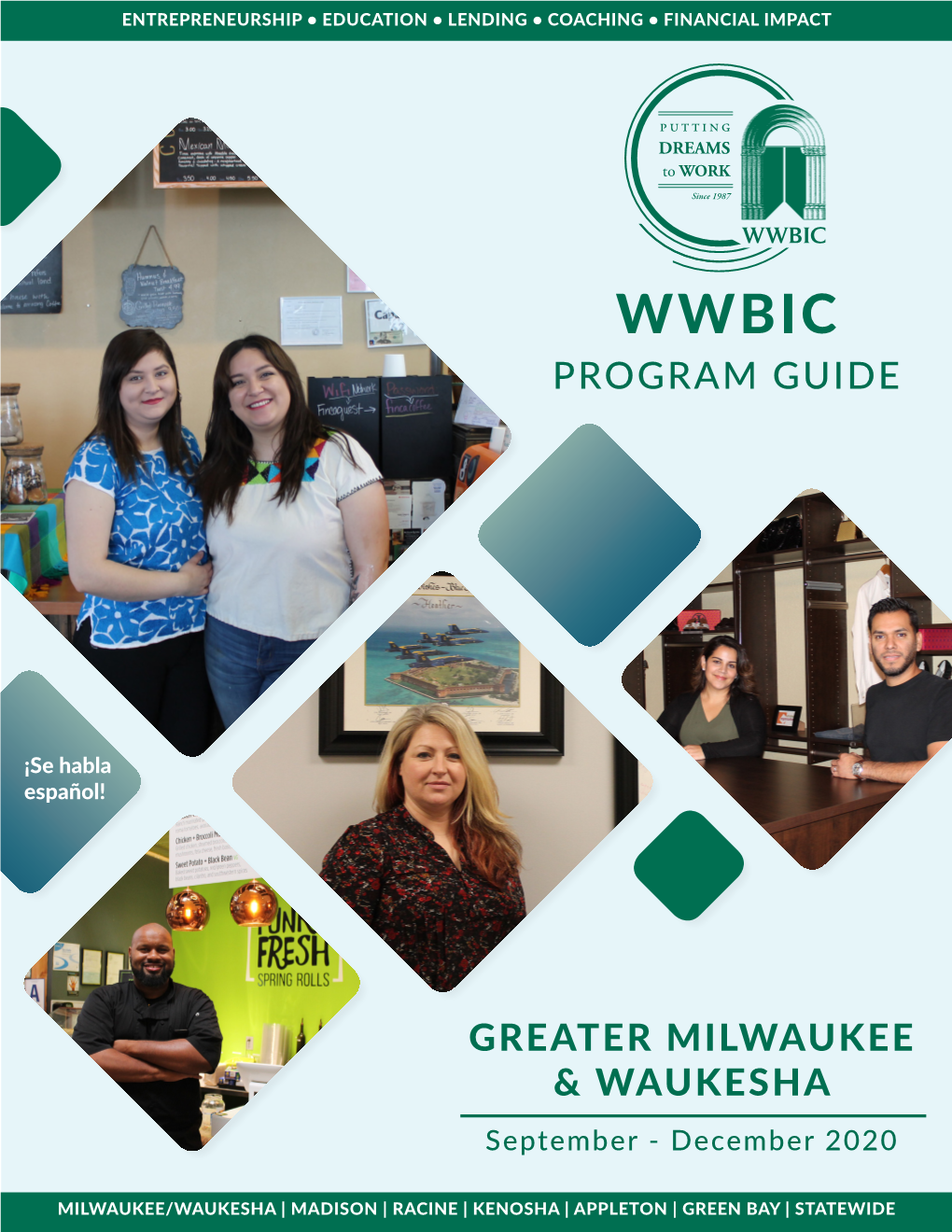

Program Guide Greater Milwaukee & Waukesha

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEBRASKA WRESTLING Weekly Notes: Tuesday, Feb

