Office Traction @ Glance Knight Frank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chaipoint Outlets

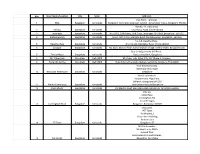

Sno Store Name/Location City State Address1 Chai Point , Terminal, 1 BIAL Bangalore Karnataka Bangalore International Airport Limited , Devanahali Taluka, Bangalore-560300 Plot No. 44, Electronics 2 Infosys Bangalore Karnataka City, Hosur Road, B'lore-560100 3 Jayanagar Bangalore Karnataka No.524/2, 10th Main, 33rd Cross, Jayanagar 4th Block, Bangalore - 560 011 4 Malleshwaram Bangalore Karnataka No.64, 18th Cross, Margosa Road, Malleshwaram, Bangalore - 560 055 No.A-8, Devatha Plaza, 5 Devatha Plaza Bangalore Karnataka No.131-132, Residency Road, B'lore-560025 6 Sarjapur Bangalore Karnataka No. 38/2, Ground Floor, Kaikondrahalli village, Varthur Hobli, Bangalore East Opp to Adigas hotel, MG Road , 7 Trinity Metro Bangalore Karnataka Next to Axis Bank, Bangalore 8 DLF Cyber Hub Gurugram Delhi NCR K5, Cyber hub, Cyber City, DLF Phase 3, Gurgaon 9 Huda City Centre Gurugram Delhi NCR Huda City Centre Metro Station, Sector 29, Gurgaon, HR 122009 Near Electronics City Bommasandra village 10 Narayana Healthcare Bangalore Karnataka Bangalore Mantri commercio Kariyammana Ahgrahara , Bellendur,Bangalore-560103 11 Mantri Commercio Bangalore Karnataka Near Sakara Hospital Bangalore 12 RMZ Infinity Bangalore Karnataka Old Madras Road, Bennigana Halli, Bangalore, Karnataka 560016 S No 50, Little Plaza, Cunningham Rd, Vasanth Nagar, 13 Cunningham Road Bangalore Karnataka Bangalore, Karnataka 560002 Chai point #77 Town Building No,3 Divya shree building Yamalur post 14 77 Town Bangalore Karnataka Bangalore -37 NH Cardio center NH Health city -258/a Ground floor, Bommasandra Industrial area, 15 NH Cardio Bangalore Karnataka Bangalore, Karnataka 16 Unitech Infospace Gurugram Delhi NCR Store No 6, Unitech Infospace SEZ Sector-21, Gurgaon 17 Salarpuria Softzone Bangalore Karnataka Salarpuria Softzone ,Outer ring road ,Near sarjapur junction ,Bangalore -43 John F. -

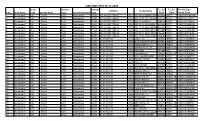

CIN CODE UPTO 30.11.2020 Circle Division Division Feeder Feeder Final 14 Digit SS Name Feeder Name S.No

CIN CODE UPTO 30.11.2020 Circle Division Division Feeder Feeder Final 14 Digit SS Name Feeder Name S.No. Circle Name Code Division Name Code Sub Division Name Code Code Type Feeder Code 1 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV EMAAR MGF MRMGF INDPT. 126531551MRMGF 2 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV ITPG DEVELOITPGD INDPT. 126531551ITPGD 3 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV NOVA INOVA INDPT. 126531551INOVA 4 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-65 1576 IND 33 KV MANGLAM MANGL INDPT. 126531576MANGL 5 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV PALM DRIVE PALMD INDPT. 126531308PALMD 6 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV PALM SQUARPALMS INDPT. 126531308PALMS 7 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV TULIP ORAN TULIO INDPT. 126531308TULIO 8 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV TULIP WHITE TULIW INDPT. 126531308TULIW 9 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 ANSAL (U) ANSAU URBAN 126531269ANSAU 10 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 B.S.F/MODERN JAIL COINDBS URBAN 126531269INDBS 11 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 BADSHAHPUR-I (U) BADSH URBAN 126531269BADSH 12 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 DARBARIPUR DS DARDS RURAL DS 126531269DARDS 13 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 DOLPHIN DLPHN INDL. -

