Annual Report April 30, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Altegris /AACA Opportunistic Real Estate Fund

Altegris /AACA Opportunistic Real Estate Fund PORTFOLIO OF INVESTMENTS (Unaudited) September 30, 2020 Shares Value COMMON STOCK - 36.1 % ASSET MANAGEMENT - 0.4 % 32,801 Brookfield Infrastructure Corp. $ 1,816,854 ELECTRIC UTILITIES - 0.9 % 77,975 Brookfield Renewable Corporation 4,569,320 LEISURE TIME - 12.5 % 484,238 Caesars Entertainment, Inc. * 27,146,382 3,344,000 Drive Shack, Inc. * 3,745,280 98,756 Las Vegas Sands Corp. 4,607,955 1,054,511 MGM Resorts International 22,935,614 60,393 Wynn Resorts Ltd. 4,336,821 62,772,052 REAL ESTATE - 3.0 % 890,864 IQHQ *^(a)(b) 14,887,852 TECHNOLOGY SERVICES - 5.1 % 30,069 CoStar Group, Inc. * 25,513,847 TELECOMMUNICATIONS - 14.2 % 449,324 GDS Holdings Ltd. - ADR *+ 36,768,183 2,215,783 Switch, Inc. 34,588,373 71,356,556 TOTAL COMMON STOCK (Cost - $144,134,832) 180,916,481 PARTNERSHIP SHARES -13.9 % ELECTRIC UTILITIES - 5.7 % 250,509 Brookfield Infrastructure Partners LP 11,929,239 311,899 Brookfield Renewable Partners LP 16,390,292 28,319,531 SPECIALTY FINANCE - 8.2 % 2,399,241 Fortress Transportation & Infrastructure Investors LLC 41,098,998 TOTAL PARTNERSHIP SHARES (Cost - $47,859,371) 69,418,529 REITS - 62.6 % REITS - 62.1 % 181,610 Alexandria Real Estate Equities, Inc. + 29,057,600 144,893 American Tower Corp. + 35,024,985 240,140 Americold Realty Trust 8,585,005 217,330 Crown Castle International Corp. + 36,185,445 232,737 CyrusOne, Inc. 16,298,572 25,447 Equinix, Inc. 19,343,028 234,215 Equity Lifestyle Properties, Inc. -

Top Investors Dallas Regional Chamber

DALLAS REGIONAL CHAMBER | TOP INVESTORS DALLAS REGIONAL CHAMBER REGIONAL DALLAS JBJ Management Norton Rose Fulbright Silicon Valley Bank The Fairmont Hotel Top Investors JE Dunn Construction NTT DATA Inc. Simmons Bank The Kroger Co. Jim Ross Law Group PC Omni Dallas Hotel Slalom The University of The Dallas Regional Chamber (DRC) recognizes the following companies and organizations for their membership investment at JLL Omniplan, Inc. Smoothie King Texas at Arlington one of our top levels. Companies in bold print are represented on the DRC Board of Directors. For more information about the Jones Day Omnitracs, LLC SMU - Southern Methodist Thompson & Knight LLP University benefits of membership at these levels call (214) 746-6600. JPMorgan Chase & Co. Oncor Thompson Coburn Southern Dock Products Katten Muchin Rosenman LLP On-Target Supplies Thomson Reuters Southern Glazer’s Wine and KDC Real Estate Development & & Logistics Ltd TIAA Spirits 1820 Productions Bell Nunnally Crowe LLP Google Investments Options Clearing Corporation T-Mobile | Southwest Airlines 4Front Engineered Solutions BGSF CSRS goPuff TOP INVESTORS Ketchum Public Relations Origin Bank Tom Thumb - Albertsons 7-Eleven, Inc. Billingsley Company CyrusOne Granite Properties Southwest Office Systems, Inc. Kilpatrick Townsend ORIX Corporation USA Town of Addison A G Hill Partners LLC BKD LLP Dallas Baptist University Grant Thornton LLP & Stockton LLP Spacee Inc. OYO Hotels and Homes Toyota Motor North America ABC Home & Commercial bkm Total Office of Texas Dallas College Green Brick Partners Kimberly-Clark Corporation Spectra Pacific Builders Transworld Business Advisors - Services Kimley-Horn and Associates Spencer Fane LLP Blackmon Mooring & BMS CAT Dallas Cowboys Football Club Greenberg Traurig Pape-Dawson Downtown Dallas Accenture Ltd. -

Schedule 14A

Use these links to rapidly review the document Table of Contents Table of Contents Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material under §240.14a-12 CyrusOne Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

US Vegan Climate

US Vegan Climate ETF Schedule of Investments April 30, 2021 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.4% Administrative and Support and Waste Management and Remediation Services - 13.4% 1,675 Accenture plc - Class A $ 485,700 233 Allegion plc 31,311 107 Booking Holdings, Inc. (a) 263,870 293 Broadridge Financial Solutions, Inc. 46,479 317 Equifax, Inc. 72,666 352 Expedia Group, Inc. 62,033 70 Fair Isaac Corporation (a) 36,499 729 Fidelity National Financial, Inc. 33,257 214 FleetCor Technologies, Inc. (a) 61,572 782 Global Payments, Inc. 167,841 961 IHS Markit, Ltd. 103,384 5,607 Mastercard, Inc. - Class A 2,142,210 425 Moody's Corporation 138,852 212 MSCI, Inc. 102,983 3,091 PayPal Holdings, Inc. (a) 810,738 491 TransUnion 51,354 8,745 Visa, Inc. - Class A 2,042,482 6,653,231 Construction - 0.9% 890 DR Horton, Inc. 87,478 1,956 Johnson Controls International plc 121,937 705 Lennar Corporation - Class A 73,038 19 NVR, Inc. (a) 95,344 682 PulteGroup, Inc. 40,320 396 Sunrun, Inc. (a) 19,404 437,521 Finance and Insurance - 14.1% 1,735 Aflac, Inc. 93,222 40 Alleghany Corporation (a) 27,159 797 Allstate Corporation 101,060 969 Ally Financial, Inc. 49,855 1,588 American Express Company 243,520 2,276 American International Group, Inc. 110,272 314 Ameriprise Financial, Inc. 81,138 657 Anthem, Inc. 249,259 596 Aon plc - Class A 149,858 1,025 Arch Capital Group, Ltd. (a) 40,703 496 Arthur J. -

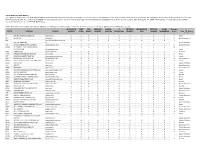

Ticker Company Domain Application Security Cubit

Cyber Security Risk Rating The Egan-Jones Cyber Security Risk Ratings helps stakeholders assess the security posture (health) of covered entities. EJPS analysts use the SecuritiesScorecard platform to ascertain the company’s Score, which is incorporated into the EJPS Proxy Research Report. The methodology utilized for determining the Score can be found at http://ejproxy.com/media/documents/Egan-Jones_Proxy_Services_Cyber_Risk_Rating.pdf. For additional questions or comments, please contact [email protected] or +1-844-495-5244 x1102. Please be aware scores posted here may be delayed. For subscription questions about the direct live feed or the full SSC report please contact [email protected]. APPLICATION CUBIT DNS ENDPOINT HACKER IP NETWORK INFORMATION PATCHING SOCIAL Minimum TICKER COMPANY DOMAIN SECURITY SCORE HEALTH SECURITY CHATTER REPUTATION SECURITY LEAK CADENCE ENGINEERING Grade Final_EJP_Rating A AGILENT TECHNOLOGIES, INC. agilent.com B A B A A A B A A A B Good AA ALCOA INC. alcoa.com D A D B A B A A A A D Some Concerns AAC americanaddictioncenters.o F B D A A A A A B A F AAC HOLDINGS INC rg Needs Attention AAL ANGLO AMERICAN PLC, LONDON angloamerican.com C A D A A A A A A A D Some Concerns AAMC ALTISOURCE ASSET MANAGEMENT B A A A A A A A A A B CORPORATION altisourceamc.com Good AAN AARON'S INC. aaronrents.com A A A A A A A A A A A Superior AAOI APPLIED OPTOELECTRONICS INC. ao-inc.com B A B A A A B A A A B Good AAT AMERICAN ASSETS TRUST INC americanassetstrust.com B A A A A A A A A A B Good AAV ADVANTAGE OIL & GAS LTD. -

