Audited Financial Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Making the Right Move

MAKING THE RIGHT MOVE Investing and Creating Jobs in the Pittsburgh Region REAL PITTSBURGH REAL PEOPLE Looking Ahead: 2014 and Beyond Imagining a Bright Future for Our Region – and Making it Happen By Charles E. Bunch In many ways, the Pittsburgh region has com- Boomers. We’re seeing this on our job search engine within Imag- pleted the economic, environmental and qual- inePittsburgh.com, where the number of open jobs across the 10- ity-of-life transformation begun 30 years ago. county Pittsburgh region numbered around 25,000 at last count. We bottomed out in 1983, with an unemploy- ment rate over 18 percent. Throughout 2013, The Conference is addressing this opportunity in a variety of ways, in- WHEN YOU INVEST IN THE cluding through our robust talent attraction and retention initiative, COMMUNITY, THE RETURNS our jobless rate outperformed the state and the nation as a whole. We’re closing the year with the largest workforce which includes ImaginePittsburgh.com. We’re also working with ARE GUARANTEED. in regional history – about 100,000 more people employed than at our partners in workforce development to increase the supply of trained At Huntington, we know how important it is to give back to workers in the region. One such program, ShaleNET, has been such the community. After all, we do more than just work here – we industrial peak in 1979. live and raise our families here too. And after everything this a success that the federal government has increased its investment to community has done for us, we’re just happy to be able to We are enjoying the fruits of three decades of hard work by countless expand it to other states. -

Palumbo-Donahue School of Business 2015-2016 Graduate Outcomes

Palumbo-Donahue School of Business 2015-2016 Graduate Outcomes NUMBER OF RESPONDENTS RESPONDENTS ATTENDING AVERAGE MAJOR RESPONDENTS EMPLOYED GRADUATE SCHOOL SALARY TOP EMPLOYERS Bachelor’s Degree Accounting 61 59% 26% $49,283 BNY Mellon, Deloitte, EY, KPMG, PNC, PwC, Schneider Downs, ThermoFisher Scientific Economics 6 67% 33% $50,000 Craneware, Henderson Brothers, PNC Entrepreneurship 3 33% 33% Dick’s Sporting Goods Finance 31 64% 16% $51,038 Deloitte, Federated Investors, Hudson Companies, PNC, Rockwell Automation Information Systems 23 96% 4% $55,450 Duquesne Light, Federated Investors, Management Giant Eagle, Pittsburgh Pirates, PNC, UPMC International Business 7 71% $51,500 Amazon, Hertz, Westinghouse Electric Legal Studies 3 100% Management 13 69% 15% $45,450 American Eagle, Brookstone Inc., Embassy Suites, Macy’s, PNC Marketing 24 67% 16% $46,409 ADP, Diamond Kinetics, MARC USA, PNC Sports Marketing 6 67% $39,333 Ferguson, Fragasso Financial Advisors, Tesla Motors Supply Chain Management 41 78% 7% $56,930 Amazon, Bechtel Plant Machinery, Cisco Systems, Lockheed Martin, PPG, Wabtec, Wesco Distribution Master’s Degree Accountancy 5 100% $49,333 Deloitte, EY, KPMG Business Administration 31 74% 6% $76,881 Bayer, BNY Mellon, Cigna, Federated Investors, FedEx PNC, United States Steel Information Systems 5 60% 20% $65,333 Apple, PNC Sustainability 5 60% AECOM, BNY Mellon, Idea Foundry Palumbo-Donahue School of Business 2015-2016 Graduate Outcomes AUGUST 2015, DECEMBER 2015 AND MAY 2016 GRADUATES Profile information is based on student -

