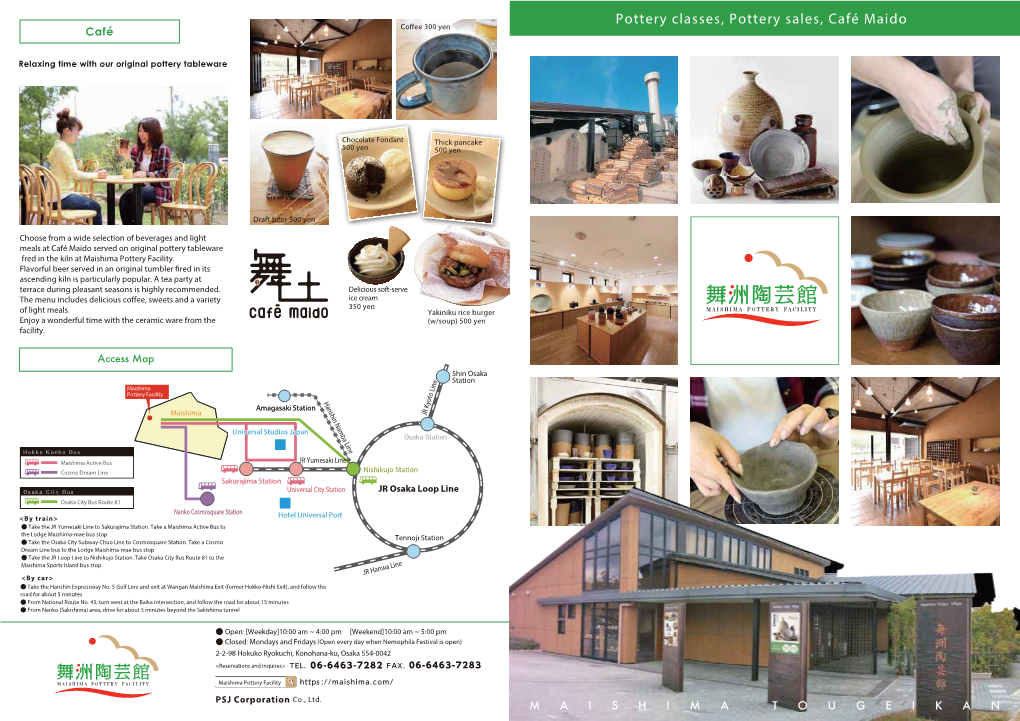

Maishima Pottery Facility's English Pamphlet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotel Brochure

A leafy oasis right in the heart of the city. Banquet Room[Oak Room] Lobby A lush green setting, established quality. A comfortable space in the center of Osaka. A place where business or sightseeing travelers enjoy the pleasure of relaxing. The comfort of our guests is the treasure we hold. Check In 15:00 / Check Out 11:00 2-5-7 Koraibashi, chuo-ku, Osaka, 541-0043 TEL: 06-6223-1131 FAX: 06-6223-0257 Superior Queen Guest room information Standard【12m2】 Superior Queen【24m2】 We support business users with the functionality-oriented room. You can enjoy a comfortable hotel life in a room has a queen size bed and a bathroom with separate tub and shower. Comfort Moderate Twin (+Sofa Bed) Moderate Twin Superior Twin 【13m2】 【24m2】 【24m2】 【24m2】 A room with a closet, is popular among This room is available up to three Two modular bath in the room. You can use The high quality twin room completed with long-stay guests. persons. a bath room without waiting time. an espresso machine and a bathroom with separate tub and shower. Internet service Amenities Wireless LAN internet service is available in all guest-rooms, ●Toothbrush kit ●Razor ●Hairbrush ●Cotton swabs ●Shampoo while guests may also set up a wired network connection ●Hair conditioner ●Body soap ●Face & hand soap ●Green tea kit using the provided LAN cable. This service is complimentary ●Face towel ●Bath towel ●Slippers ●Nightwear ●Shower cap and available 24 hours a day. * The area of this room is calculated using the center line of the wall, including the pipe shaft. -

JR-West Group Medium-Term Management Plan 2017 Progress and Future Priority Measures (Update)