NEBRASKA WRESTLING Weekly Notes: Tuesday, Feb. 27, 2007 2006-07 Schedule Date Meet/Match Time/Score This Week in Husker Wrestling Nov. 11 Cowboy Open ! NTS Nov. 18 Kaufman-Brand Open @ NTS Conference Championships: Nov. 24 at Virginia Tech W, 34-9 No. 23/19 Nebraska (10-7-1) at 2007 Big 12 Championships Nov. 25 at Maryland W, 27-12 Hearnes Center•Columbia, Mo.•Saturday, March 3 Dec. 1-2 Las Vegas Invitational # 4th Last Year: Third Place, 52 pts, 9 NCAA qualifiers, one champion (Padden-197) Dec. 9 South Dakota State W, 32-9 TV: Tape-Delayed on FSN (channel 37 in Lincoln), Sunday, March 11, 12:30 p.m. Dec. 9 Northern Colorado W, 34-9 Dec. 16 Wyoming $ W, 34-10 Huskers Compete for Conference Title Dec. 16 Nebraska-Kearney $ W, 30-18 The 19th-ranked Nebraska wrestling team will aim for the program’s seventh conference championship Jan. 5 Oregon State L, 15-21 at the 2007 Big 12 Championships at the Hearnes Center in Columbia, Mo. Thirty-eight wrestlers will Jan. 13-14 National Duals % qualify for the NCAA Championships, including the top-three finishers in each weight class and eight Jan. 13 vs. Hofstra L, 6-32 wild-card selections. Jan. 13 vs. Michigan W, 23-13 Last year, 197-pound Big 12 champion B.J. Padden led the way as nine Husker wrestlers earned bids Jan. 13 vs. Iowa L, 5-30 to nationals from the Big 12 Championships. Along with Padden, 174-pound wrestler Jacob Klein reached Jan. 20 Iowa State L, 12-25 the finals, while Paul Donahoe (125), Patrick Aleksanyan (133), Dominick Moyer (141), Robert Sanders Jan. -

Bo Nickal Wins the Hodge! Date: April 1, 2019 at 12:34 PM To: Undisclosed-Recipients:;

From: Pat Donghia [email protected] Subject: Bo Nickal Wins the Hodge! Date: April 1, 2019 at 12:34 PM To: undisclosed-recipients:; Bo Nickal Wins the Hodge! Three-time NCAA Champion wins wrestling’s Heisman UNIVERSITY PARK, Pa.; April 1, 2019 – (Portion of release, including quotes, courtesy Bryan Van Kley, WIN Magazine) Penn State Nittany Lion wrestler Bo Nickal (Allen, Texas) has won the WIN Magazine/Culture House Dan Hodge Trophy, presented annually to the top collegiate wrestler in the nation by ASICS. The Hodge Trophy has been awarded since 1995. The three-time NCAA champion finished first in the voting, just ahead of teammate Jason Nolf (Yatesboro, Pa.). A Nittany Lion has now won the last three Hodge Trophy awards. Nickal joins former Nittany Lion greats Zain Retherford and David Taylor, who each claimed two Hodge Trophy honors, and former Lion stand-out Kerry McCoy, who won the honor in 1997, as Penn State recipients. In all, Penn State now has four different individuals who have won the honor six times. The Nittany Lion won his third NCAA championship on March 23, defeating Kollin Moore of Ohio State. The 5-1 finals victory at 197 pounds was Nickal’s 30th of an undefeated senior campaign that included 18 pins, three tech falls and six major decisions. In a year that featured four outstanding finalists for the award, known as “wrestling’s Heisman Trophy,” Nickal won the honor over a senior teammate Jason Nolf, also a three-time NCAA champ who had very similar stats as Nickal. The other two Hodge finalists were Rutgers’ senior Anthony Ashnault and Cornell sophomore two-time champ Yianni Diakomihalis, who won NCAA championships at 149 and 141 pounds, respectively. -

