Town of Walkerville Remaining a Small, Independent Local Government Authority

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Visualising Cohousing for Ageing Well

Cohousing for Ageing Well a collaborative design research project Part 4: Visualising Cohousing for Ageing Well Design Research Report, August 2020 Dr Damian Madigan prepared for Office for Ageing Well, SA Health South Australian State Planning Commission Department of Planning, Transport & Infrastructure City of Unley City of Burnside Town of Walkerville City of Prospect Part 1: A background to ageing well together 5 Contents 8 What is ‘ageing well’? 9 What is ‘cohousing’? 11 The Codesign Workshop 12 What we heard Cohousing for Ageing Well 13 Why one bedroom? 13 So they’re tiny houses? 18 A new housing definition Part 2: Design Tactics 21 22 Adaptability 24 Memories 25 Storage 26 Accessibility 28 Private and Public 29 Finding Space 29 Getting Along 30 Shared Gardens 30 8m Zones 31 Pets Part 3_1: Small - 325m2 33 Part 3_2: Medium - 530m2 45 Part 3_3: Large - 675m2 57 Part 3_4: Extra Large - 920m2 69 Part 4: Visualising Cohousing 83 85 Next steps 88 Visualisations 100 Bibliography and suggested reading 3 Part 4: Visualising Cohousing 83 the garden as a fulcrum around which the housing is sited 84 Although obstacles currently prohibit the housing presented by this research to be realised immediately, none of them are considered Next steps ‘trump cards’ that cannot be overcome. Each has potential answers in existing models that can be tailored to navigate the statutory, financial and operational issues of this small-scale single allotment model. To progress infill housing such as that demonstrated by this Cohousing for Ageing Well project, -

East Waste Chairperson's Report

East Waste provides helpful customer service to the operational staff at Member Councils, thinks in a future-focused ANNUAL and proactive manner, keeps costs at a minimum REPORT and achieves operational efficiency. 2016-2017 East Waste Corporate Customer Survey Response May 2017 THE EAST WASTE BOARD SAY THANK YOU TO ALL STAFF AND WELL DONE ON PROVIDING OUR MEMBER COUNCILS WITH EXCELLENT SERVICE, IMPROVING OUR EFFICIENCIES AND COMPLEMENTING THE MEMBER COUNCILS’ REPUTATIONS IN EACH OF THEIR COMMUNITIES. % COMPLIANCE100 TEXT WITH THE 2016-2017 WHS AUDIT REQUIREMENTS ANNUAL REPORT 2016-2017 CONTENTS 2 THE YEAR IN REVIEW 4 EAST WASTE SERVICE AREA 5 ABOUT EAST WASTE 7 CHAIRPERSON’S REPORT 11 GENERAL MANAGER’S REPORT 17 TONNAGE DATA 18 EAST WASTE GOVERNANCE 21 FINANCIAL STATEMENTS EASTERN WASTE MANAGEMENT AUTHORITY ANNUAL REPORT 2016-2017 MORE THAN % THE YEAR IN 97OF BINS WERE RETURNED UPRIGHT TO KERB REVIEW WITH LIDS CLOSED 2016-2017 at a glance... % 55OF WASTE DIVERTED FROM LANDFILL 102,107 TONNES WAS COLLECTED , , 2TONNES513 200BINS000 OF HARD WASTE COLLECTED COLLECTED EACH WEEK EASTERN WASTE MANAGEMENT AUTHORITY 2 ANNUAL REPORT 2016-2017 OVER LAUNCH OF Why Waste It? , CAMPAIGN WHICHBIN.COM.AU6000 PAGE VIEWS SINCE WEBSITE LAUNCH IN DECEMBER 2016 % % SATISFACTION95 SATISFACTION95 RATING AMONGST RATING AMONGST THE COMMUNITY WITHIN OUR CORPORATE OUR MEMBER COUNCILS PARTNERS BASED ON FINANCIAL THAT’S A PERFORMANCE THROUGHOUT THE 2016-2017 FINANCIAL YEAR THE EAST WASTE % BOARD RESOLVED NOT TO INCREASE MEMBER COUNCIL FEES FOR THE 2017/18 FINANCIAL -

