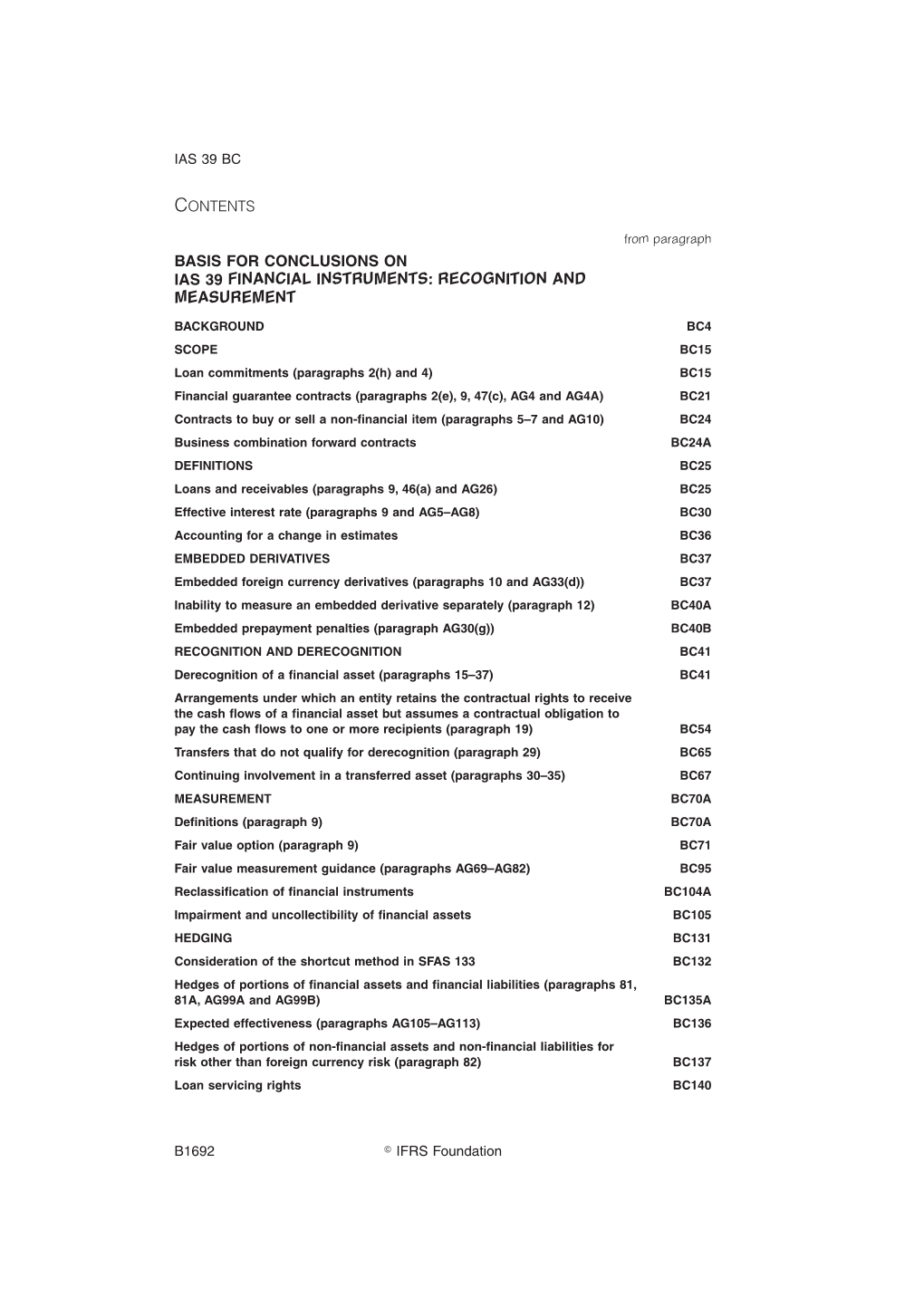

Contents Basis for Conclusions on Ias 39

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IFRS in Your Pocket 2019.Pdf

