Vaccination Update Table of Contents: 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Polio Vaccine Safety Paul Meier's Role in the Discovery And

www.barkerstats.com Polio Vaccine the cutter incident October 1, 2020 Downloaded from www.barkerstats.com/PDFs/Meier/Meier-Cutter-Incident-History.pdf Polio Vaccine Safety Paul Meier’s Role in the Discovery and Evaluation of The Cutter Incident Professor Chris Barker, Ph.D. Adjunct Associate Professor of Biostatistics, UIC SPH. www.barkerstats.com Page 1 of 11 www.barkerstats.com Polio Vaccine the cutter incident October 1, 2020 Contents Background .................................................................................................................................................................................................................... 3 Brief Polio Vaccine Overview ......................................................................................................................................................................................... 3 Polio Vaccine Manufacturing Data Suppression ............................................................................................................................................................ 4 Biological Disaster? How Serious was the vaccine manufacturing problem? ............................................................................................................... 5 Near Elimination of Vaccine development by lawsuits ................................................................................................................................................. 6 Meier’s evaluation of the safety recommendations following The Cutter Incident .................................................................................................... -

Our Global Initiative

2021 OUR GLOBAL INITIATIVE AN ASSESSMENT OF COVID-19 & THE FAILED GLOBAL HEALTH POLICIES OF THE WHO OUR GLOBAL INITIATIVE In early 2020, Australia, and indeed the world, collapsed into a lockdown prompted by the World Health Organisation in its designation of Covid 19 as a pandemic. What began as “2 weeks to flatten the curve” quickly morphed into a year of intermittent lockdowns, a loss of freedoms and liberties, the decimations of SME’s, irrational restrictions, unadulterated government surveillance, an endless state of emergencies, the rise of the police state a totalitarian grand stride towards medical fascism and a technocratic dictatorship as well as the end of civil society as we know it. What happened? How did we get here? Where are we going? What does this world of the “New Normal” hold for not only Australia, but the human civilisation? How do we navigate this reality and not only survive but thrive? The Global Health Organisation, in collaboration with the Australian Patriots Alliance, the World Solutions Foundation, the QuantumPrism Foundation, Ikighais Pty Ltd and other concerned institutions (the Initiative) have commissioned this report in effort to gain an insight into what is going on; the why, they how and the WHO! Further, the report will offer solutions to current concerns, as well as ways for interested parties to position themselves to thrive and win in the new society bound to emerge from the ashes of this dying world. 2 TIPS TO HELP READ THIS REPORT This report contains a lot of information and we appreciate SUMMARY POINTS that time is scarce. -

Chronological Introduction of Types of Vaccine Products That Are Still Licensed in the United States

Appendix 2.3 CHRONOLOGICAL INTRODUCTION OF TYPES OF VACCINE PRODUCTS THAT ARE STILL LICENSED IN THE UNITED STATES The year of introduction of each of 49 of the 51 shown in table 2.3B, American pharmaceutical com- types of vaccine prducts currently licensed in the panies were issued 37 (89 percent) of the original United States, alolng with the manufacturing estab- licenses for these 42 products. New or improved lishment with the oldest license still in effect for each types of products that are currently licensed have product, is shown in table 2.3 A.] For 42 (86 percent) been introduced at a fairly consistent rate of three to of these 49 products, the establishment that received seven products per each 5-year interval since 1940.2 the original product license still holds this license. As Ten of the currently licensed products were licensed before 1940. Table 2.3A—Chronological Introduction of Types of Vaccine Products Still Licensed in the United States Year Type of vaccine product Establishment with oldest product license still in effecta 1903 Dlphtherla antitoxin Massachusetts Public Health Biologic Laboratories (191 7) 1907 Tetanus antitoxin Parke. Davis and Company (191 5) 1914 Pertussis vaccine Lederle Laboratories Typhoid vaccine Massachusetts Public Health Biologic Laboratories (191 7) Rabies vaccine . Eli Lilly and Company* 1917 Cholera vaccine Eli Lilly and Company* 1926 Diphtheria toxoid Parke, Davis and Company (1927) 1933 Staphylococcus toxoid Lederle Laboratories* Tetanus toxoid Merck Sharp and Dohme 1941 Typhus vaccine Eli Lilly and Company 1942 Plague vaccine .., . Cutter Laboratories* Rocky Mountain Spotted Fever vaccine. Lederle Laboratories* 1945 InfIuenza virus vaccine Lederle Laboratories Merck Sharp and Dohme Parke, Davis and Company * 1946 Parke, Davis and Company ● 1947 Parke, Davis and Company (1949) 1948 Parke, Davis and Company (1952) Parke. -