Annual Report Lgfa

2 013 ANNUAL REPORT LGFA Your Local Government Finance Authority of South Australia Member Councils as at June 30 2013 Adelaide City Council District Council of Karoonda East Murray City of Port Lincoln Adelaide Hills Council District Council of Kimba Port Pirie Regional Council Alexandrina Council Kingston District Council City of Prospect The Barossa Council Light Regional Council Renmark Paringa Council District Council of Barunga West District Council of Lower Eyre Peninsula District Council of Robe Berri Barmera Council District Council of Loxton Waikerie Municipal Council of Roxby Downs City of Burnside District Council of Mallala City of Salisbury Campbelltown City Council Corporation of the City of Marion Southern Mallee District Council District Council of Ceduna Mid Murray Council District Council of Streaky Bay City of Charles Sturt City of Mitcham Tatiara District Council Clare and Gilbert Valleys Council District Council of Mount Barker City of Tea Tree Gully District Council of Cleve City of Mount Gambier District Council of Tumby Bay District Council of Coober Pedy District Council of Mount Remarkable Corporation of the City of Unley Coorong District Council Rural City of Murray Bridge City of Victor Harbor District Council of Copper Coast Naracoorte Lucindale Council Wakefield Regional Council District Council of Elliston Northern Areas Council Corporation of the Town of Walkerville The Flinders Ranges Council City of Norwood, Payneham and St. Peters Wattle Range Council District Council of Franklin Harbour City of Onkaparinga -

Emerging Needs Scoping Study

EMERGING NEEDS SCOPING STUDY SOUTHEASTERN EUROPEAN REPORT PRESENTED TO THE OFFICE FOR THE AGEING, SOUTH AUSTRALIA BY HOKJOK (Kristin Johansson & Helena Kyriazopoulos) HOKJOK Consortium partners Dr. Kate Barnett: The Australian Institute for Social Research University of Adelaide Miriam Cocking: Seniors Information Service April 2011 1 1 CONTENTS 2 Executive Summary ....................................................................................................................... 12 2.1 Census data and community size .......................................................................................... 13 2.2 Funding Issues ....................................................................................................................... 14 2.3 Current service provision ...................................................................................................... 14 2.4 Community overview ............................................................................................................ 17 2.4.1 Bosnian community ...................................................................................................... 17 2.5 Bulgarian community ............................................................................................................ 19 2.6 Croatian community ............................................................................................................. 20 2.7 Macedonian community ...................................................................................................... -

Publication2

Way2Go e-newsletter issue 1 : term 1 : 2012 Welcome to Way2Go 2012 Date to remember Our School and Education Programs Team is looking forward to working with current and Ride2School Day will be held on new Way2Go schools in 2012 and beyond. Our Way2Go partnership is with local govern- 23 March 2012. To find out more ments and schools. Below are the names and contact details of our Education Consultants and/or register your school for this event go to and the local government areas each will be working with in 2012. These include councils www.bikesa.asn.au/ and schools new to the program, as well as schools that are already actioning their School RiderInfo_Programs_ Travel Plans. Please feel welcome to contact us for advice, support or to share a good news NatRideSchoolDay story. Sue McMillan Dan Crane Krystil Ellis Coordinator School and Education Education Consultant Education Consultant Programs [email protected] [email protected] [email protected] phone: 84021917 phone: 8343 2088 phone: 8343 2459 mobile: 0400661119 mobile: 0401 120 864 mobile: 0421 832 818 Adelaide Hills Council City of Charles Sturt Alexandrina Council Berri Barmera Council City of Holdfast Bay City of Port Adelaide Enfield City of Burnside City of Marion City of Whyalla City of Campbelltown City of Onkaparinga DC Victor Harbor City of Mount Gambier City of Playford DC Yankalilla City of Mitcham City of Port Lincoln Iwantja (Indulkana) City of Payneham Norwood St Peters City of West Torrens Port Augusta City Council City of Prospect DC Streaky Bay Port Pirie DC City of Salisbury MC Roxby Downs City of Tea Tree Gully RC Murray Bridge City of Unley The Barossa Council DC Grant Town of Gawler DC Loxton Waikerie DC Mount Barker Way2Go Bike Ed DC Robe Town of Walkerville 2 Way2Go e-newsletter issue 1 : term 1 : 2012 Annual Review two we will invite several new Way2Go schools and button) crossings; school An important part of having groups of teachers, country those schools that zones and crossing monitors. -

