Ipsas 12—Inventories

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IFRS in Your Pocket 2019.Pdf

IFRS in your pocket 2019 Contents Abbreviations 1 Foreword 2 Our IAS Plus website 3 IFRS Standards around the world 5 The IFRS Foundation and the IASB 7 Standards and Interpretations 15 Standards and Interpretations 24 Summaries of Standards and Interpretations in effect at 1 January 2019 29 Requirements that are not yet mandatory 100 IASB projects 104 Deloitte IFRS resources 111 Contacts 113 IFRS in your pocket |2019 Abbreviations ARC Accounting Regulatory Commission ASAF Accounting Standards Advisory Forum DP Discussion Paper EC European Commission ED Exposure Draft EFRAG European Financial Reporting Advisory Group GAAP Generally Accepted Accounting Principles IAS International Accounting Standard IASB International Accounting Standards Board IASC International Accounting Standards Committee (predecessor to the IASB) IFRIC Interpretation issued by the IFRS Interpretations Committee IFRS International Financial Reporting Standard IFRS Standards All Standards and Interpretations issued by the IASB (i.e. the set comprising every IFRS, IAS, IFRIC and SIC) PIR Post-implementation Review SEC US Securities and Exchange Commission SIC Interpretation issued by the Standing Interpretations Committee of the IASC SMEs Small and Medium-sized Entities XBRL Extensible Business Reporting Language XML Extensible Markup Language 1 IFRS in your pocket |2019 Foreword Welcome to the 2019 edition of IFRS in Your Pocket. It is a concise guide of the IASB’s standard-setting activities that has made this publication an annual, and indispensable, worldwide favourite. At its core is a comprehensive summary of the current Standards and Interpretations along with details of the projects on the IASB work plan. Backing this up is information about the IASB and an analysis of the use of IFRS Standards around the world. -

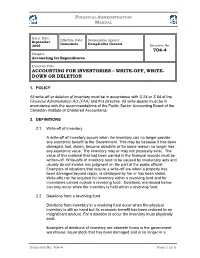

Accounting for Inventories – Write-Off, Write- Down Or Deletion

FINANCIAL ADMINISTRATION MANUAL Issue Date: Effective Date: Responsible Agency: September Immediate Comptroller General 2009 Directive No: 704-4 Chapter: Accounting for Expenditures Directive Title: ACCOUNTING FOR INVENTORIES – WRITE-OFF, WRITE- DOWN OR DELETION 1. POLICY All write-off or deletion of inventory must be in accordance with S.24 or S.64 of the Financial Administration Act (FAA) and this directive. All write-downs must be in accordance with the recommendations of the Public Sector Accounting Board of the Canadian Institute of Chartered Accountants. 2. DEFINITIONS 2.1. Write-off of inventory A write-off of inventory occurs when the inventory can no longer provide any economic benefit to the Government. This may be because it has been damaged, lost, stolen, become obsolete or for some reason no longer has any economic value. The inventory may or may not physically exist. The value of this material that had been carried in the financial records must be written-off. Write-offs of inventory tend to be caused by involuntary acts and usually do not involve any judgment on the part of the public official. Examples of situations that require a write-off are when a property has been damaged beyond repair, is destroyed by fire or has been stolen. Write-offs can be required for inventory within a revolving fund and for inventories carried outside a revolving fund. Deletions, mentioned below, can only occur when the inventory is held within a revolving fund. 2.2. Deletions from a revolving fund Deletions from inventory in a revolving fund occur when the physical inventory is still on hand but its economic benefit has been reduced to an insignificant amount. -

International Accounting Standards

Teacher Guidance for 9706 Accounting on International Accounting Standards Cambridge International AS & A Level Accounting 9706 For examination from 2023 Version 1 In order to help us develop the highest quality resources, we are undertaking a continuous programme of review; not only to measure the success of our resources but also to highlight areas for improvement and to identify new development needs. We invite you to complete our survey by visiting the website below. Your comments on the quality and relevance of our resources are very important to us. www.surveymonkey.co.uk/r/GL6ZNJB Would you like to become a Cambridge International consultant and help us develop support materials? Please follow the link below to register your interest. www.cambridgeinternational.org/cambridge-for/teachers/teacherconsultants/ Copyright © UCLES 2020 Cambridge Assessment International Education is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of the University of Cambridge Local Examinations Syndicate (UCLES), which itself is a department of the University of Cambridge. UCLES retains the copyright on all its publications. Registered Centres are permitted to copy material from this booklet for their own internal use. However, we cannot give permission to Centres to photocopy any material that is acknowledged to a third party, even for internal use within a Centre. Contents Introduction ...............................................................................................................................4 IAS -

The Application of Ias 2 Inventories Standard in Accounting Practices, BMIJ, (2020), 8(2): 2414-2430 Doi

