Islands in Greece and Across the EU Pioneering the Energy Transition A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Current Organization and Administration Situation of the Secondary Education Units in the North Aegean Region

ISSN 2664-4002 (Print) & ISSN 2664-6714 (Online) South Asian Research Journal of Humanities and Social Sciences Abbreviated Key Title: South Asian Res J Human Soc Sci | Volume-1 | Issue-4| Dec -2019 | DOI: 10.36346/sarjhss.2019.v01i04.010 Original Research Article The Current Organization and Administration Situation of the Secondary Education Units in the North Aegean Region Dimitrios Ntalossis, George F. Zarotis* University of the Aegean, Faculty of Human Sciences, Rhodes, Greece *Corresponding Author Dr. George F. Zarotis Article History Received: 14.12.2019 Accepted: 24.12.2019 Published: 30.12.2019 Abstract: After analyzing various studies, we can conclude that the elements characterizing an effective school unit are leadership, teachers, and communication among school unit members, the climate of a school unit, school culture, the logistical infrastructure, the school's relationship with the local community, and the administrative system of the educational institution. The ultimate goal of this research is to detect the current organization and administration situation of secondary education units. In particular, to examine the concept of education, the school role and the concept of effective school, to identify the existing model of administration of the educational system, the organization and administration models of the school unit in which the respondents work, and furthermore the school culture level. The method adopted for the study is the classified cluster sampling method. According to this method, clusters are initially defined, which in this case are Secondary School Units. The clusters are then classified according to their characteristics, which in this case was the geographical feature: they all belonged to the North Aegean Region. -

Passenger Ship "Zefyros"

PASSENGER SHIP "ZEFYROS" PERIOD: 17/05/2021 - 26/09/2021 MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY SUNDAY TIME TIME TIME TIME TIME TIME TIME PORT PORT PORT PORT PORT PORT PORT ARR. DEP. ARR. DEP. ARR. DEP. ARR. DEP. ARR. DEP. ARR. DEP ARR. DEP. LIPSI 8:00 LIPSI* 6:15 LIPSI 8:00 LIPSI* 6:15 LIPSI 6:30 LIPSI 8:00 AG.MARINA LEROS 8:40 8:45 AG.MARINA LEROS 6:55 7:00 AG.MARINA LEROS 8:40 8:45 AG.MARINA LEROS 6:55 7:00 AG.MARINA LEROS 7:10 7:15 AG.MARINA LEROS 8:40 8:45 MYRTIES KALYMNOS 9:25 13:00 LIPSI 7:40 7:45 POTHIA KALYMNOS 10:05 10:10 LIPSI 7:40 7:45 POTHIA KALYMNOS 8:35 8:40 POTHIA KALYMNOS 10:05 10:10 AG.MARINA LEROS 13:50 13:55 PATMOS 8:25 8:30 PSERIMOS 10:35 10:40 PATMOS 8:25 8:30 MASTICHARI KOS 9:10 10:00 PSERIMOS 10:35 10:40 LIPSI 14:35 ARKI 9:10 9:15 MASTICHARI KOS 11:00 12:30 ARKI 9:10 9:15 PSERIMOS 10:20 10:25 MASTICHARI KOS 11:00 12:30 AGATHONISI 10:10 10:15 PSERIMOS 12:50 12:55 AGATHONISI 10:10 10:15 POTHIA KALYMNOS 10:50 11:30 PSERIMOS 12:50 12:55 PITHAGORIO SAMOS 11:20 13:30 POTHIA KALYMNOS 13:20 14:00 PITHAGORIO SAMOS 11:20 13:30 PSERIMOS 11:55 12:00 POTHIA KALYMNOS 13:20 14:00 AGATHONISI 14:35 14:40 AG.MARINA LEROS 15:20 15:25 AGATHONISI 14:35 14:40 MASTICHARI KOS 12:20 15:00 AG.MARINA LEROS 15:20 15:25 ARKI 15:35 15:40 LIPSI 16:05 ARKI 15:35 15:40 POTHIA KALYMNOS 15:30 15:35 LIPSI 16:05 PATMOS 16:20 16:25 PATMOS 16:20 16:25 AG.MARINA LEROS 16:55 17:00 LIPSI 17:05 17:10 LIPSI 17:05 17:10 LIPSI 17:40 AG.MARINA LEROS 17:50 17:55 AG.MARINA LEROS 17:50 17:55 LIPSI 18:35 LIPSI 18:35 EVERY TUESDAY OF THE 2nd AND 4th WEEK OF THE MONTH THE SHIP WILL APPROACH FARMAKONISI ISLAND PERIOD: 27/09/2021 - 31/10/2021 MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY SUNDAY TIME ΩΡΑ TOME TIME TIME TIME TIME PORT PORT PORT PORT PORT PORT PORT ARR. -