The Academic Model for the Prevention and Treatment of HIV

C A S E S I N G L O B A L H E A L T H D ELIVERY GHD-045 JULY 2021 Building the Supply Chain for COVID-19 Vaccines Mid-April 2020 saw a rapid escalation of the COVID-19 pandemic. In the four months after December 2019, when the novel coronavirus that causes COVID-19 was first detected in Wuhan, China, the virus had infected several million people globally, with more than a hundred thousand confirmed deaths (see Exhibit 1 for daily confirmed deaths by country). China and Italy experienced major outbreaks early and saw hospitals flooded with COVID-19 patients, causing major shortages of vital intensive-care materials. To forestall the overburdening of health care resources, more than a dozen major countries imposed strict lockdowns to slow the spread of the disease, or “flatten the curve” (see Exhibit 2 for a map of government responses). Government lockdowns disrupted supply and demand in vital industries including retail, tourism, manufacturing, and services, crippling the global economy. As the massive scale of the crisis became apparent, financial markets began to collapse during February, leading some experts to warn of a potential next Great Depression and governments to announce unprecedented rescue packages to contain the destructive economic impact of the crisis. As governments navigated trade-offs between economic and public health outcomes, a global race had begun for the rapid discovery, production, and distribution of a safe and effective vaccine. The organization of supply chains to manufacture, distribute, and administer a vaccine to a sufficient portion of the 7.6 billion world population to contain the disease, a concept termed “herd immunity,” posed significant challenges. -

Robert J. Desalvo Papers Business Combinations in the Cosmetic and Pharmaceutical Industries 1944

Robert J. DeSalvo Papers Business Combinations in the Cosmetic and Pharmaceutical Industries 1944 - 1990 Collection #107 Abstract Robert J. DeSalvo’s research focused on business combinations (acquisitions, mergers, and joint ventures in the cosmetic and pharmaceutical industries. This topic was the basis for his master’s thesis in pharmacy administration at the University of Pittsburgh and continued as a life-long interest. This collection consists of two series of notebooks that Dr. DeSalvo developed to record relevant business combinations. The first series records acquisitions, proposed acquisitions, mergers, and joint ventures for the period of 1944 –1990 in an alphabetical arrangement. The information on these entries is cumulative so that the history of an organization is collected in one place. The second series of notebooks is arranged in chronological blocks. The information is arranged alphabetically by the name of the acquirer. The name of the acquired (merged), type of combination (acquisition, proposed acquisition, joint venture) and the date is also provided. The information is cross-referenced between the two series so that the researcher can approach the information by the name of the parent company or chronologically. Dr. DeSalvo used this resource for many of his publications as well as his master’s thesis. A copy of these publications and his thesis make up the remainder of the collection. Donor Gift of Barbara DeSalvo, 2000 Biography Robert James DeSalvo was born on July 20, 1933 in Toledo, OH. He died on January 23, 1993 in Cincinnati, OH. DeSalvo graduated from high school in Toledo and attended pharmacy school at the University of Toledo where he received his B.S. -

![[1] Vaccination Update Table of Contents: 1](https://docslib.b-cdn.net/cover/7215/1-vaccination-update-table-of-contents-1-3097215.webp)