JR-West Group Medium-Term Management Plan 2017 JR-West Group Medium-Term Management Plan 2017 Progress and Future Priority Measures (Update) Taking the Next Step. Working together with communities. April 30, 2015 West Japan Railway Company Contents 01 1. Introduction (1) Positioning of the Update (2) Review of First 2 Years—Steady Progress and Future Challenges (3) Operating Environment Changes and Future Priority Measures (4) Review of First 2 Years, Operating Environment Changes, and Future Priority Measures 2. Three Basic Strategies and Four Business Strategies Future Priority Measures Based on Review of First 2 Years 【Three Basic Strategies】 ① Safety ② Customer Satisfaction ③ Technologies 【Four Business Strategies】 ④ Shinkansen: “Enhance” ⑤ Kansai Urban Area: “Improve” ⑥ Other West Japan Area: “Invigorate” ⑦ Business Development: “Develop” 【Topics】 ① Hokuriku Shinkansen and Invigoration of Hokuriku Region ② New ”LUCUA osaka” ③ Response to Inbound Visitor Demand 3. Financial Benchmarks and Shareholder Returns 1. Introduction (1) Positioning of the Update 02 Two years ago, the Group formulated the JR-West Group Medium-Term Management Plan 2017, which defined the “Form of the New JR-West Group” for the next era. In March 2015, the Kanazawa segment of the Hokuriku Shinkansen was opened, a development that is invigorating the entire Hokuriku region. In addition, April 2015 saw the opening of the new LUCUA 1100 in OSAKA STATION CITY, bringing an even wider range of customers to this facility. In this update, we will review our initiatives and progress over the first 2 years of the plan, and discuss the priority measures that will be implemented in the future based on operating environment changes. -

Flood Depth Flooding of Yodogawa River

Mikuni Station Mikuni 9 X 9 9 9 9 Miyahara Flood depth 9 9 Flooding of Yodogawa River 9 X 9 9 Hankyu Kobe Line 9 9 9 9 9 9 9 9 9R Higashiawaji 9 Nishimiyahara 10 m to less than 20 m 9 9 5 to 7F X 9 9 (5F floor to 7F under eaves flooded) Mikunihommachi 9 9 Niitaka JR Osaka Higashi Line 9 9 Shin-Osaka Station 9R 9X X 9 9 9 Kanzakigawa Station 9 9 X 5 m to less than 10 m 9R 3 to 4F Kanzaki River 9 (3F floor to 4F under eaves flooded) Higashinakajima 9 9 9 9 9R 9 Sozenji X 9 9 9 9 Station 9 9 9 San-yo Shinkansen 9 9 X 9 9 9 9 9 3 m to less than 5 m Mitsuyakita 9 Kikawahigashi 9 Nonakakita 9R 9 9 9 9 9 9R 9 9 9 (2F floor to under eaves flooded) 9 9 9 9 9 9 Akagawa 9 Kunijima Station 2F 9 9 9 9 9 9 9 9 9R X X Nishinakajima -Minamigata 9 X X ] Nishinakajima 9 Yodogawa Ward Station 9 9 Mitsuyanaka 9 9 Kunijima 0.5 m to less than 3 m 9 9 Daitocho 9 9 9 Nonakaminami X 9 9 (1F floor to under eaves flooded) 9 Hankyu Kyoto Line 9 9 9R 9 9 1F 9 9 9 9 Minamikata Station Mitsuyaminami 9 Yodogawa-ozeki Bridge 9 Less than 0.5 m 9 9 Below 1F 9 9 (Below 1F floor flooded) 9 9\ 9 9 Kemacho Shirokitakoendori Station 9 9 9X Kikawanishi X X X Tagawakita 9g X Shin-Yodogawa-ohashi Bridge 9\ 9 9 99 9 9 9 X 9\ Nagara Bridge 9 9 National Highway Route 423 9 9 9 9 9 X 9X Hankyu Senri Line Jusohommachi X 9 9 9 9 X 9 9 9 9 X Juso Station Tagawa Jusohigashi 9 Jusomotoimazato 9R 9 X 9 9 9 9R X 9 9 9 9 Nagaranishi 9229 9 9439 69 Tomobuchicho 9R 9 9 9 9X X 9 9R 9239 9 9 9 Juso-ohashi Bridge Honjohigashi916 319 79 9 Nagarahigashi 9R 9 X 9 Honjonishi Shin-Juso-ohashi Bridge Hankyu Kobe Line 91ų 95 9 ~ 9R National Highway Route 176 Toyosaki 99 9 9 Shinkitano Line Kyoto JR X Tsukamoto 9X 9 910 79 9 9 9 9479 9 915 9 9Tsukamoto Station 9 989 Nagaranaka 9249 309 9 X 9 Nakatsu 9R 9X 9 279 9 Zengenjicho Nakatsu Station 9469 9925 9269 X 9 9 9 Kashiwazato Hanshin Expressway Osaka Ikeda Line (No. -