Research Article BUSINESS & MANAGEMENT STUDIES: ISSN: 2148-2586 AN INTERNATIONAL JOURNAL Vol.:8 Issue:2 Year:2020, 2414-2430 Citation: Boydas Hazar H., The Application Of Ias 2 Inventories Standard In Accounting Practices, BMIJ, (2020), 8(2): 2414-2430 doi: http://dx.doi.org/10.15295/bmij.v8i2.1496 THE APPLICATION OF IAS 2 INVENTORIES STANDARD IN ACCOUNTING PRACTICES Hülya BOYDAŞ HAZAR 1 Received Date (Başvuru Tarihi): 9/05/2020 Accepted Date (Kabul Tarihi): 22/06/2020 Published Date (Yayın Tarihi): 25/06/2020 ABSTRACT In this study, IAS 2 Inventories standard is examined and the real-world accounting applications related to inventories are presented.IAS 2 Inventories is an Keywords: accounting standard, which is part of the International Financial Accounting Standards (IFRS). It is the framework for the accounting treatment of inventories. Inventory makes IAS 2 up substantial part of the total asset value. Therefore, value determination and presentation IFRS of inventories is a fundamental part of accounting.The contribution of this work is highlighting the components which make up the value of inventories and the importance of Inventory choosing the inventory valuation method in managerial decision making. Moreover, Valuation Methods accounts are suggested for journal entries to record inventory related costs. JEL Codes: M11, M41 MUHASEBE UYGULAMALARINDA UMS 2 STOK STANDARDININ KULLANIMI ÖZ Bu çalışmada, UMS 2 Stoklar standardı incelenmiş ve stoklarla ilgili muhasebe Anahtar Kelimeler: uygulamalarına yer verilmiştir.UMS 2 Stoklar, Uluslararası Finansal Muhasebe Standartlarının (UFRS) bir parçası olan bir muhasebe standardıdır. Stokların UMS 2 muhasebeleştirilmesi ile ilgili temel bilgileri verir. Stoklar, toplam varlık değerinin önemli UFRS bir bölümünü oluşturur. -

Financial Instruments: Recognition and Measurement

International Exposure Draft 38 Public Sector April 2009 Accounting Comments are requested by July 31, 2009 Standards Board Proposed International Public Sector Accounting Standard Financial Instruments: Recognition and Measurement REQUEST FOR COMMENTS The International Public Sector Accounting Standards Board, an independent standard-setting body within the International Federation of Accountants (IFAC), approved this Exposure Draft, “Financial Instruments: Recognition and Measurement,” for publication in April 2009. The proposals in this Exposure Draft may be modified in light of comments received before being issued in final form. Please submit your comments, preferably by email, so that they will be received by July 31, 2009. All comments will be considered a matter of public record. Comments should be addressed to: Technical Director International Public Sector Accounting Standards Board International Federation of Accountants 277 Wellington Street, 4th Floor Toronto, Ontario M5V 3H2 CANADA Email responses should be sent to: [email protected] and [email protected] Copies of this exposure draft may be downloaded free-of-charge from the IFAC website at http://www.ifac.org. Copyright © April 2009 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided that each copy bears the following credit line: “Copyright © April 2009 by the International Federation of Accountants (IFAC). All rights reserved. Used with permission of IFAC. Contact [email protected] for permission to reproduce, store or transmit this document.” Otherwise, written permission from IFAC is required to reproduce, store or transmit, or to make other similar uses of, this document, except as permitted by law. -

IAS 2 – Inventories

IAS 2 – Inventories By Mr. Conor Foley, B. Comm., MAcc., FCA, Dip IFR Examiner: Formation 2 Financial Accounting This article provides information and application in relation to IAS 2 – Inventories. Inventories – What are they? Inventories, per paragraph 6 of IAS 2 are assets that are a) Held for sale in the ordinary course of business b) In the process of production for such sale; or c) In the form of materials or supplies to be consumed in the production process or in the rendering of services. Inventories per IAS 2 comprise a) Merchandise b) Production Supplies c) Materials d) Work in Progress e) Finished Goods In the case of a service provider, inventories include the costs of the service for which the entity has not yet recognised the related revenue. These costs consist primarily of the labour and other costs of personnel directly engaged in providing the service, including supervisory personnel and attributable overheads. Labour and others costs relating to sales and general administrative personnel are not included but are recognised as expenses in the period in which they are incurred. Valuation of Inventories Inventories are measured at the lower of a) Cost Or b) Net Realisable Value (NRV) Page 1 of 9 Each item of inventory is valued separately. Example 1 Suppose a company has three items of inventories on hand at the year-end. Their costs and NRVs are as follows: Item Cost - € NRV - € Lower of Cost/NRV - € 1 36 40 2 28 24 3 46 48 110 112 Calculate the closing value of inventory at the year-end? Solution Example 1 It would be incorrect to compare the total cost of €110 with total NRV of €112 and state inventories as €110. -