[1] Vaccination Update Table of Contents: 1

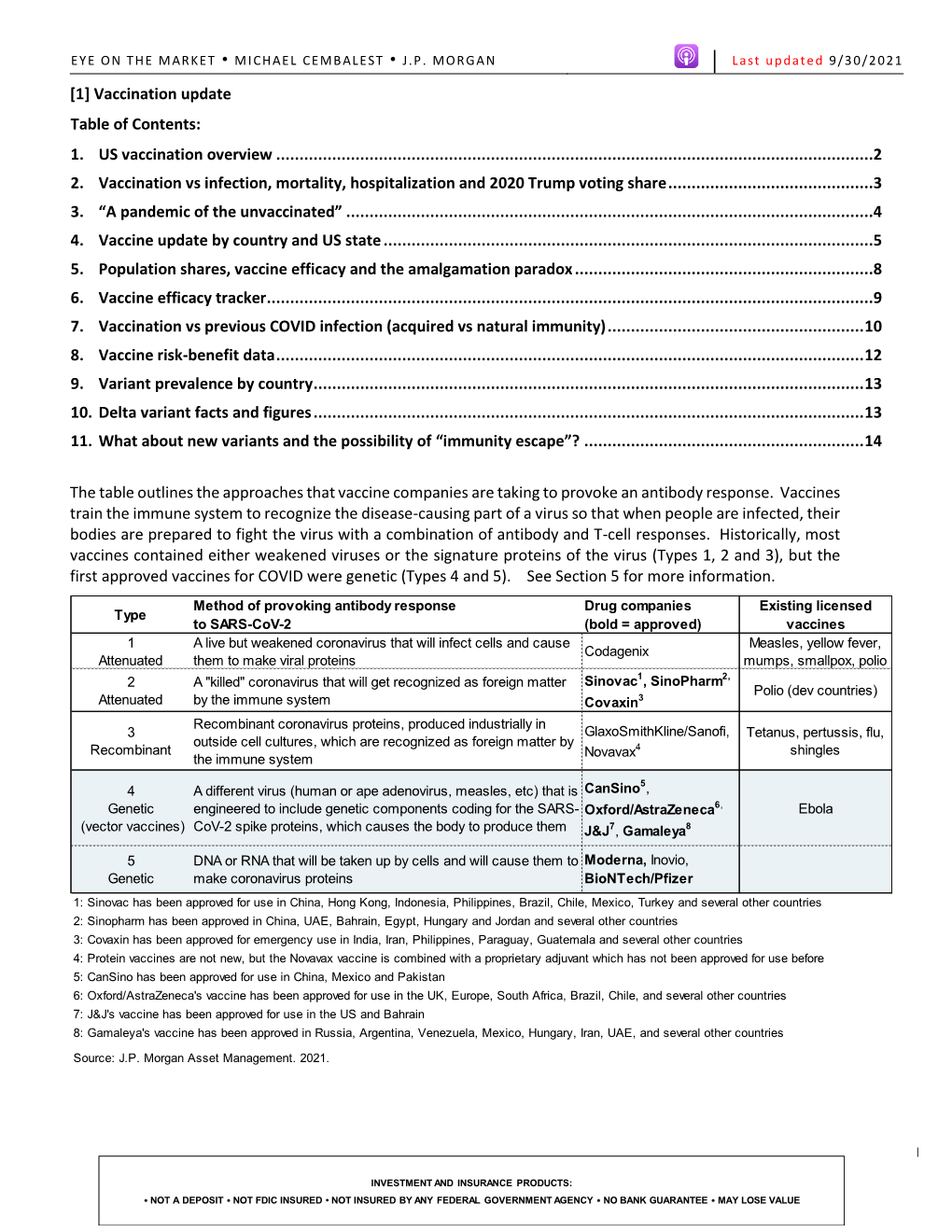

EYE ON THE MARKET • MICHAEL CEMBALEST • J.P. MORGAN Last updated 9/23/2021 [1] Vaccination update Table of Contents: 1. US vaccination overview ................................................................................................................................2 2. Vaccination vs infection, mortality, hospitalization and 2020 Trump voting share ............................................3 3. “A pandemic of the unvaccinated” .................................................................................................................4 4. Population shares, vaccine efficacy and the amalgamation paradox ................................................................5 5. Vaccine efficacy tracker ..................................................................................................................................6 6. Vaccination vs previous COVID infection (acquired vs natural immunity) .........................................................7 7. Vaccine risk-benefit data ................................................................................................................................8 8. Variant prevalence by country ........................................................................................................................9 9. Delta variant facts and figures ........................................................................................................................9 10. Vaccine update by country and US state ...................................................................................................... -

