Your Career in the Games Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contributors

gems_ch001_fm.qxp 2/23/2004 11:13 AM Page xxxiii Contributors Curtis Beeson, NVIDIA Curtis Beeson moved from SGI to NVIDIA’s Demo Team more than five years ago; he focuses on the art path, the object model, and the DirectX ren- derer of the NVIDIA demo engine. He began working in 3D while attending Carnegie Mellon University, where he generated environments for playback on head-mounted displays at resolutions that left users legally blind. Curtis spe- cializes in the art path and object model of the NVIDIA Demo Team’s scene- graph API—while fighting the urge to succumb to the dark offerings of management in marketing. Kevin Bjorke, NVIDIA Kevin Bjorke works in the Developer Technology group developing and promoting next-generation art tools and entertainments, with a particular eye toward the possibilities inherent in programmable shading hardware. Before joining NVIDIA, he worked extensively in the film, television, and game industries, supervising development and imagery for Final Fantasy: The Spirits Within and The Animatrix; performing numerous technical director and layout animation duties on Toy Story and A Bug’s Life; developing games on just about every commercial platform; producing theme park rides; animating too many TV com- mercials; and booking daytime TV talk shows. He attended several colleges, eventually graduat- ing from the California Institute of the Arts film school. Kevin has been a regular speaker at SIGGRAPH, GDC, and similar events for the past decade. Rod Bogart, Industrial Light & Magic Rod Bogart came to Industrial Light & Magic (ILM) in 1995 after spend- ing three years as a software engineer at Pacific Data Images. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

Was Darf in Die Biotonne?

Landkreis München Die neue Trennliste für die Bioabfallvergärungsanlage Kirchstockach Was darf in die Biotonne? Weil unsere Vergärungsanlage letztlich auch nur eine Kuh ist! 1 Bioabfallvergärungsanlage Die Bioabfallvergärungsanlage Brunnthal-Kirchstockach Bioabfall, was ist das? Zur Verwertung des Bioabfalls betreibt der Landkreis München seit mehr als 20 Jahren eine Bioabfallvergärungsanlage im Brunnthaler Ortsteil Kirchstockach. Aufgrund des stetigen und andauernden Einwohnerwachstums stößt die Anlage nun langsam an ihre Kapazitätsgrenzen. Da nicht alles, was in die Biotonne gegeben, wird auch wirklich für die Vergärung geeignet ist, wollen wir Sie mit diesem Merkblatt darüber informieren, was in die Biotonne darf und was nicht. Im Gegensatz zur relativ einfachen Kompostierung, bei der die zu kompostierenden Stoffe zu sogenannten Mieten (Haufwerke) aufgeschichtet und in bestimmten zeitlichen Abständen umgesetzt werden, ist eine Bioabfallvergärungsanlage deutlich komplexer. Im mittleren Teil dieser Broschüre finden Sie eine Liste der Stoffe (Trennliste), die über die Biotonne im Landkreis München gesammelt werden sollen. Daneben finden sich die Stoffe, die nichts in einer Bioabfalltonne zu suchen haben – und zwar aus guten Gründen. Die Biovergärungsanlage in Brunnthal-Kirchstockach. Quelle: Ganser Entsorgung GmbH & Co. KG Sogenannte Mieten oder Haufwerke. 2 3 Bioabfallvergärungsanlage Bioabfallvergärung, wie geht das? Der Bioabfall wird mit Wasser zu einer Art Suppe, Suspension genannt, angerührt. Danach werden alle nicht löslichen Stoffe, wie Plastik, Glas, Knochen, Steine und auch Äste, abgetrennt und entsorgt. Diese Suspension wird in großen Stahlbehältern durch Mikroorganismen Stück für Stück biochemisch zu Methan und Kohlendioxid umgewandelt. Vergärung, was ist das? Wir alle wissen noch aus unserer Schulzeit, dass man Alkohol unter Zuhilfenahme von Mikroorganis- men durch Vergärung von zuckerhaltigen Stoffen gewinnen kann. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Embracer Group

