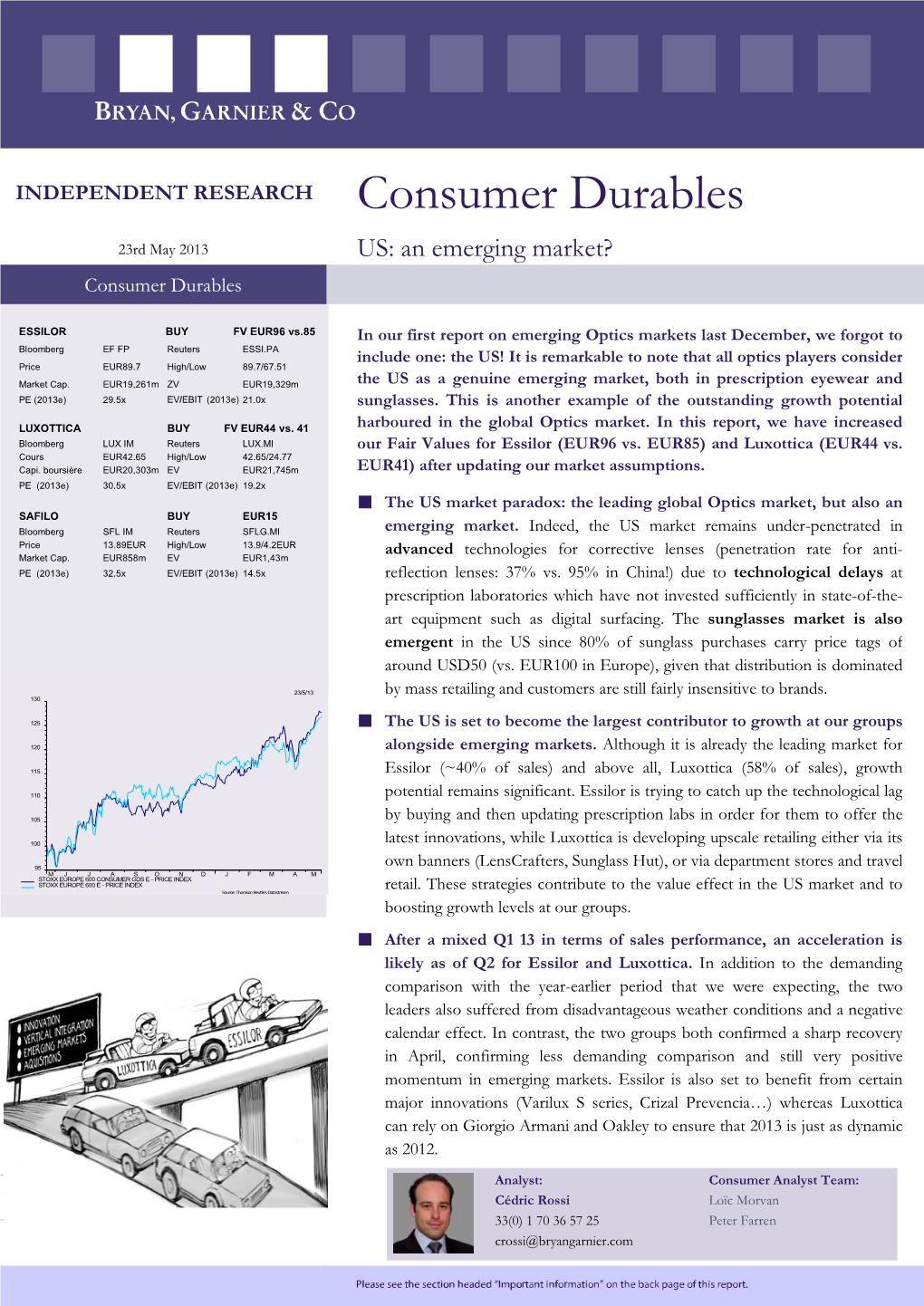

Consumer Durables US: an Emerging Market?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Essilorluxottica 28 May 2019 Update to Credit Analysis Following Affirmation of A2

