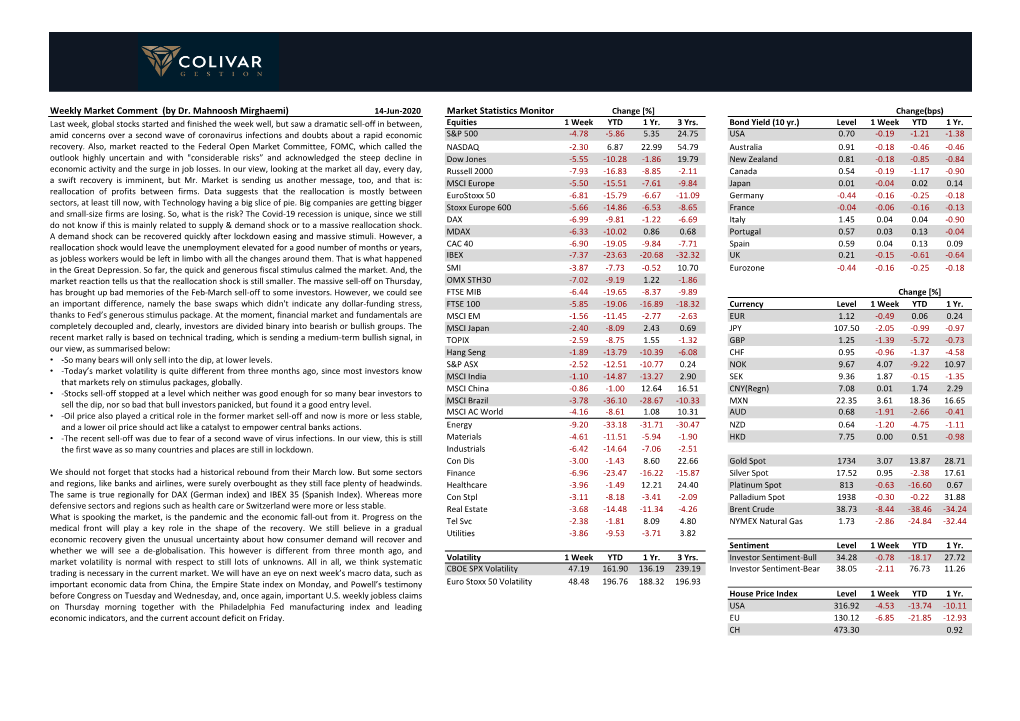

Weekly Market Comment (By Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

European Market Outlook

Market Outlook - 13 July 2021 European stocks shut higher on Monday, lifting a Both B&M and Natwest Group closed the day with a 2.2 considerable lot of the area's benchmarks to new record percent gain. Experian, Land Securities, Sage Group, highs, as financial backers bet on trusts top U.S. banks will Segro, AstraZeneca, Ashtead Group, and United Utilities report a solid second-quarter profit. all increased by 1 to 2%. The Stoxx 600 index in Europe rose 0.69 percent. The Sanofi, WorldLine, Dassault Systemes, Teleperformance, DAX in Germany increased by 0.65%, the CAC 40 in Essilor, Orange, Veolia, LOreal, STMicroelectronics, and France up by 0.46 percent, and the FTSE 100 in the Air Liquide all increased by 1 to 1.6 percent in the French United Kingdom increased by 0.05 percent. The SMI in market. Switzerland increased by 0.77 percent. Among other markets in Europe, Belgium, Czech Republic, On July 19th, British Prime Minister Boris Johnson is Denmark, Finland, Netherlands, Norway, Poland, Portgual, anticipated to endorse the proposal to abolish practically Russia, Spain and Sweden finished higher. all covid-19 limitations, however, he has cautioned the public. Meanwhile, there are concerns that as the virus Ireland and Turkey concluded the day on a low note, while spreads across Europe, many governments will impose Austria, Greece, and Iceland were all flat. new limitations. Admiral Group shares rose about 4% in the UK market According to Destatis data, wholesale prices in Germany after the business stated it expects a higher-than-expected climbed by 10.7% year on year in June, the fastest rate Group profit before tax from continuing operations in the since 1981. -

Is the Cac 40 Responsible?

