Annual Report 2017-18 Padma Vibhushan Shri Dhirubhai H

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dhirubhai H. Ambani

Annual Report 2014-15 Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Infrastructure Limited (RInfra), part of the Reliance Group was incorporated in 1929 and is amongst the largest and fastest growing companies in the infrastructure sector. RInfra is developing projects through various Special Purpose Vehicles (SPVs) in several high growth sectors within the infrastructure space i.e. Roads, Metro Rail and Cement. RInfra is also the leading utility company having presence across the value chain of power businesses i.e. Generation, Transmission, Distribution and Power Trading. RInfra through its SPVs has executed a portfolio of infrastructure projects such as a metro rail project in Mumbai on build, own, operate and transfer (BOOT) basis; eleven road projects with total length of 1,000 kms on build, operate and transfer (BOT) basis and three cement plants of combined capacity of five million tonnes each in Maharashtra and Madhya Pradesh of which the plant in Madhya Pradesh has commenced commercial production. RInfra along with its wholly owned subsidiary company generates over 941 MW of power through its five power stations; distributes power to over 64 lakh consumers in Mumbai and Delhi. RInfra subsidiary companies have commissioned three transmission projects by installing ten national grid lines, being the first set of lines commissioned in India by the private sector. RInfra also provides Engineering, Procurement and Construction (EPC) services for developing power and road projects. Mission: Excellence in Infrastructure • To attain global best practices and become a world-class utility. • To create world-class assets and infrastructure to provide the platform for faster, consistent growth for India to become a major world economic power. -

KPMG FICCI 2013, 2014 and 2015 – TV 16

#shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 kpmg.com/in ficci-frames.com We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Images Courtesy: 9X Media Pvt.Ltd. Phoebus Media Accel Animation Studios Prime Focus Ltd. Adlabs Imagica Redchillies VFX Anibrain Reliance Mediaworks Ltd. Baweja Movies Shemaroo Bhasinsoft Shobiz Experential Communications Pvt.Ltd. Disney India Showcraft Productions DQ Limited Star India Pvt. Ltd. Eros International Plc. Teamwork-Arts Fox Star Studios Technicolour India Graphiti Multimedia Pvt.Ltd. Turner International India Ltd. Greengold Animation Pvt.Ltd UTV Motion Pictures KidZania Viacom 18 Media Pvt.Ltd. Madmax Wonderla Holidays Maya Digital Studios Yash Raj Films Multiscreen Media Pvt.Ltd. Zee Entertainmnet Enterprises Ltd. National Film Development Corporation of India with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars: FICCI-KPMG Indian Media and Entertainment Industry Report 2015 Foreword Making India the global entertainment superpower 2014 has been a turning point for the media and entertainment industry in India in many ways. -

FOE/:6”???A Anil C Shah Company Secretary

Reliance infrastructure Limited ‘ A Reliance Centre Tel: +91 22 3303 1000 1 q Santacruz (E) Fax: +91 22 3303 1564 Mumbai 400 055 www.rinfra.com CIN: L75100MH1929PLCOO1530 April 6, 2019 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, 5‘h Floor, Dalal Street, Plot No. 0/1, G Block, Mumbai 400 001 Bandra Kurla Complex, BSE Scrip Code: 500390 Bandra (East), Mumbai 400 051 NSE Scrip Symbol: RELINFRA Dear Sirs, Sub: Appointment of Executive Director and Chief Executive Officer of the Company. We wish to inform you that consequent to the superannuation of Shri Laiit Jalan, the Chief Executive Officer of the Company, the Board of the Company at its meeting held today, has appointed Shri Punit Garg as the Executive Director and Chief Executive Officer of the Company, with effect from April 6, 2019. The requisite information pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements), 2015, is enclosed. Yours faithfully Infrastructure Limited 1 FOE/:6”???A Anil C Shah Company Secretary Encl. :- As above. Registers] Office: H Block, tsf Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710 m Annexure Information pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements), 2015 1. Reason for change: a. Appointment of Shri Punit Garg as an Executive Director and Chief Executive Officer of the Company. b. Superannuation of Shri Lalit Jalan as Chief Executive Officer of the Company. 2. Date of appointment, Cessation and Term of appointment: The appointment of Shri Punit Garg as an Executive Director and Chief Executive Officer and superannuation of Shri Lalit Jalan as Chief Executive Officer of the Company with effect from April 6, 2019. -