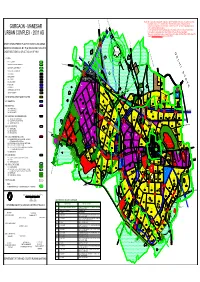

GURGAON - MANESAR on the Website for All Practical Purposes

FROM FARUKHNAGAR FROM FARUKHNAGAR NOTE: This copy is a digitised copy of the original Development Plan notified in the Gazette.Though precaution has been taken to make it error free, however minor errors in the same cannot be completely ruled out. Users are accordingly advised to cross-check the scanned copies of the notified Development plans hosted GURGAON - MANESAR on the website for all practical purposes. Director Town and Country Planning, Haryana and / or its employees will not be liable under any condition TO KUNDLI for any legal action/damages direct or indirect arising from the use of this development plan. URBAN COMPLEX - 2031 AD The user is requested to convey any discrepancy observed in the data to Sh. Dharm Rana, GIS Developer (IT), SULTANPUR e-mail id- [email protected], mob. no. 98728-77583. SAIDPUR-MOHAMADPUR DRAFT DEVELOPMENT PLAN FOR CONTOLLED AREAS V-2(b) 300m 1 Km 800 500m TO BADLI BADLI TO DENOTED ON DRG.NO.-D.T.P.(G)1936 DATED 16.04.2010 5Km DELHI - HARYANA BOUNDARY PATLI HAZIPUR SULTANPUR TOURIST COMPLEX UNDER SECTION 5 (4) OF ACT NO. 41 OF 1963 AND BIRDS SANTURY D E L H I S T A T E FROM REWARI KHAINTAWAS LEGEND:- H6 BUDEDA BABRA BAKIPUR 100M. WIDE K M P EXPRESSWAY V-2(b) STATE BOUNDARY WITH 100M.GREEN BELT ON BOTH SIDE SADHRANA MAMRIPUR MUNICIPAL CORPORATION BOUNDARY FROM PATAUDI V-2(b) 30 M GREEN BELT V-2(b) H5 OLD MUNICIPAL COMMITTEE LIMIT 800 CHANDU 510 CONTROLLED AREA BOUNDARY 97 H7 400 RS-2 HAMIRPUR 30 M GREEN BELT DHANAWAS VILLAGE ABADI 800 N A J A F G A R H D R A I N METALLED ROAD V-2(b) V2 GWS CHANNEL -

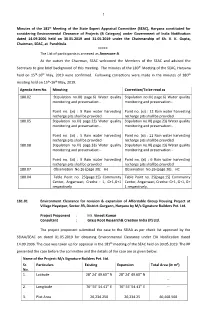

(SEAC), Haryana Constituted for Considering Environmental C

1 Minutes of the 181st Meeting of the State Expert Appraisal Committee (SEAC), Haryana constituted for considering Environmental Clearance of Projects (B Category) under Government of India Notification dated 14.09.2006 held on 30.05.2019 and 31.05.2019 under the Chairmanship of Sh. V. K. Gupta, Chairman, SEAC, at Panchkula. ***** The List of participants is annexed as Annexure-A. At the outset the Chairman, SEAC welcomed the Members of the SEAC and advised the Secretary to give brief background of this meeting. The minutes of the 180th Meeting of the SEAC, Haryana held on 15th-16th May, 2019 were confirmed. Following corrections were made in the minutes of 180th meeting held on 15th-16th May, 2019. Agenda item No. Minuting Correction/To be read as 180.02 Stipulation no.III( page.6) Water quality Stipulation no.III( page.6) Water quality monitoring and preservation:- monitoring and preservation:- Point no. (xi) : 9 Rain water harvesting Point no. (xi) : 12 Rain water harvesting recharge pits shall be provided recharge pits shall be provided 180.05 Stipulation no.III( page.23) Water quality Stipulation no.III( page.23) Water quality monitoring and preservation:- monitoring and preservation:- Point no. (xi) : 5 Rain water harvesting Point no. (xi) : 11 Rain water harvesting recharge pits shall be provided recharge pits shall be provided 180.08 Stipulation no.III( page.33) Water quality Stipulation no.III( page.23) Water quality monitoring and preservation:- monitoring and preservation:- Point no. (xi) : 9 Rain water harvesting Point no. (xi) : 6 Rain water harvesting recharge pits shall be provided recharge pits shall be provided 180.07 Observation No.26 (page 30): He Observation No.26 (page 30): HC 180.04 Table Point no. -