LESVOS LIMNOS AGIOS EFSTRATIOS CHIOS OINOUSSES PSARA SAMOS IKARIA FOURNOI 2 9 Verschiedene Welten

LESVOS LIMNOS AGIOS EFSTRATIOS CHIOS OINOUSSES PSARA SAMOS IKARIA FOURNOI 2 9 verschiedene Welten... Entdecken Sie sie!! REGIONALVERWALTUNG DER NORDÄGÄIS 1 Kountourioti Str., 81 100 Mytilini Tel.: 0030 22513 52100 Fax: 0030 22510 46652 www.pvaigaiou.gov.gr TOURISMUSBEHÖRDE Tel.: 0030 22510 47437 Fax: 0030 22510 47487 e-mail: [email protected] © REGIONALVERWALTUNG DER NORDÄGÄIS FOTOGRAFEN: Giorgos Depollas, Giorgos Detsis, Pantelis Thomaidis, Christos Kazolis, Giorgos Kakitsis, Andreas Karagiorgis, Giorgos Malakos, Christos Malahias, Viron Manikakis, Giorgos Misetzis, Klairi Moustafelou, Dimitris Pazaitis, Pantelis Pravlis, Giannis Saliaris, Kostas Stamatellis, Petros Tsakmakis, Giorgos Filios, Tolis Flioukas, Dimitris Fotiou, Tzeli Hatzidimitriou, Nikos Chatziiakovou 3 Inseln der Nordägäis Mehr als zweitausend kleine und große Inseln schmücken wie auf dem Meer schwimmende wertvolle Seerosen den Archipel Griechenlands. Im Nordostteil der Ägäis dominieren die Inseln: Limnos, Ai Stratis, Lesvos, Psara, Chios, Oinousses, Samos, Ikaria und Fournoi. Es sind besondere Inseln, auf denen die Geschichte eindringlich ihre Spuren hinterlassen hat, lebende Organismen eines vielseitigen kulturellen Wirkens, das sich in Volksfesten und Traditionen, darstellender und bildender Kunst, Produkten und Praktiken sowie in der Architektur des strukturierten Raumes ausdrückt. Die eigentümliche natürliche Umgebung und die wechselnden Landschaften heben die Inseln der Nordägäis hervor und führen den Besucher auf Entdeckungs- und Erholungspfade. Feuchtbiotope -

The Distribution of Obsidian in the Eastern Mediterranean As Indication of Early Seafaring Practices in the Area a Thesis B

The Distribution Of Obsidian In The Eastern Mediterranean As Indication Of Early Seafaring Practices In The Area A Thesis By Niki Chartzoulaki Maritime Archaeology Programme University of Southern Denmark MASTER OF ARTS November 2013 1 Στον Γιώργο 2 Acknowledgments This paper represents the official completion of a circle, I hope successfully, definitely constructively. The writing of a Master Thesis turned out that there is not an easy task at all. Right from the beginning with the effort to find the appropriate topic for your thesis until the completion stage and the time of delivery, you got to manage with multiple issues regarding the integrated presentation of your topic while all the time and until the last minute you are constantly wondering if you handled correctly and whether you should have done this or not to do it the other. So, I hope this Master this to fulfill the requirements of the topic as best as possible. I am grateful to my Supervisor Professor, Thijs Maarleveld who directed me and advised me during the writing of this Master Thesis. His help, his support and his invaluable insight throughout the entire process were valuable parameters for the completion of this paper. I would like to thank my Professor from the Aristotle University of Thessaloniki, Nikolaos Efstratiou who help me to find this topic and for his general help. Also the Professor of University of Crete, Katerina Kopaka, who she willingly provide me with all of her publications –and those that were not yet have been published- regarding her research in the island of Gavdos. -

