UBS Leads the Way in Wealth Management Corporate Profile for 1Q17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Pdf 707.34 KB

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT. EXOR N.V. ANNOUNCES FINAL RESULTS OF ITS TENDER OFFERS Amsterdam, 20 January 2021. EXOR N.V. (the Company) hereby announces the final results of its invitations to eligible Noteholders of its €750,000,000 2.125 per cent. Notes due 2 December 2022, ISIN XS1329671132 (of which €750,000,000 is currently outstanding) (the 2022 Notes) and its €650,000,000 2.50 per cent. Notes due 8 October 2024, ISIN XS1119021357 (of which €650,000,000 is currently outstanding) (the 2024 Notes, and together with the 2022 Notes, the Notes and each a Series) to tender their Notes for purchase by the Company for cash up to an aggregate maximum acceptance amount of €400,000,000 in aggregate nominal amount (the Maximum Acceptance Amount) (such invitations, the Offers and each an Offer). The Offers were announced on 12 January 2021 and were made on the terms and subject to the conditions set out in the tender offer memorandum dated 12 January 2021 (the Tender Offer Memorandum) prepared in connection with the Offers, and subject to the offer and distribution restrictions set out in the Tender Offer Memorandum. -

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Using Replicated Ledger to Reduce Swift Costs

WHITE PAPER USING REPLICATED LEDGER TO REDUCE SWIFT COSTS Abstract Nientibus et harum la aliquos que dunt harunte nat qui assimin ctincti nimoloratur? Quis sin enim expello rescitis aliberiosam, sumendu cienimil es ab in pelibus antiunt, eatur sit volorec tetur, occus asi suntiss imporer eperis dolupta que quid quatis mo volorit quas maio. Im acest, eos si beat. Ur? Nonseque reribus. Itatium re, nissi nullupietur audis sit adis con non corrum fugias eosae nones nonsenimus Itate esto moluptatur autatis sinctota dolent labo. Sum autem reriossum eos acerestectur rem que et haribus vel etur Introduction This paper proposes an approach to build a payment product that could be deployed across units of same bank or banks which have correspondent relationships, to reduce SWIFT message costs and to conserve liquidity by reducing need for Settlement and Nostro accounts. The paper proposes an outline of a product that implements a replicated, single wrapper around existing ledgers of such bank units to enable quick, irrevocable, tamper-proof approach to managing electronic payments between correspondent bank units. Existing ledgers of the bank would not be replaced or disturbed. Instead a wrapper application would be deployed that tracks specific entries in the ledger and replicates the changes to all members. This enables each member bank to see the same ledger at the same time and also be guaranteed of its accuracy. For this purpose, it is recommended the product be built using Blockchain for established and proven security. Such a replicated ledger would reduce active, recurring costs of using SWIFT network to pass payment messages. This will also reduce the much larger passive cost of holding funds in a non- remunerative settlement a/c with the correspondent bank. -

OTP Morning Brief

22 JUNE 2021 OTP Morning Brief • Western Europe's stock markets picked up, benefiting from Christine Lagarde's words • The sentiment improved in the USA, despite Fed officials' continued hints at monetary tightening • The EUR/HUF sank near 353 yesterday, when the MNB governor's hawkish article was published. • The MNB is expected to raise interest rates today; its size may determine the HUF's exchange rate. • Most of Asia's indices headed higher today; Brent climbed to USD 75 www.otpresearch.com 1 22 JUNE 2021 Western Europe's stock exchanges shifted into higher gear on Christine Lagarde’s words Western Europe's stock markets started the week with gains: Germany's DAX jumped 1.0%, reversing Friday's fall, the UK's FTSE rose by 0.6%, and the Stoxx600 closed 0.7% higher. It was the words of Christine Lagarde, the ECB's President, that set markets in motion. Speaking at a hearing in the European Parliament, she spoke about maintaining loose monetary conditions and dispelled fears about the spill-over effects of US inflation in Europe. Cyclical sectors have risen; the winners of the day in the Stoxx600 were vehicle manufacturers, chemical, and materials stocks. Retail companies also did well: the UK-based Morrisons food chain skyrocketed 35% after rejecting a GBP 5.5bn takeover bid from Clayton, Dubilier & Rice. Their rivals also jumped: Tesco advanced 1.7%, and Sainbury’s surged 3.8%. The Stoxx600 Health Sector Index stagnated, even though CureVac plummeted more than 10% on suspicion of insider trading; last week, the biopharmaceutical's stock price of fell as clinical trials pointed to low efficacy of its covid vaccine. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