List of the Projects to Be Taken-Up in the 123Rd Meeting of SEIAA to Be Held on 11.03.2020 at 11:00 AM

List of the projects to be taken-up in the 123rd meeting of SEIAA to be held on 11.03.2020 at 11:00 AM Sr. Name and Address of the Project Proponent Location of the Project Status No. 1 M/s Synergy Waste Management (P) Ltd. Environment Clearance for proposed “Common Bio-Medical Waste Treatment EC Facility (CBWTF) at Plot No. 66, Roz KaMeo Industrial Area, Sohna, Mewat, Haryana. 2 M/s Jewel Classic Hotels Pvt. Ltd. Environment Clearance for Hotel, Restaurant & Banquet Hall, Recreational Park Violation (EC) and Health Club “Noor Mahal” at Village Phusgarh, Distt. Karnal, Haryana. 3 HSIIDC Environment Clearance for Proposed Development of Sector-37 at Karnal, Complaint made by Sh. Haryana developed by HSIIDC. Vikram Singh 4 In the matter of O.A. No. 840 of 2019 as Ayush Garg V/s Union of India against illegal manufacturing of formaldehyde without Next date of hearing is obtaining Environment Clearance by M/s Om Chem under EIA Notification dated 14.09.2006. 03.04.2020 at NGT, New Delhi. 5 M/S Oasis Landmarks LLP Environment Clearance for Expansion of Group Housing Colony at Sec 88A & Site Visit report 89A, Village-Harsaru, Tehsil Gurgaon, Haryana received on 6 M/s Antariksh Warehousing & Logistics Parks Environment Clearance for Revision and Expansion of Warehouse and Logistic EC Park at Village Bhaproda, Tehsil Bahadurgarh, District Jhajjar, Haryana 7 M/s Consolidate Realtors Pvt. Ltd Environment for Expansion for expansion of Group Housing Project on area EC measuring 13.344 acres at Village-Badshahpur, Sector-67, Gurugram, Haryana. 8 M/s Balaji Infra. -

Gurugram, Haryana Dec 05, 2019 to Dec 10, 2019

ACCOMMODATION LIST AVS Cosmic Therapy Shivir - Gurugram, Haryana Dec 05, 2019 To Dec 10, 2019 Shivir Venue - Library Ground, Along HUDA Gymkhana Club, Near Crown Plaza Hotel, Sector 29, Gurgaon ** The following list of hotels as compiled by some seva sadhaks is provided for the convenience of sadhaks coming from outstation. These are private institution/ person and has no connection with the ShivYog Ashram. The rates mentioned are approximate for reference only. It is therefore your responsibility to do the final negotiation and check on the terms and conditions before booking the place. DISTANCE ROOMS MISCELLANEOUS GOOGLE RATING S.No ADDRESS CONCERNED PERSON CONTACT TARIFF ( Approximate) HOTEL FROM VENUE AVAILABLE INFORMATION ( Out of 5 ) ₹ 1200 (Single Bed) ₹ 1500(double bed) a/c 8130313553 1 C-68 south city phase -1 1 km Mr Parveen room, & ₹ 300(Extra 17 3.9 Bloom Hotel 0124-4038458 Bedding) Sharing Allowed 8800699155, Plot No.2024 Near Ramada Pacific Inn Eco 9212151785, 0124- ₹ 1200-1400 Exta 2 Hotel, Sector 45, Gurugram, 2.6 km Mr Sudeep Kr. Dagar 80-85 3.8 4201585, 0124- Bedding ₹ 500 Central Haryana 122021 2582024 Tulalip Hotels Double occupany : ₹ www.tulaliphotels.com B-25, Old DLF Sector-14, 0124-4285717,19- 1950 and ₹ 2250 + ₹ 3 3.1 km Mr Lakshman Yadav 22 3.9 (Trisha Group of Gurgaon 22 9958988562 500 (Extra Bedding) . 10 mins drive from Iffco hotels ) GST 12% metro station on auto A.C Room ₹ 750 (single Opp: Govt. College 15-20 mins Mins drive from 0124-4080185 bed ) ₹ 800- 4 Mehrauli Road 3.1 km Mr. -