IFRS in your pocket 2019 Contents Abbreviations 1 Foreword 2 Our IAS Plus website 3 IFRS Standards around the world 5 The IFRS Foundation and the IASB 7 Standards and Interpretations 15 Standards and Interpretations 24 Summaries of Standards and Interpretations in effect at 1 January 2019 29 Requirements that are not yet mandatory 100 IASB projects 104 Deloitte IFRS resources 111 Contacts 113 IFRS in your pocket |2019 Abbreviations ARC Accounting Regulatory Commission ASAF Accounting Standards Advisory Forum DP Discussion Paper EC European Commission ED Exposure Draft EFRAG European Financial Reporting Advisory Group GAAP Generally Accepted Accounting Principles IAS International Accounting Standard IASB International Accounting Standards Board IASC International Accounting Standards Committee (predecessor to the IASB) IFRIC Interpretation issued by the IFRS Interpretations Committee IFRS International Financial Reporting Standard IFRS Standards All Standards and Interpretations issued by the IASB (i.e. the set comprising every IFRS, IAS, IFRIC and SIC) PIR Post-implementation Review SEC US Securities and Exchange Commission SIC Interpretation issued by the Standing Interpretations Committee of the IASC SMEs Small and Medium-sized Entities XBRL Extensible Business Reporting Language XML Extensible Markup Language 1 IFRS in your pocket |2019 Foreword Welcome to the 2019 edition of IFRS in Your Pocket. It is a concise guide of the IASB’s standard-setting activities that has made this publication an annual, and indispensable, worldwide favourite. At its core is a comprehensive summary of the current Standards and Interpretations along with details of the projects on the IASB work plan. Backing this up is information about the IASB and an analysis of the use of IFRS Standards around the world. -

International Accounting Standards

Teacher Guidance for 9706 Accounting on International Accounting Standards Cambridge International AS & A Level Accounting 9706 For examination from 2023 Version 1 In order to help us develop the highest quality resources, we are undertaking a continuous programme of review; not only to measure the success of our resources but also to highlight areas for improvement and to identify new development needs. We invite you to complete our survey by visiting the website below. Your comments on the quality and relevance of our resources are very important to us. www.surveymonkey.co.uk/r/GL6ZNJB Would you like to become a Cambridge International consultant and help us develop support materials? Please follow the link below to register your interest. www.cambridgeinternational.org/cambridge-for/teachers/teacherconsultants/ Copyright © UCLES 2020 Cambridge Assessment International Education is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of the University of Cambridge Local Examinations Syndicate (UCLES), which itself is a department of the University of Cambridge. UCLES retains the copyright on all its publications. Registered Centres are permitted to copy material from this booklet for their own internal use. However, we cannot give permission to Centres to photocopy any material that is acknowledged to a third party, even for internal use within a Centre. Contents Introduction ...............................................................................................................................4 IAS -

The Disclosure Initiative

Issue 187/ February 2021 IFRS Developments The Disclosure Initiative – IASB amends the accounting policy requirements What you need to know Highlights In February 2021, the International Accounting Standards Board (IASB or • On 12 February 2021, the IASB issued amendments to IAS 1 the Board) issued amendments to IAS 1 Presentation of Financial Statements and the PS to provide guidance in which it provides guidance and examples to help entities apply materiality on the application judgements to accounting policy disclosures. The Board also issued amendments of materiality judgements to to IFRS Practice Statement 2 Making Materiality Judgements (the PS) to support accounting policy disclosures. the amendments in IAS 1 by explaining and demonstrating the application of the ‘four-step materiality process’ to accounting policy disclosures. • The amendments to IAS 1 replace the requirement to In particular, the amendments aim to help entities provide accounting policy disclose ‘significant’ accounting disclosures that are more useful by: policies with a requirement to disclose ‘material’ accounting • Replacing the requirement for entities to disclose their ‘significant’ accounting policies. policies with a requirement to disclose their ‘material’ accounting policies; and Adding guidance on how entities apply the concept of materiality in making • Guidance and illustrative • examples are added in the PS to decisions about accounting policy disclosures. assist in the application of the materiality concept when Background making judgements about In an attempt to enhance communication in financial reporting, the IASB has made accounting policy disclosures. ‘Better Communication in Financial Reporting’ a central theme of its standard- setting activities in recent years. The Disclosure Initiative is part of the IASB’s • The amendments to IAS 1 will be effective for annual periods Better Communication theme and aims to address how the effectiveness of starting on or after 1 January disclosures in IFRS financial statements can be improved. -