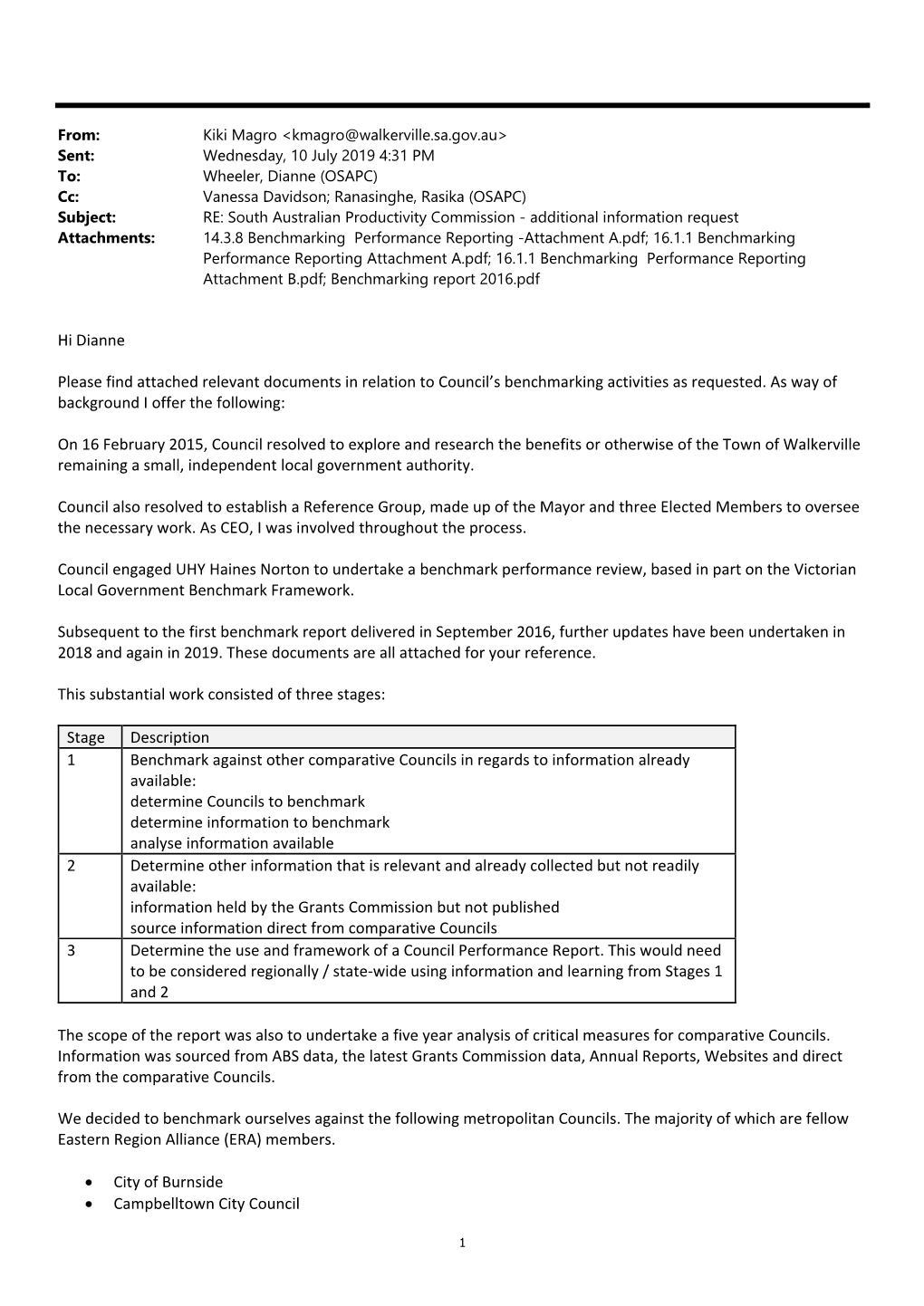

Draft Report Inquiry Into Local Government Costs and Efficiency

Inquiry into Local Government Costs and Efficiency Draft Report Inquiry into Local Government Costs and Efficiency 30 August 2019 Page | 1 Local Government Costs and Efficiency Draft Report Inquiry into Local Government Costs and Efficiency © Government of South Australia. Published 2019. All rights reserved. No part of this publication may be reproduced by any process except in accordance with the provisions of the Copyright Act 1968 (Cth), without prior written permission from the South Australian Productivity Commission. Disclaimer The views expressed herein are those of the South Australian Productivity Commission and do not purport to represent the position of the Government of South Australia. The content of this draft report is provided for information purposes only. Neither the South Australian Productivity Commission nor the Government of South Australia accepts any liability to any person for the information (or the use of such information) which is provided in this draft report or incorporated into it by reference. The information in this draft report is provided on the basis that all persons having access to this draft report undertake responsibility for assessing the relevance and accuracy of its content. South Australian Productivity Commission GPO Box 2343 Adelaide South Australia 5001 AUSTRALIA Telephone: 08 8226 7828 Email: [email protected] Website: www.sapc.gov.au An appropriate citation for this publication is: South Australian Productivity Commission 2019, Inquiry into Local Government Costs and Efficiency – draft report, August 2019 Page | 2 Local Government Costs and Efficiency Draft Report Inquiry into Local Government Costs and Efficiency Preface The release of this draft report gives interested parties the opportunity to comment on the Commission’s analysis in relation to its inquiry into local government costs and efficiency. -

Annual Report 2018 - 2019 CONTENTS

Annual Report 2018 - 2019 CONTENTS INTRODUCTION OUR PLACES Mayor’s Reflections 4 Main North Road Precinct Master Plan 44 Community Safety 44 OUR COUNCIL City Planning 48 Council Members 8 Asset Management 48 Council Boundaries 9 Tree Planting 51 Elector Representation 10 City Maintenance 53 Council Member Allowances 11 Environmental Sustainability 55 Local Government Elections 12 Council Member Conferences, Education 13 OUR PROSPERITY & Development Business and Economic Development 58 Meetings, Workshops, Panels, Committees 14 Communications Strategy 62 Council Decision Making Structure 16 Executive Leadership 17 Human Resource Management 18 OUR SERVICES Financial Management 64 Your