Interaction-Spring 08:Interaction-Spring 08

A QUARTERLY PUBLICATION OF THE EPILEPSY FOUNDATION WESTERN/CENTRAL PENNSYLVANIA Spring 2008 www.efwp.org 20th20th AAnniversary!nniversary! Pittsburgh Fun Run/Walk Going 20 Years Strong EPILEPSY FOUNDATION WESTERN/CENTRAL PENNSYLVANIA Western PA Office: Central PA Office: 1501 Reedsdale Street 900 South Arlington Avenue Suite 3002 Suite 126 Pittsburgh, PA 15233 Harrisburg, PA 17109 TOLL FREE: 1-800-361-5885 TOLL FREE: 1-800-336-0301 PHONE: 412-322-5880 PHONE: 717-541-0301 FAX: 412-322-7885 FAX: 717-541-1202 WEBSITE: www.efwp.org EMAIL: [email protected] South Central PA Office: TDD EOP/AUX AID: 1-800-855- 2880 1450 Scalp Avenue Suite 1150 Northwest PA Office: Johnstown, PA 15904 915 State Street PHONE:814-262-7494 Suite 101 Erie, PA 16501 A copy of our official registration and financial information may be obtained from the PHONE: 814-451-1135 Pennsylvania Department of State by calling toll free, within Pennsylvania, 1-800-732-0999. FAX: 814-451-1150 Registration does not imply endorsement. Policy Board Tom Trimm, Esq. Denis McCarthy James Valeriano, M.D. President Karin A.Vanek Team Aiden came out in full force for the 19th annual Pittsburgh Pirates Fun Run/Walk last year. Justin Yakovac Claudio F. Abreu, Ph.D. Sharon Aulicino Board of Governors Dick Barton Douglas Dick Joyce Bender Steve Morris Louis Catalano, M.D. Rich Ryan Fun Run/Walks All Tom Chakurda Advisory Board James D. Chiafullo Barbara Johanson Patricia Crumrine, M.D. Bobbie Martha Eugene DeFrank C. James Parks Kristin Lesker Eisel Across the State! Ronald Rohm Julie Faneca James Valeriano, M.D. -

Download the Report Here

20 20 MANAGED CARE ® 1987 SINCE DIGEST SERIES Pittsburgh Business Group on Health Type 2 Diabetes Report™ Featuring Demographic, Utilization, Charge, and Pharmacotherapy Data With a Focus on Patients With Commercial Insurance Coverage 13th Edition www.pbghpa.org PBGH TYPE 2 DIABETES REPORT™ INTRODUCTION Sanofi U.S. (Sanofi) and the Pittsburgh Business Group on Health (PBGH) Most of the data in this report (current as of calendar year 2019) were are pleased to present the 13th edition of the Type 2 Diabetes Report™, gathered by IQVIA, Durham, NC, a leading provider of innovative health an overview of key demographic, utilization, charge, pharmacotherapy, care data products and analytic services. A review process takes place, and health outcome measures for Type 2 diabetes patients in Pittsburgh before and during production of this report, between IQVIA and Forte and western Pennsylvania (Erie and Johnstown), as well as parts of Ohio Information Resources LLC. (Youngstown) and West Virginia (Wheeling). The report also provides Sanofi, as sponsor of this report, maintains an arm’s-length relationship supplemental data on patients with respiratory conditions as well as IQVIA’s with the organizations that prepare the report and carry out the research state and national benchmarks, which help providers and employers better for its contents. The desire of Sanofi is that the information in this report be identify opportunities to serve the needs of their patients. All data are drawn completely independent and objective. from the Sanofi Managed Care Digest Series®. PBGH EMPLOYER MEMBERS 84 Lumber Company Civil & Environmental Ellwood Group, Inc. Mitsubishi Electric Power Specialty Tires of America Allegheny County Consultants, Inc. -