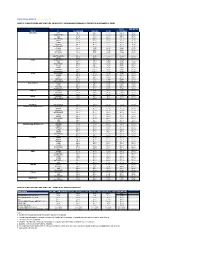

Fares for Passengers and Vehicles -High Speed Catamaran Dodekanisos Express & Dodekanisos Pride

DODEKANISOS SEAWAYS | Prices in euros (€) FARES FOR PASSENGERS AND VEHICLES -HIGH SPEED CATAMARAN DODEKANISOS EXPRESS & DODEKANISOS PRIDE MOTO PER METRE FROM TO PASSENGER VEHICLE MOTO 3/4 WHEELS RHODES SYMI 19,00 38,00 12,00 24,00 14,70 PANORMITIS 19,00 38,00 12,00 24,00 14,70 KOS 34,00 80,00 17,00 34,00 16,40 KALYMNOS 34,00 88,00 19,00 37,00 21,50 LEROS 42,00 90,00 19,00 39,00 31,10 LIPSI 47,00 90,00 19,00 45,00 31,10 PATMOS 49,00 90,00 20,00 45,00 34,30 AGATHONISI 49,00 90,00 20,00 45,00 31,10 CHALKI 18,00 42,50 11,80 23,60 14,70 TILOS 27,00 49,50 14,80 29,60 16,40 NISYROS 27,00 55,50 16,30 32,60 16,40 KASTELORIZO 39,00 50,50 10,10 20,20 20,00 SAMOS 59,00 95,00 20,00 45,00 31,10 SYMI PANORMITIS 10,00 19,00 5,90 11,80 KOS 26,00 42,00 16,30 32,60 14,70 KALYMNOS 29,00 47,00 14,80 29,60 16,00 LEROS 42,00 89,00 24,20 48,40 16,00 LIPSI 42,00 101,00 23,30 46,60 16,00 PATMOS 46,00 116,50 26,60 53,20 17,10 AGATHONISI 46,00 116,50 23,30 46,60 16,40 KOS KALYMNOS 16,00 59,00 11,80 23,60 15,00 LEROS 23,00 65,00 13,00 26,00 16,00 LIPSI 29,00 68,00 14,00 28,00 16,00 PATMOS 31,00 74,00 14,80 29,60 17,10 AGATHONISI 31,00 74,00 14,80 29,60 16,40 KALYMNOS LEROS 20,00 59,00 11,80 23,60 15,00 LIPSI 22,00 62,00 12,20 24,40 14,70 PATMOS 28,00 65,00 14,20 28,40 17,00 AGATHONISI 28,00 65,00 14,20 28,40 24,60 LEROS LIPSI 15,00 32,50 9,00 18,00 15,00 PATMOS 17,00 59,00 11,80 23,60 16,00 AGATHONISI 18,00 59,00 11,80 23,60 14,70 LIPSI PATMOS 13,50 29,00 9,00 18,00 12,00 AGATHONISI 13,50 29,00 9,00 18,00 11,10 PATMOS AGATHONISI 16,00 59,00 11,80 23,60 14,70 SAMOS (PYTHAGORIO) FOURNOI 20,00 50,00 12,00 25,00 0,00 IKARIA 25,00 60,00 12,00 30,00 22,00 PATMOS 30,00 60,00 15,00 30,00 25,00 AGATHONISI 16,00 50,00 12,00 25,00 20,00 LIPSI 32,00 70,00 15,00 35,00 25,00 LEROS 36,00 70,00 15,00 35,00 28,00 KALYMNOS 39,00 80,00 18,00 40,00 30,00 KOS 44,00 80,00 18,00 40,00 35,00 SYMI 49,00 95,00 20,00 45,00 35,00 IKARIA (AG. -

