THE ALTERNATIVE LENDING REPORT Volume 1, No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

From Alternative to Mainstream

CHAPTER 1 From Alternative to Mainstream Alternatives Ascending Foreword The specter of market volatility brought on by large-scale events, such as global pandemic- related lockdowns in early 2020, has had a strong influence on investor approaches to their portfolios. Investors are responding by building resilience into their portfolios to navigate a future with the potential for enormous surprises. Alternative asset managers face a complex mix of opportunities and challenges presented by strong investor appetite for diversification, as well as broader industry pressures. BNY Mellon, in conjunction with Mergermarket, surveyed 100 institutional investors and 100 alternative asset managers on their perceptions of current trends in the space and on whether the two sides are moving in the same direction. The findings show changing investor and asset manager attitudes and behavior, in some cases contrasting with our 2017 research report, The Race for Assets.1 In addition to shifting investor needs, highlighted in Chapter 1 of this study, alternative asset managers face structural changes within their organizations. A majority of alternative asset manager respondents cite forces of increased competition and changing economics as top factors driving structural change. They see increased product innovation as another significant structural game-changer. Like their peers in the broader asset management industry,2 alternative asset managers are deploying digital and data analysis technologies to increase efficiency, overcome regulatory hurdles, promote product innovation and improve reporting. 1 https://www.bnymellon.com/us/en/insights/content-series/the-race-for-assets.html 2 https://www.bnymellon.com/us/en/insights/asset-management-transformation-is-already-here/survey-research-series-overview.html 2 The need for robust data management and analytics is also bringing new complexities to the fore. -

A Guide to Understanding the Complex Universe of Private Debt Assets

Alternative credit and its asset classes A guide to understanding the complex universe of private debt assets First edition, May 2017 For professionals Important disclosure: The opinions expressed and conclusions reached by the authors in this publication are their own and do not represent an official position. The publication has been prepared solely for the purpose of information and knowledge-sharing. Neither NN Investment Partners B.V., NN Investment Partners Holdings N.V. nor any other company or unit belonging to NN Group make no guarantee, warranty or representation, express or implied, to the accuracy, correctness or completeness thereof. Readers should obtain professional advice before making any decision or taking any action that may affect their finances or business or tax position. This publication and its elements may contain information obtained from third parties, including ratings from credit rating agencies. Reproduction and distribution of (parts of) this publication, logos, and third party content in any form is prohibited, except with the prior written permission of NN Investment Partners B.V. or NN Investment Partners Holdings N.V. or the third party concerned. © 2017 NN Investment Partners is part of NN Group N.V. NN Group N.V. is a publicly traded corporation, and it and its subsidiaries are currently using trademarks including the “NN” name and associated trademarks of NN Group under license. All rights reserved. Alternative credit and its asset classes A guide to understanding the complex universe of private debt assets Table of contents Preface ...............................................................................................................................................................6 1. Introduction .................................................................................................................... 8 2. The history and rise of alternative credit .....................................................................11 2.1. -

Pushing Boundaries: the 2015 UK Alternative Finance Industry Report

PUSHING BOUNDARIES THE 2015 UK ALTERNATIVE FINANCE INDUSTRY REPORT February 2016 Bryan Zhang, Peter Baeck, Tania Ziegler, Jonathan Bone and Kieran Garvey In partnership with with the support of CONTENTS Forewords 04 Introduction 10 About this study 12 The Size and Growth of the UK Online Alternative 13 Finance Market Market Size and Growth by Alternative Financing 14 Models Increasing Share of the Market for Business Funding 19 Market Trends in Alternative Finance 22 Expanding Base of Funders and Fundraisers 23 Market Entrants and Partnership strategies 25 Seeking Growth Through Awareness, Increased 26 Marketing and Forging Partnerships 27 Institutionalisation of the Market Cross-Border Transactions and Internationalisation 30 The Geography and Industries & Sectors of 31 Alternative Finance Industry Perspectives on Regulation, Tax Incentives 33 and Risks Size and Growth of the Different Online 38 Alternative Finance Models Peer-to-Peer Business Lending 39 Peer-to-Peer Business Lending (Real Estate) 40 Peer-to-Peer Consumer Lending 41 Invoice Trading 42 Equity-based Crowdfunding 43 Equity-based Crowdfunding (Real Estate) 44 Reward-based Crowdfunding 45 Community Shares 46 Donation-based Crowdfunding 46 Pension-led Funding 47 Debt-based Securities 47 Conclusion 48 Acknowledgements 50 Endnotes 51 3 ABOUT THE AUTHORS BRYAN ZHANG Bryan Zhang is a Director of the Cambridge Centre for Alternative Finance and a Research Fellow at the Cambridge Judge Business School. He has co-authored !ve industry reports on alternative !nance. PETER BAECK Peter Baeck is a researcher at Nesta, where he focuses on crowdfunding, peer-to-peer lending and the role of digital technologies in public and social innovation. -

