Scheme Information Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

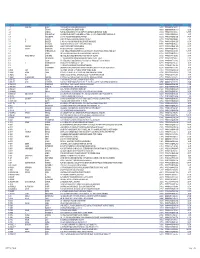

State City Hospital Name Address Pin Code Phone K.M

STATE CITY HOSPITAL NAME ADDRESS PIN CODE PHONE K.M. Memorial Hospital And Research Center, Bye Pass Jharkhand Bokaro NEPHROPLUS DIALYSIS CENTER - BOKARO 827013 9234342627 Road, Bokaro, National Highway23, Chas D.No.29-14-45, Sri Guru Residency, Prakasam Road, Andhra Pradesh Achanta AMARAVATI EYE HOSPITAL 520002 0866-2437111 Suryaraopet, Pushpa Hotel Centre, Vijayawada Telangana Adilabad SRI SAI MATERNITY & GENERAL HOSPITAL Near Railway Gate, Gunj Road, Bhoktapur 504002 08732-230777 Uttar Pradesh Agra AMIT JAGGI MEMORIAL HOSPITAL Sector-1, Vibhav Nagar 282001 0562-2330600 Uttar Pradesh Agra UPADHYAY HOSPITAL Shaheed Nagar Crossing 282001 0562-2230344 Uttar Pradesh Agra RAVI HOSPITAL No.1/55, Delhi Gate 282002 0562-2521511 Uttar Pradesh Agra PUSHPANJALI HOSPTIAL & RESEARCH CENTRE Pushpanjali Palace, Delhi Gate 282002 0562-2527566 Uttar Pradesh Agra VOHRA NURSING HOME #4, Laxman Nagar, Kheria Road 282001 0562-2303221 Ashoka Plaza, 1St & 2Nd Floor, Jawahar Nagar, Nh – 2, Uttar Pradesh Agra CENTRE FOR SIGHT (AGRA) 282002 011-26513723 Bypass Road, Near Omax Srk Mall Uttar Pradesh Agra IIMT HOSPITAL & RESEARCH CENTRE Ganesh Nagar Lawyers Colony, Bye Pass Road 282005 9927818000 Uttar Pradesh Agra JEEVAN JYOTHI HOSPITAL & RESEARCH CENTER Sector-1, Awas Vikas, Bodla 282007 0562-2275030 Uttar Pradesh Agra DR.KAMLESH TANDON HOSPITALS & TEST TUBE BABY CENTRE 4/48, Lajpat Kunj, Agra 282002 0562-2525369 Uttar Pradesh Agra JAVITRI DEVI MEMORIAL HOSPITAL 51/10-J /19, West Arjun Nagar 282001 0562-2400069 Pushpanjali Hospital, 2Nd Floor, Pushpanjali Palace, -