A Review of Desalination Potential in Greek Islands Using Renewable Energy Sources, a Life Cycle Assessment of Different Units

European Journal of Sustainable Development (2017), 6, 2, 19-32 ISSN: 2239-5938 Doi: 10.14207/ejsd.2017.v6n2p19 A Review of Desalination Potential in Greek Islands Using Renewable Energy Sources, a Life Cycle Assessment of Different Units By Karvounis Panagiotis* Abstract The scarcity of water is a long-standing problem in Greek islands. The government, as a temporary solution adopted the transportation of water using tanker ships. This type of water is of low quality non-potable and in some cases inappropriate for any use. Apart from that water transportation increases the carbon footprint of the islands that it is already stained due to the big thermal power plants that feed the grid using fossil fuels (mainly diesel). Apart from the environmental issues the economic consequences are extremely high. The cost of transported water in Dodecanese and Cyclades reached a total of 73,5 million € from 2002 to 2010. The aim of this paper is to bring forward the proposed solutions for desalination of sea water using renewable energy sources, as Greek islands have a great wind and solar potential that is hard to find in any other place on Europe. A Life Cycle Assessment is been conducted between two different desalination technologies (RES and Diesel operating desalination) to fully understand the impact these units have to the environment. Keywords: Desalination, Renewable energy, Greek islands, carbon footprint, reverse osmosis, LCA 1. Introduction Water scarcity is a timeless problem of Greek islands which lead to huge amounts of low quality and not potable water being transported to them with tanker ships. -

Gulet Charter Greece Itineraries Dodecanese Islands

GULET CHARTER GREECE ITINERARIES DODECANESE ISLANDS From Kos or Rhodes 1) FROM KOS : - SOUTH DODECANESE (KOS/RHODES/KOS) DAY 1: KOS DAY 2: KOS – NİSSIROS DAY 3: NISSIROS- TILOS DAY 4: TILOS - KALKI DAY 5: KALKI- RHODES DAY 6: RHODES/ SYMI DAY 7: SYMI/ DATCA / KOS DAY 8 : KOS => In red, the port where the customs formalities will be done in Turkey and in Greece DAY 1: KOS. Boarding at the port of Kos towards 15:00. Kos, was one of the most famous islands of the ancient world with the Asclepion medical center created by Hippocrates, considered the father of medicine. It is an island that has the most vibrant nightlife. If you do not want to stay at the port, anchorage in the bay. DAY 2: KOS-NISSIROS - Breakfast on board and navigates towards the beautiful Nisyros Island which is famous for its volcano with a crater still active which you can see up close. This is a very quiet island with white painted houses and surrounded by black wide beaches and with beautiful sea. You can visit to the monastery of Panagia Spiliani the small church built inside a large cave. Lunch, dinner and overnight stay onboard. DAY 3: NISSIROS - TILOS – After breakfast, navigate to Tilos island, a small gem in the Dodecanese. Famous for its beaches such as the Bay of Eristos. Large expanse of sand clumps of vegetation and beautiful clear water. Tholos is even more famous for its beach. And these waters are rich with its extraordinary clarity and color. The famous Red Beach, where an outcrop of rocks rubies offers unique and pleasing scenery. -

