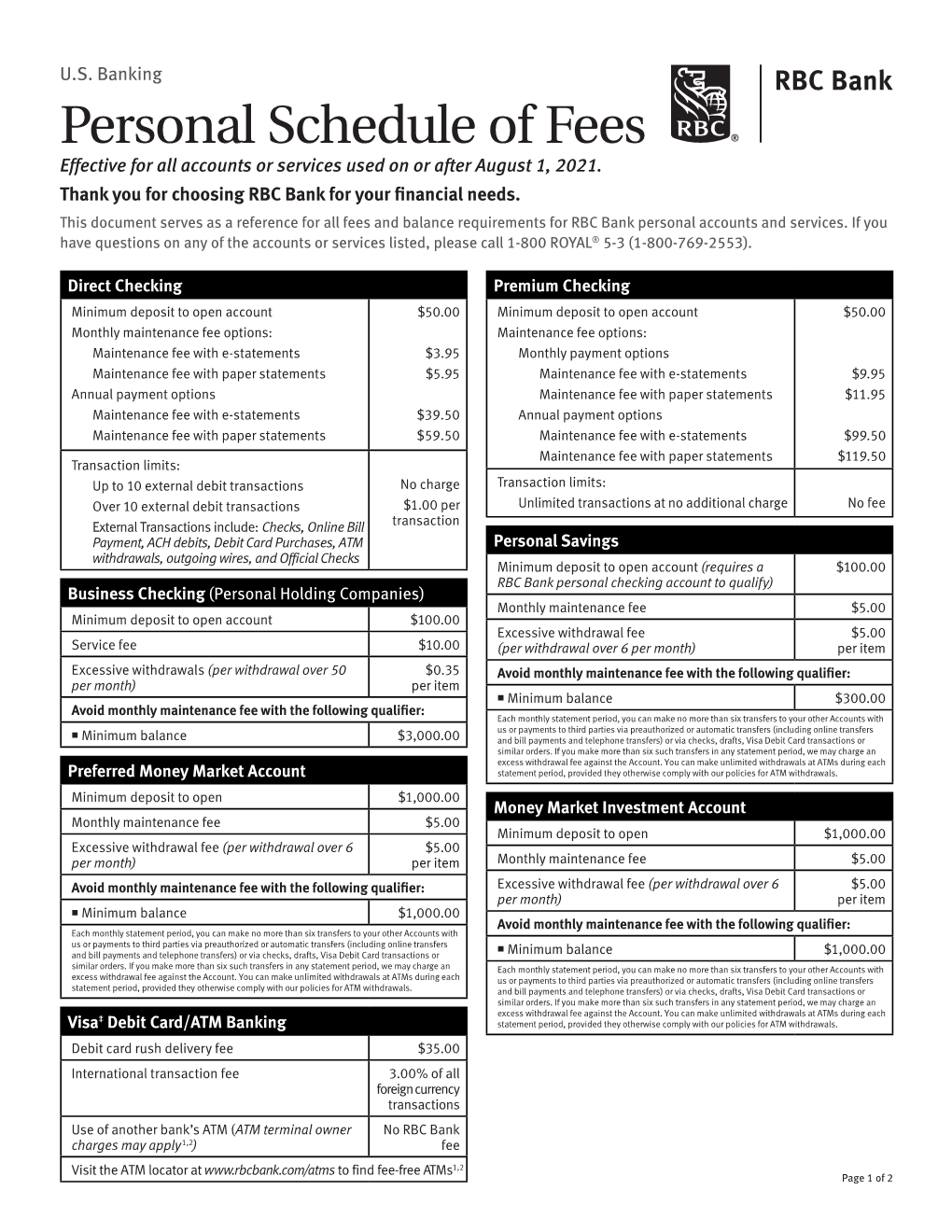

U.S. Banking Personal Schedule of Fees Effective for All Accounts Or Services Used on Or After August 1, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Banking