2019 Annual Report Demonstrating Courage and Determination

The Power of the Girl Scout Leadership Experience 2019 Annual Report Demonstrating Courage and Determination As part of the Girl Scout Law, girls promise to be “considerate and caring, courageous and strong.” One GSWISE Girl Scout’s willingness to fully embrace the spirit of the law recently caught the attention of her teacher. Elizabeth, a Girl Scout Brownie, saw a student being bullied on the playground. She tried to help him feel safe by honestly and fairly reporting the incident to her teacher. As recess continued, Elizabeth saw that the bullying began again, and could possibly Gold Award Girl Scout Trinity escalate into a physical confrontation before she could go for help. She courageously put When Girl Scout Trinity Slavik learned that children in herself between the two students and said in Ayacuchio, Peru, were suffering with severe illnesses a calm but firm voice, “You will not pick on my because they had not been taught proper hygiene, she friend.” sprung into action. The resulting project, “Clean Today for a Healthier Tomorrow,” became the focus of her Girl Scout Gold Award project. Elizabeth remained strong, never wavering from her desire to help the student, even The Girl Scout Gold Award is the highest honor a Girl Scout can receive. with tears running down her cheeks and It symbolizes outstanding accomplishments in leadership, development, despite being shoved to the ground and called project planning, and advocating for others. cruel names. Her actions helped resolve the situation and make sure everyone was safe For her Gold Award project, Trinity collected donations for toothbrushes, and secure. -

Million Dollar Babies Do Not Want to Share: an Analysis of Antitrust Issues Surrounding Boxing and Mixed Martial Arts and Ways to Improve Combat Sports

Volume 25 Issue 2 Article 5 8-1-2018 Million Dollar Babies Do Not Want To Share: An Analysis of Antitrust Issues Surrounding Boxing and Mixed Martial Arts and Ways to Improve Combat Sports Daniel L. Maschi Follow this and additional works at: https://digitalcommons.law.villanova.edu/mslj Part of the Antitrust and Trade Regulation Commons, and the Entertainment, Arts, and Sports Law Commons Recommended Citation Daniel L. Maschi, Million Dollar Babies Do Not Want To Share: An Analysis of Antitrust Issues Surrounding Boxing and Mixed Martial Arts and Ways to Improve Combat Sports, 25 Jeffrey S. Moorad Sports L.J. 409 (2018). Available at: https://digitalcommons.law.villanova.edu/mslj/vol25/iss2/5 This Comment is brought to you for free and open access by Villanova University Charles Widger School of Law Digital Repository. It has been accepted for inclusion in Jeffrey S. Moorad Sports Law Journal by an authorized editor of Villanova University Charles Widger School of Law Digital Repository. \\jciprod01\productn\V\VLS\25-2\VLS206.txt unknown Seq: 1 26-JUN-18 12:26 Maschi: Million Dollar Babies Do Not Want To Share: An Analysis of Antitr MILLION DOLLAR BABIES DO NOT WANT TO SHARE: AN ANALYSIS OF ANTITRUST ISSUES SURROUNDING BOXING AND MIXED MARTIAL ARTS AND WAYS TO IMPROVE COMBAT SPORTS I. INTRODUCTION Coined by some as the “biggest fight in combat sports history” and “the money fight,” on August 26, 2017, Ultimate Fighting Championship (UFC) mixed martial arts (MMA) superstar, Conor McGregor, crossed over to boxing to take on the biggest -

