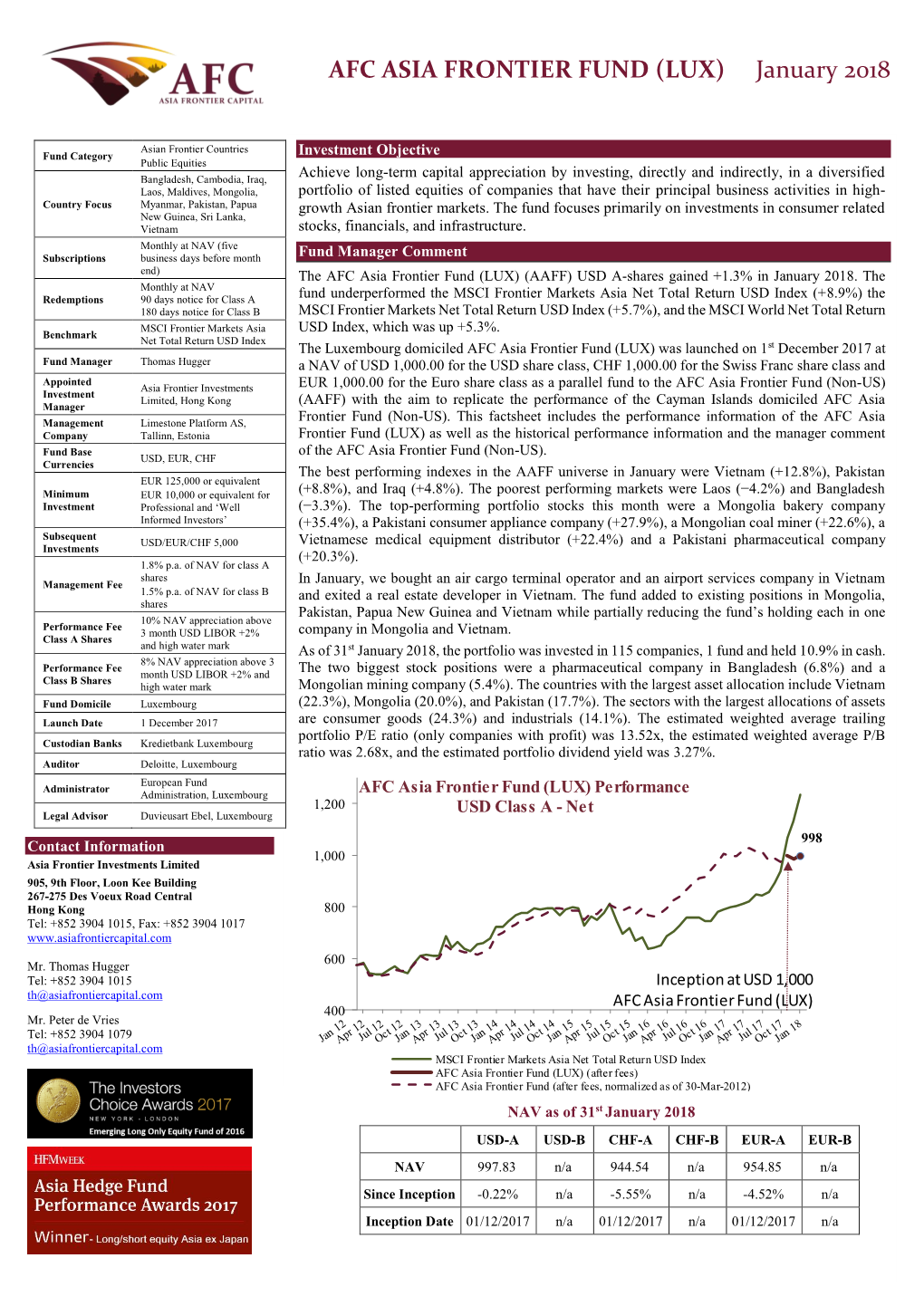

AFC ASIA FRONTIER FUND (LUX) January 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Even North Korea