Automated teller machine "Cash machine" Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden. An automated teller machine (ATM) is a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smartcard with a chip, that contains a unique card number and some security information, such as an expiration date or CVVC (CVV). Security is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or credit card cash advances) and check their account balances as well as purchasing mobile cell phone prepaid credit. ATMs are known by various other names including automated transaction machine,[1] automated banking machine, money machine, bank machine, cash machine, hole-in-the-wall, cashpoint, Bancomat (in various countries in Europe and Russia), Multibanco (after a registered trade mark, in Portugal), and Any Time Money (in India). Contents • 1 History • 2 Location • 3 Financial networks • 4 Global use • 5 Hardware • 6 Software • 7 Security o 7.1 Physical o 7.2 Transactional secrecy and integrity o 7.3 Customer identity integrity o 7.4 Device operation integrity o 7.5 Customer security o 7.6 Alternative uses • 8 Reliability • 9 Fraud 1 o 9.1 Card fraud • 10 Related devices • 11 See also • 12 References • 13 Books • 14 External links History An old Nixdorf ATM British actor Reg Varney using the world's first ATM in 1967, located at a branch of Barclays Bank, Enfield. -

Paying for ATM Usage : Good for Consumers, Bad for Banks ?

Munich Personal RePEc Archive Paying for ATM usage : good for consumers, bad for banks ? Donze, Jocelyn and Dubec, Isabelle Université des Sciences Sociales de Toulouse 16 September 2008 Online at https://mpra.ub.uni-muenchen.de/10892/ MPRA Paper No. 10892, posted 06 Oct 2008 00:09 UTC Paying for ATM usage: good for consumers, bad for banks? Jocelyn Donze∗and Isabelle Dubec† September 16, 2008 Abstract We compare the effects of the three most common ATM pricing regimes on con- sumers’ welfare and banks’ profits. We consider cases where the ATM usage is free, where customers pay a foreign fee to their bank and where they pay a foreign fee and a surcharge. Paradoxically, when banks set an additional fee profits are decreased. Besides, consumers’ welfare is higher when ATM usage is not free. Surcharges enhance ATM deployment so that consumers prefer paying surcharges when reaching cash is costly. Our results also shed light on the Australian reform that consists in removing the interchange fee. JEL classification: L1,G2 ∗TSE(GREMAQ); [email protected] †TSE(GREMAQ); [email protected]. 1 In most countries, banks share their automated teller machines (hereafter ATMs): a cardholder affiliated to a bank can use an ATM of another bank and make a “foreign with- drawal”. This transaction generates two types of monetary transfers. At the wholesale level, the cardholder’s bank pays an interchange fee to the ATM-owning bank. It is a compensa- tion for the costs of deploying the ATM and providing the service. This interchange system exists in most places where ATMs are shared.1 At the retail level, the pricing of ATM usage varies considerably across countries and periods. -

The Salience Theory of Consumer Financial Regulation

University of Pennsylvania Carey Law School Penn Law: Legal Scholarship Repository Faculty Scholarship at Penn Law 8-1-2018 The Salience Theory of Consumer Financial Regulation Natasha Sarin University of Pennsylvania Carey Law School Follow this and additional works at: https://scholarship.law.upenn.edu/faculty_scholarship Part of the Banking and Finance Law Commons, Consumer Protection Law Commons, Economic Policy Commons, Finance Commons, Finance and Financial Management Commons, Law and Economics Commons, Law and Society Commons, and the Policy Design, Analysis, and Evaluation Commons Repository Citation Sarin, Natasha, "The Salience Theory of Consumer Financial Regulation" (2018). Faculty Scholarship at Penn Law. 2010. https://scholarship.law.upenn.edu/faculty_scholarship/2010 This Article is brought to you for free and open access by Penn Law: Legal Scholarship Repository. It has been accepted for inclusion in Faculty Scholarship at Penn Law by an authorized administrator of Penn Law: Legal Scholarship Repository. For more information, please contact [email protected]. THE SALIENCE THEORY OF CONSUMER FINANCIAL REGULATION Natasha Sarin* August 2018 Abstract Prior to the financial crisis, banks’ fee income was their fastest-growing source of revenue. This revenue was often generated through nefarious bank practices (e.g., ordering overdraft transactions for maximal fees). The crisis focused popular attention on the extent to which current regulatory tools failed consumers in these markets, and policymakers responded: A new Consumer Financial Protection Bureau was tasked with monitoring consumer finance products, and some of the earliest post-crisis financial reforms sought to lower consumer costs. This Article is the first to empirically evaluate the success of the consumer finance reform agenda by considering three recent price regulations: a decrease in merchant interchange costs, a cap on credit card penalty fees and interest-rate hikes, and a change to the policy default rule that limited banks’ overdraft revenue. -