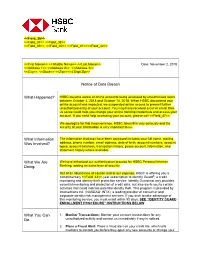

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Unilever Finance Netherlands BV

11 May 2021 Unilever Finance Netherlands B.V. (guaranteed on a joint and several basis by Unilever PLC and Unilever United States, Inc.) and Unilever PLC (guaranteed by Unilever United States, Inc.) U.S.$25,000,000,000 Debt Issuance Programme Application has been made to the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten or the “AFM”) in its capacity as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) to approve this Information Memorandum for the purpose of giving information with regard to the issue of notes by Unilever PLC (“PLC Notes”) and by Unilever Finance Netherlands B.V. (“UFN Notes”, and together with PLC Notes, “Notes”) under the debt issuance programme described herein (the “Programme”) during the period of 12 months after the date hereof. This Information Memorandum is a base prospectus for the purposes of the Prospectus Regulation. This Information Memorandum has been approved by the AFM, as competent authority under the Prospectus Regulation. The AFM only approves this Information Memorandum as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of either the Issuers, the Guarantors or the quality of the securities that are the subject of this Information Memorandum. Investors should make their own assessment as to the suitability of investing in the Notes. The requirement to publish a prospectus under the Prospectus Regulation only applies to Notes which are to be admitted to trading on a regulated market as defined in Directive 2014/65/EU (as amended, “MiFID II”) and/or offered to the public in the European Economic Area (the “EEA”) in circumstances where no exemption is available under the Prospectus Regulation. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

Citi Acquisition of Wachovia's Banking Operations

Citi Acquisition of Wachovia’s Banking Operations September 29, 2008 Transaction Structure Transaction Citi acquires Wachovia’s retail bank, corporate and investment bank and private bank Details businesses – Citi pays $2.2 billion to Wachovia in Citi common stock – Citi assumes substantially all of Wachovia’s debt; preferred stock excluded – Wachovia remains a publicly-traded holding company consisting of its retail brokerage and asset management businesses Capital Citi expects to raise $10 billion in common equity from the public markets Citi issues preferred stock and warrants to FDIC with a fair value of $12 billion at closing, accounted for as GAAP equity with full Tier 1 and leverage ratio benefit Quarterly dividend reduced to $0.16 per share immediately Regulatory capital relief on substantially all of the $312 billion of loss protected assets Risk Mitigation Citi enters loss protection arrangement with the FDIC on $312 billion of loss protected assets; maximum potential Citi losses of $42 billion – Citi is responsible for the first $30 billion of losses, recorded at closing through purchase accounting – Citi is responsible for the next $12 billion of losses, up to a maximum of $4 billion per year for the next three years – FDIC is responsible for any additional losses – Citi issues preferred stock and warrants to FDIC with a fair value of $12 billion at closing Approvals FDIC approved; subject to formal Federal Reserve approval and Wachovia shareholder approval Closing Anticipated by December 31, 2008 1 Terms of Loss Protection -

FINE-TUNED BNP PARIBAS EXCELS at the BUSINESS of BANKING BNP Paribas Is That Rarity: a Large Bank Actually Delivering on Its Promises to Stakeholders

