Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Product Recalls the Sgs Publication Gathering Consumer Product Recalls in the Eu, in the Usa and in Australia

PRODUCT RECALLS THE SGS PUBLICATION GATHERING CONSUMER PRODUCT RECALLS IN THE EU, IN THE USA AND IN AUSTRALIA CONSUMER TESTING SERVICES (CTS) 01– 15 JULY 2011 CONTENTS ELECTRICAL & ELECTRONICS Pages 2 to 13 Electrical Appliances (15) Lighting Equipments (4) Cord Sets, Plugs & Sockets (2) HARDLINES Pages 14 to 43 Toys (17) Juvenile Items (2) Children articles (2) - See ‘Personal & Home Care Items’ Children articles (1) - See ‘Sports & Leisure Goods’ Children articles (5) - See ‘SOFTLINES’ Home Furnishing & Houseware (13) Home Improvement & DIY (5) Personal & Home Care Items (14) Sport & Leisure Goods (5) PPE (2) SOFTLINES Pages 44 to 50 Wearing Apparels (9) Home Textiles (0) Footwear, Bags and Accessories (4) E&E: ELECTRICAL APPLIANCES NOTIFYING PRODUCT DANGER MEASURES COUNTRY ADOPTED EU/MALTA CATEGORY: Electrical appliances FIRE Voluntary recall PRODUCT The product poses a risk of fire from consumers. Hairdryer "Salon Essential Hairdryer" and "Salon Dry because in rare cases it can Travel Hairdryer" overheat when left plugged into the mains electrical supply, BRAND: Philips even when the appliance is TYPE/NUMBER OF MODEL switched off and not in use. models HP4931 & HP4940. Produced between June The product does not comply 2006 and April 2011. with the Low Voltage Directive DESCRIPTION: Foldable hairdryer. (LVD). COUNTRY OF ORIGIN: China EU/SPAIN CATEGORY: Electrical appliances FIRE Voluntary recall PRODUCT The product poses a risk of fire from consumers. Power Inverter "Soladin 600, Soladin Wind 500 and as a component in the inverter Windmaster 500" may fail. BRAND: Mastervolt The product does not comply with the Low Voltage Directive TYPE/NUMBER OF MODEL (LVD). Models: Soladin 600, Soladin Wind 500 and Windmaster 500, manufactured between May 2006 and September 2008. -

Mapic Insight

mapic insight THE 23RD EDITION OF MAPIC WILL TAKE PLACE ACROSS THREE DAYS DURING 15-17 NOVEMBER AT THE PALAIS DES FESTIVALS IN CANNES, ONCE AGAIN OFFERING THE INTERNATIONAL Courses RETAIL REAL ESTATE INDUSTRY AN OPPORTUNITYTO LEARN ABOUT THE LATEST TRENDS IN THE INDUSTRY, SPARK of Retail DEALS AND EXPAND BUSINESS OPPORTUNITIES. m DREAM ISLAND, MOSCOW, RUSSIA DEVELOPER: REGIONS GROUP ince 1995, MAPIC has been the premier event Food services are largely transforming shopping centres MAPIC 2017 Set to Entertain for industry professionals. Organised by Reed into convivial lifestyle venues. Media companies, film and video game specialists are MIDEM.this edition will feature more than 8,500 The point of sale experience is a vital element in disrupting leisure offerings in shopping centres through participants from across the international retail persuading consumers to go out rather than buy online. partnerships with various commercial real estate Sreal estate sector. For ultra-connected clients, the shopping experience players.The entertainment leader and top international With an extensive exhibition zone set to be on and its associated human encounters are more video game publisher Ubisoft will be taking part in a site, and with two days featuring more than 100 important than the product itself. As a result, traditional panel session during the event to discuss the growing retail conferences, keynote addresses and networking shopping centres are transforming into social sites for concept of the "Family Entertainment Centre". events featuring more than 200 industry experts, meeting others and leisure activities where people This concept is now offering a leisure attraction and MAPIC gives its attendees a chance like no other to come to spend the day. -