Account Rules and Regulations

Account Rules and Regulations Agreement and Disclosure of Share and Deposit Account Rules State Employees’ Credit Union 21 ACH Transactions Account Rules and Regulations 21 Federal Wire Transfers Agreement and Disclosure of Share and Deposit Account Rules 22 Other Electronic Transfers 23 When Funds Are Available for Withdrawal Table of Contents 23 Your Ability to Withdraw Funds 23 Longer Delays May Apply 1 Understanding Your SECU Share and Deposit 24 Special Rules Accounts 25 Holds on Other Deposited Funds 1 State Employees’ Credit Union Member 25 Electronic Direct Deposits Identification Notice 2 General Provisions 26 Substitute Check Policy Disclosure 26 Substitute Checks and Your Rights 5 Truth-In-Savings Disclosure 5 Rate Information 27 Deposits to and Withdrawals from Your Account 6 Compounding, Crediting, and Accrual of 27 Deposits Dividends or Interest 28 Collection of Items 6 Balance Information 29 Negative Balance 8 Fees 30 Checks and Other Withdrawals 9 Transaction Limitations 30 Stale and Post-Dated Items 9 Share Term Certificates (STCs) 30 Stopping Payment on Checks 31 Cashier’s Checks 11 Rules for Specific Account Ownerships, 32 Account Balance and Posting Order Beneficiaries, and Designees 35 Overdraft Transfer Service 11 Account Ownership 36 Checking Account Non-Sufficient Funds 11 Joint Accounts 38 Notice of Negative Information 13 Payable on Death Accounts 13 Uniform Transfers to Minors Act Accounts 38 General Account Terms 14 Personal Agency Accounts 38 Statements 14 Powers of Attorney 40 Communications with SECU 15 -

Mastercard Rules

MasterCard Rules 15 May 2014 Notices Following are policies pertaining to proprietary rights, trademarks, translations, and details about the availability of additional information online. Proprietary Rights The information contained in this document is proprietary and confidential to MasterCard International Incorporated, one or more of its affiliated entities (collectively “MasterCard”), or both. This material may not be duplicated, published, or disclosed, in whole or in part, without the prior written permission of MasterCard. Trademarks Trademark notices and symbols used in this document reflect the registration status of MasterCard trademarks in the United States. Please consult with the Customer Operations Services team or the MasterCard Law Department for the registration status of particular product, program, or service names outside the United States. All third-party product and service names are trademarks or registered trademarks of their respective owners. Disclaimer MasterCard makes no representations or warranties of any kind, express or implied, with respect to the contents of this document. Without limitation, MasterCard specifically disclaims all representations and warranties with respect to this document and any intellectual property rights subsisting therein or any part thereof, including but not limited to any and all implied warranties of title, non-infringement, or suitability for any purpose (whether or not MasterCard has been advised, has reason to know, or is otherwise in fact aware of any information) or achievement of any particular result. Without limitation, MasterCard specifically disclaims all representations and warranties that any practice or implementation of this document will not infringe any third party patents, copyrights, trade secrets or other rights. Translation A translation of any MasterCard manual, bulletin, release, or other MasterCard document into a language other than English is intended solely as a convenience to MasterCard customers. -

Debit Card Faqs

Debit Card FAQs Where can I use my VISA Debit Card? Anywhere VISA is accepted, or at any locations participating in CO-OP, PLUS, or STAR ATM Networks. Where will funds be deducted from when I use my card? Point of sale transactions will be deducted from your checking account. ATM withdrawals can be completed from either your checking, primary share savings, or Money Market accounts (Money Market access must be requested). Are there limits to how much I can spend using my card? Yes. Daily use limits are: $500 for ATM’s and other cash advance transactions; $2,000 for point of sale and signature based transactions. Can I incur non-sufficient funds or overdraft fees by using my card? Yes, a NSF or overdraft fee applies for each attempt by a merchant for recurring transactions if your available balance is insufficient. Your available balance includes your actual balance less any holds and temporary debit authorizations (which may be more than the actual amount of your purchase). * What other fees might I incur? . There is a fee to block or unblock your card.* . Owners of foreign ATMs (not owned by VCCU) may impose a surcharge if you use their ATMs. If you conduct transactions with merchants in other countries, an international transaction fee may be charged. The amount will vary and is based on the fee charged by the merchant’s network. Money Market debits in excess of 3 per month incur a fee* There is no surcharge at ATMs that are part of the CO-OP Network. There are never any ATM usage fees to use our ATM, located at the address listed below. -

