Financing a Net-Zero Economy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank of America Corporation Amicus Brief

Nos. 19-675 & 19-688 IN THE BANK OF AMERICA CORPORATION, et al., Petitioners, v. CITY OF MIAMI, FLORIDA, Respondent. WELLS FARGO & CO., et al., Petitioners, v. CITY OF MIAMI, FLORIDA, Respondent. On Petitions for Writs of Certiorari to the United States Court of Appeals for t he Eleventh Circuit BRIEF OF THE AMERICAN BANKERS ASSOCIATION, AMERICAN FINANCIAL SERVICES ASSOCIATION, BANK POLICY INSTITUTE, CONSUMER BANKERS ASSOCIATION, INDEPENDENT COMMUNITY BANKERS OF AMERICA, MORTGAGE BANKERS ASSOCIATION, CREDIT UNION NATIONAL ASSOCIATION AND NATIONAL ASSOCIATION OF FEDERALLY-INSURED CREDIT UNIONS AS AMICI CURIAE S UPPORT ING PETITIONERS Robert A. Long, Jr. Counsel of Record Jordan V. Hill COVINGTON & BURLING LLP One CityCenter 850 Tenth Street, N.W. Washington, DC 20001-4956 [email protected] (202) 662-6000 Counsel for Amici Curiae TABLE OF CONTENTS Page TABLE OF AUTHORITIES ....................................... ii INTEREST OF AMICI CURIAE ............................... 1 SUMMARY OF ARGUMENT .................................... 4 ARGUMENT .............................................................. 7 I. This Case Presents an Issue of Exceptional Importance That Warrants This Court’s Review. ........................................ 7 II. The Court of Appeals Failed to Heed This Court’s Decision. ............................................ 10 III. Other Plaintiffs Are Well-Positioned to Enforce the FHA ............................................ 13 CONCLUSION ......................................................... 17 i ii TABLE OF AUTHORITIES Page(s) Cases Associated Gen. Contractors of Cal., Inc. v. Carpenters, 459 U.S. 519 (1983) ................................ 6 Bank of America v. City of Miami, Florida, 137 S. Ct. 1296 (2017) ..................................... passim City of Miami Gardens, v. Bank of America Corp., No. 1:14-cv-22202 (S.D. Fla., filed June 13, 2014) ............................................................ 7 City of Miami Gardens v. Citigroup, Inc., No. 1:14-cv-22204 (S.D. -

Wall Street Money in Washington Report Here

2017-18 Election April 2019 Cycle Wall Street Money in Washington 2017-2018 Campaign and Lobby Spending by the Financial Sector In the 2017–18 election cycle, Wall Street banks and financial interests reported spending almost $2 billion to influence decision-making in Washington.1 That total – of officially reported expenditures on campaign contributions and lobbying – works out to more than $2.5 million per day. A total of 443 financial sector companies and trade associations spent at least $500,000 each during this period.2 Since 2008, financial industry spending has increased to levels even higher than they were before the financial crisis, and the spending in this cycle was the highest yet for a non-presidential year. This continued high level of spending reflects the ongoing battle to reshape the financial system and the industry’s persistent efforts to repeal or win exemptions from parts of the Dodd-Frank financial reform law, to weaken implementing regulations, to further deregulate, and to forestall proposals for accountability and change. Additional Highlights Campaign Contributions. Individuals and entities associated with the financial sector reported making $921,790,861 in contributions to federal candidates for office during this election cycle (2017-18 for House candidates and 2013-2018 for Senate candidates) through December 31, 2018 (as reported by February 12, 2019).3 The financial sector’s contributions were significantly greater than those of any other specific business sector identified in the Center for Responsive Politics data. Of the $519,619,263 in party-coded contributions by individuals and PACs associated with finance, 53% went to Republicans and 47% went to Democrats. -