Ipsas 12—Inventories

IPSAS 12—INVENTORIES Acknowledgment This International Public Sector Accounting Standard (IPSAS) is drawn primarily from International Accounting Standard (IAS) 2 (Revised 2003), “Inventories,” published by the International Accounting Standards Board (IASB). Extracts from IAS 2 are reproduced in this publication of the International Public Sector Accounting Standards Board (IPSASB) of the International Federation of Accountants (IFAC) with the permission of the International Accounting Standards Committee Foundation (IASCF). The approved text of the International Financial Reporting Standards (IFRSs) is that published by IASB in the English language, and copies may be obtained directly from IASB Publications Department, 30 Cannon Street, London EC4M 6XH, United Kingdom. E-mail: [email protected] Internet: http://www.iasb.org IFRSs, IASs, Exposure Drafts, and other publications of the IASB are copyright of the IASCF. “IFRS,” “IAS,” “IASB,” “IASCF,” “International Accounting Standards,” and “International Financial Reporting Standards” are trademarks of the IASCF and should not be used without the approval of the IASCF. IPSAS 12 314 December 2006 IPSAS 12—INVENTORIES CONTENTS Paragraph SECTOR PUBLIC Introduction ............................................................................................. IN1–IN14 Objective .................................................................................................. 1 Scope ....................................................................................................... 2–8 -

VALUE IFRS Plc Illustrative IFRS Consolidated Financial Statements December 2019

VALUE IFRS Plc Illustrative IFRS consolidated financial statements December 2019 This publication presents the sample annual financial reports of a fictional listed company, VALUE IFRS Plc. It illustrates the financial reporting requirements that would apply to such a company under International Financial Reporting Standards as issued at 31 May 2019. Supporting commentary is also provided. For the purposes of this publication, VALUE IFRS Plc is listed on a fictive Stock Exchange and is the parent entity in a consolidated entity. VALUE IFRS Plc 2019 is for illustrative purposes only and should be used in conjunction with the relevant financial reporting standards and any other reporting pronouncements and legislation applicable in specific jurisdictions. Global Accounting Consulting Services PricewaterhouseCoopers LLP This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. About PwC At PwC, our purpose is to build trust in society and solve important problems. We're a network of firms in 158 countries with more than 250,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com © 2019 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. VALUE IFRS Plc Illustrative IFRS consolidated financial statements December -

In Brief a Look at Current Financial Reporting Issues

In brief A look at current financial reporting issues inform.pwc.com December 2014 IASB issues narrow scope amendments to IAS 1: Presentation of financial statements Issue In December 2014 the IASB issued amendments to clarify guidance in IAS 1 on materiality and aggregation, the presentation of subtotals, the structure of financial statements and the disclosure of accounting policies. The amendments form a part of the IASB’s Disclosure Initiative, which explores how financial statement disclosures can be improved. The amendments are effective from 1 January 2016. Impact The following is a summary of the key changes. Materiality An entity should not aggregate or disaggregate information in a manner that obscures useful information, for example, by aggregating items that have different characteristics or disclosing a large amount of immaterial detail. When management determines an item is material, the amendments require assessment of which specific disclosures set out in the relevant standard should be presented, and whether additional information is necessary to understand the impact on the financial position or performance. Disaggregation and subtotals The amendments clarify that it may be necessary to disaggregate some of the line items specified in IAS 1 paragraphs 54 (statement of financial position) and 82 (profit or loss). That disaggregation is required where it is relevant to an understanding of the entity's financial position or performance. The amendments address additional subtotals in the statement of financial position or the statement of profit or loss and other comprehensive income. The amendments give guidance on what additional subtotals are acceptable and how they are presented. The revised guidance captures common subtotals that are not specifically This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. -

The Application of Ias 2 Inventories Standard in Accounting Practices, BMIJ, (2020), 8(2): 2414-2430 Doi