Federated Equity Income Fund, Inc

Federated Equity Income Fund, Inc. PORTFOLIO AS OF MARCH 29, 2019 CURRENT NET ASSETS - $941,525,223 Principal Amount or Shares Value COMMON STOCKS - 95.0% Communication Services - 7.0% 587,961 AT&T, Inc. $18,438,457 473,872 Comcast Corp., Class A 18,945,403 232,549 Lions Gate Entertainment Corp. 3,511,490 182,607 News Corp., Inc. 2,271,631 58,721 Nippon Telegraph & Telephone Corp. 2,495,959 86,742 Sinclair Broadcast Group, Inc. 3,337,832 349,587 Telekom Austria AG 2,542,477 248,981 Verizon Communications, Inc. 14,722,246 TOTAL 66,265,495 Consumer Discretionary - 6.2% 52,335 Carnival Corp. 2,654,431 21,953 Columbia Sportswear Co. 2,287,064 129,434 D. R. Horton, Inc. 5,355,979 110,648 DSW, Inc., Class A 2,458,599 168,704 eBay, Inc. 6,265,667 39,507 Foot Locker, Inc. 2,394,124 11,912 Home Depot, Inc. 2,285,794 164,100 Isuzu Motors Ltd. 2,164,900 55,274 McDonald's Corp. 10,496,533 24,646 Royal Caribbean Cruises Ltd. 2,824,924 98,800 Suzuki Motor Corp. 4,381,858 51,906 TJX Cos., Inc. 2,761,918 65,041 Tapestry, Inc. 2,113,182 38,319 Toyota Motor Credit Corp., ADR 4,522,408 30,590 Tractor Supply Co. 2,990,478 19,878 Yum! Brands, Inc. 1,984,023 TOTAL 57,941,882 Consumer Staples - 6.6% 110,660 British American Tobacco PLC 4,616,801 200,389 Coty, Inc. - CL A 2,304,473 29,168 Kimberly-Clark Corp. -

2019 Annual Report

2019 Annual Report www.cyrusone.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ☒ ACT OF 1934 For the fiscal year ended December 31, 2019 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ☐ EXCHANGE ACT OF 1934 For the transition period ___________ to ____________ Commission File Number: 001-35789 CyrusOne Inc. (Exact name of registrant as specified in its charter) Maryland 46-0691837 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2850 N. Harwood Street, Suite 2200, Dallas, TX 75201 (Address of Principal Executive Offices) (Zip Code) (972) 350-0060 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, $.01 par value CONE NASDAQ Securities registered pursuant to Section 12 (g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2018 Annual Report

CYR_2018AnnualReportCover_2018.pdf 1 3/4/19 10:20 AM 2018 ANNUAL REPORT CyrusOne.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period ___________ to ____________ Commission File Number: 001-35789 CyrusOne Inc. (Exact name of registrant as specified in its charter) Maryland 46-0691837 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2101 Cedar Springs Road, Suite 900, Dallas, TX 75201 (Address of Principal Executive Offices) (Zip Code) (972) 350-0060 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $.01 par value NASDAQ Securities registered pursuant to Section 12 (g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Fund Holdings As of 06/30/2021 MM S&P® Mid Cap Index Fund Northern Trust

Fund Holdings As of 06/30/2021 MM S&P® Mid Cap Index Fund Northern Trust Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting (%) Amount Value ($) Future on S&P MidCap 400 PR Sep21 0 0 1.00 1,800 4,846,320 Bio-Techne Corp TECH 09073M104 0.73 7,864 3,540,845 Cognex Corp CGNX 192422103 0.62 35,763 3,005,880 Molina Healthcare Inc MOH 60855R100 0.62 11,826 2,992,688 Fair Isaac Corp FICO 303250104 0.60 5,814 2,922,582 SolarEdge Technologies Inc SEDG 83417M104 0.60 10,527 2,909,347 XPO Logistics Inc XPO 983793100 0.59 20,563 2,876,558 Signature Bank SBNY 82669G104 0.59 11,650 2,861,822 Camden Property Trust CPT 133131102 0.54 19,774 2,623,417 Fixed Inc Clearing Corp.Repo 0 0 0.54 2,616,203 2,616,203 Graco Inc GGG 384109104 0.54 34,316 2,597,721 FactSet Research Systems Inc FDS 303075105 0.53 7,646 2,566,074 Ceridian HCM Holding Inc CDAY 15677J108 0.53 26,540 2,545,717 Brown & Brown Inc BRO 115236101 0.52 47,253 2,511,024 Masimo Corp MASI 574795100 0.51 10,220 2,477,839 Williams-Sonoma Inc WSM 969904101 0.51 15,399 2,458,450 Lennox International Inc LII 526107107 0.50 6,960 2,441,568 Steel Dynamics Inc STLD 858119100 0.50 40,629 2,421,488 Nordson Corp NDSN 655663102 0.50 10,916 2,396,171 Medical Properties Trust Inc MPW 58463J304 0.49 118,811 2,388,101 Trex Co Inc TREX 89531P105 0.49 23,300 2,381,493 The Toro Co TTC 891092108 0.49 21,624 2,376,045 RPM International Inc RPM 749685103 0.48 26,159 2,319,780 RH RH 74967X103 0.48 3,404 2,311,316 Axon Enterprise Inc AXON 05464C101 0.48 13,061 2,309,185 Cree Inc CREE 225447101 0.47