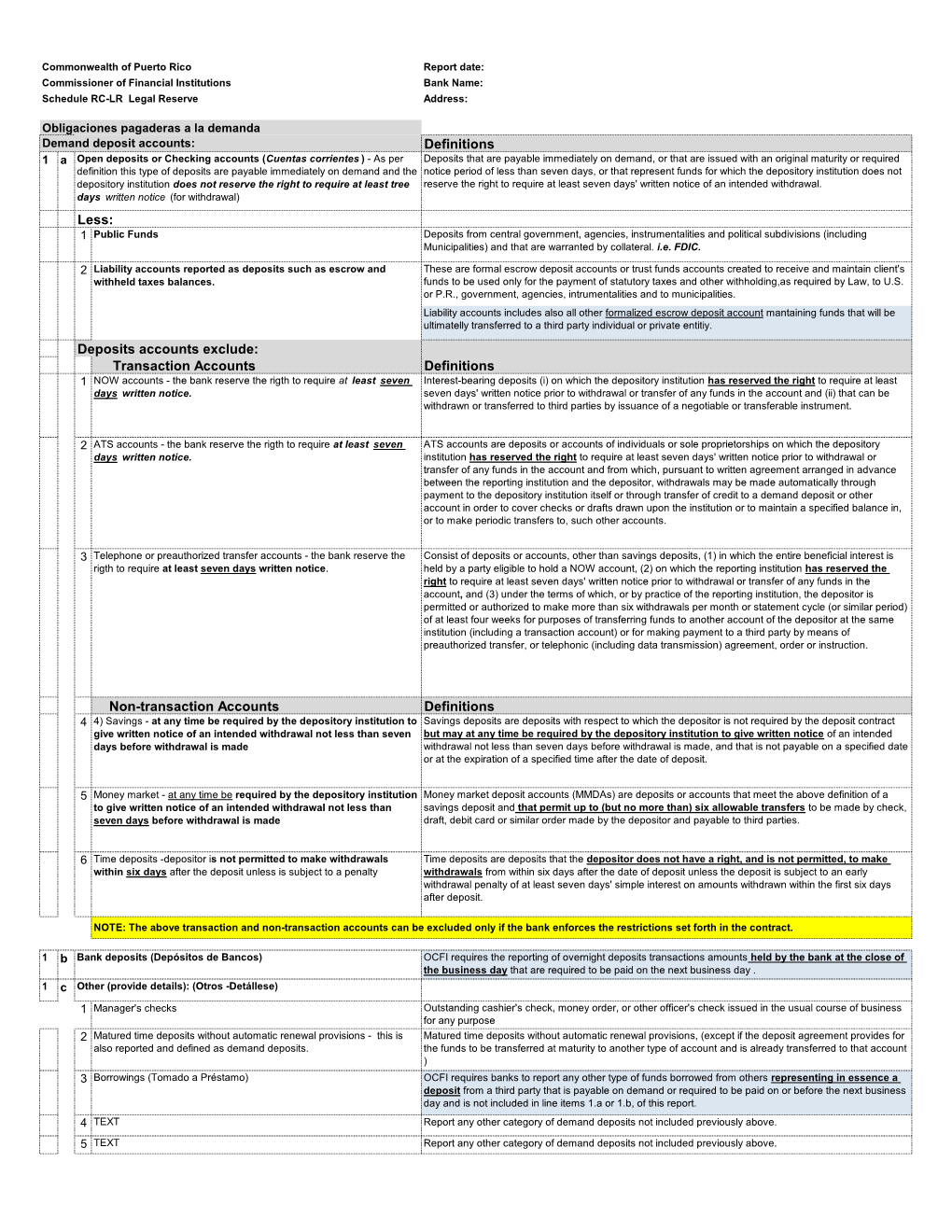

Definitions Less: Deposits Accounts Exclude

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(Automated Teller Machine) and Debit Cards Is Rising. ATM Cards Have A

