Question/Answer Forum: Import 101 About the Speakers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Texas U.S. Ports of Entry

Texas U.S. Ports of Entry www.BusinessInTexas.com TEXAS PORTS OF ENTRY Overview U.S. Ports of Entry Ports of Entry are officially designated areas at U.S. For current or further information on U.S. and Texas land borders, seaports, and airports which are ports, check the CBP website at approved by U.S. Customs and Border Protection www.cbp.gov/border-security/ports-entry or contact (CBP). There are 328 official ports of entry in the the CBP at: U.S. and 13 preclearance offices in Canada and the Caribbean. 1300 Pennsylvania Avenue, N.W. Washington, D.C. 20229 Port personnel are the face at the border for most Inquiries (877) 227-5511 cargo and visitors entering the United States. At International Callers (202)325-8000 Ports, CBP officers or Port employees accept entries of merchandise, clear passengers, collect duties, Texas Ports of Entry enforce the import and export laws and regulations of the U.S. federal government, and conduct Texas currently has 29 official U.S. ports of entry, immigration policy and programs. Ports also perform more than any other state, according to the CBP agriculture inspections to protect the nation from website. The map below provides details. potential carriers of animal and plant pests or diseases that could cause serious damage to the Information on the Texas ports of entry follows, in nation's crops, livestock, pets, and the environment. alphabetical order, in the next section. U.S. Ports of Entry In Texas 1 TEXAS PORTS OF ENTRY Texas Ports of Entry P ort of Entry: Addison Airport Port Information Port Code: 5584 Port Type: User Fee Airport Location Address: 4300 Westgrove Addison, TX 75001 General Phone: (469) 737-6913 General Fax: (469) 737-5246 Operational Hours: 8:30 AM-5:00 PM (Central) Weekdays (Monday-Friday) Brokers: View List Directions to Port Office DFW Airport: Take hwy 114 to Addison Airport Press Office Field Office Name: Houston Location Houston, TX Address: 2323 S. -

Port of Entry Helpsheet

JTCC International Student Port of Entry Help Sheet Upon arrival at the U.S. Port of Entry (POE), you will be interviewed by a Customs and Border Protection (CBP) agent. You must be able to satisfy the requirements of CBP to be admitted to the United States. Documents that you should be able to present will include, but may not be limited to, the following documents: ➢ A Form I-20, signed by the Designated School Official (DSO), from the school that you will attend. ➢ A valid F-1 visa containing the SEVIS ID and the name of the school that you will attend (unless your country is visa exempt). ➢ Financial documentation as evidence of ability to pay tuition and living expenses (same documentation as presented to JTCC and the consular officer). ➢ A passport that is valid for at least six months beyond your stay here. ➢ Proof of payment of the SEVIS I-901 Fee (This was covered in the I-20 Application). Please have all of these documents readily available for all family members in your group. Failure to have these documents with you may result in a secondary inspection which, if not satisfied, may result in your being denied entrance into the United States. Please understand that having an F-1 visa placed into your passport during your consular interview does not guarantee your entrance into the United States. Having a U.S. visa allows you to travel to a port of entry, airport or land border crossing, and request permission of the Department of Homeland Security (DHS), Customs and Border Protection (CBP) inspector to enter the United States. -

Central New York Inland Port Market Feasibility Study

FINAL REPORT CENTRAL NEW YORK INLAND PORT MARKET FEASIBILITY STUDY potenti PREPARED FOR: NEW YORK STATE DEPARTMENT OF TRANSPORTATION SUBMITTED BY: RSG CENTRAL NEW YORK INLAND PORT MARKET FEASIBILITY STUDY PREPARED FOR: NEW YORK STATE DEPARTMENT OF TRANSPORTATION CONTENTS 1.0 EXECUTIVE SUMMARY .................................................................................................................. 1 Purpose and Background ................................................................................................................ 1 Principal Findings ............................................................................................................................. 1 2.0 INTRODUCTION AND BACKGROUND .......................................................................................... 6 2.1 | Physical Requirements .................................................................................................................. 6 2.2 | Central New York Inland Port Proposals: History ......................................................................... 7 3.0 INFORMATION SOURCES .............................................................................................................. 8 4.0 TRANSPORTATION INFRASTRUCTURE AND OPERATIONS .................................................. 10 4.1 | Rail Service ................................................................................................................................. 10 4.2 | Highway ...................................................................................................................................... -