Eastern Europe Industrial Footwear in Hungary

. Market Research – Eastern Europe Industrial footwear in Hungary .......... Proexport – Colombia Equipo de Trabajo Dirección de Información Comercial Jorge Luis Gutiérrez – Director Fernando Piñeros – Subdirector Proyectos Especiales Bibiana Gutiérrez – Analista de Inteligencia de Mercados [email protected] www.proexport.gov.co www.proexport.com.co Calle 28 No. 13ª – 15, Piso 35 Tel: (571) 5600100 Fax: (571) 5600118 Bogotá, Colombia GRUPO CONSULTOR EUNITE, Nederland Todos los derechos reservados. Ni la totalidad ni parte de este documento puede reproducirse o transmitirse por ningún procedimiento electrónico o mecánico, incluyendo fotocopias, impresión o grabación. Estimado Empresario: La búsqueda de acuerdos comerciales que nos permitan como país ampliar los escenarios y mercados de exportación, nos reta como PROEXPORT a apoyar en forma directa a los empresarios en sus iniciativas exportadoras, ofreciendo servicios dentro de un modelo del gestión comercial y compartiendo un conocimiento más detallado sobre los mercados y sus oportunidades. Para lograr lo anterior, PROEXPORT, con inversión de recursos propios y de cooperación técnica no-reembolsables del BID-FOMIN, emprendió una labor de recolección y análisis de información de primera mano en los principales mercados de interés a través de la contratación de consultorías internacionales especializadas en investigaciones de mercados. Los resultados de estos trabajos permitieron analizar y conocer la dinámica comercial de los sectores en los cuales existe un potencial para nuestras -

VIENNA Cushman & Wakefield Global Cities Retail Guide

VIENNA Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | 2019 0 Vienna’s historic role as the centre of the Austro-Hungarian Empire has left the nation with an overly large capital city, where a fifth of the population of the country resides. As a consequence of its proximity to Bratislava (Slovakia) and Brno (Czech Republic) Vienna benefits from shopping tourism. On Christmas season weekends, up to 200,000 shopping tourists from neighbouring countries come to Vienna. In 2018, as in the past 8 years, Vienna ranks at the top of a leading international comparative study on the quality of living in different cities, and scores highly in many other rankings. Tourism is extremely strong in Vienna and is relatively unaffected by seasonal fluctuations. In 2018 the number of overnight stays hit a new record high of 16.48 million, and the number of tourists with high purchasing power, in particular from Asia, is increasing. The principal tourist attractions in the city are within the central ring road and surround the prime retail area. Living costs are relatively high in Vienna and this is reflected in the above-average wage levels among those employed there. It is not a place for cheap shopping but does offer numerous elegant shops and quality products. There is an increasing concentration of new luxury brands and flagship stores in the city centre. Some shopping VIENNA streets have risen in attractiveness. City shopping centres have been developed at railway stations, although the city centre is facing more competition from retail parks and OVERVIEW shopping centres on the periphery. -

Šablona Pro Skripta

MASARYKOVA UNIVERZITA EKONOMICKO-SPRÁVNÍ FAKULTA Business Management in the Czech Republic Petr Suchánek, Radoslav Škapa a kol. Brno 2008 Autorský kolektiv: Doc. Ing. Petr Suchánek, Ph.D. (kap. 1) Ing. Radoslav Škapa, Ph.D. (kap. 4, 5) vedoucí autorského kolektivu Ing. Ondřej Částek (kap. 6) Ing. Michael Doleţal (kap. 12) Ing. Lenka Jaterková (kap. 11) Ing. Eva Karpissová (kap. 7) Ing. Eva Kubátová (kap. 9, 10) Ing. Alena Klapalová, Ph.D. (kap. 2, 3) Ing. Petr Valouch (kap. 8) Recenzoval: Doc. Ing. Martin Svoboda, Ph.D. © Petr Suchánek, Radoslav Škapa a kol., 2006, 2008 ISBN 978-80-210-4662-7 CONTENT INTRODUCTION ..................................................................................... 6 1 ECONOMIC TRANSITION OF CORPORATE SECTOR: FROM CENTRAL PLANNED TO MARKET ECONOMY..................................... 7 1.1 The Methods of privatisation .................................................................... 7 1.1.1 Theoretical elements of privatisation ........................................................... 7 1.1.2 Speed of privatisation and restructuring ...................................................... 8 1.1.3 Ownership change and restructuring progress ............................................ 8 1.1.4 Restructuring and the role of the state ........................................................ 9 1.2 Transformation in the Czech Republic ................................................... 10 1.3 Appendix 1 - Situation in the Industry of the Czech Republic after 1997 ..................................................................................................................... -