FRONTIER MARKETS EVEN NORTH KOREA Frontier market investors have arrived in countries under sanctions and embarlroes' such as Iran and Guba, even those without stock markets, such as North Korea and Myanmar. Stefanie Eschenbacher investigates the investment opportunities. NORTH KOREA IS investable, Meanwhile, Myanmar revealed crippled the country. Ramin and this time it is not just a hoax plans to open a stock exchange Rabii, the managing director at Turquoise Partners, which is by a US website - The Onion following nearly half a century once declared the North Korean of military rule. Stocks that give based in Teluan, manages almost all foreign investments in the supreme leader Kim Jong Un "the exposure to Myarunar but are sexiest man alive" (and China's Iisted in third-countries, such Teluan Stock Exchange. "lran is People's Daily fell for it). as Singapore and Thailand, are the most misperceived country on high valuations. COMMUNIST in the world," Rabii says. "The Mongolian oil companY HBOiI already trading CA.PIT.U,: recently established ties with Iran, however, appears to toP There de ethical potential, once salctions are lifted, and reputational the most isolated and secretive the list of desired investments, concerns when it is enormous." comes to coutries its uncertain future and The Teluan Stock Exchange is country of aII, and is now trying despite Iile North Kolea, to entice foreign investors. decades of sanctions that have Iarge and liquid, with a market 26 Autumn 2014 capitalisation of $I45 billion, iron ore, and Khuzestan Steel and Commercial Bank and Baghdad including the junior market. Rabii MCIC, which produce steel and Soft Drinks. -

Opalesque Roundtable Series HONG KONG Opalesque Roundtable Series Sponsor

Opalesque Roundtable Series HONG KONG Opalesque Roundtable Series Sponsor: opalesque.com Editor ’s Note Over the past few years, many hedge funds were struggling in Asia across many different strategies but 2017 has been a phenomenal year for Asian managers. Return dispersion has also been much wider. For example, in Chinese long/short equity the returns could be as low as 5% to 6% and as high as 100%, whereas in previous years dispersion was less and many managers reported negative numbers. On the company level, there are more earnings upgrades than downgrades in Asia. Total hedge fund allocation across all Asian strategies is about 7% of an asset base of 2.5 trillion USD (Eurekahedge), while at the same time Asia likely contributes 60% of incremental Global GDP and attracts 45% of Global FDI. The weightage of Asia in the portfolio for global managers will have to increase by a significant number to reflect those developments. The rebirth of emerging markets Many emerging markets are beginning to have a life of their own. In the past, they have done well in good times, and then when there is a shake out, they experience a wobble. But this is changing now. For the first time, there is a fair amount of divergences or de-correlation within the different emerging markets which reflects the improved fundamentals of these markets . In the past, overnight events in CEEMEA or LatAm would have a large impact on Asia, whereas now that correlation is not there. Even within Asia, for example, Korean market developments are not able to drive China markets or for that matter China is not able to drive the rest of the markets as much as before as each of them have developed a life of their own. -

Afc Vietnam Fund Update

15th July 2019 AFC VIETNAM FUND UPDATE Fund Category Vietnam Public Equities Both indices recovered June’s losses with banks leading the rally on both exchanges. Country Focus Vietnam Market turnover continued to be unexciting with market participants waiting for the Monthly at NAV (five business release of half year results. The indices gained +2.4% in HCMC and +2.0% in Hanoi, while Subscriptions days before month end) our portfolio was little changed with our NAV at around USD 1,819, up 0.2%, according Monthly at NAV Redemptions to internal calculations. 30 days’ notice Benchmark VN Index Market Developments Fund Manager Vicente Nguyen Asia Frontier Capital (Vietnam) The mid-cap index is currently trading around 10% lower than 2 years ago. In Investment Manager Limited, Cayman Islands comparison, the mostly watched Ho Chi Minh City Index is around 25% higher than 2 Asia Frontier Investments Investment Advisor years ago. The mid-cap index has now been stabilizing for a prolonged period and Limited, Hong Kong therefore valuations are again attractive, especially when compared with blue chips. Fund Base Currency USD The risk/reward ratio is certainly in favor of mid-caps and small-caps. Minimum Investment USD 10,000 Subsequent Investments USD 1,000 Management Fee 1.8% p.a. of NAV 12.5% p.a. of NAV appreciation Performance Fee with high watermark Fund Domicile Cayman Islands Launch Date 23 December 2013 Viet Capital Securities, Ho Chi Custodian Bank Minh City Auditor Ernst & Young, Hong Kong Administrator Custom House, Singapore Legal Advisor Ogier, Hong Kong (Vietnam Mid-Cap Index from Dec 2015 to July 2019; Source: Vietcapital Securities) ISIN KYG0133A1673 Overall, we are still in a consolidation pattern with a hard to predict break-out timing. -