Does Fintech Substitute for Banks? Evidence from the Paycheck Protection Program

NBER WORKING PAPER SERIES DOES FINTECH SUBSTITUTE FOR BANKS? EVIDENCE FROM THE PAYCHECK PROTECTION PROGRAM Isil Erel Jack Liebersohn Working Paper 27659 http://www.nber.org/papers/w27659 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 August 2020, Revised December 2020 We would like to thank Daniel Green, Greg Howard, Victor Lyonnet, Karen Mills, Bernadette Minton, Claudia Robles-Garcia (discussant), René Stulz, Tejaswi Velayudhan, and participants at the Stanford-Princeton Bendheim Center Corporate Finance and the Macroeconomy conference and seminars at Cambridge, Indiana, Northeastern, Penn State, Oklahoma, Ohio State, and Zurich for very helpful comments. Thanks to May Zhu, Jason Lee and David Xu for excellent research assistance. All errors are our own. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2020 by Isil Erel and Jack Liebersohn. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Does FinTech Substitute for Banks? Evidence from the Paycheck Protection Program Isil Erel and Jack Liebersohn NBER Working Paper No. 27659 August 2020, Revised December 2020 JEL No. G00,G01,G2,G21,G23,G28,H12,H2,H3 ABSTRACT New technology promises to expand the supply of financial services to small businesses poorly served by the banking system. -

(P2p) Lending Model in Islamic Finance / Shariah-Compliant Form

CAPCO ISLAMIC FINANCE CAPABILITY APPLICATION OF PEER TO PEER (P2P) LENDING MODEL IN ISLAMIC FINANCE / SHARIAH-COMPLIANT FORM INTRODUCTION Islamic finance is growing in prominence globally owing to strong interest from consumers due to both theological reasons and its strong ethos of ethical investing. In this environment it is imperative that participants in this sector consider avenues that help with growth acceleration and expanding consumer interest. One of the most interesting avenues for potential expansion is within the alternative finance market, specifically in the P2P lending segment. This paper aims to explore the viability of deploying the P2P lending model in a manner that remains true to the framework of Islamic finance principles such as RIBA (prohibition of interest) and Shariah (prohibition of certain product types). WHAT IS P2P LENDING? P2P lending is a form of finance that enables the exchange however there has been a significant uptick in the invoice of capital without the reliance on a conventional financial lending category for the last three years (From ~£310 million institution to oversee and manage the transactions. This format in 2016 to ~£1.1 billion in 2018)2, this is due to the strong enables the borrowers and lenders to interact directly, usually demand for this service from small to medium sized enterprises facilitated through a web application or platform. (SMEs) and is likely to surge due to the impact of to the socio- economic factors of the past year. P2P lending online can trace its origins to the UK with Zopa being the first firm to market this concept, followed by firms UK Overall Volume Growth (£) such as Prosper and Lending Club in the US. -

Peer-To-Peer Lending Annual Report 2019

PEER-TO-PEER LENDING STATE OF THE MARKET ANNUAL REPORT 2019 | WWW.ALTFI.COM UK MARKETPLACE ONLINE LENDING RETURNS IN THE FINTEX LISTED DIRECT ADVERTISED IMPAIRMENTS LENDING IN EUROPE REALITY WAY LENDING RETURNS AND DEFAULTS We follow the trends so you can stay ahead of them. P2: We are specialist advisers in the AlternativeRSM Finance space. At RSM, we make it our priority to understand your business so youADVERT can make confident decisions about the future. Experience the power of being understood. Experience RSM | rsmuk.com The UK group of companies and LLPs trading as RSM is a member of the RSM network. RSM is the trading name used by the members of the RSM network. Each member of the RSM network is an independent accounting and consulting firm each of which practises in its own right. The RSM network is not itself a separate legal entity of any description in any jurisdiction. The RSM network is administered by RSM International Limited, a company registered in England and Wales (company number 4040598) whose registered office is at 50 Cannon Street, London EC4N 6JJ. The brand and trademark RSM and other intellectual property rights used by members of the network are owned by RSM International Association, an association governed by article 60 et seq of the Civil Code of Switzerland whose seat is in Zug. 3 INTRODUCTION PEER-TO-PEER LENDING: STATE OF THE UK MARKET After rapid growth from the ashes of the financial crisis, the alternative finance sector appears to be maturing. However, it faces internal and external challenges that will dictate the industry’s long-term viability and success. -