Reliance Infrastructure

Reliance Infrastructure Q3FY10 Post Result Conference Call Transcript Representative: Mr. Lalit Jalan - CEO and Wholetime Director Mr. S.C. Gupta - Director Mr. Madhukar Moolwaney - Senior Vice President-Finance and Accounts Mr. K.P.Maheshwari - Head of Metro Mr. Sudhir Hosing - Head of Road PL Rep.: Rupa Shah – 91-22-6632 2244 Date: 30th January, 2010 Ms. Rupa Shah - Prabhudas Lilladher Good afternoon everyone. Welcome to the Reliance Infra Q3 FY10 earnings conference call. We have with us, Mr. Lalit Jalan, CEO - Reliance Infrastructure, CEO and Wholetime Director of Reliance Infra, along with the senior team management, represented by Mr. S.C. Gupta, Director, Mr. Madhukar Moolwaney, Senior Vice President-Finance and Accounts, Mr. K.P.Maheshwari, Head of Metro, and Mr. Sudhir Hosing, Head of Road. What we can do is start with opening remarks by Mr Lalit Jalan, and then we can move to the Q&A. Over to you sir. Mr. Lalit Jalan, CEO - Reliance Infrastructure Yes. Good morning, this is Lalit Jalan here. And welcome to this third quarter conference call for Reliance infrastructure. I will start by quickly running through the key numbers for this quarter. Our total operating income for the quarter was, on a standalone basis, 2287 crores. Vs. 2718 crores, in the corresponding period of last year. And this reduction in topline is due to the lower FAC, that is the fuel adjustment charge, of our Mumbai circle which has been there due to the power purchase cost, that we buy from external sources. Our purchase cost from external sources has gone down, very substantially and that is reflecting in the lower billing value. -

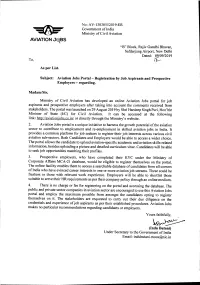

(VC) for Civil Aviation. It Can Be Accessed at the Following Link: Http:Iiaviationjobs.Co.In/ Or Directly Through the Ministry's Website

No: AV- 13030/ 5 120 1 9-ER Government of India Ministry of Civil Aviation AVTATTON JqBS "8" Block, Rajiv Gandhi Bhavan, Safclarjung Airport, New Delhi Dated: y0912019 To, t?/ As per List. Subject: Aviation Jobs Portal - Registration by Job Aspirants and Prospective Employers - regflrding. Madam/Sir, Ministry of Civil Aviation has developed an online Aviation Jobs portal for job aspirants and prospective employers after taking into account the comments received from stakeholders. The portal was launched on 29 August 2019 by Shri Hardeep Singh Puri, Hon'ble Minister of State (VC) for Civil Aviation. It can be accessed at the following link: http:iiaviationjobs.co.in/ or directly through the Ministry's website. 2. Aviation Jobs portal is a unique initiative to harness the growth potential ofthe aviation sector to contribute to employment and re-employment in skilled aviation jobs in India. It provides a common platform for job seekers to register their job interests across various civil aviation sub-sectors. Both Candidates and Employers would be able to access a wider choice. The portal allows the candidate to upload aviation-specific academic and aviation skills-related information, besides uploading a picture and detailed curriculum vitae. Candidates will be abte to seek job opportunities matching their profiles. 3. Prospective employers, who have completed their KYC under the Ministry of Corporate Affairs MCA-21 database, would be eligible to register themselves on the portal. The online facility enables them to access a searchable database of candidates from all corners of India who have evinced career interests in one or more aviation job streams. -

October 30 the Gener Corporate BSE Limite Phiroze Je Dalal Stree

Reliance Infrastructure Limited Corporate Office: 3rd floor, north wing Tel: +91 22 3303 1000 Reliance Energy Centre Fax:+91 22 3303 3664 Santa Cruz (East) www.rinfra.com Mumbai 400 055 CIN : L75100MH1929PLC001530 October 30, 2017 The General Manager The Manger Corporate Relationship Department National Stock Exchange of India limited BSE Limited Plaza, 5th Floor, Plot no.C/1, G Block Phiroze Jeejeeboy Towers Bandra Kurla Complex, Bandra (E) Dalal Street, Fort Mumbai 400 051 Mumbai 400 001 NSE Scrip Symbol: RELINFRA BSE Scrip Code: 500390 Dear Sirs, Sub: Filing of Annual Report 2016-17 under Regulation 34 (1) Pursuant to Regulation 34 (1) and all other applicable regulations of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations), we enclose herewith the Annual Report for the financial year 2016-17. Kindly take the same on record and inform your members accordingly. Yours faithfully, For Reliance Infrastructure Limited Ramesh Shenoy Company Secretary Encl. :- Ass above. Annual Report 2016-17 Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Infrastructure Limited (RInfra), constituent of the Reliance Group was incorporated in 1929 and is one of the largest infrastructure companies, developing projects through various Special Purpose Vehicles (SPVs) in several high growth sectors such as power, roads, metro rail and airport in the infrastructure space and the defence sector. RInfra is also a leading utility company having presence across the value chain of power businesses i.e. generation, transmission, distribution and power trading. RInfra through its SPVs has executed a portfolio of infrastructure projects such as a metro rail project in Mumbai on build, own, operate and transfer (BOOT) basis; eleven road projects with total length of about 1,000 kms on build, operate and transfer (BOT) basis. -