Rates, Your City 19 Rates and Property Administration 65 Policy & Administration Documents 22 Information Technology 66 Information Statement 24 APPENDICES OUR PEOPLE City of Prospect Financial Statement 69 Library Services 30 Eastern Health Authority Annual Report 123 Youth 32 Eastern Waste Management Authority 185 Our Older Residents 33 Annual Report Our Awarded Community 34 Community Inclusion 36 Our Volunteer Community 38 Art Gallery & Events 39 Events 40 INTRODUCTION City of Prospect - Annual Report 2018/2019 Page 3 Mayor’s Reflections ork continued on the delivery of Wthe Community Hub, Library and Innovation Centre (CLIC) on Prospect Road, which integrates the heritage-listed Town Hall and will usher in a new era of services and facilities for the community when it opens in October 2019 – exciting times ahead! Our largest project to date, it was far from the only activity funded by council this year. Roads, Footpaths and Parks • Council completed redevelopment of the popular George Whittle Reserve including new custom designed Skate Park, multi-use court, artwork, static fitness equipment, solar powered waste compaction bins (the first by an Eastern Region Alliance Council) and improved shelter and BBQ facilities for • Replaced air-conditioning at Nailsworth all ages and families. -

Project/Work Groups 2018-19 As at 31/12/2018

Project/Work Groups 2018-19 as at 31/12/2018 Asset Management Alex Brown, Adelaide City Council [email protected] Asset Management Alex Oulianoff, Mount Barker District [email protected] Council Asset Management Annette Martin (Deputy Chairperson), [email protected] City of Charles Sturt Asset Management Anthony Amato, Town of Gawler [email protected] Asset Management Cadel Blunt, City of Holdfast Bay [email protected] Asset Management Chris Birch, City of Prospect [email protected] Asset Management David Edgerton, APV Valuers & Asset [email protected] Management Asset Management Donna Stubbs, City of Charles Sturt [email protected] Asset Management Elizabeth Waters, The Barossa Council [email protected] Asset Management Emil Bogatec, City of Onkaparinga [email protected] Asset Management Gary Lewis, District Council of Yankalilla [email protected] Asset Management Gary Long, City of Prospect [email protected] Asset Management Gideon Joubert, Alexandrina Council [email protected] u Asset Management Grace Pelle, City of Playford [email protected] Asset Management Joe Scordo, Light Regional Council [email protected] Asset Management Jonathan Crook, City of Tea Tree Gully [email protected] Asset Management Kate George, City of Salisbury [email protected] Asset Management Katy Bone (Chairperson), Town of [email protected] Walkerville Asset Management Leta -