Lendit-Pitch Deck FINAL

The World’s Leading Event in Financial Services Innovation April 9-11 * Moscone West * San Francisco Fintech | Blockchain | Digital Banking | Lending Sponsor Prospectus The Big Picture Unparalleled Networking and Business Development Opportunities What’s New? ● 3 Days of Content and Networking ● BlockFin Summit dedicated to content, networking and experts in Blockchain for Financial Services ● Expanded 1:1 Meetings Services to help you schedule and meet everyone on your list. Your Decision Makers in One Location 1,700+ C-Level or Higher 5,000+ Focused on Financial Services Innovation 2000 PE, VC, Institutional Investors, Hedge Funds 1500 1000 Commercial, Digital, Regional 500 AI, Blockchain, 0 CXOs Vice Directors Digital Banking, & Founders Presidents & Managers Cryptocurrency, Payments, Lending, RegTech 2017 LendIt USA Stats Driven by Content Industry Pioneers take the Stage at LendIt “It’s never been more important to understand the enablers 350+ of our global mission and there’s no more important conference than LendIt in terms of understanding the power Speakers of technology and what’s happening in the financial world” Andrea Jung President and CEO Grameen America Ash Gupta Jackie Reses Antony Jenkins Richard Cordray Peter Thiel President, Global Credit Square Capital Lead Founder & Exec Chairman Director Entrepreneur, Investor Risk & Info Management Square Capital 10X Technologies CFPB Co Founder American Express PayPal Our Audience includes Everyone You Need to Meet 800+ 500+ Investors Banks 2017 LendIt USA Stats 5 Spotlight on -

Marketplace Lending a Temporary Phenomenon? Foreword 1

Marketplace lending A temporary phenomenon? Foreword 1 Executive summary 2 1. What is marketplace lending? 4 2. Marketplace lending: a disruptive threat or a sustaining innovation? 8 3. The relative economics of marketplace lenders vs banks 11 4. The user experience of marketplace lenders vs banks 23 5. Marketplace lending as an asset class 24 6. The future of marketplace lending 30 7. How should incumbents respond? 32 Conclusion 35 Appendix 36 Endnotes 37 Contacts 40 Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2016 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. -

A Case of Regulatory Evolution

Forum A CASE OF REGULATORY successful integration of sector regulation, alongside continued government support for alternative finance. EVOLUTION – A REVIEW OF While many member states have opted for a “wait and THE UK FINANCIAL CONDUCT see” approach to crowdfunding regulation, the United Kingdom was of the first nations to create bespoke reg- AUTHORITY’S APPROacH TO ulation for crowdfunding activities. As the regulating CROWDFUNDING body that monitors and supervises crowdfunding ac- tivities in the UK is the Financial Conduct Authority (FCA)2, this article will centre on the regulatory regime that it has adopted. ROBERT WarDROP AND 1 The FCA defines crowdfunding as an umbrella term to TANIA ZIEGLER capture various “categories” of activity, some of which are regulated whilst others are not. The general defini- Introduction tion of crowdfunding, according to the FCA is “an inter- net-based business model […] in which people and busi- Across Europe, crowdfunding is quickly moving from a nesses (including start-ups) can try to raise money from fringe funding instrument to becoming a mainstream fi- the public, to support a business, project, campaign or nance channel, connecting “crowds” to fund businesses, individual” (FCA 2016a). This broad term includes four projects and individuals. In its recently published Report sub-categories: on Crowdfunding in the EU Capital Markets Union, the European Commission details the importance of crowd- • Donation-based crowdfunding: people give funding as “an important source of non-bank financing money to enterprises or organisations whose activi- in support of job creation, economic growth and com- ties they want to support. petitiveness” (European Commission 2016). -

