Barrick Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arend J Hoogervorst1 B.Sc.(Hons), Mphil., Pr.Sci

Audits & Training Eagle Environmental Arend J Hoogervorst1 B.Sc.(Hons), MPhil., Pr.Sci. Nat., MIEnvSci., C.Env., MIWM Environmental Audits Undertaken, Lectures given, and Training Courses Presented2 A) AUDITS UNDERTAKEN (1991 – Present) (Summary statistics at end of section.) Key ECA - Environmental Compliance Audit EMA - Environmental Management Audit EDDA -Environmental Due Diligence Audit EA- External or Supplier Audit or Verification Audit HSEC – Health, Safety, Environment & Community Audit (SHE) – denotes safety and occupational health issues also dealt with * denotes AJH was lead environmental auditor # denotes AJH was contracted specialist local environmental auditor for overseas environmental consultancy, auditing firm or client + denotes work undertaken as an ICMI-accredited Lead Auditor (Cyanide Code) No of days shown indicates number of actual days on site for audit. [number] denotes number of days involved in audit preparation and report write up. 1991 *2 day [4] ECA - AECI Chlor-Alkali Plastics, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 day [4] ECA - AECI Chlor-Alkali Plastics- Environmental Services, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 Day [4] ECA - Soda Ash Botswana, Sua Pan, Botswana. November 1991. 1992 *2 Day [4] EA - Waste-tech Margolis, hazardous landfill site, Gauteng, South Africa. February 1992. *2 Day [4] EA - Thor Chemicals Mercury Reprocessing Plant, Cato Ridge, KwaZulu-Natal, South Africa. March 1992. 2 Day [4] EMA - AECI Explosives Plant, Modderfontein, Gauteng, South Africa. March 1992. *2 Day [4] EMA - Anikem Water Treatment Chemicals, Umbogintwini, KwaZulu-Natal, South Africa. March 1992. *2 Day [4] EMA - AECI Chlor-Alkali Plastics Operations Services Group, Midland Factory, Sasolburg. March 1992. *2 Day [4] EMA - SA Tioxide factory, Umbogintwini, KwaZulu-Natal, South Africa. -

Delivering Value…Value… Fromfrom Assets,Assets, Peoplepeople && Projectsprojects

BARRICK GOLD CORPORATION Scotia Capital Gold Conference Toronto – November 29, 2005 DeliveringDelivering Value…Value… FromFrom Assets,Assets, PeoplePeople && ProjectsProjects November 29, 2005 1 Important Information FORWARD LOOKING STATEMENTS Certain information included in this presentation, including any information as to our future financial or operating performance and other statements that express management's expectations or estimates of future performance, constitute "forward-looking statements." The words "expect", "will", “intend”, “estimate” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management are inherently subject to significant business, economic and competitive uncertainties and contingencies. The Company cautions the reader that such forward- looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual financial results, performance or achievements of Barrick to be materially different from the Company's estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. These risks, uncertainties and other factors include, but are not limited to: changes in the worldwide price of gold or certain other commodities (such as fuel and electricity) and currencies; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; the speculative nature of gold exploration and development, including the risks of diminishing quantities or grades of reserves; and the risks involved in the exploration, development and mining business. -

Proyecto Megaminero PASCUA LAMA: El Agua Como Origen De La Vida

Proyecto Megaminero PASCUA LAMA: El agua como origen de la vida. “El agua es el elemento y principio de las cosas” Tales de Mileto (624 AC-546 AC. Filósofo y matemático griego) Alexis E. Aranciva Reg. 16547 DNI 31728810 “Cátedra Virtual para la Integración Latinoamericana” Introducción Se intentará elaborar un informe que aborde las características del proyecto binacional de explotación minera denominado “Pascua Lama” y sus consecuencias para la calidad de vida de los pobladores a un lado y otro de la Cordillera de Los Andes. El principal recurso afectado por y para la explotación minera es el agua, puesto que la minería demanda enormes cantidades de agua, y contamina las cuencas hídricas con metales pesados y sustancias químicas como el cianuro, entre otros. Considerando que el agua es el origen de todo tipo de vida en nuestro planeta y que es considerado un recurso escaso, lo que se intentará demostrar en este trabajo es la inviabilidad de los explotación minera a cielo abierto, que requiere grandes cantidades de este recurso tan valioso para el desarrollo y la supervivencia del ser humano como tal. Fundamentación Minería y Contaminación: Daño a los Ecosistemas La minería es una industria altamente contaminante, afecta de manera directa al agua, suelo y aire, lo que se traduce con el tiempo en efectos sobre las personas, animales, plantas etc. es decir afectan a los ecosistemas con las implicaciones ambientales de la actividad minera. La pregunta es ¿Cómo la minería genera contaminación? y ¿Cuáles son los efectos adversos asociados a la actividad minera? La actividad minera contamina, en primer lugar el agua, ya que para poder separar los metales de la roca necesita utilizar agua en grandes cantidades, agua que luego del proceso productivo se encuentra contaminada con elementos como cianuro y metales pesados tales como cadmio, cobre, arsénico, plomo, mercurio, hierro etc. -