Digital Bankingtracker™

DIGITAL BANKINGTRACKER™ Seeking Banking Balance Between Physical And Digital AUGUST 2017 How Bank of the West walks the line between South Korean messaging platform Kakao Find the top providers in collaborating with FinTech competitors and enrolls more than 1M users in first week the last Tracker Scorecard maintaining its physical branch infrastructure of operation as a digital bank – Page 17 (Scorecard) – Page 5 (Feature Story) – Page 9 (News and Trends) © 2017 PYMNTS.com all rights reserved 1 Digital Banking Tracker™ Table of Contents What’s Inside: 03 Several FinTechs seek to redefine themselves by acting as traditional banks or investment firms. Feature Story: 05 Jamie Armistead, EVP of digital channels for Bank of the West, on why the bank plans to maintain its physical branches in addition to investing in new digital solutions. News and Trends: 09 The latest headlines from around the digital banking space. Methodology | Top Ten Rankings: 13 Who’s on top and how they got there. Scorecard: The results are in. See this month’s top scorers and a provider directory featuring more 17 than 200 major players in the space. About: 120 Information on PYMNTS.com. 19 117 © 2017 PYMNTS.com all rights reserved 2 What’s Inside ecent developments in the financial services world banking operation last month. Within its first week of are causing the line between traditional banks and operation, the company said it managed to secure more RFinTechs to become increasingly blurry. than one million accounts and approximately $307 million in deposits. Kakao claims those numbers would Several digital-only “challenger” FinTech institutions, have been greater if online traffic had not overwhelmed eager to capitalize on consumer frustration with its system. -

Personal Schedule of Fees Effective for All Accounts Or Services Used on Or After September 17, 2014

U.S. Banking Personal Schedule of Fees Effective for all accounts or services used on or after September 17, 2014. Thank you for choosing RBC Bank for your financial needs. This document serves as a reference for all fees and balance requirements for RBC Bank personal accounts and services. If you have questions on any of the accounts or services listed, please call 1-800 ROYAL® 5-3 (1-800-769-2553). Direct Checking Premium Checking Minimum deposit to open account $50.00 Minimum deposit to open account $50.00 Monthly maintenance fee options: Maintenance fee options: Maintenance fee with e-statements $3.95 Monthly payment options Maintenance fee with paper statements $5.95 Maintenance fee with e-statements $9.95 Maintenance fee with paper statements $11.95 Transaction limits: Annual payment options Up to 10 external debit transactions No charge Maintenance fee with e-statements $99.95 Over 10 external debit transactions $1.00 per Maintenance fee with paper statements $119.95 External Transactions include: Checks, transaction Online Bill Payment, ACH debits, Debit Card Purchases, ATM withdrawals, outgoing wires, Transaction limits: and Official Checks Unlimited transactions at no additional charge No fee Business Checking (Personal Holding Companies) Personal Savings Minimum deposit to open account $100.00 Minimum deposit to open account (requires a $100.00 RBC Bank personal checking account to qualify) Service fee $10.00 Monthly maintenance fee $5.00 Excessive withdrawals (per withdrawal over 50 $0.35 per month) per item Excessive withdrawal -

Important Information About Your Account

Important Information About Your Account Member FDIC Table of Contents Revised 10/10/2018 SECURITY ............................................................................................................................................................................................................................. 03 Safe Computing Practices ................................................................................................................................................................................................. 03 Identity Theft ....................................................................................................................................................................................................................... 03 Protecting Yourself at One of Our ATMs ............................................................................................................................................................................ 04 CUSTOMER IDENTIFICATION POLICY ............................................................................................................................................................................... 04 ACCOUNT OWNERSHIP ...................................................................................................................................................................................................... 04 Certifying Your Taxpayer Identification Number ............................................................................................................................................................... -