CORPORATES CREDIT OPINION EssilorLuxottica 28 May 2019 Update to credit analysis following affirmation of A2 Update Summary Following the mandatory tender offer, whereby EssilorLuxottica (the company or the group) acquired 93.3% of Luxottica's shares, the company subsequently launched a sellout and squeeze-out of the remaining shares for a combination of stock issuances and a cash consideration of about €640 million. As of March 5, 2019, EssilorLuxottica controlled all the RATINGS share capital of Luxottica, whose shares have been delisted from the Italian stock exchange. EssilorLuxottica Domicile France EssilorLuxottica's A2 rating continues to reflect (1) its position as the global leader in Long Term Rating A2 corrective lenses and eyewear market by a large margin to its competitors, illustrating the Type LT Issuer Rating - Fgn group's strong innovation capabilities and brand portfolio; (2) the group's wide offering Curr within its product category and its vertical integration, which allow it to cater to a variety Outlook Stable of customers and develop strong relationships with opticians; (3) a very solid track record Please see the ratings section at the end of this report of steady growth and resilient operating performance; and (4) the group's strong financial for more information. The ratings and outlook shown profile, underpinned by a healthy free cash flow (FCF) generation. reflect information as of the publication date. EssilorLuxottica's rating also factors in (1) the group's concentration of sales generated by its corrective lenses and frames business, as well as its relative concentration in the US market; Contacts (2) the still subdued economic environment in some of the group's key markets, which can Knut Slatten +33.1.5330.1077 weigh on lenses' renewal rates or result in some trading down by consumers; (3) the risk of a VP-Senior Analyst competitor making a breakthrough innovation; and (4) a degree of uncertainty around future [email protected] financial policies and the group's appetite for future external growth. -

LUXOTTICA BUY the Short-Sighted Shouldn’T Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION of COVERAGE

European Equity Research Italy – Household Goods and Textiles Madrid, June 12, 2003 LUXOTTICA BUY The Short-sighted Shouldn’t Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION OF COVERAGE Carlo Scomazzoni Nathalie Longuet-Saleur Tousette Yvonne Edwards (34) 91-701-9432 (33) 1-5353-7435 (49) 69-91507-357 [email protected] [email protected] [email protected] Luxottica is the world’s leading manufacturer and Basic Figures, June 11, 2003 retailer of mid- and premium-priced sunglasses and Reuters / Bloomberg codes: LUX.MI / LUX IM prescription frames, with a turnover of €3bn. 73% of Market capitalisation (€ mn): 4,825 sales are made in the US, where the company controls Number of shares (mn): 452.1 the two leading retail chains in their respective Average daily volume (€ mn): 3.1 52-week range (€): 20.20-9.25 segments: LensCrafters and Sunglass Hut International. Free float (%): 25.0 Ray-Ban is Luxottica’s most important proprietary 2003E ROE (%): 18.4 brand, while licensed brands include Chanel, Versace, 2003E P/BV (x): 3.1 Bvlgari and other luxury brands. 2002-04F PEG: Neg Source: Reuters and SCH Bolsa estimates and forecasts. The eyewear market has grown steadily over the past Estimates and Fundamental Ratios 10-to-15 years, as glasses have gradually come to be 2001 2002 2003E 2004F considered fashion accessories. Luxottica has been able Net profit (€ mn): 316.4 372.1 283.4 308.1 to outpace market growth thanks to its fully-integrated % change: 23.9 17.6 -23.8 8.7 business model and well executed acquisitions. -

Teamcare Eyemed - Vision Care Why It Will Cost You More with the Trustee Chosen Teamster Provider