Update Equity Research 2 December 2019 Embracer Group Sector: Gaming Unmotivated share price drop FAIR VALUE RANGE BEAR BASE BULL Beating estimates, again 60.0 100.0 125.0 Embracer crushed our estimates during FY’Q2, the top-line came in 25% above forecast, and Operational EBIT showed a 53% beat. As expected, there was a significant decline in volumes within Partner Publishing, so on an annual basis, the net sales were down 1%. EMBRAC.ST VERSUS OMXS30 However, the Gross profit grew by almost 66%, thanks to the uptake in Games revenue. The OMXS 30 Operational EBIT margin came in at 19% compared to our estimate of 16%. On a trailing- Embracer Group 10.0 twelve -month basis, Embracer has produced almost SEK 2bn in cash flow from operations and continues to show a high cash conversion ratio. 8.0 6.0 Investing for the future 4.0 Embracer continues to invest in its pipeline, and the game investments amounted to SEK 2.0 343m during the quarter. The company now has 86 projects in development, where we 0.0 know that at least two are AAA projects that are expected to be released during the next 03-dec 03-mar 01-jun 30-aug 28-nov financial year. The ratio between released games and ongoing development projects on the balance sheet now amounts to 4x; in other words, continued growth is to be expected. REDEYE RATING Shenmue III was released on the 19th of November. The early user reviews indicate strong receptions from fans but mixed from critics. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

City-Map-2017.Pdf

3 New Town Hall 11 Hofbräuhaus The Kunstareal (art quarter) Our Service Practical Tips Located in walking distance to one another, the rich variety contained in the museums and galleries in immediate proximity to world-renowned München Tourismus offers a wide range of services – personal and Arrival universities and cultural institutions in the art quarter is a unique multilingual – to help you plan and enjoy your stay with various By plane: Franz-Josef-Strauß Airport MUC. Transfer to the City by treasure. Cultural experience is embedded in a vivacious urban space offers for leisure time, art and culture, relaxation and enjoyment S-Bahn S1, S8 (travel time about 40 min). Airport bus to main train featuring hip catering and terrific parks. In the Alte Pinakothek 1 , in the best Munich way. station (travel time about 45 min). Taxi. Neue Pinakothek 2 and Pinakothek der Moderne 3 , Museum By railroad: Munich Hauptbahnhof, Ostbahnhof, Pasing Brandhorst 4 and the Egpytian Museum 5 as well as in the art By car: A8, A9, A92, A95, A96. Since 2008 there has been a low-emission galleries around Königsplatz 6 – the Municipal Gallery in Lenbach- Information about Munich/ zone in Munich. It covers the downtown area within the “Mittlerer Ring” haus 7 , the State Collections of Antiques 8 , the Glyptothek 9 and Hotel Reservation but not the ring itself. Access is only granted to vehicles displaying the the Documentation Center for the History of National Socialism 10 appropriate emission-control sticker valid all over Germany. – a unique range of art, culture and knowledge from more than 5,000 Mon-Fr 9am-5pm Phone +49 89 233-96500 www.muenchen.de/umweltzone 9 Church of Our Lady 6 Viktualienmarkt 6 Königsplatz years of human history can be explored. -

Radwanderkarte Radeln in Der Metropolregion München Nord

Aussichtspunkt Besucherpark Flughafen Aussichtspunkt München Besucherpark Flughafen München Aussichtspunkt mit Blick auf Neufahrner Terminal 2 Mühlseen Aussichtspunkt mit Blick auf Neufahrner Terminal 2 Mühlseen Radwanderkarte Radeln in der Metropolregion München Nord Burgstall Burgstall Erchinger Schloss Erchinger Schloss Echinger Lohe Echinger Lohe Die Region der NordAllianz Der NordAllianz gehören acht Kommunen zwischen Dietersheim dem Norden der Stadt München und dem Flughafen an. Unter dem Motto „Gemeinsam sind wir stark“ hat Echinger See Dietersheim sich das Bündnis, das seitZeichenerklärung 1982 besteht, bis heute Hollerner See bewährt. Die NordAllianz bietet eine Erholungsland- Mallertshofer HolzEchinger See Zeichenerklärungschaft mit zahlreichen Anziehungspunkten.Badesee Hollerner See mit Heiden Von den Isarauen im Osten, den Wäldern und Mallertshofer Holz Badesee BayernNetz mit Heiden Heideflächen im Zentrum bis zum Hügelland und den nahenBayernNetz Amperauen im WestenBiergarten finden Sie hier ein Hochschul- und vielfältiges Naturerlebnis. Forschungsgelände Valentins- park Biergarten Bürgerhaus Hochschul- und Die NordAllianz verfügt über ein zusammenhängen- Forschungsgelände Valentins- des Radwegenetz, ihr Gebiet eignet sich somit bes- park Mallertshofe Bürgerhaus Fahrradreparatur Kircherl tens für alle Radbegeisterten. Fahrradreparatur Gaststätte aussen Mallertshofe Mallertshofer Kircherl See www.nordallianz.deGaststätte aussen Hallenbad Mallertshofer Garchinger See See Hallenbad HistGeb/Sehensw Garchinger See Go-Kart-Bahn -

Building a Recommendation System for Everquest Landmark's

Building a Recommendation System for EverQuest Landmark’s Marketplace Ben G. Weber Director of BI & Analytics, Daybreak Game Company Motivation ● Content discovery is becoming a challenge for players ● Questions ● What games to purchase? ● Which content to download? ● What items to purchase? Daybreak’s revenue-sharing program for user-created content Infantry Gear in PlanetSide 2 Housing Items in Landmark Recommender Goals ● Make relevant content easier to discover ● Recommend content based on gameplay style, friends, and prior purchases ● Improve conversion and monetization metrics Recommender Results ● Offline Experiments ● 80% increase in recall rate over a top sellers list ● Marketplace Results ● Recommendations drive over 10% of item sales ● Used by 20% of purchasers ● Lifetime value of users that purchased recommendations is 10% higher than other purchasers Types of Recommendations ● Item Ratings ● The recommender provides a rating for an item the player has not yet rated ● Item Rankings ● The recommender provides a list of the most relevant items for a player Recommendation Algorithms ● Content-Based Filtering ● Collaborative Filtering ● Item-to-Item ● User-to-User Collaborative Filtering ● Rates items for a player based on the player’s similarity to other players ● Does not require meta-data to be maintained ● Can use explicit and implicit data collection ● Challenges include scalability and cold starts User-Based Collaborative Filtering Similar User ● Users A B ● Items 101 102 103 Recommendation Algorithm Overview Computing a -

Massively Multiplayer Online Role Playing Game Chat Project

[Massively Multiplayer Online Role Playing Game Chat] 175 Lakeside Ave, Room 300A Phone: (802)865-5744 Fax: (802)865-6446 1/21/2016 http://www.lcdi.champlain.edu Disclaimer: This document contains information based on research that has been gathered by employee(s) of The Senator Patrick Leahy Center for Digital Investigation (LCDI). The data contained in this project is submitted voluntarily and is unaudited. Every effort has been made by LCDI to assure the accuracy and reliability of the data contained in this report. However, LCDI nor any of our employees make no representation, warranty or guarantee in connection with this report and hereby expressly disclaims any liability or responsibility for loss or damage resulting from use of this data. Information in this report can be downloaded and redistributed by any person or persons. Any redistribution must maintain the LCDI logo and any references from this report must be properly annotated. Contents Introduction ............................................................................................................................................................................ 2 Background: ........................................................................................................................................................................ 2 Purpose and Scope: ............................................................................................................................................................. 3 Research Questions: ........................................................................................................................................................... -