AFC ASIA FRONTIER FUND May 2021

AFC ASIA FRONTIER FUND August 2021 Asian Frontier Countries Fund Category Investment Objective Public Equities Bangladesh, Cambodia, Iraq, Achieve long-term capital appreciation by investing in listed equities of companies that have Kazakhstan, Kyrgyzstan, Laos, their principal business activities in high-growth Asian frontier markets. The fund focuses Maldives, Mongolia, Country Focus primarily on investments in consumer related stocks, financials, and infrastructure. Myanmar, Pakistan, Papua New Guinea, Sri Lanka, Uzbekistan, Vietnam Fund Manager Comment Monthly at NAV (five The AFC Asia Frontier Fund (AAFF) USD A-shares increased by 2.5% in August 2021 with a Subscriptions business days before month end) NAV of USD 1,546.35. The fund outperformed the AFC Frontier Asia Adjusted Index (−0.5%) Monthly at NAV and the MSCI Frontier Markets Asia Net Total Return USD Index (+1.6%) but performed in Redemptions 90 days notice for Class A line with the MSCI Frontier Markets Net Total Return USD Index (+2.5%) and the MSCI World 180 days notice for Class B Net Total Return USD Index (+2.5%). The performance of the AFC Asia Frontier Fund A- AFC Adjusted Frontier Asia Benchmark st Index shares since inception on 31 March 2012 now stands at +54.6% versus the AFC Frontier Asia Thomas Hugger Adjusted Index, which is up by 27.9% during the same period. The fund’s annualized Fund Managers Ruchir Desai performance since inception is +4.7%. The broad diversification of the fund’s portfolio has Investment Asia Frontier Investments resulted in lower risk with an annualised volatility of 10.5% and a correlation of the fund versus Manager Limited, Hong Kong Fund Base the MSCI World Net Total Return USD Index of 0.55, all based on monthly observations since USD, EUR, CHF Currencies inception. -

Investment Objective Investor Profile Manager

Fund Category Asian Frontier Countries Investment Objective Public Equities Achieve long-term capital appreciation by investing in listed equities of companies that have their Country Focus Bangladesh, Cambodia, Laos, principal business activities in high-growth Asian frontier markets. Maldives, Mongolia, Myanmar, Pakistan, Papua New Guinea, Sri Lanka, Vietnam Investor Profile Subscriptions Monthly at NAV (five days before month end) Seeking medium and long-term capital appreciation by investing primarily in equity securities of companies with principal activities in Asian frontier markets. Redemptions Monthly at NAV 90 days notice for Class A 180 days notice for Class B Manager Comment on November 2012 Benchmark No applicable benchmark Leopard Asia Frontier Fund (LAFF) USD A-shares gained 0.6% in November 2012, again outperforming the Fund Manager Thomas Hugger MSCI Frontier Markets Asia Index (-1.9%) and grew in line with the MSCI World Index USD (+0.2%). Investment Leopard Capital Management Ltd. In November, indexes performances within the LAFF universe varied greatly: Laos performed best, gaining Manager 12%, followed by Pakistan (+4.7%). The top performing portfolio stocks were a Pakistani food producer Investment Leopard Capital (Hong Kong) Ltd. Advisor (+25.1%), a Myanmar conglomerate (+24.5%), a Vietnamese confectionary producer (+23.8%) and a Fund Base USD, EUR, CHF Vietnamese brewery (+22.5%). Currencies In contrast, Bangladesh (-6.3%) was the worst performing index within the Fund for in November, Minimum USD 100,000 or followed by Mongolia (-5.8%), which experienced its fourth consecutive month of negative growth. MSE Investment EUR 80,000 or CHF 100,000 Top 20 Index is down 30.2% year to date, and according to Bloomberg is the third worst performing index Subsequent USD/EUR/CHF 10,000 globally. -