Quick Ferry Guide 2018 - Correct As at 17 April

Quick Ferry Guide 2018 - correct as at 17 April Times 4 September to 30 September 2018As always subject to alteration at short notice - always check with operators Rhodes NORTH Date restrictions dep Port Area Panormitis Arr Symi Arr Kos Arr Ferry Operator Comment Monday 08:30 Kolonna 09:20 10:55 Dodekanisos Express/Pride Dodekanisos Seaways Continues to Kalymnos, Leros, Lipsi and Patmos 09:00 Akandia 11:00 Symi Sea Dreams 09:30 Akandia 12:30 13:00 Panagia Skiadeni Dodekanisos Seaways Tuesday 09:00 Akandia 11:00 Symi Sea Dreams 09:30 Akandia 11:00 Panagia Skiadeni Dodekanisos Seaways Wednesday 08:30 Kolonna 09:20 10:55 Dodekanisos Express/Pride Dodekanisos Seaways Continues to Kalymnos, Leros, Lipsi and Agathonisi 09:00 Akandia 11:00 Symi Sea Dreams 09:30 Akandia 12:30 13:00 Panagia Skiadeni Dodekanisos Seaways Until 19 Sept 13:00 Kolonna 13:50 15:20 Dodekanisos Express/Pride Dodekanisos Seaways Continues to Leros, Patmos, and Samos. 18:00 Akandia 19:15 21:45 Blue Star Patmos Blue Star Continues to Kalymnos, Leros, Lipsi, Patmos & Piraeus Thursday 26 Sept only 08:30 Kolonna 09:25 10:55 Dodekanisos Express/Pride Dodekanisos Seaways Continues to Kalymnos, Leros, Lipsi, Patmos, Samos 09:00 Akandia 11:00 Symi Sea Dreams 09:30 Akandia 11:00 Panagia Skiadeni Dodekanisos Seaways Friday 08:30 Kolonna 09:20 10:55 Dodekanisos Express/Pride Dodekanisos Seaways Continues to Kalymnos, Leros, Lipsi & Patmos 09:00 Akandia 11:00 Symi Sea Dreams 09:30 Akandia 12:30 13:00 Panagia Skiadeni Dodekanisos Seaways 19:00 Akandia 20:30 01:50 Blue Star Patmos Blue -

Most Deadly Week of 2015 in the Aegean Sea, Alarm Phone Alerted to 100 Distress Cases Alarm Phone Weekly Report 26 October - 1 November 2015

Most deadly week of 2015 in the Aegean Sea, Alarm Phone alerted to 100 distress cases Alarm Phone Weekly Report 26 October - 1 November 2015 Between the 26th of October and the 1st of November, the Alarm Phone experienced the most emergency cases since its launch about one year ago. Within just 7 days we were alerted to a total of 100 cases of distress – all but one in the Aegean Sea – and were able to provide help and support to several thousands of travellers both on boats in distress at sea and to those who had stranded on several Greek islands. In doing so, we cooperated with and relied on the invaluable work of numerous volunteers, contact persons and support networks, who forwarded distress calls to us, provided us with information and helped us to follow-up on the many incidents. The sharp rise of alerts to the Alarm Phone also reflects the enormous increase of border crossings in the Aegean Sea, where more than 210.000 travellers have entered the European Union within the last month alone – about as many as in the entire year of 2014.1 Without any prospect of legal entry and with weather conditions becoming even worse in the weeks ahead, travellers in need of protection seek to use their last chances to enter Europe through dangerous and life-threatening sea crossings. As a fatal consequence, the past week was also the most deadly week of this year in the Aegean Sea, where since January more than 450 people lost their lives. Last week, in at least 7 fatal shipwrecks, more than 100 travellers drowned, including many children and infants, and many more are still missing.2 It was only due to the brave and self-sacrificing actions of Greek and Turkish fishermen and many lifesaving volunteers, who went to the sea to rescue women, children and men who went over-board, that hundreds of further deaths could be prevented.3 The Alarm Phone was alerted to and directly witnessed the dramatic shipwreck of a wooden boat with more than 300 travellers on board, which had capsized north of the Greek island of Lesvos on Wednesday the 28th of October. -

Votives from Cretan and Cypriot Sanctuaries: Regional Versus Island-Wide Influence George Papasavvas, Sabine Fourrier