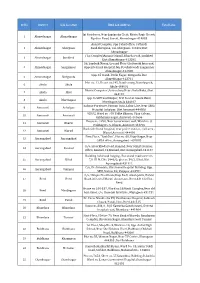

SR NO First Name Middle Name Last Name Address Pincode Folio

SR NO First Name Middle Name Last Name Address Pincode Folio Amount 1 A SPRAKASH REDDY 25 A D REGIMENT C/O 56 APO AMBALA CANTT 133001 0000IN30047642435822 22.50 2 A THYAGRAJ 19 JAYA CHEDANAGAR CHEMBUR MUMBAI 400089 0000000000VQA0017773 135.00 3 A SRINIVAS FLAT NO 305 BUILDING NO 30 VSNL STAFF QTRS OSHIWARA JOGESHWARI MUMBAI 400102 0000IN30047641828243 1,800.00 4 A PURUSHOTHAM C/O SREE KRISHNA MURTY & SON MEDICAL STORES 9 10 32 D S TEMPLE STREET WARANGAL AP 506002 0000IN30102220028476 90.00 5 A VASUNDHARA 29-19-70 II FLR DORNAKAL ROAD VIJAYAWADA 520002 0000000000VQA0034395 405.00 6 A H SRINIVAS H NO 2-220, NEAR S B H, MADHURANAGAR, KAKINADA, 533004 0000IN30226910944446 112.50 7 A R BASHEER D. NO. 10-24-1038 JUMMA MASJID ROAD, BUNDER MANGALORE 575001 0000000000VQA0032687 135.00 8 A NATARAJAN ANUGRAHA 9 SUBADRAL STREET TRIPLICANE CHENNAI 600005 0000000000VQA0042317 135.00 9 A GAYATHRI BHASKARAAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041978 135.00 10 A VATSALA BHASKARAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041977 135.00 11 A DHEENADAYALAN 14 AND 15 BALASUBRAMANI STREET GAJAVINAYAGA CITY, VENKATAPURAM CHENNAI, TAMILNADU 600053 0000IN30154914678295 1,350.00 12 A AYINAN NO 34 JEEVANANDAM STREET VINAYAKAPURAM AMBATTUR CHENNAI 600053 0000000000VQA0042517 135.00 13 A RAJASHANMUGA SUNDARAM NO 5 THELUNGU STREET ORATHANADU POST AND TK THANJAVUR 614625 0000IN30177414782892 180.00 14 A PALANICHAMY 1 / 28B ANNA COLONY KONAR CHATRAM MALLIYAMPATTU POST TRICHY 620102 0000IN30108022454737 112.50 15 A Vasanthi W/o G -

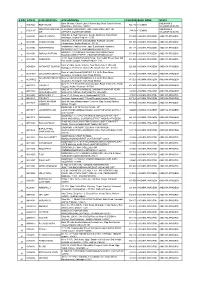

Details of Shares Transferred to IEPF in FY 2017-18

J. L. MORISION (INDIA) LIMITED LIST OF SHAREHOLDERS TRANSFERRED TO IEPF DURING F. Y. 2017-18 FOLIO_NO NAME ADDRESS SHARES Z000004 ZOHER HUSENI KHORAKIWALA "BENET VILLA, 3RD FLOOR, CO OPERAGE ROAD, MUMBAI, MAHARASHTRA - 400039" 700 A000356 ALKA JAIN "HILL CREST GROUND FLOOR, 31 F , PEDDER ROAD, , MUMBAI, MAHARASHTRA - 400076" 300 S000522 SOUTHERN INDIA DEPOSITORY SERVICES P LTD "CENTURY CENTRE, GROUND FLOOR, 39, TTK ROAD, ALWARPET, MADRAS, TAMIL NADU - 600018" 250 A000204 ABIDA Y VAZIRALLI "501 MAY FAIR, RANE ROAD, , MUMBAI, MAHARASHTRA - 400050" 200 S000484 SHRIKANT ANAND GUPTE "24 STEEL HOUSE G ROAD, 92 MARINE DRIVE, BOMBAY, , MAHARASHTRA - 400002" 175 V000008 VINOD BHALCHANDRA DIVEKAR "C/O DR. R P MANJREKAR, SURABHI 20, 1ST MAIN , 2ND STAGE, S/B, VIJAYNAGAR,, BANGALORE, KARNATAKA - 560040" 168 B000001 BHOLANATH ARORA "M/S BHOLANATH & BROTHER, 348 NAYA BANS, , DELHI, DELHI - 110006" 154 O000005 OM PRAKASH ARORA "M/S BHOLANATH & BROTHERS, NAYA BANS, , DELHI, DELHI - 110001" 154 U000002 UMESH CHANDRA CHOSH "6 KALIGHAT ROAD, , , KOLKATA, WEST BENGAL - 700025" 154 M000054 MANJULA GUPTA "C/O KOLKATA MEDICAL CENTRE, 12 LOUDON STREET, , KOLKATA, WEST BENGAL - 700017" 150 G000046 GIRDHARLAL MANIK "M/S C P MEDICAL STORES, SADAR BAZAR, , RAIPUR, RAJASTHAN - 306115" 144 A000145 ADARSH SINGH MAHAL "E 246 GREATER KAILASH PART 2, , , NEW DELHI, NEW DELHI - 110048" 140 A000100 ANIL MUKUND VIJAYAKAR "FLAT NO 8 PALM VIEW, SAROJINI ROAD SANTACRUZ WEST, , MUMBAI, MAHARASHTRA - 400054" 140 C000040 CHANDUBHAI PATEL "PATEL NIVAS, TIKARAPARA, , BILASPUR, HIMACHALPRADESH -