Asean's Frontier Economies the Next Stage of Growth for Cambodia, Laos, Myanmar and Vietnam 2 Special Edition Asean’S Frontier Dec

December 8, 2016 | bloombergbriefs.com Asean's Frontier Economies The next stage of growth for Cambodia, Laos, Myanmar and Vietnam 2 Special Edition Asean’s Frontier Dec. 8, Economies2016 2 Introduction By Tamara Henderson, Bloomberg Intelligence Economist Asean's frontier economies Cambodia, Laos, Myanmar and Vietnam are among the Inside world's fastest growing. These are the region's low income economies, each at a Big Picture different stage of transformation but all following an export-led growth strategy. This Asean's frontier economies are being makes them vulnerable in the short-term to the particularly challenging external transformed through trade with environment. China: page 3 Low labor costs have attracted foreign direct investment, which spurred the increase in export shares for CLMV countries. This is in contrast with a decline in exports as a Factsheets share of GDP for China and most of Asean over the last decade. Exports amount to Cambodia: page 4 nearly 90 percent of Vietnam's economy compared with one-third in 1995 and about two- Laos: page 5 thirds a decade ago. Exports are almost 70 percent of Cambodia's GDP, more than twice the share in 1995, and 35 percent of Laos's economy compared with 22 percent Myanmar for China. Factsheet: page 6 Open economies are more sensitive to external shocks. Asean's frontier economies are even more vulnerable because CLMV exports and imports tend to be concentrated The country's central bank braces for in a small number of products and markets. The bulk of Cambodia's exports are a deeper slide in the currency: page 7 garments, with the former French colony relying on China, Thailand and Vietnam for more than 60 percent of the inputs for garment production, according to the IMF. -

The Wild Card: Can Frontier Markets Equities Bounce Back? | Frontier Markets, Equities | Financeasia

5/6/2020 The wild card: Can frontier markets equities bounce back? | frontier markets, equities | FinanceAsia Frontier markets The wild card: Can frontier markets equities bounce back? Frontier markets have been among the worst hit amid the coronavirus equities sell-off, but one veteran fund manager believes they have rarely offered better value. By Jackie Horne April 28, 2020 The coronavirus spared many frontier markets from the same infection rates suffered by Western countries, but not their stock markets. In Vietnam, for example, the VN Index fell 26.1% in dollar terms during March, outpacing US benchmark indices such as the Dow Jones Industrial Average, which dropped by 13.74% over the same period. Frontier markets are getting used to it after taking a pounding in recent years. International investors remain firmly focused on their homes markets in the US and Europe, or rapidly opening ones like China. In the following interview, Thomas Hugger, founder and CEO of fund manager Asia Frontier Capital, argues that there has never been a better time to reconsider some of Asia's smallest stock markets. He also wishes the MSCI would re-evaulate its methodologies for upgrading or downgrading countries between its emerging markets and frontier markets index. Hugger's Hong Kong-based group currently operates four funds with $45 million under management: its benchmark AFC Asia Frontier Fund, AFC Iraq Fund, AFC Uzbekistan Fund and AFC Fund. Q. What impact is the coronavirus having on frontier markets? A number of stock exchanges like Sri Lanka and Jordan closed completely. A. There’s a major difference between the stock exchange closures in the two countries. -

Market Review: “Foreigners Tip-Toeing Into the Market” Ahmed Tabaqchali, November 9Th, 2020