Process Paper and Bibliography

From Miracle To Mishap: The Cutter Incident and its Impact on Modern Vaccine Safety Standards Melinda Chen Senior Division Individual Documentary Process Paper: 488 Words This year, I wanted to explore a topic that was both outside of my comfort zone and relevant to modern times. The topic of vaccines first caught my attention after I heard about the resurgence of measles and other preventable diseases in America. From there, I encountered many sources which vaguely referenced a past safety issue with the polio vaccine. I decided to dig deeper, and discovered that this ‘issue’ was the Cutter Incident, a catastrophe in which over 120,000 people received polio vaccines containing live virus. I soon realized that the Cutter Incident was both a perfect fit for this year’s theme of Triumph and Tragedy, as well as story waiting to be told. I started my research by looking at secondary sources, especially books, to get a general idea of the topic. Next, I turned to primary documents and accounts, including those found in the Alan Mason Chesney Medical Archives, the U.S. National Library of Medicine, and the National Archives for more specific information including statistics and correspondences between government officials. I also wanted to hear from people who could provide different perspectives regarding the incident, which led to me reaching out to Dr. Peter Salk, Dr. Paul Offit, and Anne Gottsdanker for interviews. Dr. Salk and Ms. Gottsdanker were especially helpful since, as the son of Jonas Salk and a victim of the Cutter Incident respectively, they were able to give perspectives that I could not find in any other source. -

A Successful Vaccine That Missed Its Target

BOOK REVIEW A successful vaccine that missed stringent than those established by Salk and the National Foundation for Infantile Paralysis, leaving the door open to flexible interpretations by indi- its target vidual manufacturers. The black sheep proved to be Cutter Laboratories, but other manufacturers also had problems in avoiding live virus in some The Cutter Incident: How America’s of their vaccine lots. At the time of the incident, regulatory agencies in First Polio Vaccine Led to the charge of vaccine safety were still at an embryonic stage and certainly not Growing Vaccine Crisis in a position to ascertain the absence of live viruses in the inactivated polio vaccine. The importance of lot-to-lot consistency was not yet fully realized, By Paul A Offit and communication was limited between the different players. Yale University Press, 2005 In today’s context, it is not surprising that what could go wrong did go wrong. Offit clearly explains the technical reasons accounting for the 256 pp., hardcover, $27.50 persistence of live virulent polio virus in the Cutter vaccine. He notes that ISBN 0300108648 several of the vaccine lots produced by Cutter were found by the company Reviewed by Paul-Henri Lambert to be contaminated with live virus and were discarded. This obviously http://www.nature.com/naturemedicine reflected serious lot-to-lot discrepancies and indicated major problems in the production line. It is still puzzling why this did not raise more aware- In April of 1955, fearing the polio epidemic sweeping the US, Josephine ness of a potential risk. Gottsdanker took her five-year-old daughter Anne to the pediatrician to For those who are not familiar with the heavy regulatory environment receive Jonas Salk’s new polio vaccine. -

Tecncal Report on Poliomyelitis Vaccine

Tecncal Report on Poliomyelitis Vaccine N .June 10. 1955, the Puiblic Health Service tories whiclh might wish to manufacture and sent a Teclhniical Report on the Salk store vaccine intended for commercial use pend- l'oliomiivelitis Vaccine to the Secretary of ing decision to license the product. Whlen the Healtlh, Education, anid Welfare. Publislhed success of the field trial was reported April 12, below are the sumnmary. the report on epi- 1955. official minimum requirements were is- deemiological experience and new developments sued. Six manufacturers, each of which had in biologrics, and an expan(ledl calendar of eveents. produced vaccine under the provisional require- Copies of the r-eport were inade available to all ments, were granted licenses. State an(l local lhealtlh departments. Since only Records and samples of vaccine lots had been a limite(ld unuber of copiesare available throllugh submitted to the Public Healtlh Service Labora- the Puiblic Ilealtlh Service, it is recommenided tory of Biologics Control prior to April 12, and, that initerestedl lhealth departtment employees witlhin the next few davs, tlhose which were con- obtain a copy in their own agency. sidered acceptable, were released. Most bio- logical products for commercial distribution are released on the basis of an examination of Summary the detailed record of events in maniufacture The report presenits the teelhnical problems ani(l testingc, (known as a protocol), with or involve(d in the product ion, testinl, anid safety witlhout futrther testing by the Laboratory of of Salk polioiimvelitis vaccine. It also describes Biologics Cointrol. Release of most of the lots the responsibilities of tlhe lPublic Health Serv- of polionmyvelitis vaccine was based on review ice in control of the mianuflachitue of the vaccine of the manufacturing, protocols. -