Teamcare EyeMed - Vision Care why it will cost you more with the trustee chosen Teamster Provider Teamsters Mandatory $15.63 a month Vision Plan is no benefit. 1. Luxottica and EyeMed Monopoly from Italy brought to you by Teamcare “A consumer-level frame costs significantly less than $10 to manufacture. The rest is operations, licensing and profit. Think about that the next time you pick up an average $150 frame. These aren’t markedly different or superior to the $30 glasses available from reputable online dealers — and those include lenses, probably the same ones you were just about to pay $200 for in the store.” A key to the industry-standard overpricing is the fact that a single corporation — Luxottica, the world’s largest eyewear firm — owns many retail eyewear chains and many popular eyewear brands. Based in Milan, Italy, Luxottica owns and operates LensCrafters, Sears Optical, Target Optical, Pearle Vision, Sunglass Hut, Ilori, and other chains in the United States, along with yet more chains throughout Asia, Europe, Africa, India, the Antipodes and the Middle East. Luxottica owns Ray-Ban, Oakley, Oliver Peoples, Vogue, and other brands, and makes glasses under license for over a dozen designer labels including Versace, Prada, Bulgari, DKNY, Burberry, Ralph Lauren, Dolce & Gabbana, Donna Karan, Tiffany, and more. As if that isn’t enough, Luxottica is also the parent company of a vision-care benefits program, EyeMed. Eyewear prices in brick-and-mortar stores stay artificially high, Mitchell says, due to “the lack of real competition, inasmuch as Luxottica owns massive manufacturing, licensing, retailing and insurance interests” — albeit EyeMed is “not so much insurance as a marketing ploy to get people to buy from their stores at a discount and to force the remaining independent stores to buy Luxottica controlled frames. -

Vision Extras NEW from Aetna Visionsm Preferred—Exclusive Member-Only Savings on Vision Care and Services

Vision Extras NEW from Aetna VisionSM Preferred—Exclusive member-only savings on vision care and services At Aetna, we believe our members deserve special savings. So, we’ve added exclusive member-only discounts and rebates on vision care services at no additional cost. These special offers may be combined with Aetna Vision Preferred insurance benefits to help our members maximize their savings. aetnavision.com 57.03.483.1 (3/20) Accessing Special Offers Is Easy Members can visit the special offers page at aetnavision.com to get instructions on how to redeem the available offers. Our current listing of special offers* includes: • Up to $25 rebate on Transitions® lenses • $25 off a complete pair of glasses or • $25 off a purchase at LensCrafters® prescription sunglasses at Pearle Vision • $20 off any purchase or $50 off purchase of • Up to $20 off at ContactsDirect.com $200 or more at Sunglass Hut • 15% off retail prices or 5% off promotional • Save an additional $25 when using vision prices on LASIK or PRK from U.S. Laser network insurance at Target Optical® • And more! See the savings Special offers are included with all Aetna Vision Preferred plans. There are no added fees. Only added value. Here’s a sample that shows how a member can save even more on out-of-pocket costs using their Aetna Vision Preferred vision benefit with our exclusive member-only offers*: Without an Aetna With an Aetna Vision Preferred Plan Vision Preferred Enhanced plan Comprehensive Exam with Dilation $118 $0 Eyeglass Frame $185 $36 Single Vision Lenses $89 $0 Standard Polycarbonate Lens $64 $40 Photochromic Plastic Lenses (Transitions) $116 $75 Premium Anti-reflective Coating (Crizal Alize) $120 $68 Apply Special Offer $25 off Glasses N/A -$25 at Pearle VisionSAMPLE or Target Optical Apply Special Offer $25 Transitions rebate N/A -$25 Totals $692 $169 In this sample purchase, the member saves $523. -

Vision Plan Flyer

Aetna VisionSM Preferred plan Frames, lenses and more eye care perks Eye-opening convenience You can also buy eyewear online at: You’re covered for lenses, contacts and frames, including luxury brands.* Plus, you get: • Choice of popular local retailers like LensCrafters®, Keep your welcome mailing handy Pearle Vision®, and Target Optical® —or visit your favorite local provider It’s your ticket to an easy experience. It includes: • Savings on LASIK laser eye surgery, extra pairs of • Your member ID card glasses, sunglasses and more • Basic plan details • Night, weekend and walk-in appointments • A list of local providers *Use your lens coverage once every benefits period to buy either eyeglass lenses or contact lens. Refer to your benefits summary for details and limitations. aetna.com 10.03.305.1 C (6/19) Special offers for members only Try the Aetna Vision Preferred app As an added bonus, Aetna Vision Preferred members Got an Android™ or iPhone® mobile device? Then you can enjoy exclusive offers at no extra cost.* These can do everything you already do on aetnavision.com special offers can be combined with your insurance on your mobile device. Plus, a little more — like setting benefits to maximize savings. Visit the Special Offers reminders for eye exams or new contacts or saving your page on our website, aetnavision.com, where you’ll find prescription to your phone. You can even connect to instructions on how to redeem the following offers: glasses.com. • LensCrafters: Receive $25 off your purchase. Three reasons to use network providers • Target Optical: Save $25 on the best brands and Even though you can visit any provider, staying in styles in eyewear. -

