrica A Threat Assessment United Nations publication printed in Slovenia October 2011 – 750 October 2011 UNITED NATIONS OFFICE ON DRUGS AND CRIME Vienna Organized Crime and Instability in Central Africa A Threat Assessment Copyright © 2011, United Nations Office on Drugs and Crime (UNODC). Acknowledgements This study was undertaken by the UNODC Studies and Threat Analysis Section (STAS), Division for Policy Analysis and Public Affairs (DPA). Researchers Ted Leggett (lead researcher, STAS) Jenna Dawson (STAS) Alexander Yearsley (consultant) Graphic design, mapping support and desktop publishing Suzanne Kunnen (STAS) Kristina Kuttnig (STAS) Supervision Sandeep Chawla (Director, DPA) Thibault le Pichon (Chief, STAS) The preparation of this report would not have been possible without the data and information reported by governments to UNODC and other international organizations. UNODC is particularly thankful to govern- ment and law enforcement officials met in the Democratic Republic of the Congo, Rwanda and Uganda while undertaking research. Special thanks go to all the UNODC staff members - at headquarters and field offices - who reviewed various sections of this report. The research team also gratefully acknowledges the information, advice and comments provided by a range of officials and experts, including those from the United Nations Group of Experts on the Democratic Republic of the Congo, MONUSCO (including the UN Police and JMAC), IPIS, Small Arms Survey, Partnership Africa Canada, the Polé Institute, ITRI and many others. -

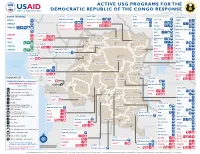

ACTIVE USG PROGRAMS for the DEMOCRATIC REPUBLIC of the CONGO RESPONSE Last Updated 07/27/20

ACTIVE USG PROGRAMS FOR THE DEMOCRATIC REPUBLIC OF THE CONGO RESPONSE Last Updated 07/27/20 BAS-UELE HAUT-UELE ITURI S O U T H S U D A N COUNTRYWIDE NORTH KIVU OCHA IMA World Health Samaritan’s Purse AIRD Internews CARE C.A.R. Samaritan’s Purse Samaritan’s Purse IMA World Health IOM UNHAS CAMEROON DCA ACTED WFP INSO Medair FHI 360 UNICEF Samaritan’s Purse Mercy Corps IMA World Health NRC NORD-UBANGI IMC UNICEF Gbadolite Oxfam ACTED INSO NORD-UBANGI Samaritan’s WFP WFP Gemena BAS-UELE Internews HAUT-UELE Purse ICRC Buta SCF IOM SUD-UBANGI SUD-UBANGI UNHAS MONGALA Isiro Tearfund IRC WFP Lisala ACF Medair UNHCR MONGALA ITURI U Bunia Mercy Corps Mercy Corps IMA World Health G A EQUATEUR Samaritan’s NRC EQUATEUR Kisangani N Purse WFP D WFPaa Oxfam Boende A REPUBLIC OF Mbandaka TSHOPO Samaritan’s ATLANTIC NORTH GABON THE CONGO TSHUAPA Purse TSHOPO KIVU Lake OCEAN Tearfund IMA World Health Goma Victoria Inongo WHH Samaritan’s Purse RWANDA Mercy Corps BURUNDI Samaritan’s Purse MAI-NDOMBE Kindu Bukavu Samaritan’s Purse PROGRAM KEY KINSHASA SOUTH MANIEMA SANKURU MANIEMA KIVU WFP USAID/BHA Non-Food Assistance* WFP ACTED USAID/BHA Food Assistance** SA ! A IMA World Health TA N Z A N I A Kinshasa SH State/PRM KIN KASAÏ Lusambo KWILU Oxfam Kenge TANGANYIKA Agriculture and Food Security KONGO CENTRAL Kananga ACTED CRS Cash Transfers For Food Matadi LOMAMI Kalemie KASAÏ- Kabinda WFP Concern Economic Recovery and Market Tshikapa ORIENTAL Systems KWANGO Mbuji T IMA World Health KWANGO Mayi TANGANYIKA a KASAÏ- n Food Vouchers g WFP a n IMC CENTRAL y i k -

A Functional View of Linguistic Meaning

SWAHILI FORUM 22 (2015): vi-viii REVIEW Le swahili de Lubumbashi. Grammaire, textes, lexique [The Swahili from Lubumbashi. Grammar, texts, lexicon]. Aurélia Ferrari, Marcel Kalunga, and Georges Mulumbwa. 2014. Paris: Editions Karthala, 226 pp., ISBN 978-2-8111- 1130-4. Swahili is one of the four national languages of the Democratic Republic of Congo, together with Ciluba, Kikongo and Lingala, spoken by many millions mainly located in the eastern provinces. This interesting volume, appeared amongst the recent contributions to the Karthala series “Dictionnaires et Langues” (Dictionaries and Languages) directed by Henri Tourneux, is devoted 1 to a specific variety of Congolese Swahili, i.e. the Swahili of Lubumbashi , an originally vehicular and hexogen language which, as a result of the colonial language policy (Fabian 1986), has increasingly been spoken among urban residents, principally, but not exclusively, in oral 2 communication and performance , thus entering an ongoing process of vernacularisation and becoming the first language for a part of the population of the Katangese region. The work is a result of the collaboration between Aurélia Ferrari, specialist in emerging African language varieties, presently lecturer at the French Ministry of Foreign Affairs, and two scholars from the DRC, experts in Swahili and Bantu languages, namely Marcel Kalunga, professor at the Universities of Lubumbashi and Kalemie, and Georges Mulumbwa, senior assistant in linguistics at the University of Lubumbashi. The book consists of three parts, the first -

Democratic Republic of the Congo Eortcrepublic Democratic Ftecongo the Of

Democratic Republic of the Congo Democratic Republic of the Congo Main objectives Reintegration and Resettlement (DDRRR) and the Multi-Country Demobilization and Reintegration Programme (MDRP) in cooperation with UNDP, the ssist local authorities to improve the national UN Observer Mission in DRC (MONUC) and the Asystem of asylum; help to increase awareness World Bank. of refugees’ rights within the Government and civil society; promote and facilitate the repatriation in safety and dignity of Rwandan and Burundian refu- Impact gees respectively, as well as the voluntary repatria- tion of Angolan refugees; prepare and organize the • UNHCR signed tripartite agreements for the repa- repatriation of Sudanese and Congolese refugees triation of DRC refugees from the Central African when conditions in their home countries have Republic (CAR) and the Republic of the Congo improved sufficiently; ensure that all refugees who (RoC). Some 2,000 DRC refugees (20 per cent of wish to remain in the Democratic Republic of the the refugee population) returned home from Congo (DRC) enjoy international protection; pro- CAR. Nearly 350 RoC refugees (representing vide international protection and humanitarian some five per cent of the refugee population) assistance to residual groups and urban refugees to were repatriated. help them to become self-reliant; support initiatives for Demobilization, Disarmament, Repatriation, UNHCR Global Report 2004 142 • In total, UNHCR in DRC assisted some 28,000 Working environment people to return home (over 20,000 of them Angolans). From eastern DRC, the Office repatri- ated more than 8,000 Rwandans who were scattered in the provinces of North and South The context Kivu. -

Democratic Republic of the Congo of the Congo Democratic Republic

Democratic Republic of the Congo of the Congo Democratic Republic Main objectives Impact • UNHCR provided international protection to some In 2005, UNHCR aimed to strengthen the protection 204,300 refugees in the DRC of whom some 15,200 framework through national capacity building, registra- received humanitarian assistance. tion, and the prevention of and response to sexual and • Some of the 22,400 refugees hosted by the DRC gender-based violence; facilitate the voluntary repatria- were repatriated to their home countries (Angola, tion of Angolan, Burundian, Rwandan, Ugandan and Rwanda and Burundi). Sudanese refugees; provide basic assistance to and • Some 38,900 DRC Congolese refugees returned to locally integrate refugee groups that opt to remain in the the DRC, including 14,500 under UNHCR auspices. Democratic Republic of the Congo (DRC); prepare and UNHCR monitored the situation of at least 32,000 of organize the return and reintegration of DRC Congolese these returnees. refugees into their areas of origin; and support initiatives • With the help of the local authorities, UNHCR con- for demobilization, disarmament, repatriation, reintegra- ducted verification exercises in several refugee tion and resettlement (DDRRR) and the Multi-Country locations, which allowed UNHCR to revise its esti- Demobilization and Reintegration Programme (MDRP) mates of the beneficiary population. in cooperation with the UN peacekeeping mission, • UNHCR continued to assist the National Commission UNDP and the World Bank. for Refugees (CNR) in maintaining its advocacy role, urging local authorities to respect refugee rights. UNHCR Global Report 2005 123 Working environment Recurrent security threats in some regions have put another strain on this situation.