Applying IFRS: Accounting for the Financial Impact of Natural Disasters

Applying IFRS Accounting for the financial impact of natural disasters December 2017 Contents Overview 3 1. Asset impairments 3 2. Insurance recoveries 5 2.1 Property, plant and equipment 5 2.2 Business interruption 8 2.3 Other recoveries 8 2.4 Presentation of insurance proceeds 9 3. Hedge accounting 9 4. Restructuring 10 4.1 Recognition 10 4.2 Measurement 11 5. Decommissioning obligations 12 6. Other considerations 13 6.1 Future operating losses 13 6.2 Onerous contracts 13 6.3 Constructive obligations 14 6.4 Contingent liabilities 14 6.5 Expenditure to be settled by a third party 15 6.6 Going concern 15 7. Classification in the statement of comprehensive income 15 8. Financial statement disclosure requirements 16 8.1 Impairments 16 8.2 Provisions 17 8.3 Contingent liabilities 17 8.4 Contingent assets 17 8.5 Reduced disclosures for seriously prejudicial information 18 8.6 Sources of estimation uncertainty 18 8.7 Subsequent events 19 1 December 2017 Accounting for the financial impact of natural disasters What you need to know • As communities begin the process of recovering from the tragedy of a natural disaster, entities operating in those locations, or providing goods and services in them, raise questions about the related financial reporting effects under IFRS. • Entities may incur impairments to assets both directly and indirectly related to operations in the affected region. • Future operating losses do not meet the definition of a liability and are recognised in periods in which the losses are incurred. • Insurance recoveries are recognised only when it is determined that the entity has insurance cover for the incident and a claim will be settled by the insurer. -

IAS 23 Borrowing Costs

ACCOUNTING SUMMARY 2017 - 05 IAS 23 Borrowing costs Objective Borrowing costs are finance charges that are directly attributable to the acquisition, construction or production of a qualifying asset that forms part of the cost of that asset, i.e. such costs are capitalised. All other borrowing costs are recognised as an expense. Scope The Standard does not apply to the following: (a) actual or imputed cost of equity, including preferred capital not classified as a liability. (b) a qualifying asset measured at fair value, for example a biological asset measured in accordance with IAS 41 Agriculture; or (c) inventories that are manufactured, or otherwise produced, in large quantities on a repetitive basis. Effective date An entity shall apply the Standard for annual periods beginning on or after 1 January 2009. Earlier application is permitted. Defined terms Borrowing costs is interest and other costs incurred by an entity in connection with the borrowing of funds. Examples may include: (a) interest expense calculated using the effective interest rate method as described in IAS 39 Financial Instruments: Recognition and Measurement; (b) finance charges in respect of finance leases recognised in accordance with IAS 17 Leases (IFRS 16 Leases if early adopted or when it becomes effective); and (c) exchange differences arising from foreign currency borrowings to the extent that they are regarded as an adjustment to interest costs. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. Examples may include: (a) inventories (b) manufacturing plants (c) power generation facilities (d) intangible assets (e) investment property (f) bearer plants Accounting summary - 2017 - 05 1 Recognition An entity shall capitalise borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. -

IAS 10 – Events After the Reporting Period

IAS 10 – Events after the Reporting Period By Mr. Conor Foley, B. Comm., MAcc., FCA, Dip IFR Examiner: Formation 2 Financial Accounting This article provides information and application in relation to IAS 10 – Events after the reporting period. Events after the reporting period are those events, favourable and unfavourable that occurs between the end of the reporting period and the date when the financial statements are authorised for issue. Two types of events can be identified i.e. 1. Events that provide evidence of conditions that existed at the end of the reporting period (adjusting events after the reporting period); and 2. Events that are indicative of conditions that arose after the reporting period (non adjusting events after the reporting period). Authorised for issue is generally where the directors of the company have reviewed the financial statements and then instruct that the financial statements can be issued to shareholders and other interested parties. Events after the reporting period include all events up to the date when the financial statements are authorised for issue, even if those events occur after the public announcement of profit or of other selected financial information. An entity shall adjust the amounts recognised in its financial statements to reflect adjusting events after the reporting period. An entity shall not adjust the amounts recognised in its financial statements to reflect non adjusting events after the reporting period. Examples of Adjusting and Non-Adjusting Events Example 1 Ding Dong Limited’s (Ding Dong) financial year ends on 31 December. On 20 December 2013, Ding Dong was involved in a court case with a customer who sued the company for delivering products where there was a dispute over the exact ingredients included in the products manufactured by Ding Dong. -