Floor, Jeevan Deep Building Parliament Street, New Delhi

GOVERNMENT OF INDIA MINISTRY OF COMMERCE & INDUSTRY DEPARTMENT OF COMMERCE OFFICE OF THE DEVELOPMENT COMMISSIONER NOIDA SPECIAL ECONOMIC ZONE NOIDA DADRI ROAD, PHASE-II, NOIDA - 201305 DISTT. GAUTAM BUDH NAGAR (UTTAR PRADESH) r. No. 10/274/2009-SEZI Date 22. 05.=012 To. I. The Director, Department of Commerce, Ministry of Commerce & Industry, Govt. of India. RnOll1 }-o. 223 D, Udyog Bhawan, Rafi Marg, New Deihl-I I OOO\.email: [email protected] 2. The Joint Director General of Foreign Trade, Ministry of Commerce & Industry, " A " Wi il~ Indr;lprastha Bhawan, I.P.Estate. New Delhi - 110002, email: [email protected] 3. The Commissioner Of Central Excise & Customs, Delhi-Ill, Udyog Minar, Vanij:ya Nikunj , lJ dyog. Vihar, Phase V, Gurgaon. 2346348. Fax No. 0124-2349463. [email protected] 4. Sh. T. Kipgen, Addl. Commissioner Of Income Tax, Range-III I, New CGO Comple'(, NH-IV, Ftridacad. Email: [email protected] 5. Sh. Sampoornanand, Joint Commissioner Income Tax, Range-II, Udyog Vihar, Pha ~e -V, Gurgaon (Hcryana). 6. The Commissioner of Central Excise & Customs (Rohtak), 17-P, Sector - I, Rohtak, Fax. 01262- 275221. email : [email protected] . 7. The Dy. Secretary (IF-I), Banking Division, Department of Economic Affairs, Miristry of Finance. I.jovt. of India, 3rd Floor, Jeevan Deep Building Parliament Street, New Delhi. 8. The Director (Industries & Commerce). Gov!. of Haryana, 30 Bays Building, Sec to r 17. Challdigaril - Tel. No. 0172-2701344. Email: industries@hry. nic.in 9. Managing Director, Haryana State Industrial Development Corporation, Govt. of Haryana, PICI No. C-13 & 14. Sector 6. -