Udon Saga Daumants Grants

Udon Saga Daumants Grants The Udon Saga The Musings and Meanderings of Daumants Grants Page 1 Udon Saga Daumants Grants Page 2 Udon Saga Daumants Grants Contents Life in the Big Udon ........................................................................................................... 4 More from the Big Udon..................................................................................................... 7 Slurpings from the Big Udon .............................................................................................. 9 Revenge of the Big Udon .................................................................................................. 11 Half-Life at the Little Udon .............................................................................................. 16 Cubing it at the Big Udon ................................................................................................. 21 The Seventh Samurai of the Big Udon ............................................................................. 24 Veggin' Out at the Big Udon ............................................................................................. 28 Heartbreak Ridge at the Big Udon .................................................................................... 33 Return to the Big Udon ..................................................................................................... 36 Go Wet, Big Udon! Go Wet to Nara................................................................................. 41 Ramblings and Roses (Stinking) -

JR-West Group Medium-Term Management Plan 2022 Major

“JR-West Group Medium-Term Management Plan 2022” Overview of Major Initiatives As of May 8, 2019 Red letters: Additions after the announcement of the medium-term management plan FY2019.3 FY2020.3 FY2021.3 FY2022.3 FY2023.3 FY2024.3~ Building tourism routes that combine railways and cruise ships, operating sightseeing trains that link Increasing Regional Setouchi Palette strategic Shinkansen stations and tourist destinations Value Project Developing wide-area tourism routes as a foundation ▼Commencing operation of the Hello Kitty Shinkansen ▼Enhancing strategic stations (Onomichi) Drawing on the appeal of distinctive regional food and souvenirs to develop strategic stations, developing appealing accommodation facilities Developing content that has the ability to draw customers Developing commercial products that feature regional appeal and opening sales routes, establishing and publicizing content combining new perspectives on regional events and attractions Opening an official Twitter account for train operating-status information (English, traditional Hospitality initiatives Chinese, simplified Chinese, Korean), opening Thai-language web site for inbound customers Installing Western-style toilets on 700-series rolling stock Improving reception systems Installing free Wi-Fi in Shinkansen trains (Sanyo/Hokuriku) Enabling Internet reservations from overseas Considering/implementing campaigns to attract overseas tourists in Developing and improving wide-area tourism routes Providing diverse products (expanding regional airport usage products -

Hankyu Hanshin Holdings Sustainability Data Book 2020 Table of Contents

Hankyu Hanshin Holdings Sustainability Data Book 2020 Table of Contents 2 Top Message 3 Group Management Philosophy 4 Hankyu Hanshin Holdings Group Sustainability Declaration Sustainability Declaration 5 Six Priority Issues and Policies Sustainability Declaration 7 Steps to Determine Priority Issues (Materiality Matrix) Sustainability Declaration 9 Comments by External Experts in Determining Priority Issues (Materiality Matrix) 1 1 What We Can Do for the New Era 13 Initiatives for the SDGs (Sustainable Development Goals) Group Social Contribution Initiatives 15 Hankyu Hanshin Dreams and Communities of the Future Project 17 Priority Issue 1: Safe, Reliable Infrastructure 28 Priority Issue 2: Thriving Communities 34 Priority Issue 3: Life Designs for Tomorrow 40 Priority Issue 4: Empowering Individuals 47 Priority Issue 5: Environmental Protection 56 Priority Issue 6: Robust Governance 63 Data Sheet 65 Corporate Data 67 GRI Standards Content Index Editorial Policy This report outlines the approach, initiatives, major performance results in fiscal 2020, future policies and plans of the Hankyu Hanshin Holdings Group for the realization of a sustainable society. ■ Guidelines for Reference: GRI Sustainability Reporting Standards ■ Report Scope: Core companies (Hankyu Corporation, Hanshin Electric Railway, Hankyu Hanshin Properties, Hankyu Travel International, Hankyu Hanshin Express, Hankyu Hanshin Hotels); companies belonging to each of the core businesses (Urban Transportation, Real Estate, Entertainment, Information and Communication Technology, Travel, International Transportation, and Hotels); and other operating companies ■ Period Covered: FY2020 (April 1, 2019 to March 31, 2020) The results data is based on our business activities conducted in fiscal 2020. However, the contents of activities include those conducted in fiscal 2021. ■ Date of Issue: January 2021 ■ Next Issue: scheduled for November 2021 01 Top Message The Hankyu Hanshin Holdings Group has a long history of more than 100 years since its foundation. -

Our Hotel Is Located in Front of Fukushima Station, Which Is One Station from JR Osaka Station on the Osaka Loop Line (Inner Circle)

Major items Q A Our hotel is located in front of Fukushima Station, which is one station from JR Osaka Station on the Osaka Loop Line (inner circle). Our hotel is also a 2- to 3-minute walk from Fukushima Where is the nearest station? Station on the Hanshin Electric Railway and from Shin-Fukushima Station on the JR Tozai Line. Due to its convenience, we recommend using the Airport Limousine Bus. Use the bus service How do I access from Kansai from Kansai International Airport to Osaka Station. Then, from Osaka Station, take a train or International Airport and Osaka taxi to our hotel. The same type of access is available from Osaka (Itami) Airport. However, at (Itami) Airport? certain times of the day, there is also a bus service direct to our hotel. (1)One station on the JR Kyoto Line (4 minutes) → Change to the Osaka Loop Line at Osaka Access Station → Get off at the next station (Fukushima Station) on the inner circle of the Osaka Loop Line How do I access from Shin- (2) Three stations on the Midosuji Line Subway (7 minutes) → Get off at Umeda Station → Osaka Station? Change to JR → Get off at the next station (Fukushima Station) on the inner circle of the Osaka Loop Line (3) Taxi (about 15 minutes *Time will vary with traffic density.) It's about 40 minutes to Osaka (Itami) Airport. The fare is ¥640 one way for adults. Seats How long does the airport cannot be reserved for this bus service. To Osaka (Itami) Airport, we have four direct early- limousine bus service take from morning bus services that leave from our hotel. -

For Translation Purposes Only November 20, 2014 for Immediate

For Translation Purposes Only November 20, 2014 For Immediate Release United Urban Investment Corporation Hitoshi Murakami Executive Officer (Securities Code: 8960) Asset Management Company: Japan REIT Advisors Co., Ltd. Ikuo Yoshida President and CEO Inquiries: Kenichi Natsume Chief Financial Officer TEL: +81-3-5402-3680 Notice Concerning Acquisition of Properties (MT Ariake Center Building I&II and 2 Other Properties) United Urban Investment Corporation (“United Urban”) hereby announces that Japan REIT Advisors Co., Ltd. (“JRA”), the asset management company to which United Urban entrusts asset management services, has decided today to acquire properties as set forth below. 1. Acquisition of the Properties United Urban will acquire the following trust beneficial interests in real estate (referred to as individually or collectively, the “Asset to be Acquired” or “Assets to be Acquired”). Estimated Scheduled Type of Estimated Post- Scheduled Property Acquisition Use Property Name Location NOI Yield Depreciation Acquisition Number Price (Note 3) Yield Date (Note 1) (Note 2) (Note 4) MT Ariake Center Building Koto-ku, ¥8,000 Nov. 25, E6 Warehouse 5.2% 4.5% I&II Tokyo million 2014 LIFE Nishikujo (Site) Osaka, ¥1,760 March 2, A34 - 5.0% 5.0% (Note 5) Osaka million 2015 LIFE Tamatsukuri (Site) Osaka, ¥1,880 March 2, A35 - 5.2% 5.2% (Note 5) Osaka million 2015 ¥11,640 5.2% 4.7% Total/Average — million (Note 6) (Note 6) (Notes) 1. Of the types of use indicated on the real estate register, the primary types are shown. 2. The prices are shown in the amount excluding acquisition costs, property taxes, city planning taxes and consumption taxes and other costs. -

Beautification of the Yodogawa River Landscape

Beautification of the Yodogawa River Landscape OsakaPrefecturalGovernment March2019 Contents Introduction ・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P2 1.Transformation of the Yodogawa River・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P3 2.YodogawaRiverLandscape 2-1SelectedAreas・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P5 2-2 Capturing the Landscape・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P5 3. Fundamental Goal and Policies for Landscape Creation 3-1 Fundamental Goal・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P7 3-2 FundamentalPolicies・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P7 4. Various Efforts to Beautify the Scenery of the Yodogawa 4-1 Maintaining and Preserving the Rich Natural Landscape of the Yodogawa・・・・・・・・・・・・・・・ P9 4-2 Utilizing the Historical and Cultural Features of the Landscape Resources ・・・・・・・・・・・・・・ P9 4-3 Creating Activities and Liveliness to Enjoy the Yodogawa Landscape・・・・・・・・・・・・・・・・・・・ P10 4-4 Organizations Effectively Transmit Information About Attractive Landscapes・・・・・・・・・・・ P10 Conclusion・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P11 Reference Materials ExamplesofLandscapeResourceUsage・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P12 Attractive Yodogawa Landscape Maps 1-3 ・・・・・・・・・・・・・・・・・・・・・・・・・・・・・ P20 1 Introduction The OsakaMetropolitanAreaGrandDesign representsthebroadscaledirectionforurbanspacecreationinthe Osakametropolitanarea.Asanexampleofurbanspacecreationbasedonacooperativestructurecoveringawide -

JR-West Group Medium-Term Management Plan 2022

JR-West Group Medium-Term Management Plan 2022 Continuity Progress Making Our Vision into Reality April 2018 West Japan Railway Company Medium-Term Management Plan 2022 Medium-Term J R - WEST GROUP Table of Contents 01. Making Our Vision into Reality, with Continuity and Progress ● Making Our Vision into Reality, with Continuity and Progress 3 ● Steps toward Our Vision 4 ● Our Initiatives to Make Progress toward Our Vision 5 ● Unchanging Determination, Initiatives to Increase Safety 7 ● Building a Company in Which Each Employee Plays a Key Role 9 02. JR-West Group Medium-Term Management Plan 2022 ● Initiatives to Date and Future Changes in the Environment 10 ● JR-West Group’s Strategic Framework 11 ● Our Vision ~ The Ideal Forms ~ The Value We Provide 12 ● Groupwide Strategies (1) Increasing Regional Value 13 (2) Increasing the Value of Railway Belts 15 (3) Increasing Business Value 16 ● Railway Business Strategies 17 ● Non-Railway Business Strategies 19 ● Building Our Management Foundation 21 03. Capital Expenditure Plan 22 04. Target Indicators 25 (Reference) JR-West Group Medium-Term Management Plan 2022: Detailed Action Plan 1 All for Smiles! Everyone at the JR-West Group is dedicated to carefully considering what needs to be done and taking appropriate action. In this way, we will strive to put smiles on the faces of our customers, people in local communities, our shareholders, and our business partners. 2 01. Making Our Vision into Reality, with Continuity and Progress Making Our Vision In April 2017, the JR-West Group marked the 30th year since its establishment. Moving forward, the JR-West Group will strive to contribute to social and into Reality, with economic development as a corporate group that provides social infrastructure, Continuity and Progress As a corporate group that provides social infrastructure, centered on railway centered on railway services. -

Attractive Yodogawa River Landscape Maps

Reference Materials Attractive Yodogawa River Landscape Maps AreaofLandscapeMap3 TakatsukiCity,ShimamotoTown,OyamazakiTown, Hirakata City, YawataCity, KumiyamaTown, Kyoto City AreaofLandscapeMap2 Osaka City, Settsu City, Takatsuki City MoriguchiCity, Neyagawa City, Hirakata City P25-P26 AreaofLandscapeMap1 OsakaCity P23-P24 N P21-P22 Guide of Map Areas 20 Attractive Yodogawa River Landscape Map 1 Completed in 1969 Shin-Kitano Near the 6.3 km mark on the right bank. 10 16 NakatsuReed Beds 1 Shin-DenpoOhashiBridge (L=about 860m) Emergency Wharf Berth length about 60m/apron length about 7.0m Completed in 1966 Completed in 1942 11 Shin-JusoOhashiBridge 2 DenpoOhashiBridge (L=about 765m) (L=about 792m) 3 Otsuka GireFlood Monument 12 Jusono WatashiBoat Route In 1917, the embankment broke in Shin-JusoOhashiBridge Completed in 1932 Otsuka, Takatsuki City, causing 13 (L=about 681m) serious damage downstream to Osaka City. In order to drain the 14 14 UmedaSky Building flooded water, a cut was made in the embankment in Nishiyodogawa ■Yodogawa Fishing Ward. Photo Credit: Osaka City NishiyodogawaWard Office 4 EbieMudflat Completed in 1926 5 Yodogawa OhashiBridge (L=about 724m) Photo Credit: Taken on: 2018/5/16 at 10:58am Sekisui House UmedaOperation Co., Ltd. Near the 5.1 km mark on the left bank. 6 EbieEmergency Wharf Berth length about 70m/apron length about 13.0m The sunset seen from the observatory has become a familiar view. Inside, there are features to enjoy the natural scenery 7 HanakawaMudflat such as the posting the sunset time. The building itself has become a landmark due to its characteristic design. 8 OyodoMudflat Naniwa Yodogawa Since 1989. Name changed from Heisei 9 Fireworks Festival Fireworks Festival in 2006 15 Skyscrapers Yodogawa-Ku In the beginning of August, viewing The Umekita2nd phase is held at the Yodogawa Riverside development is taking place in the Park Nishinakajima, Jusoand center of Osaka city. -

Landscape Map 1 Legend 0 :Nature/Life 0 :Cities/Infrastructure 0 :History/Culture 0 :Activities/Liveliness

Attractive Yodogawa River Landscape Map 1 Legend 0 :Nature/Life 0 :Cities/Infrastructure 0 :History/Culture 0 :Activities/Liveliness Shin-Kitano Near the 6.3 km mark on the right bank. 1 Shin-DenpoOhashiBridge Completed in 1969 10 16 NakatsuReed Beds ■ Mudflats KunijimaMudflat (L=about 860m) Emergency Wharf Berth length about 60m/apron length about 7.0m 20 鳥飼下地区 Reed beds slow water flow in Mudflats are places where sand appears after a tide has Completed in 1983 Completed in 1942 Completed in 1966 2 DenpoOhashiBridge 11 Shin-JusoOhashiBridge addition to proving a place for receded. Seawater and freshwater mix and many creatures 21 NagarabashiBridge (L=about 656m) (L=about 765m) (L=about 792m) creatures to live and hide from live in the nutrient rich sand. There used to be many 仁和寺野草 The center has arch shape地区 and predators. Reed also absorbs 3 Otsuka GireFlood Monument 12 Jusono WatashiBoat Route mudflats along the Yodogawa, but most of them are gone is called a Nielsen Lohse bridge. phosphorus and nitrogen, which In 1917, the embankment broke due to development of the river and its surroundings. In It has been selected as one of Completed in 1932 cause water to become dirty. 佐太西地区 in Otsuka, Takatsuki City, causing 13 Shin-JusoOhashiBridge recent years, they have been reinstated to conserve the鳥飼野草地区 50 best Naniwa bridges. (L=about 681m) They help keep the water clean serious damage downstream to conservation. ⇒See: Illuminated at night, the bridge and protect the natural 4 7 8 17 20 大日地区 Osaka City. In order to drain the matches the vast Yodogawa 14 14 UmedaSky Building environment of the Yodogawa.