Technology Solutions for PPP and Beyond

Technology Solutions for PPP and Beyond Research Brief JUNE 2020 Small businesses’ struggles to obtain federal Paycheck Protection Program loans over the last two months underscore the substantial obstacles that they face in accessing capital and financial services more generally. Using data and technology to make small business lending faster, less resource intensive, and more accurate is critical to fostering a more rapid and inclusive economic recovery and to building a more resilient small business sector going forward. Small businesses are experiencing severe hardships during the COVID-19 crisis. To help support businesses with fewer than 500 employees, Congress established the Paycheck Protection Program (PPP) in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).1 The PPP is a temporary emergency Small Business Administration (SBA) 7(a) loan program with favorable terms, including a 100% government guarantee and potential forgiveness. However, PPP implementation has high- lighted and in some cases exacerbated longstanding challenges faced by small businesses in accessing credit: » Verification of identity. Many small businesses did not have extensive relationships with participating banks at the start of the Paycheck Protection Program. To onboard new customers, lenders must comply with identity verification and due diligence requirements, which demand a certain level of rigor, time, and resources. No central information repository exists for businesses, and traditionally used data sources may not include certain companies, such as newly formed businesses. » Insufficient information to evaluate loan applications. Small businesses’ financial information is not publicly available, less standardized than larger companies, and often not digitized. Lenders have historically devoted substantial resources to gathering and analyzing documents and data about small businesses. -

BAI-Webinar„Direct Lending"

BAI-Webinar„Direct Lending" Speakers: Tobias Bittrich, Leiter Corporate Banking, Berenberg Joanna Layton, Managing Director, Alcentra August 24, 2021 Philipp Bunnenberg Referent Alternative Markets, BAI Poppelsdorfer Allee 106 53115 Bonn +49 (0) 228 96987-52 [email protected] Die Sprecher unserer BAI Mitgliedsunternehmen Tobias Bittrich leitet seit 2008 das Corporate Banking Joanna Layton joined Alcentra in May 2005 and is a bei Berenberg. Hierzu gehören die Bereiche Structured senior member of the investment team, with over 20 Finance, Schifffahrt, Real Estate sowie das years of investing experience. Joanna was originally a Firmenkundengeschäft, Infrastructure & Energy, die member of the European Loans and High Yield team, Immobilien-finanzierungen und der internationale where she was a senior analyst covering a variety of Zahlungsverkehr. Zudem hat er den Bereich zum Asset sectors. She has been a member of the European Loans Manager für illiquide Assets (Private Debt) ausgebaut. and High Yield Investment Committee since 2014. In Er hat mehr als 20 Jahre Branchenerfahrung. Bevor er line with the importance of monitoring a growing 2007 als Structured Finance Spezialist zu Berenberg investment base, Joanna formed the European Direct kam, war er bei der Commerzbank in verschiedenen Lending Portfolio Monitoring Team in early 2018. This Positionen in Hamburg und Frankfurt tätig. Nach has grown to a team of six investment professionals. seinem Studium der Volkswirtschaft startete er als Joanna is also a member of the European Direct Anlage- und Derivatespezialist im Lending Investment Committee. Firmenkundengeschäft. 2 BAI Webinar / August 2021 1st out / 2nd out Direct Lending Mit Super Senior in Richtung Investment Grade? Berenberg Wichtige Hinweise und wesentliche Risiken Wichtige Hinweise Bei dieser Information handelt es sich um eine Marketingmitteilung. -

