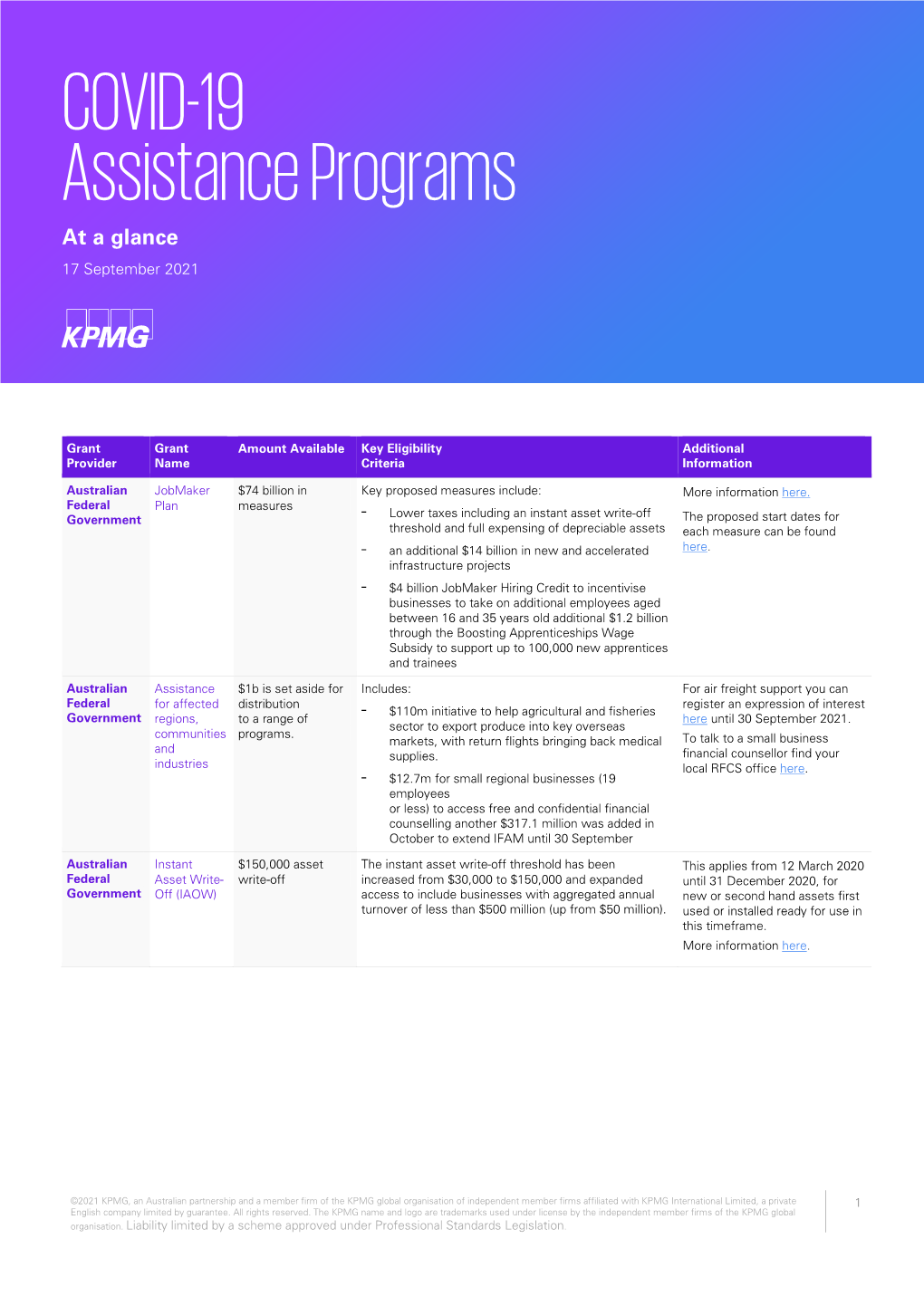

COVID-19 Government Assistance Programs at a Glance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Effect of Fireworks, Chinese New Year and the COVID-19 Lockdown on Air Pollution and Public Attitudes

Special Issue on COVID-19 Aerosol Drivers, Impacts and Mitigation (VII) Aerosol and Air Quality Research, 20: 2318–2331, 2020 ISSN: 1680-8584 print / 2071-1409 online Publisher: Taiwan Association for Aerosol Research https://doi.org/10.4209/aaqr.2020.06.0299 Effect of Fireworks, Chinese New Year and the COVID-19 Lockdown on Air Pollution and Public Attitudes Peter Brimblecombe1,2, Yonghang Lai3* 1 Department of Marine Environment and Engineering, National Sun Yat-Sen University, Kaohsiung 80424, Taiwan 2 Aerosol Science Research Center, National Sun Yat-Sen University, Kaohsiung 80424, Taiwan 3 School of Energy and Environment, City University of Hong Kong, Hong Kong ABSTRACT Concentrations of primary air pollutants are driven by emissions and weather patterns, which control their production and dispersion. The early months of the year see the celebratory use of fireworks, a week-long public holiday in China, but in 2020 overlapped in Hubei Province with lockdowns, some of > 70 days duration. The urban lockdowns enforced to mitigate the COVID-19 pandemic give a chance to explore the effect of rapid changes in societal activities on air pollution, with a public willing to leave views on social media and show a continuing concern about the return of pollution problems after COVID-19 restrictions are lifted. Fireworks typically give rise to sharp peaks in PM2.5 concentrations, though the magnitude of these peaks in both Wuhan and Beijing has decreased under tighter regulation in recent years, along with general reductions in pollutant emissions. Firework smoke is now most evident in smaller outlying cities and towns. The holiday effect, a reduction in pollutant concentrations when normal work activities are curtailed, is only apparent for NO2 in the holiday week in Wuhan (2015–2020), but not Beijing. -

Policy Bulletin BUL-5469.2 Page 1 of 5 June 26, 2014 Office of The

LOS ANGELES UNIFIED SCHOOL DISTRICT Policy Bulletin TITLE: Lockdown And Rapid Relocation Procedures For All ROUTING Schools All Schools and Offices NUMBER: BUL-5469.2 ISSUER: Michelle King, Senior Deputy Superintendent School Operations Office of the Superintendent Earl R. Perkins Assistant Superintendent School Operations Office of the Superintendent DATE: June 26, 2014 POLICY: The Los Angeles Unified School District is committed to providing a safe and secure learning environment for its students. When an event on or near a campus occurs that requires the school to initiate a lockdown, school site administrators are to follow the guidelines in this Bulletin. MAJOR This Bulletin replaces BUL-5469.1 dated February 13, 2013, issued by the Office of CHANGES the Superintendent, and includes procedures for Rapid Relocation during an “Active Shooter” incident. GUIDELINES: The following guidelines apply: A lockdown may be initiated by the Los Angeles School Police Department (LASPD), local law enforcement, or the school principal/designee when gunfire or a threat of violence is identified and it is necessary to shield students from gunfire or prevent the perpetrator(s) from entering any occupied campus areas. NOTE: During a lockdown due to an “Active Shooter” incident on campus, procedures delineated in Attachment B of this bulletin shall be followed if a “Rapid Relocation” is initiated. I. When a school initiates a lockdown, the following procedures will occur: A. The principal/designee will initiate the Incident Command System (ICS) as defined for that school in the Safe School Plan, Volume 2, Emergency Procedures, Section 2.0. The principal/designee becomes the School Incident Commander (School IC) and directs the students and staff to go into lockdown via the school intercom system, using the term “lockdown.” Do not use special codes, as they are not universally understood. -

FINED out a Practical Guide for People Having Problems with Fines What Is FINED out All About? FINED out Is a Practical Guide to the NSW Fines System

FINED OUT A practical guide for people having problems with fines What is FINED OUT all about? FINED OUT is a practical guide to the NSW fines system. It provides information about how to deal with fines and contact information for services that can help people with their fines. 5th edition, March 2021. Produced by Legal Aid NSW Design and production: ARMEDIA Illustrations: Carolyn Ridsdale © Inner City Legal Centre, Redfern Legal Centre and the State of NSW through the Legal Aid Commission of NSW, 2021. You may copy, print, distribute, download and otherwise freely deal with this work for a non-profit purpose provided that you attribute Inner City Legal Centre, Redfern Legal Centre and Legal Aid NSW as the owners. To reproduce or modify the work for any other purpose, you need to ask for and be given permission by Legal Aid NSW or Inner City Legal Centre. DISCLAIMER: This guide applies only to residents and the law of NSW. The information in this resource is general and is not intended to be specific legal advice on any matter. If you have a specific legal problem, you should consult a lawyer. To the extent permissible by law, Inner City Legal Centre, Redfern Legal Centre and Legal Aid NSW disclaim all liability for anything contained in this resource and any use you make of it. First published in 2006 by Legal Aid NSW. ISBN 978-0-9806128-9-9 If you are hearing/speech impaired, you can communicate with us by calling the National Relay Service (NRS) on 133 677 TIS provides free interpreters if you do not speak English. -

ABN 53 001 228 799 Directors' Report and Financial Report

ABN 53 001 228 799 Directors’ Report and Financial Report For the year ended 30 June 2014 TABLE OF CONTENTS Directors' report ................................................................................................................................ 1 - 9 Auditor's independence declaration ................................................................................................. 10 Financial report Statement of comprehensive income ..................................................................................... 11 Statement of financial position ............................................................................................... 12 Statement of changes in accumulated funds ......................................................................... 13 Statement of cash flows .......................................................................................................... 14 Notes to financial statements ................................................................................................. 15 - 25 Directors' declaration ........................................................................................................................ 26 Independent auditor's report ............................................................................................................ 27 - 28 Trust account statement ................................................................................................................... 29 Notes to trust account statement .................................................................................................... -

COVID-19: How Hateful Extremists Are Exploiting the Pandemic

COVID-19 How hateful extremists are exploiting the pandemic July 2020 Contents 3 Introduction 5 Summary 6 Findings and recommendations 7 Beliefs and attitudes 12 Behaviours and activities 14 Harms 16 Conclusion and recommendations Commission for Countering Extremism Introduction that COVID-19 is punishment on China for their treatment of Uighurs Muslims.3 Other conspiracy theories suggest the virus is part of a Jewish plot4 or that 5G is to blame.5 The latter has led to attacks on 5G masts and telecoms engineers.6 We are seeing many of these same narratives reoccur across a wide range of different ideologies. Fake news about minority communities has circulated on social media in an attempt to whip up hatred. These include false claims that mosques have remained open during 7 Since the outbreak of the coronavirus (COVID-19) lockdown. Evidence has also shown that pandemic, the Commission for Countering ‘Far Right politicians and news agencies [...] Extremism has heard increasing reports of capitalis[ed] on the virus to push forward their 8 extremists exploiting the crisis to sow division anti-immigrant and populist message’. Content and undermine the social fabric of our country. such as this normalises Far Right attitudes and helps to reinforce intolerant and hateful views We have heard reports of British Far Right towards ethnic, racial or religious communities. activists and Neo-Nazi groups promoting anti-minority narratives by encouraging users Practitioners have told us how some Islamist to deliberately infect groups, including Jewish activists may be exploiting legitimate concerns communities1 and of Islamists propagating regarding securitisation to deliberately drive a anti-democratic and anti-Western narratives, wedge between communities and the British 9 claiming that COVID-19 is divine punishment state. -

Office of the Governor Annual Report 2014

Office of the Governor of Tasmania Annual Report 1 July 2014- 30 June 2015 Government House Hobart Available on the Office of the Governor website: www. ovhouse. tas. ov. au Table of Contents Table of Contents 1 Letter ofTransmittal 3 Mission 4 Objectives The Office of the Governor 4 Overview 4 Organisational Structure 4 Functions of the Office 5 Corporate Governance 5 Output Report 6 Output 1. 1 Support of the Governor 6 Financial Performance 6 Performance Indicators for Output 1.1 6 Qualitative Assessment 7 Key Activities - Results 7 The Year in Review 8 Constitutional 8 Administration in the absence of the Governor 10 Ceremonial 11 Visitors to Government House 13 Significantevents 13 School and community groups 19 Official callers and DiplomaticVisits 20 Recqrtions 22 Monthly State Rooms and garden tours 24 Government House productivity and training services 24 External events 25 The Government House website 28 The Government House Estate 28 Staff 29 Honorary Aides-de-Camp 30 Human Resource Management 31 Indicators of OrganisationalHealth 31 - Sick Leave and Overtime 31 - Staff Turnover 31 -Staff Leave 31 - Workers' Compensation 31 StaffEnterprise Agreement and StaffAward 31 Training and Development 32 Training Services 32 Industrial Relations 32 Work Health and Safety 32 Asset Management and Risk Policies 32 Asset Management 32 Maintenance and Capital Programs 33 Asset Management Systems 33 Acquisition and Disposal ofAssets 33 Risk Management 33 Government Procurement - Support for Local Business 33 Supplementary Information 33 Pricing -

Government and Indigenous Australians Exclusionary Values

Government and Indigenous Australians Exclusionary values upheld in Australian Government continue to unjustly prohibit the participation of minority population groups. Indigenous people “are among the most socially excluded in Australia” with only 2.2% of Federal parliament comprised of Aboriginal’s. Additionally, Aboriginal culture and values, “can be hard for non-Indigenous people to understand” but are critical for creating socially inclusive policy. This exclusion from parliament is largely as a result of a “cultural and ethnic default in leadership” and exclusionary values held by Australian parliament. Furthermore, Indigenous values of autonomy, community and respect for elders is not supported by the current structure of government. The lack of cohesion between Western Parliamentary values and Indigenous cultural values has contributed to historically low voter participation and political representation in parliament. Additionally, the historical exclusion, restrictive Western cultural norms and the continuing lack of consideration for the cultural values and unique circumstances of Indigenous Australians, vital to promote equity and remedy problems that exist within Aboriginal communities, continue to be overlooked. Current political processes make it difficult for Indigenous people to have power over decisions made on their behalf to solve issues prevalent in Aboriginal communities. This is largely as “Aboriginal representatives are in a better position to represent Aboriginal people and that existing politicians do not or cannot perform this role.” Deeply “entrenched inequality in Australia” has led to the continuity of traditional Anglo- Australian Parliamentary values, which inherently exclude Indigenous Australians. Additionally, the communication between the White Australian population and the Aboriginal population remains damaged, due to “European contact tend[ing] to undermine Aboriginal laws, society, culture and religion”. -

Respondus Lockdown Browser & Monitor Remote Proctoring Is Available, but Not Recommended. Please Consider Alternative Assess

Respondus Lockdown Browser & Monitor Remote proctoring is available, but not recommended. Please consider alternative assessment strategies. If you absolutely cannot use alternatives, and want to move forward using Respondus Lockdown Browser, here are some aspects to consider to minimize the impact to your students: Definitions: • Respondus Lockdown Browser is an internet browser downloaded and installed by students, which locks down the computer on which they are taking the test so that students cannot open other applications or web pages. Lockdown Browser does not monitor or record student activity. • Respondus Monitor is an instructor-enabled feature of Respondus Lockdown Browser, which uses the students’ webcams to record video and audio of the exam environment. It also records the students’ computer screens. Instructors can view these recordings after the exam session is over. Considerations: • If Respondus Monitor is enabled, students must have a webcam to take the test. Be aware that many of your students may not have access to a webcam. You will need to offer an alternative assessment for students who do not have a webcam. o Students may not be asked to purchase a webcam for these exams, unless one was required as an initial expectation for the course. Requiring the purchase of additional materials not specified in the class description or original syllabus opens up a host of concerns, including but not limited to: student financial aid and ability to pay, grade appeals, and departmental policies. • Both Respondus Lockdown Browser and Respondus Monitor require a Windows or Mac computer. iPads require a specialized app, and are not recommended. -

Strategy-To-Win-An-Election-Lessons

WINNING ELECTIONS: LESSONS FROM THE AUSTRALIAN LABOR PARTY 1983-1996 i The Institute of International Studies (IIS), Department of International Relations, Universitas Gadjah Mada, is a research institution focused on the study on phenomenon in international relations, whether on theoretical or practical level. The study is based on the researches oriented to problem solving, with innovative and collaborative organization, by involving researcher resources with reliable capacity and tight society social network. As its commitments toward just, peace and civility values through actions, reflections and emancipations. In order to design a more specific and on target activity, The Institute developed four core research clusters on Globalization and Cities Development, Peace Building and Radical Violence, Humanitarian Action and Diplomacy and Foreign Policy. This institute also encourages a holistic study which is based on contempo- rary internationalSTRATEGY relations study scope TO and WIN approach. AN ELECTION: ii WINNING ELECTIONS: LESSONS FROM THE AUSTRALIAN LABOR PARTY 1983-1996 By Dafri Agussalim INSTITUTE OF INTERNATIONAL STUDIES DEPARTMENT OF INTERNATIONAL RELATIONS UNIVERSITAS GADJAH MADA iii WINNING ELECTIONS: LESSONS FROM THE AUSTRALIAN LABOR PARTY 1983-1996 Penulis: Dafri Agussalim Copyright© 2011, Dafri Agussalim Cover diolah dari: www.biogenidec.com dan http:www.foto.detik.com Diterbitkan oleh Institute of International Studies Jurusan Ilmu Hubungan Internasional, Fakultas Ilmu Sosial dan Ilmu Politik Universitas Gadjah Mada Cetakan I: 2011 x + 244 hlm; 14 cm x 21 cm ISBN: 978-602-99702-7-2 Fisipol UGM Gedung Bulaksumur Sayap Utara Lt. 1 Jl. Sosio-Justisia, Bulaksumur, Yogyakarta 55281 Telp: 0274 563362 ext 115 Fax.0274 563362 ext.116 Website: http://www.iis-ugm.org E-mail: [email protected] iv ACKNOWLEDGMENTS This book is a revised version of my Master of Arts (MA) thesis, which was written between 1994-1995 in the Australian National University, Canberra Australia. -