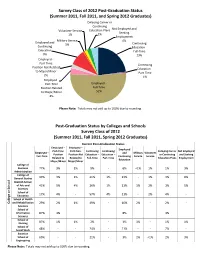

Survey Class of 2012 Post-Graduation Status (Summer

Survey Class of 2012 Post-Graduation Status (Summer 2011, Fall 2011, and Spring 2012 Graduates) Delaying Career or Continuing Not Employed and Volunteer Service Education Plans Seeking 1% 2% Employment Military Service 4% Employed and 1% Continuing Continuing Education - Education Full-Time 9% 23% Employed - Part-Time Continuing Position Not Related Education - to Major/Minor Part-Time 2% 1% Employed - Part-Time Employed - Position Related Full-Time to Major/Minor 52% 4% Please Note: Totals may not add up to 100% due to rounding. Post-Graduation Status by Colleges and Schools Survey Class of 2012 (Summer 2011, Fall 2011, Spring 2012 Graduates) Current Post-Graduation Status Employed – Employed – Employed Part-Time Part-Time Continuing Continuing Delaying Career Not Employed Employed – and Military Volunteer Position Position Not Education – Education – or Continuing and Seeking Full-Time Continuing Service Service Related to Related to Full-Time Part-Time Education Plans Employment Education Major/Minor Major/Minor College of Business 77% 3% 1% 9% - 6% <1% 1% 1% 3% Administration College of General Studies 49% 3% 1% 21% 1% 13% - 1% 3% 8% Dietrich School of Arts and 41% 5% 4% 26% 1% 11% 1% 2% 3% 5% Sciences School of Education 17% 4% - 57% 4% 11% - 2% 4% - School of Health College orSchool College and Rehabilitation 29% 2% 1% 49% - 16% 2% - 2% - Sciences School of Information 87% 3% - - - 8% - - 3% - Sciences School of Nursing 87% 1% 1% 2% - 3% 3% - 1% 1% School of Social Work 48% - - 24% - 21% - - 7% - Swanson School of 69% - - 21% - 3% 2% <1% 2% 3% Engineering Please Note: Totals may not add up to 100% due to rounding. -

Executive Branch—2009 Registrations by Lobbyist Name

03/17/10 12:03:09 EXECUTIVE BRANCH—2009 REGISTRATIONS BY LOBBYIST NAME Aaron, Lisa . 850/412-0300 Greentree Group, The 413 N Meridian St, Tallahassee, FL 32301 1360 Technology Court Ste 100, Beavercreek, OH 45430 Lobbying Firm(s): Industry Code: 541512 Effective: 11/24/2009 One Eighty Consulting Harvest Technology Group, Inc 413 N Meridian St, Tallahassee, FL 32301 3510 Old Milton Pkwy, Alpharetta, GA 30005 Phone: 850/412-0300 Industry Code: 541512 Richwood Governmental Consultants, LLC Effective: 02/12/2009 413 N Meridian St, Tallahassee, FL 32301 Insight Public Sector Phone: 850/412-0300 6820 S Harl Ave, Tempe, AZ 85283 Industry Code: 423430 Principal(s): Effective: 01/02/2009 AAJ Technologies Inspired Technologies 6301 NW 5th Way Ste 1700, Fort Lauderdale, FL 2700 Blairstone Rd Ste E, Tallahassee, FL 32301 33309 Industry Code: 541511 Industry Code: 541511 Effective: 04/21/2009 Effective: 01/02/2009 Intel Corporation AirTight Network, Inc Building Chandler 7, 5000 W Chandler Blvd, 339 N Bernardo Ste 200, Mountain View, CA Chandler, AZ 85226 94043 Industry Code: 334413 Industry Code: 334210 Effective: 01/02/2009 Effective: 03/13/2009 KPMG LLP Asysco 111 N Orange Ave Ste 1600, PO Box 3031, 3301 Thomasville Rd, Tallahassee, FL 32308 Orlando, FL 32802 Industry Code: 541512 Industry Code: 541219 Effective: 01/02/2009 Effective: 01/02/2009 BDNA McAfee, Inc 339 N Bernardo Ave, Mountain View, CA 94043 3965 Freedom Circle, Santa Clara, CA 95054 Industry Code: 511210 Industry Code: 511210 Effective: 01/02/2009 Effective: 01/27/2009 Blue Coat Systems, Inc. Metatomix, Inc 420 N Mary Ave, Sunnyvale, CA 94085 3 Allied Dr Ste 210, Dedham, MA 02026 Industry Code: 334210 Industry Code: 511210 Effective: 01/02/2009 Effective: 01/02/2009 BMC Software, Inc Novell, Inc 8401 Greensboro Dr Ste 100, McLean, VA 22102 1800 S Novell Place PRV-C111, Provo, UT 84606 Industry Code: 511210 Industry Code: 511210 Effective: 01/02/2009 Effective: 12/18/2009 Brandt Information Services, Inc Panasonic Computer Solutions Co., Unit of 1377 Cross Creek Circle, Tallahassee, FL 32301 Panasonic Corp. -