IS THE CAC 40 RESPONSIBLE? ENGAGEMENT REPORT ANNUAL GENERAL MEETINGS 2020 MORE EFFORTS TO BE MADE Faced with the challenges of our time – climate change, the collapse of biodiversity, the global growth in inequality – the social responsibility of companies and investors is considerable. Responsible investors have a role to play in engaging in a constructive dialogue with companies on key issues that affect their future as well as that of their stakeholders. For this reason, in 2020, the FIR launched its first campaign of written questions, which were submitted to the general meetings of CAC 40 companies. Large companies not only have an impact on the economy but also on the environment and on the social equilibrium of the countries in which they operate. The FIR has therefore chosen to conduct this campaign with the CAC 40 by acquiring one share of each company on the CAC 40. While the FIR’s stock portfolio remains modest, the members of its “Dialogue and Engagement Commission” manage over €4,500 billion in assets, which is somewhat less so. In this campaign, which included 12 questions1 on 12 major social responsibility themes, our assessments were guided by the quality of the response and the seriousness with which companies answered. Although our analyses of the responses are necessarily subjective to a certain extent, this report is based on meticulous work carried out by a group of ESG analysis professionals, based on a detailed and shared analysis grid. We can say straight away that the answers we received did not live up to our expectations. -

Letter to Shareholders APRIL 2016

Letter to shareholders APRIL 2016 Highlights Shaping the Dear shareholders, 2015 KEY Teleperformance set yet another FIGURES record year, with revenue of €3.4 billion and net profit of €200 million, respec- tively up 23.2% and 33.3%. We not only outperformed the market but also REVENUE strengthened our number one global market leadership position. * + 23.2% These tangible results, recorded in a challenging market environment, show the effectiveness of our development strategy based on people, innovation, and expertise. 2015 was also a critical preparatory year for €3,398 M us as the world transitioned full steam ahead toward a new age economy. The digital dawn * reported growth and ever more stringent security standards are a clear advantage for Teleperformance because new and formidable barriers to entry are emerging. From a corporate management perspective, our Board will become younger, more diverse and have a better gender balance with, among its 14 members, 6 women, 9 independent RECURRING EBITA MARGIN directors and 6 different nationalities (related resolutions submitted to your approval at (% OF REVENUE) the Annual General Meeting on April 28, 2016). We are maintaining our successful governance structure, and in view of our solid 10.3% market dynamics, we can be confident in the Group’s long-term outlook. We are targeting €5 billion in revenue in 2020, fueled by commercial wins and highly-selective acquisitions €351 M and alliances. A dividend payment of €1.20 per share, up 30% compared to last year, will be submitted to you for approval at the next Annual General Meeting to be held on April 28, 2016 in Paris. -

FINAL TERMS DATED 5 AUGUST 2021 BNP Paribas Issuance B.V

FINAL TERMS DATED 5 AUGUST 2021 BNP Paribas Issuance B.V. (incorporated in The Netherlands) (as Issuer) Legal entity identifier (LEI): 7245009UXRIGIRYOBR48 BNP Paribas (incorporated in France) (as Guarantor) Legal entity identifier (LEI): R0MUWSFPU8MPRO8K5P83 (Warrant and Certificate Programme) EUR "Open End Turbo" Certificates relating to a Share BNP Paribas Arbitrage S.N.C. (as Manager) Any person making or intending to make an offer of the Securities may only do so: (i) in those Non-exempt Offer Jurisdictions mentioned in Paragraph 37 of Part A below, provided such person is a Manager or Authorised Offeror (as such term is defined in the Base Prospectus and that the offer is made during the Offer Period specified in that paragraph and that any conditions relevant to the use of the Base Prospectus are complied with; or (ii) otherwise in circumstances in which no obligation arises for the Issuer, the Guarantor or any Manager to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or to supplement a prospectus pursuant to Article 23 of the Prospectus Regulation, in each case, in relation to such offer. None of the Issuer, the Guarantor or any Manager has authorised, nor do they authorise, the making of any offer of Securities in any other circumstances. PART A - CONTRACTUAL TERMS Terms used herein shall be deemed to be defined as such for the purposes of the Conditions set forth in the Base Prospectus dated 1 July 2021, each Supplement to the Base Prospectus published and approved on or before the date of these Final -

Notice of Meeting (Brochure)

COMBINED GENERAL MEETING NOTICE OF MEETING FRIDAY APRIL 23, 2021 - 3:00 P.M. WWELCOMEELCOME to the Renault Combined General Meeting Friday April 23, 2021 - 3:00 P.M. The Annual General Meeting will be held in closed session, at the Palais des Congrès, 2, place de la Porte Maillot 75017 Paris. T he Annual General Meeting being held in closed session, Renault invites you to vote by post or online or to give proxy to the Chairman of the Meeting or to any other person . For more information, visit the “Annual General Meeting” section on https://group.renault.com/en/fi nance-2/general-meeting/ FOR ADDITIONAL INFORMATION Hotline dedicated to the General Meeting: - from France at 0 800 109 119 (toll-free number and free services), - from other countries at +33 (0)1 40 14 89 25 (national calling rates). Investors Relations department (Toll-free from France only) Or +33 (0)1 76 84 59 99 (France and abroad) E-mail: [email protected] SUMMARY p.04 I. Agenda of the Annual General Meeting April 23, 2021 p.06 II. Renault i n 2020 p.14 III. Governance of Renault p.35 IV. Compensation of directors and corporate offi cers p.57 V. Explanations and resolutions p.76 VI. Statutory auditors’ reports p.89 VII. How to participate in the Annual General Meeting A WORD FROM THE CHAIRMAN Your Annual General Meeting Dear Madam, Dear Sir, Dear Shareholder, In the context of the unprecedented crisis that we are going through and that marked the year 2020, your support and loyalty are precious assets for Groupe Renault. -

Gb0002771052 En Hk Retai

EUROPEAN FUND THREADNEEDLE INVESTMENT FUNDS ICVC FUND FACTSHEET AS AT 31 AUGUST 2021 OEIC Hong Kong IMPORTANT NOTE: nThreadneedle Investment Funds ICVC – European (the “Fund”) principally invests in the equities of companies domiciled in Continental Europe or which have significant Continental European operations with growth prospects. Contact Details nThe Fund may invest in one or a combination of the following instruments which may involve embedded leverage: fixed Tel: +852 3798 1212* interest securities, other securities and money market securities. Investing in any one of the above instruments may involve *Please note that calls and electronic communications substantial credit/counterparty, market, volatility and liquidity risk. If the issuers default or such instruments, or their underlying may be recorded. assets, cannot be realised or perform badly, investors’ entire investment may be lost. nThe Fund focuses on investing in a single geographical area is subject to higher risks of concentration than Funds following a [email protected] more diversified policy. Fund Manager: Paul Doyle, Frederic Jeanmaire nThe investment decision is yours but you should not invest unless the intermediary which sells you the Fund has advised you Since: Jun-14, Dec-19 that the Fund is suitable for you and has explained why, including how investment in the Fund will be consistent with your investment objectives. Management Co: Threadneedle Inv. Services Ltd. nInvestors should not base their investment decision on this document alone and must refer to the Prospectus of each Fund Fund Inception Date: 30/09/85 prior to investing. Target Benchmark: FTSE World Europe ex UK Fund Currency: EUR Fund Domicile: United Kingdom XD Date: 08-Mar Pay Date: 07-May Portfolio Size: €1,064.0m No. -

International-Investment-Map.Pdf

International Investment in West Virginia AUSTRALIA FRANCE JAPAN TAIWAN UNITED KINGDOM • ALS Environmental • Axens • Diamond Electric Mfg. • APG Polytech • AFAC • CFoam • Constellium • Feroleto Steel Co., Inc. • Alamo Energy Corp. • Incitec Pivot Ltd./Dyno Nobel • Pernod Ricard/Smooth Ambler • Green Metals UKRAINE • Caledonian Alloys • Felman Production • Minova • Teleperformance USA • Hino Motors • Elementis Specialties • Metinvest/Carter Roag Coal • Saint-Gobain/CertainTeed • JPN Precision • Ferguson • Metinvest/United Coal AUSTRIA • Saint-Gobain/Corhart • Kuraray • Ferroglobe • ANDRITZ Separation Inc. • SAFRAN/MorphoTrak • Kureha PGA • LefargeHolcim/Aggregate Industries • Virginia Crews Coal Co. • Sonepar/Hagemeyer NA • K.S. of West Virginia • ProLogic BELGIUM • Veolia Environmental Services • Meiji Corp • Randox Laboratories • Proviron Industries • Mitsubishi Chemical/Matheson • Thistle Processing GERMANY • Mitsubishi Chemical/Lucite International • Williams Lea Tag • Allnex BRAZIL • NGK Spark Plug Mfg. • Braskem SA • Armacell • Nippon Thermostat • Gerdau Ameristeel • Baum America Corp. • Nippon Tungsten USA • Pilgrim’s Pride • Covestro • Okaya • Becker Mining Systems • Okuno International CANADA • Brenntag Mid-South • Bidell Gas Compression • Sanko Denki • Fasloc • Bombardier Services • Teikoku USA/Chempump • Fontaine Engineering • Brookfield Power • Toyota Motor Mfg. • FLYTEG North America LLC • Chrome Deposit • Toyota Tsusho • Fuchs Lubricants • Cobalt Coal • Wheeling-Nisshin • Klöckner-Pentaplast • Hercules, Inc. • Knauf Insulation -

Notice of Meeting Friday June 19, 2020 - 3 P.M

COMBINED GENERAL MEETING NOTICE OF MEETING FRIDAY JUNE 19, 2020 - 3 P.M. WELCOME to the Renault Combined General Meeting Friday June 19, 2020 - 3 P.M. The Annual General Meeting will be held in closed session, at the registered office Given that the Annual General Meeting will be held in closed session, Renault invites you to vote by post or online or to give proxy to the Chairman of the Meeting or to a third party. For more information, visit the “Annual General Meeting” section on www.groupe.renault.com/en/finance/general-meeting/ FOR ADDITIONAL INFORMATION Hotline dedicated to the General Meeting : - from France at 0 800 109 119 (toll-free number and free services), - from other countries at +33 (0)1 40 14 89 25 (national calling rates). Investors Relations department (Toll-free from France only) Or +33 (0)1 76 84 59 99 (France and abroad) E-mail: [email protected] SUMMARY p. 04 I. Agenda Annual General Meeting June 19, 2020 p. 05 II. Renault in 2019 p. 14 III. Governance of Renault p. 30 IV. Compensation of corporate officers p. 57 V. Draft resolutions p. 91 VI. Statutory auditors’ reports p. 107 VII. How to participate in the Annual General Meeting A WORD FROM THE CHAIRMAN Your Annual General Meeting Dear Madam, Dear Sir, Dear shareholder, First of all, I would like to thank you for the confidence and support you have shown in Groupe Renault. During the period of refoundation that the Group is going through, your commitment is a strength. We are going through a major health and economic crisis. -

Fidelity® Variable Insurance Products: Overseas Portfolio

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Overseas Portfolio September 30, 2020 VIPOVRS-QTLY-1120 1.808774.116 Schedule of Investments September 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.4% Shares Value Shares Value Australia – 0.0% France – 9.8% National Storage (REIT) unit 1 $ 1 ALTEN (a) 88,970 $ 8,449,343 Amundi SA (b) 104,310 7,362,355 Austria – 0.3% Capgemini SA 116,920 15,044,843 Erste Group Bank AG 196,500 4,118,157 Dassault Systemes SA 55,500 10,395,088 Mayr‑Melnhof Karton AG 1,900 330,138 Edenred SA 245,353 11,046,302 Kering SA 21,108 14,047,007 TOTAL AUSTRIA 4,448,295 Legrand SA 142,900 11,423,089 LVMH Moet Hennessy Louis Vuitton SE 56,433 26,405,042 Bailiwick of Jersey – 1.3% Pernod Ricard SA 80,000 12,770,325 Experian PLC 320,000 12,023,801 Sanofi SA 223,515 22,398,850 Glencore Xstrata PLC 392,700 814,136 SR Teleperformance SA 58,360 18,036,614 Sanne Group PLC 991,298 8,403,827 Total SA 50,642 1,739,176 TOTAL BAILIWICK OF JERSEY 21,241,764 TOTAL FRANCE 159,118,034 Belgium – 0.7% Germany – 7.2% KBC Groep NV 208,968 10,483,744 adidas AG 51,764 16,756,703 UCB SA 7,200 818,839 Allianz SE 75,900 14,560,373 Bayer AG 136,853 8,442,973 TOTAL BELGIUM 11,302,583 Bertrandt AG 18,195 689,047 Delivery Hero AG (a) (b) 6,800 782,277 Bermuda – 2.0% Deutsche Borse AG 79,200 13,910,134 Credicorp Ltd. -

VIRTUS ALLIANZGI GLOBAL DYNAMIC ALLOCATION FUND SCHEDULE of INVESTMENTS (Unaudited) JUNE 30, 2021

VIRTUS ALLIANZGI GLOBAL DYNAMIC ALLOCATION FUND SCHEDULE OF INVESTMENTS (Unaudited) JUNE 30, 2021 ($ reported in thousands) Par Value Value Par Value Value Par Value Value U.S. GOVERNMENT SECURITIES—1.1% Netherlands—continued United States—continued U.S. Treasury Bonds NXP B.V. 144A Athene Global Funding 1.875%, 2/15/51 $ 362 $ 346 3.400%, 5/1/30(1) $75$ 82 144A U.S. Treasury Notes (1) 539 2.550%, 6/29/25 $60$ 63 0.875%, 6/30/26 95 95 144A (1) 1.250%, 6/30/28 30 30 Puerto Rico—0.3% 2.500%, 3/24/28 40 41 1.625%, 5/15/31 133 135 Popular, Inc. Avnet, Inc. 6.125%, 9/14/23 165 178 3.000%, 5/15/31 75 75 TOTAL U.S. GOVERNMENT SECURITIES Bank of America Corp. (Identified Cost $586) 606 South Korea—0.4% 2.456%, 10/22/25 145 152 LG Chem Ltd. 144A 2.496%, 2/13/31 130 133 CORPORATE BONDS AND NOTES—21.3% 1.375%, 7/7/26(1) 200 198 Berkshire Hathaway Finance Corp. Austria—0.0% United Kingdom—0.6% 2.850%, 10/15/50 21 21 Suzano Austria GmbH BAE Systems plc 144A Boeing Co. (The) (1) 3.750%, 1/15/31 30 31 3.400%, 4/15/30 80 87 2.196%, 2/4/26 91 92 Natwest Group plc 3.625%, 2/1/31 65 70 Canada—0.0% 2.359%, 5/22/24 200 206 Booking Holdings, Inc. Cenovus Energy, Inc. Vodafone Group plc 4.625%, 4/13/30 60 72 3.800%, 9/15/23 20 21 5.125%, 6/4/81 45 46 Boston Gas Co. -

CAC 40 Companies, Paris EUROPLACE and Finance For

CAC 40 companies, Paris EUROPLACE and Finance for Tomorrow Join the French Ministry of Economy, Finance and the Recovery, Euronext, and the French Market Authority in Support of the TCFD Recommendations New endorsements underscore progress on climate-related financial disclosures on the five-year anniversary of the Paris Agreement Paris, December 12, 2020 – Today the 40 largest listed companies in France in the CAC 40 index declared their support for the recommendations of the Task Force on Climate- Related Financial Disclosures (TCFD), demonstrating a commitment to building a more resilient financial system and safeguarding against climate risk through better disclosures. There has been substantial progress in the “mainstreaming” of the Task Force’s recommendations, with support for the TCFD recommendations growing from just 100 CEOs in June 2017 to more than 1,600 supporters today. Nearly 60% of the world’s 100 largest public companies support the TCFD, report in line with the recommendations, or both, and the number of supporters for the TCFD recommendations has increased 85% in the past year. The statement of support was signed by Bruno Le Maire (French Minister of Economy, Finance and the Recovery, France) and Olivia Grégoire (Secretary of State for Social Economy), Augustin de Romanet (Chairman, Paris EUROPLACE), Thierry Déau (Chairman, Finance for Tomorrow), Stéphane Boujnah (CEO and Chairman of the Managing Board, Euronext) and Robert Ophèle (Chairman, French Market Authority). This announcement coincides with the five-year anniversary of the Paris Agreement and was discussed at the One Planet Finance follow-up meeting hosted by President of the French Republic Emmanuel Macron. -

Letter to Shareholders MAY 2017 Inspiring Impact

Letter to shareholders MAY 2017 inspiring impact Dear Shareholder, 2016 KEY 2016 was not only another record year of growth, but also, truly, a transformational FIGURES year for Teleperformance. Teleperformance delivered a robust financial performance, with €3.6 billion in revenue, up +7.4% vs. 2015, a significant increase in recurring REVENUE EBITA margin, to 11.2%, and sustained cash generation. + 7.4% Teleperformance’s transformation has been remarkable on all fronts: • Sustained Innovation, with our TPClient® integrated omnichannel solutions, our initiatives in Artificial Intelligence, and the development of our advanced predictive models; €3,649 M • Geographic Expansion, notably in our key markets in Asia; • Transformational Acquisition, with the September 2016 purchase of LanguageLine Solutions (LLS), a U.S. company delivering, with its 8,000 online interpreters, mission-critical online interpretations by phone and video; • Enhanced Profile and Status, as a worldwide leader in customer experience management RECURRING EBITA MARGIN expanding in high-value specialized services. (% OF REVENUE) These performances and achievements allow us to be confident in the Group’s long-term outlook and to set our sights on the following challenging but reasonable objectives for 2020: revenue in excess of €5 billion through above-market organic growth and targeted acquisitions, and an EBITA 11.2% margin before non-recurring items of at least 14%. The Board of Directors invites you to approve a 2016 dividend of €1.30 per share, up compa- €408 M red with last year. The Board will also submit to your vote the renewal of the terms of office of three directors, the purpose being to sustain the Board’s diversity in terms of expertise, skills and nationalities, its balance in terms of gender representation, and its independence.