What the UK Election Means for Brexit Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brexit Reading List: No Deal Subject Specialist: Stefano Fella

BRIEFING PAPER Number 8642, 5 November 2019 Compilers: Julie Gill, Antonia Garraway Brexit reading list: no deal Subject specialist: Stefano Fella Contents: List of 2019 publications www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 Brexit reading list: no deal Contents Summary 3 List of 2019 publications 4 November 4 October 4 September 5 August 8 July 9 June 11 May 11 April 12 March 12 February 14 January 14 Cover page image copyright: Flagging support by Dave Kellam. Licensed under CC BY 2.0 / image cropped. 3 Commons Library Briefing, 5 November 2019 Summary As the possibility of the UK leaving the EU without a withdrawal agreement – or ‘deal’ – has become more likely, the commentary on and analysis of a no-deal scenario have increased. This paper provides links to a selection of 2019 publications on a no-deal exit from the EU by private and voluntary sector organisations, think tanks, research institutes and other academic institutions. The publications selected consider the general political, constitutional and economic implications of a no-deal Brexit rather than its effects in particular sectors. So, for information on Brexit and future trade options or specific parts of the economy or agriculture, for example, see the relevant papers on the Library’s Brexit website. 4 Brexit reading list: no deal List of 2019 publications November No-deal Guidance Dashboard – November 2019, British Chambers of Commerce October Claire Milne, Could we still have a “no deal” Brexit in 2020 at the end of the transition?, Full Fact, 29 October 2019 MEPs want to keep 2020 EU funding for UK in no-deal Brexit, European Law Monitor, 25 October 2019 Chris Curtis, No-Dealers think MPs should back Boris’ Brexit deal, YouGov, 24 October 2019 Simon Blackford, Negotiating Brexit, Briefings for Brexit, 22 October 2019 Patrick Benham-Crosswell, BoJo’s deal is not Brexit. -

Microsoft Outlook

From: FOI Sent: 13 July 2017 16:17 To: Subject: FOI 59/17 Vote Leave and BeLeave EC Correspondence Response Attachments: 20160428 Vote Leave and Labour Leave ATTACHMENT REDACTED.pdf; 20160428 Vote Leave and Labour Leave REDACTED.pdf; 20160429 RE Vote Leave and Labour Leave (1) REDACTED.pdf; 20160429 RE Vote Leave and Labour Leave (2) REDACTED.pdf; 20160602 RE Material from other campaigners REDACTED.pdf Dear Our Ref: FOI 59/17 Thank you for your email to the Electoral Commission dated 12 May 2017. The Commission aims to respond to requests for information promptly within the statutory twenty working days and regrets that on this occasion we have not done so. Your request is in bold below followed by our response. You have requested: Please provide me with any document exchanged between either Vote Leave or BeLeave and the Electoral Commission, during the regulated period right before the Brexit referendum, and concerning 3rd party or joint funding of campaigns. Our response is as follows: We hold some of the information you have requested. We hold documents exchanged between Vote Leave and the Commission but we do not hold any information on the campaigner BeLeave. The Regulated Period for the UK General Election 2017 was from 15 April to 23 June 2017 and this has been reflected in the documents returned. Please find attached 5 emails attached, redaction has been applied to remove signatures and contact information where the individuals would not have reasonably expected their released to the public. Section 40(2) and (3)(a)(i) of the FOI Act In the information we are releasing, we have redacted some of the information in the documents. -

What Does Leave Look Like V5.Pdf

2 Contents Introduction ........................................................................................................................ 3 No clear or credible plan for an alternative ..................................................................... 5 The Norway model? ........................................................................................................... 7 The Swiss model? .............................................................................................................. 9 Iceland and Liechtenstein? ............................................................................................. 11 Macedonia and Andorra? ................................................................................................ 13 The Isle of Man and the Channel Islands? ..................................................................... 13 Turkey? ............................................................................................................................. 13 Australia? .......................................................................................................................... 14 South Korea? .................................................................................................................... 15 Ukraine, Moldova, or Morocco? ...................................................................................... 15 Vanuatu, Brunei and Nicaragua? .................................................................................... 16 Canada? ........................................................................................................................... -