U.S. Customs and Border Protection Guide to Importing Into the U.S

1 Importing into the United States A Guide for Commercial Importers A Notice To Our Readers On March 1, 2003, U.S. Customs and Border Protection, or CBP, was born as an agency of the Department of Homeland Security, merging functions of the former Customs Service, Immigration and Naturalization Service, Border Patrol, and Animal and Plant Health Inspection Service. Many changes took place in preparation for this merger and many have occurred since in order to safeguard U.S. borders against high- risk cargo, contraband, and unsafe imports. We encourage you to visit our Website (www.cbp.gov) for the latest information on specific laws, regulations or procedures that may affect your import transactions. * * * * * * This edition of Importing Into the United States contains material pursuant to the Trade Act of 2002 and the Customs Modernization Act (Title VI of the North American Free Trade Agreement Implementation Act), commonly referred to as the Mod Act. The Customs Modernization Act (Title VI of the North American Free Trade Agreement Implementation Act [P.L. 103-182, 107 Stat. 2057]) became effective December 8, 1993. Its provisions have fundamentally altered the relationship between importers and CBP by shifting to the importer, the legal responsibility for declaring the value, classification, and rate of duty applicable to entered merchandise. A prominent feature of the Mod Act is a relationship between CBP and importers that is characterized by informed compliance. (See Section Three of this book, which starts on page 26, for details and definitions.) A key component of informed compliance is the shared responsibility between CBP and the import community, wherein CBP communicates its requirements to the importer, and the importer, in turn, uses reasonable care to assure that CBP is provided with accurate and timely data pertaining to his or her importations. -

Deferred Inspection Instructions

CBP Deferred Inspection- Boston Logan Airport Correcting an I-94 Record, I-94 Card or Passport Admission Stamp What is an electronic arrival record/I-94? U.S. Customs and Border Protection inspects all foreign national students, scholars, dependents and visitors to the U.S. arriving at an air, land or sea border and grants admission to the U.S. in an appropriate immigration classification status (including F-1, J-1, etc). Admission to the U.S. in a specific immigration status is documented via an entry stamp in the passport as well as an electronic or paper I-94 arrival record. Electronic I-94 records can be downloaded and printed at: http://i94.cbp.dhs.gov/I94. Occasionally when entering the U.S., errors may occur on the passport stamp notation, electronic I-94 record, or paper I-94 card. These errors must be corrected to ensure that the status of the student, scholar, dependent or visitor is documented properly and that immigration benefits (such as permission to study or work) are correctly applied. How can I correct my I-94 record? There are two ways to correct an I-94 card/record or a passport stamp notation. If you need immediate assistance or if the error was made on your paper I-94 card or passport stamp, then you must go in person to the Deferred Inspection Office. However, if your passport notation is correct and the error was made to your electronic I-94 record, then you may be able to resolve this matter by e-mail. -

Designated Ports-Of-Departure (Pod) Alphabetical List

DESIGNATED PORTS-OF-DEPARTURE (POD) ALPHABETICAL LIST A I Alcan, Port of Entry Derby Line Port of Entry International Falls Port of Entry Tok, AK Derby Line, VT International Falls, MN Amistad Dam Detroit Canada Int. Bridge, J Del Rio, TX Port of Entry, Detroit, MI Anchorage Int. Airport Detroit Canada Tunnel, Port JFK International Airport, New Anchorage, AK of Entry, Detroit, MI York City - Jamaica, NY Atlanta-Hartsfield Int. Airport Detroit Metro Int. Airport, K Atlanta, GA Detroit, MI B Douglas Port of Entry Ketchikan Seaport-Port of Douglas, AZ Entry, Ketchikan, AK Baltimore Int. Airport E Kona Air and Sea Ports Baltimore, MD Kailua Kona, HI Bell Harbor Pier 66 Cruise Ship Eagle Pass Bridge L Terminal Seattle, WA Eagle Pass, TX Bridge of the Americas Eastport Port of Entry Laredo Gateway to the El Paso, TX Eastport, ID Americas - Laredo, TX Brownsville/Matamoras Int. Bridge F Las Vegas (McCarran) Int. Brownsville, TX Airport, Las Vegas, NV Buffalo Peace Bridge Fort Covington Port of Entry Lewiston Bridge, Niagara Falls, Buffalo, NY Fort Covington, NY New York Lewiston, NY C Fort Duncan Int. Bridge Logan International Airport Eagle Pass, TX East Boston, MA Calais Port of Entry G Long Beach Seaport Calais, ME Long Beach, CA Calexico Port of Entry Galveston Seaport Los Angeles Int. Airport Calexico, CA Galveston, TX Los Angeles, CA Cape Canaveral Seaport Grand Potage - Port of Entry M Port Canaveral, FL Grand Potage, MN Cape Vincent - Hornes Ferry Dock Guam Int. Airport Madawaska Port of Entry, Cape Vincent, NY Tamuning, Guam Madawaska, ME Champlain Port Of Entry H Massena (Seaway International Champlain, NY Bridge) - Massena, NY Charlotte/Douglas Int. -