DISTRICT GURGAON Sr

DISTRICT GURGAON Sr. No. Name of the applicant File No. Location Zone Purpose Area (sq. mts.) Date 1 GULAB FARM G-1224 Vill. BHONDSI, GGN AGRICULTURE FARM HOUSE 10117.5 07-Jan-99 2 SHYAM SUNDER INDUSTRY G-1012 Vill. DUNDAHERA, GGN INDUSTRIAL INDUSTRIAL 758.78 08-Jan-99 3 AMTECH AUTO LTD. G-1209 Vill. MOHAMMAD PUR , GGN INDUSTRIAL INDUSTRIAL 7486.7 08-Jan-99 4 R.S INDUSTRIES Vill. KHANDSA, GGN INDUSTRIAL INDUSTRIAL 445.8 08-Jan-99 5 N.K RABBAR G-914 Vill. LAKHNAULA, GGN AGRICULTURE INDUSTRIAL 72286.78 13-Jan-99 6 SPARKLING MINERAL WATER G-1078 Vill. BHONDSI, GGN AGRICULTURE 3493.47 28-Jan-99 7 S & A OVERSEAS G-1041 Vill. KHERKI DAULA, GGN AGRICULTURE INDUSTRIAL 7055 10-Feb-99 8 SAVITA RANI G-1108 Vill. NATHUPUR , GGN RESIDENTIAL RESIDENTIAL 922.26 19-Feb-99 CONTINENTAL WARE 9 Vill. GARHI HARSARU, GGN AGRICULTURE WAREHOUSE 48537.13 01-Mar-99 HOUSING CO-OP LTD. 10 DHANUKA LAB PVT.LTD Vill. MOHAMMAD PUR JHARSA, GGN AGRICULTURE INDUSTRIAL 1239.35 02-Apr-99 11 AMP INTERNATIONAL PVT. LTD. Vill. BEGAMPUR KHATOLA INDUSTRIAL INDUSTRIAL 8001.76 02-Apr-99 12 ANU POLY PACK Vill. BHONDSI, GGN AGRICULTURE INDUSTRIAL 4033.33 02-Apr-99 13 GOLDEN REMEDIES Vill. SARHAUL, GGN INDUSTRIAL INDUSTRIAL 682.9 02-Apr-99 14 GOOD CARE FARMA Vill. MOHAMMAD PUR, GGN INDUSTRIAL INDUSTRIAL 3891.04 22-Apr-99 15 MARUTI UIDYOG LTD. Vill. BHONDSI, GGN AGRICULTURE SCHOOL 20233.62 05-May-99 16 ANKUR TAYAL Vill. SADHRANA, GGN AGRICULTURE FARM HOUSE 9915.15 25-May-99 17 GUPTA MOTORS Vill. -

REVISED AGENDA AS the AGENDA NO. 5 IS DELETED (LISTED DUE to TYPOGRAPHICAL ERROR) List of the Projects to Be Taken-Up in the 119Th at 11:30AM Meeting of SEIAA Sr

**REVISED AGENDA AS THE AGENDA NO. 5 IS DELETED (LISTED DUE TO TYPOGRAPHICAL ERROR) List of the projects to be taken-up in the 119th at 11:30AM meeting of SEIAA Sr. No. File No. Name and Address of the Project Proponent Location of the Project 1. SEIAA/HR/19/24 M/s Agrasain Spaces LLP # A-59, Sector 11, Faridabad. EC for Revision & Expansion of Affordable Group EC Housing Project located at Village Mujeri, Sector 70, Faridabad 2. SEIAA/HR/18/ 440 M/s Alesia Buildtech Pvt. Ltd. EC for construction of affordable group housing colony EC at revenue estate Village Riwazpur and Tikawali, SEIAA/HR/19/102 Sector 89, Faridabad, Haryana 3. SEIAA/HR/18/ 422 M/s Puri Construction Pvt. Ltd. EC for construction of Group Housing Colony located EC SEIAA/HR/19/104 in the revenue estate of village Ullawas, Sector-61, District-Gurugram, Haryana 4. SEIAA/HR/19/136 Sh. Bikram Singh S/o S/o Sh. Raghu Nath Singh in EC for Affordable Group Housing Project located in EC collaboration with M/s Nani Resorts and Floriculture the revenue estate of Village Mewka, Sector-92, Pvt. Ltd. Gurugram Manesar Urban Complex, Haryana 5. SEIAA/HR/19/47 M/s Pyramid Infratech Pvt. Ltd. ECfor Proposed Affordable Group Housing Colony EC Sector- 70A, Village-Palra, Gurugram, Haryana. 6. SEIAA/HR/19/156 M/s Pyramid Infratech Pvt. Ltd. EC for Affordable Group Housing Colony Village- EC Nawada, Sector- 86, Gurugram, Haryana. 7. SEIAA/HR/19/53 M/s ELAN LIMITED # 1A 8th Avenue, Bandh Road, EC Proposed Commercial Complex at Village EC Village-Jonpur, New Delhi Badshahpur, Sector- 70, Gurugram, Haryana. -