BPI Testimony

“The Legacy of George Floyd: An Examination of Financial Services Industry Commitments to Economic and Racial Justice” Testimony of Fabrice Emmanuel Coles, Vice President, Bank Policy Institute Before the U.S. House of Representatives Committee on Financial Services, Subcommittee on Diversity and Inclusion June 29, 2021 Chairwoman Beatty, Ranking Member Wagner, Chairwoman Waters, Ranking Member McHenry and Honorable Members of the Subcommittee, thanks so much for having me here today. I’m honored to appear before you. My name is Fabrice Coles and I appreciate the invitation to discuss the efforts of the banking industry to address racial inequality. I am a Vice President of Government Affairs at the Bank Policy Institute, a nonpartisan public policy, research and advocacy group representing the nation’s leading banks. BPI members include universal banks, regional banks and the major foreign banks doing business in the United States. Collectively, they employ nearly 2 million Americans, make 68 percent of all loans and nearly half of the nation’s small business loans and serve as an engine for financial innovation and economic growth. Madame Chair and esteemed Members of this Committee, I have worked with these financial institutions since 2019. I am here today to report that the nation’s banks are rising up to meet the moment, helping reduce racial inequity by leveraging business models, networks and resources to better serve Black communities. Banks are actively engaged across the country in efforts to bring change – especially in the wake of the deadly pandemic and global awakening brought about by the murder of George Floyd. -

600 13Th St NW, Suite 400 Washington

Appendix: Sample of Racial Equity Efforts by BPI Member Banks This list is a sample compiled by the Bank Policy Institute of our members’ efforts and does not represent a comprehensive list of all BPI member activities. Additionally, categorization of each announcement was determined by BPI. Release Member Bank Effort Category Resource Date Ally Ally Supports New Affordable 6/23/2021 Community Development Read More Homes In A Historically Black Neighborhood In Charlotte Ally Provides Scholarships With 2/2/2021 Scholarships Read More The Congressional Black Caucus Foundation, The Thurgood Marshall College Fund And Other Organizations Supporting Black And Brown Students In An Effort To Fill Opportunity Gaps And Expand Career Options Ally Launched Moguls In The 10/7/2020 Career Development Read More Making, An Entrepreneur Pitch Competition In Collaboration With The Thurgood Marshall College Fund And The Sean Anderson Foundation, To Offer Students From Historically Black Colleges And Universities (HBCUs) An Opportunity To Develop Vital Skills And To Secure Paid Internships And Full-Time Employment -1- 600 13th St. NW, Suite 400, Washington, DC 20005 | www.bpi.com | @bankpolicy | 202.289.4322 Release Member Bank Effort Category Resource Date Ally (Contd.) New Ally Charitable Foundation 9/24/2020 Grants Read More To Focus On Economic Mobility Foundation To Make $1.6 Million In Inaugural Grants, Including Support For Minority-Owned Small Businesses Statement: Ally's Commitment To 6/2/2020 Awareness Read More Racial Justice And Equity In Our -

Download Issue

FOR THE RECORD 9 Greg Baer, THE QUARTERLY JOURNAL OF THE CLEARING HOUSE AND BANK POLICY INSTITUTE Bank Policy Institute MY PERSPECTIVE 14 Jim Colassano, The Clearing House Q1 2019, VOLUME 7, ISSUE 1 STATE OF BANKING 20 Michael O’Grady, Northern Trust THE NEXT CRISIS IMPACT THROUGH SPECIALIZATION Oliver Wyman is a global leader in management consulting that combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. Visit us at: www.oliverwyman.com Leveraging our broad regulatory knowledge and global capabilities, our market-leading financial regulatory practice helps clients around the world cultivate relationships with regulators, deliver innovative solutions to increasingly complex issues, and benefit from the opportunities presented by regulatory reform initiatives and market developments. This focus on regulatory activity across geographies and the excellence of our U.S., U.K. and European practices in particular make us the international law firm of choice for clients with difficult regulatory challenges in their home jurisdictions that are also seeking to meet global best practices. Backed by clear technical advice and strong relationships with regulators, our thought leaders advise clients on the laws and regulations of the world’s key financial and commercial centers, particularly on how local initiatives fit into the global regulatory architecture. With a deep understanding of the key issues affecting our financial services clients, we often act as an extension of our clients’ own legal team — pragmatic, commercial and solutions-oriented. We know your business. For more information, visit www.shearman.com. THE QUARTERLY JOURNAL OF THE CLEARING HOUSE AND BANK POLICY INSTITUTE Q1 2019, VOLUME 7, ISSUE 1 UPFRONT FEATURED ARTICLES For the Record Banks and the Next Recession 9 Has the enhanced resilience and resolvability of 26 Bankers and regulators must consider how changes in the large banks reduced the likelihood of another financial system could affect us in the next recession. -