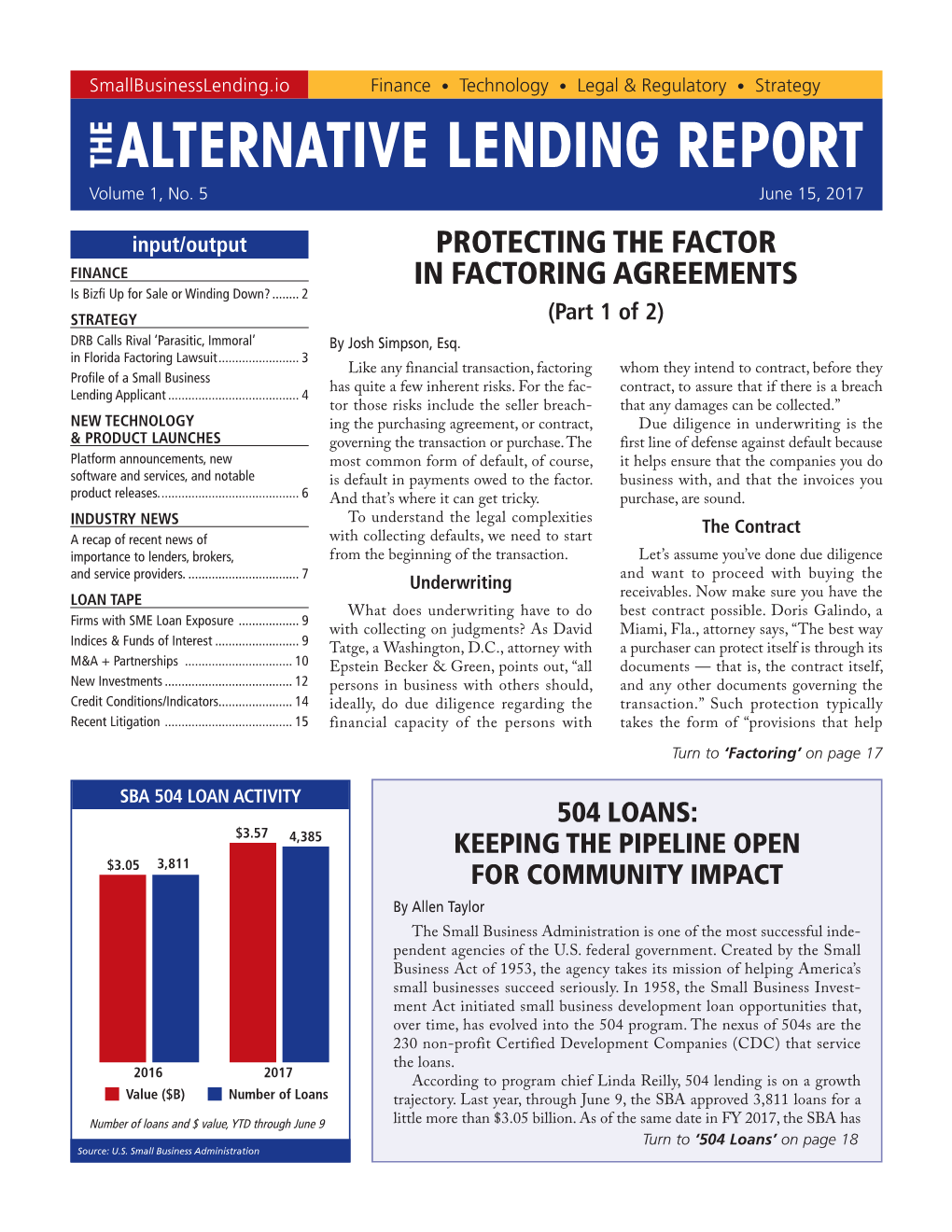

THE ALTERNATIVE LENDING REPORT Volume 1, No

SmallBusinessLending.io Finance • Technology • Legal & Regulatory • Strategy THE ALTERNATIVE LENDING REPORT Volume 1, No. 2 May 4, 2017 input/output CAN ALTERNATIVE DATA SOLVE ONLINE LEGAL & REGULATORY LENDERS’ ‘ALGORACISM’ PROBLEM? MCA Funder 3 Leaf Capital Called a Fraud by Partner ........................... 3 By Tim Lloyd STRATEGY A March 2017 letter written by Con- Beyond the prevalence of high costs, Online Commercial Lending: gressman Emanuel Cleaver, II (D-Mo.), double dipping, hidden fees, misaligned How it’s Changing the Landscape ............... 4 to Consumer Financial Protection Bureau sales incentives and stacking, the HBS Live Oak Cuts Risk, Woos Director Richard Cordray raises fresh con- paper opines that new algorithms could Women in Business .................................... 5 cerns about “algoracism” tainting the credit- “create unfair or discriminatory access to FINANCE risk-scoring models used by online lenders. credit.” This problem disproportionately Online Lending Associations Rep. Cleaver’s suspicions draw heav- affects black, Hispanic and women-owned Targeting Fintech and Education ................. 6 ily from a 2016 Harvard Business School businesses, in addition to entities that NEW TECHNOLOGY paper titled the “State of Small Business operate in low-income neighborhoods. & PRODUCT LAUNCHES Lending,” which addresses digital disrup- Biased algorithm design can occur if Platform announcements, new tion’s impact on regulation. Cleaver’s let- engineers code data correlation parameters software and services, and notable ter highlighted five predatory practices with attributes that make inadvertently product releases. ......................................... 7 cited by the HBS paper as pervasive in the discriminatory assumptions, which could INDUSTRY NEWS “Wild West” of online lending and alleges be violating the Equal Credit Opportunity A recap of recent news of that risk-scoring algorithms may be Act.