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending December 31, 2013. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Dec 30 As of Dec 15 Net Change LUNDIN MINING CORPORATION LUN 60,372,644 62,894,431 -2,521,787 BOMBARDIER INC. CL B SV BBD.B 52,650,735 33,988,500 18,662,235 NEW GOLD INC. NGD 46,377,287 47,205,108 -827,821 OSISKO MINING CORPORATION J OSK 43,675,171 43,720,790 -45,619 THOMSON REUTERS CORPORATION TRI 41,633,981 28,979,682 12,654,299 ATHABASCA OIL CORPOATION J ATH 37,568,553 38,388,408 -819,855 MANULIFE FINANCIAL CORPORATION MFC 37,428,824 46,959,284 -9,530,460 BARRICK GOLD CORPORATION ABX 32,416,329 24,026,847 8,389,482 BROOKFIELD OFFICE PROPERTIES INC. BPO 32,255,989 20,777,738 11,478,251 HUSKY ENERGY INC. HSE 29,269,593 26,681,348 2,588,245 LEGACY OIL + GAS INC. LEG 29,210,825 29,114,197 96,628 CELESTICA INC. SV CLS 28,638,415 36,833,550 -8,195,135 BCE INC. BCE 28,544,803 24,118,117 4,426,686 GREAT-WEST LIFECO INC. -

Acacia Mining: Human Rights Violations and the Company’S Grievance Mechanism in North Mara, Tanzania

Questions & Answers Acacia Mining: Human rights violations and the company’s grievance mechanism in North Mara, Tanzania Click on the question to jump to the answer. 1. What is an operational-level grievance mechanism? 2. Why are they important? 3. What do grievance mechanisms have to do with human rights? 4. Why do businesses like company-based grievance mechanisms? 5. Do companies themselves investigate and decide grievances? 6. Who is Acacia Mining and where is its North Mara Gold Mine? 7. How is Acacia Mining linked to Barrick Gold? 8. What are the human rights problems at North Mara mine? 9. Who are these ‘intruders’ who come into the mine? 10. How does the Mine deal with ‘intruders’? 11. Is it necessary to use force against the ‘intruders’? 12. Is the company’s private security also involved in violations? 13. Does Acacia Mining have similar problems at its other mine sites? 14. Why does Acacia use the Tanzanian police to provide security? 15. Intruders have decreased so aren’t violations only a historical problem? 16. Are ‘intruders’ still being killed at North Mara mine? 17. Does Acacia report on how many ‘intruders’ are injured? 18. Has Acacia been questioned about its reporting on deaths/injuries? 19. Is Acacia right to say that RAID has made 'sweeping claims' and misrepresented the human rights situation? 20. If the Tanzanian police are shooting people, why is this the company’s responsibility? 21. How many police officers have been charged with criminal offences? 22. Has Acacia raised the issue of police violations with government officials? 23. -

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

Abuse by Barrick Gold Corporation Barrick's Porgera Gold Mine

FACTSHEET: Abuse by Barrick Gold Corporation Representing survivors of gang rape and those killed by Barrick Gold Corporation’s security guards at the Porgera gold mine in Papua New Guinea Canadian mining company Barrick Gold Corporation, the largest gold mining company in the world, operates the Porgera mine in Papua New Guinea (PNG), where security guards have raped and gang-raped hundreds of local women and girls and killed several local men. EarthRights International (ERI) represents a number of survivors of rape and family members whose relatives were killed by Barrick security guards. Barrick’s Porgera Gold Mine Barrick has owned and operated the Porgera gold mine since 2006, when it acquired the previous owner, Placer Dome. Barrick also acquired a legacy of environmental damage and human rights abuses that it has failed to remedy. Each day, Barrick dumps more than 16,000 tons of waste into the Porgera River and local creeks that villagers have long relied upon for drinking water, bathing, and washing clothes and food. The mine’s ever-expanding waste dumps continue to take over the land and bury the homes of the original landowners that have lived in the region for generations, long before large-scale mining came to Porgera. Surrounded on all sides, villagers have no choice but to cross the dangerous dumps to reach agricultural land, commercial areas, schools or other villages. Many have not been compensated for the loss of their land and their homes, and Barrick has refused to relocate them. Without land to farm and sources of clean water, practically the only means of income available to some of the local indigenous communities is to scavenge for remnants of gold in the open pit or the treacherous waste dumps. -