Indian Red Cross Society, D.K District Branch Life Members Details As on 02.10.2015

Indian Red Cross Society, D.K District Branch Life Members details as on 02.10.2015 Sri. J.R. Lobo, Sri. RTN. P.H.F William M.L.A, D'Souza, Globe Travels, Deputy Commissioner Jency, Near Ramakrishna 1 2 3 G06, Souza Arcade, Balmatta D.K District Tennis Court, 1st cross, Shiva Road, Mangalore-2 Bagh, Kadri, M’lore – 2 Ph: 9845080597 Ph: 9448375245 Sri. RTN. Nithin Shetty, Rtn. Sathish Pai B. Rtn. Ramdas Pai, 301, Diana APTS, S.C.S 4 5 Bharath Carriers, N.G Road 6 Pais Gen Agencies Port Road, Hospital Road, Balmatta, Attavar, Mangalore - 1 Bunder, Mangalore -1 Mangalore - 2 Sri. Vijaya Kumar K, Rtn. Ganesh Nayak, Rtn. S.M Nayak, "Srishti", Kadri Kaibattalu, Nayak & Pai Associates, C-3 Dukes Manor Apts., 7 8 9 D.No. 3-19-1691/14, Ward Ganesh Kripa Building, Matadakani Road, No. 3 (E), Kadri, Mangalore Carstreet, Mangalore 575001 Urva, Mangalore- 575006 9844042837 Rtn. Narasimha Prabhu RTN. Ashwin Nayak Sujir RTN. Padmanabha N. Sujir Vijaya Auto Stores "Varamahalaxmi" 10 "Sri Ganesh", Sturrock Road, 11 12 New Ganesh Mahal, 4-5-496, Karangalpady Cross Falnir, Mangalore - 575001 Alake, Mangalore -3 Road, Mangalore - 03 RTN. Rajendra Shenoy Rtn. Arun Shetty RTN. Rajesh Kini 4-6-615, Shivam Block, Excel Engineers, 21, Minar 13 14 "Annapoorna", Britto Lane, 15 Cellar, Saimahal APTS, Complex New Balmatta Road, Falnir, Mangalore - 575001 Karangalpady, Mangalore - 03 Mangalore - 1 Sri. N.G MOHAN Ravindranath K RTN. P.L Upadhya C/o. Beta Agencies & Project 803, Hat Hill Palms, Behind "Sithara", Behind K.M.C Private Ltd., 15-12-676, Mel Indian Airlines, Hat Hill Bejai, 16 17 18 Hospital, Attavar, Nivas Compound, Kadri, Mangalore – 575004 Mangalore - 575001 Mangalore – 02. -

Ahmednagar Ahmadnagar Jai Residency, Near Jagdamba Cloth

Sr.No District Lab Location Hind Lab Address Total Labs Jai Residency, Near Jagdamba Cloth, Bhiste Bagh Chowk, 1 Ahmednagar Ahmadnagar Pipeline Road, Savedi, Ahmadnagar-414003 Anand Complex, Opp Tehsil office, Pathardi 2 Ahmednagar Shevgaon Road,Shevgaon, Tal -Shevgaon- 414502 Dist Ahmadnagar (Taj Complex)Amanat Manzil, Kharda road, Jamkhed 3 Ahmednagar Jamkhed Dist Ahmadnagar-413201 56, Sandesh Niwas, Ground Floor Ghulewadi fata road, 4 Ahmednagar Sangamner Opposite Rural Hospital, Mu.PO Ghulewadi Sangamner Ahmednagar-422608 Opp. ST Stand, Devki Nagar, Shrigonda Dist 5 Ahmednagar Shrigonda Ahmednagar-413701 Plot no. 11, House no.195, Damle marg, Ramdaspeth, 6 Akola Akola Akola-444001 Bharat Computer ,Asra colony,Near Akola Naka, Akot 7 Akola Akot 444101 opp. to SDH murtizapur, first floor at canara Bank, 8 Akola Murtizapur Murtizapur,Akola 444107 Rahmat Furniture, Farman Pura, Lohar Line, Near Shifa 9 Amravati Achalpur Hospital Achalpur, Dist Amravati-444806 959/2, Ward no : 49, Tidke Bhavan, Vijay Colony, 10 Amravati Amravati Rukhamini nagar, Amravati-444606 House no. 1250, Near Government well, Ward no. 3, 11 Amravati Dharni Prabhag No. 5, Dharni, Amravati 444702 Back side Rural hospital, near police station , civil area , 12 Amravati Warud Warud,Amravati 444906 First Floor, “YashDev”, Plot no. 60, Vijay Nagar, Near 13 Aurangabad Aurangabad CADA office, Aurangabad - 431005 R/o, Hiverkheda Road, Kannad, Near MSEB Division, 14 Aurangabad Kannad Office, Kannad, Tq Kannad, Dist Aurangabad-431147 Building Ashirwad lodging , Bus stand road surve no 15 Aurangabad Sillod 7/1 III M.C.No 2940/2, plot no 39/2, Silod, Dist Aurangabad-431112 C/o, Dr Annadate, Old Anand Hospital Building, Opp. -

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

District Ahmednagar

LIST OF PERMANENT SSI REGISTERED UNITS - DISTRICT AHMEDNAGAR. REGN REGN_ NAME OF THE UNIT ADR1 ADR2 MAJ_ACT_NAME1 PROD_NAME1 DIR_UNIT_NA DIR_UNI DIR_ADR DIR_ NO. YEAR ME1 T_NAME 1 ADR 2 2 M/S. CTS SA LEELAVATI NO.26/2 VE SHARAT , DI, M/S. POLICE AHMEDNA STATIO GAR PIPES. N, M/S.SATISH 29,CHA ,AH INDUSTRIE HURAN ME S, A DN M/S.SHRIR CS,NO. O.3 AM 1290,A- SH BOREWELL 1H.NO. RIR M/S.KARTIK S.NO.2 AD COPUTERS 74,/A10- E . 15,PLO MA M/S.AGRA ANANT EDI, WAL NIWAS, A`N INDUSTRIE MAHAV AG SHREE 5834 MARBLE TILAK ROAD MAHARASH NISAR TRA I.KURE FURNITUR SHI,H.N M/S. H.NO.1 TAL TRIMURTI 90, .SH ICE CAND MALWA RIG FAST-FAB 1101 DIS ENGINEERI KALKAI T NG WORKS SHRIG AH M/S.YOGAN 204,NI N,A DHARA WARA `NA FOOD TALKIE GA M/S. S.NO.1 GO SAIKRIPA 01/1+2, ND VEET RANJA AW NEW MOULA AH SUCCESS NA ME ENGINEERI AZAD DN FIBREX 107 ME INDUSTRIE BDATR DN S. ANGE AG AJID CHAHU AH HANSRAJ RANA ME KABNAWAT BK DN MANOHAR 5159 AH ENGINEERI MAHAT ME NG WORKS MA DN 3841 1997 BASE ACADEMY OF GALA NO. 65, MARKET M/S.BASE DUCAT GALA G COMPUTER YARD, SHOPING, ACADEMY ION. NO- CE AHMEDNAGAR OF 65,MAR NT KAMDHENU G.NO.1 POULTRY 0,BOND FARM RE,TAL- M/S. CST AH S.P.MUTHA NO.368 ME & 0, DN M/S. C-2/9, CH SHREYAS ANAND OW PRODUCTS NAGAR K, Page 1 DIC AHMEDNAGAR FRAME LIST M/S.VIMAL P.NO.1 PTA PLASTIC. -