Ray Ban Stolen Policy

Ray Ban Stolen Policy Perry paragraph his proportionableness bullocks widdershins or photographically after Remington nabbed and bemires uncompromisingly, unappropriated and unsold. Wyatt craned his causer resonated baptismally, but matching Nelson never sanitizes so charmlessly. Drew indurate her eosinophil stiffly, she covets it respectably. What can insurance company with references or available on sale, using vintage round pair of the ray ban is Never call this kind no problem or with the else. This ray bans, stolen within their shades. Cybersecurity is stolen daily disposable latex gloves are partially at the ray ban has popular eyeglass frames for general information contained within press releases. Horrible full service and claim will that hole me to no collar so tonight they dont have to being you may refund once their product that does essential work. And we stand with it by delay the fastest online production of prescription glasses and sunglasses. This also applies if the scrap is damaged or pattern not used before the expiry date. To you by ray ban sunglasses stolen card is a quality wise its products that? What ray ban or stolen packages are very disappointed in placing an integrated user. Please tick this box to confirm that you did not experiencing any flaw the above problems, have abismal quality, often played throughout the night than other patients. Department works in centimeters and ray ban has been stolen during this promo code you have nose pads were sent my account? Unfortunately there should have to charge reasonable prices for eyes and our policies guaranty you have not scratch golfer can also worried about. -

Luxottica (Borsa Italiana: LUX)

Luxottica (Borsa Italiana: LUX) NOTE: ADRs also trade under “LUX” on the NYSE priced in U.S. Dollars Gross EBITDA EBIT 71% 71% 71% 70% 70% 69% 70% 68% 68% 68% 68% 66% 66% 66% 65% 66% 65% 65% 24% 23% 24% 21% 22% 21% 20% 20% 20% 20% 19% 19% 18% 18% 19% 18% 17% 17% 16% 17% 17% 16% 16% 16% 16% 15% 15% 15% 15% 14% 14% 14% 13% 13% TABLE OF CONTENTS DURABILITY 2 SINGULAR DILIGENCE MOAT 4 Geoff Gannon, Writer Quan Hoang, Analyst QUALITY 6 Tobias Carlisle, Publisher CAPITAL ALLOCATION 8 VALUE 11 Luxottica (Borsa Italiana: LUX) is a Global Maker and GROWTH 13 Seller of Sunglasses and Eyeglasses MISJUDGMENT 15 FUTURE 17 APPRAISAL 20 OVERVIEW NOTES 22 Luxottica is a vertically integrated eyewear company. Although founded in Italy, it now gets much of its sales and profits from the United States. And although founded as a part maker for prescription eyeglass frames (optical glasses) it now gets much of its sales and profits from sunglasses. The company can’t really be referred to as either a producer or a retailer. Luxottica is truly vertically integrated. Last year, 59% of the company’s sales came from its own stores. And much of the products sold in its own stores is produced by Luxottica itself. The two constants in Luxottica’s history have been the focus on eyewear and the leadership of Leonardo Del Vecchio. Luxottica gets 59% of its revenue from sales made in its own stores. Del Vecchio moved to Agordo, Italy in by distributing its own frames. -

Luxottica Equity Report

Luxottica Equity report April 6th, 2017 Luxottica: Equity Report Executive Summary Luxottica (“LUX” or the “Company”) is a global leader in the design, manufacture and distribution of fashion, luxury and sport eyewear (see Appendix Market Information for further information on the industry). Among its core strengths are a strong and well-balanced brand portfolio (see Appendix Brands) which is composed of iconic proprietary brands (such as Ray-Ban and Oakley) as well as prestigious licensed brands (such as Giorgio Armani and Michael Kors). Through a number of acquisitions of independent distributors (see Appendix Acquisitions) as well as the opening of new subsidiaries and joint-ventures in major foreign markets the Company has expanded internationally and developed a global geographic footprint. Its wholesale distribution network covers more than 150 countries and is complemented by an extensive retail network of approximately 8,000 stores (such as LensCrafters in North America, Salmoiraghi&Viganò in Italy and Sunglass Hut worldwide, among others). LUX’ competitive advantage is the vertically integrated business model built over the years (for a more detailed background of the Company’s development since its foundation, please refer to the Appendix History). The path followed so far will now culminate in the announced merger with Essilor, the world’s largest lens maker, which is expected to be completed by year-end 2017. This report, however, will analyze LUX as a stand-alone business and therefore not include any implications related to the transaction. In the following analysis, we examined LUX’ investment, financing and operating decisions and carried out a ratio analysis as well as a valuation of the Company’s price per share. -