Research Article BUSINESS & MANAGEMENT STUDIES: ISSN: 2148-2586 AN INTERNATIONAL JOURNAL Vol.:8 Issue:2 Year:2020, 2414-2430 Citation: Boydas Hazar H., The Application Of Ias 2 Inventories Standard In Accounting Practices, BMIJ, (2020), 8(2): 2414-2430 doi: http://dx.doi.org/10.15295/bmij.v8i2.1496 THE APPLICATION OF IAS 2 INVENTORIES STANDARD IN ACCOUNTING PRACTICES Hülya BOYDAŞ HAZAR 1 Received Date (Başvuru Tarihi): 9/05/2020 Accepted Date (Kabul Tarihi): 22/06/2020 Published Date (Yayın Tarihi): 25/06/2020 ABSTRACT In this study, IAS 2 Inventories standard is examined and the real-world accounting applications related to inventories are presented.IAS 2 Inventories is an Keywords: accounting standard, which is part of the International Financial Accounting Standards (IFRS). It is the framework for the accounting treatment of inventories. Inventory makes IAS 2 up substantial part of the total asset value. Therefore, value determination and presentation IFRS of inventories is a fundamental part of accounting.The contribution of this work is highlighting the components which make up the value of inventories and the importance of Inventory choosing the inventory valuation method in managerial decision making. Moreover, Valuation Methods accounts are suggested for journal entries to record inventory related costs. JEL Codes: M11, M41 MUHASEBE UYGULAMALARINDA UMS 2 STOK STANDARDININ KULLANIMI ÖZ Bu çalışmada, UMS 2 Stoklar standardı incelenmiş ve stoklarla ilgili muhasebe Anahtar Kelimeler: uygulamalarına yer verilmiştir.UMS 2 Stoklar, Uluslararası Finansal Muhasebe Standartlarının (UFRS) bir parçası olan bir muhasebe standardıdır. Stokların UMS 2 muhasebeleştirilmesi ile ilgili temel bilgileri verir. Stoklar, toplam varlık değerinin önemli UFRS bir bölümünü oluşturur. -

IAS 7 STATEMENT of CASH FLOWS Contents 1

IFRS IN PRACTICE 2019-2020: IAS 7 STATEMENT OF CASH FLOWS Contents 1. Introduction 4 2. Definition of cash and cash equivalents 5 2.1. Demand deposits 5 2.2. Short term maturity 6 2.3. Investments in equity instruments 6 2.4. Changes in liquidity and risk 6 2.5 Cryptocurrencies 6 2.6 Short-term credit lending and cash and cash equivalent classification 7 3. Restricted cash and cash equivalent balances – disclosure requirements 8 3.1. Interaction with IAS 1 8 4. Classification of cash flows as operating, investing or financing 9 4.1. Operating activities 9 4.2. Investing activities 9 4.3. Financing activities 9 4.3.1. Disclosure of changes in liabilities arising from financing activities 10 4.4. Classification of interest and dividends 10 4.5. Common classification errors in practice 11 5. Offsetting cash inflows and outflows in the statement of cash flows 13 5.1. Effect of bank overdrafts on the carrying amount of cash and cash equivalents 13 5.2. Refinancing of borrowings with a new lender 14 6. Presentation of operating cash flows using the direct or indirect method 15 7. Income taxes and sales taxes 16 8. Foreign exchange 17 8.1. Worked example – foreign currency translation 17 9. Group cash pooling arrangements in an entity’s separate financial statements 20 10. Securities and loans held for dealing or trading 22 11. Classification of cash flows arising from a derivative used in an economic hedge 23 12. Revenue from Contracts with Customers 24 13. Leases 25 13.1. Payments made on inception of a lease 25 13.2. -

Ifrs-9-Presentation-Of-Interest-Revenue-For-Particular-Financial-Instruments-Mar-18.Pdf

Presentation of interest revenue for particular financial instruments (IFRS 9 Financial Instruments and IAS 1 Presentation of Financial Statements)—March 2018 The Committee received a request about the effect of the consequential amendment that IFRS 9 made to paragraph 82(a) of IAS 1. That consequential amendment requires an entity to present separately, in the profit or loss section of the statement of comprehensive income or in the statement of profit or loss, interest revenue calculated using the effective interest method. The request asked whether that requirement affects the presentation of fair value gains and losses on derivative instruments that are not part of a designated and effective hedging relationship (applying the hedge accounting requirements in IFRS 9 or IAS 39 Financial Instruments: Recognition and Measurement). Appendix A to IFRS 9 defines the term ‘effective interest method’ and other related terms. Those interrelated terms pertain to the requirements in IFRS 9 for amortised cost measurement and the expected credit loss impairment model. In relation to financial assets, the Committee observed that the effective interest method is a measurement technique whose purpose is to calculate amortised cost and allocate interest revenue over the relevant time period. The Committee also observed that the expected credit loss impairment model in IFRS 9 is part of, and interlinked with, amortised cost accounting. The Committee noted that amortised cost accounting, including interest revenue calculated using the effective interest method and credit losses calculated using the expected credit loss impairment model, is applied only to financial assets that are subsequently measured at amortised cost or fair value through other comprehensive income. -