Cin Code Upto 30.09.2020

CIN CODE UPTO 30.09.2020 e ion Divisi Final 14 Digit SS Name Feeder Name FeederCode Feeder Type S.No Circle Name Cod Division Name Code Sub Division Name on Feeder Code 1 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV EMAAR MGF MRMGF INDPT. 126531551MRMGF 2 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV ITPG DEVELO ITPGD INDPT. 126531551ITPGD 3 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-57 1551 IND 33 KV NOVA INOVA INDPT. 126531551INOVA 4 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-65 1576 IND 33 KV MANGLAM MANGL INDPT. 126531576MANGL 5 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV PALM DRIVE PALMD INDPT. 126531308PALMD 6 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV PALM SQUAR PALMS INDPT. 126531308PALMS 7 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV TULIP ORANG TULIO INDPT. 126531308TULIO 8 Gurugram-II 126 Sohna 1265 Badshahpur 12653 220 KV SECTOR-72 1308 IND 33 KV TULIP WHITE TULIW INDPT. 126531308TULIW 9 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 ANSAL (U) ANSAU URBAN 126531269ANSAU 10 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 B.S.F/MODERN JAIL COINDBS URBAN 126531269INDBS 11 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 BADSHAHPUR-I (U) BADSH URBAN 126531269BADSH 12 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 DARBARIPUR DS DARDS RURAL DS 126531269DARDS 13 Gurugram-II 126 Sohna 1265 Badshahpur 12653 66 KV B/ PUR 1269 DOLPHIN DLPHN INDL. -

DLF AR 2015 for Web.Indd

Contents Company Information ……………………………………………………………………… 3 Message from the Chairman ……………………………………………………………… 4 Board of Directors ………………………………………………………………………… 6 Directors’ Report …………………………………………………………………………… 7 Management Discussion & Analysis Report …………………………………………… 38 Corporate Governance Report …………………………………………………………… 46 Financial Statements ……………………………………………………………………… 74 Auditors’ Report …………………………………………………………………………… 75 Balance Sheet ……………………………………………………………………………… 82 Statement of Pro¿ t & Loss ………………………………………………………………… 83 Cash Flow Statement ……………………………………………………………………… 84 Notes ………………………………………………………………………………………… 86 Consolidated Financial Statements ……………………………………………………… 140 Details of Subsidiary Companies ………………………………………………………… 210 Notice ………………………………………………………………………………………… 219 Company Information Board of Directors Reference Information Executive Directors Registered Of¿ ce Dr. K.P. Singh Shopping Mall, 3rd Floor, Arjun Marg Chairman Phase-I, DLF City, Gurgaon-122 002 Mr. Rajiv Singh Vice Chairman (Haryana) Mr. T.C. Goyal Managing Director (upto 31.03.2015) Corporate Of¿ ce Ms. Pia Singh DLF Centre, Sansad Marg Whole-time Director (upto 20.05.2015)* New Delhi-110 001 Mr. Mohit Gujral Whole-time Director Statutory Auditors Mr. Rajeev Talwar Whole-time Director Walker Chandiok & Co LLP Non-Executive Directors Registrar & Share Transfer Agent Mr. K.N. Memani Lead Independent Director Karvy Computershare Private Limited Mr. G.S. Talwar Dr. D.V. Kapur Listed at Mr. B. Bhushan Mr. Pramod Bhasin Bombay Stock Exchange Mr. Rajiv Krishan Luthra -

Bus Route Planning and Rationalization

Implementation of City Bus Service Project in Gurugram – Bus DFR Route Planning and Rationalization Implementation of City Bus Service Project in Gurugram – Bus Route Planning and Rationalization Draft Final Report November - 2017 Implementation of City Bus Service Project in Gurugram – Bus DFR Route Planning and Rationalization Table of Contents 1 Introduction ................................................................................................................................... 8 1.1 Background and Study Context............................................................................... 8 1.2 Objectives of the study ............................................................................................ 8 1.3 Scope of Work ........................................................................................................ 8 1.4 Structure of the Draft Final Report ........................................................................ 10 2 Project Area Description ............................................................................................................ 14 2.1 Introduction to city ................................................................................................. 14 2.2 Project Area Delineation ....................................................................................... 14 2.3 Transport Network & System ................................................................................ 15 2.4 Demographic Profile ............................................................................................