Recalibrating Vaccination Laws

RECALIBRATING VACCINATION LAWS EFTHIMIOS PARASIDIS INTRODUCTION ............................................................................................. 2154 I. PLACING THE VACCINE ACT IN HISTORICAL CONTEXT ..................... 2166 A. Manufacturer’s Liability for Vaccine-Related Injuries ............. 2167 1. The Cutter Incident and Vaccine-Induced Polio ................. 2167 2. Cancer and SV40 Contaminated Polio Vaccines ................. 2172 3. Products Liability Claims for Vaccine-Related Injuries ...... 2178 4. Vaccine-Related Injuries and Market Share Liability ......... 2186 B. The 1976 Swine Flu Vaccine: Industry Demands Government Indemnification for Vaccine-Related Injuries ........................... 2192 C. 1980s Public Health Politics: Portraying the FDA as a Bureaucratic Hindrance to Health and Safety .......................... 2200 II. THE VACCINE ACT FRAMEWORK ...................................................... 2208 A. National Vaccine Program: Goals, Funding, and Administration ........................................................................... 2209 B. The National Vaccine Injury Compensation Program .............. 2211 C. The Vaccine Act’s Limits on Tort Claims Against Vaccine Manufacturers ........................................................................... 2219 III. MODERNIZING THE VACCINE ACT ..................................................... 2221 A. Adjusting the Requirements for Adverse Event Reporting and Post-Market Analysis of Vaccine Safety and Efficacy ............... 2222 B. Predicating -

Polio and Eli Lilly and Company

Polio and Eli Lilly and Company While polio has a history that some say dates back to ancient times, it was not until 1789 that British physician Michael Underwood provided the first clinical description of the disease.1 The first outbreaks of polio in the United States were in 1894, with a major epidemic occurring in the summer of 1916 when thousands of children in New York, New Jersey, Pennsylvania, and Connecticut experienced unusual and frightening symptoms. 2 First, they came down with an apparent cold accompanied by a headache and chills. Soon, without warning, they might wake up partially paralyzed. Some victims even became unable to swallow or breathe due to paralyzed muscles. By mid-August that year, 9,000 children had exhibited these symptoms.3 No one knew what the disease was or how it was contracted, but they did know that children were disproportionately affected, which led to increased fear and panic. Autopsies revealed an inflammation of the anterior spinal cord. Thus the disease got its name – poliomyelitis.4 Various measures were taken to try to control the disease and to stop its spread. According to one source, New York City scrubbed the streets with four million gallons of water a day and killed 72,000 stray cats in an effort to destroy polio germs.5 In her book Patenting the Sun: Polio and the Salk Vaccine, Jane S. Smith noted: Nonresident bathing was banned at the Hudson Park Beach. Sunday schools were closed, and children under sixteen were forbidden to attend the local vaudeville theatres. Travelers were stopped at the city limits and issued transit passes good for one-half hour. -

Commercial Biotechnology: an International Analysis

Index . Index Abbott Laboratories, 149, 196 generic applied research, 312 Abello Co. (F. R.G.), 130 international comparisons, 317 acquired immunedeficiency syndrome (AIDS), 125, 132 issues and options, 325 Advanced Genetic Sciences, Inc., 82 National Institutes of Health, 310, 323 Agent Orange, 222 National Science Foundation, 310 Agricultural Genetics (U.K.), 71, 82, 320, 425 USDA, 311, 323 Ajinomoto Co., 83, 131, 196, 197, 505 Baxter Travenol Laboratories, 134, 196 Allied Corp., 82 Baxter, William, Assistant Attorney General, 436 American Association for the Advancement of Science, Bayer Co., 83 309 Beckman Instruments, 87, 88 American Association of Universities, 421 Becton Dickinson Co., 145 American Cancer Society, 123 Beecham Co. (U.K.), 75 American Commercial Co., 87 Bell Laboratories, 308, 532 American Cyanamid, 80, 81, 167 Berkey Photo, Inc. v. Eastman Kodak Co., 440 American Hospital Supply, 196 Bethesda Research Laboratories, 84, 199 American Society for Engineering Education, 341 bioelectronics, 7, 253-256 Amgen Co., 80, 130, 149, 167 biochips, 254 Amicon Co., 54, 88 biosensors, 253 analysis, framework for, 263-266 future research, 256 competitiveness in biotechnology, factors influencing, bioengineering, novel techniques, 3, 4, 25 263 Biogen Co., 99, 101, 122, 133, 134 firms commercializing biotechnology, 265 Bio Logicals, 85, 90 Anheuser Busch, 102, 247 Biopol@, 211 animal agriculture industry, 6, 79-81, 162-171 bioprocessing separation and purification animal nutrition and growth promotion, 167 instrumentation, 88 commercial