Market Review: “Foreigners tip-toeing into the Market” Ahmed Tabaqchali, November 9th, 2020 The market, as measured by the Rabee Securities RSISX USD Index (RSISUSD), declined 1.6% in October, signalling a pause in the five-month recovery from the multi-year lows reached in April. However, in local currency terms the market was flat for the month, suggesting the current pause is likely to develop into a consolidation of recent gains. The 32.2% five-month recovery from the April lows merely takes the market to just short of where it started the year – at the tail end of a brutal five- year bear market. While the equity market’s overly subdued tone in October was similar to that of the prior two months, adjusting for the disruptions to economic activity in the wake of the 40-day Arbaeen pilgrimage, the overall picture suggests a resumption of the multi-month gradual recovery in daily turnover from the lows seen during the big lockdown. Encouragingly, the overall level of turnover was higher than seen during most of 2019 (chart below). 30 ISX Daily Turnover Index 25 Turnover Index 20 10 day MA 15 10 5 0 9 9 9 9 9 9 0 0 0 0 0 -1 1 -1 -1 -1 -1 -2 2 -2 -2 -2 b r- n g t c b r- n g t e p u u c e e p u u c F A J A O D F A J A O (Source: Iraq Stock Exchange (ISX), Asia Frontier Capital, data as of October 30th) Foreigners were active participants in the equity market and continued mostly as net buyers, with the overall buying pattern in line with that of turnover as discussed in the prior paragraph. -

AFC ASIA FRONTIER FUND October 2015

AFC ASIA FRONTIER FUND October 2015 Asian Frontier Countries Fund Category Investment Objective Public Equities Achieve long-term capital appreciation by investing in listed equities of companies that have their Bangladesh, Cambodia, Iraq, Laos, Maldives, Mongolia, principal business activities in high-growth Asian frontier markets. The fund focuses primarily on Country Focus Myanmar, Pakistan, Papua investments in consumer related stocks, financials and infrastructure. New Guinea, Sri Lanka, Vietnam Fund Manager Comment Monthly at NAV (five Subscriptions business days before month AFC Asia Frontier Fund (AAFF) USD A-shares gained +2.1% in October 2015. This month, the end) fund underperformed the MSCI Frontier Asia Index (+3.2%), the MSCI World Index (+7.8%), and Monthly at NAV the MSCI Frontier Index (+3.6%) after outperforming the same indexes in September. The year to Redemptions 90 days notice for Class A 180 days notice for Class B date performance of the AFC Asia Frontier Fund A-shares stands now at +1.4% versus the MSCI MSCI Frontier Markets Asia Frontier Asia Index which is down 11.6% during the same period. Benchmark Index Fund Manager Thomas Hugger The best performing indices within the AAFF universe in October were Vietnam (+8.0%), followed by Pakistan (+6.1%) and Laos / Mongolia (both +0.6%). The poorest performing markets Investment Asia Frontier Capital Ltd., Manager Cayman Islands were Iraq with (-9.9%) and Bangladesh (-5.9%). The top-performing portfolio stocks were a Investment Asia Frontier Investments Ltd., Cambodian junior gold mining company (+40%), followed by a Vietnamese truck producer Advisor Hong Kong (+39.8%), an oil producer from Myanmar (+33.3%), and a Mongolian construction material Fund Base USD, EUR, CHF company (+29%). -