2006-07 Hofstra University Wrestling

HOFSTRA NOTES, STREAKS AND TIDBITS: • Hofstra has won 30 of its last 43 duals and 38 of its last 53 dual matches dating back to 2003. • Hofstra is undefeated in 48 consecutive dual conference matches posting a 47-0-1 record during that time. The last time Hofstra dropped a conference match was February 17, 1999 when the Broncs of Rider beat the Pride, 28-10, in an East Coast Wrestling Association (ECWA) match. The Pride has won 45 straight conference matches. • The Pride has won 12 of its last 16 home matches dating back 2006-07 HOFSTRA to the start of the 2003-04 season. Hofstra dropped a 25-13 UNIVERSITY WRESTLING decision to #5 Michigan on January 2, 2006, an 18-17 decision to Oregon State on November 17, 2005, a 30-10 decision to #1 CLIFF KEEN/LAS VEGAS INVITATIONAL Oklahoma State on February 13, 2005, and a 20-12 decision to #5 Hofstra Pride (6-0) #17 Cornell on February 5, 2005 at the Hofstra Arena. Before that, the last home dual match that the Pride dropped was on Friday & Saturday, December 1-2, 2006 November 29, 2003 when the ninth-ranked Cornhuskers of Star of the Desert Arena – Primm, NV Nebraska downed Hofstra, 30-10. PROJECTED HOFSTRA STARTERS: 2006-07 HOFSTRA Class Rank - Name Cl. 05-06 06-07 WRESTLING SCHEDULE/RESULTS 125 #7 Dave Tomasette*+ Jr. 14-8 3-1 Nov. 14 at Wagner * 56-0 W 133 Lou Ruggirello Fr. ----- 9-1 Nov. 15 ARMY 41-0 W 141 #16 Charles Griffin*+ Jr. -

COMPLAINT 25 V

Case5:14-cv-05484 Document1 Filed12/16/14 Page1 of 63 1 Joseph R. Saveri (State Bar No. 130064) Joshua P. Davis (State Bar No. 193254) 2 Andrew M. Purdy (State Bar No. 261912) Kevin E. Rayhill (State Bar No. 267496) 3 JOSEPH SAVERI LAW FIRM, INC. 505 Montgomery Street, Suite 625 4 San Francisco, California 94111 Telephone: (415) 500-6800 5 Facsimile: (415) 395-9940 [email protected] 6 [email protected] [email protected] 7 [email protected] 8 Benjamin D. Brown (State Bar No. 202545) Hiba Hafiz (pro hac vice pending) 9 COHEN MILSTEIN SELLERS & TOLL, PLLC 1100 New York Ave., N.W., Suite 500, East Tower 10 Washington, DC 20005 Telephone: (202) 408-4600 11 Facsimile: (202) 408 4699 [email protected] 12 [email protected] 13 Eric L. Cramer (pro hac vice pending) Michael Dell’Angelo (pro hac vice pending) 14 BERGER & MONTAGUE, P.C. 1622 Locust Street 15 Philadelphia, PA 19103 Telephone: (215) 875-3000 16 Facsimile: (215) 875-4604 [email protected] 17 [email protected] 18 Attorneys for Individual and Representative Plaintiffs Cung Le, Nathan Quarry, and Jon Fitch 19 [Additional Counsel Listed on Signature Page] 20 UNITED STATES DISTRICT COURT 21 NORTHERN DISTRICT OF CALIFORNIA SAN JOSE DIVISION 22 Cung Le, Nathan Quarry, Jon Fitch, on behalf of Case No. 23 themselves and all others similarly situated, 24 Plaintiffs, ANTITRUST CLASS ACTION COMPLAINT 25 v. 26 Zuffa, LLC, d/b/a Ultimate Fighting DEMAND FOR JURY TRIAL Championship and UFC, 27 Defendant. 28 30 Case No. 31 ANTITRUST CLASS ACTION COMPLAINT 32 Case5:14-cv-05484 Document1 Filed12/16/14 Page2 of 63 1 TABLE OF CONTENTS 2 3 I. -