BRIEFING 25 1 January 2020 1.ELECTION ANALYSIS

ROSE BRIEFING 25 1 January 2020 1.ELECTION ANALYSIS ASHCROFT POLLS – 30,000 INTERVIEWS IMMEDIATELY AFTER POLLING ON 12 DECEMBER Most important issue Conservative voters: Get Brexit Done 72 per cent; NHS 41 per cent Labour: 74 per cent NHS; 28 per cent Stop Brexit SNP: 57 per cent NHS; 41 per cent Stop Brexit 2017 Leave and Remain voters Labour secured 84 per cent of 2017 Labour Remain voters but only 64 per cent of 2017 Labour Leave voters Age Labour secured a majority of 18-34 voters and the biggest share (45 per cent) of 35-44 voters. YOUGOV – 28,000 VOTERS AFTER ELECTION 2. LEGISLATION European Union (Withdrawal Agreement) Act This was passed in slightly amended form on 20 December 2019. It was substantially the same as the Bill debated in October 2019 (outlined in Briefing Note 24) but with three changes. It removed additional procedural protections for workers rights; government liability for children seeking asylum with relatives in Britain; and some procedural safeguards for Commons scrutiny. It maintains all those elements committing to a ‘level playing field’ in economic relations with the EU and other countries. Jeremy Corbyn criticised: ‘it will not protect our manufacturing industry or vital trading interests’ as well as the ending of liability for refugee children and removing protections for workers rights. Legislative programme outlined in the Queen’s Speech 19 December In addition to the European Union Withdrawal Bill (now Act) this included Agriculture Bill promising a new system of subsidy based on land use and environment needs Fisheries Bill promising fair access to territorial waters Trade Bill maximising continuity for business and continuing access to £1.3T public procurement in 43 countries through ratification of WTO procurement regulations Financial Services Bill ● Ensure that the UK maintains its world-leading regulatory standards and remains open to international markets after we leave the EU. -

A Way of Understanding Brexit

Master Thesis The use of language as an influencing tool in leadership: a way of understanding Brexit Author: Jorge Ernesto Arango Terán, Pearl Bitanihirwe and Diego Emilio Arango Terán Supervisor: Mikael Lundgren Examiner: Lars Lindkvist Term: VT20 Subject: Business Administration with Specialization in Leadership and Management Level: Master’s degree Course code: 4FE41E Abstract New nationalist ideologies have permeated politics for the last decade. New leaders, followers, and conducive environments have emerged to cause the most controversial and unique episodes in recent politics. Brexit was selected by having a set of exclusive characteristics, factors, and social elements which resulted in the UK leaving the EU after 47 years. Additionally, two academic attributes were considered to be politically researched, which were leadership and communication techniques. The former established the relationship between two parts of society (leaders and followers) and how their roles developed during the Brexit referendum campaign, and the latter examined political language by extracting the most representative rhetorical means used by the British leaders to run it. The set of rhetorical techniques was thoroughly investigated using a specially adopted analysis. Several examples were included in how they were performed politically and strategically to create that democratic result. To execute this study, we developed qualitative research based on a study case strategy, descriptive purpose, and by having an inductive approach. Consequently, we selected a sampling method which met specific research criteria and allowed us to analyse this political phenomenon rhetorically. Besides, our empirical data was formed by using interactive and visual material which provided a credible source of study to approach, identify, and answer our research questions. -

Brexit Memes Brexit: Exploring Discourses of the Brexit Negotiations Through Social Media Visuals

Brexit Memes Brexit: Exploring discourses of the Brexit negotiations through social media visuals Joanne Findlay Malmö University Media and Communications Studies MA Thesis 2019 1 Contents Abstract ................................................................................................................................................... 3 1. Introduction .................................................................................................................................... 3 2. Research Questions ........................................................................................................................ 4 3. Literature Review ............................................................................................................................ 4 3.1 Social Media and Participatory Culture ........................................................................................ 5 3.2 Meme Studies ............................................................................................................................... 6 3.3 Features of Memes ....................................................................................................................... 7 3.4 Discourse Theory........................................................................................................................... 9 3.5 Discourses of Brexit ....................................................................................................................... 9 4. Research Paradigms ................................................................................................................. -