Reprinted from July 2016 www.euromoney.com WORLD’S BEST BANK BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING World’s best bank Reprinted from July 2016 Copyright© Euromoney magazine www.euromoney.com WORLD’S BEST BANK FINE-TUNED BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING BNP Paribas is that rarity: a large bank actually delivering on its promises to stakeholders. It is producing better returns even than many of the US banks, despite being anchored in a low-growth home region, building capital and winning customers – all while proving the benefits of a diversified business model. Its cadre of loyal, long-serving senior executives look to have got the strategy right: staying the course in Asia and the US and running global customer franchises, but only in the select services it excels at By: Peter Lee Illustration: Jeff Wack eset by weak profitability, negative interest rates and Its third division, international financial services, includes banking low growth in their home markets, European banks in the US, Latin America and Asia, as well as specialist business such are losing out to US rivals that restructured and as consumer finance, asset and wealth management and insurance. recapitalized quickly after the global financial crisis At a time when peers are still shrinking, BNP Paribas is growing. and whose home economy has enjoyed a much more While new and uncertain management teams struggle to get back Brobust recovery since. to basics, the technicians at BNP Paribas embrace geographic and In April, the European Banking Authority published its latest update business diversity. Critics see a large bank running on six engines in on the vulnerabilities of the 154 biggest European banks and noted a the age of the monoplane. -

Inward Remittance — Quick Reference Guide

Inward Remittance — Quick Reference Guide How to instruct a Remitting Bank to remit funds to your account with BOCHK Please instruct the Remitting Bank to send a detailed payment instruction in SWIFT MT103 format to us using the below SWIFT BIC of BOCHK. To designate BOCHK as the Beneficiary’s bank, please provide below details. SWIFT BIC: BKCHHKHHXXX Bank Name: BANK OF CHINA (HONG KONG) LIMITED, HONG KONG Main Address: BANK OF CHINA TOWER, 1 GARDEN ROAD, CENTRAL, HONG KONG Bank Code: 012 (for local bank transfer CHATS / RTGS only) Please provide details of your account for depositing the remittance proceeds. Beneficiary’s Account Number: Please provide the 14-digit account number to deposit the incoming funds. (Please refer to Part 3 for further explanation.) Beneficiary’s Name: Please provide the name of the above account number as in our record. Major Clearing Arrangement and Correspondent Banks of BOCHK CCY SWIFT BIC Name of Bank Details Bank of China (Hong Kong) Ltd - RMB BKCHHKHH838 BOCHK’s CNAPS No.: 9895 8400 1207 Clearing Centre CNY BKCHCNBJXXX Bank of China Head Office, Beijing Direct Participant of CIPS (Payment through CIPS) BKCHCNBJS00 Bank of China, Shanghai Correspondent Bank of BOCHK in the mainland CCY SWIFT BIC Name of Bank CCY SWIFT BIC Name of Bank AUD BKCHAU2SXXX Bank of China, Sydney NOK DNBANOKKXXX DNB Bank ASA, Oslo Bank Islam Brunei Darussalam NZD BND BIBDBNBBXXX ANZBNZ22XXX ANZ National Bank Ltd, Wellington Berhad CAD BKCHCATTXXX Bank of China (Canada), Toronto SEK NDEASESSXXX Nordea Bank AB (Publ), Stockholm CHF UBSWCHZH80A UBS Switzerland AG, Zurich SGD BKCHSGSGXXX Bank of China, Singapore DKK DABADKKKXXX Danske Bank A/S, Copenhagen THB BKKBTHBKXXX Bangkok Bank Public Co Ltd, Bangkok Commerzbank AG, Frankfurt AM COBADEFFXXX CHASUS33XXX JPMorgan Chase Bank NA, New York EUR Main BKCHDEFFXXX Bank of China, Frankfurt USD CITIUS33XXX Citibank New York GBP BKCHGB2LXXX Bank of China, London BOFAUS3NXXX Bank of America, N.A. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP.