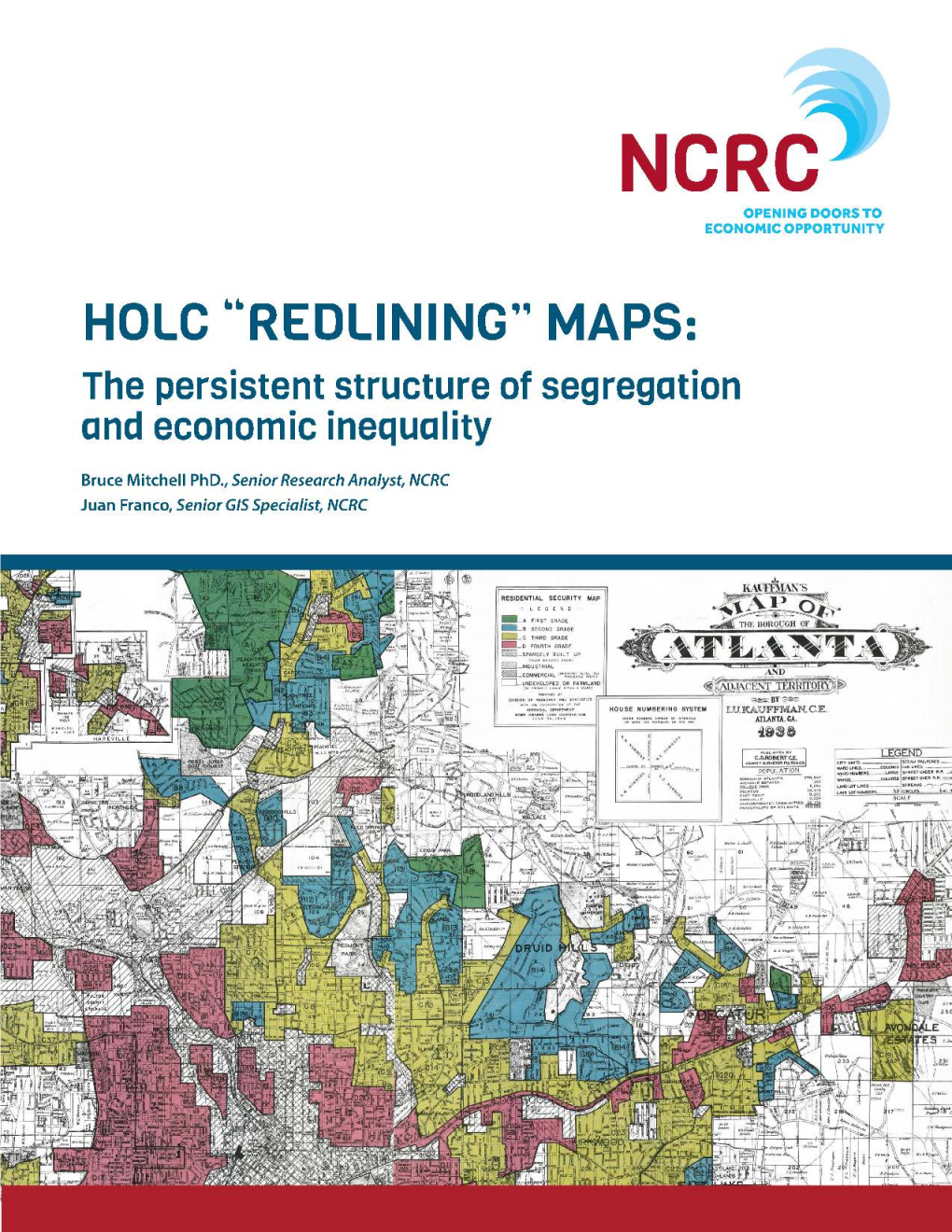

HOLC “REDLINING” MAPS: the Persistent Structure of Segregation and Economic Inequality

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RACIAL SEGREGATION and the ORIGINS of APARTHEID, 1919--36 Racial Segregation and the Origins of Apartheid in South Africa, 1919-36

RACIAL SEGREGATION AND THE ORIGINS OF APARTHEID, 1919--36 Racial Segregation and the Origins of Apartheid in South Africa, 1919-36 Saul Dubow, 1989 Palgrave Macmillan ISBN 978-1-349-20043-6 ISBN 978-1-349-20041-2 (eBook) DOI 10.1007/978-1-349-20041-2 © Saul Dubow, 1989 Softcover reprint ofthe hardcover Ist edition 1989 All rights reserved. For information, write: Scholarly and Reference Division, St. Martin's Press, Inc., 175 Fifth Avenue, New York, N.Y. 10010 First published in the United States of America in 1989 ISBN 978-0-312-02774-2 Library of Congress Cataloging-in-Publication Data Racial segregation and the origins of apartheid in South Africa. 1919-36/ Sau1 Dubow. p. cm. Bibliography: p. Includes index. ISBN 978-0-312-02774-2 1. Apartheid-South Africa-History-20th century. I. Dubow, Saul. DT763.R34 1989 88-39594 968.05'3--dc19 CIP Contents Pre/ace vii List 0/ Abbreviations x Introduction 1 PART I 1 The Elaboration of Segregationist Ideology, c. 1900-36 21 1 Early Exponents of Segregation 21 2 'Cultural Adaptation' 29 3 Segregation after the First World War 39 4 The Liberal Break with Segregation 45 2 Segregation and Cheap Labour 51 1 The Cheap-Iabour Thesis 51 2 The Mines 53 3 White Labour 56 4 Agriculture 60 5 The Reserves 66 6 An Emergent Proletariat 69 PART 11 3 Structure and Conßict in the Native Affairs Department 77 1 The Native Affairs Department (NAD) 77 2 Restructuring the NAD: the Public Service Commission, 1922-3 81 3 Conftict within the State and the Native Administration Bill ~ 4 'Efficiency', 'Economy' and 'Flexibility' -

What Anti-Miscegenation Laws Can Tell Us About the Meaning of Race, Sex, and Marriage," Hofstra Law Review: Vol

Hofstra Law Review Volume 32 | Issue 4 Article 22 2004 Love with a Proper Stranger: What Anti- Miscegenation Laws Can Tell Us About the Meaning of Race, Sex, and Marriage Rachel F. Moran Follow this and additional works at: http://scholarlycommons.law.hofstra.edu/hlr Part of the Law Commons Recommended Citation Moran, Rachel F. (2004) "Love with a Proper Stranger: What Anti-Miscegenation Laws Can Tell Us About the Meaning of Race, Sex, and Marriage," Hofstra Law Review: Vol. 32: Iss. 4, Article 22. Available at: http://scholarlycommons.law.hofstra.edu/hlr/vol32/iss4/22 This document is brought to you for free and open access by Scholarly Commons at Hofstra Law. It has been accepted for inclusion in Hofstra Law Review by an authorized administrator of Scholarly Commons at Hofstra Law. For more information, please contact [email protected]. Moran: Love with a Proper Stranger: What Anti-Miscegenation Laws Can Tel LOVE WITH A PROPER STRANGER: WHAT ANTI-MISCEGENATION LAWS CAN TELL US ABOUT THE MEANING OF RACE, SEX, AND MARRIAGE Rachel F. Moran* True love. Is it really necessary? Tact and common sense tell us to pass over it in silence, like a scandal in Life's highest circles. Perfectly good children are born without its help. It couldn't populate the planet in a million years, it comes along so rarely. -Wislawa Szymborskal If true love is for the lucky few, then for the rest of us there is the far more mundane institution of marriage. Traditionally, love has sat in an uneasy relationship to marriage, and only in the last century has romantic love emerged as the primary, if not exclusive, justification for a wedding in the United States. -

Race, Gender, “Redlining,” and the Discriminatory Access to Loans, Credit, and Insurance: an Historical and Empirical Analys

Digital Commons at St. Mary's University Faculty Articles School of Law Faculty Scholarship 1996 Race, Gender, “Redlining,” and the Discriminatory Access to Loans, Credit, and Insurance: An Historical and Empirical Analysis of Consumers Who Sued Lenders and Insurers in Federal and State Courts, 1950-1995 Willy E. Rice St. Mary's University School of Law, [email protected] Follow this and additional works at: https://commons.stmarytx.edu/facarticles Part of the Law Commons Recommended Citation Willy E. Rice, Race, Gender, “Redlining,” and the Discriminatory Access to Loans, Credit, and Insurance: An Historical and Empirical Analysis of Consumers Who Sued Lenders and Insurers in Federal and State Courts, 1950-1995, 33 San Diego L. Rev. 583 (1996). This Article is brought to you for free and open access by the School of Law Faculty Scholarship at Digital Commons at St. Mary's University. It has been accepted for inclusion in Faculty Articles by an authorized administrator of Digital Commons at St. Mary's University. For more information, please contact [email protected]. QUESTIONABLE SUMMARY JUDGMENTS, APPEARANCES OF JUDICIAL BIAS, AND INSURANCE DEFENSE IN TEXAS DECLARATORY-JUDGMENT TRIALS: A PROPOSAL AND ARGUMENTS FOR REVISING TEXAS RULES OF CIVIL PROCEDURE 166A(A), 166A(B), AND 166A(I) WILLY E. RICE* I. Introduction ........................................... 536 II. Brief Overview-Federal and Texas's Summary- Judgm entRules ........................................ 570 A. Federal Motions for Summary Judgment .......... 570 B. Texas's "Traditional" Summary-Judgment Motion-Texas Rules of Civil Procedure 166a(a) and 166a(b) ........................................ 574 C. Texas's "No-Evidence" Summary-Judgment Motion-Texas Rule of Civil Procedure 166a(i) . -

Apartheid and Jim Crow: Drawing Lessons from South Africaâ•Žs

Journal of Dispute Resolution Volume 2019 Issue 1 Article 16 2019 Apartheid and Jim Crow: Drawing Lessons from South Africa’s Truth and Reconciliation Benjamin Zinkel Follow this and additional works at: https://scholarship.law.missouri.edu/jdr Part of the Dispute Resolution and Arbitration Commons Recommended Citation Benjamin Zinkel, Apartheid and Jim Crow: Drawing Lessons from South Africa’s Truth and Reconciliation, 2019 J. Disp. Resol. (2019) Available at: https://scholarship.law.missouri.edu/jdr/vol2019/iss1/16 This Comment is brought to you for free and open access by the Law Journals at University of Missouri School of Law Scholarship Repository. It has been accepted for inclusion in Journal of Dispute Resolution by an authorized editor of University of Missouri School of Law Scholarship Repository. For more information, please contact [email protected]. Zinkel: Apartheid and Jim Crow: Drawing Lessons from South Africa’s Truth Apartheid and Jim Crow: Drawing Lessons from South Africa’s Truth and Reconciliation Benjamin Zinkel* I. INTRODUCTION South Africa and the United States are separated geographically, ethnically, and culturally. On the surface, these two nations appear very different. Both na- tions are separated by nearly 9,000 miles1, South Africa is a new democracy, while the United States was established over two hundred years2 ago, the two nations have very different climates, and the United States is much larger both in population and geography.3 However, South Africa and the United States share similar origins and histories. Both nations have culturally and ethnically diverse populations. Both South Africa and the United States were founded by colonists, and both nations instituted slavery.4 In the twentieth century, both nations discriminated against non- white citizens. -

Before and After Segregation and Apartheid: a Comparative Analysis

NEW CITIES NEW ECONOMIES Before and After Segregation and Apartheid: A Comparative Analysis By Leland Ware | Peer Review Introduction This article compares conditions in South Africa elimination of apartheid in South Africa, significant before and after apartheid to the circumstances in improvements have been made, but most poor Black America during and after segregation. During the eras people still reside in impoverished communities in of segregation and apartheid, conditions for Black townships and the countryside. people in America and South Africa were oppressive in the extreme. The two systems had some differences, The broad-based, grass roots, Civil Rights movement but the overall impact was the same. Black people started in America in the 1950s. Over the next decade, were physically separated and treated differently, marches, boycotts, and other forms of nonviolent and less favourably, than their white counterparts. protests were organised and executed. These activities The progress made by African Americans during culminated with the enactment of the Civil Rights the 50 years since the end of segregation has been Act of 1964, the Voting Rights Act of 1965, and the Fair substantial, but significant disparities between Black Housing Act of 1968. In the years that followed, African and white people still linger. In the 25 years since the Americans made significant advances in educational Volume 85 / 2020 63 NEW CITIES NEW ECONOMIES attainment levels, employment opportunities, family income, home ownership, and wealth. The South African government In South Africa, Black people and other non-white is in danger of becoming the groups stepped up their opposition to apartheid in political stereotype of what is the 1950s. -

Racial and Class Segregation Patterns in the United States

e.polis Volume V, Fall/Winter 2012 76 Racial and Class Segregation Patterns in the United States: Comparing Atlanta and Chicago Neal Andrew Johnson Urban Studies Undergraduate Capstone Research Project Proposal Dr. Jamie Harris, Professor University of Wisconsin – Milwaukee Spring 2012 e.polis Volume V, Fall/Winter 2012 77 Introduction Segregation is not a new phenomenon. Its roots can be traced back to places such as ancient China in the 6th Century (Kiang, 1994). Here, during the Sui and early Tang dynasties, ‘functional segregation’ was the rule where “the strict social hierarchy of society had been reflected and reinforced by the rigid segregation of populations in their respective wards” (Kiang, 1994; 48). Nobility and highly ranked officials were segregated in separate wards from the craftsmen and merchants. Similarly, Lubeck, Germany was segregated with separate quarters for merchants and craftsmen throughout much of the 12th-16th centuries (Parker, 1986). Furthermore, Jews and other religious groups were excluded from living in the city altogether based on their religious backgrounds (Cowan, 1978). So this is nothing new, and has created a serious challenge for cities throughout the centuries. Segregation patterns throughout the twentieth century vary in their scope and implementation. Most American’s are aware of the racial segregation that is apparent in many cities throughout the country. The past century has proven to be a decisive time in the study of these patterns. However, what can be said about segregation along class and economic lines? Does the racial discrimination, particularly between blacks and whites, have any correlation with class segregation? How did these patterns change throughout the twentieth century? Was there any difference between cities of the north versus the cities of the south? These are the questions I seek to answer as I study the segregation patterns of the United States. -

A Complete List of the Definitions Found in the Dictionary of Race, Ethnicity and Culture

A complete list of the definitions found in The Dictionary of Race, Ethnicity and Culture A Aborigine \ Acculturation Group \ Adaptation \ Adjustment \ Affirmative \ Afrocentrism \ Aggression \ Alien \ Alienation \ Altruism \ Amnesty \ Anticipated \ Anti-Racism \ Anti-Semitism \ Apartheid \ Art \ Assimilation \ Asylum \ Ausländer B Bilingualism \ Bioethics \ Black \ Boat People \ Border C Caste \ Chauvinism \ Circumcision \ Citizenship \ Civilization \ Colonialism \ Colour Bar \ Colour- Blind Society \ Coloured \ Commission for Racial Equality \ Community \ Complementarism \ Concentration Camp or Death Camp \ Conformism \ Cosmopolitism \ Creole \ Cross-Cultural \ Cross-Cultural Medicine \ Cultural Areas \ Cultural Determinism \ Cultural Evolutionism \ Cultural Imperialism \ Cultural Relativism \ Culture \ Cybernazis D Dance \ Denizen \ Deportation \ Developing Countries \ Diaspora \ Differentialism \ Discrimination \ Diversity-Similarity \ Double Consciousness \ Dual Citizenship E Ebonics \ Eco-Racism \ Emancipation \ Emigration \ Empowerment - Disempowerment \ Enculturation \ Equality \ Ethnic \ Ethnic Cleansing \ Ethnic Enterprises \ Ethnic Minority \ Ethnic Politics \ Ethnicity \ Ethnicity and Race \ Ethnicization \ Ethnocentrism \ Ethnocide \ Ethno-Nationalism \ Ethnopsychiatry \ Evolution \ Exclusion \ Exile \ Exoticism \ Extracomunitario F Family \ Family Reunification \ Flows \ Folklore \ Foreigner \ Fortress \ Free Movement \ Frontier \ Fundamentalism G Gastarbeiter \ Genocide \ Genome \ Genotype \ Ghetto \ Globalization \ Gypsy -

JEWS and the CIVIL RIGHTS MOVEMENT

ENTREE: A PICTURE WORTH A THOUSAND NARRATIVES JEWS and the FRAMING A picture may be worth a thousand words, but it’s often never quite as CIVIL RIGHTS simple as it seems. Begin by viewing the photo below and discussing some of the questions that follow. We recommend sharing more MOVEMENT background on the photo after an initial discussion. APPETIZER: RACIAL JUSTICE JOURNEY INSTRUCTIONS Begin by reflecting on the following two questions. When and how did you first become aware of race? Think about your family, where you lived growing up, who your friends were, your viewing of media, or different models of leadership. Where are you coming from in your racial justice journey? Please share one or two brief experiences. Photo Courtesy: Associated Press Once you’ve had a moment to reflect, share your thoughts around the table with the other guests. GUIDING QUESTIONS 1. What and whom do you see in this photograph? Whom do you recognize, if anyone? 2. If you’ve seen this photograph before, where and when have you seen it? What was your reaction to it? 3. What feelings does this photograph evoke for you? 01 JEWS and the CIVIL RIGHTS MOVEMENT BACKGROUND ON THE PHOTO INSTRUCTIONS This photograph was taken on March 21, 1965 as the Read the following texts that challenge and complicate the Rev. Dr. Martin Luther King, Jr. marched with others from photograph and these narratives. Afterwards, find a chevruta (a Selma to Montgomery, Alabama in support of voting partner) and select several of the texts to think about together. -

Resisting the Tendency to Disconnect

INTERSECTIONALITY IN PSYCHOLOGICAL SCIENCE 1 Intersectionality Research in Psychological Science: Resisting the Tendency to Disconnect, Dilute, and Depoliticize NiCole T. Buchanan & Lauren O. Wiklund Michigan State University Department of Psychology East Lansing, MI, US This is a post-peer-review, pre-copyedit version of an article accepted for publication in Research on Child and Adolescent Psychopathology on 11/30/2020. The final authenticated version is available online at: http://dx.doi.org/10.1007/s10802-020-00748-y Author Note NiCole T. Buchanan https://orcid.org/0000-0001-9288-5245 Lauren O. Wiklund https://orcid.org/0000-0001-9997-0813 Correspondence concerning this article should be addressed to NiCole T. Buchanan, Department of Psychology, Michigan State University, 316 Physics Rd, East Lansing, MI, 48824. E-mail: [email protected]. INTERSECTIONALITY IN PSYCHOLOGICAL SCIENCE 2 Abstract Psychological science has been slow to incorporate intersectionality as a concept and as a framework for conducting research. This limits not only the potential for intersectionality theory, but also limits the potential impact of the research claiming to use it. Mennies and colleagues conducted a study of psychopathology and treatment utilization using a large racially diverse sample of youth and frame their work as intersectional because they compare across three social categories (race, sex, and social class) and consider social issues that may impact the groups studied. We argue that while this represents a preliminary step, it does not represent intersectionality theory and praxis. In this article we review intersectional theory and praxis, examine psychological science and its resistance to fully incorporating intersectionality, and highlight how research must shift to be truly intersectional. -

Urban Politics Cities and Suburbs in a Global Age

Urban Politics Cities and Suburbs in a Global Age Edited by Myron A. Levine First published 2010 ISBN 13: 978-1-138-60433-9 (hbk) ISBN 13: 978-1-138-60434-6 (pbk) ISBN 13: 978-0-429-46854-4 (ebk) Chapter 2 The Evolution of Cities and Suburbs Myron A. Levine CC BY-NC-ND 4.0 40 THE EVOLUTION OF CITIES AND SUBURBS Box 2.1 2 The Evolution of Cities and Suburbs A “Willful Blindness” : Failing to Recognize Government’s Role in Promoting Racial Imbalances in the Metropolis In 2007, the United States Supreme Court struck down moderate school integra- tion programs in Denver and Seattle. Denver and Seattle established high-quality “magnet schools” in an attempt to promote voluntary school integration. No one would be forced to attend the special schools. But public offi cials hoped that the schools would attract families of all races who were interested in schools of excel- lence. The admissions program took an applicant’s racial and ethnic background into account in order to ensure that school enrollments would be well integrated. The parents of some white students, however, objected that their children were suffering discrimination as a consequence of the school systems’s effort to shape Are urban problems “natural,” that is, the unavoidable result of the choices made by classroom diversity. citizens in a free society? That’s what many Americans think. This point of view was The Supreme Court struck down the voluntary integration plans. In his plurality also reflected in the opinion of United States Supreme Court Chief Justice John Roberts opinion, Chief Justice John Roberts stated that the school districts had given who argued that present-day school segregation is largely natural, that it is the result of unallowable consideration to race in their admissions decisions. -

Systematic Inequality: Displacement, Exclusion, and Segregation How America’S Housing System Undermines Wealth Building in Communities of Color

GETTY/BASTIAAN SLABBERS Systematic Inequality: Displacement, Exclusion, and Segregation How America’s Housing System Undermines Wealth Building in Communities of Color By Danyelle Solomon, Connor Maxwell, and Abril Castro August 2019 WWW.AMERICANPROGRESS.ORG Systematic Inequality: Displacement, Exclusion, and Segregation How America’s Housing System Undermines Wealth Building in Communities of Color By Danyelle Solomon, Connor Maxwell, and Abril Castro August 2019 Contents 1 Introduction and summary 2 American public policy systematically removes people of color from their homes and communities 6 Federal, state, and local policies have fortified housing discrimination 13 Conclusion 14 About the authors 15 Methodology 16 Appendix 18 Endnotes Authors’ note: CAP uses “Black” and “African American” interchangeably throughout many of our products. We chose to capitalize “Black” in order to reflect that we are discussing a group of people and to be consistent with the capitalization of “African American.” Introduction and summary Homeownership and high-quality affordable rental housing are critical tools for wealth building and financial well-being in the United States.1 Knowing this, American lawmakers have long sought to secure land for, reduce barriers to, and expand the wealth-building capacity of property ownership and affordable rental housing. But these efforts have almost exclusively benefited white households; often, they have removed people of color from their homes, denied them access to wealth- building opportunities, and relocated them to isolated communities. Across the country, historic and ongoing displacement, exclusion, and segregation continue to prevent people of color from obtaining and retaining their own homes and accessing safe, affordable housing. For centuries, structural racism in the U.S. -

Occupation, Not Apartheid | the Washington Institute

MENU Policy Analysis / Fikra Forum Occupation, Not Apartheid by Mohammed Dajani Apr 7, 2017 Also available in Arabic ABOUT THE AUTHORS Mohammed Dajani Mohammed S. Dajani Daoudi is the former Weston Fellow at the Washington Institute for Near East Policy and is Director of the Wasatia Academic Institute in Jerusalem. Brief Analysis n 2014, U.S. Secretary of State John Kerry warned that Israel risked becoming an apartheid state if a two-state I solution could not be reached. In March 2017, a UN report titled "Israeli Practices toward the Palestinian People and the Question of Apartheid," published by the Economic and Social Commission for Western Asia (ESCWA), accused Israel of being an "apartheid state" over its treatment of Palestinians. The authors of the report, Richard Falk and Virginia Tilley, based their definition of apartheid primarily on Article II of the 1973 International Convention on the Suppression and Punishment of the Crime of Apartheid and the Rome Statute of the International Criminal Court. The Rome Statute states: "The term 'the crime of apartheid,' which shall include similar policies and practices of racial segregation and discrimination as practiced in southern Africa, shall apply to...inhuman acts committed for the purpose of establishing and maintaining domination by one racial group of persons over any other racial group of persons and systematically oppressing them." The Apartheid Convention sets forth that the "crime of apartheid" consists of "discrete inhuman acts that acquire the status of crimes against humanity