BLIND SPORTS AUSTRALIA A.B.N. 68 008 621 252 a Foundation Member of the Australian Paralympic Committee

BLIND SPORTS AUSTRALIA A.B.N. 68 008 621 252 A Foundation Member of the Australian Paralympic Committee Newsletter April 2015 been included as a sport. I was also good to From the CEO catch up with Cathy Lambert from the Australian Paralympic Committee, Kent Dredge from BSA SA, Rajini Vasan from the Over the last three months Blind Sports Blind Sporting Council and David Tiller from Australia has been working hard on all three Goalball South Australia. of our main objectives – participation, promotion and advocacy. We have signed a tri-party Memorandum of Understanding with Blind and Vision Impaired Tenpin Bowling and Tenpin Bowling Australia. The press release (which is below) resulted in a segment on ABC News Perth (TV). I was very pleased to be asked to talk to Sports and Recreation students at Holmesglen Institute and discuss both the opportunities and the challenges that blind sports in Australia face. The students at Holmesglen are travelling to Fiji in October to run sports The All Abilities Cricket Championship was programmes for blind and vision impaired held in Melbourne to coincide with the Cricket persons. Sports will include rugby, netball World Cup (which I won’t talk about further!). rugby league and soccer. South Australia was the worthy champions in the final against Queensland. It was good to I also talked to a group of students from get out to see some of the matches and if you Melbourne Grammar School about NGOs and listened carefully you would of heard my the issues they face. dulcet tones assisting Marco, Hamish and Peter commentate the South Australia v ACT match. -

Clubs Australia (PDF

TABLE OF CONTENTS Chapter 1 Economic contribution of clubs 1.1 Introduction 1 1.2 Executive summary 2 1.3 Economic impact of the Club Movement 4 1.4 Industry characteristics 5 1.5 Revenue 5 1.6 Employment 9 1.7 Taxation 22 1.8 Club expenditure 24 1.9 Debt 30 1.10 Clubs produce significant flow-on economic benefits 33 1.11 Linkages to tourism 34 1.12 Aged care 38 1.13 Diversification 38 1.14 Alignment with community needs 43 1.15 Impact of clubs in rural and regional development 46 1.16 Partnerships with local government 47 1.17 Clubs and new/planned communities 49 Chapter 2 Social contribution of clubs 2.1 The social contribution of clubs 51 2.2 The nature and beneficiaries of clubs social contributions 52 2.3 Clubs contribution to social capital 53 2.3.1 Gaming revenue and “compulsory” community support 53 2.3.2 Non-compulsory support 57 2.4 Sporting infrastructure and support 63 2.5 Ageing population 70 2.6 Support for people with disabilities 74 2.7 Support for young people 75 2.8 Promoting social connections 76 2.9 Volunteering 77 2.10 Club tax 80 Chapter 3 Club Governance and Regulation 3.1 The club mode – not for private gain 81 3.2 Roles of board and management 81 3.3 Complexity of governance requirements 82 ii TABLE OF FIGURES Page Chapter 1 Economic contribution of clubs 1.1 State and Territory comparisons, all organisations 5 1.2 Division of income across the states and territories 6 1.3 Selected sources of income, all organisations 6 1.4 Sources of revenue, NSW -

Epidemics and Pandemics in Victoria: Historical Perspectives

Epidemics and pandemics in Victoria: Historical perspectives Research Paper No. 1, May 2020 Ben Huf & Holly Mclean Research & Inquiries Unit Parliamentary Library & Information Service Department of Parliamentary Services Parliament of Victoria Acknowledgments The authors would like to thank Annie Wright, Caley Otter, Debra Reeves, Michael Mamouney, Terry Aquino and Sandra Beks for their help in the preparation of this paper. Cover image: Hospital Beds in Great Hall During Influenza Pandemic, Melbourne Exhibition Building, Carlton, Victoria, circa 1919, unknown photographer; Source: Museums Victoria. ISSN 2204-4752 (Print) 2204-4760 (Online) Research Paper: No. 1, May 2020 © 2020 Parliamentary Library & Information Service, Parliament of Victoria Research Papers produced by the Parliamentary Library & Information Service, Department of Parliamentary Services, Parliament of Victoria are released under a Creative Commons 3.0 Attribution-NonCommercial- NoDerivs licence. By using this Creative Commons licence, you are free to share - to copy, distribute and transmit the work under the following conditions: . Attribution - You must attribute the work in the manner specified by the author or licensor (but not in any way that suggests that they endorse you or your use of the work). Non-Commercial - You may not use this work for commercial purposes without our permission. No Derivative Works - You may not alter, transform, or build upon this work without our permission. The Creative Commons licence only applies to publications produced by the