IIM-Ahmadabad and Harvard Tie up to Train Indian Taxmen First FYUP

Financial Exp ND 8.07.2014 p-2 IIM-Ahmadabad and Harvard tie up to train Indian taxmen Fe Bureau In a major branding exercise both for India's top B-school IIM Ahmedabad and babus of the much-feared Income Tax department, the former has roped in no less than the Harvard Business School (HBS) to train taxmen to become more citizen friendly and responsive. IIM-A's Executive Education wing has tied up with HBS Executive Education to offer a four-week course to senior officials of the Income Tax department to provide perspective, skills and insights. “One of our key priorities is to connect not only with the private sector but also with public sector institutions, and renowned B- schools,” said Professor Ashish Nanda, director, IIM-A. Thirty Central Board of Direct Taxes officials of the rank chief commissioner of income tax and above will spend two weeks at the IIM-A campus and two weeks at the HBS campus. http://www.financialexpress.com/news/iima-and-harvard-tie-up-to-train-indian- taxmen/1267717 Times of India ND 8.07.2014 p-3 First FYUP batch in dark over course NEW DELHI : There is an entire batch of students that's carrying the baggage of the four-year- undergraduate programme (FYUP) and will do so for another two years. Classes for the new academic session are set to start in two weeks but the university administration seems in no hurry to come to its help. Its silence over convening of the academic council for initiating structural changes has once again forced the students and teachers to the path of agitation. -

Reliance Infrastructure Limited Q1 FY18 Earnings Conference Call of Reliance Infrastructure Limited August 03, 2017

Reliance Infrastructure Limited Q1 FY18 Earnings Conference Call of Reliance Infrastructure Limited August 03, 2017 Moderator: Ladies and gentlemen, good day and welcome to the Q1 FY18 Earnings Conference Call of Reliance Infrastructure Limited. As a reminder, all participant lines will be in the listen-only mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. Please note that this conference is being recorded. I would now like to hand the conference over to Mr. Lalit Jalan – CEO and Group Director, Strategy and Corporate Affairs. Thank you and over to you, sir. Lalit Jalan: Good Afternoon, friends, and a very warm welcome to Reliance Infrastructure’s Q1 Earnings Concall. The company continues on its well articulated strategy which was informed to all the analysts and the investors. The numbers, the Media Release and the Results are all with you. I will quickly go through the highlights over the next 15-20 minutes and then we will open the floor to as many questions as you might have. Coming to the key numbers: The standalone total income for the quarter has been at Rs. 3,209 crores which is a slight increase of 2%, the standalone EBITDA is at Rs. 1,449 crores which is a strong growth of 16% and the standalone net profit is at Rs. 417 crores which is a growth of 5%. Coming to the consolidated numbers: We have the consol income at Rs. -

Reliance Power Limited (We Were Originally Incorporated As Bawana Power Private Limited on January 17, 1995

Prospectus Please read Section 60 of the Companies Act, 1956 100% Book Built Offer Dated January 19, 2008 Reliance Power Limited (We were originally incorporated as Bawana Power Private Limited on January 17, 1995. For details of the change in our name and registered office, see “History and Certain Corporate Matters” on page 126 of this Prospectus.) Registered and Corporate Office: H Block, First Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710, Maharashtra Company Secretary and Compliance Officer: Mr. Paresh Rathod Tel: (91 22) 3038 6010; Fax: (91 22) 3037 6633; Email: [email protected]; Website: www.reliancepower.co.in PUBLIC ISSUE OF 260,000,000 EQUITY SHARES OF Rs. 10 EACH OF RELIANCE POWER LIMITED (“RELIANCE POWER” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF Rs. 450# PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF Rs. 440# PER EQUITY SHARE) AGGREGATING TO Rs. 115,632 MILLION (NET OF RETAIL DISCOUNT) (THE “ISSUE”). THE ISSUE COMPRISES A NET ISSUE TO THE PUBLIC OF 228,000,000 EQUITY SHARES AGGREGATING TO Rs. 101,232 MILLION (NET OF RETAIL DISCOUNT) ("THE NET ISSUE") AND A PROMOTERS’ CONTRIBUTION OF 32,000,000 EQUITY SHARES AGGREGATING Rs. 14,400 MILLION. THE ISSUE WILL CONSTITUTE 11.5% OF THE POST ISSUE PAID-UP CAPITAL OF THE COMPANY AND THE NET ISSUE WILL CONSTITUTE 10.1% OF THE POST ISSUE PAID-UP CAPITAL OF THE COMPANY. ISSUE PRICE: Rs. 450 PER EQUITY SHARE OF FACE VALUE Rs. 10 EACH# THE ISSUE PRICE IS 45 TIMES THE FACE VALUE # A discount of Rs. -