TABLE of CONTENTS TEAM INFORMATION 2016-17 OPPONENTS 2016-17 Quick Facts

2016-17 MIZZOU WRESTLING TABLE OF CONTENTS TEAM INFORMATION 2016-17 OPPONENTS 2016-17 Quick Facts .................................................................................2 Mid-American Conference...................................................................44 2016-17 Roster ..........................................................................................3 Non-Conference.....................................................................................45 2016-17 Schedule .....................................................................................4 2015-16 SEASON IN REVIEW Season in Review...................................................................................46 2016-17 ROSTER Cox’s Summer in Rio ..............................................................................56 Seniors .......................................................................................................5 Juniors .....................................................................................................11 HISTORY AND RECORDS Sophomores ............................................................................................15 Mizzou National Champions ................................................................60 Freshmen .................................................................................................26 Mizzou All-Americans ...........................................................................62 100-Win Club ...........................................................................................64 -

Division I Wrestling Championships Records Book

DIVISION I WRESTLING CHAMPIONSHIPS RECORDS BOOK 2019 Championships 2 History 13 Individual National Champions 21 Team Finishes 27 All-Time Team Results 33 28 Central Mich. 12½ 29 Fresno St. 11½ 2019 CHAMPIONSHIPS Purdue Utah Valley 32 Old Dominion 11 33 Michigan St. 10½ 34 Pittsburgh 9½ TEAM STANDINGS Wyoming 36 Army West Point 7½ 1 Penn St. 137½ 37 Navy 7 2 Ohio St. 96½ Rider 3 Oklahoma St. 84 39 North Dakota St. 6½ 4 Iowa 76 40 Stanford 5½ 5 Michigan 62½ 41 Binghamton 5 6 Missouri 62 CSU Bakersfield 7 Cornell 59½ 43 West Virginia 4½ 8 Minnesota 53½ 44 Brown 4 9 Rutgers 51½ 45 Campbell 3½ 10 Nebraska 51 Penn 11 Virginia Tech 50 47 Appalachian St. 3 12 Arizona St. 42 48 Cal Poly 2 13 Lehigh 40½ 49 American 1½ UNI Bucknell 15 Princeton 35 George Mason 16 Iowa St. 32 Northern Colo. 17 NC State 31½ 53 Buffalo 1 18 Lock Haven 29 Indiana 19 North Carolina 28½ Ohio 20 Oregon St. 28 56 Air Force ½ 21 Wisconsin 27 Chattanooga 22 Northwestern 26 Columbia 23 Virginia 20½ Drexel 24 Duke 19 Kent St. 25 Oklahoma 18½ Northern Ill. 26 Illinois 16 SIUE 27 Maryland 13 2019 Championships 2 2019 NCAA Division I Wrestling Championships 125 CHAMPIONSHIP Thursday Morning Thursday Night Friday Morning Friday Night Saturday Night (1) Sebastian Rivera (NW) 30-2 (1) Rivera (NW) 11 TF-1.5 5:00 (21-6) (33) Trey Chalifoux (ARMY) 22-15 (33) Trey Chalifoux (ARMY) 22-15Dec 6-4 (1) Rivera (NW) 1 181 Dec 4-0 (32) Willy Girard (BLOO) 23-13 (17) Devin Schroder (PUR) 21-13 12 (16) Mattin (MICH) Dec 5-3 (1) Rivera (NW) (16) Drew Mattin (MICH) 20-9 341 (9) RayVon Foley (MSU) -