SERBIAN REAL ESTATE MARKET OVERVIEW H2 2013 Macroeconomic Indicators

SERBIAN REAL ESTATE MARKET OVERVIEW H2 2013 Macroeconomic indicators Economy key facts Macroeconomic Indicators 2008 2009 2010 2011 2012 2013 GDP (EUR bn) 33.2 31.5 33.0 31.1 28.7 31.6 The most significant news for 2013 is that the GDP growth (y-o-y %) 3.8 -3.5 1 1.6 -1.5 2.6 European Union plans to start negotiations with CPI (y-o-y %) 8.6 6.6 10.3 7.0 12.2 2.2 Serbia. Serbian EU accession talks are expected to be Central Bank reference rate 17.8 17.0 8 11.42 9.5 9.5 launched in January 2014. This step will represent a Exports of goods (in mil. EUR) 10,157 8,478 10,070 11,472 11,913 14,375 strong positive signal for all foreign investors to Imports of goods (in mil. EUR) -18,843 -13,404 -14,643 -16,627 -17,211 -18,024 come and invest in Serbia. Public debt (ext.+int. in % of GDP) 29.2 34.7 44.5 48.2 60.0 64.4 External debt to GDP (in %) 64.6 77.7 85.0 76.7 86.9 81.7 Serbia has been able to sustain its economic progress Current account (as % of GDP) -21.6 -6.6 -6.7 -9.1 -10.5 -6.3 as a result of its macroeconomic stability fueled by Population (in mil) 7.5 7.3 7.3 7.1 7.4 7.2 the Serbian government. Increasing private sector Unemployment rate (%) 13.3 16.1 20 23.7 26.5 24.4 participation in Serbia economic structure is another Exchange rate to EUR 89.8 94.2 103.5 102.0 115.0 113,09 key factor that helped the nation to sustain an rising Inflation rate (%) 10.6 9.0 7.2 7 12 4 Average net salary (in EUR) 369.6 330.9 324 363 364 383 real GDP growth. -

AUPO Geographica 41

Acta Universitatis Palackianae Olomucensis – Geographica, Vol. 41, No. 2, 2010, pp. 5-20 5 DEVELOPMENT OF RETAIL GEOGRAPHICAL STRUCTURE IN THE CZECH REPUBLIC: A CONTRIBUTION TO THE STUDY OF URBAN ENVIRONMENT CHANGES 1 Zdeněk Szczyrba 1 Department of Geography, Faculty of Science, Palacký University Olomouc, 17. listopadu 12, 771 46 Olomouc, [email protected] Abstract In the last 20 years of transformation, the Czech retail business underwent fundamental changes in its ter- ritorial and organisational structure and in numerous cases refl ects the model of retail trade transformation within the Central European region. After a long period of time of the development of the so-called socialist trading, the countries in the region were affected, with unprecedented intensity, by new, hitherto unknown forms of retailing within the expansion of foreign retail chains to their markets. Such changes took very marked effect in the urban structure of the landscape in these countries, for example in the Czech Republic. The following paper captures the basic extent of transformation of the Czech retail business and its refl ection in the urban environment. Key words: Czech Republic, internationalisation of retail, urban environment INTRODUCTION joint-ventures and strategic alliances. As a matter of course, they establish their own logistic and distri- Retail trade belongs to the sectors of economy bution centres for supplying the network of their characterised by heavy internationalisation trad- stores. This alone is an interesting geographical ing activities. The essential feature of the current problem allowing the monitoring of complicated retail trade is constant penetration of multina- and ever-changing relations between the manufac- tional retail chains to foreign markets and related turers and the vendors (Birkin et al. -