Votives from Cretan and Cypriot sanctuaries: regional versus island-wide influence George Papasavvas, Sabine Fourrier To cite this version: George Papasavvas, Sabine Fourrier. Votives from Cretan and Cypriot sanctuaries: regional versus island-wide influence. Parallel lives: ancient island societies in Crete and Cyprus, Nov 2006, Nicosie, Cyprus. pp.289-305. hal-01453005 HAL Id: hal-01453005 https://hal.archives-ouvertes.fr/hal-01453005 Submitted on 2 Feb 2017 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. 16 Votives from Cretan and Cypriot sanctuaries: regional versus island-wide influence∗ George Papasavvas and Sabine Fourrier VOTIVES FROM CRETAN SANCTUARIES: these places did not experience any break between the REGIONAL VERSUS ISLAND-WIDE two eras, despite the disruption in the settlement patterns and the changes even in cult activities, indicate RADIANCE that this persistence was a deliberate act rather than a George Papasavvas simple perpetuation of Bronze Age cult sites.6 Visitors to the extra-urban sanctuaries, such as Symi Cult diversity is an important feature of Iron Age or the Idaean Cave began to be commemorated by Crete. Cretan sanctuaries show great variety in their names and ethnics by the Archaic and particularly in landscape settings, their votive assemblages and their the Hellenistic period.7 For the earlier periods, however, architectural forms, and many of them display unique the epigraphic record is elusive, if at all present. -

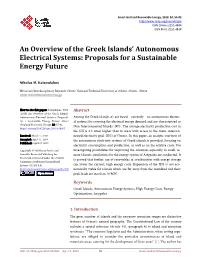

An Overview of the Greek Islands' Autonomous Electrical Systems

Smart Grid and Renewable Energy, 2019, 10, 55-82 http://www.scirp.org/journal/sgre ISSN Online: 2151-4844 ISSN Print: 2151-481X An Overview of the Greek Islands’ Autonomous Electrical Systems: Proposals for a Sustainable Energy Future Nikolas M. Katsoulakos Metsovion Interdisciplinary Research Center, National Technical University of Athens, Athens, Greece How to cite this paper: Katsoulakos, N.M. Abstract (2019) An Overview of the Greek Islands’ Autonomous Electrical Systems: Proposals Among the Greek islands, 61 are based—currently—on autonomous electric- for a Sustainable Energy Future. Smart al systems for covering the electrical energy demand and are characterized as Grid and Renewable Energy, 10, 55-82. Non-Interconnected Islands (NII). The average electricity production cost in https://doi.org/10.4236/sgre.2019.104005 the NII is 2.5 times higher than in areas with access to the main, intercon- Received: March 7, 2019 nected electricity grid (IEG) of Greece. In this paper, an analytic overview of Accepted: April 14, 2019 the autonomous electricity systems of Greek islands is provided, focusing on Published: April 17, 2019 electricity consumption and production, as well as on the relative costs. For Copyright © 2019 by author(s) and investigating possibilities for improving the situation, especially in small, re- Scientific Research Publishing Inc. mote islands, simulations for the energy system of Astypalea are conducted. It This work is licensed under the Creative is proved that further use of renewables in combination with energy storage Commons Attribution International License (CC BY 4.0). can lower the current, high energy costs. Expansion of the IEG is not eco- http://creativecommons.org/licenses/by/4.0/ nomically viable for islands which are far away from the mainland and their Open Access peak loads are less than 10 ΜW. -

Obesity in Mediterranean Islands

Obesity in Mediterranean Islands Supervisor: Triantafyllos Pliakas Candidate number: 108693 Word count: 9700 Project length: Standard Submitted in part fulfilment of the requirements for the degree of MSc in Public Health (Health Promotion) September 2015 i CONTENTS 1 INTRODUCTION ........................................................................................................... 1 1.1 Background on Obesity ........................................................................................... 1 1.2 Negative Impact of Obesity ..................................................................................... 1 1.2.1 The Physical and Psychological ....................................................................... 1 1.2.2 Economic Burden ............................................................................................ 2 1.3 Obesity in Mediterranean Islands ............................................................................ 2 1.3.1 Obesity in Europe and the Mediterranean region ............................................. 2 1.3.2 Obesogenic Islands ......................................................................................... 3 1.4 Rationale ................................................................................................................ 3 2 AIMS AND OBJECTIVES .............................................................................................. 4 3 METHODS ....................................................................................................................