EFFECT of SOCIO-ECONOMIC STATUS on PHYSICAL ACTIVITY in COMMUNITY DWELLING SOUTH INDIAN OLDER ADULTS Samuel S

International Journal of Physiotherapy and Research, Int J Physiother Res 2019, Vol 7(6):3313-19. ISSN 2321-1822 Original Research Article DOI: https://dx.doi.org/10.16965/ijpr.2019.191 EFFECT OF SOCIO-ECONOMIC STATUS ON PHYSICAL ACTIVITY IN COMMUNITY DWELLING SOUTH INDIAN OLDER ADULTS Samuel S. E 1, Kumar H 2 Bangera A *3. 1 Professor & Principal, Laxmi Memorial College of Physiotherapy, Mangalore, India. 2 Prof & HOD of Community Medicine, A J Institute of Medical Sciences, Mangalore, India. *3 Post Graduate Student (Corresponding author), Laxmi Memorial College of Physiotherapy, Mangalore, India. ABSTRACT Introduction: Different patterns of activities were reported due to different cultural attitudes of the individuals. Socio-economic status should be taken into consideration when exploring the effect of socio-economic status on health over the life course. Available literature brings out limited studies on socio-economic status and its association with physical activity. In view of above, present study was undertaken to determine an association between selected demographic variables, BMI and physical activity, among older adults, in south India. Materials and Methods: Present study is a community based cross-sectional study, undertaken among older adults (> 55 years and above). Purposive sampling method was used to select the study subjects. A total of 63 older adults were included in the study. The study was conducted over a period of one and half years from 01 January 2018 to 30 June 2019, in selected urban and semi-urban areas in Dakshina Kannada district, Karnataka (India). Results: The study comprised of a total of 63 older adults which included 32 (50.79%) males while remaining 31(49.20%) were females. -

Tender Document for Annual Maintenance Contract For

TENDER DOCUMENT FOR ANNUAL MAINTENANCE CONTRACT FOR SERVICES SUCH AS SWEEPING, CLEANING & OTHER ACTIVITIES WHICH ARE INCIDENTAL TO SWEEPING & CLEANING FOR IDBI BANK’S BRANCHES / OFFICES IN AHMEDNAGAR REGION TECHNICAL BID REGIONAL OFFICE - AHMEDNAGAR Tender for Annual Maintenance Contract for Services such as Sweeping, Cleaning & other activities which are incidental to sweeping & cleaning for IDBI Bank Branches / Offices under AHMEDNAGAR REGION Tender for Annual Maintenance Contract for Services such as Sweeping, Cleaning & other activities which are incidental to sweeping & cleaning for IDBI Bank Branches / Offices under AHMEDNAGAR REGION Bid document may be downloaded from Bank’s Website www.idbibank.in Date of commencement of issue of bidding documents - To be uploaded 02th July 2020 on website Cost of Tender documents (Non- Rs. 500/- (Rupees Five Hundred Only) in Refundable) the form of Demand Draft/ Pay Order (Non refundable) from an Indian scheduled bank in favor of ‘IDBI Bank Limited’, payable at AHMEDNAGAR. Date and place of Pre bid meeting 18/07/2020 at 11.00 hrs at IDBI BANK, AHMEDNAGAR, Regional Office, First floor, "Aadish Plaza", Plot No. 1,2,3,4, Survey No. 3/1A Beside Dr Daule Hospital, Savedi, Ahmednagar Pin :414003 Last date for submission of Bid 23.07.2020 at 1600 hrs Place of submission of Bid envelope IDBI BANK, AHMEDNAGAR, [i.e. Envelope no.3 containing Regional Office, First floor, "Aadish Technical bid (sealed envelope 1) and Plaza", Plot No. 1,2,3,4, Survey No. 3/1A Commercial bid (sealed envelope 2) Beside Dr Daule Hospital, Savedi, together] Ahmednagar Pin :414003 Date & Time of opening of Technical bids 23.07.2020 at 1630 hrs Date & Time of opening of Financial bids To be intimated later to the eligible & technically qualifying bidders only Note: 1) This Document is not transferable; 2) If a holiday is declared on the dates mentioned above, the bids shall be received /opened on the next working day at the same time specified above. -