Vision Is the Art of Seeing the Invisible.”

Seeing the Invisible 2004 ANNUAL REPORT “Vision is the art of seeing the invisible.” Jonathan Swift Our Mission: Cure leukemia, lymphoma, Hodgkin’s disease and myeloma, and improve the quality of life of patients and their families. 2 In 1949, the de Villiers, parents who had lost a child to leukemia, were able to “see” something that existed only in their minds’ eyes: a cure for the disease that took the life of their son. Their vision grew, supported by the belief that only through research of the highest caliber would cures be found. Over the years, exceptional people have shared the de Villiers’ art — the ability to see cures for leukemia, lymphoma and myeloma that only now, more than a half century later, are increasingly visible. The vision of these people, most of them volunteers, has advanced the course of research that has led to longer and better lives for patients battling blood cancers. This year’s annual report recalls the history of The Leukemia & Lymphoma Society’s vision and celebrates the promise that today’s research holds for blood cancer patients — the hope for a future in which cures for leukemia, lymphoma and myeloma are no longer the purview of the visionary, but are crystal clear for all to see. Dwayne Howell John Kamins President & CEO Chairman 3 Into the Light The Society is the world’s leading voluntary health organization fighting blood cancers. The size and scope of its blood cancer research programs are unparalleled in the nonprofit sector. In the mid-1940s, when the de Villiers family lost their son, Robert, to acute leukemia, the only thing known for certain about the disease was that it was fatal. -

Annual Report08

08_AR_build.qxd:Layout 1 3/23/09 1:04 PM Page 1 ANNUAL REPORT08 ALLEGHENY CONFERENCE ON COMMUNITY DEVELOPMENT AND ITS AFFILIATES GREATER PITTSBURGH CHAMBER OF COMMERCE PENNSYLVANIA ECONOMY LEAGUE OF SOUTHWESTERN PENNSYLVANIA PITTSBURGH REGIONAL ALLIANCE About the Conference ounded in 1944, the Allegheny Con - Three affiliated organizations, each staffed The PITTSBURGH REGIONAL ALLIANCE Fference on Community Development by the Conference, provide research and (PRA), a 10-county regional economic is one of the nation’s leading economic analysis, advocacy and marketing to realize development partnership, markets south - and community development organiza - the vision of the Conference leadership. western Pennsylvania to companies tions. Combining strong private sector across the region and around the world The PENNSYLVANIA ECONOMY LEAGUE OF leadership with commitment from public to attract capital investment and stim - SOUTHWESTERN PENNSYLVANIA provides sector partners, we work to stimulate eco - ulate job creation. public policy research and analysis on the nomic growth and improve the Pittsburgh most critical issues for our region’s com - region’s quality of life. Our strategic focus petitiveness. is on creating a more competitive busi - ness climate and marketing the Pitts - The GREATER PITTSBURGH CHAMBER OF burgh region for investment and job COMMERCE, working with private and creation. The Conference relies upon the public sector partners, serves as our re - Regional Investors Council – leaders of gion’s chief advocate at all levels of gov - more than 300 companies and organiza - ernment to secure public sector investment tions – to provide time, talent and re - and legislative and regulatory improve - sources to advance our agenda. ments to our business climate. -