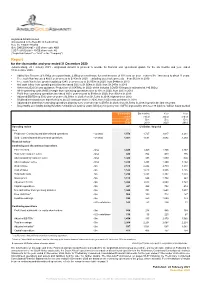

Year End 2020

AngloGold Ashanti Limited (Incorporated in the Republic of South Africa) Reg. No. 1944/017354/06 ISIN: ZAE000043485 – JSE share code: ANG CUSIP: 035128206 – NYSE share code: AU (“AngloGold Ashanti” or “AGA” or the “Company”) Report for the six months and year ended 31 December 2020 Johannesburg, 22 February 2021 - AngloGold Ashanti is pleased to provide its financial and operational update for the six months and year ended 31 December 2020. • Added Ore Reserve of 6.1Moz on a gross basis, 2.6Moz on a net basis, for a net increase of 10% year-on-year - reserve life ∧ increased to about 11 years • Free cash flow increased 485% year-on-year to $743m in 2020 – excluding asset sale proceeds – from $127m in 2019 • Free cash flow before growth capital up 124% year-on-year to $1,003m in 2020, from $448m in 2019 • Net cash inflow from operating activities increased 58% to $1,654m in 2020, from $1,047m in 2019 • Achieved 2020 full year guidance: Production of 3.047Moz in 2020, which includes COVID-19 impacts estimated at 140,000oz • All-in sustaining costs (AISC) margin from continuing operations rose to 40% in 2020, from 28% in 2019 • Profit from continuing operations increased 160% year-on-year to $946m in 2020, from $364m in 2019 • Adjusted EBITDA up 50% year-on-year to $2,593m in 2020, from $1,723m in 2019; highest since 2012 • Dividend increased more than fivefold to 48 US cents per share in 2020, from 9 US cents per share in 2019 • Adjusted net debt from continuing operations down by 62% year-on-year to $597m in 2020, from $1,581m in 2019; -

Annual Information Form for the Year Ended December 31, 2018 Dated As of March 22, 2019 BARRICK GOLD CORPORATION

Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, ON M5J 2S1 Annual Information Form For the year ended December 31, 2018 Dated as of March 22, 2019 BARRICK GOLD CORPORATION ANNUAL INFORMATION FORM TABLE OF CONTENTS GLOSSARY OF TECHNICAL AND BUSINESS TERMS 4 REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION 10 FORWARD-LOOKING INFORMATION 11 SCIENTIFIC AND TECHNICAL INFORMATION 14 THIRD PARTY DATA 15 GENERAL INFORMATION 15 Organizational Structure 15 Subsidiaries 16 Areas of Interest 18 General Development of the Business 18 History 18 Significant Acquisitions 18 Strategy 19 Recent Developments 21 Results of Operations in 2018 22 NARRATIVE DESCRIPTION OF THE BUSINESS 26 Production and Guidance 26 Reportable Operating Segments 26 Barrick Nevada 27 Pueblo Viejo (60% basis) 28 Lagunas Norte 29 Veladero (50% basis) 29 Turquoise Ridge (75% basis) 30 Acacia Mining plc (63.9% basis) 31 Pascua-Lama Project 32 Mineral Reserves and Mineral Resources 33 Marketing and Distribution 46 Employees and Labor Relations 47 Competition 48 Sustainability 48 Operations in Emerging Markets: Corporate Governance and Internal Controls 49 Board and Management Experience and Oversight 50 Communications 51 - i - Internal Controls and Cash Management Practices 51 Managing Cultural Differences 52 Books and Records 52 MATERIAL PROPERTIES 52 Cortez Property 52 Goldstrike Property 58 Turquoise Ridge Mine 63 Pueblo Viejo Mine 69 Veladero Mine 76 Kibali Mine 86 Loulo-Gounkoto Mine Complex 93 EXPLORATION -