Port of Alaska

2019 Proposed Utility/Enterprise Activities Budgets Port of Alaska Mayor Municipal Manager Port Director Finance & Operations & Marketing & Port Engineering Administration Maintenance External Affairs PORT - 1 2019 Proposed Utility/Enterprise Activities Budgets Port of Alaska Organizational Overview The Port of Alaska is an enterprise function of the Municipality. The Port Director oversees all Port operations, which include: maintenance, safety functions, management of vessel scheduling, movements and dockside activities, general upkeep and operation of the facilities, infrastructure, equipment, and security. This also includes the upkeep and day-to-day management of all municipally-owned infrastructure, roads, and docks. The Maintenance Section is also responsible for the dredging and upkeep of the Ship Creek Boat Launch and Dry Barge Berth. Further, the Port’s Operations Manager also serves in the role of Facility Security Officer, wherein he oversees the contract for Port security forces. Additionally, the Port’s Safety Coordinator is in this section. The Deputy Port Director not only acts for the Director in his absence, but is now responsible for overseeing the Port’s Capital Improvement Program (CIP), to include managing the Port’s engineering services contract, and execution of all FEMA port security grant program funds. While managing these programs, the Deputy Port Director will coordinate, as necessary, with the Port Engineer. The Port Engineer has overall responsibility to serve as the contract technical representative for all matters related to the ongoing Port modernization project. Under the Finance & Administration Section, responsibilities include performing the day-to-day business functions that support to the Port Director and other Port staff. Functions carried out by the staff of this section include: telephone switchboard/receptionist duties, accounts payable and receivable, financial management, and analysis of reports and budgets. -

Profiles of Top U.S. Agricultural Ports

Agricultural Marketing le, WA tt Service a Profiles of Top U.S. e S Tacom September 2013 a , W A Agricultural Ports a, WA m York, N la ew Y a anco N K V uv e r , W A e ilad lph h ia P , P P R A o O O rtland, ak land, CA ston, ou TX H A , V ve No olk al sto rf G n L , o A s C T , X Angeles A S G a , va ah L nn o A n C g h, Beac J a L c F C , k le o so il nv L r X p T F u i, , s t s C is B X hr e e T P a , o d u nt r la mo t Everg N e LA w , M Orleans L iami, F he agricultural community uses the ocean Top 20 U.S. Ports Moving Waterborne Agricultural Trade, 2011 transportation network extensively to serve its global customers. In calendar year 2011, 80 percent Imports Exports Total T Rank U.S. Ports State Share of U.S. agricultural exports (146.5 million metric tons), Metric Tons and 78 percent of imports (40.7 million metric tons) were waterborne (Census Bureau, U.S. Department of 1 New Orleans Port Region* LA 1,905,984 59,716,467 61,622,450 33% Commerce, and PIERS). The following Agricultural Port 2 Los Angeles CA 2,725,490 7,666,611 10,392,101 6% Profiles provide a view of the top 20 U.S. -

Final Rule; Technical and Land Transportation Are Listed in 8 Amendment

75631 Rules and Regulations Federal Register Vol. 80, No. 232 Thursday, December 3, 2015 This section of the FEDERAL REGISTER Department of Homeland Security facility, CBP will provide a variety of contains regulatory documents having general where CBP officers or employees are inspection services, including applicability and legal effect, most of which assigned to accept entries of immigration services. are keyed to and codified in the Code of merchandise, clear passengers, collect The CBX facility was designed in Federal Regulations, which is published under duties, and enforce the various accordance with U.S. and international 50 titles pursuant to 44 U.S.C. 1510. provisions of the customs and security standards. It includes an The Code of Federal Regulations is sold by immigration laws, as well as other laws enclosed pedestrian walkway the Superintendent of Documents. Prices of applicable at the border. The term ‘‘port connecting the Tijuana Airport in new books are listed in the first FEDERAL of entry’’ is used in the Code of Federal Mexico to San Diego, California and a REGISTER issue of each week. Regulations (CFR) in title 19 for customs passenger terminal located in San Diego purposes and in title 8 for immigration that will be used exclusively to process purposes. Subject to certain exceptions, ticketed Tijuana Airport passengers DEPARTMENT OF HOMELAND all individuals entering the United traveling to and from the United States SECURITY States must present themselves to an via the walkway. The pedestrian immigration officer for inspection at a walkway will be accessible only for U.S. Customs and Border Protection U.S. -