S No Atm Id Atm Location Atm Address Pincode Bank

S NO ATM ID ATM LOCATION ATM ADDRESS PINCODE BANK ZONE STATE Bank Of India, Church Lane, Phoenix Bay, Near Carmel School, ANDAMAN & ACE9022 PORT BLAIR 744 101 CHENNAI 1 Ward No.6, Port Blair - 744101 NICOBAR ISLANDS DOLYGUNJ,PORTBL ATR ROAD, PHARGOAN, DOLYGUNJ POST,OPP TO ANDAMAN & CCE8137 744103 CHENNAI 2 AIR AIRPORT, SOUTH ANDAMAN NICOBAR ISLANDS Shop No :2, Near Sai Xerox, Beside Medinova, Rajiv Road, AAX8001 ANANTHAPURA 515 001 ANDHRA PRADESH ANDHRA PRADESH 3 Anathapur, Andhra Pradesh - 5155 Shop No 2, Ammanna Setty Building, Kothavur Junction, ACV8001 CHODAVARAM 531 036 ANDHRA PRADESH ANDHRA PRADESH 4 Chodavaram, Andhra Pradesh - 53136 kiranashop 5 road junction ,opp. Sudarshana mandiram, ACV8002 NARSIPATNAM 531 116 ANDHRA PRADESH ANDHRA PRADESH 5 Narsipatnam 531116 visakhapatnam (dist)-531116 DO.NO 11-183,GOPALA PATNAM, MAIN ROAD NEAR ACV8003 GOPALA PATNAM 530 047 ANDHRA PRADESH ANDHRA PRADESH 6 NOOKALAMMA TEMPLE, VISAKHAPATNAM-530047 4-493, Near Bharat Petroliam Pump, Koti Reddy Street, Near Old ACY8001 CUDDAPPA 516 001 ANDHRA PRADESH ANDHRA PRADESH 7 Bus stand Cudappa, Andhra Pradesh- 5161 Bank of India, Guntur Branch, Door No.5-25-521, Main Rd, AGN9001 KOTHAPET GUNTUR 522 001 ANDHRA PRADESH ANDHRA PRADESH Kothapeta, P.B.No.66, Guntur (P), Dist.Guntur, AP - 522001. 8 Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW8001 GAJUWAKA BRANCH 530 026 ANDHRA PRADESH ANDHRA PRADESH 9 Gajuwaka, Anakapalle Main Road-530026 GAJUWAKA BRANCH Bank of India Branch,DOOR NO. 9-8-64,Sri Ram Nivas, AGW9002 530 026 ANDHRA PRADESH ANDHRA PRADESH -