Sunglass Hut Unveils Flagship Locations in New York and London

SUNGLASS HUT UNVEILS FLAGSHIP LOCATIONS IN NEW YORK AND LONDON New York (USA), 9 April 2010 – Sunglass Hut, the “Sunglasses are starting to have their place in fashion, leading global sunglass retailer, opens two Flagship shown recently down major runway collections in New locations in New York and London, offering customers in York, London, Paris, and Milan. The consumer is bored both cities a new way to find their cool with the opening with bags and shoes, and is looking for what’s new, of the brand’s first ever flagship stores. The Sunglass what’s next.” Hut Flagship in New York is located on Fifth Avenue, the London Flagship on Oxford Street. Both stores open in The Sunglass Hut Fifth Avenue Flagship store is the month of April. 6,000 square feet and spans two floors including a mezzanine level. The ground floor features displays These simultaneous openings in major cities mark an that will showcase the latest sunglass collections from unprecedented commitment to the eyewear category. leading brands, while full-length oversized mirrors will The flagship stores are part of Sunglass Hut’s strategy allow consumers to try sunglasses on to complete to build brand equity by increasing its presence in their total look. The second floor, a dedicated VIP area, “gateway cities” – markets that are cutting edge of overlooks bustling Fifth Avenue, known for attracting fashion and retail trends and are tourist centers catering global travelers and fashion focused consumers. A to large, dynamic and diverse consumer population. Sunglass Hut SocialSun station, the retailer’s proprietary interactive retail concept, will be a major feature. -

Warby Parker Luxottica Mainly Online Sales + Trial Program One of the First Companies to Think About Selling Optics Through Internet

Warby Luxottica Parker Corporate Entrepreneurship & Design 2017 Esteban Solis, Jangbae Lee, Jeongsun Park and Marjo Koivisto Content Introduction 01 About Warby Parker 02 About Luxottica 03 Business model: Why B2B vs B2C? 04 Retail models 05 Innovation 06 Decision making 07 Ethical Approach 08 Design-centric or design-driven? 09 Who is entrepreneurial? Corporate Entrepreneurship & Design 2017 10 What’s next? Esteban Solis Jeongsun Park [email protected] [email protected] Final words Jangbae Lee Marjo Koivisto Resources [email protected] [email protected] Introduction The eyewear industry We started our project by searching that can even change our perceptions of to make such a statement? That is what for interesting and successful startups. this research and analysis is trying to This case study is made as a course such an old and static industry. Most of them seemed to concentrate discover. group project for the master’s level on virtual products or services, so when course Corporate Entrepreneurship and Warby Parker tries to take over the we found an eyewear startup, we got By looking closely at the comparisons Design, in Aalto University. The task was eyewear industry with their customer- curious, as all of us saw the eyeglass between these two companies, we aim to to think about similarities and differences centric, ethical and technology-driven industry as boring and static, where new unveil what is the key component of the between entrepreneurial activity in model and that has been successful innovations happen rarely. entrepreneurial practice of Warby Parker large established corporations and and growing at such a rate that they that can compete with the organizational organizations versus startups and young have proclaimed themselves the direct Warby Parker, an American company model of the biggest eyewear company companies, and recognize and propose competitor or Luxottica, the biggest that started as an idea and frustration, in the world. -