Annual Report Are a Result of the Hard Work and Generosity of Our Agency and Corporate Partners, Donors, and Volunteers

Answering The Call United Way of Southwestern Pennsylvania UNITED WAY OF SOUTHWEstERN PENNSYLVANIA 2017 REPORT TO THE COMMUNITY Dear Friends, What if you felt so alone, you didn’t know where to turn? What if you were hungry, in jeopardy of losing your home, your heat, your dignity? What if you returned home after serving your country and felt lost? What if your child had all the potential in the world and no resources to realize it? These are the problems facing many people in our community, but there is an answer. United Way of Southwestern PA is answering the call. By mobilizing thousands of volunteers, donors, corporate and community leaders across Allegheny, Westmoreland, Fayette and Southern Armstrong counties, we are fighting for the health, education and financial stability of everyone in our community. We are truly helping people and our whole community. The successes captured in this 2017 Annual Report are a result of the hard work and generosity of our agency and corporate partners, donors, and volunteers. We thank you for working with us to answer the call. Bob Nelkin Karen Larrimer President and CEO Board Chair United Way of United Way of Southwestern Pennsylvania Southwestern Pennsylvania United Way of Southwestern Pennsylvania United, we have improved thousands of lives in our community 165,336 hard-working, low-income families including veterans and women in crisis, were helped to improve financial stability, prevent hunger and homelessness, and provide access to basic needs, help to overcome financial hardship, and assistance to secure employment. 167,669 children were served through United For Children initiatives, including programs to improve health, mentoring to keep kids on track and prepared for high school, improved reading proficiency and school readiness, and increasing attendance rates among kids so they can be successful in school. -

USCIS - H-1B Approved Petitioners Fis…

5/4/2010 USCIS - H-1B Approved Petitioners Fis… H-1B Approved Petitioners Fiscal Year 2009 The file below is a list of petitioners who received an approval in fiscal year 2009 (October 1, 2008 through September 30, 2009) of Form I-129, Petition for a Nonimmigrant Worker, requesting initial H- 1B status for the beneficiary, regardless of when the petition was filed with USCIS. Please note that approximately 3,000 initial H- 1B petitions are not accounted for on this list due to missing petitioner tax ID numbers. Related Files H-1B Approved Petitioners FY 2009 (1KB CSV) Last updated:01/22/2010 AILA InfoNet Doc. No. 10042060. (Posted 04/20/10) uscis.gov/…/menuitem.5af9bb95919f3… 1/1 5/4/2010 http://www.uscis.gov/USCIS/Resource… NUMBER OF H-1B PETITIONS APPROVED BY USCIS IN FY 2009 FOR INITIAL BENEFICIARIES, EMPLOYER,INITIAL BENEFICIARIES WIPRO LIMITED,"1,964" MICROSOFT CORP,"1,318" INTEL CORP,723 IBM INDIA PRIVATE LIMITED,695 PATNI AMERICAS INC,609 LARSEN & TOUBRO INFOTECH LIMITED,602 ERNST & YOUNG LLP,481 INFOSYS TECHNOLOGIES LIMITED,440 UST GLOBAL INC,344 DELOITTE CONSULTING LLP,328 QUALCOMM INCORPORATED,320 CISCO SYSTEMS INC,308 ACCENTURE TECHNOLOGY SOLUTIONS,287 KPMG LLP,287 ORACLE USA INC,272 POLARIS SOFTWARE LAB INDIA LTD,254 RITE AID CORPORATION,240 GOLDMAN SACHS & CO,236 DELOITTE & TOUCHE LLP,235 COGNIZANT TECH SOLUTIONS US CORP,233 MPHASIS CORPORATION,229 SATYAM COMPUTER SERVICES LIMITED,219 BLOOMBERG,217 MOTOROLA INC,213 GOOGLE INC,211 BALTIMORE CITY PUBLIC SCH SYSTEM,187 UNIVERSITY OF MARYLAND,185 UNIV OF MICHIGAN,183 YAHOO INC,183 -