A Roadmap to the Preparation of the Statement of Cash Flows

A Roadmap to the Preparation of the Statement of Cash Flows May 2020 The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, PO Box 5116, Norwalk, CT 06856-5116, and is reproduced with permission. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. The services described herein are illustrative in nature and are intended to demonstrate our experience and capabilities in these areas; however, due to independence restrictions that may apply to audit clients (including affiliates) of Deloitte & Touche LLP, we may be unable to provide certain services based on individual facts and circumstances. As used in this document, “Deloitte” means Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and Deloitte Financial Advisory Services LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Copyright © 2020 Deloitte Development LLC. All rights reserved. Publications in Deloitte’s Roadmap Series Business Combinations Business Combinations — SEC Reporting Considerations Carve-Out Transactions Comparing IFRS Standards and U.S. -

IFRS Example Consolidated Financial Statements 2019

IFRS Assurance IFRS Example Global Consolidated Financial Statements 2019 with guidance notes Contents Introduction 1 19 Cash and cash equivalents 61 IFRS Example Consolidated Financial 3 20 Disposal groups classified as held for sale and 61 Statements discontinued operations Consolidated statement of financial position 4 21 Equity 63 Consolidated statement of profit or loss 6 22 Employee remuneration 65 Consolidated statement of comprehensive income 7 23 Provisions 71 Consolidated statement of changes in equity 8 24 Trade and other payables 72 Consolidated statement of cash flows 9 25 Contract and other liabilities 72 Notes to the IFRS Example Consolidated 10 26 Reconciliation of liabilities arising from 73 Financial Statements financing activities 1 Nature of operations 11 27 Finance costs and finance income 73 2 General information, statement of compliance 11 28 Other financial items 74 with IFRS and going concern assumption 29 Tax expense 74 3 New or revised Standards or Interpretations 12 30 Earnings per share and dividends 75 4 Significant accounting policies 15 31 Non-cash adjustments and changes in 76 5 Acquisitions and disposals 33 working capital 6 Interests in subsidiaries 37 32 Related party transactions 76 7 Investments accounted for using the 39 33 Contingent liabilities 78 equity method 34 Financial instruments risk 78 8 Revenue 41 35 Fair value measurement 85 9 Segment reporting 42 36 Capital management policies and procedures 89 10 Goodwill 46 37 Post-reporting date events 90 11 Other intangible assets 47 38 Authorisation -

Financial Instruments: Recognition and Measurement

International Exposure Draft 38 Public Sector April 2009 Accounting Comments are requested by July 31, 2009 Standards Board Proposed International Public Sector Accounting Standard Financial Instruments: Recognition and Measurement REQUEST FOR COMMENTS The International Public Sector Accounting Standards Board, an independent standard-setting body within the International Federation of Accountants (IFAC), approved this Exposure Draft, “Financial Instruments: Recognition and Measurement,” for publication in April 2009. The proposals in this Exposure Draft may be modified in light of comments received before being issued in final form. Please submit your comments, preferably by email, so that they will be received by July 31, 2009. All comments will be considered a matter of public record. Comments should be addressed to: Technical Director International Public Sector Accounting Standards Board International Federation of Accountants 277 Wellington Street, 4th Floor Toronto, Ontario M5V 3H2 CANADA Email responses should be sent to: [email protected] and [email protected] Copies of this exposure draft may be downloaded free-of-charge from the IFAC website at http://www.ifac.org. Copyright © April 2009 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided that each copy bears the following credit line: “Copyright © April 2009 by the International Federation of Accountants (IFAC). All rights reserved. Used with permission of IFAC. Contact [email protected] for permission to reproduce, store or transmit this document.” Otherwise, written permission from IFAC is required to reproduce, store or transmit, or to make other similar uses of, this document, except as permitted by law.