Trading Revenue and Stress Tests

Trading Revenue and Stress Tests 12.17.20 In addition to extending loans to households and businesses, the largest banks earn revenue from Francisco Covas trading, investment banking and other advisory services as part of their market-making and [email protected] underwriting activities on behalf of customers. These sources of noninterest income help these banks diversify against loan losses during economic recessions and reductions in net interest 1 income typically registered during periods of correspondingly low interest rates. Anna Harrington In this note, we examine whether the benefit of this diversification is adequately recognized in the [email protected] U.S. stress tests. In reality, mark-to-market losses on these activities—losses that banks’ trading assets experience when prices fall (for long positions) or rise (for short positions)—are being “double-counted” in the U.S. stress tests. The double-count arises from the inclusion of trading Bill Nelson losses in both the global market shock (GMS) and, separately, in trading revenue. This duplication [email protected] mitigates the benefits of diversification. Banks with large trading operations and private equity exposures are subject to the GMS, which applies to 11 of the 33 banks subject to the stress tests.2 The GMS is a set of instantaneous, hypothetical shocks to a large set of risk factors, intended to capture mark-to-market losses that banks with large trading operations could experience during a sudden market stress.3 Generally, these shocks involve large and sudden changes in asset prices, interest rates and spreads, reflecting general market distress and heightened uncertainty.4 In addition, the stress tests also include a separate projection for trading revenue, which is a subcomponent of noninterest income. -

The Decline of Too Big to Fail

The Decline of Too Big to Fail By ANTJE BERNDT,DARRELL DUFFIE, AND YICHAO ZHU* For globally systemically important banks (GSIBs) with U.S. headquarters, we find significant post-Lehman reductions in market-implied probabilities of government bailout, along with 50%-to-100% higher wholesale debt financing costs for these banks after controlling for insolvency risk. The data are consis- tent with measurable effectiveness for the official sector’s post- Lehman GSIB failure-resolution intentions, laws, and rules. GSIB creditors now appear to expect to suffer much larger losses in the event that a GSIB approaches insolvency. In this sense, we esti- mate a major decline of “too big to fail.” JEL: G12, G13, G21, G28 Keywords: Too big to fail, systemically important banks, govern- ment bailouts * Berndt: Professor of Finance, College of Business and Economics, Australian National Univer- sity, 26C Kingsley Street, Acton, ACT 2601, Australia, [email protected]. Duffie: Adams Distinguished Professor of Management and Professor of Finance, Graduate School of Business, Stanford University, 655 Knight Way, Stanford, CA 94305, duffi[email protected]. Zhu: Senior Lec- turer (Assistant Professor) in Finance, College of Business and Economics, Australian National University, 26C Kingsley Street, Acton, ACT 2601, Australia, [email protected]. Duffie is a research fellow of the National Bureau of Economic Research. Between October 2008 and April 2018, Duffie was on the board of directors of Moody’s Corporation, which supplied some of the data used in this -