Type 2 Diabetes Report for 2018

Pittsburgh Business Group on Health TYPE 2 DIABETES REPORT | 2018 Featuring Demographic, Utilization, Charge, and Pharmacotherapy Data With a Focus on Commercial Insurance Coverage 11th Edition MANAGED CARE ® 1987 SINCE DIGEST SERIES www.pbghpa.org PBGH TYPE 2 DIABETES REPORT INTRODUCTION Sanofi U.S. (Sanofi) and the Pittsburgh Business Group on Health (PBGH) are Most of the data in this report (current as of calendar year 2017) were pleased to present the 11th edition of the Type 2 Diabetes Report for 2018, gathered by IQVIA, Durham, NC, a leading provider of innovative health an overview of key demographic, utilization, charge, pharmacotherapy, care data products and analytic services. A review process takes place, and health outcome measures for Type 2 diabetes patients in Pittsburgh before and during production of this report, between IQVIA and Forte and western Pennsylvania (Erie and Johnstown), as well as parts of Ohio Information Resources, LLC. (Youngstown) and West Virginia (Wheeling). The report also provides Sanofi, as sponsor of this report, maintains an arm’s-length relationship supplemental data on patients with cardiovascular conditions as well with the organizations that prepare the report and carry out the research as IQVIA’s state and national benchmarks, which help providers and for its contents. The desire of Sanofi is that the information in this report be employers better identify opportunities to serve the needs of their patients. completely independent and objective. All data are drawn from the Sanofi Managed Care Digest Series®. NOTE: Throughout this report, commercial coverage includes HMOs, PPOs, point-of-service plans, and exclusive provider organizations. -

Letter to Secretary Chao on FTA Small Starts Funding for Bus Rapid

Richard J. Harshman, Chair William S. Demchak, Vice Chair 11 Stanwix Street, 17th Floor Kimberly Tillotson Fleming, Treasurer Venkee Sharma, Secretary PITTSBURGH, PA 15222-1312 Morgan K. O’Brien, Immediate Past Chair Dennis Yablonsky, Chief Executive Officer T: 412.281.4783 David A. Brownlee, At Counsel F: 412.392.4520 Robert O. Agbede Leroy M. Ball, Jr. AlleghenyConference.org John A. Barbour Paul M. Boechler September 4, 2017 Jeff Broadhurst Julie Caponi Helen Hanna Casey Randall S. Dearth The Honorable Elaine Chao Nicholas J. Deluliis Vincent J. Delie, Jr. Secretary J. Christopher Donahue U.S. Department of Transportation Audrey Dunning Laura E. Ellsworth 1200 New Jersey Ave SE John J. Engel Mark Eubanks Washington, DC 20590 Michele Fabrizi Karen Wolk Feinstein Daniel K. Fitzpatrick RE: Urban Redevelopment Authority of Pittsburgh Downtown- Dawn Fuchs Patrick D. Gallagher Uptown-Oakland-East End Bus Rapid Transit (BRT) Project – FY19 William P. Getty Kenneth G. Gormley FTA Small Starts Funding Steven J. Guy Charles L. Hammel, III Paul Hennigan Dear Secretary Chao: David L. Holmberg Christopher B. Howard Michael Huwar Scott D. Izzo The Allegheny Conference on Community Development and its Laura Karet William Lambert Affiliates – the Greater Pittsburgh Chamber of Commerce, the Gerald F. MacCleary Pennsylvania Economy League of Greater Pittsburgh, and the Henry J. Maier David J. Malone Pittsburgh Regional Alliance – work together to improve the economy Michael H. McGarry Linda L. Moss and quality of life in the 10-county Pittsburgh region. On behalf of the Todd C. Moules Robert P. Oeler Allegheny Conference and our member organizations, we write to Grant Oliphant express our full support for the Pittsburgh Downtown-Uptown- Stacey Olson Antonis Papadourakis Oakland-East End Bus Rapid Transit (BRT) project.