Afc Vietnam Fund Update

15th April 2019 AFC VIETNAM FUND UPDATE Fund Category Vietnam Public Equities Country Focus Vietnam The start to April trading was very uneventful with movements in the stock market Monthly at NAV (five business indices limited and volumes low as investors wait for first quarter earnings results which Subscriptions days before month end) will be published over the next two weeks. The indices in HCMC and Hanoi were both Monthly at NAV Redemptions up a slight +0.2%, while our fund gained +0.3% to USD 1,832, according to internal 30 days’ notice calculations. Benchmark VN Index Fund Manager Vicente Nguyen Market Developments Asia Frontier Capital (Vietnam) Investment Manager Limited, Cayman Islands Most listed companies are holding their AGM’s in April and May, which tend to grab Asia Frontier Investments Investment Advisor investors’ attention. We have already seen the first reactions to these AGM’s with Limited, Hong Kong strong swings in both directions from several companies, some of which we own. With Fund Base Currency USD our diversified portfolio we can avoid this volatility which other investors might not be able to. Minimum Investment USD 10,000 Subsequent Investments USD 1,000 The AGM is an important event for management and shareholders, especially fund managers like us. We use the opportunity for many of our holdings at these meetings Management Fee 1.8% p.a. of NAV to intensify our contacts with the companies’ Chairmen, CEOs, CFOs, chief accountants 12.5% p.a. of AV appreciation and also other shareholders to get more information, particularly to get a better feeling Performance Fee with high watermark about how management are running their businesses. -

Spring Time in Uzbekistan? Political Risk for Frontier Investors Amidst Reform in Uzbekistan

Spring Time in Uzbekistan? Political Risk for Frontier Investors amidst Reform in Uzbekistan Jonathon P Sine 1 | Political Risk in Uzbekistan EXECUTIVE SUMMARY Uzbekistan is emerging as an attractive investment opportunity for frontier investors. Following the fall of the Soviet Union, the country spent years in a low-equilibrium state of autarkic control. During this phase of Uzbekistan’s history, Islam Karimov, the country’s strongman ruler, strove to maintain the country’s stability and sovereignty, while allowing only gradual reform to take place. Karimov’s death in 2016 represented a crucial juncture in the country’s history, as the reform oriented Prime Minister, Shavkat Mirziyoyev, took over control and transitioned the country from a period of slow, evolutionary change to rapid, revolutionary transformation. The hallmarks of Uzbekistan’s reforms thus far have been exchange rate liberalization, reductions to bureaucratic and regulatory excess, partnerships with multilateral development banks, rapprochement with neighbors, and abolition of capital controls. While presenting substantial opportunity, Uzbekistan also carries substantial political risk for frontier investors. Chief amongst these are country, regulatory, and financial risk. The overarching concern within country and regulatory risk is that concentration of power within the executive’s hands fosters the ability for capricious policy changes. While reforms have thus far been positive, the lack of institutional checks on power means reforms could be rolled back. Meanwhile, liquidity risk is the key financial risk in Uzbekistan. With diminutive capital markets and limited numbers of market participants, investors will face high bid-ask spreads and substantial transaction clearing times, particularly if seeking to unload positions under duress. -

Afc Vietnam Fund Update

30th September 2020 AFC VIETNAM FUND UPDATE Fund Category Vietnam Public Equities Vietnam continued to show strength despite increased volatility in developed markets. Country Focus Vietnam Favorable economic news and bullish sentiment from local investors contributed to Monthly at NAV (five business strong gains in the broader market. Indices in Ho Chi Minh City and Hanoi rose +2.7% Subscriptions days before month end) and +6.5% respectively, with small and mid-cap stocks showing similar gains. Our Monthly at NAV Redemptions portfolio also rose strongly, gaining +6.0% (NAV USD 1,880), according to internal 30 days’ notice calculations. This is just around 1% below our all-time high, while the HSX-index is still Benchmark VN Index 25% below its high from early 2018. Despite recent gains, Vietnam shows attractive valuations when compared to other markets in Asia and around the globe, while the Fund Manager Vicente Nguyen valuation of our portfolio is trading at an astonishing discount to the market of roughly Asia Frontier Capital (Vietnam) Investment Manager Limited, Cayman Islands 45%. This might explain why we see increased general interest in Vietnam and in our Asia Frontier Investments fund again. Investment Advisor Limited, Hong Kong Fund Base Currency USD Market Developments Minimum Investment USD 10,000 The market continued its upward trend in September, which started on 27th July 2020. Subsequent Investments USD 1,000 Maybe more important than the start of the latest rally is the fact that despite foreign selling over the past few months, the upward price pressure continued with little Management Fee 1.8% p.a.