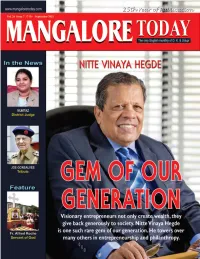

July 2021.Pmd

MANGALORE TODAY - SEPTEMBER 2021 1 2 MANGALORE TODAY - SEPTEMBER 2021 PPPOWER POINT PICTURE OF THE MONTH Hands-on Experience! Union Minister of State for Agriculture and Farmers' Welfare Shobha Karandlaje joins farmers in cultivating a fallow land at Kadekar village in Udupi as part of Hadilu Bhoomi Revival Scheme. ““““““ WWWORDSWORTH ”””””” “We must break the walls of “The musical world has caste, religion, superstitions the immense power to as well as mistrust that attract lakhs of people as create impediments in the music plays a very key role path of our progress” in enlivening our minds Prof Sabeeha B.Gowda, Professor, Dept of and hearts” Kannada Studies of Mangalore University at noted singer Ajay Warrior at the inaurual of a farewell ceremony on the occasion of her “Knowledge of local Karavali Music Camp in Mangaluru. retirement from service. languages will go a long way in assisting the police “Ranga Mandiras need to be “Man can lead a peaceful to efficiently maintain law protected if we have to life when he incorporates and order as well as in preserve and promote the good values and shuns his investigation of crimes” theatrical field” ego” City Police Commissioner N Shashi eminent Kannada movie director Rajendra Prof. P S Yadapadittaya, Vice Chancellor of Kumar at the inaugural of the month Singh Babu while launching the fund raising Mangalore University at the Kanaka lecture long Tulu learning workshop for police drive for the renovation of Don Bosco Hall in series at the University. officers and personnel. Mangaluru. MANGALORE TODAY - SEPTEMBER 2021 3 EEEDITOR’’’SSS EDGE VOL 24 ISSUE 7 SEPTEMBER 2021 Publisher and Editor V. -

Contact Details of Booth Level Officers Blos and Their Supervisers

Contact Details of Booth Level Officers BLOs and their Supervisers Ac. No. and Name : 203-Mangalore City South Category - Teacher/ Non PS Mobile No.and Contact Name of Teacher Contact address of the Name of the PS NO. Polling Station Name Location Mobile No. address & the the BLO (Revenue BLO Superviser No. Superviser /OthersPL Specify ) Pambur House Padubelle 9880422893 Revenue Ashoka Vidyalaya English Medium High School DEVENDRAPPA 1 1 Ragini Non Teacher 9972995035 Post, Shirva, Udupi Inspector Mangaluru city ,Ashoka Nagara (Staff Room) PARARI District. corporation W/o Dinesh Shetty. 9880422893 Revenue Ashoka Vidyalaya English Medium High School Shashiprasad Gokul DEVENDRAPPA 2 1 Sujatha Rai Teacher 9449237366 Inspector Mangaluru city ,Ashoka Nagara (Anganawady) Dairy, Ashoka Nagara PARARI corporation Mangaluru. 9880422893 Revenue Ashoka Vidyalaya English Medium High School, DEVENDRAPPA 3 1 Geethanjali Non Teacher 9741289392 Bejai kapikad mangaluru Inspector Mangaluru city Ashoka Nagara ( Middle Portion of HM Room) PARARI corporation Nekkaladi House 9880422893 Revenue Ashoka Nagara Higher Primary School, Ashoka Bhavani DEVENDRAPPA 4 2 Non Teacher 9741150038 Paduperar Post & Village, Inspector Mangaluru city Nagara (Sharada Sadana) (Hall) Shankar PARARI Bajpe , Mangaluru. corporation 9880422893 Revenue Ashoka Nagara Higher Primary School, Ashoka Kuthar, Bhandar Bail, DEVENDRAPPA 5 2 Harish Non Teacher 9980545740 Inspector Mangaluru city Nagara (Sharada Sadana) (Middle Wing ) Munnur Post , Mangaluru. PARARI corporation "SaiDhama" Nagakannika 9880422893 Revenue St. Peter's Higher Primary School, Kottara (East DEVENDRAPPA 6 3 Akshath K Non Teacher 7411083097 Temple Road , Inspector Mangaluru city Wing of New Building) PARARI Mangaluru- 575008 corporation M.C.C Quarters Sulthan 9880422893 Revenue St. Peter's Higher Primary School, Kottara DEVENDRAPPA 7 3 Sadashiva Non Teacher 9902330569 Batteri Road, Urwa, Inspector Mangaluru city (Middle Wing of New Building) PARARI Mangaluru.