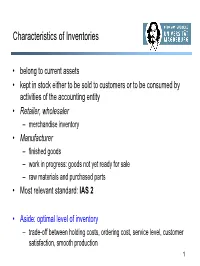

Characteristics of Inventories

Characteristics of Inventories • belong to current assets • kept in stock either to be sold to customers or to be consumed by activities of the accounting entity • Retailer, wholesaler – merchandise inventory • Manufacturer – finished goods – work in progress: goods not yet ready for sale – raw materials and purchased parts • Most relevant standard: IAS 2 • Aside: optimal level of inventory – trade-off between holding costs, ordering cost, service level, customer satisfaction, smooth production 1 The Inventory Balance Equation • Value of inventory at time t = Initial inventory + inflows – outflows up to t – initial inventory: from past period; zero at start of business • depends on valuation method used for inflows and outflows – inflows: valued at cost • same as for fixed assets: „all costs incurred in order to bring the inventories to their present location and condition“ – outflows: different approaches • direct identification • assumed order of depletion • averaging – determine market value of ending inventory and apply balance equation 2 Importance of Inventory Valuation • inventory valuation affects the income statement and the balance sheet • impact on ratios used in financial statement analysis • The Gross Profit Equation: Gross profit = Sales Revenue ⎧ ⎪ -( beginning inventory ⎪ COGS ⎨ ⎪ +purchases ⎩⎪ – ending inventory) • Effect of inventory valuation on gross profit: – closing inventory understated (overstated) Î gross profit for the period understated (overstated) – opening inventory understated (overstated) Î gross profit -

Recognition of Lack of Recoverability of Inventories (US GAAP)

Because Experience Matters Recognition of Lack of Recoverability of Inventories (US GAAP) 546 Fifth Ave, New York, NY 10036 212-808-0070 565 Taxter Road, Elmsford, NY 10523 914-523-2047 [email protected] lhfcpa.com Final Logos co. LHF L Frishkoff Company Accounting Tax Assurance co. LHF L Frishkoff Company Accounting Tax Assurance Accounting for the recognition of lack of recoverability of inventories can be a complex area that often requires the exercise of judgment. Although, US GAAP provides guidance under ASC 330, Inventory, it is the obligation of each entity to establish procedures to comply with the guidance. In this post, we’ll take a deeper dive into accounting for recognition of lack of recoverability of inventories. I. US GAAP – Recognition of Lack of Recoverability A. Lower of Cost or Net Realizable Value ASC 330-10-35-1B Inventory measured using any method other than LIFO or the retail inventory method (for example, inventory measured using first-in, first-out (FIFO) or average cost) shall be measured at the lower of cost and net realizable value. When evidence exists that the net realizable value of inventory is lower than its cost, the difference shall be recognized as a loss in earnings in the period in which it occurs. That loss may be required, for example, due to damage, physical deterioration, obsolescence, changes in price levels, or other causes. Although cost is the primary basis for inventory pricing, a departure from cost is required when the loss of usefulness of an item or other factors indicate that cost will not be recovered when the item is sold. -

IFRS in Your Pocket 2021.Pdf

IFRS in your pocket 2021 Contents Abbreviations 1 Foreword 2 Deloitte Accounting Research Tool (DART) 4 Our IAS Plus website 6 IFRS Standards around the world 8 The IFRS Foundation and the Board 10 Standards, Interpretations and Practice Statements 20 Board projects 127 Deloitte IFRS resources 137 Contacts 139 IFRS in your pocket |2021 Abbreviations ARC Accounting Regulatory Committee ASAF Accounting Standards Advisory Forum DP Discussion Paper EC European Commission ED Exposure Draft EFRAG European Financial Reporting Advisory Group GAAP Generally Accepted Accounting Principles IAS International Accounting Standard IASB/Board International Accounting Standards Board IASC International Accounting Standards Committee (predecessor to the Board) IFRIC Interpretation issued by the IFRS Interpretations Committee IFRS International Financial Reporting Standard IFRS Standards All Standards and Interpretations issued by the Board (i.e. the set comprising every IFRS, IAS, IFRIC and SIC) PIR Post-implementation Review SEC US Securities and Exchange Commission SIC Interpretation issued by the Standing Interpretations Committee of the IASC SMEs Small and Medium-sized Entities XBRL Extensible Business Reporting Language XML Extensible Markup Language 1 IFRS in your pocket |2021 Foreword Welcome to the 2021 edition of IFRS in your pocket. IFRS in your pocket is a comprehensive summary of the current IFRS Standards and Interpretations along with details of the projects on the standard-setting agenda of the International Accounting Standards Board (Board). Backing this up is information about the Board and an analysis of the use of IFRS Standards around the world. This combination has made IFRS in your pocket an annual, and indispensable, worldwide favourite. It is the ideal guide, update and refresher for everyone involved.