Proposed Revisions to Prohibitions and Restrictions on Proprietary

October 16, 2018 By Electronic Mail Ann E. Misback, Secretary Legislative and Regulatory Activities Board of Governors of the Division Federal Reserve System Office of the Comptroller of the Currency 20th Street and Constitution Avenue NW 400 7th Street SW Washington, DC 20551 Suite 3E-218 Washington, D.C. 20219 Robert E. Feldman Brent J. Fields, Secretary Executive Secretary Securities and Exchange Commission Attention: Comments/Legal ESS 100 F Street NE Federal Deposit Insurance Corporation Washington, DC 20549-1090 550 17th Street NW Washington, DC 20429 Christopher Kirkpatrick, Secretary Commodity Futures Trading Commission 1155 21st Street NW Washington, DC 20581 Re: Proposed Revisions to Prohibitions and Restrictions on Proprietary Trading and Certain Interests In, and Relationships With, Hedge Funds and Private Equity Funds Docket No. R-1608; RIN 7100-AF 06 (Federal Reserve); Docket ID OCC- 2018-0010 (OCC); RIN 3064-AE67 (FDIC); File No. S7-14-18 (SEC); RIN 3038- AE72 (CFTC) Ladies and Gentlemen: We appreciate the opportunity to comment on the notice of proposed rulemaking (“Proposal”)1 issued by the Office of the Comptroller of the Currency (“OCC”), the Board of Governors of the Federal Reserve System (“Federal Reserve”), the Federal Deposit Insurance Corporation (“FDIC”), the Securities and Exchange Commission (“SEC”), and the Commodity Futures Trading Commission (“CFTC”) (together, the “Agencies”) seeking the public’s input on how the final rules (“Final Rule”) 2 implementing section 13 of the Bank Holding Company Act of 1956, 12 U.S.C. §1851 (“Volcker Rule” or “Statute”), should be amended to provide banking entities with clarity about what activities are prohibited and to improve supervision and 1 See Proposed Revisions to Prohibitions and Restrictions on Proprietary Trading and Certain Interests in, and Relationships With, Hedge Funds and Private Equity Funds, 83 Fed. -

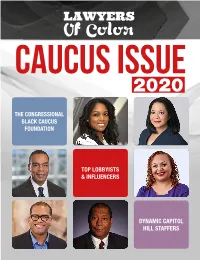

LAWYERS of Color Caucus Issue 2020

LAWYERS Of Color Caucus Issue 2020 THE CONGRESSIONAL BLACK CAUCUS FOUNDATION TOP LOBBYISTS & INFLUENCERS DYNAMIC CAPITOL HILL STAFFERS Hogan Lovells, including partners Ari Fitzgerald and Lillian S. Hardy, supports Lawyers of Color and lobbyists of color. Hogan Lovells is an international legal practice that includes Hogan Lovells International LLP, Hogan Lovells US LLP and their affiliated businesses. Images of people may feature current or former lawyers and employees at Hogan Lovells or models not connected with the firm. www.hoganlovells.com © Hogan Lovells 2020. All rights reserved. Our Team Christopher Nelson - Editor at Large Gabriela Martinez - Administrator Kaitlyn Williamson - Coordinator Yolanda Young - President & Executive Director awyers of Color is a 501(c)(3) devoted to promoting diversity in the legal profession and advancing democracy and equality in margin- alized communities. WeL conduct and commission research and studies regarding the intersec- tion of the legal profession and social justice. We also create and curate articles, blogs, studies, and videos. Our global online community advocates for the well-being of our people, especially marginalized communities. We mobilize to eradicate injustice. We give change agents a vehicle to respond quickly and forcefully to oppressive and damaging policies and systems. We motivate business, political, and community leaders to effect change and advance equality. Hogan Lovells, including partners Ari Fitzgerald and Lillian S. Hardy, supports Lawyers of Color and lobbyists of color. Hogan Lovells is an international legal practice that includes Hogan Lovells International LLP, Hogan Lovells US LLP and their affiliated businesses. Images of people may feature current or former lawyers and employees at Hogan Lovells or models not connected with the firm. -

Wall Street Money in Washington 2019–2020 Campaign and Lobby Spending by the Financial Sector

2019–20 March 2021 Election Cycle Wall Street Money in Washington 2019–2020 Campaign and Lobby Spending by the Financial Sector In the 2019–20 election cycle, Wall Street banks and financial services interests reported spending $2.9 billion to influence decision-making in Washington.1 That total – officially reported expenditures on campaign contributions and lobbying – works out to $4 million a day. A total of 591 financial sector companies and trade associations spent at least $500,000 each during this period. In the last election cycle, the financial services industry boosted spending on politics to its highest level ever, a full 50 percent above the previous record of $2 billion in the presidential cycle of 2015-16. The extraordinary amount of cash reflects the industry’s enduring effort to influence policy no matter which party controls Congress and the executive branch. It also reflects, for those Democrats who sought their party’s presidential nomination, an expensive primary process. Wall Street poured money into campaign coffers of both presidential candidates and seems to have made a particular effort to preserve Republican control of the Senate to both lock in pro-industry measures passed during the Trump administration and to forestall reform under President Biden.2 Notably, the contributions from the financial sector3 to organizations making independent expenditures exploded in the 2019-20 cycle, to more than double the level reported in the last presidential cycle. All these contributions flowed before the country began a much-needed debate on corporate money in politics in the wake of the Jan. 6 insurrection at the U.S. -