Anglogold Ashanti Holdings Plc Anglogold Ashanti Limited

Use these links to rapidly review the document TABLE OF CONTENTS Prospectus Supplement TABLE OF CONTENTS TABLE OF CONTENTS 3 Table of Contents Filed pursuant to Rule 424(b)(5) Registration Nos. 333-182712 and 333-182712-02 CALCULATION OF REGISTRATION FEE Amount of Registration Title of Each Class of Aggregate Securities to be Registered Offering Price Fee (1) 5.125% Notes due 2022 of AngloGold Ashanti Holdings plc $750,000,000 $85,950 Guarantee of AngloGold Ashanti Limited in connection with the 5.125% Notes due 2022 (2) — — (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933. (2) Pursuant to Rule 457(n) under the Securities Act of 1933, no separate fee is payable with respect to the guarantee of AngloGold Ashanti Limited in connection with the guaranteed debt securities. Prospectus Supplement to Prospectus dated July 17, 2012 GRAPHIC AngloGold Ashanti Holdings plc $750,000,000 5.125% notes due 2022 Fully and Unconditionally Guaranteed by AngloGold Ashanti Limited The 5.125% notes due 2022, or the "notes", will bear interest at a rate of 5.125% per year. AngloGold Ashanti Holdings plc, or "Holdings", will pay interest on the notes each February 1 and August 1, commencing on February 1, 2013. Unless Holdings redeems the notes earlier, the notes will mature on August 1, 2022. The notes will rank equally with Holdings' senior, unsecured debt obligations and the guarantee will rank equally with all other senior, unsecured debt obligations of AngloGold Ashanti Limited. Holdings may redeem some or all of the notes at any time and from time to time at the redemption price determined in the manner described in this prospectus supplement. -

Building a Sustainably Profitable Business

2008 Annual Report2008 Annual profitable business profitable Building a sustainably Randgold Resources | Annual Report 2008 | Building a sustainably profitable business www.randgoldresources.com Shareholders’ diary Randgold Resources is an African-focused gold mining and 800 exploration business with primary listings on the London Stock Exchange and Nasdaq. 600 400 Financial year end 31 December Annual general meeting Tuesday 5 May 2009 Major discoveries to date include the 7.5 million ounce Morila deposit in southern Mali, the 200 +7 million ounce Yalea deposit at Loulo in western Mali and the +4 million ounce Tongon deposit in the Côte d’Ivoire. Randgold Resources financed and built the Morila mine which Announcement of quarterly results 0 since October 2000 has produced more than 5 million ounces of gold and distributed more First quarter Thursday 7 May 2009 than US$1.3 billion to stakeholders. It also financed and built the Loulo project which started Second quarter Tuesday 4 August 2009 as two open pit mines in November 2005. Since then, an underground mine has been Third quarter Tuesday 10 November 2009 developed at the Yalea deposit and a second underground operation is planned for the Gara Year end and fourth quarter Monday 8 February 2010 deposit. First gold production from the company’s new Tongon project is scheduled for the fourth quarter of 2010. Stock exchange Ticker symbol Randgold Resources has an extensive portfolio of organic growth prospects, constantly replenished by intensive exploration programmes in Mali, Senegal, Burkina Faso, Côte Ticker symbols d’Ivoire, Ghana and Tanzania. Its advanced targets include the significant new Massawa London Stock Exchange (ords) RRS discovery in Senegal, currently at scoping study stage. -

Golden Rules Making the Case for Responsible Mining

GOLDEN RULES Making the case for responsible mining A REPORT BY EARTHWORKS AND OXFAM AMERICA Contents Introduction: The Golden Rules 2 Grasberg Mine, Indonesia 5 Yanacocha Mine, Peru, and Cortez Mine, Nevada 7 BHP Billiton Iron Ore Mines, Australia 9 Hemlo Camp Mines, Canada 10 Mongbwalu Mine, the Democratic Republic of Congo 13 Rosia Montana Mine, Romania 15 Marcopper Mine, the Philippines, and Minahasa Raya and Batu Hijau Mines, Indonesia 17 Porgera Gold Mine, Papua New Guinea 18 Junín Mine, Ecuador 21 Akyem Mine, Ghana 22 Pebble Mine, Alaska 23 Zortman-Landusky Mine, Montana 25 Bogoso/Prestea Mine, Ghana 26 Jerritt Canyon Mine, Nevada 27 Summitville Mine, Colorado 29 Following the rules: An agenda for action 30 Notes 31 Cover: Sadiola Gold Mine, Mali | Brett Eloff/Oxfam America Copyright © EARTHWORKS, Oxfam America, 2007. Reproduction is permitted for educational or noncommercial purposes, provided credit is given to EARTHWORKS and Oxfam America. Around the world, large-scale metals mining takes an enormous toll on the health of the environment and communities. Gold mining, in particular, is one of the dirtiest industries in the world. Massive open-pit mines, some measuring as much as two miles (3.2 kilometers) across, generate staggering quantities of waste—an average of 76 tons for every ounce of gold.1 In the US, metals mining is the leading contributor of toxic emissions to the environment.2 And in countries such as Ghana, Romania, and the Philippines, mining has also been associated with human rights violations, the displacement of people from their homes, and the disruption of traditional livelihoods.