Annual Report 2017-18 (Abridged) Padma Vibhushan Shri Dhirubhai H

Annual Report 2017-18 (Abridged) Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Infrastructure Limited (RInfra), Constituent of the Reliance Group was incorporated in 1929 and is one of the largest infrastructure companies, developing projects through various Special Purpose Vehicles (SPVs) in several high growth sectors such as power, roads, metro rail and airport in the infrastructure space and in the defence sector. RInfra is a major player in providing Engineering, Procurement and Construction (EPC) services for developing power, infrastructure, metro and road projects. RInfra is also a leading utility Company having presence across the value chain of power businesses i.e. generation, transmission, distribution and power trading. Mission: Excellence in Infrastructure • To attain global best practices and become a world-class Company. • To create world-class assets and infrastructure to provide the platform for faster, consistent growth for India to become a major world economic power. • To achieve excellence in service, quality, reliability, safety and customer care. • To earn the trust and confidence of all customers and stakeholders, exceeding their expectations and make the Company a respected household name. • To work with vigour, dedication and innovation with total customer satisfaction as the ultimate goal. • To consistently achieve high growth with the highest levels of productivity. • To be a technology driven, efficient and financially sound organisation. • To be a responsible corporate citizen nurturing human values and concern for society, the environment and above all people. • To contribute towards community development and nation building. • To promote a work culture that fosters individual growth, team spirit and creativity to overcome challenges and attain goals. -

Institutional Equities

Institutional Equities This page has been intentionally left blank IV Institutional Equities Infrastructure Sector 26 September 2011 Light At The End Of The Tunnel View: Positive The infrastructure sector has witnessed many pitfalls in the last two years which have hurt investor sentiment. We believe the valuation of the sector is Amit Srivastava close to the bottom as the stocks of infrastructure companies have corrected [email protected] between 60%-75% in the period July 2010 to August 2011. Post correction, they +91-22-3926 8116 are trading 33%-47% below their five-year historical average price-to-earnings of 20x-44x. We believe slower order inflow, rising interest rates, regulatory issues Nitin Arora and earnings downgrade have been largely discounted by the market. Although [email protected] we believe the earnings will not improve significantly, concerns over rising +91-22-3926 8169 interest rates, regulatory issues and execution risks are likely to subside in the short term, thereby leading to outperformance by infrastructure stocks. Sector Sector Fundamentals versus valuation: We believe the infrastructure sector is currently moving from a moderation phase to a slowdown phase, and the slowdown has started One Year Indexed Performance hurting profitability (as seen from a sharp decline in earnings in 1QFY12 by 97% YoY) 230 which will continue in the short term. However, as the slowdown has already been 210 190 factored in (stock prices have declined by around 60%- 75% between July 2010 170 150 & August 2011), we believe the sector is set for a re-rating as FY13 net profit for 130 our universe of companies is set to grow by 44%. -

Annual Report 2008-09 (Abridged)

Infrastructure Annual Report 2008-09 (Abridged) Profile Reliance Infrastructure Limited is a part of the Reliance Anil Dhirubhai Ambani Group, India’s second largest business house. Incorporated in 1929, Reliance Infrastructure is one of India’s fastest growing companies in the infrastructure sector. It ranks among India’s top listed private companies on all major financial parameters, including assets, sales, profits and market capitalization. Reliance Infrastructure companies distribute more than 36 billion units of electricity to over 30 million consumers across an area that spans over 1,24,300 sq kms and includes India’s two premier cities, Mumbai and Delhi. The group generates over 940 MW of electricity through its power stations located in Maharashtra, Andhra Pradesh, Kerala, Karnataka and Goa. Reliance Infrastructure has emerged as the leading player in India in the Engineering, Procurement and Construction (EPC) segment of the power sector. In the last few years, Reliance Infrastructure has expanded its foot-print much beyond the power sector. Currently, Reliance Infrastructure group is engaged in the implementation of projects not only in the field of generation, transmission, distribution and trading of power but also in other key infrastructural areas such as highways, roads, bridges, metro rail and other mass rapid transit systems, special economic zones, real estate, etc. Mission: Excellence in Infrastructure To attain global best practices and become a world-class utility. To create world-class assets and infrastructure to provide the platform for faster, consistent growth for India to become a major world economic power. To achieve excellence in service, quality, reliability, safety and customer care.