Big 12 Record Book Wrestling

Big 12 Record Book Wrestling BIG 12 CHAMPIONSHIP RESULTS 1997 1998 March 8 March 7 Hearnes Center Lloyd Noble Center Columbia, Mo. Norman, Okla. Attendance: 2,700 Attendance: 6,505 Team Results Team Results 1. Oklahoma State 92.0 1. Oklahoma State 98.0 2. Iowa State 78.0 2. Oklahoma 55.5 3. Oklahoma 55.0 3. Nebraska 54.0 4. Nebraska 41.5 4. Iowa State 47.0 5. Missouri 20.0 5. Missouri 15.0 Individual Results Individual Results 118-Pound 118-Pound Championship -- No. 1 Teague Moore, OSU dec. No. 2 Shane Valdez, OU; 4-3 Championship -- No. 1 Teague Moore, OSU dec. No. 2 Shane Valdez, OU; 3-1 (OT) Third Place -- No. 3 Cody Sanderson, ISU maj. dec. No. 4 Todd Beckerman, NU; Third Place -- No. 3 Cody Sanderson, ISU dec. No. 4 Paul Gomez, NU; 6-3 11-3 126-Pound 126-Pound Championship -- No. 1 Dwight Hinson, ISU dec. No. 2 Eric Guerrero, OSU; 2-0 Championship -- No. 1 Dwight Hinson, ISU dec. No. 2 Eric Guerrero, OSU; 3-2 Third Place -- No. 3 Dane Valdez, OU dec. No. 4 Jeramie Welder, NU; 6-1 Third Place -- No. 3 Dane Valdez, OU dec. No. 4 Jeramie Welder, NU; 3-1 134-Pound 134-Pound Championship -- No. 3 Michael Lightner, OU dec. No. 1 Brad Canoyer, NU; 10-3 Championship -- No. 1 Steven Schmidt, OSU dec. No. 2 Brad Canoyer, NU; 6-4 Third Place -- No. 2 Jamil Kelly, OSU dec. No. 4 Jeff Urban, MU; 9-2 Third Place -- No. 3 Bo Eubanka, OU dec. -

ALL-TIME COACHING RECORDS Overall Conference Season Coach W L T Pct

NIU WRESTLING RECORD BOOK ALL-TIME COACHING RECORDS Overall Conference Season Coach W L T Pct. W L T Pct. Conf. Tournament 1931-32 George Evans 0 4 0 .000 -- -- -- -- -- 1932-33 George Evans 0 4 0 .000 -- -- -- -- -- 1933-34 George Evans 0 2 0 .000 -- -- -- -- -- 1934-35-* Carl Appell 1 1 0 .500 -- -- -- -- -- 1935-36 John Schone 2 4 0 .333 -- -- -- -- -- 1936-37-* Reino Nori 2 2 0 .500 -- -- -- -- -- 1937-38 John Oldham 4 5 0 .444 -- -- -- -- -- 1938-39 Ed Hill 5 7 1 .423 -- -- -- -- -- 1939-40 George Davenport 5 3 1 .611 -- -- -- -- -- 1940-41 Harold Taxman 1 7 0 .125 -- -- -- -- -- 1941-42 Harold Taxman 1 6 0 .143 -- -- -- -- -- 1942-43 Harold Taxman 0 5 0 .000 -- -- -- -- -- 1943-44 No Team * World War II 1944-45 No Team * World War II 1945-46 George Evans 2 2 0 .500 -- -- -- -- -- 1946-47 George Evans 4 3 0 .571 -- -- -- -- -- 1947-48 Harry Garrett 1 5 1 .214 -- -- -- -- -- 1948-49 John Schone 3 4 0 .429 -- -- -- -- -- 1949-50 Robert Kahler 5 5 0 .500 -- -- -- -- -- 1950-51 Robert Kahler 5 3 0 .625 -- -- -- -- -- 1951-52 Robert Kahler 6 2 0 .750 -- -- -- -- -- 1952-53 Robert Kahler 4 1 2 .714 -- -- -- -- -- 1953-54 Robert Kahler 4 1 0 .800 -- -- -- -- -- 1954-55 Robert Kahler 2 3 0 .400 -- -- -- -- -- 1955-56 Robert Kahler 3 5 1 .389 -- -- -- -- -- 1956-57 Robert Brigham 11 0 0 1.000 -- -- -- -- -- 1957-58 Robert Brigham 10 6 0 .625 -- -- -- -- -- 1958-59 Robert Brigham 11 3 0 .786 -- -- -- -- -- 1959-60 Robert Brigham 6 4 1 .591 -- -- -- -- -- 1960-61 John Wrenn 6 5 0 .545 -- -- -- -- -- 1961-62 John Wrenn 7 2 1 .750 -- -- -- -- -

Press Release

Press Release FOR IMMEDIATE RELEASE Contact: Russell Luna July 6, 2021 469.524.1009 / [email protected] OU’s Webb and BU’s Butler Named Big 12 Athletes of the Year IRVING, Texas -- Oklahoma gymnast Anastasia Webb and Baylor men’s basketball player Jared Butler were named the 2020-21 Big 12 Athletes of the Year. Webb is the seventh Sooner female and third consecutive to win the accolade. Butler is the third Baylor male to win the award and first since 2014. Nominees are submitted by Big 12 institutions and selected, based on athletic performance, academic achievement and citizenship, by a media panel as well as fan voting conducted through Big12Sports.com. Webb won three individual NCAA Championships with triumphs in the vault, floor exercise and all-around. She became just the ninth gymnast in NCAA history to accomplish the feat of winning three titles in one championship. Additionally, she placed third on the balance beam and seventh on bars to lead OU to a runner-up finish. A native of Morton Grove, Illinois, Webb was named the 2021 Honda Sport Award for women’s gymnastics. She was selected as the 2021 Big 12 Co-Gymnast of the Year and was the WCGA Region 4 Gymnast of the Year. Also, she was selected as a finalist for the AAI Award. The senior won Big 12 titles in the balance beam and vault. Webb collected five All-America honors and was the only gymnast nationally to earn first-team recognition on all four events and the all-around. In 2021, she collected 33 event titles and scored four perfect 10s. -

9 #17 #4 #6 #4 #1

2016-17 UNIVERSITY OF MISSOURI WRESTLING MATCH NOTES DUALS WRESTLING #9 5-2 (3-0) 8-10 Head Coach: Brian Smith (19th season) Alma Mater: Michigan State, ‘90 Overall Record: 242-91-3 MU Record: 242-91-3 2016-17 SCHEDULE VS BUFFALO CORNELL EASTERN MICHIGAN OVERALL: 5-2 HOME: 3-0 AWAY: 2-2 MAC: 3-0 DATE OPPONENT SCORE/TIME (CT) 6-3 (1-1) 4-1 (1-0) #7 4-2 (1-1) Head Coach: John Stutzman (4th season) Head Coach: Rob Koll (23rd season) Head Coach: David Bolyard (3rd season) N 13 at Old Dominion* W, 36-3 Alma Mater: Buffalo, ‘98 Alma Mater: North Carolina, ‘89 Alma Mater: Edinboro, ‘93 Overall Record: 121-99-1 UB Record: 24-43 N 20 Virginia Tech W, 23-19 Overall Record: 271-88-5 CU Record: 271-88-5 Overall Record: 20-21 EMU Record: 20-21 Ithaca, N.Y. Ypsilanti, Mich. D 3 UNI Open NTS, 3 Individual Titles Buffalo, N.Y. Alumni Arena Friedman Wrestling Center Convocation Center Thursday, Jan. 12 (6 pm) TrackWrestling.com Saturday, Jan. 14 (Noon) TrackWrestling.com Sunday, Jan. 15 (1 pm) TrackWrestling.com D 8 at Ohio State L, 30-9 ESPN3 TWITTER / INSTAGRAM: Ivy Digital Network TWITTER / INSTAGRAM: ESPN3 TWITTER / INSTAGRAM: D 11 at Ohio* W, 35-7 @MizzouWrestling @MizzouWrestling @MizzouWrestling D 20 Kent State* W, 34-4 SERIES SERIES SERIES D 20 Appalachian State W, 24-13 ALL-TIME .......................... 4-0 Mizzou ALL-TIME .......................... 6-3 Mizzou ALL-TIME .......................... 5-0 Mizzou J 1-2 Southern Scuffle 2nd, 1 Individual Title LAST MEETING ...................