2006 Annual Report Document De Référence

2006 Annual Report Document de Référence Nagoya TABLE OF CONTENTS COMPANY OVERVIEW 3 Financial highlights 4 The year 2006 6 The outdoor advertising industry 8 One business, three segments 16 Our advertisers 31 Sustainable developement 34 Research and development 43 FINANCIAL STATEMENTS 45 Management discussion and analysis of group consolidated financial statements 46 Consolidated financial statements and notes 56 Management discussion and analysis of corporate financial statements 114 Corporate financial statements and notes 116 LEGAL INFORMATION 139 Corporate governance and internal control 140 Shareholders and trading information 164 Share capital 169 Other legal information 178 COMBINED ANNUAL MEETING OF SHAREHOLDERS, 10 MAY 2007 188 Agenda 189 Summary of proposed resolutions 190 Proposed resolutions 192 OTHER INFORMATION 206 Statutory auditors’ reports 207 Person responsible for the Annual Report and persons responsible for the audit of the financial statements 211 Incorporation by reference In accordance with Article 28 of EU Regulation n°809/2004 dated 29 April 2004, the reader is referred to previous “Documents de référence” containing certain information: 1. Relating to fiscal year 2005: - The Management Discussion and Analysis and consolidated financial statements, including the statutory auditors’ report, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 42 to 113 and 191, respectively). - The corporate financial statements of JCDecaux SA, their analysis, including the statutory auditors’ report, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 114 to 134 and 192, respectively). - The statutory auditors’ special report on regulated agreements with certain related parties, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 193 and 194). -

From the Very Beginning, SES Has Successfully Built Upon Its Roots in the Retail Sector and Has Relied on Competitive Grocery Stores to Serve As Anchor Companies

Company 12 Our Company Profile 14 Milestones in the History of SES 16 Competencies and Services Locations 22 20 Property Portfolio 22 New Openings 30 Refurbishments 31 Joint Ventures Variety 36 Future Talk with Matthias Horx und Marcus Wild 40 Regional Focus 42 Local Supply 44 Retail & Gastronomy 46 Services 50 Event Highlights 52 Sustainability 54 Imprint YEARBOOK 2019/2020 Dear Business Partners, 2019 was a very successful year for SES. Our retail partners across our 29 shopping centers ge- nerated gross sales of EUR 2.83 billion – an increase of 2.5% over the previous year. 2020 has already presented us with a host of new challenges. Our company, along with many others, has been severely impacted by the coronavirus pandemic since March of this year. In cooperation with our retail partners, we are working on fair solutions that will enable our shopping centers to, once again, become thriving business places as soon as possible. Nevertheless, we are extremely pleased with everything that we managed to achieve last year. Let us look back on our joint suc- cesses together. As the market leader for large-scale retail properties in Austria and Slovenia, we intend to remain one of the most successful shopping center operators. To that end, we will continue to make con- sistent investments in the quality of our locations and to expand. In 2019, the refurbishment of existing shopping centers in Slovenia and Croatia was a key area of focus. Another main activity was the construction of the new ALEJA shopping center in the north of Ljubljana, which was com- pleted in March 2020. -

Business Management in the Czech Republic Ing.�Petr�Suchánek,�Ph.D.,�Ing.�Radoslav�Škapa,�Ph.D.,�A�Kolektiv

MASARYKOVA UNIVERZITA EKONOMICKO-SPRÁVNÍ FAKULTA Business Management in the CzechRepublic Petr Suchánek, Radoslav Škapa a kol. Brno 2006 Autorský kolektiv: Ing. Petr Suchánek, Ph.D. (kap. 1) Ing. Radoslav Škapa, Ph.D. (kap. 8, 9, 10) vedoucí autorského kolektivu Ing. Ondřej Částek (kap. 8, 9, 10) Ing. Michael Doležal (kap. 2) Ing. Eva Kubátová (kap. 5) Ing. Alena Klapalová (kap. 6, 7) Ing. Martin Krištof (kap. 3) Ing. Petr Valouch (kap. 4) Recenzoval: Doc. Ing. Martin Svoboda, Ph.D. © Petr Suchánek, Radoslav Škapa a kol., 2006 ISBN 80-210-4147-1 CONTENT INTRODUCTION ..................................................................................... 6 1 ECONOMIC TRANSITION OF CORPORATE SECTOR: FROM CENTRAL PLANNED TO MARKET ECONOMY ..................................... 7 1.1 The Methods of privatisation ....................................................................7 1.1.1 Theoretical elements of privatisation ............................................................7 1.1.2 Speed of privatisation and restructuring .......................................................8 1.1.3 Ownership change and restructuring progress .............................................8 1.1.4 Restructuring and the role of the state ..........................................................9 1.2 Transformation in the Czech Republic ...................................................10 1.3 Appendix 1 - Situation in the Industry of the Czech Republic after 1997 ......................................................................................................................13 -