International Banking Standards & Regulatory

FOR THE RECORD 9 Greg Baer, BPI THE QUARTERLY JOURNAL OF THE CLEARING HOUSE AND BANK POLICY INSTITUTE OUR PERSPECTIVE 14 Stephanie Heller & Rob Hunter, TCH, and Richard Taffet, Morgan Lewis Q3 2018, VOLUME 6, ISSUE 3 STATE OF BANKING 16 Andy Cecere, U.S. Bancorp INTERNATIONAL BANKING STANDARDS & REGULATORY BALKANIZATION Quarter after quarter, global business continues to speed up. Sullivan & Cromwell has been helping financial services clients stay the course for more than a century. We provide high-quality counsel and intense dedication to solving the complex issues faced by the financial services industry. Our market leading Financial Services practice focuses on M&A, finance and capital raising, complex regulatory issues, corporate governance, legislative developments, significant litigation and enforcement matters, corporate investigations and tax matters. For more information, please contact: H. Rodgin Cohen Mitchell S. Eitel Michael M. Wiseman [email protected] [email protected] [email protected] www.sullcrom.com new york . washington, d.c. los angeles . palo alto london . paris . frankfurt . brussels tokyo . hong kong . beijing . melbourne . sydney LG5983_Clearing House Annual Ad_Banking Perspective Mag_2018.indd 1 7/25/2018 2:28:20 PM We’ve never lost sight of putting others first. At BB&T, we make sure you get the attention you deserve. We know how important it is to listen and understand your needs so you can live your best financial life. So while everyone else may be distracted with other things, rest assured, our focus remains on you. Member FDIC. Only deposit products are FDIC insured. THE QUARTERLY JOURNAL OF THE CLEARING HOUSE AND BANK POLICY INSTITUTE Q3 2018, VOLUME 6, ISSUE 3 UPFRONT FEATURED ARTICLES For the Record Do Ring Fences Make 9 The regulatory and examination regime applied to 28 Good Neighbors? foreign banks operating in the U.S. -

January 4, 2021 Via Electronic Mail Office of The

January 4, 2021 Via Electronic Mail Office of the Comptroller of the Currency 400 7th Street, SW, Suite 3E-218 Washington, DC 20219 Re: Fair Access to Financial Services (RIN 1557-AFO5) Ladies and Gentlemen: The Bank Policy Institute1 appreciates the opportunity to comment on the Office of the Comptroller of the Currency’s notice of proposed rulemaking regarding fair access to financial services.2 Given the Proposal’s serious substantive and procedural deficiencies, which we describe below, we strongly urge the OCC to withdraw the Proposal. The Proposal would create a unique, far-reaching precedent in instructing national banks—under threat of enforcement action—to make or not make certain loans and provide other financial services. Under the Proposal, national banks could no longer consider the range of factors they have traditionally taken into account, both in the context of applying their own sound risk management practices and meeting the OCC’s supervisory expectations, when deciding whether and how to provide a customer with financial services. Given these critical deficiencies and their serious consequences, it is only appropriate that the Proposal is withdrawn. I. Executive Summary The stated goal of the Proposal is to ensure that national banks provide fair access to financial services. However, the Proposal’s approach to promoting fair access is impractical, unworkable and inconsistent with safe and sound banking practices. The Proposal would impose a series of requirements that are vague and overbroad, going well beyond any purported concerns over businesses’ and consumers’ access to financial services. Instead, by providing for the government to dictate the business and risk management decisions of the banking industry, the Proposal would fundamentally alter the manner in which banks conduct their business.