State Urban Forest Leaderboard

WHERE WILL ALL THE TREES BE? URBAN FORESTS IN SA 10.5% 5.3% Suburban, spacious Urban, spacious Urban, compact 36.8% 1 3 5 Place type and low rainfall and low rainfall and low rainfall 11-50% Biggest gain*: 3.6% 19 47.4% urban forest cover SA by % 2 Suburban, spacious 4 Urban, spacious and 6 Urban, compact and Biggest loss*: 3.6% and avg-high rainfall avg-high rainfall avg-high rainfall PLACES DIFFERENCE IN URBAN FOREST COVER (2013-2020) DIFFERENCE IN URBAN FOREST COVER (2016-2020) URBAN FOREST COVER 2020 1 City of Adelaide 5.70% 1 City of Adelaide 3.60% 1 City of Mitcham 50.30% 2 City of Burnside 4.70% 2 City of Unley 3.00% 2 Adelaide Hills Council 50.10% 3 City of Tea Tree Gully Council 1.00% 3 City of Tea Tree Gully Council 2.80% 3 City of Burnside 42.20% 4 City of Mitcham 0.79% 4 City of Onkaparinga 2.20% 4 City of Onkaparinga 31.20% 4 City of Holdfast Bay -1.30% 5 City of Salisbury 1.40% 5 City of Tea Tree Gully Council 31.00% 6 City of Norwood Payneham and St Peters -1.50% 5 City of Playford 1.40% 6 City of Unley 29.80% 7 City of Unley -2.10% 7 City of Marion 0.80% 7 City of Adelaide 27.30% 8 City of Prospect -2.20% 8 Town of Gawler Council 0.70% 8 Cambelltown City Council 24.60% 8 City of Salisbury -2.20% 9 City of Holdfast Bay 0.60% 9 City of Norwood Payneham and St Peters 23.70% 10 Cambelltown City Council -2.90% 10 City of Charles Sturt 0.50% 10 Town of Walkerville 22.60% 11 City of Onkaparinga -2.90% 11 Adelaide Hills Council 0.50% 11 City of Salisbury 22.10% 12 City of Port Adelaide Enfield -3.30% 12 City of Norwood Payneham -

Insurance Policy Renewal

CERTIFICATE NO. 54997 This certificate confirms that the under mentioned policy is effective in accordance with the details shown. Name of Insured: AUSTRALIAN FLYING DISC ASSOCIATION LTD SOUTH AUSTRALIAN FLYING DISC ASSOCIATION INC AND AFFILIATED CLUBS AUSTRALIAN DISC GOLF INC Cover: Public Liability: $20,000,000 any one occurrence Products Liability: $20,000,000 any one occurrence and in the aggregate Professional Indemnity: $5,000,000 any one claim and in the aggregate Management Liability: $5,000,000 any one claim and in the aggregate (For The Business of Disc Sports only) Sport/Business: Disc Sports Excess: As per policy schedule. Period of Insurance: 1/3/2021 to 1/3/2022 Underwriter: Certain Underwriters at Lloyd’s Policy Number: PMEL99/0107355 Counterparties: Adelaide City Council, Adelaide Lutheran Sports and Recreation Association, Christian Brothers College, City of Charles Sturt, City of Holdfast Bay, City Of Tea Tree Gully, Flinders University, Goolwa & Port Elliot Football Club, Old Ignatians Football Club Inc, Pulteney Grammar School, St Ignatius College, Adelaide Hills Council, Alexandria Council, Campbelltown City Council, City of Marion, City of Mitcham, City of Playlord, City of Port Adelaide Enfield, City of Prospect, City of Salisbury, City of Unley, City of West Torrens, Corporation of the Town of Walkerville, The Barossa Council, The City of Burnside, The City of Norwood, Payneham & St Peters, Town of Gawler, St John’s Grammar, Seymour Girls College, SA Department of Education and Children''s Services, Victor Harbor Primary School, Walford Anglican, Westminster School, 1-27 Alison Avenue Marion, South Australia 5043, Wilderness School, City of Port Augusta, Stirling North Primary School, Coorong District Council, City of Mount Gambier shall be indemnified for acts of negligence by the Insured only arising out The Business nominated in the schedule. -

Council Membership Pricing Model

COUNCIL MEMBERSHIP PRICING MODEL COUNCILS ARE CLASSIFIED PER THE CRITERIA BELOW. THE INTENT BEHIND METHODOLOGY IS TO ENSURE ACCESSIBILITY TO STAFF FROM ALL COUNCILS. THE CLASSIFICATIONS ARE: LARGE MEDIUM SMALL THIS CLASSIFICATION THIS CLASSIFICATION THIS CLASSIFICATION APPLIES TO COUNCILS: APPLIES TO COUNCILS: APPLIES TO COUNCILS: ◥ with resident ◥ with resident ◥ with resident populations populations of populations of of 70,000+ between 10,000 under 10,000 OR and 69,999 OR ◥ which employ AND ◥ which are more more than ◥ which are within than 70 kms from 500 FTEs 70 kms of the the Adelaide CBD Adelaide CBD ANNUAL ANNUAL ANNUAL MEMBERSHIP MEMBERSHIP MEMBERSHIP PRICING: PRICING: PRICING: ◥ $7,500 ex gst ◥ $5,000 ex gst ◥ $1,000 ex gst COUNCIL CLASSIFICATIONS BACKGROUND FOR CERTAIN PROFESSIONAL DEVELOPMENT PROGRAMS, LG PROFESSIONALS SA OFFERS TIERED PRICING ACCORDING TO THE FOLLOWING CLASSIFICATIONS IN ORDER TO ENSURE TRAINING IS ACCESSIBLE TO ALL COUNCILS. THIS PRICING STRUCTURE IS GENERALLY APPLIED TO OUR LEADERSHIP PROGRAMS WHICH SPAN SEVERAL MONTHS AND INVOLVE VARIOUS LOCATIONS. THE CLASSIFICATIONS ARE: LARGE MEDIUM SMALL THIS CLASSIFICATION THIS CLASSIFICATION THIS CLASSIFICATION APPLIES TO COUNCILS: APPLIES TO COUNCILS: APPLIES TO COUNCILS: ◥ with resident ◥ with resident ◥ with resident populations populations of populations of of 70,000+ between 10,000 under 10,000 OR and 69,999 OR ◥ which employ AND ◥ which are more more than ◥ which are within than 70 kms from 500 FTEs 70 kms of the the Adelaide CBD Adelaide CBD ◥ REFER TO THE NEXT -

Local Government Infrastructure Partnership Program

LOCAL GOVERNMENT INFRASTRUCTURE PARTNERSHIP PROGRAM Council name Project name Project description State Grant This project encompasses a series of accelerated capital works to be incorporated into City of Adelaide’s Transportation Asset Renewal Program for 2021/22). Proposed works include road resurfacings, footpath renewals and kerb and water table renewals. Adelaide City Accelerated Asset Council Renewal Program $ 1,000,000 A sustainable approach to using and managing water is important in addressing the pressures of demand and key issues, such as water security, building resilience to climate change, meeting environmental and regulatory requirements associated with water resources. As most of the Adelaide Hills Council’s area is in the Mt Lofty Ranges Watershed we are very aware of the critical nature of water management. Council’s Strategic Plan has a priority to ‘improve water security by maximising water reuse opportunities, reducing reliance on ground water and improving water efficiencies for open space irrigation and Sustainable Water building facilities’. This key focus along with the Council’s Water Management Plan will ensure an integrated and sustainable approach. While Council Adelaide Hills Management in the already uses recycled water on two ovals the only regional sport and recreation ground within the district at Woodside has the potential for significant Council Adelaide Hills reuse opportunity from the nearby SA Water Bird in Hand Wastewater Treatment Plan thereby reducing the reliance on ground water. $ 727,000 Adelaide Plains Council Rural Road Sealing – Freight and Tourism project seeks to seal freight and tourism networks that are currently unsealed roads and will deliver improved quality roads that will assist residents move from one area of Council to another, allow tourists to reach their destinations safely and Adelaide Plains Rural Road Sealing – achieve freight efficiencies that could not otherwise have been recognised.