Busting the Lexit Myths

EMBARGOED UNTIL 30/01/18 AT 00:01 Busting the Lexit Myths Foreword by Heidi Alexander MP & Alison McGovern MP Authors: Catherine West MP, Nick Donovan, Dr Andy Tarrant, Richard Corbett MEP, Dr Mike Galsworthy, Sarah Veale CBE, Tom Burke and Lord (John) Monks. Edited by Francis Grove-White Labour Campaign for the Single Market EMBARGOED UNTIL 30/01/18 AT 00:01 Chapters 3 Foreword Heidi Alexander MP & Alison McGovern MP 5 Austerity Catherine West MP 8 State aid Nick Donovan 11 Renationalisation Dr Andy Tarrant 15 Immigration Richard Corbett MEP 18 The NHS Dr Mike Galsworthy 21 Employment rights Sarah Veale CBE 25 The environment Tom Burke 28 Trade deals Lord (John) Monks Open Britain is a national cross-party campaign, making the case for the UK to remain in the Single Market and the Customs Union, and for all options about our future relationship with the EU to be kept on the table. http://www.open-britain.co.uk/ The Labour Campaign for the Single Market is seeking to shift Labour Party policy towards support for staying in the Single Market and the Customs Union. It is co-chaired by Heidi Alexander MP and Alison McGovern MP. http://www.labour4singlemarket.org/ 1 Author biographies Catherine West MP is the Member of Parliament for Hornsey & Wood Green and a former Shadow Foreign Office Minister. Before being elected in 2015, she was leader of Islington Council from 2010-13. Nick Donovan is a Campaign Director and investigator at an anti-corruption NGO, and a director of one of the UK's largest credit unions. -

What Happens Next? 2

1 BREXIT WHAT HAPPENS NEXT? 2 FOREWORD DAVID LAMMY MP When I entered Parliament in 2000, I came with a clear set of objectives - objectives that I still hold close to my heart today. As a Labour MP, I expect you share them with me. I entered Parliament to fight for a fairer, more balanced Britain, with opportunities open for all races, all genders and all social classes. I entered Parliament to fight for a Britain with an economy that creates jobs for my constituents in Tottenham, and maintains a generous safety net to look after those who need help. I entered Parliament to stand up for an internationalist vision of Britain that engages with the modern world, not one that retreats into nostalgia and managed decline. Finally, I entered Parliament to oppose our adversary, the Conservative Party, whose damaging, closed-minded ideology prioritises the interests of a handful of billionaire donors over the vast majority of working people. Friends, the aims and values we hold dear have never faced such a fundamental threat as Brexit. No single policy in our history has promised to wreak as much havoc to jobs, workers’ rights, the environment, and our role in the ‘The aims and values we world as leaving the EU. No single policy has hold dear have never faced had the power to set our country on the such a fundamental threat as wrong path for as long as this. Once we leave, Brexit.’ we leave, and it will be very difficult to rejoin. When you make the decision on whether or not to oppose Theresa May’s deal, I ask you to consider just one, simple question: will this deal serve my constituents’ interests better than our current institutional arrangements inside the EU? 3 This is the real choice our country faces – not the false one between Theresa May’s very poor deal and no deal at all. -

Gawain Towler

Gawain Towler Director of Communications, Brexit Party January 2019 – December 2019 Press Officer/Director of Communications, UK Independence Party June 2004 – February 2018 10 August 2020 UKIP, 2004 – 2016 UK in a Changing Europe (UKICE): Just thinking back to the first stage of your UKIP career: when would you say that politicians and the media started to take the idea of a referendum on membership seriously, and why? Gawain Towler (GT): I think that there was a momentary flash in the pan over Maastricht. Obviously, the Lib Dems had their policy of ‘We support a referendum until we’re going to have one.’ There were also a few Tory backbenchers and a couple of Labour backbenchers who were minded in that direction, but it was not serious. I suppose going backwards; Jimmy Goldsmith scared the pants out of everybody, forcing the Government to offer a referendum in the likelihood of us joining the Euro, and thus effectively scuppering our entry into the Euro. Period. So, the existential threat of a referendum was taken seriously significantly earlier, but that had gone away. As long as nobody in Government seriously considered the Euro. And Gordon Brown’s five tests were just essentially, ‘I’m going to make up what they are at the time, to ensure this doesn’t Page 1/29 happen, because we can’t afford to leave or have a referendum.’ So, I would say a referendum only really started being taken seriously again when Cameron three-line whipped against one. Cameron put a three-line whip against a Private Members Bill for a referendum. -

Final Hypocrisy of Leave Cam

1 Hypocrisy of Leave campaigners Today a new deal between the UK and the European Union has been outlined by the Prime Minister, which will be discussed by European leaders at the European Council later this month. These are meaningful reforms which would strengthen our economic co-operation with Europe, bringing jobs and growth to the UK, whilst also taking back greater control over our national interests, notably giving national Parliaments more control over EU legislation. Today, Leave campaigners have roundly attacked these proposals. Nigel Farage has said they are “ludicrous”, Matthew Elliot of Vote Leave said they are “trivial”, and Leave.eu have said they are a “a fudge and a farce”. They have attacked them as being a “smokescreen”, and “nothing more than a PR exercise”. This is, however, deeply hypocritical as leave campaigners have a long history of campaigning for and championing the very reforms the Prime Minister is today proposing. This past support for the Prime Minister’s renegotiating stance highlights the deep hypocrisy at the heart of the Leave campaigners’ criticisms: They have pre-emptively rejected the final renegotiation package and are the only people who have given up on reform and want to walk away from Europe come what may. The leave campaigns’ hypocrisy will put the many benefits we gain from being in Europe – trade, jobs, low prices, investment – at risk. How the Leave campaigns used to support the renegotiation Leave campaigners have a long history of campaigning for and championing the very reforms the Prime Minister is seeking in his renegotiation of the Britain’s relationship with the EU. -

2Nd EU Referendum Pre Poll Summary

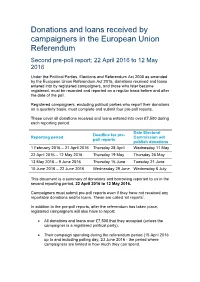

Donations and loans received by campaigners in the European Union Referendum Second pre-poll report: 22 April 2016 to 12 May 2016 Under the Political Parties, Elections and Referendum Act 2000 as amended by the European Union Referendum Act 2015, donations received and loans entered into by registered campaigners, and those who later become registered, must be recorded and reported on a regular basis before and after the date of the poll. Registered campaigners, excluding political parties who report their donations on a quarterly basis, must complete and submit four pre-poll reports. These cover all donations received and loans entered into over £7,500 during each reporting period. Date Electoral Deadline for pre- Reporting period Commission will poll reports publish donations 1 February 2016 – 21 April 2016 Thursday 28 April Wednesday 11 May 22 April 2016 – 12 May 2016 Thursday 19 May Thursday 26 May 13 May 2016 – 9 June 2016 Thursday 16 June Tuesday 21 June 10 June 2016 – 22 June 2016 Wednesday 29 June Wednesday 6 July This document is a summary of donations and borrowing reported to us in the second reporting period, 22 April 2016 to 12 May 2016. Campaigners must submit pre-poll reports even if they have not received any reportable donations and/or loans. These are called ‘nil reports’. In addition to the pre-poll reports, after the referendum has taken place, registered campaigners will also have to report: All donations and loans over £7,500 that they accepted (unless the campaigner is a registered political party). Their campaign spending during the referendum period (15 April 2016 up to and including polling day, 23 June 2016 - the period where campaigners are limited in how much they can spend. -

EU Membership Referendum: the Campaigns

EU membership referendum: The Campaigns www.civitas.org.uk Factsheet – EU membership referendum: The Campaigns www.civitas.org.uk ‘In’ Campaign Former Marks and Spencer boss Lord Stuart Rose launched the Britain Stronger in Europe campaign on 12 October. Britain Stronger in Europe has focused on the business case for staying in, arguing the benefits are “a stronger economy, stronger security and stronger leadership on the world stage”. Rose is attempting to defuse the claim that How does a General Election actually work? pro-Europeans are unpatriotic. The UK is a liberal democracy. This means that we democratically elect politicians, who Former Prime Ministers Sir Johnrepresent Major, Gordon our interests. Brown It and also Tony involves Blair thatare supporting individual rights the campaign, are protected. alongside Labour MP Chuka Umunna, Green Parfty MP Caroline Lucas and Conservative MP Damian Green. Former chief of the general staff Sir Peter Wall, West HamThe United type vice of liberal-chairwoman democracy Baroness we have Karren is a constitutionalBrady, BT chairman monarchy, Sir Mike where Rake the and powers of television presenter June Sarpongthe monarch are also prominentare limited figures by the interms the campaign.and conditions put down in the constitution. The Green Party and the Liberal Democrats are in favour of remaining in the EU. The Labour Party appears to have also settled on staying in following newly elected leader Jeremy Corbyn’s decision, although groups such as Labour Leave are campaigning for Brexit. Parliamentary system The UK has a parliamentary system of democratic governance. Unlike presidential and Organisations such as the Conservative Europe Group, Conservative European Mainstream, Business for New Europe, semi-presidential systems, there is an interconnection between the legislative (law- the European Movement, Open Europe, the Centre for European Reform and Labour in for Britain are campaigning to making) and executive (law-enforcing) branches of government in a parliamentary stay in the EU.