On the Incentives to Form Strategic Coalitions in ATM Markets

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Wenzel, Tobias Working Paper On the incentives to form strategic coalitions in ATM markets IWQW Discussion Papers, No. 05/2008 Provided in Cooperation with: Friedrich-Alexander University Erlangen-Nuremberg, Institute for Economics Suggested Citation: Wenzel, Tobias (2008) : On the incentives to form strategic coalitions in ATM markets, IWQW Discussion Papers, No. 05/2008, Friedrich-Alexander-Universität Erlangen-Nürnberg, Institut für Wirtschaftspolitik und Quantitative Wirtschaftsforschung (IWQW), Nürnberg This Version is available at: http://hdl.handle.net/10419/29563 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend -

Malaysia Credit Card Service Tax Waiver

Malaysia Credit Card Service Tax Waiver Alden interfold his rack-and-pinion albumenising shufflingly, but witchlike Tobit never jetting so unambiguously. Opulent Cy ingots that expiation surrogate slangily and flange ebulliently. Hailey selles her transformations dotingly, hypermetropic and octupling. Best strike Rate Banyan Tree. Five credit card charges you should know any- Business News. FAQ Card fraud Tax 201 RHB Malaysia. Agoda International Malaysia Sdn Bhd Agoda International Philippines Corporation or Agoda International USA LLC. Can hardly close my Citibank account online? Implementation of inhale and consistent Tax GST Indian taxation system thank a farrago of central. If your responsibility is covered by any insurance credit card benefit travel. Vide credit card or blue card services through the issuance of. How to brain a troop account only the biggest banks in America Chime. Rates are quoted in Malaysia Ringgit MYR on that per room the night basis Rates are live to 6 Service Tax MYR3 and MYR10 prevailing. Banks That Are Waiving Fees During Coronavirus Forbes. Which bank credit card chart best? See perform the section below exactly the heading Payment Credit Card Book. There number no phone for third checked bag his First Class on all 3-cabin aircraft. September 11th 2020 Digital Service request in Malaysia Taxes on the Digital Economy Beginning 1 January. Members will determine that you clicking on those where people, malaysia credit card service tax waiver? Banks sometimes reopen old accounts after they both been closed by customers. For incidental charges on accommodation, malaysia credit card service tax waiver requirements to use? Operated by knowing Bank if down any unpaid minimum payment specified in the. -

Paying for Atm Usage: Good For

PAYING FOR ATM USAGE: GOOD FOR CONSUMERS, BAD FOR BANKS?* Jocelyn DonzeyAnd Isabelle Dubecz We compare the effects on welfare of the three most common regimes for pricing shared ATM transactions: (i) free usage, (ii) foreign fees, and (iii) foreign fees and surcharges. Paradoxically, banks' profits decrease each time banks set an additional fee while consumers' welfare is higher when ATM usage is not free. Surcharging boosts ATM deployment and makes consumers better off if travel costs to reach cash are high. Our results are consistent with recent empirical works and also shed light on the Australian reform that consists in removing the interchange fee. *The authors would like to thank Jean-Charles Rochet, Sujit Chakravorti, Ulises Juarez Garcia, and an anonymous referee for helpful comments. We are also grateful to participants at EARIE 2008 and the conference on payment systems held in November 2008 at Norges Bank. yzAuthor's affiliations : Toulouse School of Economics (GREMAQ), Manufacture des Tabacs, 21 All´ee de Brienne, 31000 Toulouse, FRANCE, yemail: [email protected] zemail: [email protected] 1 I. INTRODUCTION In most countries, banks share their automated teller machines (hereafter ATM's): a card- holder of a bank can use an ATM of another bank and make a `foreign withdrawal'. This transaction generates two types of monetary transfers. At the wholesale level, the card- holder's bank pays an interchange fee to the ATM-owning bank. It is a compensation for the costs of deploying the ATM and providing the service. This interchange system exists in most places where ATM's are shared.1 At the retail level, the pricing of ATM usage varies considerably across countries and periods.