Weekly News Digest #47

INVESTGAME Nov 16 — Nov 22, 2020 Weekly News Digest #47 Hi everyone, Last week we decided to create the archive of the weekly newsletter for your convenience — click here to access it. Roblox to go public on the New York Stock Exchange CAbased video game platform Roblox has filed its S1 registration documents targeting an IPO on NYSE before the end of this year. Roblox has neither disclosed the sum it’s planning to raise, nor the valuation of the company. Founded in 2004, Roblox Corporation has raised $335.9m investments over the course of 8 rounds with the most recent Series G round closed in Feb 2020 — raising $150m at a $4B postmoney valuation. Just eight months later in Oct 2020, Roblox’s rumored potential IPO valuation was said to be $8B. Such an impressive valuation enhancement could be explained by the strong demand for entertainment content due to COVID19 and shelterinplace orders (Roblox’s DAUs increased by 90% from 19.1m in Q4’19 to 36.2m DAU in Q3’20). The company’s financial results over the last twelve months ending 30 Sep 2020 are: > $1,477m Bookings vs. $727m Revenue — Roblox gradually recognizes revenue over the average lifetime of a paying user; > ($245m) Loss from operations vs. +$301m Free cash flow. Roblox is an operationally profitable business (taking into account bookings numbers), and we consider the rumored $8B as a probable valuation at IPO. The valuation multiples in such case would be 5.4x Bookings, 11.0x Revenue, and 27x Free cash flow. -

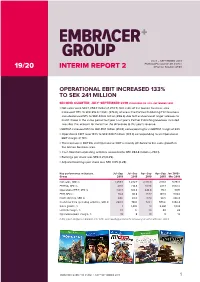

19/20 Interim Report 2 Reg No

JULY – SEPTEMBER 2019 EMBRACER GROUP AB (PUBL) 19/20 INTERIM REPORT 2 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 133% TO SEK 241 MILLION SECOND QUARTER, JULY–SEPTEMBER 2019 (COMPARED TO JULY–SEPTEMBER 2018) > Net sales were SEK 1,259.7 million (1,272.7). Net sales of the Games business area increased 117% to SEK 816.0 million (376.0), whereas the Partner Publishing/Film business area decreased 51% to SEK 443.6 million (896.6) due to the absence of larger releases to match those in the same period last year. Last year’s Partner Publishing revenues included two titles that account for more than the difference to this year’s revenue. > EBITDA increased 95% to SEK 418.1 million (214.8), corresponding to an EBITDA margin of 33%. > Operational EBIT rose 133% to SEK 240.7 million (103.4) corresponding to an Operational EBIT margin of 19%. > The increase in EBITDA and Operational EBIT is mainly attributed to the sales growth in the Games business area. > Cash flow from operating activities amounted to SEK 284.8 million (–740.1). > Earnings per share was SEK 0.21 (0.25). > Adjusted earnings per share was SEK 0.65 (0.28). Key performance indicators, Jul–Sep Jul–Sep Apr–Sep Apr–Sep Jan 2018– Group 2019 2018 2019 2018 Mar 2019 Net sales, SEK m 1,259.7 1,272.7 2,401.8 2,110.1 5,754.1 EBITDA, SEK m 418.1 214.8 807.6 421.7 1,592.6 Operational EBIT, SEK m 240.7 103.4 444.8 173.1 897.1 EBIT, SEK m 76.4 90.8 157.7 143.3 574.6 Profit after tax, SEK m 64.6 65.0 117.4 98.5 396.8 Cash flow from operating activities, SEK m 284.8 –740.1 723.1 –575.6 1,356.4 Sales growth, % –1 1,403 14 2,281 1,034 EBITDA margin, % 33 17 34 20 28 Operational EBIT margin, % 19 8 19 8 16 In this report, all figures in brackets refer to the corresponding period of the previous year, unless otherwise stated.