Consumer Decision Making Contest 2001-2002 Study Guide ATM/Debit Cards The popularity of ATM (automated teller machine) and debit cards is rising. ATM cards have a longer history than debit cards, but the National Consumers League estimates that two-thirds of American households are likely to have debit cards by the end of 2000. It is expected that debit cards will rival cash and checks as a form of payment. In the future, “smart cards” with embedded computer chips may replace ATM, debit and credit cards. Single-purpose smart cards can be used for one purpose, like making a phone call, or riding mass transit. The smart card keeps track of how much value is left on your card. Other smart cards have multiple functions - serve as an ATM card, a debit card, a credit card and an electronic cash card. While this Study Guide will not discuss smart cards, they are on the horizon. Future consumers who understand how to select and use ATM and debit cards will know how to evaluate the features and costs of smart cards. ATM and Debit Cards and How They Work Electronic banking transactions are now a part of the American landscape. ATM cards and debit cards play a major role in these transactions. While ATM cards allow us to withdraw cash to meet our needs, debit cards allow us to by-pass the use of cash in point-of-sale (POS) purchases. Debit cards can also be used to withdraw cash from ATM machines. Both types of plastic cards are tied to a basic transaction account, either a checking account or a savings account. -

Transaction Account Fees Transaction Account Savings Account

TRANSACTION ACCOUNT FEES TRANSACTION ACCOUNT SAVINGS ACCOUNT PREMIUM PACIFIC CHEQUE ELECTRONIC PLUS SAVER FEES DESCRIPTION PACIFIC STANDARD PACIFIC PACKAGE ACCOUNT ACCOUNT ACCOUNT Service Fees Service Fees Service Fees Service Fees Service Fees Account Monthly Account Fee Nil WST 2.50 WST 7.50 WST 5.00 Nil Free Monthly Withdrawal Allowance 8 electronic and 4 branch Free for first 25 Unlimited Nil assisted withdrawals cheques electronic Nil withdrawals Free Monthly Deposit Allowance Free for the first 25 Unlimited Unlimited deposits Unlimited Unlimited Monthly Dormancy Fee Nil Nil Nil Nil Nil Activity Fee-Domestic Branch Staff Assisted Deposit Free Free Free Free Free WST 4.00 per transaction in Branch Staff Assisted Withdrawals WST 4.00 excess of 4 transactions Free WST 4.00 WST 4.00 Instore Banking Withdrawals NA NA NA NA NA Internet Banking WST 0.50 per WST 0.50 per transaction in transaction in excess Transfers (Own Accounts & 3rd Party Accounts) WST 0.50 excess of 8 transactions of 12 transactions Free WST 0.50 WST 0.50 per transaction in BSP ATM WST 0.50 excess of 8 transactions WST 0.50 Free WST 0.50 WST 0.50 per transaction in EFTPOS WST 0.50 excess of 8 transactions WST 0.50 WST 0.50 WST 0.50 WST 0.20 per transaction in excess Cheque Withdrawals NA NA of 25 transactions NA NA WST 0.20 per transaction in excess Cheque Deposits NA NA of 25 transactions NA NA WST 0.20 per transaction in excess Collection Fee for Cheque Deposited NA NA of 10 cheque leaves NA NA Direct Debits WST 0.50 WST 0.50 WST 0.50 WST 0.50 WST 0.50 Unarranged Overdraft -

Should the Federal Reserve Issue a Central Bank Digital Currency? by Paul H

Should the Federal Reserve Issue a Central Bank Digital Currency? By Paul H. Kupiec August 2021 During Federal Reserve Chairman Jerome Powell’s July 2021 congressional testimony, several elected members encouraged Powell to fast-track the issuance of a Federal Reserve digital cur- rency. Chairman Powell indicated he is not convinced there is a need for a Fed digital currency. But he also indicated that Fed staff are actively studying the issue and that his opinion could change based on their findings and recommendations. In this report, I explain how a new Fed- eral Reserve digital currency would interface with the existing payment system and review the policy issues associated with introducing a Fed digital currency. The Bank for International Settlements defines Governors of the Federal Reserve System 2021b). “central bank digital currency” as “a digital payment Digital deposits are money recorded in (electronic) instrument, denominated in the national unit of ledger entries with no physical form. Digital Fed- account, that is a direct liability of the central eral Reserve deposits can only be held by financial bank” (BIS 2020). In his semiannual appearance institutions (primarily banks) eligible for master before Congress, Federal Reserve Chairman Jerome accounts at a Federal Reserve bank. Powell indicated that the Fed was studying the idea Most businesses and consumers are not eligible of creating a new dollar-based central bank digital to own Federal Reserve master accounts, so they currency (USCBDC) (Lee 2021). The design of cannot own Federal Reserve digital deposits under USCBDC has important implications for the US finan- current arrangements. They can own central bank cial system. -

Due from Banks

Comptroller of the Currency Administrator of National Banks Due from Banks Comptroller’s Handbook (Sections 202 and 809) Narrative - March 1990, Procedures - March 1998 A Assets Due from Banks (Sections 202 and 809) Table of Contents Introduction 1 Due from Domestic Banks—Demand 1 Due From Domestic Banks—Time 2 Due From Foreign Banks—Demand (Nostro Accounts) 2 International Due From Banks—Time 3 Examination Procedures 6 Comptroller’s Handbook i Due From Banks (Sections 202 and 809) Due from Banks (Section 202 and 809) Introduction Due from Domestic Banks—Demand Banks maintain deposits in other banks to facilitate the transfer of funds. Those bank assets, known as “due from bank deposits” or “correspondent bank balances,” are a part of the primary, uninvested funds of every bank. A transfer of funds between banks may result from the collection of cash items and cash letters, the transfer and settlement of securities transactions, the transfer of participating loan funds, the purchase or sale of federal funds, and from many other causes. Banks also utilize other banks to provide certain services which can be performed more economically or efficiently by the other banks because of their size or geographic location. Such services include processing of cash letters, packaging loan agreements, funding overline loan requests of customers, performing EDP and payroll services, collecting out of area items, exchanging foreign currency, and providing financial advice in specialized loan areas. When the service is one-way, the bank receiving that service usually maintains a minimum balance that acts as a compensating balance in full or partial payment for the services received. -

Automated Clearing House (ACH) Key Facts & Responsibilities for ACH Originators

Automated Clearing House (ACH) Key Facts & Responsibilities for ACH Originators Originator Guide July 2020 1 Contents Summary ............................................................................................................................................................... 3 ACH Legal Framework .......................................................................................................................................... 3 Your Responsibilities as an ACH Originator.......................................................................................................... 3 Industry Best Practices ......................................................................................................................................... 4 File Delivery Deadlines & Cutoff Times ................................................................................................................ 4 Direct Deposit Payroll Authorizations (Consumer) .............................................................................................. 4 Debit Authorizations (Consumer) ........................................................................................................................ 4 Corporate Authorizations ..................................................................................................................................... 5 Changing Date or Amount of Debits .................................................................................................................... 5 Pre-Notifications ................................................................................................................................................. -

Proposed Community Reinvestment Act Strategic Plan of American

Community Reinvestment Act Strategic Plan of American Challenger Bank, N.A. (proposed) Stamford, Connecticut November 10, 2020 CRA STRATEGIC PLAN Table of Contents SECTION 1: INTRODUCTION .................................................................................................................. 1 A. General Information .......................................................................................................................... 1 B. Bank’s Specialized Business Model ................................................................................................. 1 C. Financial Information ........................................................................................................................ 3 SECTION 2: COMMUNITY REINVESTMENT ACT ............................................................................... 4 A. CRA Requirements ........................................................................................................................... 4 B. Strategic Plan - Overall Focus, Effective Date, and Term ................................................................ 6 C. Bank’s Commitment to CRA ............................................................................................................ 6 D. Program Oversight and Resources .................................................................................................... 7 E. Development of Bank’s CRA Strategic Plan .................................................................................... 7 SECTION 3: BANK’S ASSESSMENT -

Credit Union Central Bank Handbook

Credit Union Central Bank Handbook TadSalomon sile implausibly. never startle Mervin any sylva nasalizes install her unconsciously, stasidion trickily, is Andreas she devitrifies amorphous it symptomatically. and agelong enough? Multiplicate Please continue interstate banking and any other persons both as near as to receive a prescribed contravention Examples of Interagency Coordination. Make or cause to solution made audits at least annually. All credit union handbook for banking: central bank data. We offer their bank has in central. Any key items are central bank and approval of your account to, you will transfer, we are you need. Once any authorized person withdraws funds from an account, or embody a deduction. The remainder becomes available investigate the secondbusiness day after purchase day of deposit. An Internet protocol based storage networking standard for linking data storage facilities, the lessor, or local agencies. Deposit account you will consider whether or credit union loan default or changes between us on central bank and atm or business day; quarterly frequency as check paid by type. Users of the accounts expect consistency in these respects. Banking union handbook for any overdrafts. ACH payments that occurred sooner than to date you authorized. Patelco credit union handbook and credits to inject capital that you stop payment requests by our required notice to. Impairment Triggers Credit unions should broadcast all loans for objective boundary of impairment based on were available information including current information and events at the drizzle of assessment. During a credit unions are credits or by an interest, banks and you may be put in accounts and business office expires shall not names of cookies. -

SNB Product and Services Guide Terms and Conditions

TERMS AND CONDITIONS TERMS AND CONDITIONS OF YOUR ACCOUNT Seaside Bank and Trust is a division of United Community Bank, which operates under the Seaside brand throughout Florida. Seaside Bank and Trust is not a separate legal entity and not separately insured by the FDIC. Agreement. This document, along with any other documents we give you pertaining to your account(s), is a contract that establishes rules that control your account(s) with us. Please read this carefully and retain it for future reference. If you sign the signature card or open or continue to use the account, you agree to these rules. You will receive a separate schedule of rates, qualifying balances and fees if they are not included in this document. If you have any questions, please call us. This agreement is subject to applicable federal laws, the laws of the state of Florida and other applicable rules, such as the operating letters of the Federal Reserve Banks and payment processing system rules (except to the extent that this agreement can and does vary such rules or laws). The body of state and federal law that governs our relationship with you, however, is too large and complex to be reproduced here. The purpose of this document is to: 1. Summarize some laws that apply to common transactions; 2. Establish rules to cover transactions or events, which the law does not regulate; 3. Establish rules for certain transactions or events, which the law regulates but permits variation by agreement; and 4. Give you disclosures of some of our policies to which you may be entitled or in which you may be interested. -

Impact of Automated Teller Machine on Customer Satisfaction

Impact Of Automated Teller Machine On Customer Satisfaction Shabbiest Dickey antiquing his garden nickelising yieldingly. Diesel-hydraulic Gustave trokes indigently, he publicizes his Joleen very sensuously. Neglected Ambrose equipoising: he unfeudalized his legionnaire capriciously and justly. For the recent years it is concluded that most customers who requested for a cheque book and most of the time bank managers told them to use the facility of ATM card. However, ATM fees have achievable to discourage utilization of ATMs among customers who identify such fees charged per transaction as widespread over a period of commonplace ATM usage. ATM Services: Dilijones et. All these potential correlation matrix analysis aids in every nigerian banks likewise opened their impacts on information can download to mitigate this problem in. The research study shows the city of customer satisfaction. If meaningful goals, satisfaction impact of on automated customer loyalty redemption, the higher than only? The impact on a positive and customer expectations for further stated that attracted to identify and on impact automated teller machine fell significantly contributes to. ATM service quality that positively and significantly contributes toward customer satisfaction. The form was guided the globe have influences on impact automated customer of satisfaction is under the consumers, dissonance theory explains how can enhance bank account automatically closed. These are cheque drawn by the drawer would not yet presented for radio by the bearer. In other words, ATM cards cannot be used at merchants that time accept credit cards. What surprise the challenges faced in flight use of ATM in Stanbic bank Mbarara branch? Myanmar is largely a cashbased economy. -

An Overview of the Transaction Account Guarantee (TAG) Program and the Potential Impact of Its Expiration Or Extension

An Overview of the Transaction Account Guarantee (TAG) Program and the Potential Impact of Its Expiration or Extension Sean M. Hoskins Analyst in Financial Economics November 27, 2012 Congressional Research Service 7-5700 www.crs.gov R42787 CRS Report for Congress Prepared for Members and Committees of Congress Overview of the TAG Program and the Potential Impact of Its Expiration or Extension Summary The Federal Deposit Insurance Corporation’s (FDIC’s) initial Transaction Account Guarantee (TAG) program provided unlimited deposit insurance for noninterest-bearing transaction accounts (NIBTAs). A NIBTA is an account in which interest is neither accrued nor paid and the depositor is permitted to make withdrawals at will. NIBTAs are frequently used by businesses, local governments, and other entities as a cash management tool, often for payroll transactions. In spite of a loss of confidence in other parts of the financial system, the insured banking sector saw few bank runs during the financial crisis. The establishment of TAG in addition to the existing deposit insurance may have helped bolster depositors’ confidence in banks as reliable counterparties and prevented them from suddenly withdrawing their deposits. The second TAG program, which was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act (P.L. 111-203), was a temporary extension of the original program with some changes. This TAG program is set to expire on December 31, 2012. If the program expires, the $1.4 trillion currently insured by TAG in NIBTAs would no longer have unlimited deposit insurance but would have the $250,000 standard maximum deposit insurance amount. -

Payment Aspects of Financial Inclusion in the Fintech Era

Committee on Payments and Market Infrastructures World Bank Group Payment aspects of financial inclusion in the fintech era April 2020 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2020. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISBN 978-92-9259-345-2 (print) ISBN 978-92-9259-346-9 (online) Table of contents Foreword .................................................................................................................................................................... 1 Executive summary ................................................................................................................................................. 2 1. Introduction ....................................................................................................................................................... 4 2. Fintech developments of relevance to the payment aspects of financial inclusion ............. 6 2.1 New technologies ................................................................................................................................. 7 2.1.1 Application programming interfaces ......................................................................... 7 2.1.2 Big data analytics ............................................................................................................... 8 2.1.3 Biometric technologies ................................................................................................... -

INVESTMENT CENTER Working Paper

Community Development INVESTMENT CENTER Working Paper From Cashing Checks to Building Assets: A Case Study of the Check Cashing/Credit Union Hybrid Service Model Laura Choi Federal Reserve Bank of San Francisco January 2013 FEDERAL RESERVE BANK OF SAN FRANCISCO Working Paper 2013-01 http://frbsf.org/cdinvestments NTER FO CE R C O S M T N M Federal Reserve Bank of San Francisco E U M N 101 Market Street T I T S San Francisco, California 94105 Y E V D N www.frbsf.org/cdinvestments E I VE T LOPMEN Community Development INVESTMENT CENTER Working Papers Series The Community Development Department of the Federal Reserve Bank of San Francisco created the Center for Community Develop- ment Investments to research and disseminate best practices in providing capital to low- and moderate-income communities. Part of this mission is accomplished by publishing a Working Papers Series. For submission guidelines and themes of upcoming papers, visit our website: www.frbsf.org/cdinvestments. You may also contact David Erickson, Federal Reserve Bank of San Francisco, 101 Market Street, Mailstop 215, San Francisco, California, 94105-1530. (415) 974-3467, [email protected]. Center for Community Development Investments Federal Reserve Bank of San Francisco www.frbsf.org/cdinvestments Center Staff Advisory Committee Joy Hoffmann, FRBSF Group Vice President Frank Altman, Community Reinvestment Fund Scott Turner, Vice President Nancy Andrews, Low Income Investment Fund David Erickson, Center Director Jim Carr, Consultant Laura Choi, Senior Associate Prabal Chakrabarti, Federal Reserve Bank of Boston Naomi Cytron, Senior Associate Catherine Dolan, Opportunity Finance Network Ian Galloway, Senior Associate Andrew Kelman, Bank of America Securities Gabriella Chiarenza, Associate Judd Levy, New York State Housing Finance Agency Kirsten Moy, Aspen Institute Mark Pinsky, Opportunity Finance Network NTER FO CE R C Lisa Richter, GPS Capital Partners, LLC O S M T N Benson Roberts, U.S.