Directors' Commentary

INTERIM CONDENSED CONSOLIDATED FINANCIAL RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 NEPI Rockcastle plc is incorporated and registered in the Isle of Man with registered number 014178V Registered office: 2nd Floor, 30 Athol Street Douglas, Isle of Man, IM1 1JB Share code: NRP ISIN: IM00BDD7WV31 (‘NEPI Rockcastle’, ‘the Group’ or ‘the Company’) DIRECTORS’ COMMENTARY All information below excludes joint ventures, unless otherwise stated DIRECTORS’ REPORT with ongoing work on a significant development pipeline, including extensions and refurbishments: “NEPI Rockcastle continues to leverage on its strengths and consolidate its position as the dominant, high-quality shopping centre owner with the most • Strong leasing activity during H1 2019, with 319 new lease agreements robust management platform in Europe’s highest growth region. We constantly signed, out of which 246 were renewals and new leases in existing assets, enhance our properties via extension, reconfiguration and modernising capital and the rest are related to developments; expenditure, active asset management and marketing activities. We focus on the implementation of technological solutions that would further enhance our CEE leadership and stakeholder value. We continue to pursue a development • Five extensions and refurbishments finalised in Croatia, Romania and and acquisition pipeline that improves the overall quality of the portfolio and Poland; adds to the business’s long-term sustainability. Our approach balances between pursuing commercial opportunities and maintaining a prudent balance sheet, • Notable brands entering markets where the Group is present include: and we are confident that our dominant position in the CEE will allow us to Body Shop, Lacoste and Ted Baker in Arena Zagreb, Miniso (a Japanese further grow our business.” Alex Morar, CEO. -

Accessguide Template Document

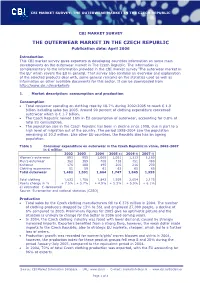

CBI MARKET SURVEY: THE OUTERWEAR MARKET IN THE CZECH REPUBLIC CBI MARKET SURVEY THE OUTERWEAR MARKET IN THE CZECH REPUBLIC Publication date: April 2006 Introduction This CBI market survey gives exporters in developing countries information on some main developments on the outerwear market in The Czech Republic. The information is complementary to the information provided in the CBI market survey ‘The outerwear market in the EU’ which covers the EU in general. That survey also contains an overview and explanation of the selected products deal with, some general remarks on the statistics used as well as information on other available documents for this sector. It can be downloaded from http://www.cbi.nl/marketinfo 1. Market description: consumption and production Consumption • Total consumer spending on clothing rose by 18.7% during 2002-2005 to reach € 1.9 billion including sales tax 2005. Around 90 percent of clothing expenditure concerned outerwear which is € 1.7 billion. • The Czech Republic ranked 16th in EU consumption of outerwear, accounting for 0.8% of total EU consumption. • The population size in the Czech Republic has been in decline since 1998, due in part to a high level of migration out of the country. The period 1998-2004 saw the population remaining at 10.2 million. Like other EU countries, the Republic also has an ageing population. Table 1 Consumer expenditure on outerwear in the Czech Republic in value, 2002-2007 in € million 2002 2003 2004 2005 e) 2006 f) 2007 f) Women’s outerwear 893 955 1,000 1,051 1,113 1,180 Men’s outerwear 362 389 408 428 451 480 Knitwear 176 188 195 206 216 230 Clothing accessories 51 59 61 62 65 65 Total outerwear 1,482 1,591 1,664 1,747 1,845 1,955 Total clothing 1,633 1,756 1,842 1,939 2,054 2,175 Yearly change in % + 7.5% + 5.7% + 4.9% + 5.3% + 5.9% + 6.1% e) estimated f) forecasted Source: Euromonitor and national statistics (CZSO) Production • Total sales by the Czech clothing manufacturers fell to € 376 million in 2004.