What to Do If You Are Detained at a Port of Entry

New England Chapter Know Your Rights: What to Do if You are Detained at a Port of Entry (F & J visa holders) All people arriving at the U.S. border or a port of entry • You likely do not have a right of privacy to protect have basic rights, but non-immigrant visa holders, such your electronic devices. CBP may search your device, as F1 and J1, have very little legal recourse. Like all access your email and screen your social media international travelers, F1 /J1’s are subject to inspection activity during the inspection process. Your devices by U.S. Customs and Border Protection (CBP) when may be held and returned to you later if you refuse to arriving at an port of entry such as an airport or land share passwords. border. CBP will screen you to determine whether you are “admissible.” They will want to match all • Not to be questioned about your religious or political information you previously provided with the answers beliefs. Ask for a supervisor if this happens. You can file a you give upon inspection. complaint later so get the officers’ names. If questions arise and CBP is unable to admit you • Iranians should be aware that questions can be and will quickly, you may be taken to a separate area for be asked regarding your and your family’s bank accounts, “secondary inspection.” A referral by itself is not assets, companies and property because Iran is subject adverse, but you can expect to be detained anywhere to sanctions by the United States. -

Claiming Asylum in the United States: Entering at a Port of Entry

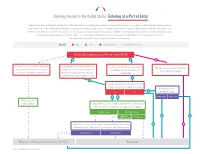

Claiming Asylum in the United States: Entering at a Port of Entry Immigration law allows individuals to apply for asylum in the United States who are fleeing their country and seeking protection based on “persecution or a well-founded fear of persecution on account of their race, religion, nationality, membership in a particular social group, or political opinion.” Individuals can present themselves for asylum at ports of entry before U.S. Customs and Border Protection (CBP) officers. As these charts show, U.S. officials also have significant discretionary powers over what to do with individuals who are inadmissible to the United States, which can impact when and how individuals make their credible fear claim as they enter different processes for removal from the United States based on these official decisions. This chart provides a general overview of the process. Individual cases may vary. BOX KEY: CBP USCIS Immigration Courts Additional ICE Involvement Individual appears at a Port of Entry (PoE) 1 2 3 Person has a visa or is otherwise determined If not admissible due to misrepresentation or For other cases, CBP officer refers individual CBP officer allows individual to withdraw to have legal authorization to enter the U.S. insufficient docs, CBP officer can place the to immigration court for determination without immigration penalty and chooses not to make an asylum claim individual in expedited removal and they are of admissibility deported without seeing an immigration judge 2 1 Does the individual, when interviewed by CBP, express -

CBP) Responsible for Carrying out CBP’S Complex and Demanding Border Security Mission at All Ports of Entry (POE

Resource Optimization at the Ports of Entry June 7, 2016 Fiscal Year 2016 Report to Congress U.S. Customs and Border Protection Executive Summary The Office of Field Operations (OFO) is the law enforcement component within U.S. Customs and Border Protection (CBP) responsible for carrying out CBP’s complex and demanding border security mission at all ports of entry (POE). OFO manages the lawful access of people and goods to our Nation by securing and expediting international trade and travel. Continued growth in international trade and travel, expanding mission requirements, and new facility demands continue to strain CBP resources and its efforts to secure the homeland. This report outlines CBP’s progress on the implementation of its resource optimization strategy (ROS), which is CBP’s robust, integrated, long-term strategy for improving POE operations. The ROS has three components: optimize current business processes; utilize the Workload Staffing Model (WSM) to identify staffing requirements; and implement alternative funding strategies to improve the adequacy of user fees to support operations more effectively. Within this report, CBP provides updates on its business transformation initiatives (BTI), the BTIs’ impact on staffing requirements, the updated WSM staffing projections, and CBP’s ongoing efforts to implement funding strategies that complement the Fiscal Year (FY) 2014 appropriation of an additional 2,000 CBP officers (CBPO). While business process improvements and increasing the number of CBP officers (CBPO) have been successful, the updated WSM results continue to show a need for additional capability in order to fully meet the standards set by statute, regulation, and CBP policies, assuming maintenance of current processes, procedures, technology, and facilities and anticipated growth in travel and trade volumes.