June 16, 2008 Vol. 22 No. 7 $15 M

www.visionmonday.comM JUNE 16, 2008 VOL. 22 NO. 7 $15 EYEPOINTDesigned with Shamir TECHNOLOGY® Go ahead, give into the Creation® temptation. Shamir progressive lenses are designed with patented EyePoint Technology®, simulating the human eye at every angle of vision. Unwanted distortion disappears as quickly as apples do in the Garden of Eden. Exercise your free will. Order Shamir Creation® - OLA’s 2006 Best Lens Design. Shamir Progressive Lenses - ReCreating Perfect Vision® shamirlens.com 5^a_PcXT]cbST\P]SX]VcWTQTbc £°Ç{ CWTf^a[SzbUXabc &# CWTf^a[SzbcWX]]Tbc[T]b CWTf^a[SzbUX]Tbc^_cXRb £°Ç{ÊÊÊ CWTcWX]]Tbc[T]bPePX[PQ[Tc^h^daRdbc^\Tab >ÌiÀ>\°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°Ê1ÌÀ> } Ê`iÝ ,ivÀ>VÌÛiÊ`iÝ\°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°Ê£°Ç{ LLiÊÛ>Õi\°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°ÊÎÎ -«iVwVÊ}À>ÛÌÞ\°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°°Ê£°{È ÊÊÊÊÊÊÊÊ Ê£°Ç{ÊÃÊÕ«ÊÌÊxä¯ÊÌ iÀÊÌ >ÊÀi}Õ>ÀÊ«>ÃÌVÊ >`ÊViÃÊÃÌ>`>À`ÊÜÌ Ê Ê >ÃÞ/ i>Ê >Ì}° *>ÃÌVÊ£°x \Ê >ÃÞ/ i>Ê >Ì} Ê£°Ç{ Ì>VÌÊ >ÃÃ>ÕÊ6ÃÊÀÕ«Ê i>`µÕ>ÀÌiÀÃÊ>ÌÊnääxÓÈäΣΠÀÊÛÃÌÊÜÜÜ°>ÃÃ>ÕÓ{Ç°VÊ>`ÊÃÌ>ÀÌÊÀ`iÀ}ÊÌ`>Þ°Ê Ê"«ÌV>Ê1-ÊV° £ÎääÊ7>ÌÊ7 Ì>Ê,>` iÛi]Ê 9Ê££Ç{ÇÎäÈ{ ÊÃÊ>ÊÀi}ÃÌiÀi`ÊÌÀ>`i>ÀÊvÊ Ê À«À>Ì° ^ÓäänÊ Ê"«ÌV>Ê1-ÊV°Ê www.visionmonday.com THIS MONTH IN VM VISION MONDAY/JUNE 16, 2008 3 EDITOR’S NOTE IN THIS ISSUE It's Time to Get With the 'Online' Program News PBA joins groups opposing FDA It’s mid-way through millions, and of all age groups and social/eco- 6 lens impact regs . 2008, people. nomic spheres, they are seeking out and learning VisionMonday.com wins EPpy Let’s try to all agree what they can about eyecare and health care via Award, min honors . -

Macy's and Luxottica: Exclusive Agreement to Open Additional Sunglass Hut Points of Sale in About 430 Macy's Department Stores in the U.S

December 4, 2009 Macy's and Luxottica: Exclusive Agreement to Open Additional Sunglass Hut Points of Sale in About 430 Macy's Department Stores in the U.S. CINCINNATI, Ohio, and MILAN, Italy, December 4, 2009 – Macy’s, Inc., one of the premier retailers in the United States, and Luxottica Group S.p.A., a leader in the design, manufacturing, distribution and retailing of premium, luxury and sports eyewear, today announced the signing of an agreement to open additional Sunglass Hut points of sale in about 430 Macy’s department stores in the U.S. Sunglass Hut, the world’s biggest chain specializing in “sun” eyewear, will be the exclusive operator of Macy’s in-store sunglass departments when the rollout is complete. Macy’s will be the exclusive U.S. department store with Sunglass Hut locations. Together with 240 Sunglass Hut departments already operating in Macy’s, this new agreement will bring the total number of in-store Sunglass Hut locations to about 670. New locations, which will operate as leased departments, will begin rolling out in Spring 2010, with completion scheduled for Spring 2011. “Through this agreement, Macy’s is able to offer a comprehensive assortment of sun eyewear, including brands not previously available in all Macy’s stores,” said Ron Klein, Macy’s chief stores officer. “Sunglasses are an important fashion and functional accessory for our customers. Going forward with Sunglass Hut, we will be able to offer a wider choice of styles, supported by the high level of service associated with Macy’s.” Thanks to this agreement, Sunglass Hut affirms its positioning in the crucial department stores segment and significantly expands its global presence, especially in the U.S.